false000167158400016715842024-11-072024-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 07, 2024 |

APTEVO THERAPEUTICS INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-37746 |

81-1567056 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

2401 4th Avenue Suite 1050 |

|

Seattle, Washington |

|

98121 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (206) 838-0500 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.001 par value |

|

APVO |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 7, 2024, Aptevo Therapeutics Inc. (the “Company”) issued a press release announcing its financial results for the period ended September 30, 2024. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

The information in this report, including the exhibit hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained herein and in the accompanying exhibit shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission (the “SEC”) made by the Company, whether made before, on or after the date hereof, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

APTEVO THERAPEUTICS INC. |

|

|

|

|

Date: |

November 7, 2024 |

By: |

/s/ Marvin L. White |

|

|

|

Marvin L. White

President and Chief Executive Officer |

Exhibit 99.1

APTEVO THERAPEUTICS REPORTS 3Q 2024 FINANCIAL RESULTS AND

PROVIDES A BUSINESS UPDATE

Company Achieves Milestones in Both Clinical Programs

Initiates Mipletamig Phase 1b/2 Clinical Trial, “RAINIER,” in Frontline Acute Myeloid Leukemia, Informed by Positive Dose Escalation Trial Results

Presented Interim Data from ALG.APV-527 Phase 1 Trial in Multiple Solid Tumors at the European Society for Medical Oncology Congress

Additional Favorable Data to be Presented at the Society for Immunotherapy of Cancer Conference on November 8th

Raises $5.75 Million in the Quarter

SEATTLE, WA – November 7, 2024 – Aptevo Therapeutics Inc. (Nasdaq: APVO), a clinical-stage biotechnology company focused on developing novel immune-oncology therapeutics based on its proprietary ADAPTIR™ and ADAPTIR-FLEX™ platform technologies, today reported financial results for the quarter ending September 30, 2024 and provided a business update.

Business Highlights

Aptevo met multiple clinical milestones in the third quarter, including:

•Based on positive safety, tolerability efficacy and durability data in its completed dose escalation trial, Aptevo Initiated the mipletamig Phase 1b/2 dose optimization trial, "RAINIER," as part of its ongoing program to evaluate the compound in combination with standard of care venetoclax + azacitidine in frontline patients with acute myeloid leukemia (AML). RAINIER will be conducted in two parts. First, a Phase 1b frontline AML dose optimization study followed by a Phase 2 study

•Presented positive interim data from their Phase 1 trial evaluating ALG.APV-527 as monotherapy for the treatment of solid tumors likely to express the tumor antigen 5T4 at the European Society of Medical Oncology (ESMO) Congress in September. Additional positive trial data will be presented at the Society for Immunotherapy of Cancer conference on November 8th.

•Highlights from the ESMO presentation include:

oClinical Activity/Efficacy: To date, nine of 15 efficacy evaluable patients (60%) have a best overall response of stable disease (SD). The longest SD duration was in a breast cancer patient who entered the study with progressive disease, achieved stable disease

and remained on study for >11 months. This patient successfully transitioned to a higher dose level twice.

oSafety and Tolerability: ALG.APV-527 demonstrated a well-tolerated safety profile across all dose-level cohorts dosed to date.

oEvidence of biological activity: ALG.APV-527 could be measured in all patients with serum concentration of ALG.APV-527 consistent with the administered dose and preclinical predictions. Biomarker analyses confirm biological activity of ALG.APV-527

•Closed two financings for total proceeds of $5.75 million during the quarter

"Aptevo achieved significant clinical progress in both programs this quarter, marking important progress toward our mission and goals. We were thrilled to initiate the next phase of our mipletamig development program—a robust Phase 1b/2 trial for frontline AML patients, combining mipletamig with the established standard of care, venetoclax and azacitidine. This trial structure is informed by the encouraging results from our dose expansion trial, reinforcing our belief in mipletamig's transformative potential for AML patients,” stated Marvin White, President and CEO of Aptevo. “We also released positive interim data on our solid tumor drug, ALG.APV-527, at the European Society of Medical Oncology conference in September that further underscores the impact of our innovation. In early clinical evaluation, our solid tumor targeting bispecific demonstrated safety, tolerability, and compelling activity, with 60% of evaluable patients achieving stable disease in monotherapy across challenging tumor types, including breast and colon cancer. The progress we’re witnessing, combined with nearly $6 million in capital secured in the quarter, sets a promising stage for the fourth quarter and lays the groundwork for continued successes into 2025.”

3Q Summary Financial Results

Cash Position: Aptevo had cash and cash equivalents totaling $7.8 million as of September 30, 2024.

Research and Development Expenses: Research and development expenses decreased by $0.8 million, from $3.9 million for the three months ended September 30, 2023, to $3.1 million for the three months ended September 30, 2024. The decrease was primarily due to lower spending on preclinical projects and employee costs.

General and Administrative Expenses: General and administrative expenses decreased by $0.6 million, from $2.7 million for the three months ended September 30, 2023, to $2.1 million for the three months ended September 30, 2024. The decrease is primarily due to lower employee and consulting costs.

