0001064728false00010647282024-10-312024-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 31, 2024

PEABODY ENERGY CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Delaware | | 1-16463 | | 13-4004153 |

(State or other jurisdiction of

incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | | | |

| 701 Market Street, | St. Louis, | Missouri | | | | 63101-1826 |

| (Address of principal executive offices) | | | | (Zip Code) |

| |

| Registrant's telephone number, including area code: | (314) | 342-3400 |

| |

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

| |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | BTU | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On October 31, 2024, Peabody Energy Corporation (“Peabody” or the “Company”) issued a press release setting forth Peabody’s third quarter 2024 financial results and providing guidance on selected fourth quarter and full-year 2024 targets. A copy of Peabody’s press release is attached hereto as Exhibit 99.1.

The information furnished in this Item 2.02, including Exhibit 99.1 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filings under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 8.01. Other Events.

On October 31, 2024, the Company issued a press release announcing that its Board of Directors declared a quarterly dividend of $0.075 per share on the Company’s common stock. The dividend is payable on December 4, 2024 to stockholders of record on November 14, 2024.

A copy of the Company’s press release regarding the foregoing is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Exhibit No. | Description of Exhibit |

| 99.1 | |

| 99.2 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| PEABODY ENERGY CORPORATION |

| |

| October 31, 2024 | By: /s/ Mark A. Spurbeck |

| Name: Mark A. Spurbeck |

| Title: Executive Vice President and Chief Financial Officer |

|

Exhibit 99.1

Peabody Reports Results For Quarter Ended September 30, 2024

Completed $100 Million of Share Repurchases

Centurion Development Making Exceptional Progress

ST. LOUIS, October 31, 2024 – Peabody (NYSE: BTU) today reported net income attributable to common stockholders of $101.3 million, or $0.74 per diluted share, for the third quarter of 2024, compared to $119.9 million, or $0.82 per diluted share in the prior year quarter. Peabody had Adjusted EBITDA1 of $224.8 million in the third quarter of 2024.

“In the third quarter, we delivered strong operational and safety performance across all segments and completed $100 million of share repurchases," said Peabody President and Chief Executive Officer Jim Grech. "We continue to execute on our strategy and recently provided a comprehensive update on Centurion, repositioning Peabody as a leading metallurgical coal producer."

Highlights

•Reported third quarter Adjusted EBITDA of $224.8 million and generated operating cash flow of $359.9 million

•Centurion development rates continue to exceed expectations, developing 2,700 meters in the third quarter compared to a plan of 1,200 meters. First development coal was washed in September and first customer shipment is scheduled for the fourth quarter

•Powder River Basin volumes were better than expected at 22.1 million tons

•Seaborne Thermal production increased, adding approximately 300 thousand tons to saleable coal inventory during the quarter

•Completed $100 million of share repurchases

•Declared a dividend on common stock of $0.075 per share on October 31, 2024

1 Adjusted EBITDA is a non-GAAP financial measure. Adjusted EBITDA margin is equal to segment Adjusted EBITDA (excluding insurance recoveries) divided by segment revenue. Revenue per Ton and Adjusted EBITDA Margin per Ton are equal to revenue by segment and Adjusted EBITDA by segment (excluding insurance recoveries), respectively, divided by segment tons sold. Costs per Ton is equal to Revenue per Ton less Adjusted EBITDA Margin per Ton. Management believes Costs per Ton and Adjusted EBITDA Margin per Ton best reflect controllable costs and operating results at the reporting segment level. We consider all measures reported on a per ton basis, as well as Adjusted EBITDA margin, to be operating/statistical measures. Please refer to the tables and related notes herein for a reconciliation of non-GAAP financial measures.

Third Quarter Segment Performance

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Seaborne Thermal |

| Quarter Ended | | Nine Months Ended |

| Sept. | | Jun. | | Sept. | | Sept. | | Sept. |

| 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| Tons sold (in millions) | 4.1 | | | 4.1 | | | 4.2 | | | 12.2 | | | 11.8 | |

| Export | 2.6 | | 2.7 | | | 2.7 | | | 7.8 | | | 7.4 | |

| Domestic | 1.5 | | 1.4 | | | 1.5 | | | 4.4 | | | 4.4 | |

| Revenue per Ton | $ | 76.21 | | | $ | 74.43 | | | $ | 71.38 | | | $ | 73.99 | | | $ | 89.06 | |

| Export - Avg. Realized Price per Ton | 105.51 | | | 98.43 | | | 99.55 | | | 101.13 | | | 127.67 | |

| Domestic - Avg. Realized Price per Ton | 25.36 | | | 26.69 | | | 20.92 | | | 26.11 | | | 23.23 | |

| Costs per Ton | 47.01 | | | 49.14 | | | 43.68 | | | 47.96 | | | 48.35 | |

| Adjusted EBITDA Margin per Ton | $ | 29.20 | | | $ | 25.29 | | | $ | 27.70 | | | $ | 26.03 | | | $ | 40.71 | |

| Adjusted EBITDA (in millions) | $ | 120.0 | | | $ | 104.4 | | | $ | 115.5 | | | $ | 318.2 | | | $ | 477.0 | |

