UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2024

Commission File Number: 001-33765

AIRNET TECHNOLOGY INC.

(Exact name of registrant as specified in its

charter)

Suite 301

No. 26 Dongzhimenwai Street

Chaoyang District, Beijing 100027

The People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ¨

EXPLANATORY NOTE

The

document attached as Exhibit 99.1 to this report on Form 6-K is hereby incorporated by reference into the Company’s Registration

Statement on Form F-3, as amended, initially filed with the U.S. Securities and Exchange Commission on May 10, 2024 (Registration No. 333-279318), and

shall be a part thereof from the date on which this current report is furnished, to the extent not superseded by documents or reports

subsequently filed or furnished.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

AIRNET TECHNOLOGY INC. |

| |

|

|

| Date: September 20, 2024 |

By: |

/s/ Fuying Yan |

| |

Name: |

Fuying Yan |

| |

Title: |

Co-Chief Executive Officer |

EXHIBIT INDEX

Exhibit 99.1

AirNet Announces Receipt of Deficiency Letters

from Nasdaq

BEIJING, September 20, 2024 /PRNewswire/

– AirNet Technology Inc., formerly known as AirMedia Group Inc. (“AirNet” or the “Company”) (Nasdaq: ANTE),

today announced that it received two deficiency letters (the “Deficiency Letters”) from the Listing Qualifications Department

of The Nasdaq Stock Market Inc. (“Nasdaq”) both dated on September 18, 2024 indicating that (1) the Company is no

longer in compliance with the minimum bid price requirement set forth in Rule 5550(a)(2) of the Nasdaq Listing Rules as

the Company’s closing bid price per American depositary share (“ADS”), each representing one ordinary share of the Company,

has been below $1.00 for a period of 30 consecutive business days, and (2) the Company is no longer in compliance with Rule 5550(a)(5) of

the Nasdaq Listing Rules for continued listing due to its failure to maintain a minimum Market Value of Publicly Held Shares

(“MVPHS”) of US$1.0 million for a period of 30 consecutive business days.

The Deficiency Letters have no immediate impact

on the Company’s listing on the Nasdaq Capital Market. Pursuant to Rules 5810(c)(3)(A) and 5810(c)(3)(D) of the Nasdaq

Listing Rules, respectively, the Company has a compliance period of 180 calendar days, or until March 17, 2025 (the “Compliance

Period”), to regain compliance with Nasdaq's minimum bid price and minimum MVPHS requirements. If at any time during the Compliance

Period, the closing bid price per ADS is at least $1.00 for a minimum of ten consecutive business days, Nasdaq will provide the Company

a written confirmation of compliance with the minimum bid price requirement, and the matter will be closed. If at any time during

the Compliance Period, the Company’s MVPHS is at least US$1.0 million for a minimum of ten consecutive business days, Nasdaq will

provide the Company a written confirmation of compliance with the minimum MVPHS requirement, and the matter will be closed.

If the Company does not regain compliance with

the minimum bid price requirement by March 17, 2025, the Company may be eligible for additional time to regain compliance. To

qualify, the Company must meet the continued listing requirements for MVPHS and all other initial listing standards, with the exception

of bid price requirement, of the Nasdaq Capital Market, and provides written notice to Nasdaq of its intention to cure the deficiency,

including by effecting a reverse stock split, if necessary. If the Company meets these requirements, Nasdaq will grant an additional 180

calendar days to the Company (the “Second Compliance Period”). However, if Nasdaq concludes that the Company will not be able

to cure the deficiency, or if the Company is otherwise not eligible, Nasdaq will provide notice that the Company’s securities will

be subject to delisting. If the Company chooses to implement a reverse stock split, it must complete the split no later than ten business

days prior to March 17, 2025, or the expiration of the Second Compliance Period if granted.

In the event the Company does not regain compliance

with the minimum MVPHS requirement by March 17, 2025, the Company will receive written notification that its securities are

subject to delisting. In the event of such notification, the Company may appeal Nasdaq’s determination to delist its securities,

but there can be no assurance Nasdaq would grant the Company’s request for continued listing.

This announcement is made in compliance with the Nasdaq Listing Rule 5810(b),

which requires prompt disclosure of receipt of a notification of deficiency.

Forward-Looking Statements

This announcement contains forward-looking statements within the meaning

of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified

by terminology such as “will,” “expects,” “is expected to,” “anticipates,” “aim,”

“future,” “intends,” “plans,” “believes,” “are likely to,” “estimates,”

“may,” “should” and similar expressions. The Company may also make written or oral forward-looking statements

in its reports filed with, or furnished to, the U.S. Securities and Exchange Commission, in its annual reports to shareholders, in press

releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Forward-looking

statements are based upon management’s current expectations and current market and operating conditions, and involve inherent risks

and uncertainties, all of which are difficult to predict and many of which are beyond the Company’s control, which may cause its

actual results, performance or achievements to differ materially from those in the forward-looking statements. Further information is

included in the Company’s filings with the U.S. Securities and Exchange Commission. All information provided in this announcement

is as of the date of this announcement, and the Company does not undertake any obligation to update any forward-looking statement as a

result of new information, future events or otherwise, except as required under law.

Company Contact

Penny Pei

Investor Relations

AirNet Technology Inc.

Tel: +86-10-8460-8678

Email: penny@ihangmei.com

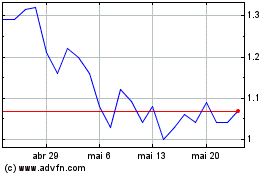

AirNet Technology (NASDAQ:ANTE)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

AirNet Technology (NASDAQ:ANTE)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025