UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE

ISSUER

PURSUANT TO RULE 13a-16

OR 15d-16

UNDER THE SECURITIES

EXCHANGE ACT OF 1934

For the month of September,

2024

Commission File Number

001-15106

PETRÓLEO BRASILEIRO

S.A. - PETROBRAS

(Exact name of registrant

as specified in its charter)

Brazilian Petroleum

Corporation - PETROBRAS

(Translation of Registrant's

name into English)

Avenida Henrique Valadares,

28

20241-030 - Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal

executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form

40-F ¨

PETROBRAS ANNOUNCES EXPIRATION AND EXPIRATION

DATE

RESULTS OF CASH TENDER OFFERS

RIO

DE JANEIRO, BRAZIL – September 9, 2024 – Petróleo Brasileiro S.A. – Petrobras (“Petrobras”)

(NYSE: PBR) today announced the expiration and expiration date results of the previously announced cash tender offers (each, an “Offer”

and collectively, the “Offers”) by its wholly-owned subsidiary, Petrobras Global Finance B.V. (“PGF”),

with respect to any and all of its notes of the series set forth in the table below (the “Notes” and such offers, the

“Offers”).

The

following table sets forth certain information about the Offers, including the aggregate principal amount of Notes validly

tendered and accepted for purchase in such Offers, and the aggregate principal amount of Notes reflected in notices of guaranteed

delivery delivered at or prior to the Expiration Date (as defined below):

| Title

of Security | |

CUSIP/ISIN | |

Acceptance

Priority Level | | |

Principal

Amount

Outstanding(1) | |

|

Consideration(2) | | |

Principal

Amount

Tendered | |

Principal

Amount

Accepted | |

Principal

Amount

Reflected in

Notices of

Guaranteed

Delivery |

5.093%

Global Notes

Due January 2030 | |

71647N

BE8, 71647N BF5, N6945A AL1 / US71647NBE85, US71647NBF50, USN6945AAL19 | |

1 | | |

US$ |

560,542,000 | |

| US$ |

991.15 | | |

US$ |

180,759,000 | |

US$ |

180,759,000 | |

US$ |

1,000,000 |

5.600%

Global Notes

Due January 2031 | |

71647NBH1

/ US71647NBH17 | |

2 | | |

US$ |

1,040,365,000 | |

| US$ |

998.00 | | |

US$ |

204,845,000 | |

US$ |

204,845,000 | |

US$ |

12,294,000 |

5.500%

Global Notes

Due June 2051 | |

71647NBJ7

/ US71647NBJ72 | |

3 | | |

US$ |

666,283,000 | |

| US$ |

849.33 | | |

US$ |

101,858,000 | |

US$ |

101,858,000 | |

US$ |

12,637,000 |

5.625%

Global Notes

Due May 2043 | |

71647NAA7

/ US71647NAA72 | |

4 | | |

US$ |

361,065,000 | |

| US$ |

910.30 | | |

US$ |

19,915,000 | |

US$ |

19,915,000 | |

US$ |

10,000 |

6.750%

Global Notes

Due June 2050 | |

71647NBG3

/ US71647NBG34 | |

5 | | |

US$ |

416,884,000 | |

| US$ |

980.26 | | |

US$ |

218,989,000 | |

US$ |

218,989,000 | |

US$ |

4,586,000 |

6.900%

Global Notes

Due March 2049 | |

71647NBD0

/ US71647NBD03 | |

6 | | |

US$ |

670,445,000 | |

| US$ |

1,000.00 | | |

US$ |

203,322,000 | |

US$ |

203,322,000 | |

US$ |

1,100,000 |

| (1) | Including Notes held by Petrobras or its affiliates. |

| (2) | Per US$1,000 principal amount of Notes validly tendered and accepted for purchase. The applicable consideration does not include accrued

and unpaid interest on the Notes accepted for purchase from, and including, the last interest payment date for the relevant series of

Notes to, but not including, the Settlement Date, which will be payable in cash. |

The Offers were made pursuant to the terms and conditions set forth

in the offer to purchase dated September 3, 2024 (the “Offer to Purchase” and, together with the accompanying

notice of guaranteed delivery, the “Offer Documents”).

The Offers expired at 5:00 p.m., New York City time, on September 9,

2024 (the “Expiration Date”). The settlement date with respect to the Offers is expected to occur on September 13,

2024 (the “Settlement Date”).

In order to be eligible to participate in the Offers, holders of Notes

reflected in notices of guaranteed delivery received by PGF prior to the Expiration Date must deliver such Notes to PGF by 5:00 p.m.,

New York City time, on September 11, 2024 (the “Guaranteed Delivery Date”).

On

the terms and subject to the conditions set forth in the Offer to Purchase, PGF has accepted for purchase all of the Notes validly tendered,

and expects to accept all of the Notes for which PGF has received notices of guaranteed delivery and that are delivered on or prior

to the Guaranteed Delivery Date.

