false000007874900000787492024-11-212024-11-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 21, 2024 |

AGILYSYS, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

000-5734 |

34-0907152 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

3655 Brookside Parkway Suite 300 |

|

Alpharetta, Georgia |

|

30022 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 770 810-7800 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, without par value |

|

AGYS |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

Agilysys, Inc. (“the Company”) may use a slide presentation, in whole or in part, from time to time in presentation to investors, analysts and others. A copy of the slide presentation is furnished as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference herein. A copy of the slide presentation is also available on the Company’s website at www.agilysys.com.

The information contained in this Item 7.01 as well as in Exhibit 99.1 is furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and such information shall not be deemed to be incorporated by reference into any of the Company’s filings under the Securities Act of 1933, as amended, or the Exchange Act.

Item 9.01 Financial Statements and Exhibits.

(c) Exhibits

The following item is furnished as an exhibit to this current report on Form 8-K:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

AGILYSYS, INC. |

|

|

|

|

Date: |

November 21, 2024 |

By: |

/s/ William David Wood III |

|

|

|

William David Wood III

Chief Financial Officer

(Principal Financial Officer) |

INVESTOR PRESENTATION Q2 Fiscal Year 2025

Forward-looking Statements & Non-GAAP Financial Information Forward-Looking Language This presentation contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as: “anticipate,” “intend,” “plan,” “goal,” “seek,” “believe,” “project,” “estimate,” “expect,” “strategy,” “future,” “likely,” “may,” “should,” “will” and similar references to future periods. Examples of forward-looking statements include, among others, our revenue, subscription revenue and Adjusted EBITDA guidance for the 2024 fiscal year and statements we make regarding expected property management room growth. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the impact macroeconomic factors may have on the overall business environment, our ability to achieve our fiscal 2025 guidance, future revenue growth, the company's ability maintain sales levels, the Company's ability to integrate Book4Time and realize future synergies, and the risks described in the Company’s filings with the Securities and Exchange Commission, including the Company’s reports on Form 10-K and Form 10-Q. Additionally, references to "record" financial and business levels in this document refer only to the time period after Agilysys made the transformation to an entirely hospitality focused software solutions company in FY2014. . Any forward-looking statement made by us in this press release is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement that may be made from time to time, whether written or oral, whether as a result of new information, future developments or otherwise. Use of Non-GAAP Financial Information To supplement the unaudited consolidated financial statements presented in accordance with U.S. GAAP in this press release, certain non-GAAP financial measures as defined by the SEC rules are used. These non-GAAP financial measures include EBITDA, Adjusted EBITDA, adjusted net income, adjusted basic earnings per share, adjusted diluted earnings per share and free cash flow. Management believes that such information can enhance investors’ understanding of the Company’s ongoing operations.

Thank You For your partnership and �your business Our Mission Helping Our Customers Improve Employee & Guest Experiences, With Dedication To Past, Present & Future Customer Investments �In Our Products And Services.

Agilysys Defining Strategy Pillars

100% Hospitality Focused - Why It Matters FUNCTIONAL DEPTH

Obsessively Customer-Centric - Why It Matters

Core Product Focus & Innovation Driven - Why It Matters

State Of The Art Cloud-native & On-premise Options - Why It Matters

End-To-End Comprehensive Solution Offerings - Why It Matters GUEST JOURNEY COMMON PROFILE

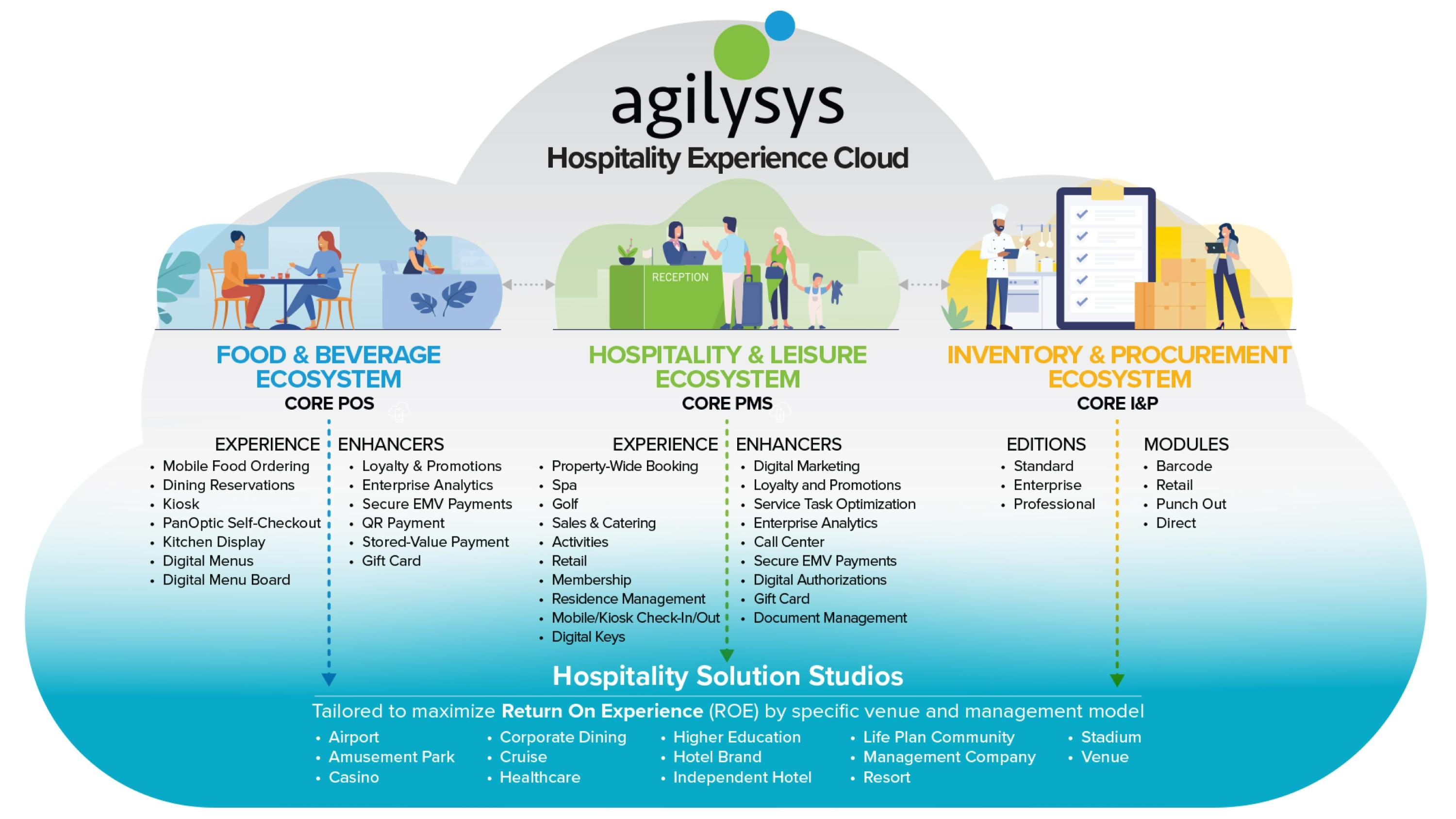

Agilysys Hospitality Product Suite IN-VENUE RESERVATIONS IN-VENUE�AMENITIES SURVEYS PAYMENTS PRE-ARRIVAL ANALYTICS &�RE-ENGAGE TRIP BOOKING IN-VENUE DINING BACK OF HOUSE�OPTIMIZATION TRIP PLANNING Food & Beverage Hospitality & Leisure Inventory &�Procurement Document Management 3rd Party Solution Integration With Modern Restful APIs