Peabody expected seaborne thermal volume of 4.0 million tons, including 2.5 million export tons, at costs of $48 to $53 per ton. Better than anticipated production and costs drove Adjusted EBITDA margin per ton higher by 15 percent compared to the second quarter. Higher production resulted in adding approximately 300 thousand tons to saleable coal inventory during the quarter. The segment reported Adjusted EBITDA margins of 38 percent and Adjusted EBITDA of $120.0 million.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Seaborne Metallurgical |

| Quarter Ended | | Nine Months Ended |

| Sept. | | Jun. | | Sept. | | Sept. | | Sept. |

| 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| Tons sold (in millions) | 1.7 | | | 2.0 | | | 1.5 | | | 5.1 | | | 4.8 | |

| Revenue per Ton | $ | 144.60 | | | $ | 149.29 | | | $ | 162.02 | | | $ | 154.31 | | | $ | 189.50 | |

| Costs per Ton | 128.04 | | | 117.47 | | | 110.38 | | | 126.98 | | | 132.74 | |

| Adjusted EBITDA Margin per Ton | $ | 16.56 | | | $ | 31.82 | | | $ | 51.64 | | | $ | 27.33 | | | $ | 56.76 | |

| Adjusted EBITDA, Excluding Insurance Recovery (in millions) | $ | 27.8 | | | $ | 62.8 | | | $ | 78.6 | | | $ | 138.9 | | | $ | 271.9 | |

| Shoal Creek Insurance Recovery (in millions) | $ | — | | | $ | 80.8 | | | $ | — | | | $ | 80.8 | | | $ | — | |

| Adjusted EBITDA (in millions) | $ | 27.8 | | | $ | 143.6 | | | $ | 78.6 | | | $ | 219.7 | | | $ | 271.9 | |

Peabody expected seaborne met volume of 1.7 million tons at costs of $120 to $130 per ton. Third quarter shipments and costs were in-line with expectations. We opportunistically withheld nearly 90 thousand tons of shipments at Shoal Creek to avoid higher alternate logistics costs and weak market conditions for spot sales. The segment reported Adjusted EBITDA of $27.8 million and is positioned for a stronger fourth quarter.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Powder River Basin |

| Quarter Ended | | Nine Months Ended |

| Sept. | | Jun. | | Sept. | | Sept. | | Sept. |

| 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| Tons sold (in millions) | 22.1 | | | 15.8 | | | 22.7 | | | 56.6 | | | 63.6 | |

| Revenue per Ton | $ | 13.84 | | | $ | 14.02 | | | $ | 13.79 | | | $ | 13.82 | | | $ | 13.80 | |

| Costs per Ton | 11.50 | | | 12.89 | | | 11.41 | | | 12.30 | | | 11.98 | |

| Adjusted EBITDA Margin per Ton | $ | 2.34 | | | $ | 1.13 | | | $ | 2.38 | | | $ | 1.52 | | | $ | 1.82 | |

| Adjusted EBITDA (in millions) | $ | 51.7 | | | $ | 17.8 | | | $ | 54.1 | | | $ | 85.9 | | | $ | 116.1 | |

Peabody expected PRB volumes of 21.5 million tons at costs of $11.50 to $12.50 per ton. Better than expected customer nominations and continued focus on cost management increased Adjusted EBITDA margins to $2.34 per ton, more than double the second quarter. The segment reported Adjusted EBITDA margins of 17 percent and Adjusted EBITDA of $51.7 million.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Other U.S. Thermal |

| Quarter Ended | | Nine Months Ended |

| Sept. | | Jun. | | Sept. | | Sept. | | Sept. |

| 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| Tons sold (in millions) | 4.0 | | | 3.7 | | | 4.2 | | | 10.9 | | | 12.5 | |

| Revenue per Ton | $ | 53.52 | | | $ | 55.21 | | | $ | 53.89 | | | $ | 55.92 | | | $ | 54.12 | |

| Costs per Ton | 46.50 | | | 45.53 | | | 42.28 | | | 45.81 | | | 40.92 | |

| Adjusted EBITDA Margin per Ton | $ | 7.02 | | | $ | 9.68 | | | $ | 11.61 | | | $ | 10.11 | | | $ | 13.20 | |

| Adjusted EBITDA (in millions) | $ | 28.4 | | | $ | 35.4 | | | $ | 49.1 | | | $ | 110.3 | | | $ | 165.2 | |

Peabody expected Other U.S. Thermal volume of 4.0 million tons at costs of approximately $44 to $48 per ton. Peabody delivered 4.0 million tons at costs of $46.50 per ton, in-line with expectations. For the quarter, the segment reported Adjusted EBITDA margins of 13 percent and Adjusted EBITDA of $28.4 million.

Centurion Update

On October 14, 2024, Peabody provided a comprehensive update on the Centurion premium hard coking coal project (click here to view), estimating a net present value of $1.6 billion with a 25 percent internal rate of return. The project is expected to produce 4.7 million tons annually at first quartile costs over a 25 plus year mine life. Two continuous miner units are operational, first development coal was produced in June, first coal was washed in September and first customer shipment is scheduled for the fourth quarter. Peabody has invested $250 million of the projected $489 million needed to reach longwall production in March 2026. Centurion's benchmark premium hard coking coal from the Bowen Basin is highly attractive to customers in the Asian market, making Centurion a cornerstone asset in Peabody's global coal portfolio.

Shareholder Return Program

During the third quarter of 2024, Peabody repurchased 4.5 million shares for a total of $100 million. The total repurchases for the year is 7.7 million shares totaling $180.4 million. Since recommencing the program in 2023, Peabody has repurchased 23.8 million shares for a total amount of $530.4 million, leaving $469.6 million remaining under its existing $1 billion share repurchase program.