The

principal amount of Notes that will be purchased by PGF on the Settlement Date is subject to change based on deliveries of Notes pursuant

to the guaranteed delivery procedures described in the Offer to Purchase. A press release announcing the final results of the Offers

is expected to be issued on or promptly after the Settlement Date.

The total cash payment to purchase Notes accepted and expected to be

accepted in the Offers, excluding accrued and unpaid interest, will be approximately US$935.8 million, which will be funded with cash

on hand.

All conditions described in the Offer to Purchase that were to be satisfied

or waived on or prior to the Expiration Date have been satisfied.

# # #

PGF engaged BofA Securities, Inc. (“BofA”),

Banco Bradesco BBI S.A. (“Bradesco BBI”), HSBC Securities (USA) Inc. (“HSBC”), J.P. Morgan Securities

LLC (“J.P. Morgan”), Mizuho Securities USA LLC (“Mizuho”) and Morgan Stanley & Co. LLC

(“Morgan Stanley” and together with BofA, Bradesco BBI, HSBC, J.P. Morgan and Mizuho, the “Dealer Managers”)

to act as dealer managers with respect to the Offers. Global Bondholder Services Corporation acted as the depositary and information agent

(the “Depositary”) for the Offers.

This announcement is for informational purposes only, and does not

constitute an offer to purchase or a solicitation of an offer to sell any securities.

Any questions or requests for assistance regarding the Offers may be

directed to BofA collect at +1 (646) 855-8988 or toll-free (U.S. only) at +1 (888) 292-0070, Bradesco BBI collect at +(646) 432-6643,

HSBC collect at +1 (212) 525-5552 or toll-free (U.S. only) at +1 (888) HSBC-4LM, J.P. Morgan collect at +1 (212) 834 2042 / +1 (212) 834-4533

or toll-free (U.S. only) at +1 (866) 834-4666 / +1 (866) 846-2874, Mizuho collect at +1 (212) 205-7736 or toll-free (U.S. only) at +1

(866) 271-7403 and Morgan Stanley collect at +1 (212) 761-1057 or toll-free (U.S. only) at +1 (800) 624-1808. Requests for additional

copies of the Offer Documents may be directed to Global Bondholder Services Corporation at +1 (855) 654-2014 (toll-free) or +1 (212) 430-3774

(banks and brokers call). The Offer Documents can be accessed at the following link: https://www.gbsc-usa.com/Petrobras/.

The Offers were made solely pursuant to the Offer Documents. The Offer

Documents have not been filed with, and have not been approved or reviewed by any federal or state securities commission or regulatory

authority of any country. No authority has passed upon the accuracy or adequacy of the Offer Documents or any other documents related

to the Offers, and it is unlawful and may be a criminal offense to make any representation to the contrary.

Notice to Prospective Investors in the United Kingdom

The communication of this announcement and any other documents or

materials relating to the Offers is not being made and such documents and/or materials have not been approved by an authorized person

for the purposes of Section 21 of the Financial Services and Markets Act 2000. This announcement and any other documents related

to the Offers are for distribution only to persons who (i) have professional experience in matters relating to investments falling

within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”),

(ii) are persons falling within Article 49(2)(a) to (d) (“high net worth companies, unincorporated associations, etc.”)

of the Order, (iii) are outside the United Kingdom, (iv) are members or creditors of certain bodies corporate as defined by

or within Article 43(2) of the Order, or (v) are persons to whom an invitation or inducement to engage in investment activity

(within the meaning of section 21 of the Financial Services and Markets Act 2000) in connection with the issue, sale or offer to purchase

of any securities may otherwise lawfully be communicated or caused to be communicated (all such persons together being referred to as

“relevant persons”). This announcement and any other documents related to the Offers are directed only at relevant persons

and must not be acted on or relied on by persons who are not relevant persons. Any investment or investment activity to which this process

release and any other documents related to the Offers are available only to relevant persons and will be engaged in only with relevant

persons.

Forward-Looking Statements

This announcement contains forward-looking statements. Forward-looking

statements are information of a non-historical nature or which relate to future events and are subject to risks and uncertainties. No

assurance can be given that the transactions described herein will be consummated or as to the ultimate terms of any such transactions.

Petrobras undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information

or future events or for any other reason.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

PETRÓLEO BRASILEIRO S.A--PETROBRAS |

| |

|

| |

By: |

/s/ Guilherme Rajime Takahashi Saraiva |

| |

|

Name: Guilherme Rajime Takahashi Saraiva |

| |

|

Title: Attorney-in-fact |

| |

|

| |

By: |

/s/ Andre Luis Campos Silva |

| |

|

Name: Lucas Tavares de Mello |

| |

|

Title: Attorney-in-fact |

Date: September 10, 2024

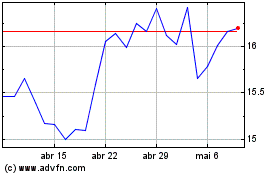

Petroleo Brasileiro ADR (NYSE:PBR.A)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Petroleo Brasileiro ADR (NYSE:PBR.A)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024