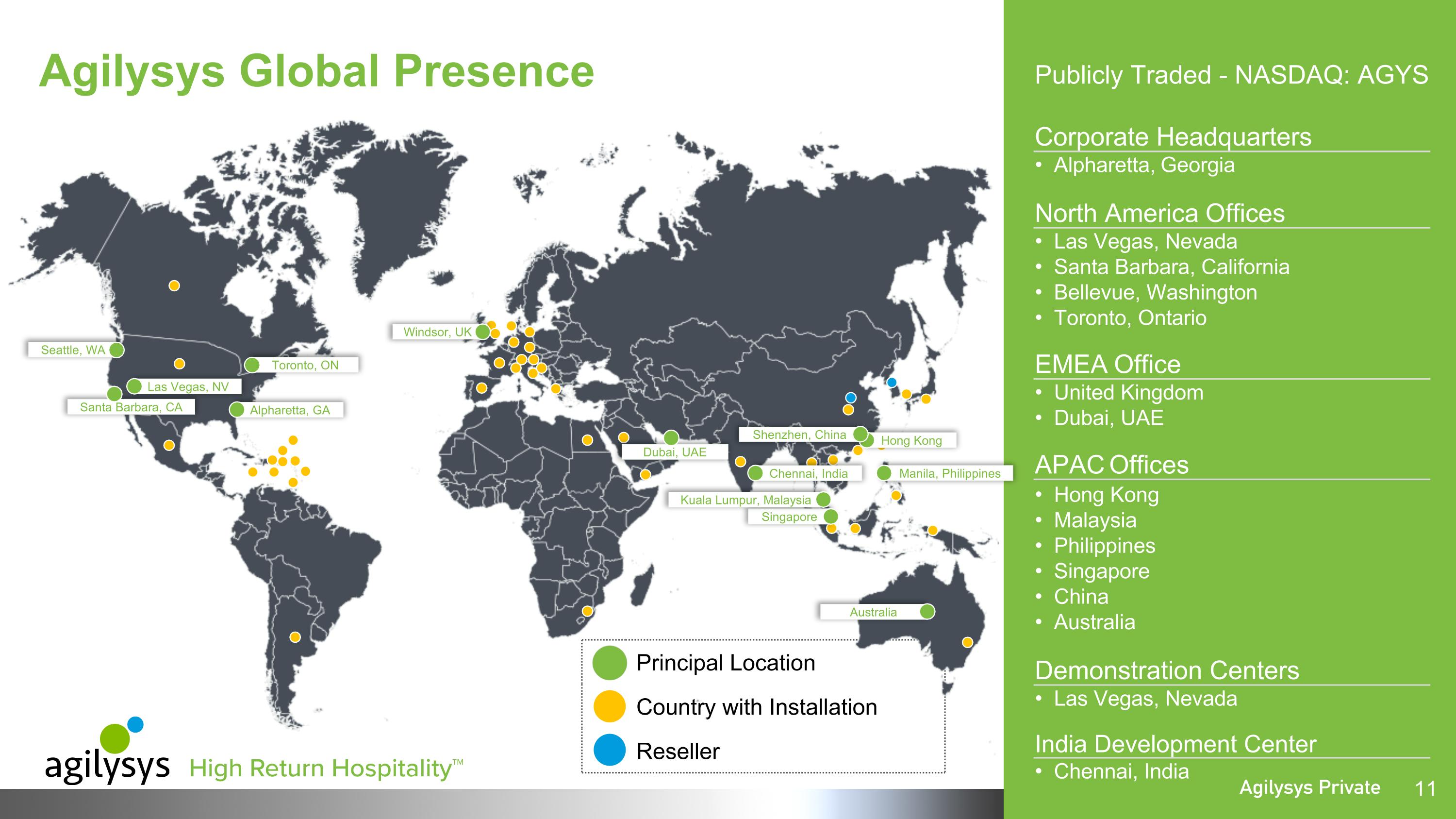

Agilysys Global Presence Principal Location Country with Installation Reseller Santa Barbara, CA Seattle, WA Las Vegas, NV Alpharetta, GA Windsor, UK Hong Kong Manila, Philippines Singapore Kuala Lumpur, Malaysia Chennai, India Shenzhen, China Australia Toronto, ON Publicly Traded - NASDAQ: AGYS Corporate Headquarters Alpharetta, Georgia North America Offices Las Vegas, Nevada Santa Barbara, California Bellevue, Washington Toronto, Ontario EMEA Office United Kingdom Dubai, UAE APAC Offices Hong Kong Malaysia Philippines Singapore China Australia Demonstration Centers Las Vegas, Nevada India Development Center Chennai, India Dubai, UAE

Global Customers Managed Foodservice Gaming Hotels, Resorts �& Cruise International

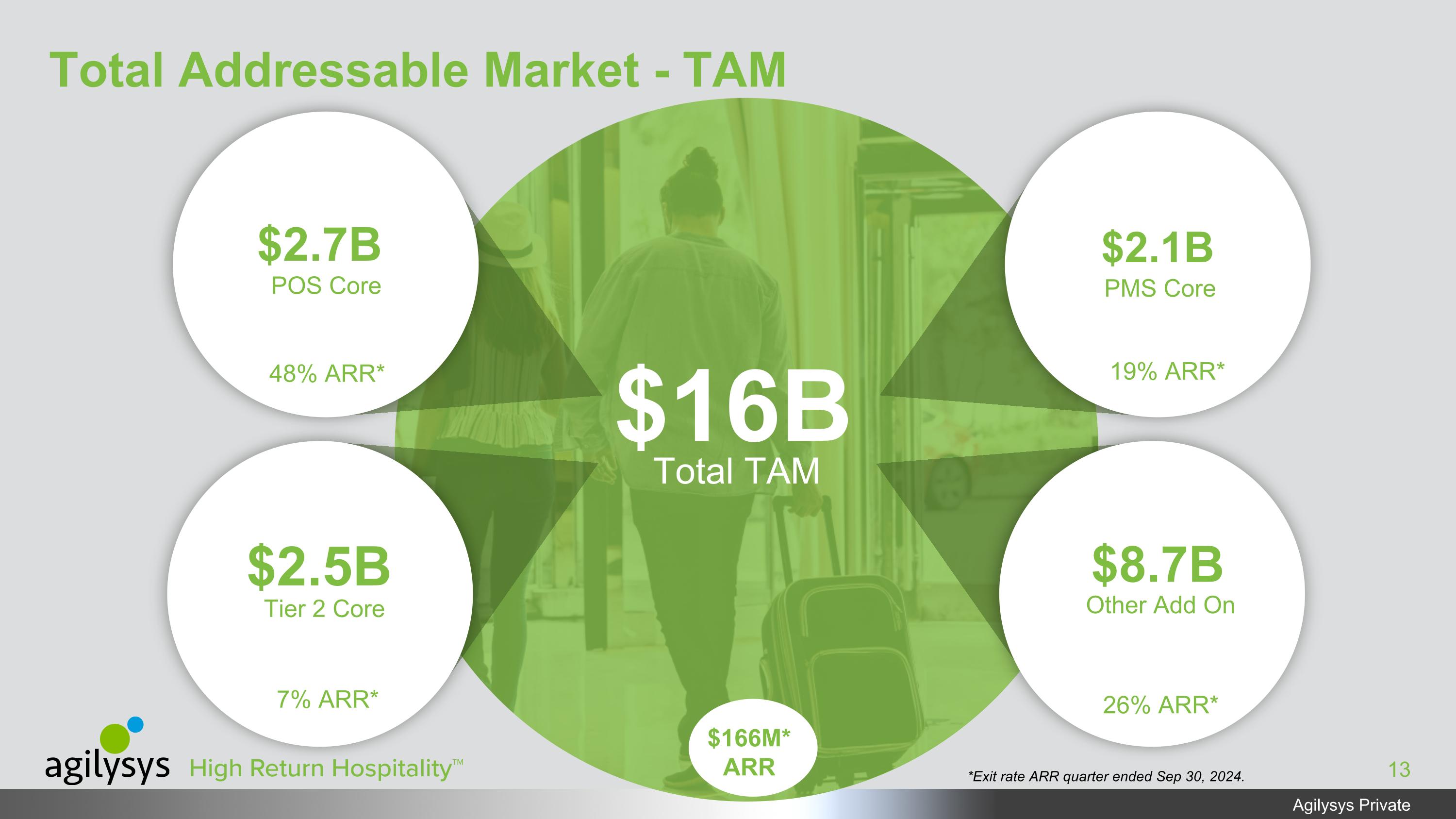

Total Addressable Market - TAM POS Core $2.7B $73m Tier 2 Core $2.5B $11m PMS Core $2.1B $26m Other Add On $8.7B $55m Total TAM $16B $166M* ARR *Exit rate ARR quarter ended Sep 30, 2024. 48% ARR* 19% ARR* 7% ARR* 26% ARR*

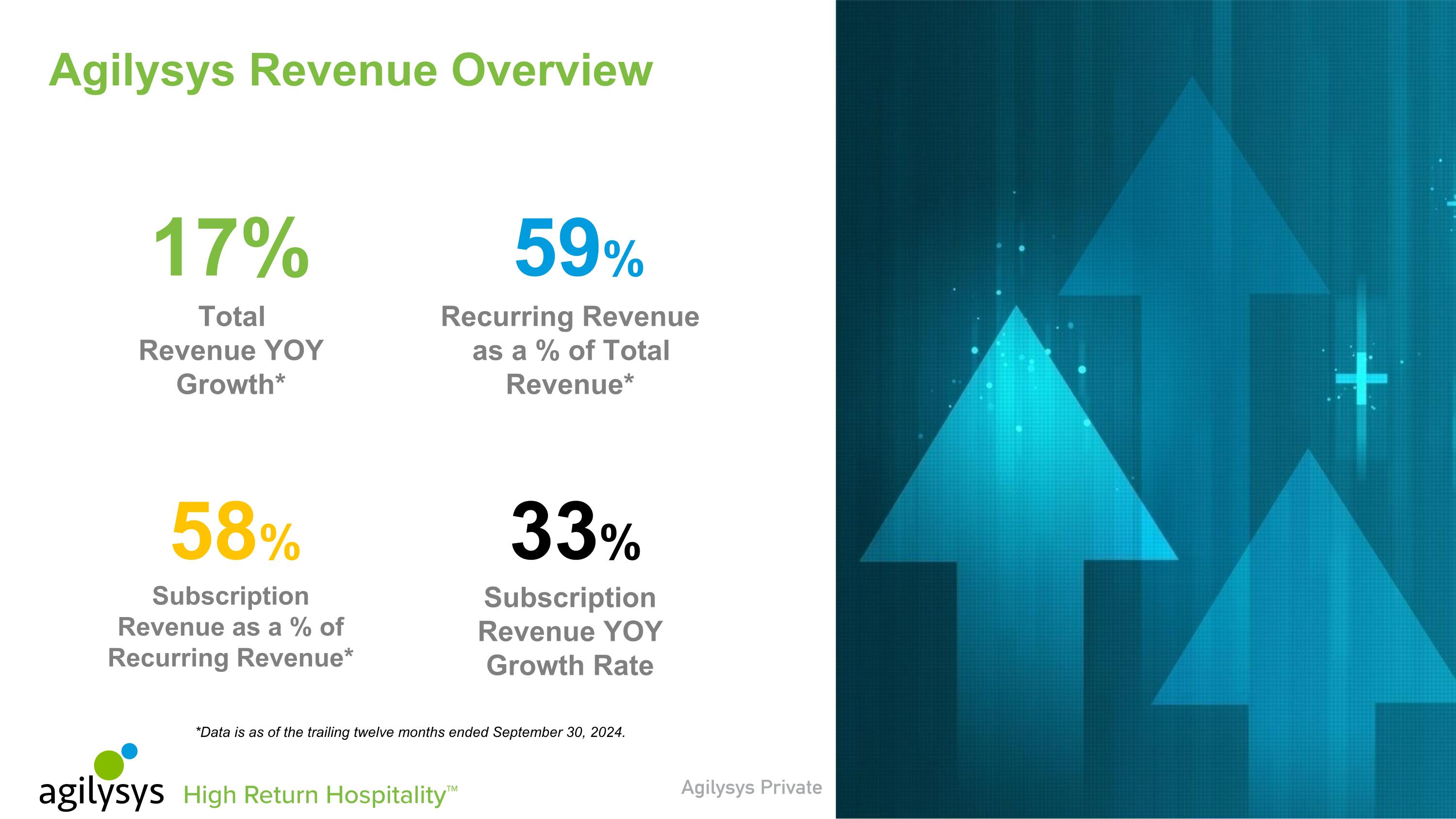

*Data is as of the trailing twelve months ended September 30, 2024. Subscription Revenue as a % of Recurring Revenue* Subscription Revenue YOY Growth Rate Total �Revenue YOY Growth* Recurring Revenue as a % of Total Revenue* 17% 59% 58% 33% Agilysys Revenue Overview

