UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Under § 240.14a-12 |

SOUTHWEST AIRLINES CO.

|

(Name of Registrant as Specified In Its Charter)

|

| |

ELLIOTT INVESTMENT MANAGEMENT L.P.

ELLIOTT ASSOCIATES, L.P.

ELLIOTT INTERNATIONAL, L.P.

THE LIVERPOOL LIMITED PARTNERSHIP

ELLIOTT INVESTMENT MANAGEMENT GP LLC

PAUL E. SINGER

MICHAEL CAWLEY

DAVID CUSH

SARAH FEINBERG

JOSHUA GOTBAUM

DAVID GRISSEN

ROBERT MILTON

GREGG SARETSKY

PATRICIA WATSON

|

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED OCTOBER 15, 2024

ELLIOTT INVESTMENT MANAGEMENT

L.P.

_____________, 2024

Dear Fellow Southwest Shareholder:

Elliott Investment Management

L.P., together with its affiliates (collectively, “Elliott” or “we”), holds an 11% economic interest in Southwest

Airlines Co., a Texas corporation (“Southwest” or the “Company”), making us one of Southwest’s largest shareholders.

We made this substantial investment because we strongly believe that with the right leadership and proper oversight, Southwest can reclaim

its position as a top-performing airline.

As we discuss in detail in the

attached Proxy Statement, we delivered to the Company a formal request that the Company call a special meeting of the Company’s

shareholders (the “Special Meeting”), and nominated eight highly-qualified independent directors who would bring significant

expertise and deep experience to the Company’s Board of Directors. Once elected, these individuals would collaborate with their

fellow Southwest directors to form a world-class, independent Board with the right skills will be able to hold management accountable

and ensure that the Company successfully executes on the necessary operational and strategic changes. We are pursuing action at the Special

Meeting because shareholders need a best-in-class Board in place – NOW – during this critical juncture for the future of Southwest.

We requested that the Company

hold the Special Meeting on December 10, 2024, and that the Company set a record date for the Special Meeting that is not fewer than 10

days, and not greater than 20 days, after we delivered the request for the Special Meeting. The Company has announced that the Special

Meeting is scheduled to be held on _____________, 2024, and set the close of business on _____________, 2024 as the record date for determining

the shareholders entitled to vote at the Special Meeting.

We urge you to carefully consider

the information contained in the attached Proxy Statement and then support our efforts and vote by following the instructions on the enclosed

GOLD proxy card. The attached Proxy Statement and the enclosed GOLD proxy card are first being furnished to the shareholders

on or about ___________, 2024.

If you vote using a proxy card

other than the attached GOLD proxy card and wish to change your vote, you have every right to change your vote by voting the attached

GOLD proxy card.

If you have any questions or require

any assistance with your vote, please contact Okapi Partners LLC, which is assisting us, at its address and toll-free numbers listed below.

Thank you for your support,

Elliott Investment Management L.P.

Okapi Partners LLC is assisting Elliott with

its effort to solicit proxies. If you have any questions or require assistance in authorizing a proxy or voting your Southwest shares,

please contact:

1212 Avenue of the Americas, 17th Floor

New York, NY 10036

Banks and Brokerage Firms, Please Call: (212) 297-0720

Shareholders and All Others Call Toll-Free: (877) 629-6357

E-mail: info@okapipartners.com

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED OCTOBER 15, 2024

SPECIAL MEETING OF SHAREHOLDERS

OF

SOUTHWEST AIRLINES CO.

PROXY STATEMENT

OF

ELLIOTT INVESTMENT MANAGEMENT L.P. |

PLEASE VOTE THE ENCLOSED

GOLD PROXY CARD TODAY – BY INTERNET, BY PHONE OR BY SIGNING, DATING AND RETURNING THE GOLD PROXY CARD

Elliott Investment Management

L.P., a Delaware limited partnership (“Elliott Management,” and together with the other participants named herein, “Elliott”

or “we”), is furnishing this proxy statement (“Proxy Statement”) and accompanying GOLD proxy card to holders

of common stock, par value $1.00 per share (“Common Stock”), of Southwest Airlines Co., a Texas corporation (“Southwest”

or the “Company”), in connection with the solicitation of proxies in connection with the Company’s special meeting of

shareholders (including any and all adjournments, postponements, continuations or reschedulings thereof, or any other meeting of shareholders

held in lieu thereof, the “Special Meeting”). The Special Meeting is scheduled to be held on _____________, 2024, at _________.

This Proxy Statement is first being furnished to shareholders on or about ____________, 2024.

We are pursuing action

at the Special Meeting because shareholders need a best-in-class Board of Directors (the “Board”) in place – NOW –

during this critical juncture for the future of Southwest. We have nominated eight highly-qualified independent directors who would collaborate

with their fellow Southwest directors to form a world-class, independent Board with the right skills will be able to hold management accountable

and ensure that the Company successfully executes on the necessary operational and strategic changes. We are seeking your support at the

Special Meeting for the following proposals:

| 1. | to repeal each provision of, or amendment to, the Company’s Fourth Amended and Restated Bylaws (the

“Bylaws”) adopted by the Board without the approval of the shareholders of the Company after February 2, 2024 and up to and

including the date of the Special Meeting (the “Bylaw Restoration Proposal”); |

| 2. | to remove the following members of the Board: Douglas H. Brooks, Eduardo F. Conrado, William H. Cunningham,

Thomas W. Gilligan, David P. Hess, Gary C. Kelly, Elaine Mendoza and Jill A. Soltau, as well as any other person or persons elected or

appointed to the Board without shareholder approval after September 26, 2024 and up to and including the date of the Special Meeting (other

than any Nominee (as defined and set forth below)), effective immediately (the “Removal Proposal”); and |

| 3. | to elect the following Nominees to serve as directors of the Company: Michael Cawley, David C. Cush, Sarah

E. Feinberg, Joshua Gotbaum, David J. Grissen, Robert A. Milton, Gregg A. Saretsky and Patricia A. Watson (each individually, a “Nominee”

and collectively, the “Nominees”) (the “Director Election Proposal”). |

We refer to each of the

Bylaw Restoration Proposal, the Removal Proposal, and the Director Election Proposal as a “Proposal”, and collectively as

the “Proposals.”

As of the date hereof,

Elliott Management and the other Participants (as defined below) collectively beneficially own 61,179,691 shares of Common Stock (the

“Elliott Group Shares”). We intend to vote the Elliott Group Shares “FOR” the Bylaw Restoration Proposal,

“FOR” the removal of each of the incumbent directors specified in the Removal Proposal, and “FOR”

the election of each of the Nominees specified in the Director Election Proposal. While we currently intend to vote all of the Elliott

Group Shares in favor of the election of each of the Nominees, we reserve the right to vote some or all of the Elliott Group Shares as

we see fit, in order to achieve a Board composition that we believe is in the best interest of all shareholders. We would only intend

to vote some or all of the Elliott Group Shares in a different manner than what we are otherwise recommending in the event it were to

become apparent to us, based on the projected voting results at such time, that less than all of the Nominees would be elected at the

Special Meeting and that by voting the Elliott Group Shares in a different manner we could help achieve a Board composition that we believe

is in the best interest of all shareholders. Shareholders should understand that all shares of Common Stock represented by the enclosed

GOLD proxy card will be voted at the Special Meeting as marked.

The Company has set the

close of business on _____________, 2024 as the record date for determining the shareholders entitled to vote at the Special Meeting (the

“Record Date”). Each share of Common Stock is entitled to one vote for each of the proposals to be voted on. The principal

executive offices of the Company are located at P.O. Box 36611, Dallas, Texas 75235-1611. According to the Company’s proxy statement,

as of the close of business on the Record Date, there were ____________ shares of Common Stock issued and outstanding.

