UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c) of

the Securities Exchange Act of 1934

(Amendment No. )

______________________

Check the appropriate box:

| | | | | |

| ☒ | Preliminary Information Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| ☐ | Definitive Information Statement |

GLOBALSTAR, INC.

(Name of Registrant As Specified In Its Charter)

Payment of Filing Fee (Check all boxes that apply):

| | | | | |

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) of Schedule 14A (17 CFR 240.14a-101) per Item 1 of this Schedule and Exchange Act Rules 14c-5(g) and 0-11 |

GLOBALSTAR, INC.

1351 HOLIDAY SQUARE BLVD.

COVINGTON, LA 70433

______________________

NOTICE OF ACTION TAKEN PURSUANT TO WRITTEN CONSENT OF MAJORITY STOCKHOLDERS

______________________

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY

You are not being asked to take or approve any action.

This Information Statement is being provided to you solely for your information.

______________________

To the Stockholders of Globalstar, Inc.:

This Notice and the accompanying Information Statement are being furnished by Globalstar, Inc., a Delaware corporation (“we”, “us”, “our”, the “Company”, or “Globalstar”), to the holders of shares of our common stock, par value $0.0001 per share (the “Common Stock”), to inform you of the approval, upon approval and recommendation by the Strategic Review Committee (the “SRC”) of our Board of Directors (the “Board of Directors” or the “Board”) and the Board, on December 17, 2024, of the corporate actions described below by written consent (the “Written Consent”) executed by James Monroe III, a director and Executive Chairman of the Board, and certain of Mr. Monroe’s affiliates, including FL Investment Holdings LLC, Thermo Funding Company, LLC, Thermo Funding II LLC, Globalstar Satellite, L.P., Monroe Irrevocable Educational Trust, Thermo Properties II LLC, James Monroe III Grantor Trust, Thermo Investments LP, and Thermo XCOM LLC (collectively, our “Majority Stockholder” or “Thermo”), who collectively hold 1,099,945,953 shares of Common Stock, representing the right to vote approximately 58% of our total issued and outstanding shares of Common Stock and the total voting power entitled to vote on the foregoing matters, approving the following items:

1.an amendment to our Third Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”) to effect a reverse stock split (the “Reverse Stock Split”) of the Common Stock, at a ratio of between 1 for 10 to 1 for 25, such ratio to be determined by the Chief Executive Officer or the Chief Financial Officer of the Company (the “Authorized Officers”) in conjunction with the Board (the “Reverse Stock Split Charter Amendment”); and

2.an amendment to the Certificate of Incorporation to reduce the 2,150,000,000 shares of Common Stock currently authorized under the Certificate of Incorporation to a lower amount in proportion to the Reverse Stock Split (the “Authorized Share Reduction Charter Amendment” and, together with the Reverse Stock Split Charter Amendment, the “Charter Amendments”).

These actions may be taken at such future date as determined by the Authorized Officers, in conjunction with the Board, but in no event (i) earlier than the 20th day after the Information Statement is mailed or furnished to the stockholders, or (ii) later than December 17, 2025, the one-year anniversary of the effective date of the Written Consent.

If the Company decides to proceed with the Reverse Stock Split and related Charter Amendments, the Authorized Officers, in conjunction with the Board, will set the exact Reverse Stock Split ratio within the approved range and file a Certificate of Amendment (the “Certificate of Amendment”) effecting the Reverse Stock Split and related Charter Amendments with the Secretary of State of the State of Delaware after re-assessing the factors described in the accompanying Information Statement. This Notice and the accompanying Information Statement are first being mailed to stockholders of record as of December 17, 2024 on or about , 2024.

The accompanying Information Statement is being furnished only to inform stockholders, in accordance with Rule 14c-2 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), of the actions taken by Written Consent described in the Information Statement before the Reverse Stock Split and related Charter Amendments take effect. We are also furnishing the Information Statement to our stockholders in satisfaction of the notice requirement under Section 228 of the General Corporation Law of the State of Delaware. Because the Written Consent of the Majority Stockholder satisfies all applicable stockholder voting requirements, the Board is not soliciting your proxy or consent in connection with the matters discussed above or in the accompanying Information Statement. You are urged to read the Information Statement carefully and in its entirety for further information regarding the Reverse Stock Split and related Charter Amendments.

This is not a notice of special meeting of stockholders and no stockholder meeting will be held to consider any matter which is described herein or the accompanying Information Statement. We are not asking you for a consent or proxy and you are requested not to send us a consent or proxy. The accompanying Information Statement is provided solely for your information.

By order of the SRC and the Board of Directors

/s/ James Monroe III

James Monroe III

Executive Chairman of the Board

Notice Dated: , 2024

GLOBALSTAR, INC.

1351 HOLIDAY SQUARE BLVD.

COVINGTON, LA 70433

______________________

INFORMATION STATEMENT

PURSUANT TO SECTION 14(c)

OF THE SECURITIES EXCHANGE ACT OF 1934

AND RULE 14c-2 THEREUNDER

______________________

WE ARE NOT ASKING FOR YOUR PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

You are not being asked to take or approve any action.

This Information Statement is being provided to you solely for your information.

______________________

General Information

Globalstar, Inc., a Delaware corporation (“we”, “us”, “our”, the “Company”, or “Globalstar”), is distributing this Information Statement to its stockholders in full satisfaction of any notice requirements it may have under Securities Exchange Act of 1934, as amended (the “Exchange Act”), and applicable Delaware law, including Section 228 of the General Corporation Law of the State of Delaware (“DGCL”).

