false

0001893448

A1

0001893448

2024-09-25

2024-09-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): September 25, 2024

| STRONG

GLOBAL ENTERTAINMENT, INC. |

| (Exact

name of registrant as specified in its charter) |

| British

Columbia, Canada |

|

001-41688 |

|

N/A

|

| (State

or other jurisdiction of |

|

(Commission

|

|

(IRS

Employer |

| incorporation

or organization) |

|

File

No.) |

|

Identification

Number) |

108

Gateway Blvd, Suite 204

Mooresville,

NC |

|

28117 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(704)

471-6784

(Registrant’s

telephone number including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on Which Registered |

| Class

A Common Voting Shares, without par value |

|

SGE |

|

NYSE

American |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item

2.01 |

Completion

of Acquisition or Disposition of Assets. |

Combination

with Fundamental Global Inc.

On

September 30, 2024, Strong Global Entertainment, Inc. (“SGE”), Fundamental Global Holdings BC ULC, an unlimited liability

company existing under the laws of the Province of British Columbia and majority owner of SGE (“FG BC”), and 1483530 B.C.

Ltd., a newly formed subsidiary of FG BC (“Subco”), completed an arrangement transaction pursuant to the terms of the Arrangement

Agreement, dated May 30, 2024 (the “Arrangement Agreement”) among such parties, and implemented the plan of arrangement contemplated

therein (the “Plan of Arrangement”). In connection with the Arrangement Agreement, among other matters, shares of Class A

Common Voting shares of SGE (the “SGE Common Shares”) were deemed to be transferred by the holders thereof to FG BC in exchange

for the arrangement consideration (“Arrangement Consideration”) consisting of 1.5 shares of the common stock of Fundamental

Global Inc., the indirect sole owner of FG BC (the “Company”), with any fractional shares being rounded up to the nearest

whole share.

The

Arrangement Agreement and Plan of Arrangement were approved and authorized by stockholders of SGE on September 17, 2024, and a final

order of the Supreme Court of British Columbia approving and authorizing the transaction was issued on September 23, 2024.

The

issuance of the Arrangement Consideration was registered pursuant to a joint proxy statement/prospectus on Form S-4 (Registration No.

333-280346) (as amended, the “Joint Proxy Statement/Prospectus”) filed by the Company with the Securities Exchange Commission

(the “Commission”) and declared effective on July 31, 2024 and filed as definitive proxy materials by SGE on August 13, 2024.

The

Joint Proxy Statement/Prospectus contains among other things (i) summary descriptions of the Arrangement Agreement and Plan of Arrangement

(see section titled “Arrangement Agreement and Plan of Arrangement” beginning on page 69), each of which is included as an

exhibit thereto, (ii) historical financial statements of the parties (see “Financial Statements” beginning on page F-1) and

pro forma financial information (see “Unaudited Pro Forma Combined Financial Information” beginning on page 14), and (iii)

information regarding certain relationships and related transactions (see “Certain Relationships and Related Person Transactions”

beginning on page 101), which descriptions are incorporated herein by reference. The summary descriptions of the Arrangement Agreement

and Plan of Arrangement are not complete and are qualified in their entirety by reference to the full text of such documents filed with

the Joint Proxy Statement/Prospectus.

Sale

by SGE of Strong/MDI

On

September 25, 2024, SGE completed the previously announced transfer of its subsidiary, Strong/MDI Screen Systems, Inc. (“MDI”),

to FG Acquisition Corp., a Canadian special purpose acquisition company (“FGAC”), which was renamed Saltire Holdings, Ltd

(“Saltire”). Pursuant to the acquisition agreement, dated May 3, 2024 (the “Acquisition Agreement”), SGE received

the equivalent of approximately $29.5 million in cash and preferred and common shares of Saltire, consisting of: (i) cash consideration

in an amount equal to 25% of the net proceeds of a concurrent private placement (or $0.8 million), (ii) the issuance of preferred shares

with an initial preferred share redemption amount of $9.0 million, and (iii) the issuance $19.7 million of Saltire common shares. The

summary description of the Acquisition Agreement is not complete and is qualified in its entirety by reference to the full text of such

document filed with the Commission.