THIS SOLICITATION IS BEING

MADE BY ELLIOTT AND NOT ON BEHALF OF THE BOARD OR MANAGEMENT OF THE COMPANY. WE ARE NOT AWARE OF ANY OTHER MATTERS TO BE BROUGHT BEFORE

THE SPECIAL MEETING OTHER THAN AS SET FORTH IN THIS PROXY STATEMENT. SHOULD OTHER MATTERS, WHICH ELLIOTT IS NOT AWARE OF A REASONABLE

TIME BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE SPECIAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED GOLD PROXY CARD

WILL VOTE ON SUCH MATTERS IN THEIR DISCRETION.

ELLIOTT URGES YOU TO VOTE

THE ENCLOSED GOLD PROXY CARD TODAY IN FAVOR OF EACH OF THE PROPOSALS – BY INTERNET, BY PHONE OR BY SIGNING, DATING AND RETURNING

THE GOLD PROXY CARD.

IF YOU HAVE ALREADY SENT

A WHITE PROXY CARD FURNISHED BY COMPANY MANAGEMENT OR THE BOARD, YOU MAY REVOKE THAT PROXY AND VOTE ON EACH OF THE PROPOSALS DESCRIBED

IN THIS PROXY STATEMENT BY VOTING THE ENCLOSED GOLD PROXY CARD. THE LATEST DATED PROXY IS THE ONLY ONE THAT COUNTS. ANY PROXY MAY

BE REVOKED AT ANY TIME PRIOR TO THE SPECIAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER DATED PROXY FOR THE SPECIAL

MEETING OR BY VOTING IN PERSON AT THE SPECIAL MEETING.

Important Notice Regarding the Availability of

Proxy Materials for the Special Meeting:

The proxy materials are available at:

www.StrongerSouthwest.com

IMPORTANT

Your vote is important,

no matter how many or how few shares of Common Stock you own. Elliott urges you to vote “FOR” each of the Proposals by following

the instructions on the enclosed GOLD proxy card.

| · | If your shares of Common Stock are registered in your own name, please vote (i) through the Internet at

any time prior to __________ on __________, 2024 by following the instructions on the enclosed GOLD proxy card; (ii) by telephone

from the United States, by calling __________ at any time prior to __________ on __________, 2024; or (iii) by signing and dating the

enclosed GOLD proxy card and returning it to Elliott, c/o Okapi Partners LLC (“Okapi Partners”), in the enclosed postage-paid

envelope today. |

| · | If your shares of Common Stock are held in a brokerage account or bank, you are considered the beneficial

owner of the shares of Common Stock, and these proxy materials, together with a voting form, are being forwarded to you by your broker

or bank. As a beneficial owner, you must instruct your broker, trustee or other representative how to vote. Your broker cannot vote your

shares of Common Stock on your behalf without your instructions. Depending upon your broker or custodian, you may be able to vote either

by toll-free telephone or by the internet. Please refer to the enclosed voting form for instructions on how to vote electronically. You

may also vote by signing, dating and returning the enclosed voting form. |

Since only your latest

dated proxy card will count, we urge you not to vote any proxy card you receive from the Company. If you vote the WHITE management proxy

card, it will revoke any proxy card you may have previously sent to us, so please make certain that the latest dated proxy card you vote

is the GOLD proxy card.

Okapi Partners is assisting

Elliott with its effort to solicit proxies. If you have any questions or require assistance in authorizing a proxy or voting your shares

of Common Stock, please contact:

1212 Avenue of the Americas, 17th Floor

New York, NY 10036

Banks and Brokerage Firms, Please Call: (212) 297-0720

Shareholders and All Others Call Toll-Free: (877) 629-6357

E-mail: info@okapipartners.com

TABLE OF CONTENTS

| QUESTIONS AND ANSWERS RELATING TO THIS PROXY SOLICITATION |

5 |

| BACKGROUND TO THE SOLICITATION |

10 |

| REASONS FOR THE SOLICITATION |

16 |

| PROPOSAL NO. 1 – BYLAW RESTORATION PROPOSAL |

23 |

| PROPOSAL NO. 2 – REMOVAL PROPOSAL |

24 |

| PROPOSAL NO. 3 – DIRECTOR ELECTION PROPOSAL |

25 |

| SOLICITATION OF PROXIES |

36 |

| ADDITIONAL PARTICIPANT INFORMATION |

36 |

| OTHER MATTERS AND CERTAIN ADDITIONAL INFORMATION |

38 |

| SHAREHOLDER PROPOSALS |

39 |

| INCORPORATION BY REFERENCE |

40 |

QUESTIONS AND ANSWERS

RELATING TO THIS PROXY SOLICITATION

The following are some

of the questions you may have as a shareholder and the answers to those questions. The following is not a substitute for the information

contained in this Proxy Statement and the information contained below is qualified in its entirety by the more detailed descriptions and

explanations contained elsewhere in this Proxy Statement. We urge you to read this Proxy Statement carefully and in its entirety.

Who is Making This Solicitation?

The solicitation is being

made by Elliott Management and the other Participants in this solicitation. Elliott Management is a Delaware limited partnership. The

principal business of Elliott Management is to act as investment manager for Elliott Associates, L.P. (“Elliott Associates”)

and Elliott International, L.P. (“Elliott International”). The Liverpool Limited Partnership (“Liverpool”) is

a wholly-owned subsidiary of Elliott Associates.

Who Requested the Special Meeting?

Elliott

Associates, Elliott International and Liverpool, shareholders of record of the Company that collectively hold more than 10% of the outstanding

shares of Common Stock, together with Elliott Management, requested that the Company call the Special Meeting by delivering a request

letter and associated materials to the Company on October 14, 2024. We requested that the Company hold the Special Meeting on December

10, 2024, and that the Company set a record date for the Special Meeting that is not fewer than 10 days, and not greater than 20 days,

after we delivered the request for the Special Meeting.

What Proposals will be Voted on at the

Special Meeting?

Shareholders will be able

to vote on the three Proposals at the Special Meeting:

| · | The Bylaw Restoration Proposal: To repeal each provision of, or amendment to, the Bylaws

adopted by the Board without the approval of the shareholders of the Company after February 2, 2024 and up to and including the date

of the Special Meeting. |

| · | The Removal Proposal: To remove the following members of the Board: Douglas H. Brooks, Eduardo

F. Conrado, William H. Cunningham, Thomas W. Gilligan, David P. Hess, Gary C. Kelly, Elaine Mendoza and Jill A. Soltau, as well as any

other person or persons elected or appointed to the Board without shareholder approval after September 26, 2024 and up to and including

the date of the Special Meeting (other than any Nominee set forth below), effective immediately. |

| · | The Director Election Proposal: To elect the following Nominees to serve as directors of

the Company: Michael Cawley, David Cush, Sarah Feinberg, Joshua Gotbaum, David Grissen, Robert Milton, Gregg Saretsky and Patricia Watson. |

Who Are Elliott’s Nominees?

At the Special Meeting,

we are seeking to remove eight of the Company’s current directors and replace them with our eight Nominees:

| · | Michael Cawley – Former Deputy CEO, COO and CFO of Ryanair |

| · | David Cush – Former CEO of Virgin America |

| · | Sarah Feinberg – Former Transportation Regulator and Administrator of the Federal Railroad

Administration |

| · | Joshua (Josh) Gotbaum – Seasoned Advisor to Companies and Labor Groups and Former Hawaiian

Airlines Trustee |

| · | David (Dave) Grissen – Former Group President of Marriott International |

| · | Robert Milton – Former CEO of Air Canada and ACE Aviation Holdings and Former Chairman of

United Airlines |

| · | Gregg Saretsky – Former CEO of WestJet |

| · | Patricia (Patty) Watson – Chief Information & Technology Officer at NCR Atleos |

Who is Entitled to Vote at the Special

Meeting and How Many Votes Do You Have?

The Company has set the

close of business on _________, 2024 as the Record Date for determining the shareholders entitled to vote at the Special Meeting. Each

share of Common Stock is entitled to one vote on each of the proposals to be voted on.

Only shareholders of record

on the Record Date will be entitled to notice of and to vote at the Special Meeting. Shareholders who sell their shares of Common Stock

before the Record Date (or acquire them without voting rights after the Record Date) may not vote such shares of Common Stock. Shareholders

of record on the Record Date will retain their voting rights in connection with the Special Meeting even if they sell such shares of Common

Stock after the Record Date.