On December 17, 2024, by written consent (the “Written Consent”), following the approval and recommendation of the Strategic Review Committee (the “SRC”) of our Board of Directors (the “Board of Directors” or the “Board”) and the Board, James Monroe III, a director and Executive Chairman of the Board, and certain of Mr. Monroe’s affiliates, including FL Investment Holdings LLC, Thermo Funding Company, LLC, Thermo Funding II LLC, Globalstar Satellite, L.P., Monroe Irrevocable Educational Trust, Thermo Properties II LLC, James Monroe III Grantor Trust, Thermo Investments LP, and Thermo XCOM LLC (collectively, our “Majority Stockholder” or “Thermo”), who collectively hold 1,099,945,953 shares of the Company’s common stock, par value $0.0001 per share (the “Common Stock”), representing the right to vote approximately 58% of our total issued and outstanding shares of Common Stock and the total voting power entitled to vote on the foregoing matters, approved the following items:

1.an amendment to our Third Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”) to effect a reverse stock split (the “Reverse Stock Split”) of the Common Stock, at a ratio of between 1 for 10 to 1 for 25, such ratio to be determined by the Chief Executive Officer or the Chief Financial Officer of the Company (the “Authorized Officers”), in conjunction with the Board (the “Reverse Stock Split Charter Amendment”); and

2.an amendment to the Certificate of Incorporation to reduce the 2,150,000,000 shares of Common Stock currently authorized under the Certificate of Incorporation to a lower amount in proportion to the Reverse Stock Split (the “Authorized Share Reduction Charter Amendment” and, together with the Reverse Stock Split Charter Amendment, the “Charter Amendments”).

The Charter Amendments permit (but do not require) the Authorized Officers to: (i) effect the Reverse Stock Split at a ratio of between 1 for 10 to 1 for 25, such ratio to be determined by the Authorized Officers, in conjunction with the Board, whereby every 10 to 25 shares of the authorized, issued and outstanding Common Stock shall be combined into one share of authorized, issued and outstanding Common Stock, and (ii) reduce the 2,150,000,000 shares of Common Stock currently authorized for issuance under the Certificate of Incorporation to a lower amount in proportion to the Reverse Stock Split, if and only if the Reverse Stock Split is effectuated.

These actions may be taken at such future date as determined by the Authorized Officers, in conjunction with the Board, but in no event (i) earlier than the 20th day after this Information Statement is mailed or furnished to the stockholders of record, or (ii) later than December 17, 2025, the one-year anniversary of the effective date of the Written Consent.

If the Company decides to proceed with the Reverse Stock Split and related Charter Amendments, the Authorized Officers, in conjunction with the Board, will set the exact Reverse Stock Split ratio within the approved range and file a

Certificate of Amendment (the “Certificate of Amendment”) effecting the Reverse Stock Split and related Charter Amendments with the Secretary of State of the State of Delaware after re-assessing the factors described below. The accompanying Notice and this Information Statement are first being mailed to stockholders of record as of December 17, 2024 on or about , 2024.

The entire cost of furnishing this Information Statement will be borne by the Company. We will request banks, brokers, custodians or other nominees to forward this Information Statement to the beneficial owners of the Common Stock held of record by them and will reimburse such persons for their reasonable charges and expenses in connection therewith.

No Appraisal Rights

Stockholders are not entitled to appraisal rights (or other dissenters’ rights) with respect to the Reverse Stock Split or any other matters described in this Information Statement or the accompanying Notice under the DGCL, the Certificate of Incorporation or our bylaws, each as amended through the date hereof.

Interests of Certain Persons in Matters Acted Upon

None of the Company’s officers or directors has a substantial interest in the Reverse Stock Split or related Charter Amendments, other than to the extent they are holders of shares of our Common Stock or securities convertible into or exercisable for our Common Stock, which shares and other securities would be subject to the same proportionate adjustment in accordance with the terms of the Reverse Stock Split as all other outstanding shares of our Common Stock and securities convertible into or exercisable for our Common Stock.

Notice Pursuant to Section 228(e)

Section 228 of the DGCL generally provides in substance that unless a company’s certificate of incorporation provides otherwise, stockholders may take any action without a meeting of stockholders, without prior notice and without a vote if a consent or consents in writing, setting forth the action so taken, is signed by holders of the outstanding stock having not less than the minimum number of votes that would be necessary to authorize and take such action at a meeting at which all shares entitled to vote thereon were present voted. In order to eliminate the costs and management time involved in obtaining proxies and to effect the Reverse Stock Split and related Charter Amendments as early as possible in order to accomplish the purposes of the Company as herein described, management and the Board determined to pursue stockholder action by written consent and successfully obtained the Written Consent of the Majority Stockholder.

FORWARD-LOOKING STATEMENTS

Certain statements contained in this Information Statement other than purely historical information, including, but not limited to, the implementation and potential impacts of the Reverse Stock Split and the related Charter Amendments, and our potential uplisting on the NASDAQ Stock Market, LLC (“NASDAQ”), and the assumptions upon which those statements are based, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “plan,” “may,” “could,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions, although not all forward-looking statements contain these identifying words. These forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. Risks and uncertainties that could cause or contribute to such differences include, without limitation, those described under Item 1A. Risk Factors of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and in the Company’s other filings with the SEC. The Company undertakes no obligation to update any of the forward-looking statements after the date of this Information Statement to reflect actual results, future events or circumstances or changes in our assumptions, business plans or other changes.

THE CHARTER AMENDMENTS

General

The Charter Amendments permit (but do not require) the Authorized Officers to: (i) effect the Reverse Stock Split at a ratio of between 1 for 10 to 1 for 25, such ratio to be determined by the Authorized Officers, in conjunction with the Board, whereby every 10 to 25 (the “Split Denominator”) shares of the authorized, issued and outstanding Common Stock shall be combined into one share of authorized, issued and outstanding Common Stock, and (ii) reduce the 2,150,000,000 shares of

Common Stock currently authorized for issuance under the Certificate of Incorporation to a lower amount in proportion to the Reverse Stock Split, if and only if the Reverse Stock Split is effectuated.

Depending on the ratio for the Reverse Stock Split, no fewer than 10 and no more than 25 shares of existing Common Stock will be combined into one share of Common Stock. The amendment to our Certificate of Incorporation to effect the Reverse Stock Split, if filed, will include the Reverse Stock Split ratio determined by the Authorized Officers, in conjunction with our Board, to be in the best interests of our stockholders.

Except as otherwise provided below in connection with our 2006 Equity Incentive Plan (as amended and restated, the “Incentive Plan”) and awards granted thereunder, to avoid the existence of fractional shares of our Common Stock, we will round up any fractional shares resulting from the Reverse Stock Split or Charter Amendments to the next whole share.