The company declared a $0.075 per share dividend on October 31, 2024.

| | | | | | | | | | | | | | | |

| Nine Months Ended | | Year Ended | | |

| Sept. | | Dec. | | | | |

| 2024 | | 2023 | | | | |

| (Dollars in millions) | | | | |

| Net Cash Provided by Operating Activities: | $ | 486.7 | | | $ | 1,035.5 | | | | | |

| - Net Cash Used in Investing Activities | (389.6) | | | (342.6) | | | | | |

| - Distributions to Noncontrolling Interest | (34.8) | | | (59.0) | | | | | |

+/- Changes to Restricted Cash and Collateral (1) | (24.7) | | | 90.2 | | | | | |

| - Anticipated Expenditures or Other Requirements | — | | | — | | | | | |

Available Free Cash Flow (AFCF) (2) | $ | 37.6 | | | $ | 724.1 | | | | | |

| | | | | | | |

| Amount Allocated to Shareholder Returns | $ | 127.9 | | | $ | 470.7 | | | | | |

| | | | | | | |

| (1) This amount is equal to the total change in Restricted Cash and Collateral on the balance sheet, excluding partially offsetting amounts included in operating cash flow consisting of an inflow of $143 million and an outflow of $200 million for the nine months ended September 30, 2024 and the year ended December 31, 2023, respectively. | | | | |

| (2) AFCF is a non-GAAP financial measure defined as operating cash flow less investing cash flow and distributions to noncontrolling interests; plus/minus changes to restricted cash and collateral and other anticipated expenditures. Available Free Cash Flow is used by management as a measure of our ability to generate excess cash flow from our business. The Company’s policy is to return at least 65% of annual AFCF to shareholders. | | | | |

| | | | |

Fourth Quarter 2024 Outlook

Seaborne Thermal

•Volume is expected to be 4.1 million tons, including 2.5 million export tons. 0.4 million export tons are priced at approximately $120 per ton, and 0.8 million tons of Newcastle product and 1.3 million tons of high ash product are unpriced. Costs are anticipated to be $48-$53 per ton. Full year volume guidance increased by 200 thousand tons to 16-16.4 million tons due to higher production at Wilpinjong.

Seaborne Metallurgical

•Volume is anticipated to be 2.3 million tons and is expected to achieve 70 to 75 percent of the premium hard coking coal price index. Costs are anticipated to be $120-$125 per ton.

U.S. Thermal

•PRB volume is expected to be 21.2 million tons at an average price of $13.50 per ton and costs of approximately $11.50-$12.00 per ton.

•Other U.S. Thermal volume is expected to be 3.9 million tons at an average price of $52.40 per ton and costs of approximately $44-$48 per ton. Full year costs have been increased $2 per ton to $43-$47 per ton as Twentymile is experiencing challenging geological conditions temporarily reducing production.

Capital Expenditures

•Full-year anticipated capital has been increased by $50 million to $425 million primarily due to accelerated development at Centurion and timing of spend at Wambo Open-Cut.

Today’s earnings call is scheduled for 10 a.m. CT and can be accessed via the company’s website at PeabodyEnergy.com.

Peabody (NYSE: BTU) is a leading coal producer, providing essential products for the production of affordable, reliable energy and steel. Our commitment to sustainability underpins everything we do and shapes our strategy for the future. For further information, visit PeabodyEnergy.com.

Contact:

Karla Kimrey

ir@peabodyenergy.com

Guidance Targets

| | | | | | | | | | | | | | | | | |

| Segment Performance | | | | | |

| | 2024 Full Year |

| | Total Volume (millions of

short tons) | Priced Volume (millions of short tons) | Priced Volume Pricing per Short Ton | Average Cost per Short Ton |

| Seaborne Thermal | 16 - 16.4 | 14.2 | $69.98 | $45.00 - $50.00 |

| Seaborne Thermal (Export) | 10 - 10.4 | 8.2 | $102.05 | NA |

| Seaborne Thermal (Domestic) | 6.0 | 6.0 | $26.09 | NA |

| Seaborne Metallurgical | 7.2 - 7.6 | 5.4 | $151.00 | $118.00 - $128.00 |

| PRB U.S. Thermal | 75 - 82 | 85 | $13.70 | $11.75 - $12.50 |

| Other U.S. Thermal | 14.5 - 15.5 | 15.2 | $54.20 | $43.00 - $47.00 |

| | | | |

Other Annual Financial Metrics ($ in millions) |

| | 2024 Full Year | | | |

| SG&A | $90 | | | |

| Total Capital Expenditures | $425 | | | |

| Major Project Capital Expenditures | $275 | | | |

| Sustaining Capital Expenditures | $150 | | | |

| ARO Cash Spend | $50 | | | |

| | | | | |

| Supplemental Information |

| | | | | |

| Seaborne Thermal | ~40% of unpriced export volumes are expected to price on average at Globalcoal “NEWC” levels and ~60% are expected to have a higher ash content and price at 80-95% of API 5 price levels. |

| Seaborne Metallurgical | On average, Peabody's metallurgical sales are anticipated to price at 70-75% of the premium hard-coking coal index price (FOB Australia). |

| PRB and Other U.S. Thermal | PRB and Other U.S. Thermal volumes reflect volumes priced at September 30, 2024. Weighted average quality for the PRB segment 2024 volume is approximately 8670 BTU. |