Other Income (Expense), Net:

Other Income (Expense) from Continuing Operations, Net consists of other income, net of $0.1 million and $0.2 million for the three months ended September 30, 2024, and 2023, respectively. The change in other income, net is primarily due to the decrease of interest income from our money market accounts.

Net Income (Loss): Aptevo had a net loss of $5.1 million or $0.48 per share for the three months ended September 30, 2024, compared to a net loss of $6.3 million or $22.16 per share for the corresponding period in 2023.

Aptevo Therapeutics Inc.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share amounts, unaudited)

|

|

|

|

|

|

|

|

|

|

|

September 30, 2024 |

|

|

December 31, 2023 |

|

ASSETS |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

7,753 |

|

|

$ |

16,904 |

|

Prepaid expenses |

|

|

1,635 |

|

|

|

1,473 |

|

Other current assets |

|

|

624 |

|

|

|

689 |

|

Total current assets |

|

|

10,012 |

|

|

|

19,066 |

|

Property and equipment, net |

|

|

614 |

|

|

|

895 |

|

Operating lease right-of-use asset |

|

|

4,520 |

|

|

|

4,881 |

|

Total assets |

|

$ |

15,146 |

|

|

$ |

24,842 |

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable and other accrued liabilities |

|

$ |

3,532 |

|

|

$ |

3,984 |

|

Accrued compensation |

|

|

922 |

|

|

|

2,098 |

|

Other current liabilities |

|

|

1,428 |

|

|

|

1,142 |

|

Total current liabilities |

|

|

5,882 |

|

|

|

7,224 |

|

Other long-term liabilities |

|

|

14 |

|

|

|

— |

|

Operating lease liability |

|

|

4,830 |

|

|

|

5,397 |

|

Total liabilities |

|

|

10,726 |

|

|

|

12,621 |

|

|

|

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

|

Preferred stock: $0.001 par value; 15,000,000 shares authorized, zero shares issued or outstanding |

|

|

— |

|

|

|

— |

|

Common stock: $0.001 par value; 500,000,000 shares authorized; 17,050,536 and 442,458 shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively |

|

|

82 |

|

|

|

61 |

|

Additional paid-in capital |

|

|

245,603 |

|

|

|

235,607 |

|

Accumulated deficit |

|

|

(241,265 |

) |

|

|

(223,447 |

) |

Total stockholders' equity |

|

|

4,420 |

|

|

|

12,221 |

|

Total liabilities and stockholders' equity |

|

$ |

15,146 |

|

|

$ |

24,842 |

|

Aptevo Therapeutics Inc.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except share and per share amounts, unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

(3,103 |

) |

|

$ |

(3,887 |

) |

|

|

(10,498 |

) |

|

|

(13,516 |

) |

General and administrative |

|

|

(2,110 |

) |

|

|

(2,674 |

) |

|

|

(7,722 |

) |

|

|

(8,978 |

) |

Loss from operations |

|

|

(5,213 |

) |

|

|

(6,561 |

) |

|

|

(18,220 |

) |

|

|

(22,494 |

) |

Other income: |

|

|

|

|

|

|

|

|

|

|

|

|

Other income from continuing operations, net |

|

|

112 |

|

|

|

227 |

|

|

|

402 |

|

|

|

390 |

|

Gain related to sale of non-financial asset |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

9,650 |

|

Net loss from continuing operations |

|

$ |

(5,101 |

) |

|

$ |

(6,334 |

) |

|

$ |

(17,818 |

) |

|

$ |

(12,454 |

) |

Discontinued operations: |

|

|

|

|

|

|

|

|

|

|

|

|

Income from discontinued operations |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

946 |

|

Net loss |

|

$ |

(5,101 |

) |

|

$ |

(6,334 |

) |

|

$ |

(17,818 |

) |

|

$ |

(11,508 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted net loss per share from continuing operations: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.48 |

) |

|

$ |

(22.16 |

) |

|

$ |

(5.01 |

) |

|

$ |

(60.84 |

) |

Diluted |

|

$ |

(0.48 |

) |

|

$ |

(22.16 |

) |

|

$ |

(5.01 |

) |

|

$ |

(60.84 |

) |

Basic and diluted net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.48 |

) |

|

$ |

(22.16 |

) |

|

$ |

(5.01 |

) |

|

$ |

(56.22 |

) |

Diluted |

|

$ |

(0.48 |

) |

|

$ |

(22.16 |

) |

|

$ |

(5.01 |

) |

|

$ |

(56.22 |

) |

Shares used in calculation: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

10,548,470 |

|

|

|

285,886 |

|

|

|

3,554,796 |

|

|

|

204,694 |

|

Diluted |

|

|

10,548,470 |

|

|

|

285,886 |

|

|

|

3,554,796 |

|

|

|

204,694 |

|

About Aptevo Therapeutics Inc.

Aptevo Therapeutics Inc. is a clinical-stage biotechnology company focused on developing novel immuno-oncology therapies for the treatment of cancer. Aptevo is seeking to improve treatment outcomes for cancer patients. For more information, please visit www.aptevotherapeutics.com.