We Provide Industry Leading Hospitality Solutions Lodging Solutions Food and Beverage Solutions 58% of Revenue 23% of Revenue 5% of Revenue INVENTORY & PROCUREMENT 6% of Revenue DOCUMENT MANAGEMENT PROPERTY MANAGEMENT POINT-OF-SALE Note: Revenue contribution figures represent percentage for the trailing twelve months ended September 30, 2024 and include an allocation of total revenue (excluding services) amounts to our 4 core product groupings and payment software related revenue. Region 92% of Revenue North America 8% of Revenue APAC Plus EMEA Allocation of Revenue 9% of Revenue Payment Revenue Cross Functional

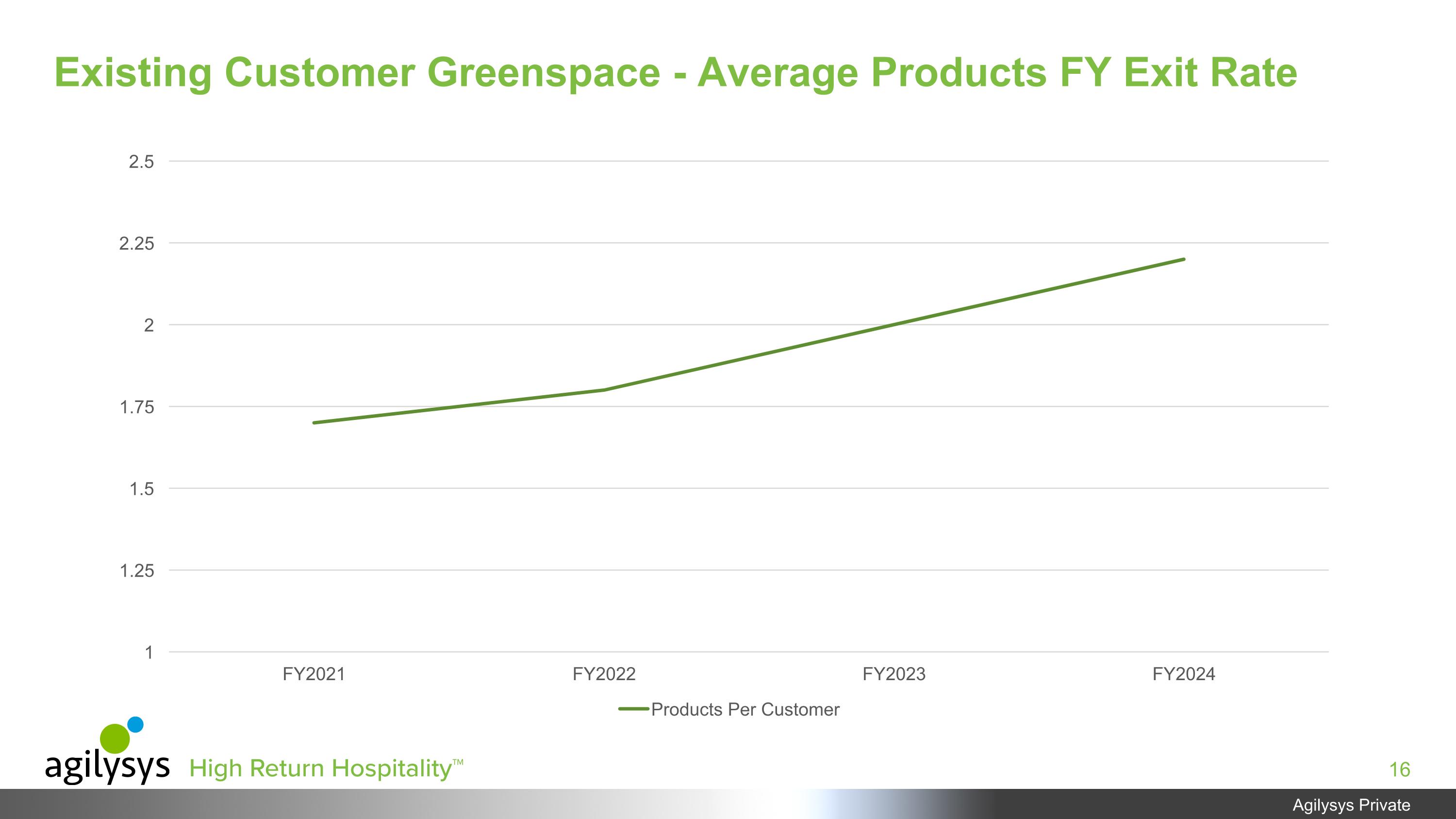

Existing Customer Greenspace - Average Products FY Exit Rate

Property Management Room Growth Opportunity Less than 300,000 rooms under PMS management today Should reach about 900,000 rooms under management in 3 years with combined current growth momentum in PMS and Marriott rooms Expected to add a majority of the Marriott U.S. and Canada Luxury, Premium and Select Service rooms (min. 450,000)

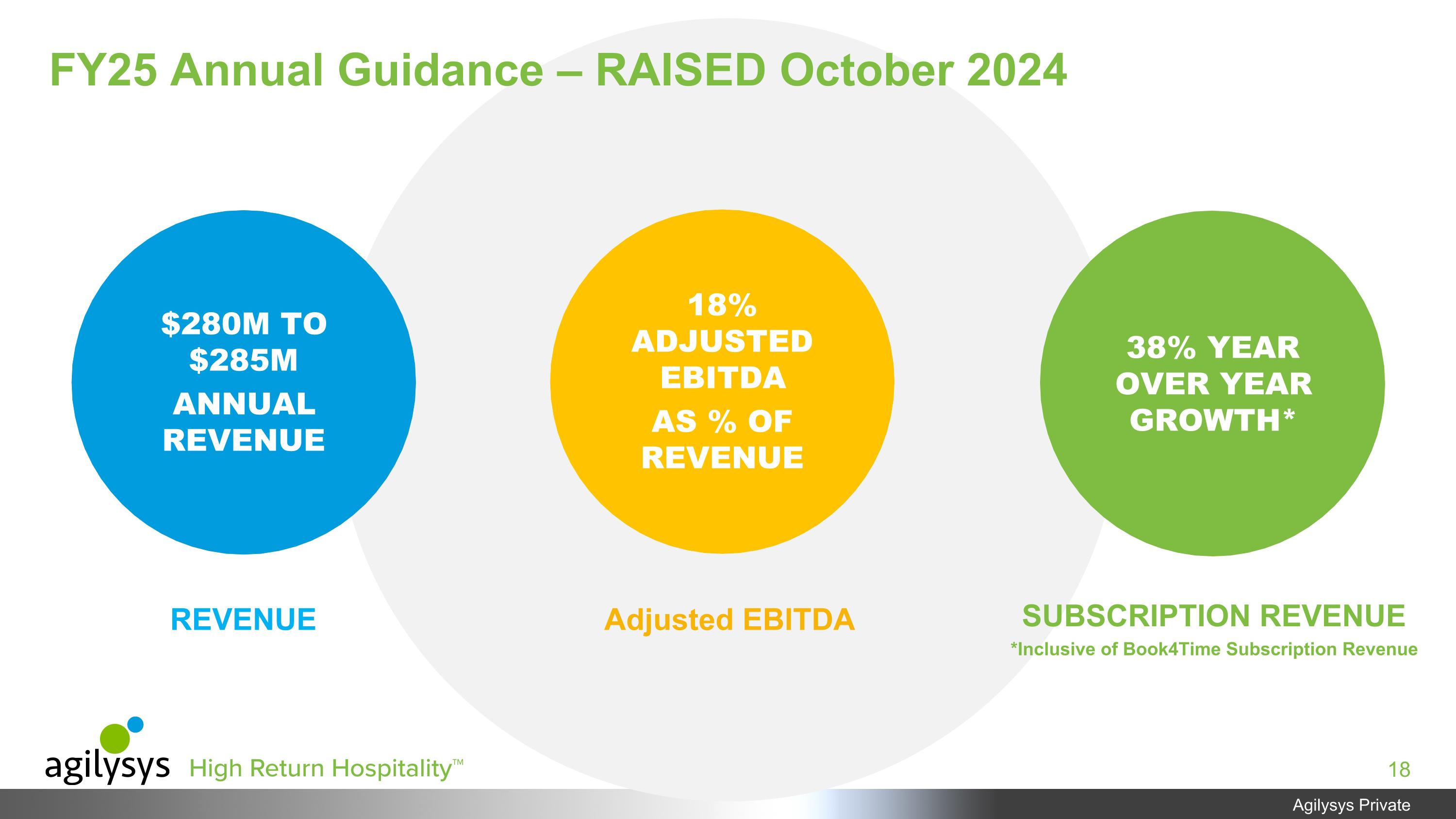

$280M TO $285M ANNUAL REVENUE 18% ADJUSTED EBITDA AS % OF REVENUE 38% YEAR OVER YEAR GROWTH* REVENUE Adjusted EBITDA SUBSCRIPTION REVENUE *Inclusive of Book4Time Subscription Revenue FY25 Annual Guidance – RAISED October 2024