The form of amendment to be filed with the Secretary of State of the State of Delaware to give effect to the Reverse Stock Split is set forth as Appendix A to this Information Statement.

We believe that enabling the Authorized Officers, in conjunction with our Board, to decide whether and when to effect the Reverse Stock Split and to set the ratio within the stated range without the necessity of further action by our stockholders will provide us with the flexibility to implement the Reverse Stock Split and related Charter Amendments in a manner designed to maximize the anticipated benefits for our stockholders. In making these decisions, the Authorized Officers and our Board may consider, among other things, factors such as:

•the listing requirements of the stock exchanges;

•the historical trading price and trading volume of our Common Stock;

•the number of shares of our Common Stock outstanding;

•the then-prevailing trading price and trading volume of our Common Stock and the anticipated impact of the Reverse Stock Split on the trading market for our Common Stock in the short- and long-term;

•the anticipated impact of a particular ratio on our ability to reduce administrative costs; and

•prevailing general market and economic conditions.

Purposes for the Reverse Stock Split and Related Charter Amendments

As discussed in greater detail below, implementing the Reverse Stock Split would reduce the number of our issued and outstanding Common Stock, which we expect, absent other factors, would proportionately increase the per share market price of our common stock following the effective date. Set forth below are the principal reasons why we currently expect these changes would benefit the Company and its shareholders.

To potentially improve the marketability and trading costs of our common stock. The primary purpose of authorizing a Reverse Stock Split is to increase the per share market price of our Common Stock. The Board believes the anticipated increase in the per share market price of our Common Stock could improve the marketability and liquidity of our Common Stock and encourage interest and trading in our Common Stock, as described further below.

•Broader Marketability: For various reasons, including stock price volatility, many brokers, institutional investors and funds have internal policies and practices that (i) prohibit them from investing in low-priced stocks, (ii) discourage individual brokers from recommending low-priced stocks to their customers or (iii) restrict or limit the ability of customers to purchase such stocks on margin. Some of those policies and practices may make the processing of trades in low-priced stocks economically unattractive to brokers. We believe the Reverse Stock Split could increase analyst and broker interest in our Common Stock by avoiding the applicability of these internal policies and practices.

•Lower Trading Costs: Investors may be dissuaded from purchasing stocks below certain prices because brokers’ commissions, as a percentage of the total transaction value, can be higher for low-priced stocks.

To achieve and maintain listing of our Common Stock on NASDAQ. We believe the Reverse Stock Split will better position the Company to transfer its Common Stock listing from the NYSE American to NASDAQ, which management, the SRC and the Board believe could make our Common Stock more attractive to a broader range of investors. We also believe that the anticipated increase of the per share market price of our Common Stock resulting from implementing the Reverse Stock Split could help us maintain compliance with the continued listing requirements of NASDAQ.

Accordingly, the Company believes that effecting the Reverse Stock Split and related Charter Amendments would be in the Company and its stockholders’ best interests. However, no assurances can be given that the Reverse Stock Split and related Charter Amendments will serve these intended purposes.

Additionally, management, the SRC and the Board believe that the related Authorized Share Reduction Charter Amendment will appropriately balance the needs for available shares for capital raising, strategic transactions, and equity incentive awards with the desire to avoid having an unreasonably high number of authorized shares. Management, the SRC and the Board believe that the number of remaining available shares after implementing the Authorized Share Reduction Charter Amendment will be appropriate to provide for our long-term needs.

In the event that we need to increase our authorized shares of Common Stock in the future, we may, subject to stockholder approval, seek to amend the Certificate of Incorporation, as amended, to increase the number of authorized shares of Common Stock.

Effects of the Reverse Stock Split and Related Charter Amendments

If the Company implements the Reverse Stock Split and related Charter Amendments, it will amend its Certificate of Incorporation by filing a Certificate of Amendment to the Certificate of Incorporation in substantially the same form as Appendix A with the Secretary of State of the State of Delaware, which will result in the number of shares of the Common Stock held by each stockholder being reduced to a number of shares determined by dividing the number of shares held immediately before the effective time of the Reverse Stock Split by the Split Denominator, and then rounding any fractional interests up to the nearest whole share of Common Stock. The Reverse Stock Split would not materially affect any stockholder’s percentage ownership interests in the Company or proportionate voting power, except to the extent that such interests would be impacted by rounding any fractional interests resulting from the Reverse Stock Split up to the nearest whole share of Common Stock. Pursuant to the DGCL, the Reverse Stock Split and Reverse Stock Split Charter Amendment only impacts outstanding shares of Common Stock and not authorized shares unless the Certificate of Amendment by its terms also decreases the authorized shares of Common Stock. As discussed in more detail herein, if the Reverse Stock Split and Reverse Stock Split Charter Amendment are effected, the Company will also proportionately reduce its authorized shares of Common Stock pursuant to the Authorized Share Reduction Charter Amendment.

When a company engages in a reverse stock split, it substitutes one share of stock for a predetermined amount of shares of stock. Except as otherwise provided below, the Reverse Stock Split will affect all of our stockholders uniformly and will not affect any stockholder’s percentage ownership interests in the Company or proportionate voting power, except to the extent that the Reverse Stock Split results in any fractional share interests, which will be rounded up to the nearest whole number unless otherwise provided herein. The Reverse Stock Split will result in the number of shares of Common Stock issued and outstanding being reduced from 1,894,003,551 shares as of December 17, 2024, to a lower number depending on the final ratio selected by the Authorized Officers, in conjunction with the Board. See the table below on the following page.

The Reverse Stock Split is not intended as, and will not have the effect of, a “going private transaction” covered by Rule 13e-3 under the Exchange Act. We will continue to be subject to the periodic reporting requirements of the Exchange Act.

