FALSE000009747600000974762024-09-192024-09-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED): September 19, 2024

TEXAS INSTRUMENTS INCORPORATED

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-03761 | | 75-0289970 |

(State or other jurisdiction

of incorporation) | | (Commission

file number) | | (I.R.S. employer

identification no.) |

12500 TI Boulevard

Dallas, Texas 75243

(Address of principal executive offices)

Registrant’s telephone number, including area code: (214) 479-3773

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $1.00 | | TXN | | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 8.01. Other Events.

The Registrant’s news release dated September 19, 2024, regarding a planned dividend increase, attached hereto as Exhibit 99 is incorporated by reference herein.

ITEM 9.01. Financial Statements and Exhibits.

| | | | | | | | |

Designation

of Exhibit

in this

Report | | Description of Exhibit |

| | | |

| 99 | | |

| | | Dated September 19, 2024 |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | TEXAS INSTRUMENTS INCORPORATED |

| | | | | |

| Date: September 19, 2024 | | By: | | /s/ Rafael R. Lizardi |

| | | | | Rafael R. Lizardi |

| | | | | Senior Vice President and |

| | | | | Chief Financial Officer |

TI increases dividend 5%, marking 21 consecutive years of increases

DALLAS (Sept. 19, 2024) – Texas Instruments Incorporated (TI) (Nasdaq: TXN) today said it will raise its quarterly cash dividend 5%, from $1.30 per share to $1.36, or $5.44 annualized. The higher dividend will be payable November 12, 2024, to stockholders of record on October 31, 2024, contingent upon formal declaration by the board of directors at its regular meeting in

October.

The increase is consistent with TI’s long-term objective for dividends by providing a sustainable and growing dividend and reflects the company’s continued commitment to return all free cash flow to its owners over time. Today’s announcement marks 21 consecutive years of dividend increases.

Notice regarding forward-looking statements

This release includes forward-looking statements intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. These forward-looking statements generally can be identified by phrases such as TI or its management "believes," "expects," "anticipates," "foresees," "forecasts," "estimates" or other words or phrases of similar import. Similarly, statements herein that describe TI's business strategy, outlook, objectives, plans, intentions or goals also are forward-looking statements. All such forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those in forward-looking statements.

We urge you to carefully consider the following important factors that could cause actual results to differ materially from the expectations of TI or our management:

•Economic, social and political conditions, and natural events in the countries in which we, our customers or our suppliers operate, including global trade policies;

•Market demand for semiconductors, particularly in the industrial and automotive markets, and customer demand that differs from forecasts;

•Our ability to compete in products and prices in an intensely competitive industry;

•Evolving cybersecurity and other threats relating to our information technology systems or those of our customers, suppliers and other third parties;

•Our ability to successfully implement and realize opportunities from strategic, business and organizational changes, or our ability to realize our expectations regarding the amount and timing of associated restructuring charges and cost savings;

•Our ability to develop, manufacture and market innovative products in a rapidly changing technological environment, our timely implementation of new manufacturing technologies and installation of manufacturing equipment, and our ability to realize expected returns on significant investments in manufacturing capacity;

•Availability and cost of key materials, utilities, manufacturing equipment, third-party manufacturing services and manufacturing technology;

•Our ability to recruit and retain skilled personnel and effectively manage key employee succession;

•Product liability, warranty or other claims relating to our products, software, manufacturing, delivery, services, design or communications, or recalls by our customers for a product containing one of our parts;

•Compliance with or changes in the complex laws, rules and regulations to which we are or may become subject, or actions of enforcement authorities, that restrict our ability to operate our business or subject us to fines, penalties or other legal liability;

•Changes in tax law and accounting standards that impact the tax rate applicable to us, the jurisdictions in which profits are determined to be earned and taxed, adverse resolution of tax audits, increases in tariff rates, and the ability to realize deferred tax assets;

•Financial difficulties of our distributors or semiconductor distributors' promotion of competing product lines to our detriment; or disputes with current or former distributors;

•Losses or curtailments of purchases from key customers or the timing and amount of customer inventory adjustments;

•Our ability to maintain or improve profit margins, including our ability to utilize our manufacturing facilities at sufficient levels to cover our fixed operating costs, in an intensely competitive and cyclical industry and changing regulatory environment;

•Our ability to maintain and enforce a strong intellectual property portfolio and maintain freedom of operation in all jurisdictions where we conduct business; or our exposure to infringement claims;

•Instability in the global credit and financial markets; and

•Impairments of our non-financial assets.

For a more detailed discussion of these factors, see the Risk factors discussion in Item 1A of TI's most recent Form 10-K. The forward-looking statements included in this release are made only as of the date of this release, and we undertake no obligation to update the forward-looking statements to reflect subsequent events or circumstances. If we do update any forward-looking statement, you should not infer that we will make additional updates with respect to that statement or any other forward-looking statement.

About Texas Instruments

Texas Instruments Incorporated (Nasdaq: TXN) is a global semiconductor company that designs, manufactures and sells analog and embedded processing chips for markets such as industrial, automotive, personal electronics, communications equipment and enterprise systems. At our core, we have a passion to create a better world by making electronics more affordable through semiconductors. This passion is alive today as each generation of innovation builds upon the last to make our technology more reliable, more affordable and lower power, making it possible for semiconductors to go into electronics everywhere. Learn more at TI.com.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

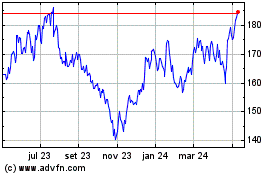

Texas Instruments (NASDAQ:TXN)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

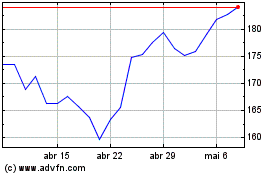

Texas Instruments (NASDAQ:TXN)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025