UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 6)*

Wheels Up Experience Inc.

(Name of Issuer)

Class A Common Stock, par value $0.0001 per

share

(Title of Class of Securities)

96328L 205

(CUSIP Number)

Peter W. Carter

Executive Vice President – External Affairs

Delta Air Lines, Inc.

1030 Delta Boulevard

Atlanta, GA 30354

(404) 715-2600

(Name, Address and Telephone Number of Person Authorized

to Receive Notices and Communications)

November 13, 2024

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G

to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f)

or 240.13d-1(g), check the following box ☐.

Note: Schedules filed in paper format shall include a signed

original and five copies of the schedule, including all exhibits. See Rule §240.13d-7 for other parties to whom copies are to be

sent.

* The remainder of this cover page shall be filled out for a reporting

person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information

which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

| CUSIP No. 96328L 205 |

SCHEDULE 13D |

|

| 1 |

|

Names of Reporting Persons

DELTA AIR LINES, INC. |

| 2 |

|

Check the Appropriate Box If a Member of a Group (See Instructions)

a. ☐

b. ☒

|

| 3 |

|

SEC Use Only

|

| 4 |

|

Source of Funds (See Instructions)

SC |

| 5 |

|

Check Box If Disclosure of Legal Proceedings Is Required Pursuant to

Items 2(d) or 2(e) ☐

|

| 6 |

|

Citizenship or Place of Organization

Delaware |

|

Number of

Shares

Beneficially

Owned By

Each

Reporting

Person

With

|

|

7 |

|

Sole Voting Power

263,369,307 |

| |

8 |

|

Shared Voting Power

0 |

| |

9 |

|

Sole Dispositive Power

263,369,307 |

| |

10 |

|

Shared Dispositive Power

0 |

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

263,369,307 |

| 12 |

|

Check Box If the Aggregate Amount in Row (11) Excludes Certain Shares

(See Instructions) ☐

|

| 13 |

|

Percent of Class Represented By Amount in Row (11)

37.7%(1) (2) |

| 14 |

|

Type of Reporting Person (See Instructions)

CO |

_____________________

1 Percentage calculated on

the basis of 697,811,664 shares of Class A Common Stock, $0.0001 par value (the “Class A Common Stock”), of Wheels

Up Experience Inc. (the “Issuer”), outstanding as of November 4, 2024, as reported by the Issuer on Form 10-Q for

the quarterly period ended September 30, 2024 filed with the Securities and Exchange Commission (“SEC”) on November

7, 2024. Neither this percentage nor the shares listed above as being beneficially owned reflect Earnout Shares (as defined in the Issuer’s

initial statement on Schedule 13D), which are issuable only upon the achievement of share price thresholds for Class A Common Stock that

have not been satisfied.

2 The percentage reported

above does not give effect to the Voting Agreement (as defined in Amendment No. 3 to the Issuer’s initial statement on Schedule

13D), pursuant to which the Reporting Person has agreed with the Issuer that any shares of Class A Common Stock held directly or indirectly

by the Reporting Person in excess of 29.9% of the issued and outstanding Class A Common Stock shall be neutral shares with respect to

voting rights, voted on any matter submitted to a vote of the stockholders of the Issuer in the same proportions “for”, “against”,

“abstain” and/or “withhold” on such matter as the shares of Class A Common Stock voted by the stockholders of

the Issuer other than the Reporting Person.

Explanatory Note

This Amendment No. 6 (“Amendment No. 6”)

to Schedule 13D relates to the Issuer’s Class A Common Stock and amends and supplements the initial statement on Schedule 13D filed

by the Reporting Person on July 22, 2021, as amended by Amendment No. 1 thereto (“Amendment No. 1”), filed by the Reporting

Person on August 15, 2023, Amendment No. 2 thereto (“Amendment No. 2”), filed by the Reporting Person on August 29,

2023, Amendment No. 3 thereto (“Amendment No. 3”), filed by the Reporting Person on September 22, 2023, Amendment No.

4 thereto (“Amendment No. 4”), filed by the Reporting Person on November 17, 2023, and Amendment No. 5 thereto (“Amendment

No. 5”), filed by the Reporting Person on September 24, 2024 (as so amended, the “Schedule 13D”). Capitalized

terms used but not defined in this Amendment No. 6 shall have the same meanings ascribed to them in the Schedule 13D. Except as specifically

provided herein, this Amendment No. 6 does not modify any of the information previously reported in the Schedule 13D.

| Item 3. |

Source and Amount of Funds or Other Consideration |

Item 3 is hereby amended by deleting the first

paragraph of Item 3 and replacing it with the following:

“The responses of the Reporting Person to

Items 2, 4, 5 and 6 of the Schedule 13D, as amended by this Amendment No. 6, are incorporated into this Item 3 by reference.”

| Item 4. |

Purpose of Transaction. |

Item 4 is hereby amended and supplemented by deleting

the last paragraph of Item 4 of Amendment No. 5 and replacing it with the following:

“Credit Support for the Revolving Equipment

Notes Facility and Amendment No. 2 to the Credit Agreement

As disclosed by the Issuer in a Current Report

on Form 8-K filed by the Issuer with the Securities and Exchange Commission on November 14, 2024 (the “Form 8-K”),

