0001524472false00015244722025-02-042025-02-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 4, 2025

XYLEM INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

| Indiana | | 001-35229 | | 45-2080495 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | | | | | | | |

| | | | |

| 301 Water Street SE | | 20003 |

| Washington | | DC | | |

| (Address of principal executive offices) | | (Zip Code) |

(202) 869-9150

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange of which registered |

| Common Stock, par value $0.01 per share | | XYL | | New York Stock Exchange |

| | | | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.¨

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition |

On February 4, 2025, Xylem Inc. issued a press release announcing its financial results for the quarter and fiscal year ended December 31, 2024. A copy of the press release is furnished as Exhibit 99.1 to this report and is incorporated by reference herein.

This information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits.

| | | | | |

Exhibit

No. | Description |

| |

| Press Release issued by Xylem Inc. on February 4, 2025. |

| 104.0 | The cover page from Xylem Inc.'s Form 8-K, formatted in Inline XBRL (included as Exhibit 101). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | XYLEM INC. |

| | | | |

| Date: February 4, 2025 | | By: | | /s/ William K. Grogan |

| | | | William K. Grogan |

| | | | Senior Vice President & Chief Financial Officer

(Authorized Officer of Registrant) |

Exhibit 99.1

Xylem Inc.

301 Water Street SE, Suite 200

Washington, DC 20003

Tel +1.202.869.9150

| | | | | | | | | | | | | | |

| Contacts: | | Media | | Investors |

| | Houston Spencer +1 (914) 240-3046 | | Keith Buettner +1 (724) 772-1531 |

| | houston.spencer@xylem.com | | keith.buettner@xylem.com |

Xylem Reports Fourth Quarter and Full Year 2024 Results

Fourth-Quarter Highlights

•Orders of $2.2 billion, up 7% on a reported and organic basis

•Revenue of $2.3 billion, up 7% on a reported and organic basis

•Earnings per share of $1.34, up 22%; $1.18 on an adjusted basis, up 19%

Full-Year Highlights

•Revenue of $8.6 billion, up 16% on a reported basis and 6% organically

•Earnings per share of $3.65, up 31%; $4.27 on an adjusted basis, up 13%

•2025 full-year adjusted earnings per share guidance range of $4.50 to $4.70

WASHINGTON, D.C., Feb. 4, 2025 -- Xylem Inc. (NYSE: XYL), a leading global water solutions company dedicated to solving the world’s most challenging water issues, today reported fourth-quarter and full-year 2024 results. The Company’s total revenue of $2.3 billion surpassed prior guidance, on strong execution and demand. Fourth-quarter earnings also exceeded Xylem’s previous guidance.

“The team delivered a strong fourth quarter to close a record-breaking year for Xylem,” said Matthew Pine, Xylem’s CEO. “We set new benchmarks for full-year revenue, net income and adjusted EBITDA margins, and earnings per share, with the team showing great operating discipline across the portfolio. All segments delivered strong Q4 orders growth, giving us momentum coming into 2025 on resilient underlying demand.”

“In a year of transition and transformation, the team focused on what matters while delivering on the initiatives that have laid the foundation for sustainable growth and value creation. Our 2025 guidance reflects the team’s commitment to our long-term framework as we continue to enable our customers to address the world’s greatest water challenges.”

Net income for the quarter was $326 million, or $1.34 per share. Net income margin increased 190 basis points to 14.5 percent. These results are driven by a non-recurring gain on the remeasurement of our previously held equity interest in Idrica and strong operational performance, partially offset by non-recurring tax benefits in the prior year, a loss on sale of businesses, and increased restructuring and realignment costs. Adjusted net income was $287 million, or $1.18 per share, which excludes the impacts of the gain on remeasurement of previously held equity investment, loss on sale of businesses, purchase accounting intangible amortization, restructuring and realignment costs, and special charges.

Fourth-quarter adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) margin was 21.0 percent, reflecting a year-over-year increase of 140 basis points. Productivity savings, strong

price realization and higher volume drove the margin expansion, exceeding the impact of inflation and strategic investments.

The Board of Directors of Xylem has declared a first-quarter dividend of $0.40 per share, an increase of 11 percent. The dividend is payable on March 19, 2025, to shareholders of record as of February 18, 2025.

Outlook

Xylem forecasts full-year 2025 revenue of approximately $8.6 to $8.7 billion, up approximately 0 to 2 percent on a reported basis and up approximately 3 to 4 percent on an organic basis.

Full-year 2025 adjusted EBITDA margin is expected to be approximately 21.3 to 21.8 percent, an increase of 70 to 120 basis points from Xylem’s 2024 adjusted results. Full-year free cash flow margin is expected to be approximately 9 to 10 percent.

Further 2025 planning assumptions are included in Xylem’s fourth-quarter 2024 earnings materials posted at www.xylem.com/investors. Excluding revenue, Xylem provides guidance only on a non-GAAP basis due to the inherent difficulty in forecasting certain amounts that would be included in GAAP earnings, such as discrete tax items, without unreasonable effort.

Supplemental information on Xylem’s fourth-quarter earnings, as well as definitions of and reconciliations for certain non-GAAP items is posted at www.xylem.com/investors.

###

About Xylem

Xylem (XYL) is a Fortune 500 global water solutions company that empowers customers and communities to build a more water-secure world. Our 23,000 diverse employees delivered revenue of $8.6 billion in 2024, optimizing water and resource management with innovation and expertise. Join us at www.xylem.com and Let’s Solve Water.

Forward-Looking Statements

This press release contains “forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Generally, the words “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” "contemplate," "predict," “forecast,” “likely,” “believe,” “target,” “will,” “could,” “would,” “should,” "potential," "may" and similar expressions or their negative, may, but are not necessary to, identify forward-looking statements. By their nature, forward-looking statements address uncertain matters and include any statements that: are not historical, such as statements about our strategy, financial plans, outlook, objectives, plans, intentions or goals (including those related to our social, environmental and other sustainability goals); or address possible or future results of operations or financial performance, including statements relating to orders, revenues, operating margins and earnings per share growth.