Certain forward-looking measures and metrics presented are non-GAAP financial and operating/statistical measures. Due to the volatility and variability of certain items needed to reconcile these measures to their nearest GAAP measure, no reconciliation can be provided without unreasonable cost or effort.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Condensed Consolidated Statements of Operations (Unaudited) | | | | |

| For the Quarters Ended Sept. 30, 2024, Jun. 30, 2024 and Sept. 30, 2023 and the Nine Months Ended Sept. 30, 2024 and 2023 | |

| | | | | | | | | | |

| (In Millions, Except Per Share Data) | | | | | | | | | |

| | Quarter Ended | | Nine Months Ended |

| | Sept. | | Jun. | | Sept. | | Sept. | | Sept. |

| | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | | | | |

| Tons Sold | 31.9 | | | 25.6 | | | 32.6 | | | 84.9 | | | 93.0 | |

| | | | | | | | | | |

| Revenue | $ | 1,088.0 | | | $ | 1,042.0 | | | $ | 1,078.9 | | | $ | 3,113.6 | | | $ | 3,711.7 | |

Operating Costs and Expenses (1) | 845.8 | | | 803.9 | | | 803.7 | | | 2,463.9 | | | 2,512.3 | |

| Depreciation, Depletion and Amortization | 84.7 | | | 82.9 | | | 82.3 | | | 247.4 | | | 239.2 | |

| Asset Retirement Obligation Expenses | 12.9 | | | 12.9 | | | 15.4 | | | 38.7 | | | 46.3 | |

| Selling and Administrative Expenses | 20.6 | | | 22.1 | | | 21.5 | | | 64.7 | | | 66.0 | |

| | | | | | | | | |

| Restructuring Charges | 1.9 | | | 0.1 | | | 0.9 | | | 2.1 | | | 3.0 | |

| | | | | | | | | |

| Other Operating (Income) Loss: | | | | | | | | | |

| Net Gain on Disposals | (0.1) | | | (7.5) | | | (1.4) | | | (9.7) | | | (8.5) | |

| Asset Impairment | — | | | — | | | — | | | — | | | 2.0 | |

| Provision for NARM and Shoal Creek Losses | — | | | 1.9 | | | 3.3 | | | 3.7 | | | 37.0 | |

| Shoal Creek Insurance Recovery | — | | | (109.5) | | | — | | | (109.5) | | | — | |

| Loss (Income) from Equity Affiliates | 2.1 | | | 1.3 | | | (5.6) | | | 7.1 | | | (9.7) | |

| Operating Profit | 120.1 | | | 233.9 | | | 158.8 | | | 405.2 | | | 824.1 | |

| Interest Expense, Net of Capitalized Interest | 9.7 | | | 10.7 | | | 13.8 | | | 35.1 | | | 45.5 | |

| Net Loss on Early Debt Extinguishment | — | | | — | | | — | | | — | | | 8.8 | |

| Interest Income | (17.7) | | | (16.8) | | | (20.3) | | | (53.7) | | | (56.5) | |

| Net Periodic Benefit Credit, Excluding Service Cost | (10.1) | | | (10.2) | | | (10.0) | | | (30.4) | | | (29.4) | |

| | | | | | | | | |

| | | | | | | | | |

| Income from Continuing Operations Before Income Taxes | 138.2 | | | 250.2 | | | 175.3 | | | 454.2 | | | 855.7 | |

| Income Tax Provision | 25.7 | | | 39.4 | | | 46.5 | | | 85.2 | | | 238.7 | |

| Income from Continuing Operations, Net of Income Taxes | 112.5 | | | 210.8 | | | 128.8 | | | 369.0 | | | 617.0 | |

| (Loss) Income from Discontinued Operations, Net of Income Taxes | (1.0) | | | (1.6) | | | 2.5 | | | (3.3) | | | (0.1) | |

| Net Income | 111.5 | | | 209.2 | | | 131.3 | | | 365.7 | | | 616.9 | |

| | | | | | | | | |

| Less: Net Income Attributable to Noncontrolling Interests | 10.2 | | | 9.8 | | | 11.4 | | | 25.4 | | | 49.3 | |

| Net Income Attributable to Common Stockholders | $ | 101.3 | | | $ | 199.4 | | | $ | 119.9 | | | $ | 340.3 | | | $ | 567.6 | |

| | | | | | | | | | |

Adjusted EBITDA (2) | $ | 224.8 | | | $ | 309.7 | | | $ | 270.0 | | | $ | 695.0 | | | $ | 1,018.8 | |

| | | | | | | | | |

Diluted EPS - Income from Continuing Operations (3)(4) | $ | 0.74 | | | $ | 1.43 | | | $ | 0.80 | | | $ | 2.47 | | | $ | 3.68 | |

| | | | | | | | | | |

Diluted EPS - Net Income Attributable to Common Stockholders (3) | $ | 0.74 | | | $ | 1.42 | | | $ | 0.82 | | | $ | 2.44 | | | $ | 3.68 | |

| | | | | | | | | | |

| (1) | Excludes items shown separately. |

| (2) | Adjusted EBITDA is a non-GAAP financial measure. Refer to the “Reconciliation of Non-GAAP Financial Measures” section in this document for definitions and reconciliations to the most comparable measures under U.S. GAAP. |

| (3) | Weighted average diluted shares outstanding were 141.6 million, 142.8 million and 149.9 million during the quarters ended September 30, 2024, June 30, 2024 and September 30, 2023, respectively. Weighted average diluted shares outstanding were 143.1 million and 156.7 million during the nine months ended September 30, 2024 and 2023, respectively. |

| (4) | Reflects income from continuing operations, net of income taxes less net income attributable to noncontrolling interests. |

| | | | | | | | | | |

| This information is intended to be reviewed in conjunction with the company's filings with the SEC. |

