0000066756FALSE00000667562024-12-192024-12-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported) - December 19, 2024

ALLETE, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Minnesota | 1-3548 | 41-0418150 |

| (State or other jurisdiction of | (Commission File Number) | (IRS Employer |

| incorporation or organization) | | Identification No.) |

30 West Superior Street

Duluth, Minnesota 55802-2093

(Address of principal executive offices, including zip code)

(218) 279-5000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

| Title of each class | Trading symbol | Name of each exchange on which registered |

| Common Stock, without par value | ALE | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter)

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

SECTION 7 – REGULATION FD

Item 7.01. Regulation FD Disclosure

On December 19, 2024, ALLETE, Inc. (the “Company”) issued a press release announcing the receipt of the FERC Order (as defined below). The press release is attached to this report as Exhibit 99.1 and is incorporated herein by reference.

The press release is being furnished, not filed, pursuant to Regulation FD. Accordingly, the press release will not be incorporated by reference into any registration statement filed by the Company under the Securities Act of 1933, as amended (the “Securities Act”), unless specifically identified therein as being incorporated therein by reference. The furnishing of the press release is not intended to, and does not, constitute a determination or admission by the Company that the information in the press release is material or complete, or that investors should consider this information before making an investment decision with respect to any security of the Company or any of its affiliates.

SECTION 8 – OTHER EVENTS

Item 8.01. Other Events.

As previously announced, on May 6, 2024, the Company entered into an Agreement and Plan of Merger (the “Merger Agreement”) by and among the Company, Alloy Parent LLC, a Delaware limited liability company (“Parent”), and Alloy Merger Sub LLC, a Delaware limited liability company and wholly owned subsidiary of Parent (“Merger Sub”). Pursuant to the Merger Agreement, on the terms and subject to the conditions set forth therein, Merger Sub will merge with and into the Company (the “Merger”), with the Company continuing as the surviving corporation in the Merger and becoming a subsidiary of Parent. On August 21, 2024, the Company’s shareholders approved the Merger Agreement.

On December 19, 2024, the Federal Energy Regulatory Commission (the “FERC”) issued an order approving the Merger (the “FERC Order”).

SECTION 9 – FINANCIAL STATEMENTS AND EXHIBITS

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

Exhibit Description

104 Cover Page Interactive Data File (embedded within the Inline XBRL document).

Readers are cautioned that forward-looking statements should be read in conjunction with disclosures under the heading: “Forward-Looking Statements” located on page 2 of this Current Report on Form 8-K.

1

ALLETE, Inc. Form 8-K dated December 19, 2024

Forward-Looking Statements

This Form 8-K contains “forward-looking statements” within the meaning of the federal securities laws, including safe harbor provisions of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding the proposed acquisition of the Company, regulatory approvals, the expected timetable for completing the proposed transaction and any other statements regarding the Company’s future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not historical facts. This information may involve risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. These risks and uncertainties include, but are not limited to: the timing to consummate the proposed transaction; the risk that the conditions to closing of the proposed transaction may not be satisfied; the risk that a regulatory approval that may be required for the proposed transaction is not obtained or is obtained subject to conditions that are not anticipated; and the diversion of management’s time on transaction-related issues.

When used in this Form 8-K, or any other documents, words such as “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “target,” “could,” “goal,” “intend,” “objective,” “plan,” “project,” “seek,” “strategy,” “target,” “may,” “will” and similar expressions are intended to identify forward-looking statements. These forward-looking statements are based on the beliefs and assumptions of management at the time that these statements were prepared and are inherently uncertain. Such forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward-looking statements. These risks and uncertainties, as well as other risks and uncertainties that could cause the Company’s actual results to differ materially from those expressed in the forward looking statements, are described in greater detail under the heading “Item 1A. Risk Factors” in the Company’s Form 10-Q for the quarter ended September 30, 2024, the Company’s Form 10-K for the year ended December 31, 2023 and in subsequently filed Forms 10-Q and 8-K, and in any other SEC filings made by the Company. Management cautions against putting undue reliance on forward-looking statements or projecting any future results based on such statements or present or prior earnings levels. Forward-looking statements speak only as of the date hereof, and the Company does not undertake any obligation to update or supplement any forward-looking statements to reflect actual results, new information, future events, changes in its expectations or other circumstances that exist after the date as of which the forward-looking statements were made.