Although we believe that the expectations reflected in any of our forward-looking statements are reasonable, actual results could differ materially from those projected or assumed in any of our forward-looking statements. Our future financial condition and results of operations, as well as any forward-looking statements, are subject to change and to inherent risks and uncertainties, many of which are beyond our control. Important factors that could cause our actual results, performance and achievements, or industry results to differ materially from estimates or projections contained in or implied by our forward-looking statements include, among others, the following: the impact of overall industry and general economic conditions on our markets, customers’ operating conditions and demand; geopolitical events, conditions and volatility, including protectionism and other anti-global sentiment, possible escalation of

the conflicts involving Russia and Ukraine, and the Middle East, and regulatory, economic and other risks associated with our global sales, supply chain and operations; manufacturing and operating cost increases due to macroeconomic conditions, including inflation, energy supply, supply chain shortages, logistics challenges, tight labor markets, prevailing price changes, new or additional tariffs and other factors; demand for our products, disruption, competition or pricing pressures in the markets we serve; cybersecurity incidents or other disruptions of information technology systems on which we rely, or involving our connected products and services; lack of availability or delays in receiving parts and raw materials from our supply chain, including electronic components (in particular, semiconductors); disruptions in operations at our facilities or that of third parties upon which we rely; uncertainty related to the realization of revenue synergies related to our acquisition of Evoqua Water Technologies Corp.; safe and compliant treatment and handling of water, wastewater and hazardous materials; failure to successfully execute large projects, including meeting performance guarantees and customers’ budgets, timelines and safety requirements; our ability to retain and attract leadership and other key talent, as well as competition for overall talent and labor; defects, security, warranty and liability claims, and recalls related to our products; uncertainty around our simplification, productivity, restructuring and realignment actions and related costs, savings and business impacts; our ability to execute strategic investments for growth, including acquisitions and divestitures; availability, regulation or interference with radio spectrum used by certain of our products; volatility in served markets or impacts on our business and operations due to weather conditions, including the effects of climate change; risks related to our sustainability commitments and related voluntary or required disclosures; fluctuations in foreign currency exchange rates; difficulty predicting our financial results; risk of future impairments to goodwill and other intangible assets; changes in our effective tax rates or tax expenses; regulatory and financial market risks related to our pension and other defined benefit plans; failure to comply with, or changes in, laws or regulations, including related to our business conduct, operations, products and services, including anti-corruption, data privacy and security, trade, competition, the environment, climate change and health and safety; legal, governmental or regulatory claims, investigations or proceedings and associated contingent liabilities; matters related to intellectual property infringement or expiration of rights; and other factors set forth under “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023 and in subsequent filings we make with the Securities and Exchange Commission (“SEC”).

Forward-looking and other statements in this press release regarding our environmental and other sustainability plans and goals are not an indication that these statements are necessarily material to investors, to our business, operating results, financial condition, outlook, or strategy, to our impacts on sustainability matters or other parties, or are required to be disclosed in our filings with the SEC. In addition, historical, current, and forward-looking social, environmental and sustainability-related statements may be based on: standards for measuring progress that are still developing; internal controls and processes that continue to evolve; third-party data, review, representations, or certifications; information from acquired entities, which may be subject to ongoing review, may not yet or ever be integrated into our reporting processes, and may not be reconcilable with our processes; and assumptions that are subject to change in the future. All forward-looking statements made herein are based on information currently available to us as of the date of this press release. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

XYLEM INC. AND SUBSIDIARIES

CONSOLIDATED INCOME STATEMENTS (Unaudited)

(in millions, except per share data)

| | | | | | | | | | | | | | | | | |

| Year Ended December 31, | 2024 | | 2023 | | 2022 |

| Revenue from products | $ | 7,095 | | | $ | 6,291 | | | $ | 4,978 | |

| Revenue from services | 1,467 | | | 1,073 | | | 544 | |

| Revenue | 8,562 | | | 7,364 | | | 5,522 | |

| Cost of revenue from products | 4,250 | | | 3,817 | | | 3,002 | |

| Cost of revenue from services | 1,100 | | | 830 | | | 436 | |

| Cost of revenue | 5,350 | | | 4,647 | | | 3,438 | |

| Gross profit | 3,212 | | | 2,717 | | | 2,084 | |

| Selling, general and administrative expenses | 1,911 | | | 1,757 | | | 1,227 | |

| Research and development expenses | 230 | | | 232 | | | 206 | |

| | | | | |

| Restructuring and asset impairment charges | 62 | | | 76 | | | 29 | |

| | | | | |

| Operating income | 1,009 | | | 652 | | | 622 | |

| Interest expense | 44 | | | 49 | | | 50 | |

| U.K. pension settlement expense | — | | | — | | | 140 | |

| Gain on remeasurement of previously held equity interest | 152 | | | — | | | — | |

| Other non-operating income, net | 16 | | | 33 | | | 7 | |

| (Loss) Gain on sale of businesses | (46) | | | (1) | | | 1 | |

| Income before taxes | 1,087 | | | 635 | | | 440 | |

| Income tax expense | 197 | | | 26 | | | 85 | |

| Net income | 890 | | | 609 | | | 355 | |

| | | | | |

| | | | | |

| Earnings per share: | | | | | |

| Basic | $ | 3.67 | | | $ | 2.81 | | | $ | 1.97 | |

| Diluted | $ | 3.65 | | | $ | 2.79 | | | $ | 1.96 | |

| Weighted average number of shares: | | | | | |

| Basic | 242.6 | | 217.0 | | 180.2 |

| Diluted | 243.5 | | 218.2 | | 181.0 |

| | | | | |

XYLEM INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS (Unaudited)

(in millions, except per share amounts)

| | | | | | | | | | | |

| December 31, | 2024 | | 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 1,121 | | | $ | 1,019 | |

Receivables, less allowances for discounts, returns and credit losses of $59 and $56 in 2024 and 2023, respectively | 1,668 | | | 1,617 | |

| Inventories | 996 | | | 1,018 | |

| Assets held for sale | 77 | | | — | |

| Prepaid and other current assets | 232 | | | 230 | |

| | | |

| Total current assets | 4,094 | | | 3,884 | |

| Property, plant and equipment, net | 1,152 | | | 1,169 | |

| Goodwill | 7,980 | | | 7,587 | |

| Other intangible assets, net | 2,379 | | | 2,529 | |

| Other non-current assets | 892 | | | 943 | |

| Total assets | $ | 16,497 | | | $ | 16,112 | |

| LIABILITIES, REDEEMABLE NONCONTROLLING INTEREST, AND STOCKHOLDERS’ EQUITY |

| Current liabilities: | | | |

| Accounts payable | $ | 1,006 | | | $ | 968 | |

| Liabilities held for sale | 21 | | | — | |

| Accrued and other current liabilities | 1,271 | | | 1,221 | |

| Short-term borrowings and current maturities of long-term debt | 25 | | | 16 | |