The

Company, which is SGE’s indirect controlling shareholder, held an investment in FGAC. A description of the relationships between

the Company and SGE is included in “Certain Relationships and Related Person Transactions” beginning on page 101 of the Joint

Proxy Statement/Prospectus and is incorporated herein by reference.

| Item

3.01 | Notice

of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing. |

Prior

to the completion of the Plan of Arrangement, SGE’s common stock was listed and traded on the New York Stock Exchange (“NYSE”)

under the trading symbol “SGE.” In connection with the completion of the Plan of Arrangement, SGE will be delisted from NYSE

prior to the open of trading on September 30, 2024. SGE will also file with the SEC a Form 15 requesting that the reporting obligations

of SGE under Sections 13(a) and 15(d) of the Exchange Act be suspended.

| Item

7.01 |

Regulation

FD Disclosure. |

On

September 26, 2024, SGE and the Company issued a press release in connection with the completion of the MDI sale and on September 30,

2024, SGE and the Company issued a press release in connection with the completion of the Arrangement Agreement and Plan of Arrangement.

Those press releases are furnished as Exhibits 99.1 and 99.2 hereto and are incorporated herein by reference.

The

information in this Item 7.01 and in Exhibit 99.1 attached hereto is furnished pursuant to the rules and regulations of the SEC and shall

not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section,

nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except

as shall be expressly set forth by specific reference in such a filing.

| Item

9.01. | Financial

Statements and Exhibits. |

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| |

STRONG

GLOBAL ENTERTAINMENT, INC. |

| |

|

|

| Date:

October 2, 2024 |

By: |

/s/

Todd R. Major |

| |

|

Todd

R. Major |

| |

|

Chief

Financial Officer |

Exhibit

99.1

Strong

Global Entertainment Announces Closing of Sale of Strong/MDI for Approximately $30 Million

Mooresville,

NC, September 26, 2024 –Strong Global Entertainment, Inc. (NYSE: SGE) (“Strong Global”) and Fundamental

Global Inc. (Nasdaq: FGF, FGFPP) (“Fundamental Global”) are pleased to announce the closing of the previously announced

sale of Strong/MDI Screen Systems, Inc. (“MDI”) from Strong Global to Saltire Holdings Ltd (“Saltire”).

Mark

Roberson, Chief Executive Officer of Strong Global, commented, “We are pleased to announce the closing of the sale of MDI. This

is one element of our previously announced strategy to streamline operations, increase liquidity and drive shareholder value. We expect

the transaction to result in a net pre-tax financial statement gain in excess of $25 million. At closing, Strong Global holds approximately

37% of the outstanding common shares of Saltire, and we look forward to participating in the Saltires’ long term growth strategy.”

At

closing, and after a working capital adjustment, Strong Global received total consideration of $29.5 million, consisting of $0.8 million

of cash, $9.0 million of preferred shares of Saltire, and $19.7 million of common shares of Saltire.

Prior

to the Closing, Strong Global did not own or control any securities of Saltire. Strong Global received 1,972,723 common shares and 900,000

series A preferred shares of Saltire as consideration under the transaction.

Strong

Global may acquire additional securities including on the open market or through private acquisitions or sell the securities including

on the open market or through private dispositions in the future depending on market conditions, general economic and industry conditions,

Saltire’s business and financial condition, and/or other relevant factors, and Strong Global may develop such plans or intentions

in the future.

A

copy of the Early Warning Report to be filed by Strong Global in connection with the transaction described above will be available on

its SEDAR+ profile at www.sedarplus.ca.

About

Strong Global Entertainment, Inc.

Strong

Global Entertainment, Inc., a majority owned subsidiary of Fundamental Global Inc., is a leader in the entertainment industry, providing

mission critical products and services to cinema exhibitors and entertainment venues for over 90 years.

About

Fundamental Global Inc.

