VIASAT INC false 0000797721 0000797721 2025-02-06 2025-02-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): February 6, 2025

VIASAT, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

| Delaware |

|

000-21767 |

|

33-0174996 |

(State or Other Jurisdiction of

Incorporation) |

|

(Commission File No.) |

|

(I.R.S. Employer

Identification No.) |

6155 El Camino Real

Carlsbad, California 92009

(Address of Principal Executive Offices, Including Zip Code)

(760) 476-2200

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

|

|

|

|

| (Title of Each Class) |

|

(Trading Symbol) |

|

(Name of Each Exchange

on which Registered) |

| Common Stock, par value $0.0001 per share |

|

VSAT |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 |

Results of Operations and Financial Condition. |

On February 6, 2025, Viasat, Inc. released its financial results for the third quarter of fiscal year 2025 in a letter to shareholders that is available on the investor relations section of its website. A copy of the press release announcing the release of financial results is furnished herewith as Exhibit 99.1 and a copy of the letter to shareholders is furnished herewith as Exhibit 99.2.

The information contained herein and in the accompanying exhibits shall not be incorporated by reference into any filing of the registrant, whether made before or after the date hereof, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference to such filing. The information in this report, including the exhibit hereto, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended.

| Item 9.01 |

Financial Statements and Exhibits. |

1

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

| Date: February 6, 2025 |

|

Viasat, Inc. |

|

|

|

|

|

By: |

|

/s/ Brett Church |

|

|

|

|

Brett Church |

|

|

|

|

Associate General Counsel |

2

Exhibit 99.1

Viasat Releases Third Quarter Fiscal Year 2025 Financial Results

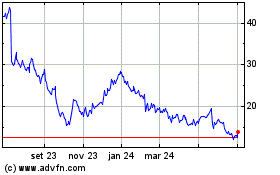

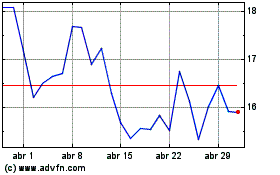

CARLSBAD, Calif., February 6, 2025 — Viasat, Inc. (NASDAQ: VSAT),

a global leader in satellite communications, today published its third quarter fiscal year 2025 financial results in a letter to shareholders, which, along with webcast slides, is now posted to the Investor Relations section of Viasat’s

website.

As previously announced, Viasat will host a conference call today, Thursday, February 6, 2025 at 2:30 p.m.

Pacific Time / 5:30 p.m. Eastern Time. The dial in numbers for the conference are U.S. (800) 715-9871 and International (646) 307-1963. Please

reference conference ID 2357759.

Participants can also listen to the live webcast from the Investor Relations section of the

Viasat website. The call will be archived and available on the site for approximately one month immediately following the conference call.

# # #

About Viasat

Viasat is a global

communications company that believes everyone and everything in the world can be connected. With offices in 24 countries around the world, our mission shapes how consumers, businesses, governments and militaries around the world communicate and

connect. Viasat is developing the ultimate global communications network to power high-quality, reliable, secure, affordable, fast connections to positively impact people’s lives anywhere they are—on the ground, in the air or at sea, while

building a sustainable future in space. In May 2023, Viasat completed its acquisition of Inmarsat, combining the teams, technologies and resources of the two companies to create a new global communications partner. Learn more at

www.viasat.com, the Viasat News Room or follow us on Facebook, Instagram, LinkedIn, X or YouTube.

Copyright © 2025 Viasat, Inc. All rights reserved. Viasat, the Viasat logo and the Viasat

Signal are registered trademarks in the U.S. and in other countries of Viasat, Inc. All other product or company names mentioned are used for identification purposes only and may be trademarks of their respective owners.

Viasat, Inc. Contacts

Jonathan Sinnatt/Scott Goryl, Corporate

Communications, pr@viasat.com

Lisa Curran/Peter Lopez, Investor Relations, +1 (760) 476-2633, IR@viasat.com

Exhibit 99.2

Q3 FY25 Shareholder Letter

Fellow shareholders, Our Q3 fiscal year 2025 results are good and moderately better than expectations — and we remain on track for

our full fiscal year guidance. Performance reflected a blend of good growth in our strongest target markets, transitions to enhanced value propositions in maritime, and expected declines in fixed broadband. We are also making steady progress in

achieving capital synergies and operating cost efficiencies supporting earnings and driving cash conversion. We intend to sustain and enhance already strong positions in attractive and growing satellite services and technology markets. Key factors

enabling our growth, and progress on areas we expect can sustain and accelerate growth include: › In aviation, the number of commercial IFC aircraft in service grew ~13% YoY, business jets grew ~18% YoY, and backlog grew even faster at 22% YoY.