| Total current liabilities | 2,323 | | | 2,205 | |

| Long-term debt, net | 1,991 | | | 2,268 | |

| Accrued post-retirement benefit obligations | 304 | | | 344 | |

| Deferred income tax liabilities | 497 | | | 557 | |

| Other non-current accrued liabilities | 500 | | | 562 | |

| Total liabilities | 5,615 | | | 5,936 | |

| Redeemable noncontrolling interest | 235 | | | — | |

| Stockholders’ equity: | | | |

| Common stock — par value $0.01 per share: | | | |

Authorized 750.0 shares, issued 259.2 and 257.6 shares in 2024 and 2023, respectively | 3 | | | 3 | |

| Capital in excess of par value | 8,687 | | | 8,564 | |

| Retained earnings | 3,140 | | | 2,601 | |

Treasury stock – at cost 16.2 shares and 16.0 shares in 2024 and 2023, respectively | (753) | | | (733) | |

| Accumulated other comprehensive loss | (435) | | | (269) | |

| Total stockholders’ equity | 10,642 | | | 10,166 | |

| Non-controlling interest | 5 | | | 10 | |

| Total equity | 10,647 | | | 10,176 | |

| Total liabilities and stockholders’ equity | $ | 16,497 | | | $ | 16,112 | |

XYLEM INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

(in millions) | | | | | | | | | | | | | | | | | |

| Year Ended December 31, | 2024 | | 2023 | | 2022 |

| Operating Activities | | | | | |

| Net income | $ | 890 | | | $ | 609 | | | $ | 355 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | |

| Depreciation | 258 | | | 193 | | | 111 | |

| Amortization | 304 | | | 243 | | | 125 | |

| Deferred income taxes | (36) | | | (79) | | | (64) | |

| Share-based compensation | 56 | | | 60 | | | 37 | |

| | | | | |

| Restructuring and asset impairment charges | 62 | | | 76 | | | 29 | |

| | | | | |

| U.K. pension settlement expense | — | | | — | | | 140 | |

| Loss (gain) from sale of businesses | 46 | | | 1 | | | (1) | |

| Gain on remeasurement of previously held equity interest | (152) | | | — | | | — | |

| Other, net | 4 | | | — | | | (4) | |

| Payments for restructuring | (32) | | | (30) | | | (11) | |

| Contributions to post-retirement benefit plans | (25) | | | (25) | | | (19) | |

| Changes in assets and liabilities (net of acquisitions): | | | | | |

| Changes in receivables | (107) | | | (87) | | | (192) | |

| Changes in inventories | (41) | | | 41 | | | (147) | |

| Changes in accounts payable | 64 | | | 22 | | | 117 | |

| Changes in accrued liabilities | 17 | | | (4) | | | 57 | |

| Changes in accrued and deferred taxes | 14 | | | (109) | | | 57 | |

| Net changes in other assets and liabilities | (59) | | | (74) | | | 6 | |

| Net Cash — Operating activities | 1,263 | | | 837 | | | 596 | |

| Investing Activities | | | | | |

| Capital expenditures | (321) | | | (271) | | | (208) | |

| Proceeds from the sale of property, plant and equipment | 4 | | | 1 | | | 4 | |

| Acquisitions of businesses, net of cash acquired | (193) | | | (476) | | | — | |

| Proceeds from sale of businesses | 11 | | | 105 | | | 1 | |

| Cash received from investments | 6 | | | 1 | | | 5 | |

| Cash paid for investments | (11) | | | (1) | | | (11) | |

| Cash paid for equity investments | (6) | | | (57) | | | (3) | |

| Cash received from interest rate swaps | — | | | 38 | | | — | |

| Cash received from cross-currency swaps | 29 | | | 28 | | | 28 | |

| Settlement of currency forward agreement | — | | | — | | | (10) | |

| Other, net | (1) | | | 4 | | | 3 | |

| Net Cash — Investing activities | (482) | | | (628) | | | (191) | |

| Financing Activities | | | | | |

| | | | | |

| | | | | |

| Short-term debt repaid | (268) | | | — | | | — | |

| Long-term debt issued, net | 1 | | | 278 | | | — | |

| Long-term debt repaid, net | (17) | | | (160) | | | (527) | |

| Repurchase of common stock | (20) | | | (25) | | | (52) | |

| | | | | |

| Proceeds from exercise of employee stock options | 67 | | | 62 | | | 8 | |

| | | | | |

| | | | | |

| Dividends paid | (350) | | | (299) | | | (217) | |

| Other, net | (28) | | | (13) | | | (2) | |

| Net Cash — Financing activities | (615) | | | (157) | | | (790) | |

| Effect of exchange rate changes on cash | (53) | | | 23 | | | (20) | |

| Cash classified within assets held for sale | (11) | | | — | | | — | |

| Net change in cash and cash equivalents | 102 | | | 75 | | | (405) | |

| Cash and cash equivalents at beginning of year | 1,019 | | | 944 | | | 1,349 | |

| Cash and cash equivalents at end of year | $ | 1,121 | | | $ | 1,019 | | | $ | 944 | |

| Supplemental disclosure of cash flow information: | | | | | |

| Cash paid during the year for: | | | | | |

| Interest | $ | 67 | | | $ | 69 | | | $ | 76 | |

| Income taxes (net of refunds received) | $ | 219 | | | $ | 211 | | | $ | 91 | |

Xylem Inc. Non-GAAP Measures

Management reviews key performance indicators including revenue, gross margins, segment operating income and margins, orders growth, working capital and backlog, among others. In addition, we consider certain non-GAAP (or “adjusted”) measures to be useful to management and investors evaluating our operating performance for the periods presented, and to provide a tool for evaluating our ongoing operations, liquidity and management of assets. This information can assist investors in assessing our financial performance and measures our ability to generate capital for deployment among competing strategic alternatives and initiatives, including but not limited to, dividends, acquisitions, share repurchases and debt repayment. Excluding revenue, Xylem provides guidance only on a non-GAAP basis due to the inherent difficulty in forecasting certain amounts that would be included in GAAP earnings, such as discrete tax items, without unreasonable effort. These adjusted metrics are consistent with how management views our business and are used to make financial, operating and planning decisions. These metrics, however, are not measures of financial performance under GAAP and should not be considered a substitute for revenue, operating income, net income, earnings per share (basic and diluted) or net cash from operating activities as determined in accordance with GAAP. We consider the following items to represent the non-GAAP measures we consider to be key performance indicators, as well as the related reconciling items to the most directly comparable measure calculated and presented in accordance with GAAP. The non-GAAP measures may not be comparable to similarly titled measures reported by other companies.