| | | | | | | | | | | | | | |

| Condensed Consolidated Balance Sheets | |

| As of Sept. 30, 2024 and Dec. 31, 2023 |

| | | | |

| (Dollars In Millions) | | | |

| | (Unaudited) | | |

| | Sep. 30, 2024 | | Dec. 31, 2023 |

| | | | |

Cash and Cash Equivalents | $ | 772.9 | | | $ | 969.3 | |

| | | |

Accounts Receivable, Net | 304.2 | | | 389.7 | |

| Inventories, Net | 444.3 | | | 351.8 | |

| | | |

| | | |

Other Current Assets | 286.6 | | | 308.9 | |

Total Current Assets | 1,808.0 | | | 2,019.7 | |

Property, Plant, Equipment and Mine Development, Net | 3,013.5 | | | 2,844.1 | |

| Operating Lease Right-of-Use Assets | 121.1 | | | 61.9 | |

| Restricted Cash and Collateral | 839.0 | | | 957.6 | |

Investments and Other Assets | 85.3 | | | 78.8 | |

| | | |

Total Assets | $ | 5,866.9 | | | $ | 5,962.1 | |

| | | | |

Current Portion of Long-Term Debt | $ | 14.8 | | | $ | 13.5 | |

| | | |

Accounts Payable and Accrued Expenses | 763.8 | | | 965.5 | |

Total Current Liabilities | 778.6 | | | 979.0 | |

Long-Term Debt, Less Current Portion | 323.7 | | | 320.7 | |

Deferred Income Taxes | 17.8 | | | 28.6 | |

| Asset Retirement Obligations, Less Current Portion | 647.4 | | | 648.6 | |

Accrued Postretirement Benefit Costs | 143.1 | | | 148.4 | |

Operating Lease Liabilities, Less Current Portion | 94.6 | | | 47.7 | |

Other Noncurrent Liabilities | 171.3 | | | 181.6 | |

Total Liabilities | 2,176.5 | | | 2,354.6 | |

| | | | |

| | | |

Common Stock | 1.9 | | | 1.9 | |

Additional Paid-in Capital | 3,988.9 | | | 3,983.0 | |

Treasury Stock | (1,926.5) | | | (1,740.2) | |

| Retained Earnings | 1,424.3 | | | 1,112.7 | |

Accumulated Other Comprehensive Income | 150.7 | | | 189.6 | |

Peabody Energy Corporation Stockholders' Equity | 3,639.3 | | | 3,547.0 | |

Noncontrolling Interests | 51.1 | | | 60.5 | |

Total Stockholders' Equity | 3,690.4 | | | 3,607.5 | |

Total Liabilities and Stockholders' Equity | $ | 5,866.9 | | | $ | 5,962.1 | |

| | | | |

| This information is intended to be reviewed in conjunction with the company's filings with the SEC. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Condensed Consolidated Statements of Cash Flows (Unaudited) | |

| For the Quarters Ended Sept. 30, 2024, Jun. 30, 2024 and Sept. 30, 2023 and the Nine Months Ended Sept. 30, 2024 and 2023 |

| | | | | | | | | |

| (Dollars In Millions) | | | | | | | | | |

| Quarter Ended | | Nine Months Ended |

| Sept. | | Jun. | | Sept. | | Sept. | | Sept. |

| 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

Cash Flows From Operating Activities | | | | | | | | | |

| Net Cash Provided By Continuing Operations | $ | 361.4 | | | $ | 9.7 | | | $ | 87.5 | | | $ | 491.4 | | | $ | 832.7 | |

Net Cash Used in Discontinued Operations | (1.5) | | | (1.9) | | | (74.1) | | | (4.7) | | | (79.6) | |

| Net Cash Provided By Operating Activities | 359.9 | | 7.8 | | 13.4 | | 486.7 | | 753.1 |

Cash Flows From Investing Activities | | | | | | | | | |

Additions to Property, Plant, Equipment and Mine Development | (98.7) | | | (105.6) | | | (68.1) | | | (265.7) | | | (190.4) | |

| Changes in Accrued Expenses Related to Capital Expenditures | 7.2 | | | (6.9) | | | 0.3 | | | (6.5) | | | (5.1) | |

| Wards Well Acquisition | — | | | (143.8) | | | — | | | (143.8) | | | — | |

| | | | | | | | | |

| Insurance Proceeds Attributable to Shoal Creek Equipment Losses | 5.3 | | | 5.6 | | | — | | | 10.9 | | | — | |

Proceeds from Disposal of Assets, Net of Receivables | 0.6 | | | 13.1 | | | 1.9 | | | 16.1 | | | 13.9 | |

| | | | | | | | | |

Contributions to Joint Ventures | (176.6) | | | (170.7) | | | (202.6) | | | (550.1) | | | (573.4) | |

Distributions from Joint Ventures | 189.2 | | | 167.4 | | | 213.6 | | | 549.8 | | | 579.4 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

Other, Net | 0.2 | | | (0.7) | | | 0.3 | | | (0.3) | | | 1.0 | |

| Net Cash Used In Investing Activities | (72.8) | | (241.6) | | (54.6) | | (389.6) | | (174.6) |

Cash Flows From Financing Activities | | | | | | | | | |

| | | | | | | | | |

Repayments of Long-Term Debt | (2.6) | | | (2.4) | | | (2.1) | | | (7.2) | | | (6.9) | |

Payment of Debt Issuance and Other Deferred Financing Costs | — | | | (0.3) | | | — | | | (11.1) | | | (0.3) | |

| | | | | | | | | |

| Common Stock Repurchases | (100.0) | | | — | | | (91.0) | | | (183.1) | | | (264.0) | |

