Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

06 Fevereiro 2025 - 9:00AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange

Act of 1934

For the month of

February, 2025

Commission File Number

1-15106

PETRÓLEO BRASILEIRO

S.A. – PETROBRAS

(Exact name of registrant

as specified in its charter)

Brazilian Petroleum

Corporation – PETROBRAS

(Translation of Registrant's

name into English)

Avenida Henrique Valadares, 28 – 9th floor

20231-030 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal

executive office)

Indicate by check mark

whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form

40-F _______

Indicate by check mark

whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Petrobras and Régia Capital Create Bioeconomy

Fund

—

Rio de Janeiro, February 6, 2025 –

Petróleo Brasileiro S.A. – Petrobras announces the establishment of an Impact Fund for Bioeconomy and Nature-Based Solutions

Socio-Environmental Projects (Petrobras Bioeconomy Fund) in partnership with Régia Capital, a management firm focused on sustainable

investments and financial solutions. Petrobras allocated R$ 50 million to the Fund, with Régia contributing an additional R$ 50

million.

This is a voluntary socio-environmental

investment by Petrobras, complementing the company’s other Social Responsibility initiatives. The Fund aims to support socio-environmental

projects in Brazil with the goal of transforming them into sustainable businesses that generate large-scale positive impacts, preserving

Petrobras' allocated capital while leveraging these initiatives. Any financial return will be reinvested to further scale the socio-environmental

benefits.

The selection of projects will prioritize

initiatives in areas deemed critical for climate action and biodiversity preservation, such as the Amazon; actions in regions under deforestation

pressure; initiatives with a positive impact on job and income generation; projects with the potential to generate high-integrity carbon

credits; and biodiversity credits as well as fauna and flora restoration.

The Petrobras Bioeconomy Fund is the first

in Brazil to adopt the Impact Linked Compensation model, which aligns financial incentives with sustainability objectives. That is, the

fund's performance fee varies according to the socio-environmental impact rate of the projects.

The Fund also has its own governance structure

for project selection, considering economic, social, environmental, innovation, and sustainable development impact indicators. With these

innovative financial mechanisms, the Fund aims to become a scalable hub of support for the development of Brazil's bioeconomy sector.

The selection of Régia Capital

as the manager of the Petrobras Bioeconomy Fund was made through a competitive process involving proposals from various institutions.

Régia Capital is a sustainable investment platform created by JGP and BB Asset.

The creation of the Fund aligns with Petrobras'

2050 Strategic Plan and 2025-2029 Business Plan, which include guidelines for promoting conservation and environmental restoration actions

across Brazilian territory.

www.petrobras.com.br/ir For more information: PETRÓLEO BRASILEIRO S.A. – PETROBRAS | Investors Relations email: petroinvest@petrobras.com.br/acionistas@petrobras.com.br Av. Henrique Valadares, 28 – 9 th floor – 20231-030 – Rio de Janeiro, RJ. Tel.: 55 (21) 3224-1510/9947 | 0800-282-1540 This document may contain forecasts within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Trading Act of 1934, as amended (Trading Act) that reflect the expectations of the Company's officers. The terms: "anticipates", "believes", "expects", "predicts", "intends", "plans", "projects", "aims", "should," and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties, predicted or not by the Company. Therefore, future results of the Company's operations may differ from current expectations, and the reader should not rely solely on the information included herein. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: February 6, 2025

PETRÓLEO BRASILEIRO S.A–PETROBRAS

By: /s/ Fernando Sabbi Melgarejo

______________________________

Fernando Sabbi Melgarejo

Chief Financial Officer and Investor Relations

Officer

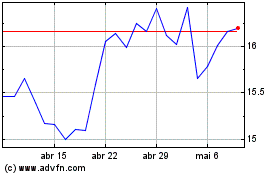

Petroleo Brasileiro ADR (NYSE:PBR.A)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Petroleo Brasileiro ADR (NYSE:PBR.A)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025