“Organic revenue” and “Organic orders” defined as revenue and orders, respectively, excluding the impact of fluctuations in foreign currency translation and contributions from acquisitions and divestitures. Divestitures include sales or discontinuance of insignificant portions of our business that did not meet the criteria for classification as a discontinued operation. The period-over-period change resulting from foreign currency translation impacts is determined by translating current period and prior period activity using the same currency conversion rate.

“Constant currency” defined as financial results adjusted for foreign currency translation impacts by translating current period and prior period activity using the same currency conversion rate. This approach is used for countries whose functional currency is not the U.S. dollar.

“EBITDA” defined as earnings before interest, taxes, depreciation and amortization expense. “Adjusted EBITDA” and “Adjusted Segment EBITDA” reflect the adjustments to EBITDA and segment EBITDA, respectively, to exclude share-based compensation charges, restructuring and realignment costs, gain or loss from sale of businesses and special charges.

“Adjusted EBITDA Margin” and “Adjusted Segment EBITDA margin” defined as adjusted EBITDA and adjusted segment EBITDA divided by total revenue and segment revenue, respectively.

“Adjusted Operating Income”, “Adjusted Segment Operating Income”, “Adjusted Net Income” and “Adjusted EPS” defined as operating income, segment operating income, net income and earnings per share, adjusted to exclude restructuring and realignment costs, amortization of acquired intangible assets, gain or loss from sale of businesses, special charges and tax-related special items, as applicable.

“Adjusted Operating Margin” and “Adjusted Segment Operating Margin” defined as adjusted operating income and adjusted segment operating income divided by total revenue and segment revenue, respectively.

“Free Cash Flow” defined as net cash from operating activities, as reported in the Statement of Cash Flows, less capital expenditures.

“Free Cash Flow Conversion” defined as Free Cash Flow, or Adjusted Free Cash Flow as applicable; divided by net income, excluding the gain on sale of businesses and other non-recurring, significant non-cash impacts, such as non-cash impairment charges and significant deferred tax items. "Adjusted Free Cash Flow" used in Free Cash Flow Conversion defined as free cash flow adjusted for significant cash items for which the corresponding income statement impact does not occur within the same fiscal year.

"Free Cash Flow Margin" defined as free cash flow, adjusted for significant cash paid or received for non-operational tax, acquisition or divestiture activities; divided by revenue.

“Realignment costs” defined as costs not included in restructuring costs that are incurred as part of actions taken to reposition our business, including items such as professional fees, severance, relocation, travel, facility set-up and other costs.

“Special charges” defined as non-recurring costs incurred by the Company, such those related to acquisitions and integrations, divestitures and non-cash impairment charges.

“Tax-related special items” defined as tax items, such as tax return versus tax provision adjustments, tax exam impacts, tax law change impacts, excess tax benefits/losses and other discrete tax adjustments.

Xylem Inc. Non-GAAP Reconciliation

Reported vs. Organic & Constant Currency Orders

($ Millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (As Reported - GAAP) | | (As Adjusted - Organic) | | Constant Currency |

| | | (A) | | (B) | | | | | | (C) | | (D) | | (E)=B+C+D | | (F) = E/A | | (G) = (E - C) / A |

| Orders | | Orders | | Change 2024 v. 2023 | | % Change 2024 v. 2023 | | Book-to-Bill | | Acquisitions/

Divestitures | | FX

Impact | | Change Adj. 2024 v. 2023 | | % Change Adj. 2024 v. 2023 | | |

| 2024 | | 2023 | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Year Ended December 31 | | | | | | | | | | | | | | | | | | | |

| Xylem Inc. | 8,730 | | | 7,501 | | | 1,229 | | | 16 | % | | 102 | % | | (891) | | | 11 | | | 349 | | | 5 | % | | 17 | % |

| Water Infrastructure | 2,727 | | | 2,313 | | | 414 | | | 18 | % | | 107 | % | | (243) | | | 2 | | | 173 | | | 7 | % | | 18 | % |

| Applied Water | 1,824 | | | 1,770 | | | 54 | | | 3 | % | | 102 | % | | — | | | 3 | | | 57 | | | 3 | % | | 3 | % |

| Measurement and Control Solutions | 1,672 | | | 1,670 | | | 2 | | | 0 | % | | 89 | % | | (5) | | | — | | | (3) | | | — | % | | — | % |

| Water Solutions and Services | 2,507 | | | 1,748 | | | 759 | | | 43 | % | | 107 | % | | (643) | | | 6 | | | 122 | | | 7 | % | | 44 | % |

| | | | | | | | | | | | | | | | | | | |

| Quarter Ended December 31 | | | | | | | | | | | | | | | | | | | |

| Xylem Inc. | 2,196 | | | 2,044 | | | 152 | | | 7 | % | | 97 | % | | (5) | | | 5 | | | 152 | | | 7 | % | | 8 | % |

| Water Infrastructure | 691 | | | 633 | | | 58 | | | 9 | % | | 95 | % | | — | | | 3 | | | 61 | | | 10 | % | | 10 | % |

| Applied Water | 442 | | | 420 | | | 22 | | | 5 | % | | 97 | % | | — | | | — | | | 22 | | | 5 | % | | 5 | % |

| Measurement and Control Solutions | 473 | | | 442 | | | 31 | | | 7 | % | | 101 | % | | (5) | | | 1 | | | 27 | | | 6 | % | | 7 | % |

| Water Solutions and Services | 590 | | | 549 | | | 41 | | | 7 | % | | 97 | % | | — | | | 1 | | | 42 | | | 8 | % | | 8 | % |

| | | | | | | | | | | | | | | | | | | |

| Quarter Ended September 30 | | | | | | | | | | | | | | | | | | | |

| Xylem Inc. | 2,201 | | | 2,031 | | | 170 | | | 8 | % | | 105 | % | | — | | | (4) | | | 166 | | | 8 | % | | 8 | % |

| Water Infrastructure | 700 | | | 656 | | | 44 | | | 7 | % | | 112 | % | | — | | | (4) | | | 40 | | | 6 | % | | 6 | % |

| Applied Water | 437 | | | 422 | | | 15 | | | 4 | % | | 98 | % | | — | | | — | | | 15 | | | 4 | % | | 4 | % |

| Measurement and Control Solutions | 386 | | | 343 | | | 43 | | | 13 | % | | 84 | % | | — | | | (2) | | | 41 | | | 12 | % | | 12 | % |

