U.S. SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 6-K

REPORT OF FOREIGN

PRIVATE ISSUER

PURSUANT TO RULE

13a-16 OR 15d-16 UNDER THE

SECURITIES

EXCHANGE ACT OF 1934

Dated December 13,

2024

Commission File

Number 1-14878

GERDAU S.A.

(Translation of

Registrant’s Name into English)

Av. Dra. Ruth Cardoso,

8,501 – 8° andar

São Paulo,

São Paulo - Brazil CEP 05425-070

(Address of principal

executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F x Form 40-F ¨

Exhibit Index

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by

the undersigned, thereunto duly authorized.

Date: December

13, 2024

| |

GERDAU S.A. |

| |

|

| |

By: |

/s/

Rafael Dorneles Japur |

| |

Name: |

Rafael Dorneles Japur |

| |

Title: |

Executive Vice President Investor Relations Director |

Exhibit 99.1

THIS

ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY, AND IS

NOT

AN OFFER TO SELL SECURITIES.

CLOSING

ANNOUNCEMENT

OF

THE PUBLIC OFFERING OF THE 18TH (EIGHTEENTH) ISSUANCE OF SIMPLE, NON-COVERTIBLE DEBENTURES, UNSECURED, IN A SINGLE SERIES,

FOR PUBLIC DISTRIBUTION, UNDER THE AUTOMATIC REGISTRATION RITE OF

GERDAU

S.A.

Corporate

Taxpayer ID (CNPJ/MF) No.33.611.500/0001-19

Doutora

Ruth Cardoso Street, n.º 8.501, 8th floor, Conjunto 2

CEP

05.425-070, City of São Paulo, State of São Paulo

in

the total amount of

R$1,500,000,000.00

(one

billion and five hundred million reais)

Debentures

’s ISIN code: BRGGBRDBS078

Issuance Risk Rating by Fitch

Ratings: "AAA(bra)"*

*This

rating was issued on November 19, 2024, and the characteristics of this security are subject to change.

THE REGISTRATION OF THE DEBENTURES OFFERING WAS AUTOMATICALLY GRANTED

BY THE BRAZILIAN SECURITIES AND EXCHANGE COMMISSION ("CVM") ON DECEMBER 09, 2024, UNDER THE NUMBER CVM/SRE/AUT/DEB/PRI/2024/877.

1. SECURITIES

AND ISSUERS

Pursuant to the provisions of Section 76 and Annex

M of the Resolution of the Brazilian Securities and Exchange Commission ("CVM") No. 160, of July 13, 2022, as amended

("CVM Resolution 160"), GERDAU S.A., registered in the National Registry of Legal Entities of the Ministry of

Finance ("CNPJ/MF") under No. 33.611.500/0001-19 ("Issuer"), together with the Placement Agent (as

defined below), hereby ANNOUNCE, through this closing announcement ("Closing Announcement"), on this date, the

end of the distribution period, of the public offering of 1,500,000 (one million and five hundred thousand) simple debentures, not convertible

into shares, unsecured, in a single series, of the 18th (eighteenth) issuance of the Issuer ("Debentures", "Issuance"

and "Offering", respectively"), pursuant to the " Deed of the 18th (Eighteenth) Issuance of Simple Debentures,

Non-Convertible into Shares, of the Unsecured Type, in Up to two series, for Public Distribution, Under Automatic Registration Rite,

of Gerdau S.A." ("Original Issuance Deed") executed on November 19, 2024, between the Issuer and PENTÁGONO

S.A. DISTRIBUIDORA DE TÍTULOS E VALORES MOBILIÁRIOS, REGISTERED WITH THE CNPJ/MF under No. 17.343.682/0001-38, as fiduciary

agent, representing the community of the holders of the Debentures

THIS

ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY, AND IS

NOT

AN OFFER TO SELL SECURITIES.

