0001600620FALSE00016006202024-11-072024-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 7, 2024

Aurinia Pharmaceuticals Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Canada | | 001-36421 | | 98-1231763 |

(State or Other Jurisdiction of Incorporation) | | (Commission File No.) | | (IRS Employer Identification No.) |

#140, 14315 - 118 Avenue

Edmonton, Alberta

T5L 4S6

(250) 744-2487

(Address and telephone number of registrant's principal executive offices)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on which Registered |

| Common Shares, without par value | | AUPH | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition |

On November 7, 2024, Aurinia Pharmaceuticals Inc. (Aurinia or the Company) issued a press release announcing its financial results for the quarter ended September 30, 2024. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

The information in this Current Report on Form 8-K and the exhibit hereto are being furnished pursuant to this Item 2.02 and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. In addition, the information included in this Current Report on Form 8-K and the exhibit hereto that is furnished pursuant to this Item 2.02 shall not be incorporated by reference in any of Aurinia's filings under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, regardless of any general incorporation language in such filing, except as expressly set forth by specific reference in such filing.

| | | | | |

Item 2.05 | Cost Associated with Exit or Disposal Activities |

On November 7, 2024, Aurinia is implementing a strategic restructuring to sharpen the Company’s focus on continued LUPKYNIS® growth and the rapid development of AUR200. This restructuring will result in a workforce reduction of approximately 45% and will focus the Company’s LUPKYNIS commercial strategy on the highest growth drivers. The restructuring will also improve operational efficiency, with anticipated post-restructuring annualized cash savings of more than $40 million.

| | | | | |

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Departure of Chief Commercial Officer

As part of the restructuring that Aurinia Pharmaceuticals Inc. (Aurinia) announced on November 7, 2024, Aurinia plans to terminate its employment relationship with Scott Habig. Aurinia anticipates that it will provide Mr. Habig with a severance package substantially as set out in his employment agreement with Aurinia, dated June 27, 2022 (the Employment Agreement).

Pursuant to the Employment Agreement, provided Mr. Habig provides Aurinia with a general release of claims and waiver, he is entitled to receive severance pay equal to 12 months of his current base salary, accrued and unused vacation and performance bonus payout. In addition, if elected, Mr. Habig is entitled to medical, dental and vision benefits for up to 12 months covered by Aurinia.

The foregoing description of the Employment Agreement is qualified in its entirety by the text of the Employment Agreement for Mr. Habig, filed as Exhibit 10.19 to our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the Securities and Exchange Commission on February 15, 2024 and incorporated herein by reference.

New Director Appointment and Departure of Director

Effective November 7, 2024, Aurinia issued a press release announcing the appointment of Craig Johnson to the Board of Directors of the Company (the Board) and the Company also announced that Dr. Robert T. Foster has retired from the Board effective November 5, 2024. Dr. Foster's retirement was not the result of any disagreement between Aurinia and him on any matter relating to Aurinia's operations, policies or practices.

A copy of the press release announcing the appointment of Craig Johnson and the retirement of Dr. Robert Foster is attached as Exhibit 99.2 to this Current Report on Form 8-K.

The Company has entered into its standard form of indemnification agreement with Craig Johnson. The form of indemnification agreement was previously filed as Exhibit 10.1 to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as filed with the Securities and Exchange Commission on February 15, 2024 and is incorporated by reference herein.

Craig Johnson was not appointed pursuant to any arrangement or understanding with any other person and there are no family relationships between Craig Johnson and the other directors or executives of the Company. There are no transactions in which Craig Johnson has an interest requiring disclosure on the part of the Company under Item 404(a) of Regulation S-K promulgated under the Exchange Act.

As non-employee director, Craig Johnson will be entitled to receive annual cash retainers of $45,000 per year, payable quarterly in arrears, as well as annual equity-based compensation with an aggregate grant date value of $200,000.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: November 7, 2024

| | | | | | | | |

| | |

| | AURINIA PHARMACEUTICALS INC. |

| | |

| By: | /s/ Joseph Miller |

| Name: | Joseph Miller |

| Title: | Chief Financial Officer |

Aurinia Pharmaceuticals Reports Third Quarter and Nine Months 2024 Financial and Operational Results,

Announces Strategic Restructuring to Sharpen Focus on Continued LUPKYNIS® Growth and AUR200 Development

•Achieved $67.8 million in total net revenue and $55.5 million in net product revenue for the third quarter of 2024, representing year-over-year growth of 24% and 36%, respectively