| Water Solutions and Services | 678 | | | 610 | | | 68 | | | 11 | % | | 118 | % | | — | | | 2 | | | 70 | | | 11 | % | | 11 | % |

| | | | | | | | | | | | | | | | | | | |

| Quarter Ended June 30 | | | | | | | | | | | | | | | | | | | |

| Xylem Inc. | 2,087 | | | 1,856 | | | 231 | | | 12 | % | | 96 | % | | (265) | | | 11 | | | (23) | | | (1) | % | | 13 | % |

| Water Infrastructure | 690 | | | 563 | | | 127 | | | 23 | % | | 109 | % | | (89) | | | 5 | | | 43 | | | 8 | % | | 23 | % |

| Applied Water | 465 | | | 445 | | | 20 | | | 4 | % | | 102 | % | | — | | | 3 | | | 23 | | | 5 | % | | 5 | % |

| Measurement and Control Solutions | 384 | | | 470 | | | (86) | | | (18) | % | | 80 | % | | — | | | 1 | | | (85) | | | (18) | % | | (18) | % |

| Water Solutions and Services | 548 | | | 378 | | | 170 | | | 45 | % | | 91 | % | | (176) | | | 2 | | | (4) | | | (1) | % | | 46 | % |

| | | | | | | | | | | | | | | | | | | |

| Quarter Ended March 31 | | | | | | | | | | | | | | | | | | | |

| Xylem Inc. | 2,246 | | | 1,570 | | | 676 | | | 43 | % | | 110 | % | | (621) | | | (1) | | | 54 | | | 3 | % | | 43 | % |

| Water Infrastructure | 646 | | | 461 | | | 185 | | | 40 | % | | 113 | % | | (154) | | | (2) | | | 29 | | | 6 | % | | 40 | % |

| Applied Water | 480 | | | 483 | | | (3) | | | (1) | % | | 110 | % | | — | | | — | | | (3) | | | (1) | % | | (1) | % |

| Measurement and Control Solutions | 429 | | | 415 | | | 14 | | | 3 | % | | 93 | % | | — | | | — | | | 14 | | | 3 | % | | 3 | % |

| Water Solutions and Services | 691 | | | 211 | | | 480 | | | 227 | % | | 123 | % | | (467) | | | 1 | | | 14 | | | 7 | % | | 228 | % |

Xylem Inc. Non-GAAP Reconciliation

Reported vs. Organic & Constant Currency Revenue

($ Millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (As Reported - GAAP) | | (As Adjusted - Organic) | | Constant Currency |

| | | (A) | | (B) | | | | (C) | | (D) | | (E) = B+C+D | | (F) = E/A | | (G) = (E - C) / A |

| Revenue | | Revenue | | Change 2024 v. 2023 | | % Change 2024 v. 2023 | | Acquisitions/

Divestitures | | FX

Impact | | Change Adj. 2024 v. 2023 | | % Change Adj. 2024 v. 2023 | | |

| 2024 | | 2023 | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Year Ended December 31 | | | | | | | | | | | | | | | | | |

| Xylem Inc. | 8,562 | | | 7,364 | | | 1,198 | | | 16 | % | | (786) | | | 12 | | | 424 | | | 6 | % | | 16 | % |

| Water Infrastructure | 2,555 | | | 2,215 | | | 340 | | | 15 | % | | (221) | | | 4 | | | 123 | | | 6 | % | | 16 | % |

| Applied Water | 1,793 | | | 1,853 | | | (60) | | | (3) | % | | — | | | 2 | | | (58) | | | (3) | % | | (3) | % |

| Measurement and Control Solutions | 1,871 | | | 1,612 | | | 259 | | | 16 | % | | (4) | | | — | | | 255 | | | 16 | % | | 16 | % |

| Water Solutions and Services | 2,343 | | | 1,684 | | | 659 | | | 39 | % | | (561) | | | 6 | | | 104 | | | 6 | % | | 39 | % |

| | | | | | | | | | | | | | | | | |

| Quarter Ended December 31 | | | | | | | | | | | | | | | | | |

| Xylem Inc. | 2,256 | | | 2,118 | | | 138 | | | 7 | % | | (4) | | | 7 | | | 141 | | | 7 | % | | 7 | % |

| Water Infrastructure | 727 | | | 674 | | | 53 | | | 8 | % | | — | | | 4 | | | 57 | | | 8 | % | | 8 | % |

| Applied Water | 454 | | | 457 | | | (3) | | | (1) | % | | — | | | 1 | | | (2) | | | 0 | % | | 0 | % |

| Measurement and Control Solutions | 469 | | | 437 | | | 32 | | | 7 | % | | (4) | | | — | | | 28 | | | 6 | % | | 7 | % |

| Water Solutions and Services | 606 | | | 550 | | | 56 | | | 10 | % | | — | | | 2 | | | 58 | | | 11 | % | | 11 | % |

| | | | | | | | | | | | | | | | | |

| Quarter Ended September 30 | | | | | | | | | | | | | | | | | |

| Xylem Inc. | 2,104 | | | 2,076 | | | 28 | | | 1 | % | | — | | | (6) | | | 22 | | | 1 | % | | 1 | % |

| Water Infrastructure | 623 | | | 612 | | | 11 | | | 2 | % | | — | | | (5) | | | 6 | | | 1 | % | | 1 | % |

| Applied Water | 447 | | | 465 | | | (18) | | | (4) | % | | — | | | (2) | | | (20) | | | (4) | % | | (4) | % |

| Measurement and Control Solutions | 458 | | | 413 | | | 45 | | | 11 | % | | — | | | (1) | | | 44 | | | 11 | % | | 11 | % |

| Water Solutions and Services | 576 | | | 586 | | | (10) | | | (2) | % | | — | | | 2 | | | (8) | | | (1) | % | | (1) | % |

| | | | | | | | | | | | | | | | | |

| Quarter Ended June 30 | | | | | | | | | | | | | | | | | |

| Xylem Inc. | 2,169 | | | 1,722 | | | 447 | | | 26 | % | | (302) | | | 13 | | | 158 | | | 9 | % | | 27 | % |

| Water Infrastructure | 631 | | | 519 | | | 112 | | | 22 | % | | (84) | | | 6 | | | 34 | | | 7 | % | | 23 | % |

| Applied Water | 456 | | | 478 | | | (22) | | | (5) | % | | — | | | 4 | | | (18) | | | (4) | % | | (4) | % |

| Measurement and Control Solutions | 482 | | | 384 | | | 98 | | | 26 | % | | — | | | 2 | | | 100 | | | 26 | % | | 26 | % |