According to the Company’s

proxy statement, as of the close of business on the Record Date, there were ____________ shares of Common Stock issued and outstanding.

According to the Company’s proxy statement, there are no other securities of the Company outstanding and entitled to vote at the

Special Meeting.

How Do Proxies Work?

Elliott is asking you to

appoint _____________, and each of them, as your proxy holders to vote your shares of Common Stock at the Special Meeting. You make this

appointment by voting the enclosed GOLD proxy card or by using one of the voting methods described below. Giving us your proxy

means you authorize the proxy holders to vote your shares at the Special Meeting, according to the directions you provide. You may vote

for the removal of all, some or none of each of the eight incumbent directors specified in the Removal Proposal. You may also vote for

all, some or none of our eight director candidates. Whether or not you are able to attend the Special Meeting, you are urged to vote “FOR”

each of the Proposals by following the instructions on the enclosed GOLD proxy card. All valid proxies received prior to the Special

Meeting will be voted.

If you specify a choice

with respect to any item by marking the appropriate box on the proxy, the shares of Common Stock will be voted in accordance with that

specification and direction. If you return a signed GOLD proxy card and no direction is indicated, then the GOLD proxy card

will be voted “FOR” the Bylaw Restoration Proposal, “FOR” the removal of each of the incumbent directors

specified in the Removal Proposal, and “FOR” the election of each of the Nominees specified in the Director Election

Proposal.

What is the Difference Between Holding

Shares as a Shareholder of Record/Registered Shareholder and as a Beneficial Owner of Shares?

If your shares of Common

Stock are registered directly in your name with the Company’s transfer agent, you are considered a “shareholder of record”

or a “registered shareholder” of those shares. If your shares are held in an account at a bank, brokerage firm or other similar

organization, then you are a beneficial owner of shares held in “street name.” In that case, you will receive the Company’s

proxy materials from the bank, brokerage firm or other similar organization holding your account and, as a beneficial owner, you have

the right to direct your bank, brokerage firm or similar organization as to how to vote the shares held in your account.

How Do You Attend the Special Meeting?

The Special Meeting is

scheduled to be held on _____________, 2024, at _________. Please see the Company’s proxy statement for instructions on how to attend

the Special Meeting.

What Is the Quorum Requirement for the

Special Meeting?

A quorum is the minimum

number of shares of Common Stock that must be represented at a duly called meeting in person or by proxy in order to legally conduct business

at the meeting. A majority of the outstanding shares of Common Stock entitled to vote at the Special Meeting, present at the meeting or

represented by proxy, will constitute a quorum at the Special Meeting. Shares that abstain from voting or withhold authority on any Proposal

or that are represented by broker non-votes (as discussed below), will be treated as shares of Common Stock that are present and entitled

to vote at the Special Meeting for purposes of determining whether a quorum is present.

What is the Effect of an “ABSTAIN”

Vote?

Abstentions are considered

to be present and entitled to vote with respect to each relevant proposal but are not considered “votes cast” on the Proposals.

Votes from shareholders to “ABSTAIN” with respect to the Bylaw Restoration Proposal and the Removal Proposal will have the

same effect as a vote “AGAINST” that Proposal. Votes from shareholder to “ABSTAIN” with respect to the Director

Election Proposal will have no effect on the outcome of the outcome of that Proposal.

What is a Broker Non-Vote?

A “broker non-vote”

occurs when a broker submits a proxy for the meeting with respect to a discretionary matter but does not vote on non-discretionary matters

because the beneficial owner did not provide voting instructions on those matters. None of the matters to be voted on at the Special Meeting

will be considered a discretionary matter under the New York Stock Exchange (“NYSE”) rules governing brokers’ discretionary

authority; therefore, each Proposal will be considered to be “non-routine” and a broker that is subject to such rules will

not have authority to vote shares held by a beneficial owner without receiving instructions from the beneficial owner regarding each of

the Proposals. If your shares are held of record by a bank, broker or other nominee, we urge you to give instructions to your bank, broker

or other nominee as to how you wish your shares to be voted so you may participate in the shareholder voting on these important matters.

What Vote is Required to Approve the Proposals?

Approval of the Proposals

requires the following shareholder votes:

| · | The Bylaw Restoration Proposal: Approval of the Bylaw Restoration Proposal requires the

affirmative vote of the holders of a majority of the shares of Common Stock outstanding on the Record Date. |

| · | The Removal Proposal: Removal of an incumbent director requires the affirmative vote of

the holders of a majority of the shares of Common Stock outstanding on the Record Date. |

| · | The Director Election Proposal: The election of a Nominee requires the affirmative vote

of a majority of the votes cast by the holders of shares of Common Stock outstanding on the Record Date, assuming a quorum is present,

with “votes cast” meaning votes “FOR” or “AGAINST” the election of a Nominee; except that if the number

of director nominees exceeds the number of directors to be elected, then Nominees will be elected by a plurality of the votes cast, meaning

that the Nominees receiving the highest number of “FOR” votes will be elected. |

What Should You Do in Order to Vote for

the Proposals?

Your vote is important,

no matter how many or how few shares of Common Stock you own. Elliott urges you to vote “FOR” each of the Proposals by following

the instructions on the enclosed GOLD proxy card.

| · | If your shares of Common Stock are registered in your own name, please vote (i) through the Internet at

any time prior to __________ on __________, 2024 by following the instructions on the enclosed GOLD proxy card; (ii) by telephone

from the United States, by calling __________ at any time prior to __________ on __________, 2024; or (iii) by signing and dating the

enclosed GOLD proxy card and returning it to Elliott, c/o Okapi Partners LLC (“Okapi Partners”), in the enclosed postage-paid

envelope today. |

| · | If your shares of Common Stock are held in a brokerage account or bank, you are considered the beneficial

owner of the shares of Common Stock, and these proxy materials, together with a voting form, are being forwarded to you by your broker

or bank. As a beneficial owner, you must instruct your broker, trustee or other representative how to vote. Your broker cannot vote your

shares of Common Stock on your behalf without your instructions. Depending upon your broker or custodian, you may be able to vote either

by toll-free telephone or by the internet. Please refer to the enclosed voting form for instructions on how to vote electronically. You

may also vote by signing, dating and returning the enclosed voting form. |

Since only your latest

dated proxy card will count, we urge you not to vote any proxy card you receive from the Company. If you vote the WHITE management proxy

card, it will revoke any proxy card you may have previously sent to us, so please make certain that the latest dated proxy card you vote

is the GOLD proxy card.

What Does it Mean if You Receive More

Than One GOLD Proxy Card on or About the Same Time?

It generally means that

you hold shares registered in more than one account. In order to vote all of your shares, please sign, date, and return each GOLD

proxy card or, if you vote via the internet or telephone, vote once for each GOLD proxy card you receive.

How Do I Revoke a Proxy?

Shareholders of the Company

may revoke their proxies at any time prior to exercise by attending the Special Meeting and voting (although attendance at the Special

Meeting will not in and of itself constitute revocation of a proxy) or by delivering a written notice of revocation. The delivery of a

subsequently dated proxy which is properly completed will also constitute a revocation of any earlier proxy.

The revocation may be delivered

either to Elliott in care of Okapi Partners at the address set forth on the back cover of this Proxy Statement or to the Company at Southwest

Airlines Co., Attn: Corporate Secretary, Legal Department, HDK-4GC, P.O. Box 36611, Dallas, Texas 75235 or any other address provided

by the Company. Although a revocation is effective if delivered to the Company, we request that either the original or photostatic copies

of all revocations be mailed to Elliott in care of Okapi Partners at the address set forth on the back cover of this Proxy Statement so

that we will be aware of all revocations and can more accurately determine if and when proxies have been received from the holders of

record on the Record Date of a majority of the outstanding shares of Common Stock.

Additionally, Okapi Partners

may use this information to contact shareholders who have revoked their proxies in order to solicit later dated proxies for the approval

of the Proposals.