•Generated $17.0 million in cash flow from operations in the third quarter and had cash, cash equivalents, restricted cash, and investments of $348.7 million as of September 30, 2024

•Anticipates a one-time restructuring charge in the fourth quarter of 2024 of $15 to $19 million and estimates post-restructuring annualized cash-based operating expense savings of more than $40 million

•Reiterates 2024 net product revenue guidance range of $210 to $220 million for fiscal year 2024

Webcast and conference call to be hosted today at 8:30 a.m. ET

ROCKVILLE, Maryland and EDMONTON, Alberta – November 7, 2024 – Aurinia Pharmaceuticals Inc. (NASDAQ: AUPH) (Aurinia or the Company) today issued its financial results for the third quarter and nine months ended September 30, 2024. With continued strong commercial execution, the Company achieved significant year-over-year growth in total net revenue and net product revenue and $17.0 million in cash flow from operations in the third quarter. Having achieved $158.6 million in net product revenue for the nine months ended September 30, 2024, the Company is reiterating its net product revenue guidance range of $210 to $220 million for fiscal year 2024.

Aurinia is implementing a strategic restructuring to sharpen the Company’s focus on continued LUPKYNIS® growth and the rapid development of AUR200. This restructuring will result in a workforce reduction of approximately 45% and will focus the Company’s LUPKYNIS commercial strategy on the highest growth drivers. The restructuring will also improve operational efficiency, with anticipated post-restructuring annualized cash-based operating expense savings of more than $40 million.

“We are pleased to report continued strong momentum through the first nine months of the year,” stated Peter Greenleaf, President and Chief Executive Officer of Aurinia. “Going forward, our streamlined organization will enable us to lean further into key areas of the commercial LUPKYNIS business that have historically delivered optimal returns, while at the same time accelerating the development of our important pipeline product, AUR200.”

In the third quarter of 2024, the Company added 364 PSFs and 146 new patients who were either restarting LUPKYNIS or receiving it through a hospital pharmacy. Together, these total 510, which is 17% higher than the 436 PSFs in the third quarter of 2023. Conversion rates (PSFs converted to patients on therapy), time to conversion, and adherence rates remained consistent with the prior quarter.

Recent Milestones Achieved

•In September 2024, the first participant was dosed in a Phase 1 study of AUR200, a differentiated, potential best-in-class therapy for autoimmune diseases that targets both BAFF (B-cell Activating Factor) and APRIL (A Proliferation-Inducing Ligand). The Company continues to expect to report initial results from this study in the first half of 2025.

•In September 2024, the Japanese Ministry of Health, Labour, and Welfare approved LUPKYNIS, triggering the recognition of an additional $10 million milestone payment from Aurinia’s collaboration partner, Otsuka Pharmaceutical Co., Ltd.

Financial Results for the Three and Nine Months Ended September 30, 2024

Total net revenue was $67.8 million for the three months ended September 30, 2024, and $54.5 million for the same period in 2023, representing growth of 24%. Year to date total net revenue was $175.3 million for the nine months ended September 30, 2024, compared to $130.4 million for the same period in 2023, representing growth of 34%.

Net product revenue was $55.5 million for the three months ended September 30, 2024, and $40.8 million for the same period in 2023, representing growth of 36%. Net product revenue was $158.6 million for the nine months ended September 30, 2024, and $116.2 million for the same period in 2023, representing growth of 36%. The increase in both periods is primarily due to increased LUPKYNIS sales to the Company’s two main specialty pharmacies, driven predominantly by further penetration of the lupus nephritis (LN) market. Additionally, for the nine months ended September 30, 2024, Aurinia had sales of semi-finished product to Otsuka to support continued commercialization in its territories.

U.S. market penetration grew 25% year-over-year, with 2,422 patients on LUPKYNIS therapy as of September 30, 2024, compared to 1,939 as of September 30, 2023.

License, collaboration, and royalty revenues were $12.3 million and $13.7 million for the three months ended September 30, 2024, and September 30, 2023, respectively, and $16.7 million and $14.2 million for the nine months ended September 30, 2024, and September 30, 2023, respectively. The revenue is primarily due to a $10.0 million milestone recognized in the third quarter of 2024 for the Japanese Ministry of Health, Labour, and Welfare approval of LUPKYNIS and a $10.0 million milestone recognized in the third quarter of 2023 for pricing and reimbursement approval, coupled with manufacturing services revenue from Otsuka related to shared capacity services that commenced in late June 2023.