("Fiduciary Agent"),

as amended by the " First Amendment to the Deed of the 18th (Eighteenth) Issuance of Simple Debentures, Non-Convertible into

Shares, of the Unsecured Type, in up to two (2) series, for Public Distribution, Under Automatic Registration Rite, of Gerdau S.A."

("Amendment to the Issuance Deed", together with the Original Issuance Deed, the "Issuance Deed"),

executed on December 9, 2024, between the Issuer and the Fiduciary Agent.

2. SECURITIES

DATA

1,500,000 (one million and five hundred thousand)

Debentures were subscribed and paid in under registered and book-entry form, without issuance of cautions or certificates, with a nominal

unit value of R$1,000.00 (one thousand reais), totaling, on the date of issuance of the Debentures, that is, December 10, 2024 ("Issue

Date"), the total amount of R$1,500,000,000.00 (one billion and five hundred million reais), and, for all legal purposes, the

ownership of the Debentures will be proven by the statement issued by the Bookkeeper (as defined below).

3. LEAD

PLACEMENT AGENT, OTHER PLACEMENT AGENT AND INSTITUTIONS INVOLVED IN THE DISTRIBUTION

The Offer was intermediated by ITAÚ BBA

ASSESSORIA FINANCEIRA S.A., registered with the CNPJ/MF under No. 04.845.753/0001-59 ("Itaú BBA" or "Lead

Placement Agent"), BANCO SANTANDER (BRASIL) S.A., registered with the CNPJ/MF under No. 90.400.888/0001-42 ("Santander"),

XP INVESTIMENTOS CORRETORA DE CÂMBIO, TÍTULOS E VALORES MOBILIÁRIOS S.A., registered with the CNPJ/MF under

No. 02.332.886/0011-78 ("XP") and UBS BRASIL CORRETORA DE CÂMBIO, TÍTULOS E VALORES MOBILIÁRIOS

S.A., registered with the CNPJ/MF under No. 02.819.125/0001-73 ("UBS BB" and, when together with Itaú BBA,

Santander and XP, the " Placement Agent").

4. AUTOMATIC

DISTRIBUTION REGISTRATION RITE

The Offering was registered with the CVM

under the rite of automatic registration of distribution, without prior analysis, pursuant to Sections 25 and 26, item IV, item "a",

of CVM Resolution 160, as it is a public offering: (i) of debentures not convertible into shares; (ii) intended exclusively

for professional investors, as defined pursuant to Sections 11 and, as applicable, 13 of CVM Resolution No. 30, of May 11, 2021, as amended

("Professional Investors"); and (iii) whose issuer falls into the category of Frequent Fixed Income Issuer (EFRF), as

it is considered to have large exposure to the market (EGEM), pursuant to Section 38-A, item I of CVM Resolution No. 80, of March 29,

2022, as in force. The Offer was not submitted to prior analysis by the Brazilian Association of Financial and Capital Markets Entities

– ANBIMA, the CVM or any regulatory or self-regulatory entity.

5. REGISTRATION

OF THE OFFERING WITH THE CVM

The registration of the Offering was automatically granted by the CVM

on december 9, 2024, under No. CVM/SRE/AUT/DEB/PRI/2024/877.

6. DEED

THIS

ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY, AND IS

NOT

AN OFFER TO SELL SECURITIES.

The

institution providing the Debentures' bookkeeping services is ITAÚ CORRETORA DE VALORES S.A., a financial institution,

headquartered in the City of São Paulo, State of São Paulo, at Avenida Brigadeiro Faria Lima nº 3.500, 3º Andar

(Parte), Itaim Bibi, CEP 04.538-132, registered with the CNPJ/MF under No. 61.194.353/0001-64 ("Bookkeeper").