Our Common Stock is currently registered under the Exchange Act, and we are subject to the periodic reporting and other requirements of the Exchange Act. The Reverse Stock Split, if implemented, will not affect the registration of our Common Stock under the Exchange Act or our reporting or other requirements thereunder. Our Common Stock is currently traded on the NYSE American market under the symbol “GSAT” and, following the Reverse Stock Split, is expected to continue to be traded on the NYSE American market or NASDAQ under the symbol “GSAT”, subject to our continued satisfaction of the NYSE American market listing requirements or the NASDAQ listing requirements, as applicable. Note, however, that the CUSIP number for our Common Stock will change in connection with the Reverse Stock Split.

Fractional Shares. We will not issue fractional shares or certificates representing fractional shares in connection with the Reverse Stock Split. Except as otherwise provided below, in lieu of issuing fractional shares, we will round fractional shares up to the next whole share of Common Stock. In connection with outstanding equity awards granted under and share limits sets forth in our Incentive Plan, any fractional shares resulting from the Reverse Stock Split adjustments will be rounded down to the next whole number of shares pursuant to the terms and conditions of the Incentive Plan and the award or agreement governing such awards.

Authorized Shares and Authorized Shares Reduction Charter Amendment. The Company is currently authorized to issue 2,150,000,000 shares of Common Stock under the Certificate of Incorporation. Upon effectiveness of the Reverse Stock Split and Authorized Share Reduction Charter Amendment, the number of authorized shares of Common Stock will be reduced to

between 215,000,000 shares and 86,000,000 shares of Common Stock, in proportion to the split ratio for the Reverse Stock Split chosen by the Authorized Officers, in conjunction with the Board. Unlike the Reverse Stock Split and Reverse Stock Split Charter Amendment, the Authorized Share Reduction Charter Amendment will have no impact on the number of shares of Common Stock you own. The issuance in the future of additional shares of our Common Stock may have the effect of diluting the earnings per share and book value per share, as well as the stock ownership and voting rights of the currently outstanding shares of our Common Stock. Authorized but unissued shares will be available for issuance, and we may issue such shares in future financings as compensation, or otherwise. If we issue additional shares, the ownership interest of holders of our Common Stock would be diluted.

Incentive Plan, Employment Agreements, Employee Stock Purchase Plan, Options, Restricted Stock Awards and Units, Warrants, and Convertible or Exchangeable Securities. Based upon the Reverse Stock Split ratio determined by the Authorized Officers, in conjunction with the Board, proportionate adjustments are generally required to be made to the per share exercise price and the number of shares issuable upon the exercise or conversion of all outstanding options, warrants, convertible or exchangeable securities entitling the holders to purchase, exchange for, or convert into, shares of Common Stock. This would result in approximately the same aggregate price being required to be paid under such options, warrants, convertible or exchangeable securities upon exercise, and approximately the same value of shares of Common Stock being delivered upon such exercise, exchange or conversion, immediately following the Reverse Stock Split as was the case immediately preceding the Reverse Stock Split. Accordingly, we will adjust and proportionately decrease the number of shares of Common Stock issuable upon exercise or vesting of, and adjust and proportionately increase the exercise price of, outstanding equity awards under the Company’s 2006 Equity Incentive Plan (as amended, the “Incentive Plan”), the Company’s Employee Stock Purchase Plan (the “ESPP”), outstanding awards pursuant to any employment agreements, including Dr. Paul Jacobs’ employment agreement with the Company, and any other awards, earnout shares and other compensatory arrangements, in each case pursuant to the terms thereof (subject to our treatment of fractional shares). In addition, as of the effective time of the Reverse Stock Split, we will adjust and proportionately decrease the number of shares of Common Stock that may be the subject of future grants or awards under our Incentive Plan, the ESPP, any employment agreements, including Dr. Jacobs’ employment agreement with the Company, and any other awards, earnout shares and other compensatory arrangements, in each case pursuant to the terms thereof (subject to our treatment of fractional shares).

Accounting Matters. The Reverse Stock Split will not affect the par value of our Common Stock, which will remain at $0.0001. As a result, on the effective date of the Reverse Stock Split, the stated capital on the balance sheet attributable to the Common Stock will be reduced proportionally from its present amount, and the additional paid-in capital account will be increased by the amount by which the stated capital is reduced. The per share Common Stock net income or loss and any other per common share amount will be increased because there will be fewer shares of the Common Stock outstanding and we will adjust historical per share amounts set forth in our future financial statements. The Company does not anticipate that any other accounting consequences would arise as a result of the Reverse Stock Split.

Anti-Takeover Effects of the Reverse Stock Split. Since we are already controlled by our Majority Stockholder and our governing documents contain anti-takeover provisions, the Reverse Stock Split and related Charter Amendments will not have any additional anti-takeover effects on us. The Reverse Stock Split and related Charter Amendments are not the result of management’s knowledge of an effort to accumulate the Company’s securities or to obtain control of the Company by means of a merger, tender offer, solicitation or otherwise.

Effect of the Reverse Stock Split on Holders of Outstanding Common Stock. Depending on the ratio for the Reverse Stock Split determined by the Authorized Officers, in conjunction with the Board, a minimum of 10 and a maximum of 25 shares of existing Common Stock will be combined into one new share of Common Stock. The table below, which is for illustrative purposes only, illustrates the effects of the Reverse Stock Split at certain ratios within the foregoing range in increments of five shares, without giving effect to any adjustment for fractional shares of Common Stock, on our outstanding shares of Common Stock and authorized shares of capital stock as of the record date:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Before Reverse Stock Split and Related Charter Amendments | | After Reverse Stock Split and Related Charter Amendments |

| | 1-for-10 | | 1-for-15 | | 1-for-20 | | 1-for-25 |

| Common Stock Authorized | 2,150,000,000 | | | 215,000,000 | | | 143,333,333 | | | 107,500,000 | | | 86,000,000 | |

| | | | | | | | | |

| Common Stock Issued and Outstanding | 1,894,003,551 | | | 189,400,355 | | | 126,266,903 | | | 94,700,178 | | | 75,760,142 | |

Common Stock Reserved for Issuance(1) | 146,300,960 | | | 14,630,096 | | | 9,753,397 | | | 7,315,048 | | | 5,852,038 | |

(1) Amounts reflect the potential issuance of Common Stock for contingently issuable securities, including: 3.8 million shares upon the exercise of stock options and the vesting of restricted stock units, 46.8 million shares of Common Stock contingently issuable upon the achievement and vesting of performance based restricted stock units, warrants to purchase up to 49.1 million shares of Common Stock in connection with the Service Agreements and 5.0 million shares may be issued to Thermo upon exercise of warrants issued as consideration for its guarantee under the 2023 Funding Agreement; an additional 5.0 million warrants may vest if and when Thermo advances aggregate funds of $25.0 million or more to the Company or a permitted third party pursuant to the terms of Thermo's guarantee.