Cost of sales were $6.0 million and $6.8 million for the three months ended September 30, 2024, and September 30, 2023, respectively, and $22.7 million and $8.8 million for the nine months ended September 30, 2024, and September 30, 2023, respectively. The increase for the nine months ended September 30, 2024, is primarily due to the amortization of the monoplant finance right of use asset, which was placed into service in late June 2023 and therefore only partially impacted prior year results.

Gross margin was 91% and 88% for the three months ended September 30, 2024, and September 30, 2023, respectively, and 87% and 93% for the nine months ended September 30, 2024, and September 30, 2023, respectively.

SG&A expenses, inclusive of share-based compensation, were $42.4 million and $47.8 million for the three months ended September 30, 2024, and September 30, 2023, respectively, and $135.0 million and $145.0 million for the nine months ended September 30, 2024, and September 30, 2023, respectively. The decrease in both periods is primarily due to lower employee related costs, including share-based compensation and overhead costs, as a result of a reduction in general and administrative headcount, which occurred late in the first quarter of 2024.

R&D expenses, inclusive of share-based compensation expense, were $3.0 million and $13.6 million for the three months ended September 30, 2024, and September 30, 2023, respectively, and $12.7 million and $39.4 million for the nine months ended September 30, 2024, and September 30, 2023, respectively. The primary drivers in both periods were lower employee costs due to a reduction in headcount late in the first quarter of 2024, a decrease of expenses related to ceasing Aurinia’s AUR300 development program, and timing of expenses related to developing AUR200.

Restructuring expenses were nil and $7.8 million for the three and nine months ended September 30, 2024, and nil for the three and nine months ended September 30, 2023. Restructuring expenses primarily included employee severance, one-time benefit payments, and contract termination expenses related to the restructuring, which occurred late in the first quarter of 2024.

For the three months ended September 30, 2024, Aurinia recorded net income of $14.4 million or $0.10 net income per common share, as compared to a net loss of $(13.4) million or $(0.09) net loss per common share for the three months ended September 30, 2023. For the nine months ended September 30, 2024, Aurinia recorded a net income of $4.3 million or $0.03

net income per common share, as compared to a net loss of $(51.1) million or $(0.36) net loss per common share for the nine months ended September 30, 2023.

Financial Liquidity at September 30, 2024

As of September 30, 2024, Aurinia had cash, cash equivalents, restricted cash, and investments of $348.7 million, compared to $350.7 million at December 31, 2023.

Cash flow from operations was $17.0 million for the three months ended September 30, 2024, compared to $(13.3) million for the three months ended September 30, 2023. Cash flow from operations was $14.3 million for the nine months ended September 30, 2024, compared to $(47.8) million for the nine months ended September 30, 2023.

All amounts in this press release are expressed in U.S. dollars. This press release is intended to be read in conjunction with the Company’s unaudited condensed consolidated financial statements and Management's Discussion and Analysis for the quarter and nine months ended September 30, 2024, in the Company’s Quarterly Report on Form 10-Q and the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, including risk factors disclosed therein, which will be accessible on Aurinia's website at www.auriniapharma.com, on SEDAR at www.sedarplus.ca or on EDGAR at www.sec.gov/edgar.

Webcast & Conference Call Details

The link to the audio webcast is available here. To join the conference call, please dial (800) 715-9871 / +1 (646) 307-1963. Conference ID: 6251719 or company name required for entry. A replay of the webcast will be available on Aurinia’s website.

About Aurinia

Aurinia Pharmaceuticals is a fully integrated biopharmaceutical company focused on delivering therapies to people living with autoimmune diseases with high unmet medical needs. In January 2021, the Company introduced LUPKYNIS® (voclosporin), the first FDA-approved oral therapy dedicated to the treatment of adult patients with active lupus nephritis. Aurinia is also developing AUR200, a differentiated, potential best-in-class therapy for autoimmune diseases that targets both BAFF (B-cell Activating Factor) and APRIL (A Proliferation-Inducing Ligand).