Whom Should I Call If I Have Any Questions

About the Solicitation?

Okapi Partners is assisting

Elliott with its effort to solicit proxies. If you have any questions or require assistance in authorizing a proxy or voting your shares

of Common Stock, please contact:

1212 Avenue of the Americas, 17th Floor

New York, NY 10036

Banks and Brokerage Firms, Please Call: (212) 297-0720

Shareholders and All Others Call Toll-Free: (877) 629-6357

E-mail: info@okapipartners.com

Your vote is important,

no matter how many or how few shares of Common Stock you own. Elliott urges you to vote “FOR” each of the Proposals by following

the instructions on the enclosed GOLD proxy card.

BACKGROUND TO THE SOLICITATION

The following is a chronology of material events leading up to this

proxy solicitation.

| • | | On June 9, 2024, Elliott sent an email to Gary Kelly, Executive Chairman and former Chief

Executive Officer of the Company, requesting a phone call for later that day. Mr. Kelly and Robert Jordan, the current Chief Executive

Officer of the Company spoke with Elliott late that evening. On the call, Elliott shared that it had a significant investment in the

Company based on its belief in the Company’s tremendous potential. However, Elliott believed that the Company’s outdated

strategy and operational issues have resulted in meaningful underperformance, and changes at the Company would be necessary to address

those issues. Elliott stated that it would be issuing certain public materials on June 10, 2024 calling for changes at the Company. |

| • | | On June 10, 2024, Elliott issued a public letter to the Board and an accompanying presentation

titled “Stronger Southwest”, communicating its views on Southwest’s disappointing performance and its recommendations

to drive improved results at the Company, including enhancing the Board, upgrading leadership and undertaking a comprehensive business

review. |

| • | | Also on June 10, 2024, the Company issued a press release responding to Elliott’s letter

and presentation. Although the Company stated its willingness to meet with Elliott, the Company asserted “[w]e are confident that

Southwest Airlines has the right strategy, the right plan and the right team in place” and it is “confident in our CEO and

Leadership Team's ability to fulfill our strategy to drive long-term value for all Shareholders.” |

| • | | On June 19, 2024, Elliott met with Southwest’s representatives at the Company’s

headquarters in Dallas, Texas, including Mr. Kelly, Mr. Jordan, William Cunningham (Lead Independent Director), Christopher Reynolds

(a director), and Julia Landrum (Vice President Investor Relations). Elliott also had a separate meeting with Mr. Kelly, Mr. Cunningham

and Mr. Reynolds. During these meetings, Elliott reiterated its view that the Company had severely underperformed and that the changes

discussed in Elliott’s public letter and presentation are required to restore the Company’s industry-leading performance. |

| • | | On June 26, 2024, the Company filed a Form 8-K with the SEC updating its second quarter financial

guidance, including a substantial reduction to revenue guidance provided only two months earlier. |

| • | | Also on June 26, 2024, Elliott issued a press release observing that the Company’s

announcement represented its eighth guidance reduction in the last 18 months and reiterating the need for change in light of the Company’s

unacceptable performance. |

| • | | On July 2, 2024, Mr. Kelly and Mr. Cunningham called Elliott to request a meeting to discuss

the Company’s plans for the future. Elliott responded that it would be happy to set up a meeting, and Mr. Kelly and Mr. Cunningham

stated that their advisers would be reaching out. Mr. Kelly and Mr. Cunningham reiterated that the Board remained supportive of current

management and that management changes would not be considered. |

| • | | Later that day, Elliott joined a phone call with representatives of Bank of America and Morgan

Stanley, acting as advisors to the Company. On the call, the Company’s advisors indicated that the Board was fully supportive of

the current management team and that the Company would be announcing a series of initiatives in the coming weeks and months. Elliott

stated its continued willingness to meet with the Company and its advisors, but expressed its firm conviction that leadership change

would be necessary to restore the Company to industry-leading performance. After receiving that feedback from Elliott, Bank of America

and Morgan Stanley did not follow up to schedule the meeting with the Company to which Elliott had agreed. |

| • | | On July 3, 2024, the Company announced that the Board had adopted a defensive shareholder

rights plan (typically referred to as a “poison pill”) on July 2, 2024, which the Company asserted was done in response to

Elliott’s accumulation of a significant economic interest in the Company. The poison pill effectively prevents any shareholder

from acquiring beneficial ownership of 12.5% or more of the Common Stock outstanding (subject to certain exceptions) by imposing significant

dilution risk if a shareholder crosses that ownership threshold. The poison pill was adopted by the Board without shareholder approval,

and the poison pill’s continuation was not made subject to shareholder approval. The poison pill expires on July 1, 2025. |

| • | | On July 7, 2024, the Board expanded its size to 15 members and appointed Rakesh Gangwal as

a member of the Board, effective immediately. In a press release issued by the Company on July 8, 2024, announcing Mr. Gangwal’s

appointment to the Board, Mr. Gangwal immediately indicated his alignment with the Board and management’s status-quo plans, stating

that he “look[ed] forward to supporting the Company’s strategic direction”. |

| • | | On July 8, 2024, Elliott issued a public letter to the Board expressing concerns regarding

the Board’s adoption of the poison pill and its appointment of a new already-aligned director in an effort to entrench its failed

Board and management team. Elliott also shared supportive feedback from key constituents about the need for leadership change at the

Company, and called out the risk that the Board would announce a package of short-term focused half-measures with the objective of further

entrenching itself and avoiding more fundamental change. Elliott stated this would inevitably lead to worse performance over time. |

| • | | On July 25, 2024, the Company reported its second quarter 2024 financial results, which included

guidance for a year-over-year decrease in unit revenue and an 11% to 13% increase in unit costs excluding fuel in the third quarter.

The Company also announced various new initiatives, including plans to assign seats, offer premium seating options, and introduce redeye

flying. |

| • | | Also on July 25, 2024, Elliott issued a press release commenting on the Company’s announcement

of new initiatives, stating that the changes came “more than a decade late”, amounted to an admission that “four out

of five customers’ preferences went unmet in recent years”, and showed that management “simply was not doing its job.”

Elliott also reiterated the lack of credibility of the Company’s leadership with shareholders to execute on the announced initiatives. |

| • | | On August 5, 2024, Mr. Kelly contacted Elliott to schedule a potential meeting. After discussions

regarding timing, the Company and Elliott scheduled a meeting for September 9, 2024. |

| • | | Also on August 5, 2024, Elliott filed an initial Schedule 13D with the SEC, disclosing beneficial

ownership of approximately 7.0% of the outstanding shares of Common Stock, and a combined economic exposure in the Company of approximately

11.0% of the shares of Common Stock outstanding. |

| • | | On August 13, 2024, Elliott issued a press release announcing its intent to nominate ten

independent, highly qualified candidates for election to the Board and introducing the Nominees. |

| • | | Also on August 13, 2024, Elliott filed an amendment to the Schedule 13D, disclosing beneficial

ownership of approximately 8.2% of the outstanding shares of Common Stock and a combined economic exposure in the Company of approximately

11.0% of the shares of Common Stock outstanding. |

| • | | On August 14, 2024, the Company issued a press release commenting on Elliott’s announcement

of its intent to nominate the Nominees for election to the Board, and reiterating the Board’s confidence that the Company has the

right leadership in place. Following Elliott’s announcement of its slate of Nominees, the Company and its representatives reached

out to Elliott to request interviews with the Nominees. Elliott informed the Company that once Elliott and the Company are able to align

on a framework to address Elliott’s concerns then it would be happy to make the Nominees available for interviews and noted Elliott’s

interest in having a full discussion at the meeting scheduled for September 9, 2024. Notwithstanding Elliott’s response, the Company

reached out to certain of the Nominees directly, and without Elliott’s consent, to request interviews, which requests were declined. |

| • | | On August 26, 2024, Elliott issued an open letter to shareholders of the Company. In the

letter, Elliott laid out its framework for change at Southwest and stated that it was eager to work with the Board on the urgent changes

needed at the Company. However, Elliott expressed its concern with the Board’s public statements that discussion of the jobs of

Mr. Jordan and Mr. Kelly, the central question of the Company’s leadership and the need for accountability for the Company’s

years of underperformance, were off the table. Elliott noted that “so long as the jobs of Mr. Jordan and Mr. Kelly remain sacrosanct

– and they remain empowered to make every critical decision at the Company without proper oversight from a Board that has failed

for years to hold them accountable – it is preferable to give shareholders a direct say on the question of who should be leading

Southwest.” |

| • | | Also on August 26, 2024, Elliott filed an amendment to the Schedule 13D, disclosing beneficial

ownership of approximately 9.7% of the outstanding shares of Common Stock, and a combined economic exposure in the Company of approximately

11.0% of the shares of Common Stock outstanding. |

| • | | On September 3, 2024, Elliott filed a Form 3 reporting ownership of approximately 10.2% of

the Common Stock outstanding. |

| • | | On September 9, 2024, Elliott met with Southwest’s representatives, including Messrs.