Repurchase of Employee Common Stock Relinquished for Tax Withholding | — | | | (0.7) | | | — | | | (4.1) | | | (13.7) | |

Dividends Paid | (9.4) | | | (9.4) | | | (9.9) | | | (28.5) | | | (20.7) | |

Distributions to Noncontrolling Interests | (16.3) | | | — | | | (36.1) | | | (34.8) | | | (58.9) | |

| | | | | | | | | |

| Net Cash Used In Financing Activities | (128.3) | | (12.8) | | (139.1) | | (268.8) | | (364.5) |

Net Change in Cash, Cash Equivalents and Restricted Cash | 158.8 | | | (246.6) | | | (180.3) | | | (171.7) | | | 214.0 | |

Cash, Cash Equivalents and Restricted Cash at Beginning of Period | 1,319.7 | | | 1,566.3 | | | 1,811.9 | | | 1,650.2 | | | 1,417.6 | |

Cash, Cash Equivalents and Restricted Cash at End of Period | $ | 1,478.5 | | | $ | 1,319.7 | | | $ | 1,631.6 | | | $ | 1,478.5 | | | $ | 1,631.6 | |

| | | | | | | | | |

| This information is intended to be reviewed in conjunction with the company's filings with the SEC. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Non-GAAP Financial Measures (Unaudited) | | |

| For the Quarters Ended Sept. 30, 2024, Jun. 30, 2024 and Sept. 30, 2023 and the Nine Months Ended Sept. 30, 2024 and 2023 | |

| | | | | | | | | | |

| (Dollars In Millions) | | | | | | | | | |

| | | | | | | | | | |

Note: Management believes that non-GAAP performance measures are used by investors to measure our operating performance. These measures are not intended to serve as alternatives to U.S. GAAP measures of performance and may not be comparable to similarly-titled measures presented by other companies. |

| | | | | | |

| | Quarter Ended | | Nine Months Ended |

| | Sept. | | Jun. | | Sept. | | Sept. | | Sept. |

| | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | | | | |

| Income from Continuing Operations, Net of Income Taxes | $ | 112.5 | | | $ | 210.8 | | | $ | 128.8 | | | $ | 369.0 | | | $ | 617.0 | |

Depreciation, Depletion and Amortization | 84.7 | | | 82.9 | | | 82.3 | | | 247.4 | | | 239.2 | |

Asset Retirement Obligation Expenses | 12.9 | | | 12.9 | | | 15.4 | | | 38.7 | | | 46.3 | |

Restructuring Charges | 1.9 | | | 0.1 | | | 0.9 | | | 2.1 | | | 3.0 | |

| | | | | | | | | |

Asset Impairment | — | | | — | | | — | | | — | | | 2.0 | |

| Provision for NARM and Shoal Creek Losses | — | | | 1.9 | | | 3.3 | | | 3.7 | | | 37.0 | |

| Shoal Creek Insurance Recovery - Property Damage | — | | | (28.7) | | | — | | | (28.7) | | | — | |

| Changes in Amortization of Basis Difference Related to Equity Affiliates | (0.4) | | | (0.3) | | | (0.5) | | | (1.1) | | | (1.2) | |

| Interest Expense, Net of Capitalized Interest | 9.7 | | | 10.7 | | | 13.8 | | | 35.1 | | | 45.5 | |

| Net Loss on Early Debt Extinguishment | — | | | — | | | — | | | — | | | 8.8 | |

Interest Income | (17.7) | | | (16.8) | | | (20.3) | | | (53.7) | | | (56.5) | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Unrealized Gains on Derivative Contracts Related to Forecasted Sales | — | | | — | | | — | | | — | | | (159.0) | |

| Unrealized (Gains) Losses on Foreign Currency Option Contracts | (3.7) | | | (2.4) | | | 0.5 | | | (0.4) | | | (0.1) | |

| | | | | | | | | |

Take-or-Pay Contract-Based Intangible Recognition | (0.8) | | | (0.8) | | | (0.7) | | | (2.3) | | | (1.9) | |

| Income Tax Provision | 25.7 | | | 39.4 | | | 46.5 | | | 85.2 | | | 238.7 | |

Adjusted EBITDA (1) | $ | 224.8 | | | $ | 309.7 | | | $ | 270.0 | | | $ | 695.0 | | | $ | 1,018.8 | |

| | | | | | | | | | |

Operating Costs and Expenses | $ | 845.8 | | | $ | 803.9 | | | $ | 803.7 | | | $ | 2,463.9 | | | $ | 2,512.3 | |

| | | | | | | | | |

| Unrealized Gains (Losses) on Foreign Currency Option Contracts | 3.7 | | | 2.4 | | | (0.5) | | | 0.4 | | | 0.1 | |

Take-or-Pay Contract-Based Intangible Recognition | 0.8 | | | 0.8 | | | 0.7 | | | 2.3 | | | 1.9 | |

| | | | | | | | | |

| Net Periodic Benefit Credit, Excluding Service Cost | (10.1) | | | (10.2) | | | (10.0) | | | (30.4) | | | (29.4) | |