FINANCIAL OVERVIEW

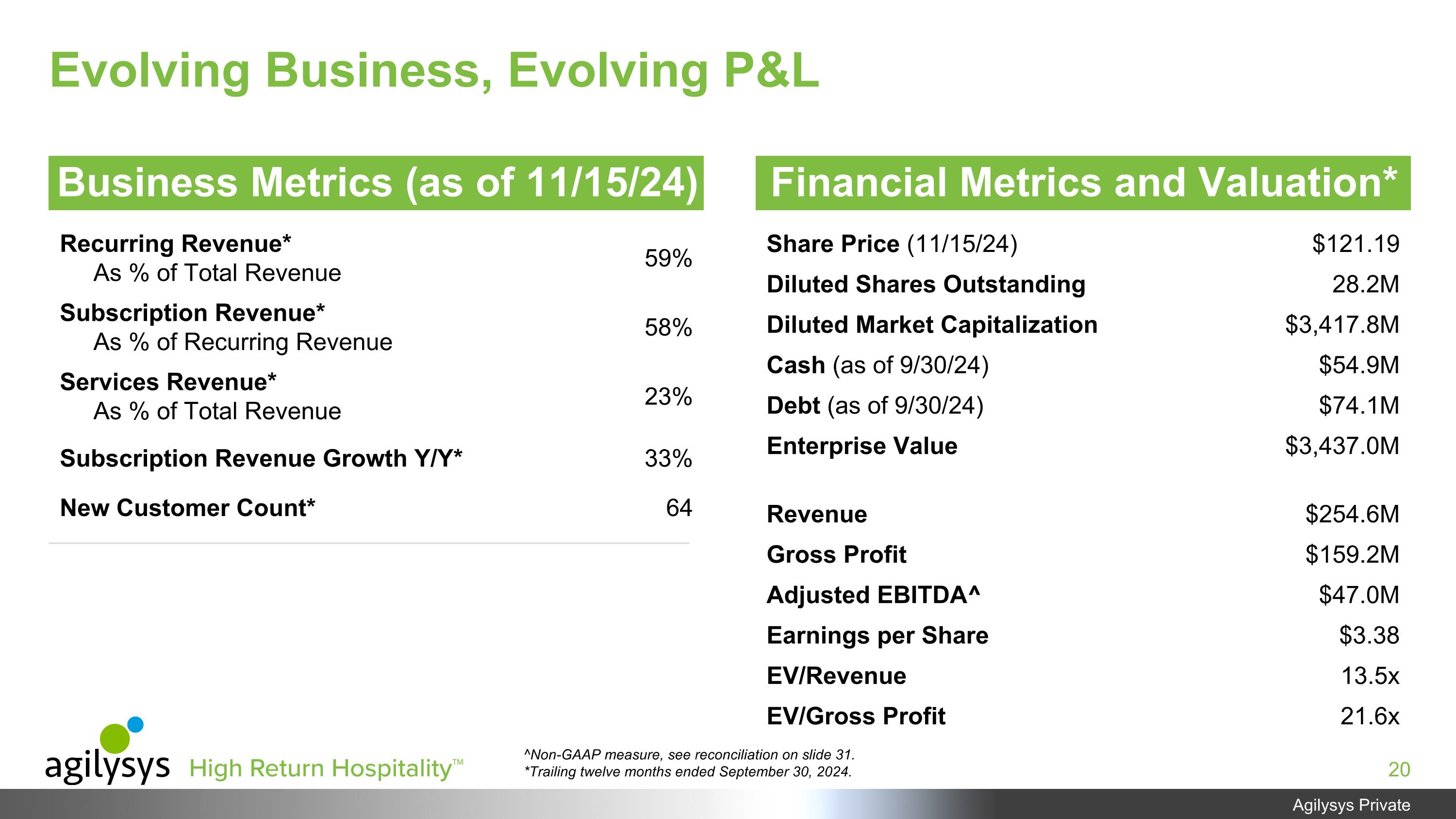

Share Price (11/15/24) $121.19 Diluted Shares Outstanding 28.2M Diluted Market Capitalization $3,417.8M Cash (as of 9/30/24) $54.9M Debt (as of 9/30/24) $74.1M Enterprise Value $3,437.0M Revenue $254.6M Gross Profit $159.2M Adjusted EBITDA^ $47.0M Earnings per Share $3.38 EV/Revenue 13.5x EV/Gross Profit 21.6x Recurring Revenue* As % of Total Revenue 59% Subscription Revenue* As % of Recurring Revenue 58% Services Revenue* As % of Total Revenue 23% Subscription Revenue Growth Y/Y* 33% New Customer Count* 64 Financial Metrics and Valuation* Business Metrics (as of 11/15/24) Evolving Business, Evolving P&L ^Non-GAAP measure, see reconciliation on slide 31. *Trailing twelve months ended September 30, 2024.

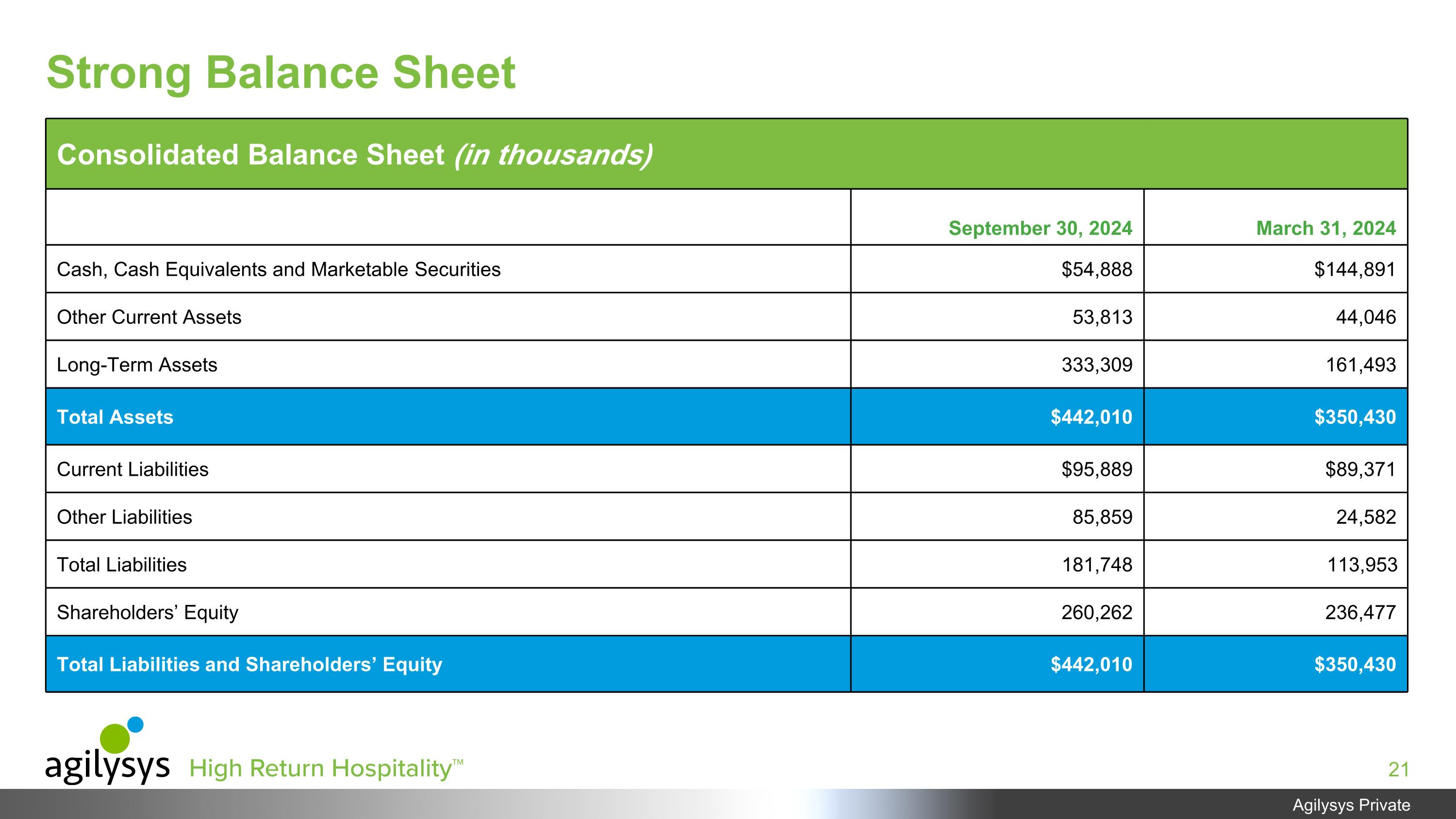

Strong Balance Sheet Consolidated Balance Sheet (in thousands) September 30, 2024 March 31, 2024 Cash, Cash Equivalents and Marketable Securities $54,888 $144,891 Other Current Assets 53,813 44,046 Long-Term Assets 333,309 161,493 Total Assets $442,010 $350,430 Current Liabilities $95,889 $89,371 Other Liabilities 85,859 24,582 Total Liabilities 181,748 113,953 Shareholders’ Equity 260,262 236,477 Total Liabilities and Shareholders’ Equity $442,010 $350,430