| Water Solutions and Services | 600 | | | 341 | | | 259 | | | 76 | % | | (218) | | | 1 | | | 42 | | | 12 | % | | 76 | % |

| | | | | | | | | | | | | | | | | |

| Quarter Ended March 31 | | | | | | | | | | | | | | | | | |

| Xylem Inc. | 2,033 | | | 1,448 | | | 585 | | | 40 | % | | (480) | | | (2) | | | 103 | | | 7 | % | | 40 | % |

| Water Infrastructure | 574 | | | 410 | | | 164 | | | 40 | % | | (137) | | | (1) | | | 26 | | | 6 | % | | 40 | % |

| Applied Water | 436 | | | 453 | | | (17) | | | (4) | % | | — | | | (1) | | | (18) | | | (4) | % | | (4) | % |

| Measurement and Control Solutions | 462 | | | 378 | | | 84 | | | 22 | % | | — | | | (1) | | | 83 | | | 22 | % | | 22 | % |

| Water Solutions and Services | 561 | | | 207 | | | 354 | | | 171 | % | | (343) | | | 1 | | | 12 | | | 6 | % | | 171 | % |

Xylem Inc. Non-GAAP Reconciliation

Adjusted Operating Income

($ Millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q1 | | Q2 | | Q3 | | Q4 | | YTD |

| 2024 | 2023 | | 2024 | 2023 | | 2024 | 2023 | | 2024 | 2023 | | 2024 | 2023 |

| Total Revenue | | | | | | | | | | | | | | |

| • Total Xylem | 2,033 | | 1,448 | | | 2,169 | | 1,722 | | | 2,104 | | 2,076 | | | 2,256 | | 2,118 | | | 8,562 | | 7,364 | |

| • Water Infrastructure | 574 | | 410 | | | 631 | | 519 | | | 623 | | 612 | | | 727 | | 674 | | | 2,555 | | 2,215 | |

| • Applied Water | 436 | | 453 | | | 456 | | 478 | | | 447 | | 465 | | | 454 | | 457 | | | 1,793 | | 1,853 | |

| • Measurement and Control Solutions | 462 | | 378 | | | 482 | | 384 | | | 458 | | 413 | | | 469 | | 437 | | | 1,871 | | 1,612 | |

| • Water Solutions and Services | 561 | | 207 | | | 600 | | 341 | | | 576 | | 586 | | | 606 | | 550 | | | 2,343 | | 1,684 | |

| • Corporate/Other | — | | — | | | — | | — | | | — | | — | | | — | | — | | | — | | — | |

| Operating Income (Loss) | | | | | | | | | | | | | | |

| • Total Xylem | 209 | | 131 | | | 253 | | 119 | | | 280 | | 191 | | | 267 | | 211 | | | 1,009 | | 652 | |

| • Water Infrastructure | 60 | | 46 | | | 78 | | 70 | | | 96 | | 84 | | | 122 | | 75 | | | 356 | | 275 | |

| • Applied Water | 61 | | 83 | | | 71 | | 84 | | | 71 | | 73 | | | 68 | | 70 | | | 271 | | 310 | |

| • Measurement and Control Solutions | 70 | | 26 | | | 79 | | 29 | | | 66 | | 35 | | | 32 | | 43 | | | 247 | | 133 | |

| • Water Solutions and Services | 50 | | 18 | | | 47 | | 26 | | | 63 | | 33 | | | 59 | | 55 | | | 219 | | 132 | |

| • Corporate/Other | (32) | | (42) | | | (22) | | (90) | | | (16) | | (34) | | | (14) | | (32) | | | (84) | | (198) | |

| | | | | | | | | | | | | | |

| Operating Margin | | | | | | | | | | | | | | |

| • Total Xylem | 10.3 | % | 9.0 | % | | 11.7 | % | 6.9 | % | | 13.3 | % | 9.2 | % | | 11.8 | % | 10.0 | % | | 11.8 | % | 8.9 | % |

| • Water Infrastructure | 10.5 | % | 11.2 | % | | 12.4 | % | 13.5 | % | | 15.4 | % | 13.7 | % | | 16.8 | % | 11.1 | % | | 13.9 | % | 12.4 | % |

| • Applied Water | 14.0 | % | 18.3 | % | | 15.6 | % | 17.6 | % | | 15.9 | % | 15.7 | % | | 15.0 | % | 15.3 | % | | 15.1 | % | 16.7 | % |

| • Measurement and Control Solutions | 15.2 | % | 6.9 | % | | 16.4 | % | 7.6 | % | | 14.4 | % | 8.5 | % | | 6.8 | % | 9.8 | % | | 13.2 | % | 8.3 | % |

| • Water Solutions and Services | 8.9 | % | 8.7 | % | | 7.8 | % | 7.6 | % | | 10.9 | % | 5.6 | % | | 9.7 | % | 10.0 | % | | 9.3 | % | 7.8 | % |

| • Corporate/Other | N/A | N/A | | N/A | N/A | | N/A | N/A | | N/A | N/A | | N/A | N/A |

| | | | | | | | | | | | | | |

| Special Charges | | | | | | | | | | | | | | |

| • Total Xylem | 16 | | 25 | | | 13 | | 67 | | | 7 | | 24 | | | 21 | | 22 | | | 57 | | 138 | |

| • Water Infrastructure | 2 | | — | | | 4 | | 12 | | | (2) | | 6 | | | 6 | | 10 | | | 10 | | 28 | |

| • Applied Water | — | | — | | | — | | — | | | — | | — | | | — | | — | | | — | | — | |

| • Measurement and Control Solutions | — | | 2 | | | 1 | | — | | | 2 | | 1 | | | 9 | | 1 | | | 12 | | 4 | |

| • Water Solutions and Services | 9 | | — | | | 3 | | 7 | | | 1 | | 9 | | | 2 | | 6 | | | 15 | | 22 | |

| • Corporate/Other | 5 | | 23 | | | 5 | | 48 | | | 6 | | 8 | | | 4 | | 5 | | | 20 | | 84 | |

| | | | | | | | | | | | | | |

| Restructuring & Realignment Costs | | | | | | | | | | | | | | |

| • Total Xylem | 15 | | 11 | | | 29 | | 37 | | | 11 | | 34 | | | 36 | | 24 | | | 91 | | 106 | |

| • Water Infrastructure | 7 | | 3 | | | 2 | | 2 | | | 6 | | 2 | | | 15 | | 11 | | | 30 | | 18 | |