Fundamental

Global Inc. (Nasdaq: FGF, FGFPP) and its subsidiaries engage in diverse business activities including reinsurance, asset management,

merchant banking, manufacturing and managed services.

The

FG® logo and Fundamental Global® are registered trademarks of Fundamental Global LLC.

Forward-Looking

Statements

This

press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities

Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements are

therefore entitled to the protection of the safe harbor provisions of these laws. These statements may be identified by the use of forward-looking

terminology such as “anticipate,” “believe,” “budget,” “can,” “contemplate,”

“continue,” “could,” “envision,” “estimate,” “expect,” “evaluate,”

“forecast,” “goal,” “guidance,” “indicate,” “intend,” “likely,”

“may,” “might,” “outlook,” “plan,” “possibly,” “potential,” “predict,”

“probable,” “probably,” “pro-forma,” “project,” “seek,” “should,”

“target,” “view,” “will,” “would,” “will be,” “will continue,”

“will likely result” or the negative thereof or other variations thereon or comparable terminology. In particular, discussions

and statements regarding the Company’s future business plans and initiatives are forward-looking in nature. We have based these

forward-looking statements on our current expectations, assumptions, estimates, and projections. While we believe these to be reasonable,

such forward-looking statements are only predictions and involve a number of risks and uncertainties, many of which are beyond our control.

These and other important factors may cause our actual results, performance, or achievements to differ materially from any future results,

performance or achievements expressed or implied by these forward-looking statements, and may impact our ability to implement and execute

on our future business plans and initiatives. Management cautions that the forward-looking statements in this release are not guarantees

of future performance, and we cannot assume that such statements will be realized or the forward-looking events and circumstances will

occur. Factors that might cause such a difference include, without limitation: risks associated with our inability to identify and realize

business opportunities, and the undertaking of any new such opportunities; our lack of operating history or established reputation in

the reinsurance industry; our inability to obtain or maintain the necessary approvals to operate reinsurance subsidiaries; risks associated

with operating in the reinsurance industry, including inadequately priced insured risks, credit risk associated with brokers we may do

business with, and inadequate retrocessional coverage; our inability to execute on our investment and investment management strategy,

including our strategy to invest in the risk capital of special purpose acquisition companies (SPACs); our ability to maintain and expand

our revenue streams to compensate for the lower demand for our digital cinema products and installation services; potential interruptions

of supplier relationships or higher prices charged by suppliers in connection with our Strong Global business; our ability to successfully

compete and introduce enhancements and new features that achieve market acceptance and that keep pace with technological developments;

our ability to maintain Strong Global’s brand and reputation and retain or replace its significant customers; challenges associated

with Strong Global’s long sales cycles; the impact of a challenging global economic environment or a downturn in the markets; the

effects of economic, public health, and political conditions that impact business and consumer confidence and spending, including rising

interest rates, periods of heightened inflation and market instability; potential loss of value of investments; risk of becoming an investment

company; fluctuations in our short-term results as we implement our new business strategy; risks of being unable to attract and retain

qualified management and personnel to implement and execute on our business and growth strategy; failure of our information technology

systems, data breaches and cyber-attacks; our ability to establish and maintain an effective system of internal controls; our limited

operating history as a public company; the requirements of being a public company and losing our status as a smaller reporting company

or becoming an accelerated filer; any potential conflicts of interest between us and our controlling stockholders and different interests

of controlling stockholders; potential conflicts of interest between us and our directors and executive officers; risks associated with

our related party transactions and investments; and risks associated with our investments in SPACs, including the failure of any such

SPAC to complete its initial business combination. Our expectations and future plans and initiatives may not be realized. If one of these

risks or uncertainties materializes, or if our underlying assumptions prove incorrect, actual results may vary materially from those

expected, estimated or projected. You are cautioned not to place undue reliance on forward-looking statements. The forward-looking statements

are made only as of the date hereof and do not necessarily reflect our outlook at any other point in time. We do not undertake and specifically

decline any obligation to update any such statements or to publicly announce the results of any revisions to any such statements to reflect

new information, future events or developments.