Aviation continues to be an attractive growth market for us. We have a compelling value proposition in IFC and have continued to expand our customer base both in the US and internationally. We have made very steady progress in integrating capacity

from multiple third-party satellite operator partners to expand our coverage and capacity. We have been successful at winning new airlines as well as new fleets with existing customers, going increasingly global with our “full, fast and

free” service plans for airlines choosing that business model, and meeting SLA’s even on the busiest routes and at major hub airports. Customers are responding positively. For instance, as just announced, we are very pleased to expand to

full fleet with STARLUX in Asia Pacific. A recent report from a Hawaii Travel News website described their experience with ViaSat WiFi on a United 737 MAX from LAX to Hawaii, receiving 130 Mbps speeds on a plane served by ViaSat-3 (VS-3) F1 testing

our newest WiFi technology provided free to passengers. We are anticipating even better performance with VS-3 F2 and F3. VS-3 F1 with its ability to dedicate satellite beams to individual planes has served over 10,000 flights to date. In business

aviation, we are in the process of upgrading a number of legacy Inmarsat-served jets to service contracts with uncapped speeds and usage volumes — and have continued to grow the number of business jets in service. › Our Defense and

Advanced Technologies segment grew revenue almost 20% YoY in Q3 FY2025, reflecting revenue increases in each of its four business lines following an exceptional level of new orders in Q2. Backlog is up YoY, as is our cumulative unawarded IDIQ

portfolio. › We are pleased to see very positive customer feedback on our GEO/LEO multi-orbit enterprise maritime service, NexusWave. We are going step by step. After launching beta service last fall, we have grown our order pipeline, turned

the leading edge of that into firm backlog and this quarter we are expecting to accelerate turning that backlog into vessels in service, thereby driving additional maritime service revenue. Based on our order pipeline, customer service plan

selection and feedback from direct customers and global distribution partners, we are targeting a return to growth in our maritime business line in FY2026. › We have been aggressive and ambitious in forming key partnerships with multiple GSO

and NGSO operators and continue to incorporate capacity on multiple new third party satellites into a more highly integrated version of the combined Inmarsat/ViaSat satellite fleet to deliver state-of-the art services. We have made meaningful

progress on techniques to expand geographic coverage and optimize resources to better serve our mobility customers. This work contributed to a portion of the capex savings in FY2025 — while still expanding total platforms in service and

increasing bandwidth per platform and reducing near-term scheduling risk for the VS-3 satellites. We have also made steady progress on getting the VS-3 satellite constellation into service — as we get closer to completion, schedule risk is

diminishing. We continue to expect VS-3 F2 to be completed and shipped to Cape Canaveral this summer and to enter commercial service late CY2025. The VS-3 F3 manufacturing and test schedule outlook is unchanged from last quarter, but given our

significantly increased coverage and capacity resources, we have chosen a less capital intensive launch configuration that has slightly extended the orbit raising time, which is expected to shift the commercial in-service date for VS-3 F3 into

CY2026. › We are also making good progress on our collaborative approach to transforming our L-band networks. We are very pleased that the European Space Agency (ESA) has established an agreement with the Mobile Satellite Services Association

(MSSA) and a new contract with Viasat, which are intended to support and promote European participation in the development of a standards-based, open architecture LEO constellation that can augment existing GEO and LEO direct-to-device (D2D)

satellite services. We see global engagement and participation in D2D satellite services as a critical element in delivering 5G NTN (Non-Terrestrial Networks) services that augment national telecommunications architectures while supporting their

sovereignty and security, and ensuring regulatory compliance. We believe it is a differentiated strategy that promotes global interests in participating in the space economy, technology innovation, and a safe and sustainable space environment. We,

and our partners in MSSA, are excited about ESA’s involvement in this endeavor. Shared, open architecture, and standards-based multi-tenant space infrastructure utilize proven business models from terrestrial mobile networks, and they are

expected to reduce costs and help countries and companies compete effectively. From ViaSat’s perspective we anticipate that these initiatives will help reduce our future capital outlays while enabling state-of-the-art networks and services.