WUP LLC, an indirect subsidiary of the Issuer (“WUP LLC”), entered into a Note Purchase Agreement, dated as of

November 13, 2024 (the “Note Purchase Agreement”), with Wilmington Trust, National Association, as subordination agent

and trustee, and Wheels Up Class A-1 Loan Trust 2024-1, a Delaware statutory trust, which provides for the issuance from time

to time by WUP LLC of Series A-1 equipment notes (the “Revolving Equipment Notes”) in the aggregate principal

amount not to exceed $332.0 million (the “Revolving Equipment Notes Facility”). The Revolving Equipment Notes

Facility utilizes an enhanced equipment trust certificate (EETC) loan structure. The Revolving Equipment Notes are secured by first-priority

liens on certain of the Issuer’s owned aircraft. The other material terms of the Note Purchase Agreement and Revolving Equipment

Notes Facility, including the use of proceeds from the initial closing of the Revolving Equipment Notes Facility, are described in more

detail in the Form 8-K.

The Reporting Person provided credit support for

the Revolving Equipment Notes Facility, which effectively guarantees WUP LLC’s payment obligations thereunder upon the occurrence

and continuation of specified events of default in exchange for an annual fee as a percentage of the aggregate principal amounts drawn

under the Revolving Equipment Notes Facility. The fee is payable-in-kind by the Issuer as if it was an amount borrowed under the revolving

working capital credit facility provided for under the Credit Agreement (as described above under the heading “Credit Agreement”

in this Item 4), over the life of the Revolving Equipment Notes Facility.

In connection with the initial closing of the Revolving

Equipment Notes Facility, the Issuer entered into Amendment No. 2 to the Credit Agreement, dated as of November 13, 2024 (the “Credit

Agreement Amendment No. 2”), by and among the Issuer, as borrower, the other loan parties party thereto, as guarantors,

the Reporting Person and CK Wheels, together constituting the Required Lenders and Lead Lenders (as each term is defined in the Credit

Agreement) thereunder, and U.S. Bank Trust Company, N.A., not in its individual capacity but solely as administrative agent

for the lenders, pursuant to which, among other things, certain technical amendments were made to permit the Revolving Equipment Notes

Facility and certain other conforming changes.

The foregoing description of the Credit Agreement

Amendment No. 2 does not purport to be complete and is qualified in its entirety by reference to the Credit Agreement Amendment No. 2

filed as Exhibit 7 to this Schedule 13D, which is incorporated by reference herein.

The Reporting Person disclaims membership in a

“group” within the meaning of Section 13(d) of the Act and beneficial ownership over any of the shares of Class A Common Stock

beneficially owned by any other person, and nothing in this Amendment No. 6 shall be deemed an admission that the Reporting Person is

a member of a “group” within the meaning of Section 13(d) of the Act.”

| Item 5. |

Interest in Securities of the Issuer |

Item 5(a-b) is hereby amended and restated as follows:

“(a-b) The responses of the Reporting Person

to rows (7) through (13) on page 1 and Items 2, 3, 4 and 6 of the Schedule 13D, as amended by this Amendment No. 6, are incorporated into

this Item 5 by reference.

To the Reporting Person’s knowledge, none

of the Covered Persons directly owns any shares of the Class A Common Stock; however, because each Covered Person is a director or executive

officer of the Reporting Person, each Covered Person may be deemed to be the beneficial owner of the Class A Common Stock beneficially

owned by the Reporting Person. The Covered Persons disclaim any beneficial ownership of the shares of Class A Common Stock held by the

Reporting Person. None of the Covered Persons shares voting or dispositive power over any shares of Class A Common Stock held by the Reporting

Person.”

| Item 6. |

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer. |

Item 6 is hereby amended by deleting the first

paragraph of Item 6 and replacing it with the following:

“The responses of the Reporting Person to

Items 2, 3, 4, 5 of the Schedule 13D, as amended by this Amendment No. 6, are incorporated into this Item 6 by reference.”

| Item 7. |

Material to Be Filed as Exhibits. |

Item 7 is hereby amended to add the following exhibit:

| Exhibit 7 |

Amendment No. 2 to Credit Agreement, dated as of November 13, 2024, by and among Wheels Up Experience Inc., as Borrower, the subsidiaries of Wheels Up Experience Inc. party thereto, Delta Air Lines, Inc. and CK Wheels LLC, constituting the Required Lenders and Lead Lenders thereunder, and U.S. Bank Trust Company, N.A., not in its individual capacity but solely as administrative agent for the lenders (with a conformed version of the Credit Agreement through and including Amendment No. 2 thereto provided in Exhibit A thereto) (incorporated by reference to Exhibit 10.1 to the Issuer’s Current

Report on Form 8-K filed on November 14, 2024).

|

SIGNATURES

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| Dated: November 14, 2024 |

DELTA AIR LINES, INC. |

| |

|

|

| |

By: |

|

/s/ Peter W. Carter |

| |

|

|

Peter W. Carter |

| |

|

|

Executive Vice President – External Affairs |

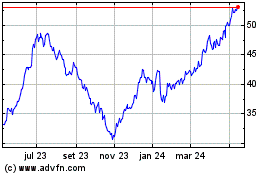

Delta Air Lines (NYSE:DAL)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Delta Air Lines (NYSE:DAL)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024