Total Reporting Segment Costs (2) | $ | 840.2 | | | $ | 796.9 | | | $ | 793.9 | | | $ | 2,436.2 | | | $ | 2,484.9 | |

| | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | |

| (1) | Adjusted EBITDA is defined as income from continuing operations before deducting net interest expense, income taxes, asset retirement obligation expenses and depreciation, depletion and amortization. Adjusted EBITDA is also adjusted for the discrete items that management excluded in analyzing each of our segment's operating performance, as displayed in the reconciliation above. Adjusted EBITDA is used by management as the primary metric to measure each of our segment's operating performance and allocate resources. |

| (2) | Total Reporting Segment Costs is defined as operating costs and expenses adjusted for the discrete items that management excluded in analyzing each of our segment's operating performance, as displayed in the reconciliation above. Total Reporting Segment Costs is used by management as a component of a metric to measure each of our segment's operating performance. |

| |

| | | | | | | | | | |

| This information is intended to be reviewed in conjunction with the company's filings with the SEC. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental Financial Data (Unaudited) | |

| For the Quarters Ended Sept. 30, 2024, Jun. 30, 2024 and Sept. 30, 2023 and the Nine Months Ended Sept. 30, 2024 and 2023 |

| | | | | | | | |

| | Quarter Ended | | Nine Months Ended |

| | Sept. | | Jun. | | Sept. | | Sept. | | Sept. |

| | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | |

| Revenue Summary (In Millions) | | | | | | | | | |

| Seaborne Thermal | $ | 313.2 | | | $ | 307.5 | | | $ | 297.4 | | | $ | 904.6 | | | $ | 1,043.4 | |

| Seaborne Metallurgical | 242.5 | | | 294.3 | | | 247.0 | | | 783.8 | | | 907.9 | |

| | | | | | | | | | |

| Powder River Basin | 305.3 | | | 221.9 | | | 313.0 | | | 781.3 | | | 878.0 | |

| Other U.S. Thermal | 216.7 | | | 202.0 | | | 228.2 | | | 610.3 | | | 677.5 | |

| Total U.S. Thermal | 522.0 | | | 423.9 | | | 541.2 | | | 1,391.6 | | | 1,555.5 | |

| Corporate and Other | 10.3 | | | 16.3 | | | (6.7) | | | 33.6 | | | 204.9 | |

| Total | $ | 1,088.0 | | | $ | 1,042.0 | | | $ | 1,078.9 | | | $ | 3,113.6 | | | $ | 3,711.7 | |

| | | | | | | | | | |

Total Reporting Segment Costs Summary (In Millions) (1) | | | | | | | | | |

| Seaborne Thermal | $ | 193.2 | | | $ | 203.1 | | | $ | 181.9 | | | $ | 586.4 | | | $ | 566.4 | |

| Seaborne Metallurgical | 214.7 | | | 231.5 | | | 168.4 | | | 644.9 | | | 636.0 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | |

| Powder River Basin | 253.6 | | | 204.1 | | | 258.9 | | | 695.4 | | | 761.9 | |

| Other U.S. Thermal | 188.3 | | | 166.6 | | | 179.1 | | | 500.0 | | | 512.3 | |

| Total U.S. Thermal | 441.9 | | | 370.7 | | | 438.0 | | | 1,195.4 | | | 1,274.2 | |

| Corporate and Other | (9.6) | | | (8.4) | | | 5.6 | | | 9.5 | | | 8.3 | |

| Total | $ | 840.2 | | | $ | 796.9 | | | $ | 793.9 | | | $ | 2,436.2 | | | $ | 2,484.9 | |

| | | | | | | | | | |

| Other Supplemental Financial Data (In Millions) | | | | | | | | | |

| Adjusted EBITDA - Seaborne Thermal | $ | 120.0 | | | $ | 104.4 | | | $ | 115.5 | | | $ | 318.2 | | | $ | 477.0 | |

| Adjusted EBITDA - Seaborne Metallurgical, Excluding Shoal Creek Insurance Recovery | 27.8 | | | 62.8 | | | 78.6 | | | 138.9 | | | 271.9 | |

| Shoal Creek Insurance Recovery - Business Interruption | — | | | 80.8 | | | — | | | 80.8 | | | — | |

| Adjusted EBITDA - Seaborne Metallurgical | 27.8 | | | 143.6 | | | 78.6 | | | 219.7 | | | 271.9 | |

| | | | | | | | | | |

| Adjusted EBITDA - Powder River Basin | 51.7 | | | 17.8 | | | 54.1 | | | 85.9 | | | 116.1 | |

| Adjusted EBITDA - Other U.S. Thermal | 28.4 | | | 35.4 | | | 49.1 | | | 110.3 | | | 165.2 | |

| Adjusted EBITDA - Total U.S. Thermal | 80.1 | | | 53.2 | | | 103.2 | | | 196.2 | | | 281.3 | |

| Middlemount | 1.8 | | | 1.9 | | | 7.7 | | | 2.9 | | | 13.7 | |

Resource Management Results (2) | 2.2 | | | 9.9 | | | 3.1 | | | 16.5 | | | 11.4 | |

| Selling and Administrative Expenses | (20.6) | | | (22.1) | | | (21.5) | | | (64.7) | | | (66.0) | |

Other Operating Costs, Net (3) | 13.5 | | | 18.8 | | | (16.6) | | | 6.2 | | | 29.5 | |