Kelly and Gangwal and Lisa Atherton (a director). At that meeting, the Company informed Elliott that it had determined to issue a press

release the next day announcing, among other things, that six directors would retire from the Board in November 2024, Mr. Kelly would

retire from the Board and his Executive Chairman position effective immediately after the 2025 Annual Meeting, and the Board would appoint

four new directors to the Board. The Company also shared with Elliott a proposed settlement framework, which provided that the four new

directors would be appointed effective upon the retirement of the departing directors in November 2024, and up to three of the new directors

could be candidates from Elliott’s slate, subject to the parties entering into a settlement agreement including standstill, voting

and non-disparagement provisions to be discussed. The Company requested feedback from Elliott on its proposed settlement framework, but

made clear that the director resignations had already taken place and would need to be announced the following morning in accordance

with the Company’s disclosure obligations. In effect, the Company presented Elliott with a “settlement” framework that

had already been approved by the Board and would be announced exactly as approved without accounting for Elliott’s input on the

key terms. |

| • | | On September 10, 2024, the Company issued a press release and letter to shareholders announcing

the director retirements and the Board’s intention to appoint new directors, as previewed with Elliott. In the letter, the Company

also stated that the Board and leadership unanimously support Mr. Jordan as CEO. |

| • | | Also on September 10, 2024, Elliott issued a press release commenting on the Company’s

announcements. In the release, Elliott criticized the “unprecedented” and chaotic resignation of nearly half of Southwest’s

Board and stated that “the need for thoughtful, deliberate change at Southwest remains urgent.” |

| • | | On September 17, 2024, Elliott and the Company entered into a mutual confidentiality agreement

to cover discussions between the parties in the lead-up to the Company’s previously announced investor day scheduled for September

26, 2024 (the “Investor Day”), expiring at the conclusion of the Investor Day. |

| • | | On September 18, 2024, Elliott met at the Company’s headquarters in Dallas, Texas,

with Southwest’s representatives, including Mr. Jordan, Andrew Watterson (Chief Operating Officer), Ryan Green (Chief Commercial

Officer), Tammy Romo (Chief Financial Officer), Justin Jones (Executive Vice President Operations), Tony Roach (Chief Customer Officer),

and Lauren Woods (Chief Information Officer). At the meeting, the Company presented the business plan that it intended to announce at

the Investor Day. |

| • | | On September 21, 2024, Elliott spoke with Mr. Kelly. Elliott informed the Company that the

business plan it intended to announce at the Investor Day fell short of the Company’s potential, and did not address the central

concern of Elliott and the Company’s other shareholders – the lack of credibility of the Company’s leadership to guide

the Company through the execution of a new business plan. Regarding the Company’s proposed settlement framework, Elliott informed

the Company that it believed more meaningful change to the Board would be necessary and proposed the appointment of eight new directors

from Elliott’s slate, the acceleration of the retirement of Mr. Kelly and the announcement of an immediate CEO transition, with

the reconstituted Board selecting an interim CEO and conducting a full search process for new leadership. |

| • | | On September 22, 2024, Elliott spoke with Ms. Atherton and Mr. Gangwal and reiterated its

views and settlement proposal shared with Mr. Kelly the day before. Ms. Atherton and Mr. Gangwal informed Elliott that the Company rejected

Elliott’s settlement proposal, and did not provide a counter-proposal. Elliott also offered the opportunity for Ms. Atherton and

Mr. Gangwal to meet with one of the Nominees to assess the skills and experience this nominee would bring to the Southwest Board, as

the Company’s representatives had previously requested. Ms. Atherton and Mr. Gangwal rejected that offer as well. |

| • | | On September 24, 2024, Elliott issued an open letter to shareholders of the Company. In the

letter, Elliott informed shareholders of its intent to call a special meeting in the coming weeks and noted the urgency of leadership

changes: “Given the reckless and chaotic actions that Southwest’s leaders keep taking in an attempt to preserve their own

jobs – and the resulting risk to the Company and its constituents – the need for change is urgent.” The letter urged

shareholders to work with their banks and brokers as soon as possible to ensure that they are able to vote all their Southwest shares

at the Special Meeting. |

| • | | Also on September 24, 2024, the Company issued a press release responding to Elliott’s

letter, asserting that “CEO Bob Jordan is the right Leader to successfully execute the Company's robust strategy to transform the

airline and deliver sustainable Shareholder value”, and “[a]ny Leadership change amid such a significant transformation would

be detrimental to all Shareholders.” |

| • | | Also on September 24, 2024, counsel to Elliott delivered a letter to counsel to the Company

requesting that the Board confirm that it will set a record date for the Special Meeting that is not fewer than ten days, and not greater

than twenty days, following Elliott’s delivery to the Company of formal notice of its request that the Company call the Special

Meeting (the “Record Date Letter”). |

| • | | On September 26, 2024, the Company held the Investor Day and announced a new business plan,

including the previously announced addition of assigned seating and premium seating, and new 2027 financial targets. |

| • | | Also on September 26, 2024, Elliott released a statement noting, “Without credible

leadership that can execute, this plan – filled with long-dated promises of better performance – risks becoming the latest

in Southwest’s long series of failed improvement initiatives.” Elliott’s statement indicated that “[w]e remain

determined to call a special meeting at which shareholders’ voices can be heard.” |

| • | | On September 27, 2024, counsel to the Company delivered a letter to counsel to Elliott confirming

receipt of the Record Date Letter, but not providing the requested confirmations. |

| • | | On October 6, 2024, Elliott had a call with Mr. Jordan and Jeff Novota (General Counsel),

which focused on better understanding each side’s perspectives. At the conclusion of the call, Elliott and Mr. Jordan agreed to

keep an open line of communication going forward. |

| • | | On October 8, 2024, Elliott spoke with members of the Company’s management, including

Messrs. Jordan, Watterson and Green, and Ms. Romo. On the call Elliott shared its perspectives regarding the Company and management’s

plans announced at the Investor Day. On the call, Elliott stated that it shares the market’s apparent skepticism regarding the

Company’s ability to execute these plans and confusion concerning certain of the figures presented in the Company’s plan. |

| • | | On October 9, 2024, Mr. Milton, a Nominee, spoke with Mr. Kelly. Mr. Milton encouraged Mr.