The actual number of shares outstanding after giving effect to the Reverse Stock Split, if implemented, will depend on the Reverse Stock Split ratio that is ultimately determined by the Authorized Officers, in conjunction with our Board.

No Impact on Preferred Stock. Neither the Reverse Stock Split nor the related Charter Amendments will have any impact on the number of shares of preferred stock we are authorized to issue under our Certificate of Incorporation or the number of issued and outstanding shares of our Perpetual Preferred Stock, Series A.

Holders of Certificate Shares of Common Stock. Stockholders of record holding some or all of their shares of Common Stock in certificate form would receive a letter of transmittal from the Company or its exchange agent, as soon as practicable after the effective date of the Reverse Stock Split. The transmittal letter would be accompanied by instructions specifying how the stockholder may exchange their certificates representing such stockholder’s pre-Reverse Stock Split shares of Common Stock for a statement of holding. Any such holders would be asked to surrender to the exchange agent their certificates representing their pre-Reverse Stock Split shares of Common Stock. When that stockholder duly submits certificates representing the pre-Reverse Stock Split shares of Common Stock, that stockholder would hold post-Reverse Stock Split shares of Common Stock electronically in book-entry form. This means that, instead of receiving a new stock certificate, that stockholder would receive a statement of holding that indicates the number of post-Reverse Stock Split shares of Common Stock held by that stockholder in book-entry form. We plan to no longer issue physical stock certificates. Beginning on the effective date of the Reverse Stock Split, each certificate representing pre-Reverse Stock Split shares of Common Stock would be deemed to be evidence ownership of the post-Reverse Stock Split shares of Common Stock. Stockholders would need to surrender their old certificates in order to effect transfers of Common Stock. If an old certificate bears a restrictive legend, the Common Stock in book-entry form would bear the same restrictive legend or notation.

STOCKHOLDERS SHOULD NEITHER DESTROY NOR SUBMIT THEIR STOCK CERTIFICATES UNTIL THEY ARE REQUESTED TO DO SO.

Registered “Book Entry” Holders of Common Stock. Certain of our registered holders of Common Stock may hold some or all of their shares electronically in book-entry form with the transfer agent. These stockholders do not have stock certificates evidencing their ownership of the Common Stock. They are, however, provided with a statement reflecting the number of shares registered in their accounts. Stockholders who hold shares electronically in book-entry form with the transfer agent will not need to take action (the exchange will be automatic) to receive whole shares of post-Reverse Stock Split Common Stock, subject to adjustment for treatment of fractional shares.

Beneficial Holders of Common Stock. Upon the implementation of the Reverse Stock Split, we intend to treat shares held by stockholders through a bank, broker, custodian or other nominee in the same manner as registered stockholders (or DTC participants) whose shares are registered in their names. Banks, brokers, custodians or other nominees will be instructed to effect the Reverse Stock Split for their beneficial holders holding our Common Stock in street name. However, these banks, brokers, custodians or other nominees may have different procedures than registered stockholders for processing the Reverse Stock Split. Stockholders who hold shares of our Common Stock with a bank, broker, custodian or other nominee and who have any questions in this regard are encouraged to contact their banks, brokers, custodians or other nominees.

Certain U.S. Federal Income Tax Consequences

The following summary describes, as of the date of this Information Statement, certain U.S. federal income tax consequences of the Reverse Stock Split to holders of our Common Stock. This summary addresses such tax consequences only to a U.S. holder, which is a beneficial owner of our Common Stock that, for U.S. federal income tax purposes, is:

•an individual who is a citizen or resident of the United States;

•a corporation (or other entity treated as a corporation for U.S. federal income tax purposes) created or organized in or under the laws of the United States, any state thereof, or the District of Columbia;

•an estate, the income of which is subject to U.S. federal income taxation regardless of its source; or

•a trust (i) the administration of which is subject to the primary supervision of a U.S. court and which has one or more “United States persons” (within the meaning of Section 7701(a)(30) of the Code) who have the authority to control all substantial decisions of the trust or (ii) that has made a valid election under applicable U.S. Treasury regulations to be treated as a United States person.

This summary is based on the provisions of the Internal Revenue Code of 1986, as amended (the “Code”), U.S. Treasury regulations, administrative rulings and judicial authority, all as in effect as of the date of this Information Statement. Subsequent developments in U.S. federal income tax law, including changes in law or differing interpretations, which may be applied retroactively, could have a material effect on the U.S. federal income tax consequences of the Reverse Stock Split.

This summary does not address all the tax consequences that may be relevant to any particular U.S. holder, including tax considerations that arise from rules of general application to all taxpayers or to certain classes of taxpayers or that are generally assumed to be known by investors. This summary also does not address the tax consequences to (i) persons that may be subject to special treatment under U.S. federal income tax law, such as banks, insurance companies, thrift institutions, regulated investment companies, real estate investment trusts, tax-exempt organizations, U.S. expatriates, persons subject to the alternative minimum tax, persons whose functional currency is not the U.S. dollar, partnerships or other pass-through entities, traders in securities that elect to mark to market and dealers in securities or currencies, (ii) persons that hold our Common Stock as part of a position in a “straddle” or as part of a “hedging transaction,” “conversion transaction” or other integrated investment transaction for federal income tax purposes or (iii) persons that do not hold our Common Stock as “capital assets” (generally, property held for investment). This summary does not address backup withholding and information reporting. This summary does not address U.S. holders who beneficially own Common Stock through a “foreign financial institution” (as defined in Code Section 1471(d)(4)) or certain other non-U.S. entities specified in Code Section 1472. This summary does not address tax considerations arising under any state, local or foreign laws, or under federal estate or gift tax laws.