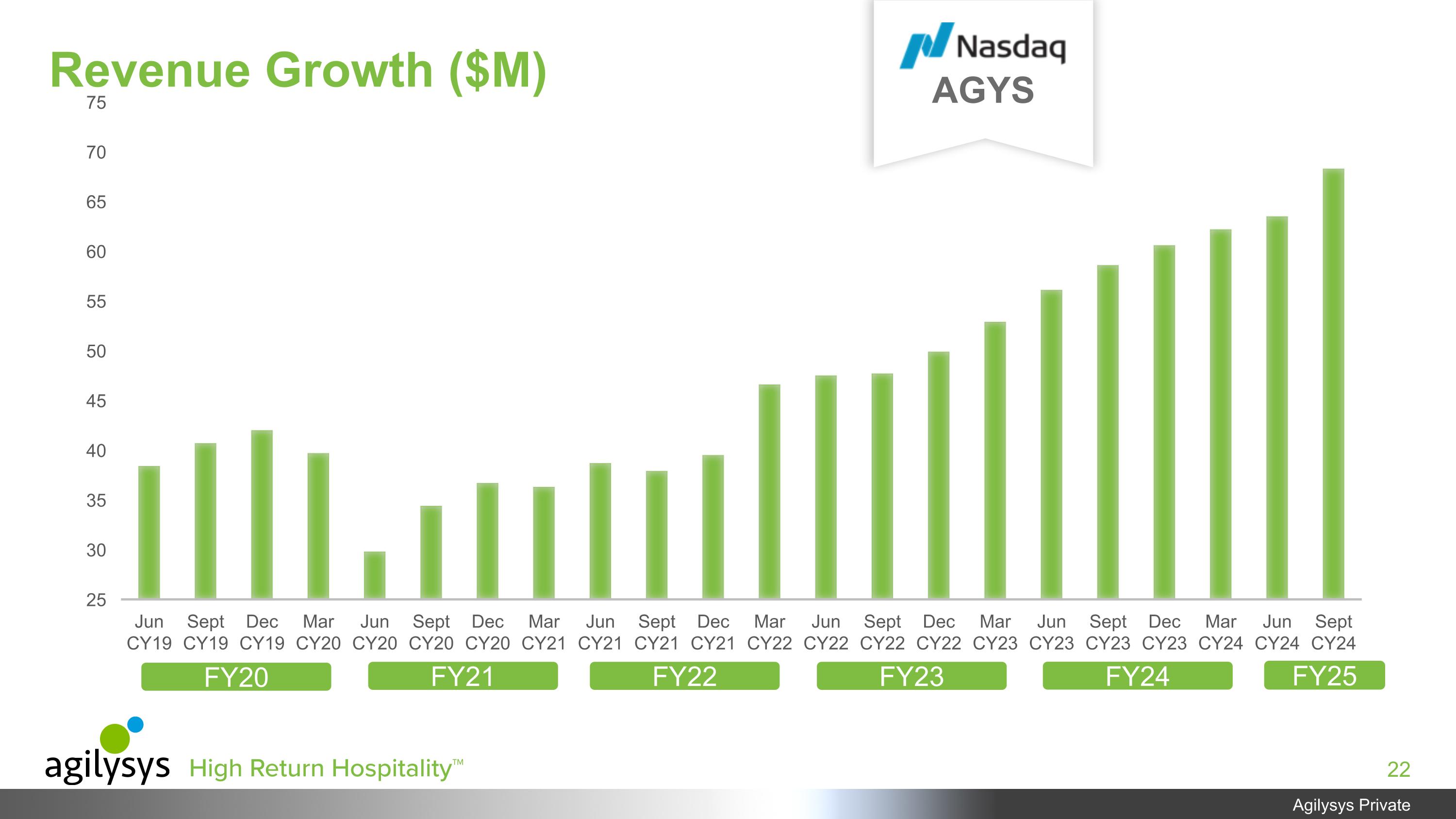

Revenue Growth ($M) FY25 FY21 FY22 FY23 AGYS FY24 FY20

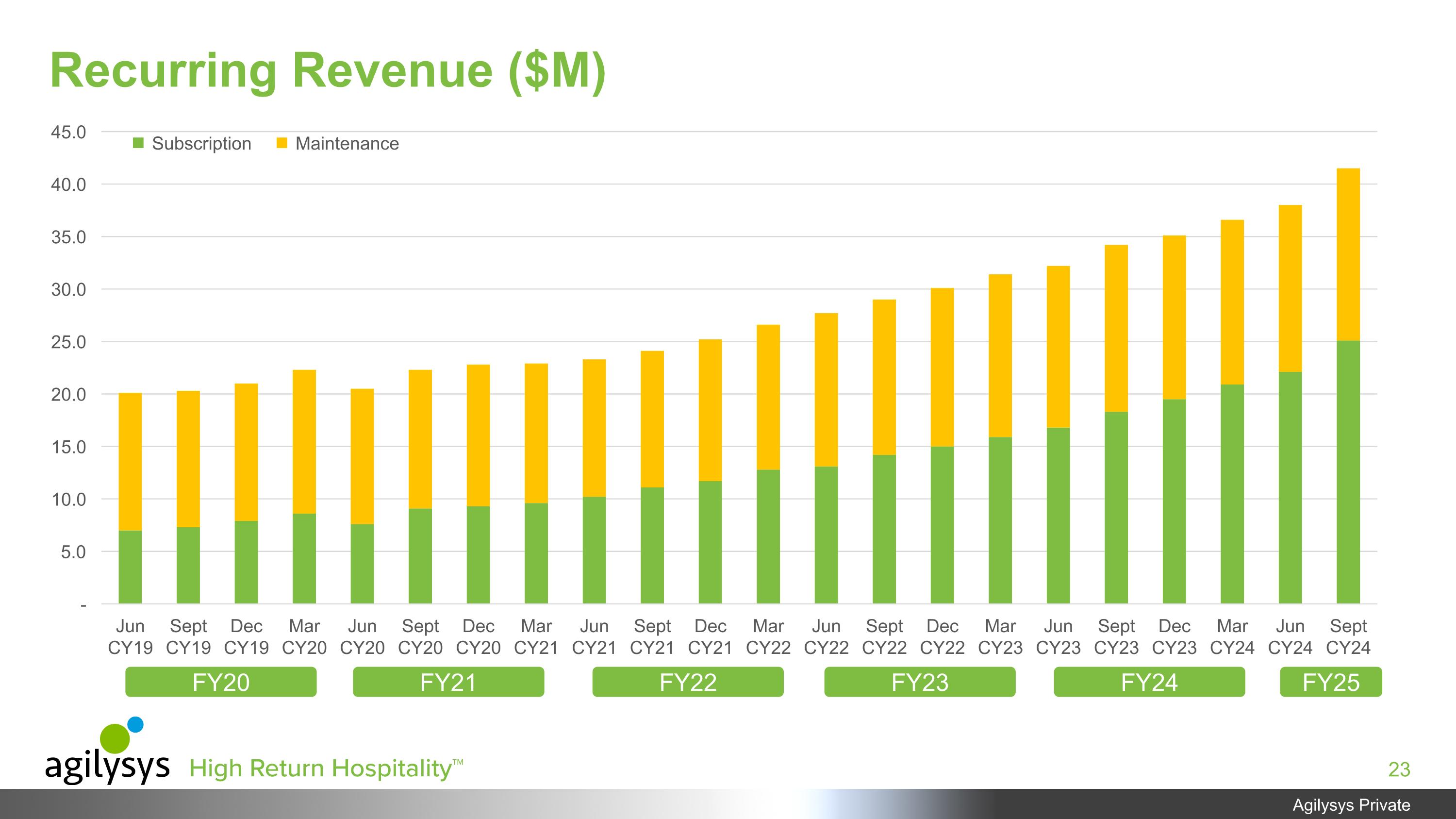

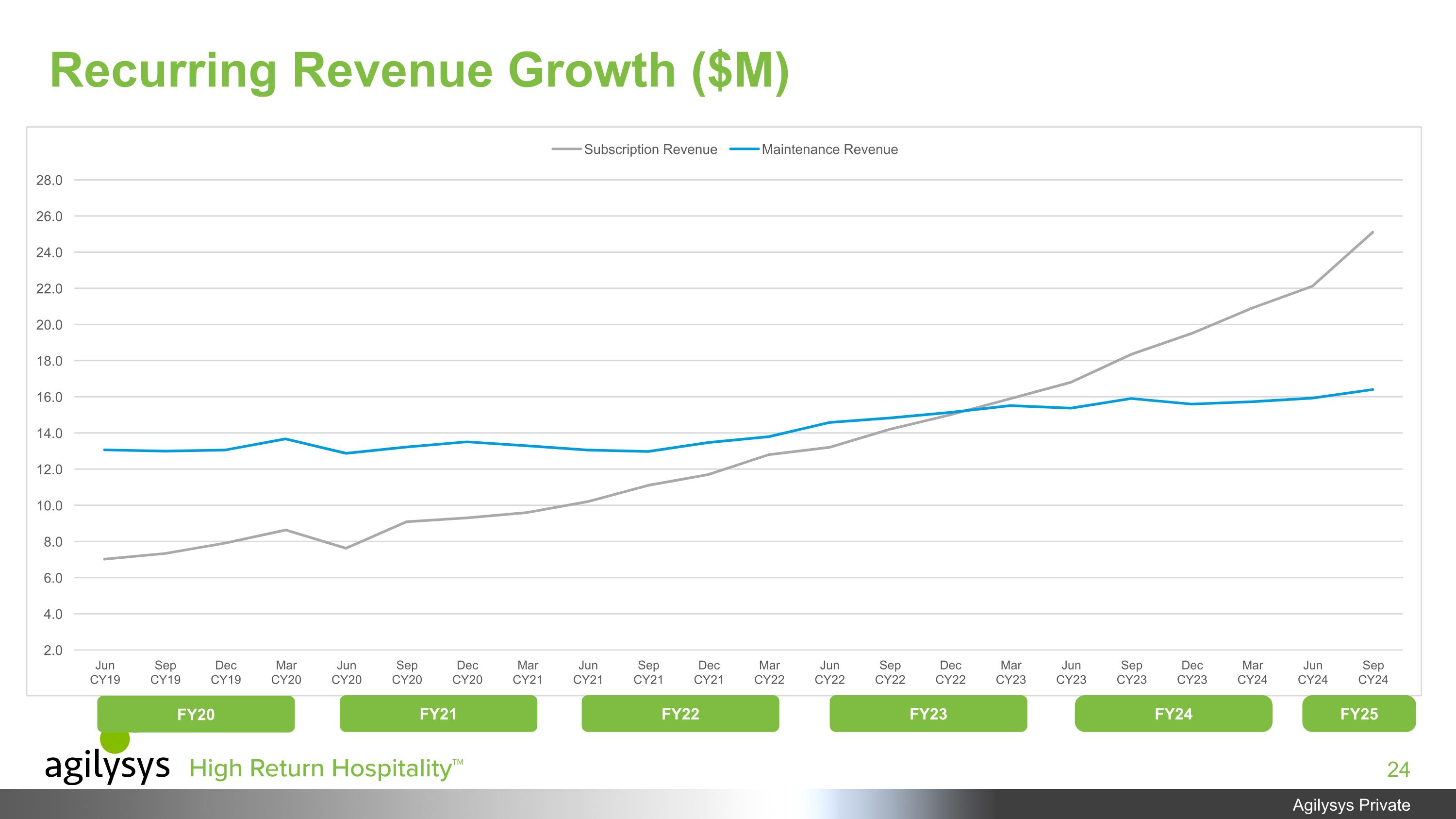

Recurring Revenue ($M) FY25 FY21 FY22 FY23 FY24 FY20

Recurring Revenue Growth ($M) FY20 FY21 FY22 FY23 FY24 FY25

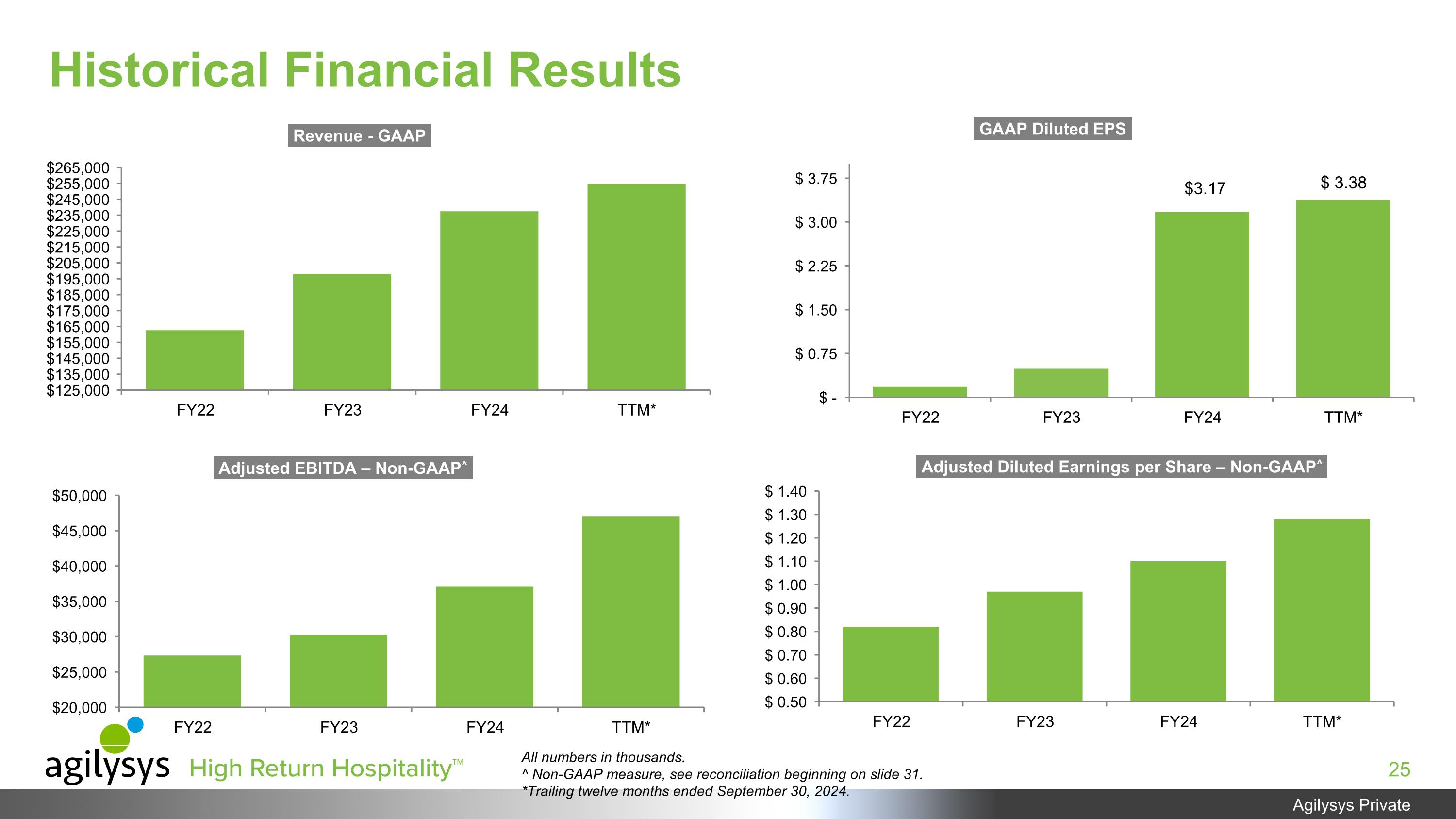

Historical Financial Results All numbers in thousands. ^ Non-GAAP measure, see reconciliation beginning on slide 31. *Trailing twelve months ended September 30, 2024.