Kelly to reach out to Elliott to engage on a potential settlement ahead of Elliott calling the Special Meeting. Mr. Milton acknowledged

that while he was not positioned to negotiate on behalf of Elliott, he relayed Elliott’s potential openness to a resolution in

which a Board led by new independent directors with the confidence of stockholders would evaluate the Company’s leadership and

hold them accountable. In view of Mr. Milton’s 20-year professional relationship with Mr. Kelly, Mr. Milton also said he would

be willing to step in as Executive Chairman on a transitional basis until a permanent Chair could be identified. |

| • | | Also on October 9, 2024, Elliott spoke with Mr. Kelly. Mr. Kelly again requested for the

Company to interview Elliott’s Nominees, and Elliott reiterated to Mr. Kelly that it would be happy to arrange for the Nominees

to be interviewed once Elliott and the Company are able to align on a comprehensive framework. Elliott also informed Mr. Kelly that Elliott

would be prepared to engage in a conversation on meaningful Board changes as part of a potential settlement framework, and to enter into

a mutual confidentiality agreement to cover discussions between the parties. Elliott did not receive a response from the Company through

October 14, 2024. |

| • | | On October 14, 2024, Elliott delivered to the Company a letter requesting that the Company

call a special meeting of shareholders for the purpose of considering and voting upon the Proposals. Concurrently, Elliott delivered

to the Company a notice of business proposals and director nominations, submitting the Proposals for shareholder consideration and nominating

the Nominees for election at the Special Meeting. The notice reflected Elliott’s nomination of the eight Nominees for election

to the Board. |

| • | | Also on October 14, 2024, Elliott issued a press release announcing the delivery of the special

meeting request and the nomination of the eight Nominees for election to the Board, and calling on the Company to confirm the date of

the Special Meeting promptly without unnecessary delay. |

| • | | Also on October 14, 2024, the Company issued a press release confirming receipt of Elliott’s

request for a special meeting. |

| • | | On October 15, 2024, Elliott filed this preliminary proxy statement for the Special Meeting

with the SEC. |

REASONS FOR THE SOLICITATION

Elliott holds an 11% economic interest in Southwest,

making us one of the Company’s largest shareholders. We made this substantial investment because we strongly believe that with the

right leadership and proper oversight, Southwest can reclaim its position as a top-performing airline.

Southwest Airlines is an iconic American company

with a storied history. Southwest revolutionized the airline industry with its innovative business model when it began service in 1971

and grew into the largest domestic carrier with a brand beloved by customers and a culture that inspired employees.

Today, however, and for many years now under the

current Board and leadership, Southwest has been delivering unacceptable financial performance and is failing shareholders, employees,

and customers alike. Southwest, which once led the industry in profitability, is expected to barely generate an operating profit this

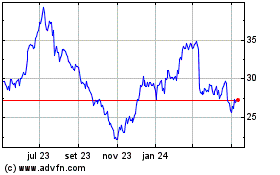

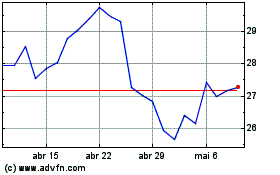

year. Southwest’s share price has declined by more than 50% over three years1,

dramatically underperforming its peers. Southwest stranded more than two million customers during the holidays in 2022 in a meltdown caused

by its outdated technology systems, and the Company now admits that its current product offering is not aligned with the preferences of

more than 80% of its current and prospective customers. Employees have suffered financially as well – they have seen profit-sharing

payments and the value of employee-owned stock decline by more than a billion dollars, and they are losing faith in leadership’s

ability to deliver a promising future for the airline.

The drivers of these problems are clear: decades

of inaction by a management team and Board that took Southwest’s success for granted, compounded by avoidable execution missteps.

Following Elliott's public push for changes, Southwest's

leadership responded with long-overdue strategic and corporate governance initiatives. While these actions signaled a recognition that

change is necessary, they failed to address Southwest's core problem: the capability of long-tenured leadership to execute on a “transformational”

shift in Southwest’s business given their track record of poor execution, and the Board’s unwillingness to hold management

accountable for unacceptable performance. Why should shareholders have confidence that the same people responsible for Southwest’s

years-long decline are now the right people to put the Company on a new path? And given the dynamic nature of the airline industry, how

can shareholders be confident that the current Board and leadership will be able to continuously adapt Southwest’s strategy to meet

changing customer preferences?

The need for accountability and competent oversight

could not be more urgent. We are pursuing a special meeting because Southwest’s serious shortcomings in oversight and expertise

cannot remain unaddressed for another seven months until the annual meeting, particularly as the management team is attempting to execute

on “the most transformational plan we have ever had.”

Shareholders need a best-in-class Board of

Directors in place – NOW – during this critical juncture for the future of Southwest.

The independent directors we have nominated bring

industry-leading expertise – including experience leading similar transformations at other airlines – and the independence

to hold the Company’s management accountable for delivering improved results. Time is of the essence to deliver these oversight

changes – as we have seen again and again, a Board and management team without the requisite experience and accountability can substantially

erode the Company’s value in a short period of time, and the cost of that failure will be borne by shareholders.

1

Represents the prior three years ending on 6/7/2024, the last trading day prior to the date Elliott launched its public campaign. Source:

Bloomberg.

Since the launch of our campaign at Southwest,

we have focused on these key initiatives aimed at restoring the Company to its rightful place as an industry leader:

1)

Board: We believe that board transformation at Southwest must be comprehensive, strengthening the Board with accomplished leaders

who bring relevant expertise in modernizing the airline. To this end, we have nominated a highly qualified slate of eight independent

directors.

2)

Leadership Accountability: Southwest’s leadership has delivered unsatisfactory results and has not been effectively overseen

by the current Board. A world-class, independent Board with the right skills will be able to hold management accountable and ensure the

successful execution of necessary operational and strategic changes.

3)

Strategy and Operations: Southwest has recently introduced a range of strategic initiatives that have never been attempted by the

current management team. For these efforts to succeed, leadership must fully leverage the expertise of a refreshed board, including that

of our eight nominees—several of whom have successfully implemented similar business model changes at other airlines. Additionally,

the Investor Day plan announced by Southwest lacks critical details and risks falling short of the Company’s full potential. We

believe it is imperative that a highly credible, independent board be in place to evaluate the Company’s strategy and operations

and enable the Company to fully capitalize on this pivotal moment.

Shareholders have waited far too long for Southwest’s

issues to be addressed and cannot afford another series of broken promises and failed initiatives. Southwest’s Board and management

team are now asking for support to execute on multiple transformational initiatives. However, this same team has repeatedly failed to

execute on improvement initiatives in the recent past: promises to increase operating income by $2.5 billion to $3.0 billion over the

last three years have instead resulted in billions of dollars of long-term profitability declines. Despite management’s latest long-dated

promises to improve profitability, shareholders are faced with the sobering reality that current leadership has delivered poor financial

performance and has driven Southwest into retreat in key markets.

FINANCIAL PERFORMANCE HAS BEEN UNACCEPTABLE

UNDER THE CURRENT MANAGEMENT AND BOARD

In the three years prior to Elliott launching

its campaign, Southwest’s stock declined by more than 50% and was trading in line with the levels it reached in March 2020, during

the depths of the COVID-related travel shutdowns. Southwest was on-pace to have its fifth consecutive year of negative shareholder returns.2

2

As of the close of business on 6/07/2024, the last trading day prior to the date Elliott launched

its public campaign. Source: Bloomberg.

This share-price underperformance has been driven

by extremely poor financial performance – from 2018 to 2023, Southwest’s unit costs increased the most among peers, while

its unit revenue increased the least among peers. EBIT margins compressed by 1,100 basis points during that period.

Despite clear feedback that this performance was

unacceptable – including 16 downgrades from research analysts, stock underperformance on 17 of 20 recent earnings events3

and direct communication from investors calling for change – management and the Board failed to acknowledge this reality and take

action. Management assessed that the Company had a “great 2023” and said they were “extremely proud of our progress

and accomplishments.”

MANAGEMENT AND THE BOARD HAVE LOST CREDIBILITY

WITH KEY CONSTITUENTS

Since launching our campaign on June 10, we have

engaged with Southwest’s shareholders and labor groups, both of whom expressed deep frustration over leadership’s failure

to address the Company’s declining performance and concerns about the capability of the current Board and management team to deliver

a brighter future for Southwest. In an independent third-party survey of the airline industry, shareholders rated Southwest as the worst-performing

major U.S. airline across all key categories.4

3

As of 6/10/2024, the date Elliott launched its public campaign.

4

An independent third party shareholder survey firm canvassed both Southwest’s shareholders and other airline investors to understand

sentiment on Southwest and its peers.

Our extensive dialogue with leaders from several

of Southwest’s labor groups has also revealed a profound lack of confidence in leadership among the frontline workers.