Forward-Looking Statements

Certain statements made in this press release may constitute forward-looking information within the meaning of applicable Canadian securities law and forward-looking statements within the meaning of applicable United States securities law. These forward-looking statements or information include but are not limited to statements or information with respect to: Aurinia’s anticipation of a one-time restructuring charge in the fourth quarter of 2024 of $15 to $19 million, with post-restructuring annualized cash-based operating expense savings of more than $40 million; Aurinia’s estimates as to annual net product revenue from sales of LUPKYNIS in the range of $210 to $220 million in fiscal year 2024; Aurinia’s estimate that it will reduce its workforce by approximately 45%; and Aurinia’s expectation that its restructuring will further improve operational efficiency. It is possible that such results or conclusions may change. Words such as “anticipate”, “will”, “believe”, “estimate”, “expect”, “intend”, “target”, “plan”, “goals”, “objectives”, “may” and other similar words and expressions, identify forward-looking statements. The Company has made numerous assumptions about the forward-looking statements and information contained herein, including among other things, assumptions about: the accuracy of reported data from third party studies and reports; the expected number of patient start forms, patients restarting therapy, and hospital fills, conversion rates and time to convert for patients; pricing for LUPKYNIS and patient persistency on the product; that Aurinia’s intellectual property rights are valid and do not infringe the intellectual property rights of third parties; the clinical development opportunities for its pipeline products; Aurinia’s assumptions relating to the capital required to fund operations; the timing and ability to execute on Aurinia’s restructuring plans; the costs, benefits and scope of Aurinia’s restructuring plans; that Aurinia’s current good relationships with its suppliers, service providers and other third parties will be maintained; assumptions relating to the burn

rate of Aurinia’s cash for operations; and that Aurinia’s third party service providers will comply with their contractual obligations.

Forward-looking information by their nature are based on assumptions and involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, or achievements of Aurinia to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements or information. Such risks, uncertainties and other factors include, among others, the following: Aurinia’s actual future financial and operational results may differ from its expectations; difficulties Aurinia may experience in completing the commercialization of LUPKYNIS; difficulties Aurinia may experience executing its restructuring program; challenges in the conduct of clinical studies; the market for the LN business may not be as estimated; Aurinia may have to pay unanticipated expenses; Aurinia may not be able to obtain sufficient supply to meet commercial demand for LUPKYNIS in a timely fashion; unknown impact and difficulties imposed by the widespread health concerns on Aurinia’s business operations including nonclinical, clinical, regulatory and commercial activities; the results from Aurinia’s clinical studies and from third party studies and reports may not be accurate; Aurinia’s third party service providers may not, or may not be able to, comply with their obligations under their agreements with Aurinia; and Aurinia’s assets or business activities may be subject to disputes that may result in litigation or other legal claims. Although Aurinia has attempted to identify factors that would cause actual actions, events, or results to differ materially from those described in forward-looking statements and information, there may be other factors that cause actual results, performances, achievements, or events to not be as anticipated, estimated or intended. There can be no assurance that forward-looking statements or information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, you should not place undue reliance on forward-looking statements or information. All forward-looking information contained in this press release is qualified by this cautionary statement. Additional information related to Aurinia, including a detailed list of the risks and uncertainties affecting Aurinia and its business, can be found in Aurinia’s most recent Annual Report on Form 10-K and its other public available filings available by accessing the Canadian Securities Administrators’ System for Electronic Document Analysis and Retrieval (SEDAR) website at www.sedarplus.ca or the U.S. Securities and Exchange Commission’s Electronic Document Gathering and Retrieval System (EDGAR) website at www.sec.gov/edgar, and on Aurinia’s website at www.auriniapharma.com.

Media & Investor Inquiries:

Andrea Christopher

Corporate Communications & Investor Relations

Aurinia Pharmaceuticals Inc.

achristopher@auriniapharma.com

General Investor Inquiries:

ir@auriniapharma.com

AURINIA PHARMACEUTICALS INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

| | | | | | | | | | | | | | |

| (unaudited) | | September 30,

2024 | | December 31, 2023 |

| ASSETS | | | | |

| Current assets | | | | |

| Cash, cash equivalents, and restricted cash | | $ | 37,142 | | | $ | 48,875 | |

| Short-term investments | | 311,605 | | | 301,614 | |

| Accounts receivable, net | | 36,483 | | | 24,089 | |

| Inventories, net | | 38,714 | | | 39,705 | |

| Prepaid expenses and deposits | | 13,815 | | | 9,486 | |

| Other current assets | | 2,700 | | | 1,031 | |

| Total current assets | | 440,459 | | | 424,800 | |

| | | | |

| Non-current assets | | | | |

| Long-term investments | | — | | | 201 | |

| Other non-current assets | | 868 | | | 1,517 | |

| Property and equipment, net | | 2,887 | | | 3,354 | |

| Acquired intellectual property and other intangible assets, net | | 4,509 | | | 4,977 | |