| • Applied Water | 2 | | 3 | | | 2 | | 2 | | | 2 | | 6 | | | 9 | | 3 | | | 15 | | 14 | |

| • Measurement and Control Solutions | 2 | | 5 | | | 2 | | 3 | | | (1) | | 6 | | | 7 | | 5 | | | 10 | | 19 | |

| • Water Solutions and Services | 3 | | — | | | 23 | | 8 | | | 4 | | 9 | | | 5 | | 3 | | | 35 | | 20 | |

| • Corporate/Other | 1 | | — | | | — | | 22 | | | — | | 11 | | | — | | 2 | | | 1 | | 35 | |

| | | | | | | | | | | | | | |

| Purchase Accounting Intangible Amortization Adjustment | | | | | | | | | | | | | | |

| • Total Xylem | 54 | | 18 | | | 57 | | 36 | | | 52 | | 66 | | | 53 | | 56 | | | 216 | | 176 | |

| • Water Infrastructure | 19 | | 1 | | | 17 | | 8 | | | 11 | | 15 | | | 12 | | 23 | | | 59 | | 47 | |

| • Applied Water | — | | — | | | — | | — | | | — | | — | | | — | | — | | | — | | — | |

| • Measurement and Control Solutions | 14 | | 14 | | | 14 | | 15 | | | 15 | | 14 | | | 15 | | 14 | | | 58 | | 57 | |

| • Water Solutions and Services | 21 | | 3 | | | 26 | | 13 | | | 26 | | 37 | | | 26 | | 19 | | | 99 | | 72 | |

| • Corporate/Other | — | | — | | | — | | — | | | — | | — | | | — | | — | | | — | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted Operating Income | | | | | | | | | | | | | | |

| • Total Xylem | 294 | | 185 | | | 352 | | 259 | | | 350 | | 315 | | | 377 | | 313 | | | 1,373 | | 1,072 | |

| • Water Infrastructure | 88 | | 50 | | | 101 | | 92 | | | 111 | | 107 | | | 155 | | 119 | | | 455 | | 368 | |

| • Applied Water | 63 | | 86 | | | 73 | | 86 | | | 73 | | 79 | | | 77 | | 73 | | | 286 | | 324 | |

| • Measurement and Control Solutions | 86 | | 47 | | | 96 | | 47 | | | 82 | | 56 | | | 63 | | 63 | | | 327 | | 213 | |

| • Water Solutions and Services | 83 | | 21 | | | 99 | | 54 | | | 94 | | 88 | | | 92 | | 83 | | | 368 | | 246 | |

| • Corporate/Other | (26) | | (19) | | | (17) | | (20) | | | (10) | | (15) | | | (10) | | (25) | | | (63) | | (79) | |

| | | | | | | | | | | | | | |

| Adjusted Operating Margin | | | | | | | | | | | | | | |

| • Total Xylem | 14.5 | % | 12.8 | % | | 16.2 | % | 15.0 | % | | 16.6 | % | 15.2 | % | | 16.7 | % | 14.8 | % | | 16.0 | % | 14.6 | % |

| • Water Infrastructure | 15.3 | % | 12.2 | % | | 16.0 | % | 17.7 | % | | 17.8 | % | 17.5 | % | | 21.3 | % | 17.7 | % | | 17.8 | % | 16.6 | % |

| • Applied Water | 14.4 | % | 19.0 | % | | 16.0 | % | 18.0 | % | | 16.3 | % | 17.0 | % | | 17.0 | % | 16.0 | % | | 16.0 | % | 17.5 | % |

| • Measurement and Control Solutions | 18.6 | % | 12.4 | % | | 19.9 | % | 12.2 | % | | 17.9 | % | 13.6 | % | | 13.4 | % | 14.4 | % | | 17.5 | % | 13.2 | % |

| • Water Solutions and Services | 14.8 | % | 10.1 | % | | 16.5 | % | 15.8 | % | | 16.3 | % | 15.0 | % | | 15.2 | % | 15.1 | % | | 15.7 | % | 14.6 | % |

| • Corporate/Other | N/A | N/A | | N/A | N/A | | N/A | N/A | | N/A | N/A | | N/A | N/A |

| | | | | | | | | | | | | | |

Xylem Inc. Non-GAAP Reconciliation

Adjusted Diluted EPS

($ Millions, except per share amounts) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q4 2024 | | Q4 2023 |

| As Reported | | Adjustments | | Adjusted | | As Reported | | Adjustments | | Adjusted |

| Total Revenue | 2,256 | | | — | | | 2,256 | | | 2,118 | | | — | | | 2,118 | |

| Operating Income | 267 | | | 110 | | a | 377 | | | 211 | | | 102 | | a | 313 | |

| Operating Margin | 11.8 | % | | | | 16.7 | % | | 10.0 | % | | | | 14.8 | % |

| Interest Expense | (9) | | | — | | | (9) | | | (14) | | | — | | | (14) | |

| Other Non-Operating Income (Expense) | 5 | | | — | | | 5 | | | 14 | | | — | | | 14 | |

| | | | | | | | | | | |

| Gain on remeasurement of previously held equity interest | 152 | | | (152) | | b | — | | | — | | | — | | | — | |

| Gain/(Loss) from sale of businesses | (40) | | | 40 | | c | — | | | (1) | | | 1 | | c | — | |

| Income before Taxes | 375 | | | (2) | | | 373 | | | 210 | | | 103 | | | 313 | |

| Provision for Income Taxes | (49) | | | (37) | | d | (86) | | | 56 | | | (130) | | d | (74) | |

| | | | | | | | | | | |

| Net Income | 326 | | | (39) | | | 287 | | | 266 | | | (27) | | | 239 | |

| Diluted Shares | 243.8 | | | | | 243.8 | | | 242.5 | | | | | 242.5 | |

| Diluted EPS | $ | 1.34 | | | $ | (0.16) | | | $ | 1.18 | | | $ | 1.10 | | | $ | (0.11) | | | $ | 0.99 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q4 YTD 2024 | | Q4 YTD 2023 |

| As Reported | | Adjustments | | Adjusted | | As Reported | | Adjustments | | Adjusted |

| Total Revenue | 8,562 | | | — | | | 8,562 | | | 7,364 | | | — | | | 7,364 | |

| Operating Income | 1,009 | | | 364 | | a | 1,373 | | | 652 | | | 420 | | a | 1,072 | |