“There’s a reason Elliott and

the FAA are here at the same time. And yet, nobody in Dallas can admit that those tasked with fixing the problem are the ones who created

it. We need bold leaders who have the creativity and insight to reexamine a corporate culture that has stagnated for years.”

- Southwest Airlines Pilots Association, 8/12/2024

“It is simply amazing that the airline

with the strongest network in the history of our industry is now retreating in a major market because this management group has failed

to evolve and innovate.” - Southwest Airlines Pilots Association, 9/25/2024

“It speaks volumes when the best

Chiefs in our system don’t step up for jobs in Dallas, and the incestuous group of Dallas good ol’ boys occupy seats that

never seem to produce the one thing we truly need: results.” - Southwest Airlines Pilots Association, 9/16/20245

Without best-in-class perspectives on the Board

to guide this “transformation,” an open-minded evaluation of management’s capability to deliver on this latest plan,

and the accountability to ensure targets are achieved, Southwest risks yet another failure at this critical juncture for the future of

the Company.

ELLIOTT HAS PROPOSED EIGHT HIGHLY QUALIFIED

INDEPENDENT DIRECTORS TO DELIVER A BRIGHER FUTURE

We have nominated eight highly-qualified independent

directors who bring significant expertise and deep experience to the Board. Once elected, these individuals will collaborate with the

remaining Board members to guide the execution of a plan to restore Southwest’s best-in-class performance, hold the current leadership

team accountable and assess new strategic and operational opportunities. The Nominees were chosen through a rigorous, months-long global

search to identify individuals with the ideal blend of skills and backgrounds to address Southwest’s current challenges and unlock

the Company's full potential.

The full biographies

of the Nominees follow:

Michael Cawley

Former Deputy CEO, COO and CFO of Ryanair

A longtime senior executive at Ryanair, Michael

Cawley has decades of experience at the world’s most successful low-cost carrier. Cawley has a broad range of expertise from his

17-year executive career at Ryanair, having served as Deputy CEO, Chief Operating Officer, CFO and Commercial Director. During Cawley’s

tenure as an executive at Ryanair, the company grew from serving less than 3 million passengers to 82 million passengers annually and

delivered a more than 2,700% total shareholder return. Cawley recently retired from the Board of Ryanair, where he guided the company

to achieve an additional 155% total shareholder return after his tenure as an executive. Cawley played an integral role in creating and

growing one of the world’s most successful airlines with a cost-focused culture that serves as a benchmark for low-cost carriers

globally. Cawley’s extensive experience in the airline industry, developed over nearly three decades of leadership at Ryanair, would

make him a valuable addition to the Southwest Board as it seeks to improve performance.

5

Emphases added.

David Cush

Former CEO of Virgin America

David Cush brings 30 years of aviation experience,

including nine years as CEO of Virgin America and two decades of experience at American Airlines in various operational, sales and network

planning roles. Under Cush’s leadership, Virgin America delivered an exceptional customer experience that resulted in the company

winning “Best U.S. Airline” in Conde Nast Traveler’s readers’ choice awards for nine consecutive years

and the top position in Consumer Reports’ airline customer satisfaction rankings. Cush joined Virgin America as CEO

just after the airline’s inaugural flight, and led the airline through the turmoil of the financial crisis and a subsequent period

of rapid growth. Cush led Virgin America to realize its first annual profit, oversaw its successful initial public offering and ultimately

negotiated the airline’s acquisition by Alaska Airlines. Cush’s leadership delivered a 148% total shareholder return

over Virgin America’s two years as a publicly traded company. After the sale of Virgin America, Cush served as interim CEO

and subsequently CEO of Service King Paint & Body, a Blackstone and Carlyle-owned collision repair business. As a former airline CEO

with a demonstrated track record of fostering a strong employee culture and best-in-class customer service, Cush would bring deep experience

to Southwest’s effort to build upon the Company’s core cultural strengths while evolving and modernizing the strategy.

Sarah Feinberg

Former Transportation

Regulator and Administrator of the Federal Railroad Administration

Sarah Feinberg is an

experienced transportation regulator who formerly served as Administrator of the Federal Railroad Administration, Chief of Staff to the

U.S. Secretary of Transportation and Interim President of the New York City Transit Authority. As Administrator of the Federal Railroad

Administration, the railroad safety regulator within the Department of Transportation, Feinberg focused on enhancing the safety of the

rail network after a series of accidents. During her tenure, Feinberg became known for her aggressive enforcement of safety regulations

and promotion of investments to improve the safety of the rail system. As Chief of Staff to the U.S. Secretary of Transportation, Feinberg

oversaw and advised on a broad range of initiatives across the aviation and broader transportation sector. Feinberg would bring experience

crucial to the Southwest Board’s foremost mission of ensuring the safety of the Company’s employees and customers.

Hon. Joshua “Josh” Gotbaum

Seasoned Advisor to Companies and Labor Groups

and Former Hawaiian Airlines Trustee

Josh Gotbaum has decades of experience as an advisor

to both airline management teams and labor. As an investment banker at Lazard, Gotbaum advised in transactions involving both US carriers

and foreign flag carriers. At Hawaiian Airlines, Gotbaum led and managed the airline’s successful emergence from chapter 11 with

Hawaiian achieving both the highest operating margin and best on-time performance of the U.S. carriers, which permitted a full recovery

for Hawaiian’s creditors, new employee contracts with pay and benefits comparable to or better than peers and a nearly 600% total

return for shareholders over his tenure. He went on to serve as the Director of the Pension Benefit Guarantee Corporation, where he helped

American Airlines preserve its pensions. In prior US government service, Gotbaum had presidential appointments in the White House Office

of Management & Budget, the Department of Treasury and the Department of Defense. As an Operating Partner at Blue Wolf Capital, he

was involved in several successful business transformations. In 2023, Gotbaum was nominated to serve on the Board of Starbucks by a coalition

of labor unions as part of a successful effort to show the connection between good union relationships and shareholder value. Gotbaum

previously served on the Boards of PulteGroup, TD Bank, N.A., Thornburg Investment Management and Safety-Kleen Systems. As he did at Hawaiian

Airlines, Gotbaum intends to work to ensure the Company’s unique employee culture is preserved and its unions are engaged as Southwest

implements strategic and operational improvements.

David “Dave”

Grissen

Former Group President of Marriott International

Dave Grissen is the former Group President of

Marriott International. As Group President, Grissen led all functions for Marriott’s brands in the Americas and for the Ritz Carlton

and EDITION brands globally, including strategy, revenue management, sales and marketing, operations, food and beverage, technology, development

and human resources. Grissen managed hotels representing approximately two-thirds of Marriott’s fee revenue, a workforce of 160,000

people and a successful growth strategy that resulted in Marriott’s Americas organization nearly doubling from 2,928 hotels to 5,640

hotels plus 1,800 pipeline hotels under his leadership. Grissen’s extensive experience leading a large hospitality franchise, growing

a storied brand and delivering top-tier results would be valuable to the Southwest Board. Grissen also currently serves as the Chairman

of Regis and is on the Board of Chatham Lodging Trust.

Robert Milton

Former CEO of Air Canada and ACE Aviation Holdings

and Former Chairman of United Airlines

Robert Milton brings more than 40 years of experience

in the aviation industry, including a total of 13 years as CEO of Air Canada and its holding company ACE Aviation and two years as Chairman

of United Airlines. After taking over as CEO of Air Canada amid a challenging operating environment and struggling financial performance,

Milton successfully repositioned the airline for long-term success and delivered substantial value creation. As Chairman of United Airlines,

Milton oversaw the initiation of the airline’s repositioning and turnaround. Milton’s deep airline turnaround experience and

track record of shareholder value creation in the airline industry would enable him to provide valuable guidance to a new management team

as it develops a strategy to restore Southwest’s industry-leading position. Milton is a current director of Air Lease Corporation

and has previously served as a director at US Airways, AirAsia, TAP Air Portugal, Cathay Pacific Airways and Breeze Airways.