7. FINAL DISTRIBUTION DATA

SINGLE SERIES

|

Type of Investor |

Number of

Subscribers |

Number of debentures

subscribed and paid in |

|

Natural persons |

0 |

0 |

|

Investment clubs |

0 |

0 |

|

Investment funds |

116 |

1.498.185 |

|

Private pension entities |

1 |

1.815 |

|

Insurance companies |

0 |

0 |

|

Foreign investors |

0 |

0 |

| Intermediary institutions participating in the distribution consortium |

0 |

0 |

| Financial institutions linked to the Issuer and/or the consortium participants |

0 |

0 |

|

Other financial institutions |

0 |

0 |

| Other legal entities linked to the Issuer and/or the consortium participants |

0 |

0 |

|

Other legal entities |

0 |

0 |

| Partners, managers, employees, proposed, and other persons connected to the Issuer and/or the participants of the consortium |

0 |

0 |

|

TOTAL |

117 |

1.500.000 |

THE DISCLOSURE OF THE PROSPECTUS AND THE OFFER SHEET FOR THE REALIZATION

OF THIS OFFERING WAS WAIVED PURSUANT TO SECTIONS 9, ITEM I AND 23, PARAGRAPH 1, OF CVM RESOLUTION 160.

PURSUANT TO SECTION 59 OF CVM RESOLUTION 160, ADDITIONAL INFORMATION

ON THE DISTRIBUTION OF THE DEBENTURES AND ON THE OFFERING MAY BE OBTAINED FROM THE

THIS

ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY, AND IS

NOT

AN OFFER TO SELL SECURITIES.

ISSUER, THE COORDINATORS AND OTHER INSTITUTIONS PARTICIPATING IN THE

DISTRIBUTION CONSORTIUM, WITH THE CVM AND/OR WITH B3.

CONSIDERING THAT THE OFFERING WAS SUBJECT TO THE AUTOMATIC REGISTRATION

OF DISTRIBUTION PROCEDURE, THE REGISTRATION OF THE OFFERING DID NOT REQUIRE PRIOR ANALYSIS BY THE CVM, THE BRAZILIAN ASSOCIATION OF FINANCIAL

AND CAPITAL MARKETS ENTITIES (ANBIMA) OR ANY REGULATORY OR SELF-REGULATORY ENTITY. IN THIS SENSE, THE DOCUMENTS RELATED TO THE DEBENTURES

AND THE OFFERING WERE NOT REVIEWED BY THE CVM, INCLUDING THIS CLOSING ANNOUNCEMENT.

CONSIDERING THAT THE OFFERING IS INTENDED EXCLUSIVELY FOR PROFESSIONAL

INVESTORS, PURSUANT TO SECTION 26, ITEM IV, ITEM "A", OF CVM RESOLUTION 160 AND IS SUBJECT TO THE AUTOMATIC REGISTRATION OF

DISTRIBUTION PROCEDURE PROVIDED FOR IN CVM RESOLUTION 160, THE DEBENTURES WILL BE SUBJECT TO RESTRICTIONS ON RESALE, AS INDICATED IN SECTION

86, ITEM I, OF CVM RESOLUTION 160.

THE REGISTRATION OF THE OFFERING DID NOT IMPLY, ON THE PART OF THE

CVM, A GUARANTEE OF THE VERACITY OF THE INFORMATION PROVIDED OR IN JUDGMENT ON THE QUALITY OF THE DEBENTURES DISTRIBUTED.

Capitalized terms used in this Closing Announcement, which are not defined

herein, shall have the meaning given to them in the Issuance Deed.

The date of this Closing Announcement is December 12, 2024.

Lead

Placement Agent

Placement Agent

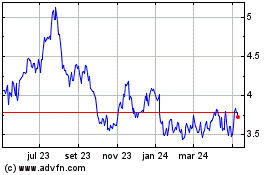

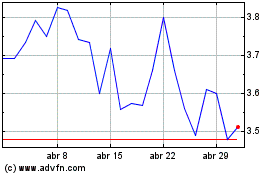

Gerdau (NYSE:GGB)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Gerdau (NYSE:GGB)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024