| Operating Margin | 11.8 | % | | | | 16.0 | % | | 8.9 | % | | | | 14.6 | % |

| Interest Expense | (44) | | | — | | | (44) | | | (49) | | | — | | | (49) | |

| Other Non-Operating Income (Expense) | 16 | | | — | | | 16 | | | 33 | | | — | | | 33 | |

| Gain on Joint Venture Remeasurement | 152 | | | (152) | | b | — | | | — | | | — | | | — | |

| Gain/(Loss) from sale of businesses | (46) | | | 46 | | c | — | | | (1) | | | 1 | | c | — | |

| Income before Taxes | 1,087 | | | 258 | | | 1,345 | | | 635 | | | 421 | | | 1,056 | |

| Provision for Income Taxes | (197) | | | (107) | | d | (304) | | | (26) | | | (205) | | d | (231) | |

| | | | | | | | | | | |

| Net Income | 890 | | | 151 | | | 1,041 | | | 609 | | | 216 | | | 825 | |

| Diluted Shares | 243.5 | | | | | 243.5 | | | 218.2 | | | | | 218.2 | |

| Diluted EPS | $ | 3.65 | | | $ | 0.62 | | | $ | 4.27 | | | $ | 2.79 | | | $ | 0.99 | | | $ | 3.78 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | |

| a | Quarter-to-date: Restructuring & realignment costs: 2024 - $36 million and 2023 - $24 million Special charges: 2024 - $15 million of acquisition & integration costs and $6 million of intangible asset impairment charges; 2023 - $21 million of acquisition, integration and other related costs and $1 million of other special charges Purchase accounting intangible amortization: 2024 - $53 million and 2023 - $56 million |

| Year-to-date: Restructuring & realignment costs: 2024 - $91 million and 2023 - $106 million Special charges: 2024 - $50 million of acquisition & integration related costs and $7 million of intangible asset impairment charges; 2023 - $134 million of acquisition, integration and other related costs and $4 million of intangible asset impairment charges Purchase Accounting Intangible amortization: 2024 - $216 million and 2023 - $176 million |

| b | Gain on joint venture remeasurement as per income statement |

| c | Gain/(Loss) from sale of business as per income statement for all periods presented |

| d | Quarter-to-date: 2024 - Net tax impact on pre-tax adjustments (note a and c) of $29 million and other tax special items of $8 million; 2023 - Net tax impact on pre-tax adjustments (note a) of $23 million and other tax special items of $107 million Year-to-date: 2024 - Net tax impact on pre-tax adjustments (note a and c) of $88 million and other tax special items of $19 million; 2023 - Net tax impact on pre-tax adjustments (note a) of $90 million and other tax special items of $115 million

|

Xylem Inc. Non-GAAP Reconciliation

EBITDA and Adjusted EBITDA by Quarter

($ Millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2024 |

| Q1 | | Q2 | | Q3 | | Q4 | | Total |

| Net Income | 153 | | | 194 | | | 217 | | | 326 | | | 890 | |

| Net Income Margin | 7.5 | % | | 8.9 | % | | 10.3 | % | | 14.5 | % | | 10.4 | % |

| Depreciation | 61 | | | 62 | | | 68 | | | 67 | | | 258 | |

| Amortization | 73 | | | 83 | | | 73 | | | 75 | | | 304 | |

| Interest Expense (Income), net | 7 | | | 6 | | | 5 | | | (2) | | | 16 | |

| Income Tax Expense | 43 | | | 53 | | | 52 | | | 49 | | | 197 | |

| EBITDA | 337 | | | 398 | | | 415 | | | 515 | | | 1,665 | |

| Share-based Compensation | 18 | | | 13 | | | 12 | | | 13 | | | 56 | |

| Restructuring & Realignment | 15 | | | 29 | | | 11 | | | 36 | | | 91 | |

| | | | | | | | | |

| Special Charges | 16 | | | 13 | | | 7 | | | 21 | | | 57 | |

| Gain on remeasurement of previously held equity interest | — | | | — | | | — | | | (152) | | | (152) | |

| Loss/(Gain) from sale of business | 5 | | | (1) | | | 2 | | | 40 | | | 46 | |

| Adjusted EBITDA | 391 | | | 452 | | | 447 | | | 473 | | | 1,763 | |

| Revenue | 2,033 | | | 2,169 | | | 2,104 | | | 2,256 | | | 8,562 | |

| Adjusted EBITDA Margin | 19.2 | % | | 20.8 | % | | 21.2 | % | | 21.0 | % | | 20.6 | % |

| | | | | | | | | |

| 2023 |

| Q1 | | Q2 | | Q3 | | Q4 | | Total |

| Net Income | 99 | | | 92 | | | 152 | | | 266 | | | 609 | |

| Net Income Margin | 6.8 | % | | 5.3 | % | | 7.3 | % | | 12.6 | % | | 8.3 | % |

| Depreciation | 28 | | | 41 | | | 63 | | | 61 | | | 193 | |

| Amortization | 32 | | | 51 | | | 84 | | | 76 | | | 243 | |

| Interest Expense (Income), net | 2 | | | 5 | | | 6 | | | 8 | | | 21 | |

| Income Tax Expense | 27 | | | 22 | | | 33 | | | (56) | | | 26 | |

| EBITDA | 188 | | | 211 | | | 338 | | | 355 | | | 1,092 | |

| Share-based Compensation | 12 | | | 15 | | | 18 | | | 15 | | | 60 | |

| Restructuring & Realignment | 11 | | | 36 | | | 33 | | | 23 | | | 103 | |

| | | | | | | | | |

| | | | | | | | | |

| Special Charges | 25 | | | 67 | | | 22 | | | 22 | | | 136 | |

| Loss/(gain) from sale of business | — | | | — | | | — | | | 1 | | | 1 | |

| Adjusted EBITDA | 236 | | | 329 | | | 411 | | | 416 | | | 1,392 | |

| Revenue | 1,448 | | | 1,722 | | | 2,076 | | | 2,118 | | | 7,364 | |

| Adjusted EBITDA Margin | 16.3 | % | | 19.1 | % | | 19.8 | % | | 19.6 | % | | 18.9 | % |

| | | | | | | | | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

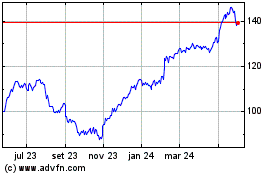

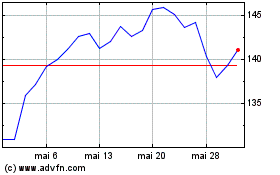

Xylem (NYSE:XYL)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Xylem (NYSE:XYL)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025