Book4Time Strategic Acquisition $150M all cash transaction �at ~9x revenue multiple �closed August 2024 Current market leader in spa software solutions Expanded Agilysys customer base of ~4,500 customers by 30%+ Only 10% customer overlap Strengthen product penetration in large global brands Strategic advantage in competitive ecosystem deals

APPENDIX

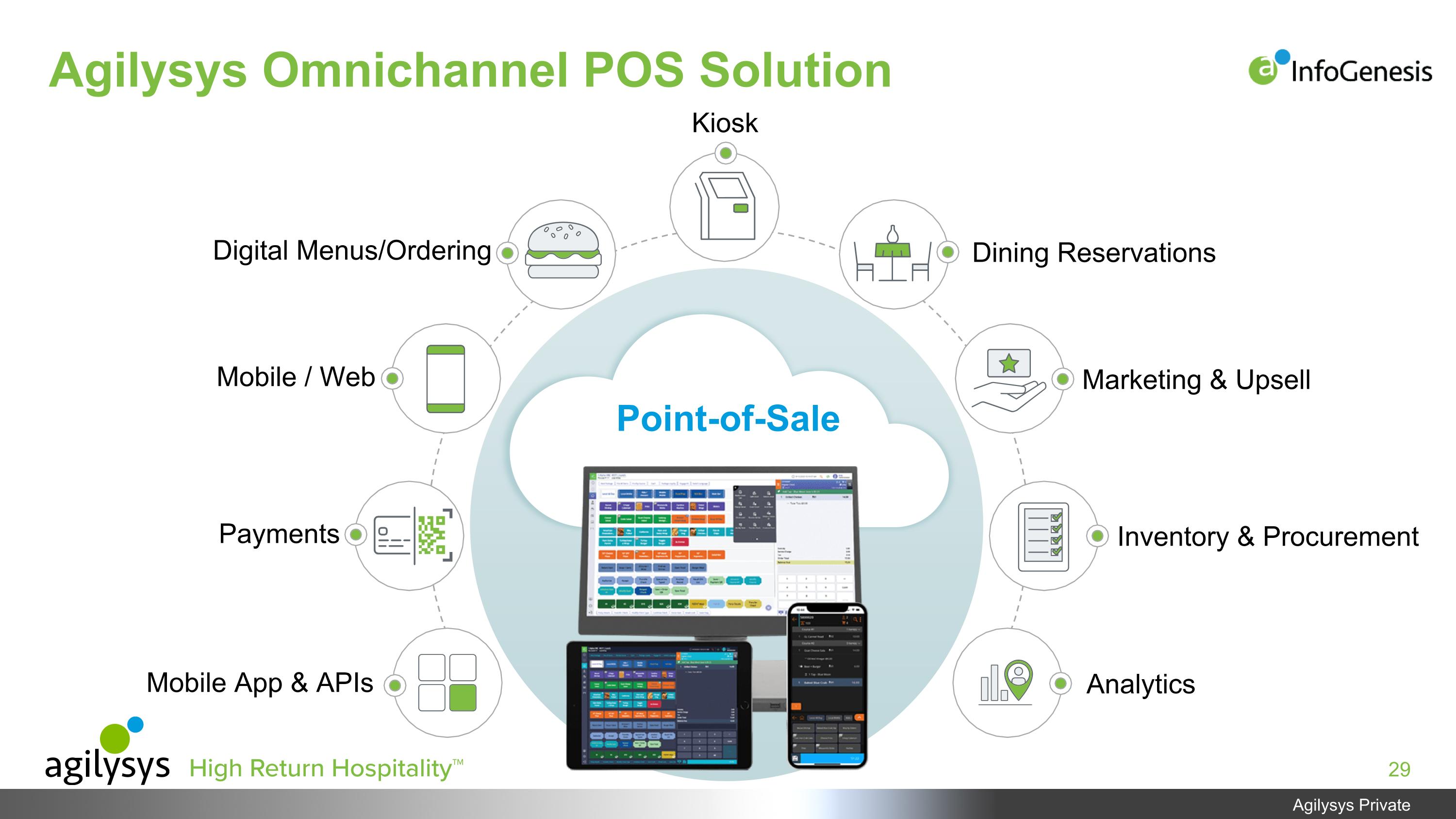

Agilysys Omnichannel POS Solution Payments Mobile App & APIs Marketing & Upsell Mobile / Web Analytics Kiosk Digital Menus/Ordering Dining Reservations Point-of-Sale Inventory & Procurement