Safe Harbor Statement

This press release includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, including, without limitation, Aptevo’s expectations about the activity, efficacy, safety, tolerability and durability of its therapeutic candidates and potential use of any such candidates, including in combination with other drugs, as therapeutics for treatment of disease, its expectations regarding the effectiveness of its ADAPTIR and ADAPTIR-FLEX platforms, statements related to the progress of Aptevo’s clinical programs, including statements related to anticipated clinical and regulatory milestones, whether further study of mipletamig in a Phase 1b dose optimization trial focusing on multiple doses of mipletamig in combination with venetoclax + azacitidine on a targeted patient population will continue to show clinical benefit, whether Aptevo’s final trial results will vary from its earlier assessment, whether further study of ALG.APV-527 across multiple tumor types will continue to show clinical benefit, whether higher dose ranges for ALG.APV-527 will result in increased signs of clinical activity, whether biomarker analyses will continue to confirm biological activity of ALG.APV-527, the possibility and timing of future preliminary or interim data readouts for ALG.APV-527, whether Aptevo's final trial results will vary from its preliminary or interim assessments, statements related to the progress of and enthusiasm for Aptevo's clinical programs, statements related to Aptevo’s cash position and balance sheet, statements related to Aptevo’s ability to generate stockholder value, whether Aptevo will continue to have momentum in its business in the future, and any other statements containing the words “may,” “continue to,” “believes,” “knows,” “expects,” “optimism,” “potential,” “designed,” “promising,” “plans,” “will” and similar expressions are intended to identify forward-looking statements. These forward-looking statements are based on Aptevo’s current intentions, beliefs, and expectations regarding future events. Aptevo cannot guarantee that any forward-looking statement will be accurate. Investors should realize that if underlying assumptions prove inaccurate or unknown risks or uncertainties materialize, actual results could differ materially from Aptevo’s expectations. Investors are, therefore, cautioned not to place undue reliance on any forward-looking statement.

There are several important factors that could cause Aptevo’s actual results to differ materially from those indicated by such forward-looking statements, including a deterioration in Aptevo’s business or prospects; further assessment of preliminary or interim data or different results from later clinical trials; adverse events and unanticipated problems, adverse developments in clinical development, including unexpected safety issues observed during a clinical trial; and changes in regulatory, social, macroeconomic and political conditions. For instance, actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors, including the uncertainties inherent in the results of preliminary or interim data and preclinical studies being predictive of the results of later-stage clinical trials, initiation, enrollment and maintenance of patients, and the completion of clinical trials, the availability and timing of data from ongoing clinical trials, the trial design includes combination therapies that may make it difficult to accurately ascertain the benefits of mipletamig, expectations for the timing and steps required in the regulatory review process, expectations for regulatory approvals, the impact of competitive products, our ability to enter into agreements with strategic partners or raise funds on acceptable terms or at all and other matters that could affect the availability or commercial potential of Aptevo’s product candidates, business or economic disruptions due to catastrophes or other events, including natural disasters or public health crises such as the coronavirus (referred to as COVID-19), geopolitical risks, including the current war between Russia and Ukraine, war between Israel and Hamas, and macroeconomic conditions such as

economic uncertainty, rising inflation and interest rates, continued market volatility and decreased consumer confidence and uncertainty in the impact of the results of the United States presidential election and congressional election. These risks are not exhaustive, Aptevo faces known and unknown risks. Additional risks and factors that may affect results are set forth in Aptevo’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the fiscal year ended December 31, 2023, and its subsequent reports on Form 10-Q and current reports on Form 8-K. The foregoing sets forth many, but not all, of the factors that could cause actual results to differ from Aptevo’s expectations in any forward-looking statement. Any forward-looking statement speaks only as of the date of this press release, and, except as required by law, Aptevo does not assume any obligation to update any forward-looking statement to reflect new information, events, or circumstances.

CONTACT:

Miriam Weber Miller

Head, Investor Relations & Corporate Communications

Aptevo Therapeutics

Email: IR@apvo.com or Millerm@apvo.com

Phone: 206-859-6628

v3.24.3

Document And Entity Information

|

Nov. 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 07, 2024

|

| Entity Registrant Name |

APTEVO THERAPEUTICS INC.

|

| Entity Central Index Key |

0001671584

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-37746

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

81-1567056

|

| Entity Address, Address Line One |

2401 4th Avenue

|

| Entity Address, Address Line Two |

Suite 1050

|

| Entity Address, City or Town |

Seattle

|

| Entity Address, State or Province |

WA

|

| Entity Address, Postal Zip Code |

98121

|

| City Area Code |

(206)

|

| Local Phone Number |

838-0500

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Trading Symbol |

APVO

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

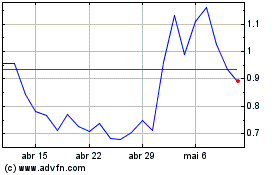

Aptevo Therapeutics (NASDAQ:APVO)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Aptevo Therapeutics (NASDAQ:APVO)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024