2

ALLETE, Inc. Form 8-K dated December 19, 2024

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| ALLETE, Inc. |

| | |

| | |

| | |

| | |

| | |

| December 19, 2024 | | /s/ Steven W. Morris |

| | Steven W. Morris |

| | Senior Vice President and Chief Financial Officer |

3

ALLETE, Inc. Form 8-K dated December 19, 2024

For Release:

12/19/24

ALLETE receives FERC approval for proposed transaction with Canada Pension Plan Investment Board and Global Infrastructure Partners

Expects transaction to close in mid-2025

DULUTH, Minn.— ALLETE, Inc. (NYSE: ALE) announced that the Federal Energy Regulatory Commission (FERC) approved the company’s proposed transaction with Canada Pension Plan Investment Board (CPP Investments) and Global Infrastructure Partners (GIP).

“FERC’s approval of ALLETE’s proposed transaction with CPP Investments and GIP marks an important milestone and brings us one step closer to realizing the benefits of this transaction for our customers, our communities, our co-workers, and our shareholders,” said ALLETE Chair, President, and CEO Bethany Owen. “We are pleased with this decision and look forward to the tremendous opportunity this transaction creates for long-term energy and infrastructure investment while maintaining local jobs, management, and regulatory oversight.”

Owen added, “We will continue diligently working to secure the remaining regulatory approvals for this transaction and value the input of all stakeholders in this process.”

As previously announced, under the terms of the merger agreement, CPP Investments and GIP will acquire all outstanding common shares of ALLETE for $67 per share in cash, or $6.2 billion, without interest, including the assumption of debt. Following close, ALLETE will remain locally managed and operated. Its utilities, Minnesota Power and SWL&P, will continue to be regulated by the Minnesota Public Utilities Commission, the Public Service Commission of Wisconsin and FERC. The acquisition is not expected to impact retail or municipal rates for utility customers. ALLETE expects to complete the transaction in mid-2025, which remains subject to certain regulatory approvals and other customary closing conditions.

About ALLETE, Inc.

ALLETE, Inc. is an energy company headquartered in Duluth, Minnesota. In addition to its electric utilities, Minnesota Power and Superior Water, Light and Power of Wisconsin, ALLETE owns ALLETE Clean Energy, based in Duluth, Minnesota; BNI Energy in Bismarck, North Dakota; and New Energy Equity, headquartered in Annapolis, Maryland; and has an 8% equity interest in the American Transmission Co. More information about ALLETE is available at www.allete.com. ALE-CORP

ALLETE calculates and reports carbon emissions based on the GHG Protocol. Details are in ALLETE’s Corporate Sustainability Report.

FORWARD-LOOKING STATEMENTS DISCLAIMER

This communication contains “forward-looking statements” within the meaning of the federal securities laws, including safe harbor provisions of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding the proposed acquisition of ALLETE, regulatory approvals, the expected timetable for completing the proposed transaction and any other statements regarding ALLETE’s future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not historical facts. This information may involve risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. These risks and uncertainties include, but are not limited to: the timing to consummate the proposed transaction; the risk that the conditions to closing of the proposed transaction may not be satisfied; the risk that a regulatory approval that may be required for the proposed transaction is not obtained or is obtained subject to conditions that are not anticipated; and the diversion of management’s time on transaction-related issues.

When used in this communication, or any other documents, words such as “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “target,” “could,” “goal,” “intend,” “objective,” “plan,” “project,” “seek,” “strategy,” “target,” “may,” “will” and similar expressions are intended to identify forward-looking statements. These forward-looking statements are based on the beliefs and assumptions of management at the time that these statements were prepared and are inherently uncertain. Such forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward-looking statements. These risks and uncertainties, as well as other risks and uncertainties that could cause ALLETE’s actual results to differ materially from those expressed in the forward looking statements, are described in greater detail under the heading “Item 1A. Risk Factors” in ALLETE’s Form 10-Q for the quarter ended September 30, 2024, ALLETE’s Form 10-K for the year ended December 31, 2023 and in subsequently filed Forms 10-Q and 8-K, and in any other SEC filings made by ALLETE. Management cautions against putting undue reliance on forward-looking statements or projecting any future results based on such statements or present or prior earnings levels. Forward-looking statements speak only as of the date hereof, and ALLETE does not undertake any obligation to update or supplement any forward-looking statements to reflect actual results, new information, future events, changes in its expectations or other circumstances that exist after the date as of which the forward-looking statements were made.

ALLETE Contacts

Media Contact:

Amy Rutledge

Director- Corporate Communications

218-723-7400

arutledge@allete.com

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

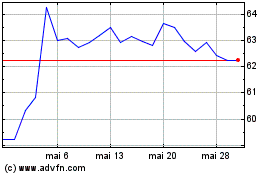

Allete (NYSE:ALE)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Allete (NYSE:ALE)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024