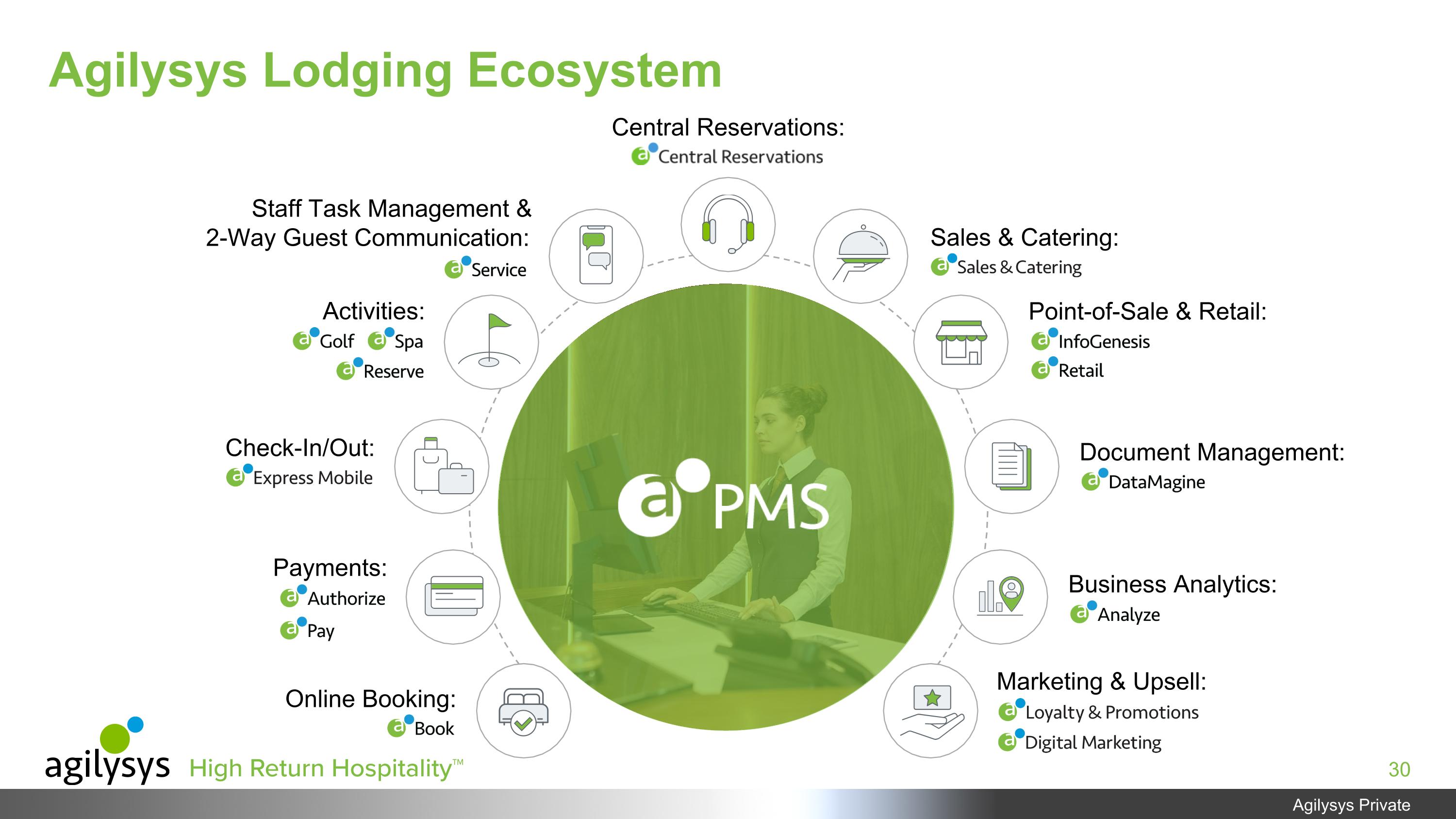

Agilysys Lodging Ecosystem Staff Task Management & 2-Way Guest Communication: Payments: Online Booking: Sales & Catering: Document Management: Business Analytics: Marketing & Upsell: Central Reservations: Activities: Check-In/Out: Point-of-Sale & Retail:

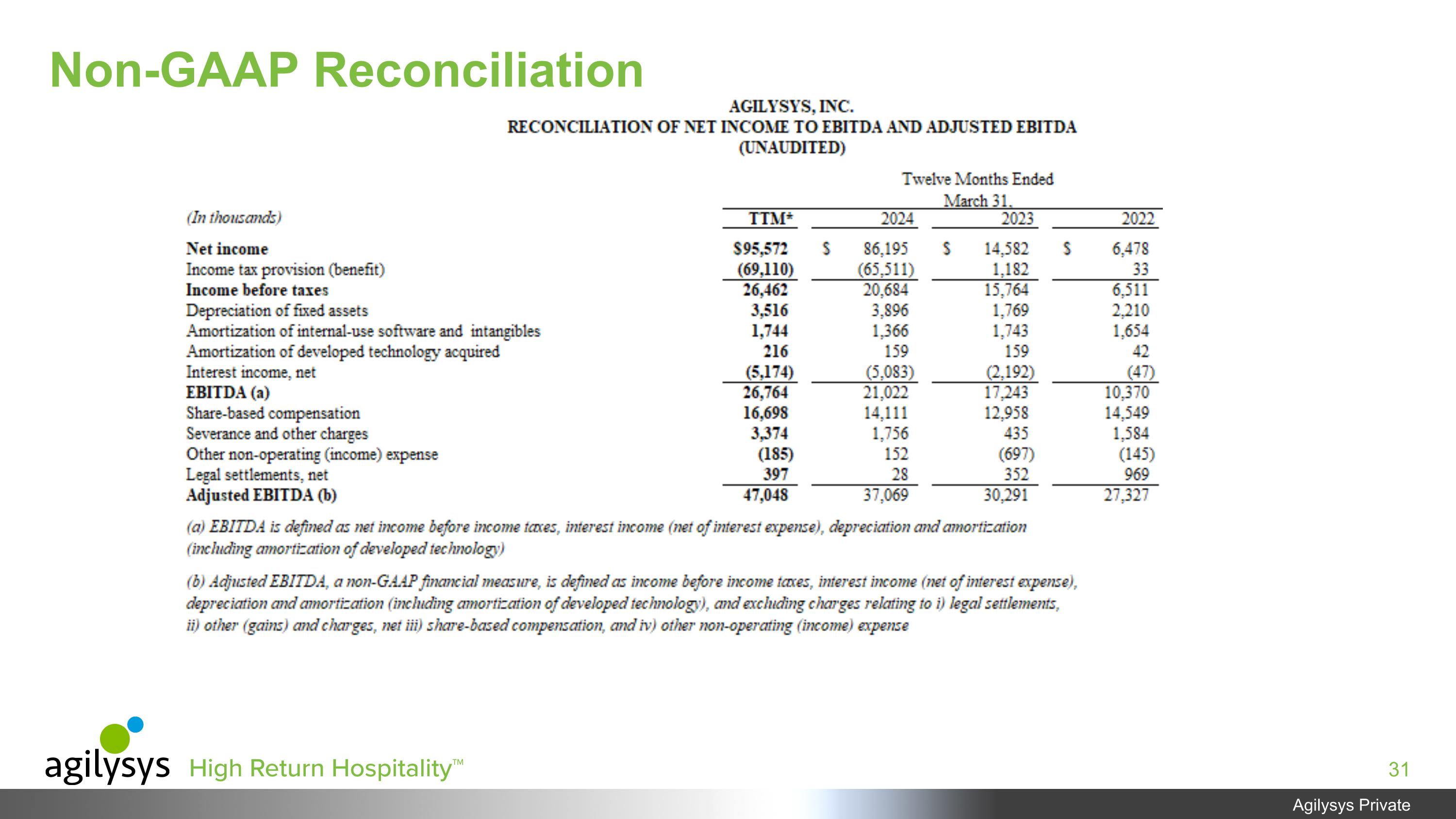

Non-GAAP Reconciliation

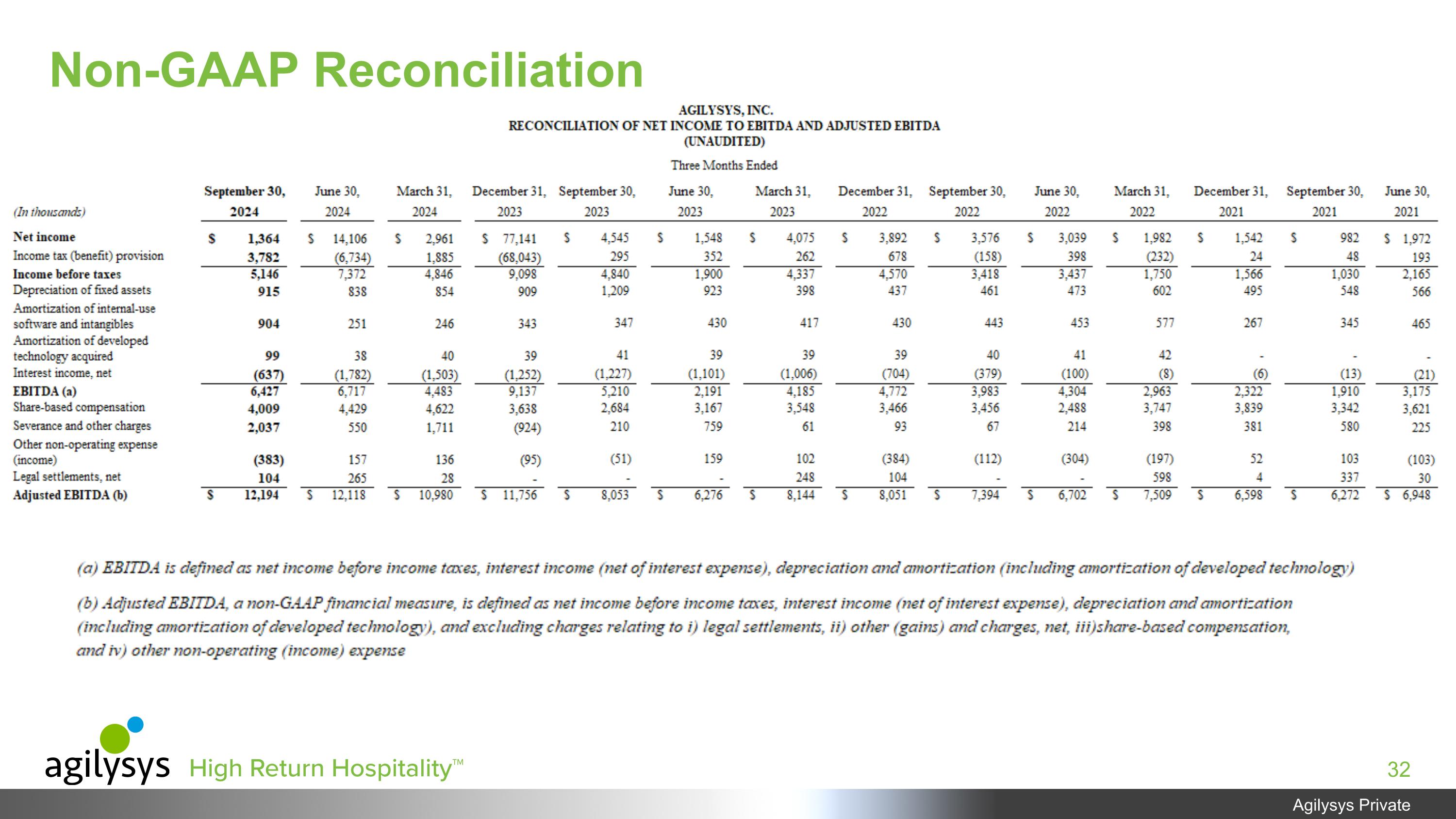

Non-GAAP Reconciliation

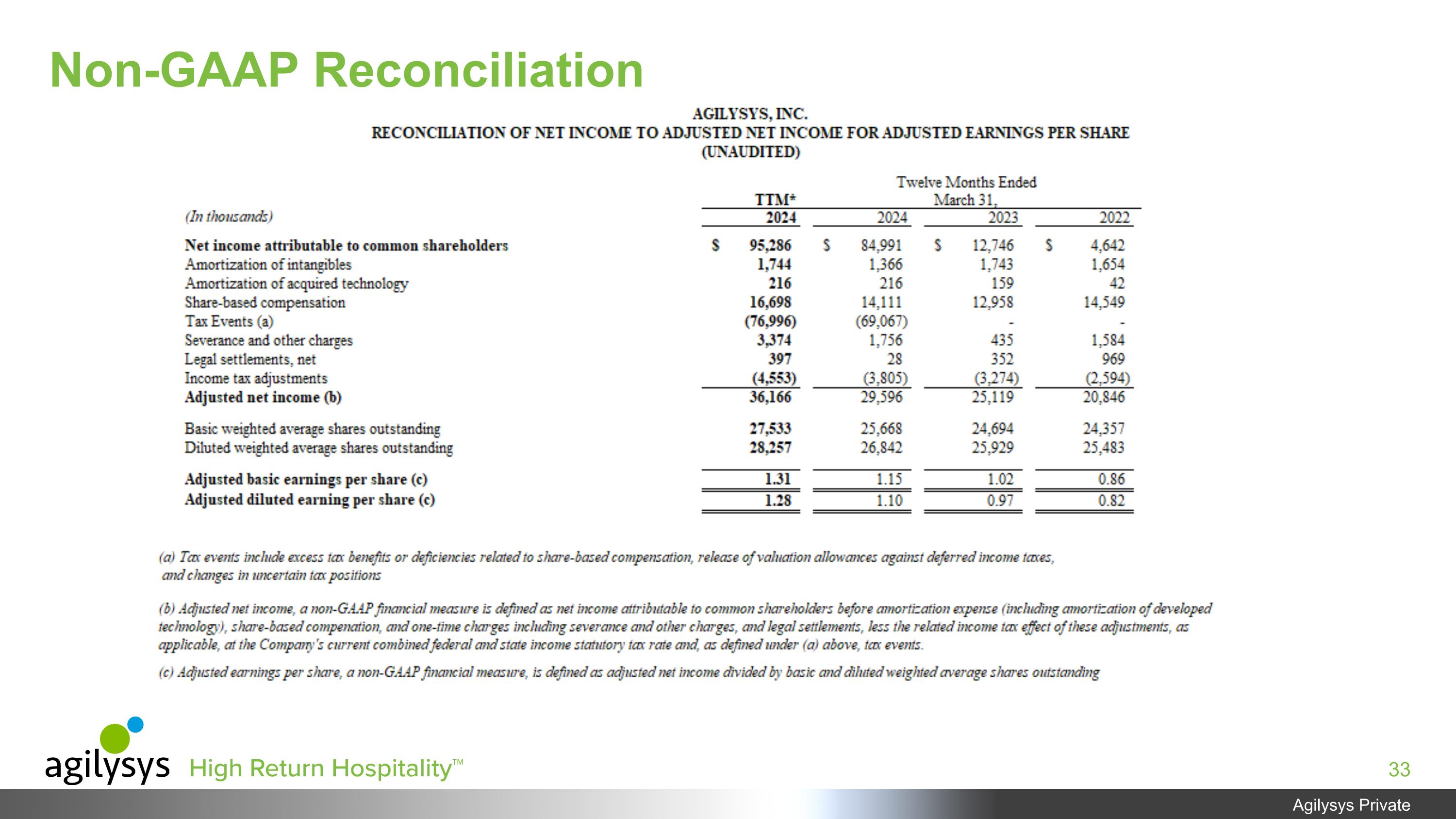

Non-GAAP Reconciliation

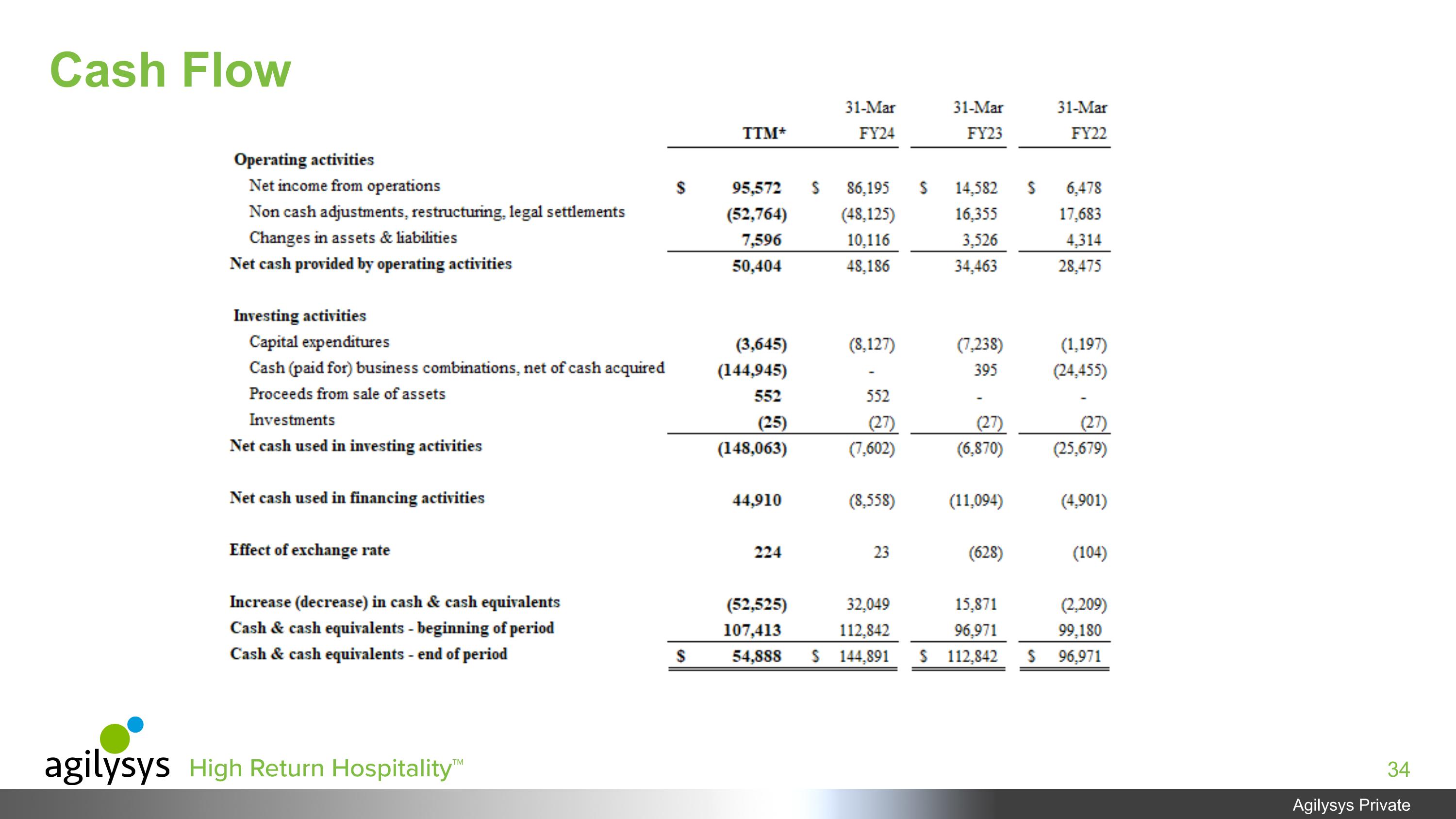

Cash Flow

Jessica Hennessy Senior Director Corporate Strategy and Investor Relations (770) 810-6116 InvestorRelations@agilysys.com

v3.24.3

Document And Entity Information

|

Nov. 21, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 21, 2024

|

| Entity Registrant Name |

AGILYSYS, INC.

|

| Entity Central Index Key |

0000078749

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

000-5734

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

34-0907152

|

| Entity Address, Address Line One |

3655 Brookside Parkway

|

| Entity Address, Address Line Two |

Suite 300

|

| Entity Address, City or Town |

Alpharetta

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30022

|

| City Area Code |

770

|

| Local Phone Number |

810-7800

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, without par value

|

| Trading Symbol |

AGYS

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

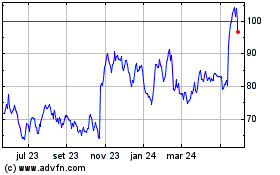

Agilysys (NASDAQ:AGYS)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Agilysys (NASDAQ:AGYS)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024