Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

30 Outubro 2024 - 8:18AM

Edgar (US Regulatory)

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a - 16 or 15d - 16 of

the Securities Exchange Act of 1934

For the

month of October

HSBC Holdings plc

42nd

Floor, 8 Canada Square, London E14 5HQ, England

(Indicate

by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F).

Form

20-F X Form 40-F

30 October

2024

HSBC HOLDINGS PLC SHARE BUY-BACK

HSBC Holdings plc ("HSBC") announces that, as outlined in its announcement

on 29 October 2024, it will commence a share buy-back of

HSBC's ordinary shares of US$0.50 each ("Ordinary

Shares") for up to a maximum

consideration of US$3,000,000,000 (three billion) (the

"Buy-back"). The purpose of the Buy-back is to reduce

HSBC's outstanding Ordinary Shares.

HSBC has entered into irrevocable, non-discretionary buy-back

agreements with Morgan Stanley & Co. International plc

("Morgan

Stanley") to enable the

purchase of Ordinary Shares by Morgan Stanley, acting as principal,

during the period running from 31 October 2024 and ending

no later than 14 February 2025 (subject to regulatory

approval remaining in place), for an aggregate purchase price of up

to US$3,000,000,000 (three billion) and the simultaneous on-sale of

such Ordinary Shares by Morgan

Stanley to

HSBC.

Morgan Stanley will make trading decisions in relation to the

Buy-back independently of HSBC. Any purchases of Ordinary Shares

will be carried out on the London Stock Exchange, Aquis Exchange,

Cboe Europe Limited (through the BXE and CXE order books) and/or

Turquoise (together, the "UK Venues") and/or The Stock Exchange of Hong Kong Limited

("Hong Kong

Stock Exchange").

The repurchases on the UK Venues will be implemented as "on

Exchange" transactions (as such term is defined in the rules of the

London Stock Exchange) and will be "market purchases" for the

purposes of the Companies Act 2006. The repurchases on the Hong

Kong Stock Exchange will be "off-market" for the purposes of the

Companies Act 2006 but will be transactions which occur "on

Exchange" for the purposes of the Rules Governing the Listing of

Securities on The Stock Exchange of Hong Kong Limited

("Hong Kong

Listing Rules") and which

constitute an "on-market share buy-back" for the purposes of the

Hong Kong Codes on Takeovers and Mergers and Share Buy-backs

("Hong Kong

Buy-back Code").

The repurchases will take place in accordance with certain

pre-set parameters and in accordance with (and subject to limits

prescribed by) HSBC's authority to make market purchases and

off-market purchases of its Ordinary Shares, in each case granted

by its shareholders at HSBC's annual general meeting on 3 May

2024 (the "2024

Authority"), Chapter 9 of the

Financial Conduct Authority's Listing Rules, Article 5(1) of the

Market Abuse Regulation (EU) No 596/2014 (as it forms part of

domestic law of the United Kingdom by virtue of the European Union

(Withdrawal) Act 2018, as amended (the "Withdrawal

Act")), the Commission

Delegated Regulation (EU) No 2016/1052 (as it forms part of

domestic law of the United Kingdom by virtue of the Withdrawal

Act), the Hong Kong Listing Rules, the Hong Kong Buy-back Code and

applicable US federal securities laws.

Ordinary Shares repurchased under the Buy-back will be

cancelled.

The maximum number of Ordinary Shares that may be repurchased under

the Buy-back is 1,216,830,835, being the number of Ordinary

Shares able to be repurchased under the 2024 Authority as reduced

by the number of Shares repurchased by the Company since the 2024

Authority was granted.

Investor enquiries to:

Neil

Sankoff

+44 (0) 20 7991

5072 investorrelations@hsbc.com

Media enquiries to:

Gillian

James

+44 (0) 20 7992

0516 gillian.james@hsbcib.com

Note to editors:

HSBC Holdings plc

HSBC Holdings plc, the parent company of HSBC, is headquartered in

London. HSBC serves customers worldwide from offices in 60

countries and territories. With assets of US$3,099bn at 30

September 2024, HSBC is one of the world's largest banking and

financial services organisations.

ends/all

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

HSBC

Holdings plc

|

|

|

|

|

|

By:

|

|

|

Name:

Aileen Taylor

|

|

|

Title:

Group Company Secretary and Chief Governance Officer

|

|

|

|

|

|

Date:

30 October 2024

|

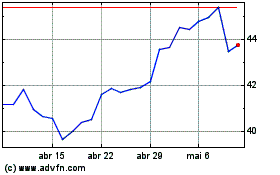

HSBC (NYSE:HSBC)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

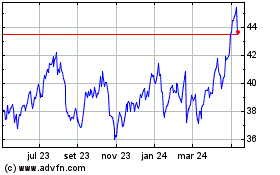

HSBC (NYSE:HSBC)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024