| Finance right-of-use assets, net | | 96,459 | | | 108,715 | |

| Operating right-of-use assets, net | | 4,179 | | | 4,498 | |

| Total assets | | $ | 549,361 | | | $ | 548,062 | |

| | | | |

| LIABILITIES | | | | |

| Current liabilities | | | | |

| Accounts payable and accrued liabilities | | 56,770 | | | 54,389 | |

| Deferred revenue | | 4,304 | | | 4,813 | |

| Other current liabilities | | 1,590 | | | 2,388 | |

| Finance lease liabilities | | 14,927 | | | 14,609 | |

| Operating lease liabilities | | 1,018 | | | 989 | |

| Total current liabilities | | 78,609 | | | 77,188 | |

| | | | |

| Non-current liabilities | | | | |

| Finance lease liabilities | | 65,955 | | | 75,479 | |

| Operating lease liabilities | | 5,951 | | | 6,530 | |

| Deferred compensation and other non-current liabilities | | 10,844 | | | 10,911 | |

| Total liabilities | | 161,359 | | | 170,108 | |

| SHAREHOLDER’S EQUITY | | | | |

| Common shares - no par value, unlimited shares authorized, 143,109 and 143,833 shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively | | 1,206,613 | | | 1,200,218 | |

| Additional paid-in capital | | 119,773 | | | 120,788 | |

| Accumulated other comprehensive loss | | (385) | | | (730) | |

| Accumulated deficit | | (937,999) | | | (942,322) | |

| Total shareholders' equity | | 388,002 | | | 377,954 | |

| Total liabilities and shareholders' equity | | $ | 549,361 | | | $ | 548,062 | |

AURINIA PHARMACEUTICALS INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | Nine months ended |

| | September 30, | | September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | (unaudited) |

| Revenue | | | | | | | | |

| Product revenue, net | | $ | 55,503 | | | $ | 40,781 | | | $ | 158,604 | | | $ | 116,218 | |

License, collaboration, and royalty revenue | | 12,268 | | | 13,734 | | | 16,662 | | | 14,200 | |

| Total revenue, net | | 67,771 | | | 54,515 | | | 175,266 | | | 130,418 | |

| Operating expenses | | | | | | | | |

| Cost of sales | | 6,035 | | | 6,769 | | | 22,696 | | | 8,753 | |

| Selling, general and administrative | | 42,367 | | | 47,759 | | | 134,996 | | | 144,964 | |

| Research and development | | 3,047 | | | 13,605 | | | 12,678 | | | 39,413 | |

| Restructuring expenses | | — | | | — | | | 7,755 | | | — | |

| Other expense (income), net | | 4,574 | | | 2,645 | | | 159 | | | (695) | |

| Total cost of sales and operating expenses | | 56,023 | | | 70,778 | | | 178,284 | | | 192,435 | |

| Income (Loss) from operations | | 11,748 | | | (16,263) | | | (3,018) | | | (62,017) | |

| Interest expense | | (1,208) | | | (1,400) | | | (3,689) | | | (1,465) | |

| Interest income | | 4,267 | | | 4,514 | | | 12,982 | | | 12,429 | |

| Net income (loss) before income taxes | | 14,807 | | | (13,149) | | | 6,275 | | | (51,053) | |

| Income tax expense | | 457 | | | 298 | | | 1,952 | | | 92 | |

| Net income (loss) | | $ | 14,350 | | | $ | (13,447) | | | $ | 4,323 | | | $ | (51,145) | |

| | | | | | | | |

| Net income (loss) per share: | | | | | | | | |

| Basic | | $ | 0.10 | | | $ | (0.09) | | | $ | 0.03 | | | $ | (0.36) | |

| Diluted | | $ | 0.10 | | | $ | (0.09) | | | $ | 0.03 | | | $ | (0.36) | |

| | | | | | | | |

| Weighted-average common shares outstanding: | | | | | | | | |

| Basic | | 143,051 | | | 142,847 | | | 143,353 | | | 143,085 | |

| Diluted | | 145,651 | | | 142,847 | | | 145,010 | | | 143,085 | |

AURINIA PHARMACEUTICALS INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS | | | | | | | | | | | | | | |

| | Nine Months Ended September 30, |

| | 2024 | | 2023 |

| (in thousands) | | (unaudited) |

| Cash flows from operating activities | | | | |

| Net income (loss) | | $ | 4,323 | | | $ | (51,145) | |

| Adjustments to reconcile net loss to net cash used in operating activities | | | | |