Gregg Saretsky

Former CEO of WestJet

Gregg Saretsky brings significant leadership experience

and industry knowledge with a nearly 40-year career in aviation, including having served as CEO of WestJet for eight years. At WestJet,

Saretsky led the evolution of the airline from providing a one-dimensional product offering to having a modern commercial strategy, generating

a total shareholder return of more than 100% during his tenure as CEO. Prior to WestJet, Saretsky served in a number of senior-level commercial

and operational roles at Alaska Airlines, including Executive Vice President of Flight Operations & Marketing. Saretsky’s extensive

industry knowledge and learnings from driving transformational change would be valuable to the Southwest Board in guiding and overseeing

strategic changes at the Company. Saretsky is also a current director of IndiGo and RECARO Aircraft Seating.

Patricia “Patty” Watson

CIO and CTO of NCR Atleos

Patty Watson is an

experienced technology executive with a track record of developing modernization plans and overseeing IT transformations at large, complex

financial services and transportation/logistics companies. Watson is currently Executive Vice President and Chief Information & Technology

Officer at NCR Atleos. Over the course of her career, she has also served as Executive Vice President and Chief Information Officer of

NCR, Total Systems Services and The Brink’s Company, the President of Cloud Collaboration at Intrado and in various senior technology

roles at Bank of America. Watson is a Director at Rockwell Automation, and previously served on the Boards of USAA Federal Savings Bank

and Texas Capital Bancshares. Prior to her corporate career, Watson served in the U.S. Air Force as a contracting and acquisition officer,

delivering aircraft technology systems, and as a director of operations. Watson’s extensive experience in developing and executing

on complex IT transformations to enable business strategy and growth will be valuable to the reconstituted Board’s task of modernizing

Southwest’s outdated technology infrastructure. As the spouse of a captain who has flown for Southwest for 24 years, Watson recognizes

the importance of preserving Southwest’s culture while modernizing the Company’s operations and strategy to facilitate its

long-term financial success and provide a rewarding career opportunity for its employees.

PROPOSAL NO. 1 –

BYLAW RESTORATION PROPOSAL

The Bylaw Restoration Proposal

seeks to restore the Bylaws to the form filed with the SEC on February 2, 2024, to the extent that the Bylaws are amended by the Board

without shareholder approval through the date of the Special Meeting. Approval of the Bylaw Restoration Proposal would have the effect

of repealing any such amendments by the current Board to the Bylaws. We believe the Bylaw Restoration Proposal is necessary to ensure

that shareholders will be able to take action at the Special Meeting without modification of their rights in a manner that impedes the

effectiveness of the other Proposals or otherwise contravenes the will of shareholders. We are not currently aware of any specific Bylaw

provisions that would be repealed by the adoption of the Bylaw Restoration Proposal.

The following is the text

of the Bylaw Restoration Proposal:

“RESOLVED, that

each provision of, or amendment to, the Bylaws adopted by the Board without the approval of the shareholders of the Company after February

2, 2024 (the date of the most recent publicly disclosed amendment to the Bylaws) and prior to the approval of this resolution be, and

they hereby are, repealed, effective as of the time this resolution is approved by the shareholders of the Company.”

Approval of the Bylaw Restoration

Proposal requires the affirmative vote of the holders of a majority of the shares of Common Stock outstanding on the Record Date. Abstentions

and broker non-votes will therefore have the same effect as a vote “AGAINST” the Bylaw Restoration Proposal.

WE STRONGLY URGE YOU

TO VOTE “FOR” THE BYLAW RESTORATION PROPOSAL ON THE ENCLOSED GOLD PROXY CARD

PROPOSAL NO. 2 –

REMOVAL PROPOSAL

The Board currently consists

of 16 directors. Through the Removal Proposal and the Director Election Proposal, at the Special Meeting we are seeking to remove eight

incumbent directors (including three directors who the Company announced intend to step down from the Board in November 2024) and elect

eight highly qualified Nominees with the ideal blend of skills and backgrounds to address Southwest’s current challenges and unlock

the Company’s full potential. The Director Election Proposal and the experience and qualifications of the Nominees are discussed

in detail in “Proposal No. 3 – Director Election Proposal” below.

In particular, we are seeking

to remove the following directors: Douglas H. Brooks, Eduardo F. Conrado, William H. Cunningham, Thomas W. Gilligan, David P. Hess, Gary

C. Kelly, Elaine Mendoza and Jill A. Soltau.

These directors have stood

behind the Company’s existing leadership team and plans during the course of our engagement with the Company, and have approved

the Company’s poison pill and other actions that appear designed to entrench the Board and management and avoid more fundamental

change. We believe these directors should be held responsible for the Company’s years of deteriorating performance and the lack

of accountability for management. We also believe that these directors have demonstrated a lack of relevant experience needed to restore

the Company to best-in-class performance.

The Company has announced

that six directors intend to step down from the Board effective immediately following the regularly scheduled fourth quarter Board meeting

(scheduled for November 21, 2024). Three of those directors are included in the Removal Proposal in case they do not follow through with

their stated intention to leave the Board. Additionally, the Company announced that the Board intends to appoint three new directors to

the Board. We believe that the appointment of new directors by the incumbent Board in advance of the Special Meeting would constitute

unlawful manipulation of the Company’s corporate machinery. If Elliott learns of the appointment of any new directors to the Board

after September 26, 2024, and a reasonable time before the Special Meeting, Elliott intends to supplement this Proxy Statement and the

enclosed proxy card to provide shareholders with an opportunity to vote by proxy directly on the removal of such new director(s).

The following is the text

of the Removal Proposal:

“RESOLVED,

that Douglas H. Brooks, Eduardo F. Conrado, William H. Cunningham, Thomas W. Gilligan, David P. Hess, Gary C. Kelly, Elaine Mendoza and

Jill A. Soltau, as well as any other person or persons elected or appointed to the Board without shareholder approval after September

26, 2024 and up to and including the date of the Special Meeting (other than any Nominee set forth herein), be and hereby are removed

from office as directors of the Company, effective immediately.”

Removal of an incumbent

director requires the affirmative vote of the holders of a majority of the shares of Common Stock outstanding on the Record Date. Abstentions

and broker non-votes will therefore have the same effect as a vote “AGAINST” the Removal Proposal.

WE STRONGLY URGE YOU

TO VOTE “FOR” THE REMOVAL PROPOSAL ON THE ENCLOSED GOLD PROXY CARD

PROPOSAL NO. 3 –

DIRECTOR ELECTION PROPOSAL

The Board currently consists

of 16 directors. Through the Removal Proposal and the Director Election Proposal, at the Special Meeting we are seeking to remove eight

incumbent directors (including three directors who the Company announced intend to step down from the Board in November 2024) and elect

eight highly qualified Nominees with the ideal blend of skills and backgrounds to address Southwest’s current challenges and unlock

the Company’s full potential.

The following is the text of the Director Election Proposal:

“RESOLVED,

that the shareholders of the Company hereby elect the following individuals to serve as directors of the Company: Michael Cawley, David

C. Cush, Sarah E. Feinberg, Joshua Gotbaum, David J. Grissen, Robert A. Milton, Gregg A. Saretsky and Patricia A. Watson (individually,

a “Nominee” and, collectively, the “Nominees”).”

Set forth below are the

names, ages, business addresses and business experience for the past five years and certain other information furnished to Elliott by

the Nominees, as well as a discussion of the specific experience, qualifications, attributes or skills that led to Elliott’s conclusion

that each Nominee should serve as a director for the Company.

The Nominees are independent

of Elliott and have not made any commitment to us as to actions they will take if elected as directors of the Company. However, we believe

that the Nominees are highly qualified and, if elected, would undertake a thorough review of Southwest’s strategy and operations,

and objectively and pragmatically evaluate additional opportunities to improve the business.

We are not aware of any

existing vacancies on the Board, nor are we aware of any intention by the Board to have any vacancies on the Board as of the Special Meeting,

other than any vacancies that may be created by the removal of existing directors through approval of the Removal Proposal. Although the

Company has announced that six directors intend to resign from the Board in November 2024, the Board decreased the size of the Board to