If a partnership (or other entity classified as a partnership for U.S. federal income tax purposes) is the beneficial owner of our Common Stock, the U.S. federal income tax treatment of a partner in the partnership will generally depend on the status of the partner and the activities of the partnership. Partnerships that hold our Common Stock, and partners in such partnerships, should consult their own tax advisors regarding the U.S. federal income tax consequences of the Reverse Stock Split.

Each U.S. holder should consult his, her or its own tax advisors concerning the particular U.S. federal tax consequences of the Reverse Stock Split, as well as the consequences arising under the laws of any other taxing jurisdiction, including any foreign, state, or local income tax consequences.

If the Reverse Stock Split is effected, it is intended to qualify as a “reorganization” under Section 368 of the Code that should constitute a “recapitalization” for U.S. federal income tax purposes. Assuming the Reverse Stock Split qualifies as a reorganization, a U.S. holder generally is not expected to recognize gain or loss upon the exchange of our Common Stock for a lesser number of shares of Common Stock, based upon the Reverse Stock Split ratio. A U.S. holder’s aggregate tax basis in the shares of Common Stock received pursuant to the Reverse Stock Split should equal such U.S. holder’s aggregate tax basis in the shares of our Common Stock that such U.S. holder owned immediately prior to the Reverse Stock Split. The holding period for the shares of Common Stock received pursuant to the Reverse Stock Split should include the period during which a U.S. holder held the shares of our Common Stock that were surrendered in the Reverse Stock Split. The United States Treasury regulations provide detailed rules for allocating the tax basis and holding period of the shares of our Common Stock surrendered to the shares of our Common Stock received pursuant to the Reverse Stock Split. U.S. holders of shares of our Common Stock acquired on different dates and at different prices should consult their tax advisors regarding the allocation of the tax basis and holding period of such shares.

THE ABOVE DISCUSSION IS NOT INTENDED OR WRITTEN TO BE USED, AND CANNOT BE USED BY ANY PERSON, FOR THE PURPOSE OF AVOIDING U.S. FEDERAL TAX PENALTIES. IT WAS WRITTEN SOLELY IN CONNECTION WITH THE INFORMATION PROVIDED HEREIN IN CONNECTION WITH THE REVERSE STOCK SPLIT.

Procedure for Implementing the Reverse Stock Split and Related Charter Amendments

The Reverse Stock Split and related Charter Amendments will become effective upon the filing (the “Effective Time”) of a Certificate of Amendment to our Certificate of Incorporation with the Secretary of State of the State of Delaware. Whether or not the Certificate of Amendment is filed and the exact timing of the filing of the Certificate of Amendment will be

determined by the Authorized Officers, based on their evaluation as to when such action will be the most advantageous to us and our stockholders. In addition, the Authorized Officers, in conjunction with our Board, reserves the right, notwithstanding stockholder approval, to elect not to proceed with the Reverse Stock Split and related Charter Amendments if, at any time prior to filing the Certificate of Amendment, the Authorized Officers and our Board determine that it is no longer in our best interest and the best interests of our stockholders to proceed with the Reverse Stock Split and related Charter Amendments. If a Certificate of Amendment effecting the Reverse Stock Split and related Charter Amendments has not been filed with the Secretary of State of the State of Delaware by the close of business on December 17, 2025, our Board will abandon the Reverse Stock Split and related Charter Amendments. No further action on the part of stockholders would be required to either effect or abandon the Reverse Stock Split and related Charter Amendments.

If we do not effectuate the Reverse Stock Split and Reverse Stock Split Charter Amendment in accordance with the terms described in this Information Statement, we will not implement the Authorized Share Reduction Charter Amendment.

Certain Risk and Potential Disadvantages Associated with the Reverse Stock Split

There are certain risks associated with the implementation of the Reverse Stock Split, including as follows.

We cannot assure you that a Reverse Stock Split would increase our stock price. We expect that a Reverse Stock Split would increase the per share market price of our Common Stock to a level that could attract more investors. However, the effect of a Reverse Stock Split on the per share market price of our Common Stock cannot be predicted with any certainty, and the history of reverse stock splits for other companies is varied, particularly since some investors may view a reverse stock split negatively. It is possible that the per share market price of our Common Stock after the Reverse Stock Split would not increase in the same proportion as the reduction in the number of our outstanding Common Shares following the Reverse Stock Split, which would cause a reduction in the value of the Company as measured by our market capitalization. In addition, it is also possible that the Reverse Stock Split may not result in a per share market price that would attract increased investor interest in our Common Stock. Although we believe the Reverse Stock Split may enhance the desirability of our Common Stock to certain potential investors, we cannot provide you with any assurances to this effect. Even if we successfully implement a Reverse Stock Split, the market price of our Common Stock may thereafter decrease due to factors unrelated to the Reverse Stock Split, including our results of operations or financial position. If the Reverse Stock Split is consummated and the per share market price of the Common Stock declines, the percentage decline as a percentage of our overall market capitalization may be greater than would occur in the absence of the Reverse Stock Split.

A Reverse Stock Split may decrease the liquidity of our common stock and result in higher transaction costs for “odd lot” positions of less than 100 shares. The liquidity of our Common Stock may be negatively impacted by a Reverse Stock Split, given the reduced number of shares that would be outstanding after the Reverse Stock Split, particularly if the stock price does not increase as a result of the Reverse Stock Split. In addition, if the Reverse Stock Split is implemented, it would likely increase the number of our shareholders who own “odd lots” of fewer than 100 Common Shares. Brokerage commission and other costs of transactions in odd lots are generally higher than the costs of transactions of 100 or more shares of Common Stock. Accordingly, the Reverse Stock Split may not achieve the desired results of increasing marketability and lowering trading costs of our Common Stock described above.