| Depreciation and amortization | | 14,583 | | | 6,698 | |

| | | | |

| Net amortization of premiums and discounts on short-term investments | | (9,752) | | | (8,836) | |

| Share-based compensation expense | | 22,650 | | | 33,543 | |

| Foreign exchange on finance lease liability | | (718) | | | (1,335) | |

| Other, net | | 220 | | | (1,659) | |

| Net changes in operating assets and liabilities | | | | |

| Accounts receivable, net | | (12,394) | | | (24,463) | |

| Inventories, net | | 991 | | | (8,984) | |

| Prepaid expenses and other current assets | | (6,001) | | | (2,889) | |

| Non-current operating assets | | (12) | | | (16) | |

| Accounts payable, accrued and other liabilities | | 934 | | | 11,812 | |

| Operating lease liabilities | | (550) | | | (499) | |

| Net cash provided by (used in) operating activities | | 14,274 | | | (47,773) | |

| Cash flows from investing activities | | | | |

| Purchase of investments | | (461,140) | | | (379,213) | |

| Proceeds from investments | | 461,448 | | | 391,287 | |

| Upfront lease payment | | (44) | | | (11,864) | |

| Purchase of property and equipment | | — | | | (419) | |

| Capitalized patent costs | | (225) | | | (240) | |

| Net cash provided by (used in) investing activities | | 39 | | | (449) | |

| Cash flows from financing activities | | | | |

| Repurchase of common shares | | (18,435) | | | — | |

| Principal portion of finance lease payments | | (8,959) | | | (3,482) | |

| Proceeds from exercise of stock options and employee share purchase plan | | 1,348 | | | 3,929 | |

| Cash (used in) provided by financing activities | | (26,046) | | | 447 | |

| | | | |

| Net decrease in cash, cash equivalents, and restricted cash | | (11,733) | | | (47,775) | |

| Cash, cash equivalents, and restricted cash, beginning of period | | 48,875 | | | 94,172 | |

| Cash, cash equivalents, and restricted cash, end of period | | $ | 37,142 | | | $ | 46,397 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Aurinia Pharmaceuticals Appoints Craig Johnson to Board of Directors to Support Next Phase of Growth

ROCKVILLE, Maryland and EDMONTON, Alberta – November 7, 2024 – Aurinia Pharmaceuticals Inc. (NASDAQ: AUPH) (Aurinia or the Company) today announced that it has appointed Craig Johnson to its Board of Directors (the Board) to support its next phase of growth. Mr. Johnson has more than 30 years of experience serving in senior financial management roles and governing companies in the biotechnology industry. He previously served as a director of Ardea Biosciences, Inc., Adamis Pharmaceuticals Corporation, Decipher Biosciences, Inc., La Jolla Pharmaceutical Company, Odonate Therapeutics, Inc. and Mirati Therapeutics, Inc. He currently serves as a director of Heron Therapeutics, Inc. His biography can be found here.

The Company also announced that Dr. Robert T. Foster has retired from the Board.

“As part of our ongoing efforts to ensure that the Board includes the most qualified professionals to help guide the Company to maximize shareholder value, we are pleased to welcome Craig to the Board,” stated Kevin Tang, Chair of the Board. “The Board would also like to thank Robert for his many contributions to the Company.”

About Aurinia

Aurinia Pharmaceuticals is a fully integrated biopharmaceutical company focused on delivering therapies to people living with autoimmune diseases with high unmet medical needs. In January 2021, the Company introduced LUPKYNIS® (voclosporin), the first FDA-approved oral therapy dedicated to the treatment of adult patients with active lupus nephritis. Aurinia is also developing AUR200, a differentiated, potential best-in-class therapy for autoimmune diseases that targets both BAFF (B-cell Activating Factor) and APRIL (A Proliferation-Inducing Ligand).

Media & Investor Inquiries:

Andrea Christopher

Corporate Communications & Investor Relations

Aurinia Pharmaceuticals Inc.

achristopher@auriniapharma.com

General Investor Inquiries:

ir@auriniapharma.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

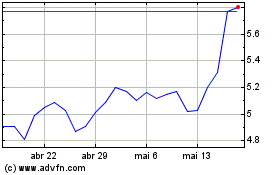

Aurinia Pharmaceuticals (NASDAQ:AUPH)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Aurinia Pharmaceuticals (NASDAQ:AUPH)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025