Adjusted EBITDA (1) | $ | 224.8 | | | $ | 309.7 | | | $ | 270.0 | | | $ | 695.0 | | | $ | 1,018.8 | |

| | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | |

| (1) | Total Reporting Segment Costs and Adjusted EBITDA are non-GAAP financial measures. Refer to the “Reconciliation of Non-GAAP Financial Measures” section in this document for definitions and reconciliations to the most comparable measures under U.S. GAAP. |

| |

| | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| (2) | Includes gains (losses) on certain surplus coal reserve, coal resource and surface land sales and property management costs and revenue. |

| (3) | Includes trading and brokerage activities, costs associated with post-mining activities, gains (losses) on certain asset disposals, minimum charges on certain transportation-related contracts, results from the Company’s equity method investment in R3 Renewables LLC, costs associated with suspended operations including the Centurion Mine, the impact of foreign currency remeasurement, expenses related to the Company’s other commercial activities and revenue of $19.2 million related to the Q1 2023 assignment of port and rail capacity. |

| |

| |

| | | | | | | | | | |

| This information is intended to be reviewed in conjunction with the company's filings with the SEC. |

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the securities laws. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words or variation of words such as "expects," "anticipates," "intends," "plans," "believes," "seeks," "estimates," "projects," "forecasts," "targets," "would," "will," "should," "goal," "could" or "may" or other similar expressions. Forward-looking statements provide management's or the Board’s current expectations or predictions of future conditions, events, or results. All statements that address operating performance, events, or developments that may occur in the future are forward-looking statements, including statements regarding the shareholder return framework, execution of the Company’s operating plans, market conditions for the Company’s products, reclamation obligations, financial outlook, potential acquisitions and strategic investments, and liquidity requirements. All forward-looking statements speak only as of the date they are made and reflect Peabody's good faith beliefs, assumptions, and expectations, but they are not guarantees of future performance or events. Furthermore, Peabody disclaims any obligation to publicly update or revise any forward-looking statement, except as required by law. By their nature, forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. Factors that might cause such differences include, but are not limited to, a variety of economic, competitive, and regulatory factors, many of which are beyond Peabody's control, that are described in Peabody's periodic reports filed with the SEC including its Annual Report on Form 10-K for the fiscal year ended Dec. 31, 2023 and Quarterly Report on Form 10-Q for the quarter ended June 30, 2024. and other factors that Peabody may describe from time to time in other filings with the SEC. You may get such filings for free at Peabody's website at www.peabodyenergy.com. You should understand that it is not possible to predict or identify all such factors and, consequently, you should not consider any such list to be a complete set of all potential risks or uncertainties.

Exhibit 99.2

Peabody Board Declares Dividend on Common Stock

ST. LOUIS, October 31, 2024 – Peabody (NYSE: BTU) announced today that its Board of Directors has declared a quarterly dividend on its common stock of $0.075 per share, payable on December 4, 2024 to stockholders of record on November 14, 2024.

Peabody is a leading coal producer, providing essential products for the production of affordable, reliable energy and steel. Our commitment to sustainability underpins everything we do and shapes our strategy for the future. For further information, visit PeabodyEnergy.com.

Contact:

Karla Kimrey

ir@peabodyenergy.com

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the securities laws. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words or variation of words such as "expects," "anticipates," "intends," "plans," "believes," "seeks," "estimates," "projects," "forecasts," "targets," "would," "will," "should," "goal," "could" or "may" or other similar expressions. Forward-looking statements provide management's current expectations or predictions of future conditions, events or results. All statements that address operating performance, events, or developments that Peabody expects will occur in the future are forward-looking statements. They may include estimates of sales and other operating performance targets, cost savings, capital expenditures, dividends, share repurchases, other expense items, actions relating to strategic initiatives, demand for the company’s products, liquidity, capital structure, market share, industry volume, other financial items, descriptions of management’s plans or objectives for future operations and descriptions of assumptions underlying any of the above. The declaration and payment of future quarterly dividends remains at the discretion of the Board of Directors and will depend on the Company's financial results, cash flow and cash requirements, future prospects, and other factors deemed relevant by the Board. All forward-looking statements speak only as of the date they are made and reflect Peabody’s good faith beliefs, assumptions and expectations, but they are not guarantees of future performance or events. Furthermore, Peabody disclaims any obligation to publicly update or revise any forward-looking statement, except as required by law. By their nature, forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. Factors that might cause such differences include, but are not limited to, a variety of economic, competitive and regulatory factors, many of which are beyond Peabody’s control, that are described in Peabody’s Annual Report on Form 10-K for the fiscal year ended Dec. 31, 2023 and Quarterly Report on Form 10-Q for the quarter ended June 30, 2024, and other factors that Peabody may describe from time to time in other filings with the SEC. You may get such filings for free at Peabody’s website at www.peabodyenergy.com. You should understand that it is not possible to predict or identify all such factors and, consequently, you should not consider any such list to be a complete set of all potential risks or uncertainties.

v3.24.3

Cover Page

|

Oct. 31, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 31, 2024

|

| Entity Registrant Name |

PEABODY ENERGY CORPORATION

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-16463

|

| Entity Tax Identification Number |

13-4004153

|

| Entity Address, Address Line One |

701 Market Street,

|

| Entity Address, City or Town |

St. Louis,

|

| Entity Address, State or Province |

MO

|

| Entity Address, Postal Zip Code |

63101-1826

|

| City Area Code |

(314)

|

| Local Phone Number |

342-3400

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

BTU

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001064728

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

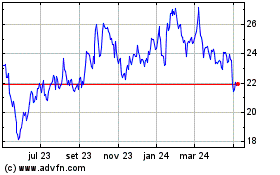

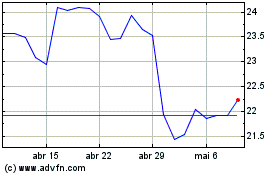

Peabody Energy (NYSE:BTU)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Peabody Energy (NYSE:BTU)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024