false

0001682639

0001682639

2024-11-15

2024-11-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d)

of the Securities Exchange

Act of 1934

Date of Report (Date

of earliest event reported): November 15, 2024

EYENOVIA, INC.

(Exact Name of Registrant

as Specified in its Charter)

| Delaware |

|

001-38365 |

|

47-1178401 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

295 Madison Avenue, Suite 2400, New York, NY

10017

(Address of Principal Executive Offices, and

Zip Code)

(833) 393-6684

Registrant’s Telephone Number, Including

Area Code

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section

12(b) of the Act:

| (Title of each class) |

|

(Trading

Symbol) |

|

(Name of each exchange

on which registered) |

| Common stock, par value $0.0001 per share |

|

EYEN |

|

The Nasdaq Stock Market

(Nasdaq Capital Market) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.05 | Costs Associated with Exit or Disposal Activities. |

The information required by this item is incorporated

by reference from Item 8.01 below.

On November 15, 2024, Eyenovia, Inc. (the “Company”) issued

a press release announcing the outcome of a review of the three-year efficacy and safety data from the MicroPine Phase 3 CHAPERONE study

conducted by an independent Data Monitoring Committee. In light of the results of this review, the Company is considering a variety of

steps to maximize value to all stakeholders, to reduce expenses and to evaluate its strategic options, which may include a business combination,

reverse merger, asset sales or a combination of those alternatives. Further information will be made available once the evaluation

of strategic options has been completed.

The Company is implementing a reduction in force affecting approximately

50% of its workforce. The remaining staff will be focused on Optejet® Gen-2 development, our dry eye collaborations and

clobetasol commercialization. The estimated total cost of severance-related expenses relating to this reduction in force is $0.2 million.

These estimated charges are subject to a number of assumptions and actual results may differ. The Company may also incur other charges

not currently contemplated due to events that may occur as a result of, or associated with, the evaluation of its strategic options.

A copy of the press release is attached hereto as Exhibit 99.1 and

is incorporated herein in its entirety by reference.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

EYENOVIA, INC. |

| |

|

|

| Dated: November 15, 2024 |

By: |

/s/ Andrew Jones |

| |

|

Andrew Jones |

| |

|

Chief Financial Officer |

Exhibit 99.1

Eyenovia Provides Update on Phase 3 CHAPERONE

Study

A review of study data by an independent Data

Review Committee found that CHAPERONE is not meeting its primary three-year efficacy endpoint

Company to discontinue study, review full data

set, and evaluate next steps for the program

NEW YORK— November 15, 2024—Eyenovia,

Inc. (NASDAQ: EYEN), an ophthalmic technology company, today announced that a review of the CHAPERONE data by an independent Data

Review Committee (DRC) found that the trial is not meeting its primary endpoint of a less than 0.5 diopter progression in visual acuity

over three years. CHAPERONE is Eyenovia’s Phase 3 study evaluating its proprietary drug-device combination of low-dose atropine

in the Company’s Optejet dispensing platform as a potential treatment for pediatric progressive myopia.

The DRC reviewed the safety and efficacy data

from 252 evaluable patients. The DRC found that the rate of myopia progression was not significantly different between the two active

treatment arms (0.01% and 0.1% atropine ophthalmic metered spray) and placebo. In the safety analysis, all dosages and placebo appeared

to be well-tolerated, with a mild and infrequent adverse event profile. Full study data has not yet been released to Eyenovia.

“We are disappointed that the DRC determined

that the CHAPERONE study does not appear to be meeting its primary efficacy endpoint,” stated Michael Rowe, Chief Executive Officer

of Eyenovia. “We plan to terminate the study, review the data more thoroughly, and evaluate next steps. On behalf of the entire

company, I would like to express my sincere appreciation to the children, parents, caregivers and healthcare professionals who participated

in this trial, as well as all the Eyenovia team members for their exceptional work on this program.”

