0000072333falseFALSE00000723332025-01-102025-01-100000072333us-gaap:CommonStockMember2025-01-102025-01-100000072333us-gaap:RightsMember2025-01-102025-01-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) January 10, 2025

Nordstrom, Inc.

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

| Washington | | 001-15059 | | 91-0515058 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

1617 Sixth Avenue, Seattle, Washington 98101

(Address of principal executive offices)

Registrant’s telephone number, including area code (206) 628-2111

Inapplicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common stock, without par value | JWN | New York Stock Exchange |

| Common stock purchase rights | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 7.01 Regulation FD Disclosure

On January 10, 2025, Nordstrom, Inc. issued a press release announcing its sales results for the nine weeks ended January 4, 2025 and an updated outlook for fiscal year 2024. A copy of this press release is attached as Exhibit 99.1.

The information furnished in this Item 7.01 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, regardless of any general incorporation language in such filing, except as shall be expressly set forth by a specific reference in such filing.

ITEM 9.01 Financial Statements and Exhibits

| | | | | | | | |

| | Nordstrom sales release dated January 10, 2025 relating to the Company's sales results for the nine weeks ended January 4, 2025 and an updated outlook for fiscal year 2024 |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| NORDSTROM, INC. |

| (Registrant) |

| |

| /s/ Ann Munson Steines |

| Ann Munson Steines |

| Chief Legal Officer, |

| General Counsel and Corporate Secretary |

Date: January 10, 2025

Nordstrom Reports Holiday Sales, Updates Outlook

SEATTLE – January 10, 2025 – Nordstrom, Inc. (NYSE: JWN) today announced a total Company net sales increase of 4.9 percent and a comparable sales increase of 5.8 percent for the nine-week holiday period ended January 4, 2025, compared with the nine weeks ended December 30, 2023. For the Nordstrom banner, net sales increased 3.7 percent and comparable sales increased 6.5 percent, while Nordstrom Rack banner net sales increased 7.4 percent and comparable sales increased 4.3 percent.

“As a result of our efforts to remain competitive in the promotional environment and the strength of our offering, our holiday sales in November and December exceeded the expectations we shared during our most recent earnings call,” said Erik Nordstrom, chief executive officer of Nordstrom, Inc. “For the full year, we’re raising our topline outlook and reaffirming our profitability guidance.”

Based on holiday results, the Company has updated its fiscal 2024 outlook. The Company now expects revenue growth, including retail sales and credit card revenues, of 1.5 to 2.5 percent versus the 53-week fiscal 2023, which includes an approximately 135 basis point unfavorable impact from the 53rd week, compared with its prior outlook of flat to 1.0 percent growth. Additionally, the Company expects comparable sales growth of 2.5 to 3.5 percent versus 52 weeks in fiscal 2023, compared with its prior outlook of 1.0 to 2.0 percent growth.

The Company is scheduled to report its fourth quarter and full-year 2024 financial results after the close of the financial markets on March 4, 2025. Additional detail on the Company’s financial performance will be provided at that time.

ABOUT NORDSTROM

At Nordstrom, Inc. (NYSE: JWN), we exist to help our customers feel good and look their best. Since starting as a shoe store in 1901, how to best serve customers has been at the center of every decision we make. This heritage of service is the foundation we’re building on as we provide convenience and true connection for our customers. Our interconnected model enables us to serve customers when, where and how they want to shop – whether that’s in-store at more than 350 Nordstrom, Nordstrom Local and Nordstrom Rack locations or digitally through our Nordstrom and Rack apps and websites. Through it all, we remain committed to leaving the world better than we found it.

Certain statements in this press release contain or may suggest “forward-looking” information (as defined in the Private Securities Litigation Reform Act of 1995) that involves risks and uncertainties that could cause results to be materially different from expectations. The words “will,” “may,” “designed to,” “outlook,” “believes,” “should,” “targets,” “anticipates,” “assumptions,” “plans,” “expects” or “expectations,” “intends,” “estimates,” “forecasts,” “guidance” and similar expressions identify certain of these forward-looking statements. The Company also may provide forward-looking statements in oral statements or other written materials released to the public. All statements contained or incorporated in this press release or in any other public statements that address such future events or expectations are forward-looking statements. Important factors that could cause actual results to differ materially from these forward-looking statements are detailed in the Company’s Annual Report on Form 10-K for the fiscal year ended February 3, 2024, our Form 10-Q for the fiscal quarter ended May 4, 2024, our Form 10-Q for the fiscal quarter ended August 3, 2024 and our Form 10-Q for the fiscal quarter ended November 2, 2024. In addition, forward-looking statements contained in this release may be impacted by the actual outcome of events or occurrences related to the Company’s entry into an Agreement and Plan of Merger dated December 22, 2024, which, if consummated, would result in the Company ceasing to be a publicly traded corporation. These forward-looking statements are not guarantees of future performance and speak only as of the date made, and, except as required by law, the Company undertakes no obligation to update or revise any forward-looking statements to reflect subsequent events, new information or future circumstances. In addition, the actual timing, price, manner and amounts of future share repurchases, if any, will be subject to the discretion of our board of directors, contractual commitments, market and economic conditions and applicable Securities and Exchange Commission rules. This press release includes references to websites, website addresses and additional materials, including reports and blogs, found on those websites. The content of any websites and materials named, hyperlinked or otherwise referenced in this press release are not incorporated by reference into this press release or in any other report or document we file with the SEC, and any references to such websites and materials are intended to be inactive textual references only. The information on those websites is not part of this press release.

| | | | | | | | |

INVESTOR CONTACT: | | James Duies |

| | Nordstrom, Inc. |

| | InvRelations@Nordstrom.com |

| | |

| MEDIA CONTACT: | | Grace Stearns |

| | Nordstrom, Inc. |

| | NordstromPR@Nordstrom.com |

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_RightsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

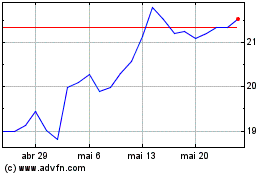

Nordstrom (NYSE:JWN)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Nordstrom (NYSE:JWN)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025