SECURITY OWNERSHIP OF PRINCIPAL STOCKHOLDERS AND MANAGEMENT

The following table shows (i) the number of shares of our Common Stock, our only voting securities, beneficially owned as of the Record Date by each director, by each executive officer, and by all directors and current executive officers as a group and (ii) all the persons who were known to be beneficial owners of five percent or more of our Common Stock, our only voting securities, on December 17, 2024, based upon 1,894,003,551 shares of Common Stock outstanding as of that date. Holders of our voting Common Stock are entitled to one vote per share.

| | | | | | | | |

| Amount and Nature

of Beneficial Ownership of Common Stock |

Name of Beneficial Owner(1) | Shares | Percent of Class |

| | |

James Monroe III(2) FL Investment Holdings, LLC Thermo Funding Company, LLC Thermo Funding II LLC Globalstar Satellite, L.P. Monroe Irr. Educational Trust Thermo Properties II LLC James Monroe III Grantor Trust Thermo Investments LP Thermo XCOM LLC | 1,105,445,952 | | 58.08 | % |

Dr. Paul E. Jacobs(3) The Paul Eric Jacobs Trust XCOM Labs, Inc. | 19,999,027 | | 1.05 | % |

James F. Lynch(4) Thermo Investments II LLC | 14,174,387 | | * |

Timothy E. Taylor(5) Thermo Investments III LLC | 9,787,884 | | * |

William A. Hasler(6) | 2,098,667 | | * |

| L. Barbee Ponder | 1,717,233 | | * |

Keith O. Cowan(7) | 1,241,667 | | * |

Benjamin G. Wolff(7) | 1,227,869 | | * |

| Rebecca S. Clary | 856,019 | | * |

All directors and current executive officers as a group (9 persons)(1)(2)(3)(4)(5)(6)(7) | 1,156,548,705 | 60.76 | % |

* Less than 1% of outstanding shares of Common Stock.

1.“Beneficial ownership” is a technical term broadly defined by the SEC to mean more than ownership in the usual sense. Stock is “beneficially owned” if a person has or shares the power (a) to vote or direct its vote or (b) to sell or direct its sale, even if the person has no financial interest in the stock. Also, stock that a person has the right to acquire, such as through the exercise of options or warrants, within sixty (60) days of the Record Date is considered to be “beneficially owned.” These shares are deemed to be outstanding and beneficially owned by the person holding the derivative security for the purpose of computing the percentage ownership of that person, but they are not treated as outstanding for the purpose of computing the percentage ownership of any other person. Unless otherwise noted, each person has full voting and investment power over the stock listed.

2.The address of Mr. Monroe, FL Investment Holdings, LLC, Thermo Funding Company, LLC, Thermo Funding II LLC, Globalstar Satellite, L.P., Monroe Irr. Educational Trust, James Monroe III Grantor Trust, Thermo Investments LP, Thermo Properties II, LLC and Thermo XCOM LLC is 1735 Nineteenth Street, Denver, CO 80202.

This number includes 640,750 shares held by FL Investment Holdings, LLC, 197,139,972 held by Thermo Funding Company, LLC, 880,621,127 shares held by Thermo Funding II LLC, 8,334,090 shares held by Thermo Properties II, LLC, 618,558 shares held by Globalstar Satellite, L.P. 3,000,000 held by the Monroe Irr. Educational Trust, 29,334 held by James Monroe III Grantor Trust, 200,200 held by Thermo Investments LP and 8,708,254 held by Thermo XCOM LLC. Mr. Monroe controls, either directly or indirectly, each of FL Investment Holdings, Thermo Funding

Company, LLC, Thermo Funding II LLC, Globalstar Satellite, L.P. Monroe Irr. Educational Trust, James Monroe III Grantor Trust, Thermo Investments LP, Thermo Properties II, LLC and Thermo XCOM LLC, and, therefore, is deemed the beneficial owner of the Common Stock held by these entities. Mr. Monroe also individually owns 653,668 shares and may acquire 499,999 shares of Common Stock upon the exercise of currently exercisable stock options.

Additionally, 5,000,000 shares of Common Stock may be issued to Thermo Funding II LLC upon exercise of warrants issued in connection with Thermo's guarantee of the Funding Agreements as described more fully in the Company's 2023 Annual Report on Form 10-K. An additional 5,000,000 warrants vest if and when Thermo advances aggregate funds of $25.0 million or more to us or a permitted third party pursuant to the terms of Thermo's guarantee. To the extent Thermo is required to advance amounts under the guarantee, the Company is required to issue shares of Common Stock of the Company in respect of such advance in an amount equal to the amount of such payment divided by the average of the volume weighted average price of the Company’s Common Stock on the five trading days immediately preceding such payment.

3.This number includes 16,745,989 shares held by The Paul Eric Jacobs Trust, 3,143,182 shares held by XCOM Labs, Inc. and 76,523 shares individually owned by Dr. Jacobs. Dr. Jacobs may acquire 33,333 shares of Common Stock upon the exercise of currently exercisable stock options.

4.Includes 999,999 shares of Common Stock that he may acquire upon the exercise of currently exercisable stock options and 12,340,720 shares held by Thermo Investments II LLC.

5.Includes 539,999 shares of Common Stock that he may acquire upon the exercise of currently exercisable stock options and 6,383,649shares held by Thermo Investments III LLC.

6.Includes 1,299,999 shares of Common Stock that he may acquire upon the exercise of currently exercisable stock options.

7.Includes 499,999 shares of Common Stock that he may acquire upon the exercise of currently exercisable stock options.

MAJORITY STOCKHOLDER APPROVAL OBTAINED

As described herein, the Reverse Stock Split and related Charter Amendments were approved by the Majority Stockholder, who holds over a majority of the outstanding shares of voting Common Stock as required by our Certificate of Incorporation.

PROPOSALS BY SECURITY HOLDERS

The Board knows of no other matters or proposals other than the actions described in this Information Statement which have been approved or considered by the Majority Stockholder.

TRANSFER AGENT AND REGISTRAR

The transfer agent and registrar for our Common Stock is Computershare Investor Services LLC.

