false

0001477845

0001477845

2025-02-05

2025-02-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

February 5, 2025

ANNOVIS BIO, INC.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

001-39202 |

26-2540421 |

|

(State or Other Jurisdiction

of Incorporation) |

(Commission

File Number) |

(I.R.S. Employer

Identification No.) |

101

Lindenwood Drive, Suite 225

Malvern, PA

19355

(Address of Principal Executive Offices, and

Zip Code)

(484) 875-3192

Registrant’s Telephone Number, Including

Area Code

Not

Applicable

(Former Name or Former Address, if Changed Since

Last Report)

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading Symbol(s) |

Name

of each exchange on which

registered |

| Common Stock, par value $0.0001 per share |

ANVS |

New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| |

¨ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communication pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 7.01 Regulation FD Disclosure

On February 5, 2025,

Annovis Bio, Inc. (“The Company”) issued a press release announcing that initial patients had entered its pivotal Phase

3 study for early Alzheimer’s disease. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

Item

9.01 Financial Statements and Exhibits.

The following exhibits

are being furnished herewith:

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ANNOVIS BIO, INC. |

| |

|

|

| Date: February 5, 2025 |

By: |

/s/ Maria Maccecchini |

| |

|

Name: Maria Maccecchini |

| |

|

Title: President and Chief Executive Officer |

Exhibit 99.1

Annovis Announces First Patients Entered into Pivotal Phase 3 Study

of Buntanetap for Early Alzheimer’s Disease

MALVERN, Pa., Feb. 5, 2025 – Annovis Bio Inc. (NYSE: ANVS)

("Annovis" or the "Company"), a late-stage clinical drug platform company pioneering transformative therapies for

neurodegenerative diseases such as Alzheimer’s disease (AD) and Parkinson’s disease (PD), today announced that the first two

patients have been entered into the pivotal Phase 3 study evaluating buntanetap in early AD.

"The launch of our highly anticipated AD study is a significant

milestone in advancing buntanetap toward market approval and addressing the unmet medical need of millions of patients. Our previous trials

have delivered compelling results, and we have meticulously designed a comprehensive protocol to evaluate both the symptomatic and potential

disease-modifying effects of our drug candidate,” said Maria Maccecchini, Ph.D., Founder, President, and CEO of Annovis.

The Phase 3 trial is a randomized, placebo-controlled, double-blind

study designed to evaluate the safety and efficacy of a daily dose of buntanetap in patients with early AD. The treatment will last for

18 months and will consist of two parts: a 6-month assessment of symptomatic effects followed by an additional 12-month evaluation of

buntanetap’s potential disease-modifying effects. This Phase 3 protocol received FDA approval following positive data from our previous

Phase 2/3 trial, which demonstrated significant cognitive improvement in a subgroup of patients with early AD and showed no safety concerns.

The Company has recently completed a public offering of 5,250,000 units

consisting of one share of our common stock and one warrant to purchase one share of common stock for gross proceeds of $21 million securing

the estimated funding for the initial 6-month portion of the study, while the 12-month phase is expected to be supported by additional

capital from the warrant exercises.

"Alzheimer’s steals so much from individuals and their families,

but with drugs like buntanetap, we aim to restore quality of life and bring hope to those affected. We are grateful to the community for

their continuous support and to everyone who has contributed to making this trial a reality. As we embark on this new chapter, we are

optimistic that this study will help redefine the future of Alzheimer’s treatment,” adds Melissa Gaines, SVP of Clinical Operations.

The study’s primary outcomes will include the assessment of cognition

using the Alzheimer's Disease Assessment Scale-Cognitive 13 (ADAS-Cog13) subscale and functional ability using the Alzheimer's Disease

Cooperative Study-Instrumental Activities of Daily Living (ADCS-iADL) scale.

Annovis anticipates enrolling over 750 participants across ~100 sites

in the United States. The first two open sites that began recruiting include Conquest Research in Winter Park, FL and Advanced Memory

Research Institute of New Jersey in Tom’s River, NJ, each managed by the dedicated teams of Malisa Agard, M.D. and Arun Singh,

D.O., respectively. Detailed information about the trial is available at clinicaltrials.gov.

About Buntanetap

Buntanetap is a small, orally available molecule that targets neurodegeneration by inhibiting the translation of neurotoxic aggregating

proteins and thereby impeding the toxic cascade. This improves axonal transport, synaptic transmission, and reduces neuroinflammation,

ultimately restoring the health of nerve cells and brain function. By normalizing these pathways, buntanetap has the potential to reverse

neurodegeneration and improve quality of life for patients.

About Annovis

Headquartered in Malvern, Pennsylvania, Annovis is dedicated to addressing

neurodegeneration in diseases such as AD and PD. For more information, visit www.annovisbio.com and follow us on LinkedIn,

YouTube, and X.

Investor Alerts

Interested investors and shareholders are encouraged to sign up for

press releases and industry updates by registering for email alerts at https://www.annovisbio.com/email-alerts. For more information,

visit www.annovisbio.com and follow us on LinkedIn, YouTube, and X.

Forward-Looking Statements

This press release contains "forward-looking" statements

within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. These statements include, but are not limited to, the Company's plans related to clinical trials. Forward-looking

statements are based on current expectations and assumptions and are subject to risks and uncertainties that could cause actual results

to differ materially from those projected. Such risks and uncertainties include, but are not limited to, those related to patient enrollment,

the effectiveness of Buntanetap, and the timing, effectiveness, and anticipated results of the Company's clinical trials evaluating the

efficacy, safety, and tolerability of Buntanetap. Additional risk factors are detailed in the Company's periodic filings with the SEC,

including those listed in the "Risk Factors" section of the Company's Annual Report on Form 10-K and Quarterly Reports

on Form 10-Q. All forward-looking statements in this press release are based on information available to the Company as of the date

of this release. The Company expressly disclaims any obligation to update or revise its forward-looking statements, whether as a result

of new information, future events, or otherwise, except as required by law.

Contact Information:

Annovis Bio Inc.

101 Lindenwood Drive

Suite 225

Malvern, PA 19355

www.annovisbio.com

Investor Contact:

Scott McGowan

InvestorBrandNetwork (IBN)

Phone: 310.299.1717

www.annovisbio.com/investors-relations

IR@annovisbio.com

v3.25.0.1

Cover

|

Feb. 05, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 05, 2025

|

| Entity File Number |

001-39202

|

| Entity Registrant Name |

ANNOVIS BIO, INC.

|

| Entity Central Index Key |

0001477845

|

| Entity Tax Identification Number |

26-2540421

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

101

Lindenwood Drive

|

| Entity Address, Address Line Two |

Suite 225

|

| Entity Address, City or Town |

Malvern

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

19355

|

| City Area Code |

484

|

| Local Phone Number |

875-3192

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

ANVS

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

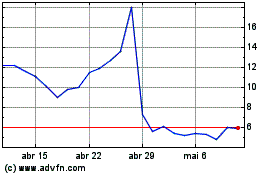

Annovis Bio (NYSE:ANVS)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Annovis Bio (NYSE:ANVS)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025