Investor

Relations Contacts:

IR@strong-entertainment.com

investors@fundamentalglobal.com

Exhibit 99.2

Fundamental

Global Completes Combination with Strong Global Entertainment

Business

Combination Advances Strategic Streamlining Efforts

Mooresville,

NC, September 30, 2024 – Fundamental Global Inc. (Nasdaq: FGF, FGFPP) (“Fundamental

Global”) has completed its combination with Strong Global Entertainment, Inc. (NYSE: SGE) (“Strong Global

Entertainment”) pursuant to a previously announced arrangement agreement.

The

combination received overwhelming support, with more than 99% of the shares cast at the Strong Global shareholders meeting on September

17, 2024 voting to approve the transaction.

Shareholders

of Strong Global Entertainment will receive 1.5 common shares of Fundamental Global for each common share they hold.

Kyle

Cerminara, Chief Executive Officer of Fundamental Global, stated, “We have completed two significant transactions this week: our

combination with Strong Global Entertainment and the sale of Strong/MDI to Saltire Holdings. These actions are part of our strategy to

streamline operations, reduce operating costs, and boost liquidity.

About

Fundamental Global Inc.

Fundamental

Global Inc. (Nasdaq: FGF, FGFPP) and its subsidiaries engage in diverse business activities including reinsurance, asset management,

merchant banking, and managed services.

The

FG® logo and Fundamental Global® are registered trademarks of Fundamental Global LLC.

Forward-Looking

Statements

In

addition to the historical information included herein, this press release contains “forward-looking statements” that are

subject to substantial risks and uncertainties. All statements, other than statements of historical fact, contained in this press release

are forward-looking statements. Forward-looking statements contained in this press release may be identified by the use of words such

as “anticipate,” “believe,” “contemplate,” “could,” “estimate,” “expect,”

“intend,” “seek,” “may,” “might,” “plan,” “potential,” “predict,”

“project,” “target,” “aim,” “should,” “will” “would,” or the

negative of these words or other similar expressions, although not all forward-looking statements contain these words. Forward-looking

statements are based on the Company’s current expectations and are subject to inherent uncertainties, risks and assumptions that

are difficult to predict. Further, certain forward-looking statements are based on assumptions as to future events that may not prove

to be accurate. These and other risks and uncertainties are described more fully in the section titled “Risk Factors” in

the final prospectus related to the public offering filed with the SEC, our Annual Report on Form 10-K for the year ended December 31,

2023, and the Company’s other reports filed with the SEC. Forward-looking statements contained in this announcement are made as

of this date, and the Company undertakes no duty to update such information except as required under applicable law.

Investor

Relations Contacts:

investors@fundamentalglobal.com

v3.24.3

Cover

|

Sep. 25, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 25, 2024

|

| Entity File Number |

001-41688

|

| Entity Registrant Name |

STRONG

GLOBAL ENTERTAINMENT, INC.

|

| Entity Central Index Key |

0001893448

|

| Entity Incorporation, State or Country Code |

A1

|

| Entity Address, Address Line One |

108

Gateway Blvd

|

| Entity Address, Address Line Two |

Suite 204

|

| Entity Address, City or Town |

Mooresville

|

| Entity Address, State or Province |

NC

|

| Entity Address, Postal Zip Code |

28117

|

| City Area Code |

(704)

|

| Local Phone Number |

471-6784

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class

A Common Voting Shares, without par value

|

| Trading Symbol |

SGE

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

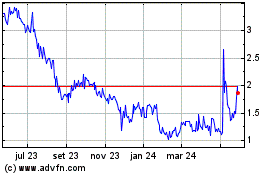

Strong Global Entertainm... (AMEX:SGE)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

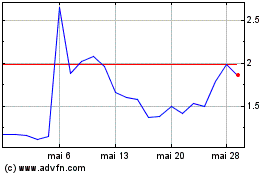

Strong Global Entertainm... (AMEX:SGE)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025