HOUSEHOLDING

Under SEC rules, only one annual report, proxy statement, or information statement, as applicable, need be sent to any household at which two or more of our stockholders reside if they appear to be members of the same family and contrary instructions have not been received from an affected stockholder. This procedure, referred to as householding, reduces the volume of duplicate information stockholders receive and reduces mailing and printing expenses for us. Brokers with account holders who are our stockholders may be householding these materials. Once you have received notice from your broker that it will be householding communications to your address, householding will continue until you are notified otherwise or until you revoke your consent. If, now or at any time in the future, you no longer wish to participate in householding and would like to receive a separate annual report, proxy statement, or information statement, as applicable, or if you currently receive multiple copies of these documents at your address and would prefer that the communications be householded, you should contact us at investorrelations@globalstar.com or Globalstar, Inc., Attention: Investor Relations, 1351 Holiday Square Blvd., Covington, Louisiana 70433.

REQUESTS FOR CERTAIN DOCUMENTS

We file annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC maintains an internet site that contains annual, quarterly and current reports, proxy and information statements and other information that issuers (including Globalstar) file electronically with the SEC. Our electronic SEC filings are available to the public at the SEC’s internet site, www.sec.gov.

We make available free of charge SEC filings, including our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to these reports as soon as reasonably practical after we electronically file such material with, or furnish it to, the SEC, on our website at www.globalstar.com under the investor relations tab. The documents available on, and the contents of, our website are not incorporated by reference into this Information Statement. You may request a copy of these documents by contacting us by phone at (985) 335-1500 or by mail at Globalstar, Inc., Attention: Investor Relations, 1351 Holiday Square Blvd., Covington, Louisiana 70433.

This Information Statement is first being mailed or furnished to stockholders on or about , 2024. The Company will pay all costs associated with the distribution of this Information Statement, including the costs of printing and mailing. The Company will reimburse banks, brokers, custodians or other nominees for reasonable expenses incurred by them in sending this Information Statement to the beneficial owners of the Common Stock.

By order of the SRC and the Board of Directors,

Richard S. Roberts

Corporate Secretary

Covington, Louisiana

, 2024

APPENDIX A

GLOBALSTAR, INC.

CERTIFICATE OF AMENDMENT

OF

CERTIFICATE OF INCORPORATION

Globalstar, Inc. (the “Corporation”), a corporation organized and existing under the General Corporation Law of the State of Delaware as set forth in Title 8 of the Delaware Code (the “DGCL”), hereby certifies as follows:

1.This Certificate of Amendment (the “Certificate of Amendment”) amends the provisions of the Corporation’s Third Amended and Restated Certificate of Incorporation filed with the Secretary of State on May 27, 2021 (the “Certificate of Incorporation”).

2.That the Board of Directors of the Corporation duly adopted resolutions setting forth the approval of the following Certificate of Amendment of the Certificate of Incorporation of the Corporation, declaring said Certificate of Amendment to be advisable and recommending that the majority stockholders of the Corporation approve the same.

3.That thereafter, pursuant to a written consent, the necessary number of shares as required by statute voted to approve this Certificate of Amendment.

4.That the Certificate of Incorporation of this Corporation be amended by changing the Article thereof numbered “FOURTH” by:

A.Amending and restating the first sentence of the Article thereof numbered “FOURTH” in its entirety, as follows:

“The Corporation shall have the authority to issue [_______________] ([_________]) total shares of capital stock, consisting of One Hundred Million (100,000,000) shares of Preferred Stock, $0.0001 par value per share (the “Preferred Stock”), and [_______________] ([_________]) shares of voting common stock, $0.0001 par value per share (the “common stock” or “Common Stock”).”

B. Inserting the following in the Article thereof numbered “FOURTH” immediately after the amended and restated first sentence thereof as amended by this Certificate of Amendment, as follows:

“Upon the filing and effectiveness (the “Effective Time”), pursuant to the General Corporation Law of the State of Delaware, of this Certificate of Amendment to the Third Amended and Restated Certificate of Incorporation of the Corporation, each [______] shares of Common Stock and either issued and outstanding or held by the Corporation in treasury stock immediately prior to the Effective Time shall, automatically and without any action on the part of the respective holders thereof, be combined and converted into one validly issued, fully-paid and non-assessable share of Common Stock without any further action by the Corporation or the holder thereof (the “Reverse Stock Split”). No fractional shares shall be issued in connection with the Reverse Stock Split. Holders of Common Stock who otherwise would be entitled to receive fractional shares of Common Stock because they hold a number of shares not evenly divisible by the Reverse Stock Split ratio will automatically be entitled to receive an additional fraction of a share of Common Stock to round up to the next whole share of Common Stock in lieu of any fractional share created as a result of such Reverse Stock Split. Each certificate that immediately prior to the Effective Time represented shares of Common Stock (the “Old Certificates”), shall thereafter represent that number of shares of Common Stock into which the shares of Common Stock represented by the Old Certificate shall have been combined, subject to the elimination of fractional share interests as described above. For avoidance of doubt, the Reverse Stock Split shall also apply to the amount of shares of the Company’s Common Stock issuable upon conversion or exercise of any derivative securities, including options, restricted stock units, warrants, and convertible debt or equity, subject to the terms and conditions of any plans or agreements governing such securities.”

5. This Certificate of Amendment has been approved and duly adopted in accordance with the provisions of Section 242 of the DGCL.

6. The effective date and time of this Certificate of Amendment shall be [_____] at [____] Eastern Time.

7. All other provisions of the Certificate of Incorporation shall remain in full force and effect.

IN WITNESS WHEREOF, the undersigned has executed this Certificate of Amendment to the Third Amended and Restated Certificate of Incorporation as of this _______ day of ______, 20__.

GLOBALSTAR, INC.

By:

Name:

Title:

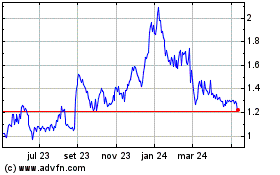

Globalstar (AMEX:GSAT)

Gráfico Histórico do Ativo

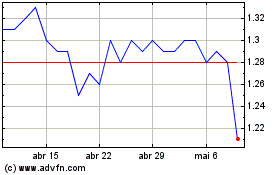

De Nov 2024 até Dez 2024

Globalstar (AMEX:GSAT)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024