In light of the results of this review, the Company

is considering a variety of steps to maximize value to all stakeholders, to reduce expenses and to evaluate its strategic options, which

may include a business combination, reverse merger, asset sales or a combination of those alternatives. Further information will

be made available once the evaluation of strategic options has been completed.

About Eyenovia, Inc.

Eyenovia, Inc. (NASDAQ:

EYEN) is an ophthalmic technology company developing and commercializing products leveraging its proprietary Optejet topical ophthalmic

medication dispensing platform. The Optejet is targeted at chronic front-of-the-eye diseases due to its ease of use, enhanced safety and

tolerability, and potential for superior compliance. The company’s current commercial portfolio includes clobetasol propionate ophthalmic

suspension, 0.05%, for post-surgical pain and inflammation, and Mydcombi® for mydriasis. Eyenovia has also secured licensing and development

agreements for additional multi-billion-dollar indications where the Optejet may be advantageous, including dry eye. For more information,

visit Eyenovia.com.

Forward-Looking Statements

Except for historical information, all the statements,

expectations and assumptions contained in this press release are forward-looking statements. Forward-looking statements include, but are

not limited to, statements that express our intentions, beliefs, expectations, strategies, predictions or any other statements relating

to our future activities or other future events or conditions, including regulatory submissions, estimated market opportunities for our

product candidates and platform technology, the impact of the Gen-2 Optejet device, and the timing for availability and sales growth of

our approved products. These statements are based on current expectations, estimates and projections about our business based, in part,

on assumptions made by management. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions

that are difficult to predict. Therefore, actual outcomes and results may, and in some cases are likely to, differ materially from what

is expressed or forecasted in the forward-looking statements due to numerous factors discussed from time to time in documents which we

file with the U.S. Securities and Exchange Commission.

In addition, such statements could be affected

by risks and uncertainties related to, among other things: the availability of sufficient financial resources to make payments on its

debt obligations to Avenue Capital and to continue the clinical development and commercialization of our products, as to which no assurance

can be given; risks of our clinical trials, including, but not limited to, the costs, design, initiation and enrollment, timing, progress

and results of such trials; the timing of, and our ability to submit applications for, obtaining and maintaining regulatory approvals

for our products and product candidates; the potential advantages of our products, product candidates and platform technology; the rate

and degree of market acceptance and clinical utility of our products and product candidates; our estimates regarding the potential market

opportunity for our products and product candidates; reliance on third parties to develop and commercialize our products and product candidates;

the ability of us and our partners to timely develop, implement and maintain manufacturing, commercialization and marketing capabilities

and strategies for our products and product candidates; intellectual property risks; changes in legal, regulatory, legislative and geopolitical

environments in the markets in which we operate and the impact of these changes on our ability to obtain regulatory approval for our products

and product candidates; and our competitive position.

Any forward-looking statements speak only as of

the date on which they are made, and except as may be required under applicable securities laws, Eyenovia does not undertake

any obligation to update any forward-looking statements.

Eyenovia Contact:

Eyenovia, Inc.

Andy Jones

Chief Financial Officer

ajones@eyenovia.com |

Eyenovia Investor Contact:

Eric Ribner

LifeSci Advisors, LLC

eric@lifesciadvisors.com

(646) 751-4363 |

|

v3.24.3

Cover

|

Nov. 15, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 15, 2024

|

| Entity File Number |

001-38365

|

| Entity Registrant Name |

EYENOVIA, INC.

|

| Entity Central Index Key |

0001682639

|

| Entity Tax Identification Number |

47-1178401

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

295 Madison Avenue

|

| Entity Address, Address Line Two |

Suite 2400

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10017

|

| City Area Code |

833

|

| Local Phone Number |

393-6684

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.0001 per share

|

| Trading Symbol |

EYEN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

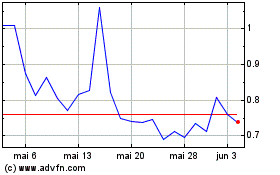

Eyenovia (NASDAQ:EYEN)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Eyenovia (NASDAQ:EYEN)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024