Lastly, we believe recent D2D transactions help underscore the value of our MSS spectrum, and the benefits of supporting 3GPP NBIoT D2D services on our existing fleet. Overall, we are making steady progress building our mid to long-term outlook and

we remain focused on growth, cash conversion and reducing leverage. We continue to believe we have portfolio and strategic optionality in the means and sequences in which we address our challenges and opportunities. Shareholder Letter | Q3 Fiscal

Year 2025 1

Q3 FY2025 Financial Results Revenue of $1.1 billion in Q3 FY2025 was flat YoY. Strong revenue growth of 20% YoY in the Defense and

Advanced Technologies segment was offset by lower revenues in the Communication Services segment. Net loss of $158 million for Q3 FY2025 increased from a net loss of $124 million in Q3 FY2024, primarily reflecting the loss on the extinguishment of

the Inmarsat 2026 senior secured notes partially offset by higher operating income and lower net interest expense. Q3 FY2025 Adjusted EBITDA1 was $393 million, an increase of 3% YoY. Strong operating performance in aviation services, government

satcom, space and mission systems, and tactical networking products was partially offset by declines in fixed services and other (FS&O), and maritime service revenues. Incremental Adjusted EBITDA contributions improved relative to revenue

compared to the prior year period. Defense and Advanced Technologies revenue increased 20% YoY driven primarily by strong growth in information security and cyber defense, space and mission systems, and tactical networking products. Communication

Services revenue decreased 6% YoY due primarily to expected declines in FS&O service revenues and lower revenue from maritime services, which were partially offset by continued growth in aviation services and government satcom services. Awards

for the quarter were $1.1 billion, a decline of 12% YoY. Defense and Advanced Technologies segment awards grew 49% to $327 million, partially offset by a decline in Communication Services of 25% primarily related to strong prior year award growth in

government satcom. Our Net Debt3 relative to LTM Adjusted EBITDA increased slightly sequentially. AWARDS $ in millions BACKLOG $ in millions REVENUE $ in millions ADJ. EBITDA1 $ in millions OPERATING INCOME (LOSS) $ in millions NET INCOME (LOSS)2 $

in millions Shareholder Letter | Q3 Fiscal Year 2025 2

Communication Services segment provides a wide range of broadband and narrowband communications solutions across government and

commercial mobility, maritime, fixed broadband (residential) energy and enterprise customers AWARDS, REVENUE AND ADJ. EBITDA1 $ in millions SERVICE REVENUE MIX $ in millions SERVICE METRICS—KA BAND ONLY End of period aircraft and vessels

Communication Services Segment Highlights › Announced leading global shipping operator “K” LINE chose to trial Inmarsat Maritime’s new bonded network service NexusWave on “K” LINE’s fleet. › Launched JetXP

enhanced performance for select business aviation connectivity customers. JetXP features uncapped speeds, expanded capacity and increased network prioritization which improve overall experience. It is a unique offering that could only be achieved

with our combination of our world-class technology, expertise and innovation, and our partner ecosystem, which includes business leading value-added resellers, OEMs and MROs. Initial results have been extremely positive. › ViaSat-3 F1 began

delivering connectivity to US Government customers including the US Marine Corps. Our ViaSat-3 satellite design provides greater capacity and the flexibility to dynamically shift bandwidth where it is needed most. The use of small beams, beam

shaping, encryption and unique anti-jam capabilities are designed to provide secure and reliable connectivity to support the most critical government missions. › Successfully completed in-orbit testing of GX10A and GX10B satellite payloads. The

payloads are hosted on Space Norway’s Arctic Satellite Broadband Mission spacecraft and are expected to provide broadband satellite coverage over the Arctic region for government and commercial customers early to mid-calendar year 2025. ›

Successfully demonstrated direct-to-device (D2D) satellite connectivity at high profile events in Saudi Arabia, India, and United Arab Emirates sending SoS and two-way messages over the company’s highly reliable L-band satellites which orbit

above Asia. › Completed the divestiture of the Energy Services System Integration business which was included in Fixed Services and Other business line. Awards Q3 FY2025 Communication Services awards decreased 25% YoY to $751M million. Strong

YoY growth in aviation was more than offset by declines in government satcom, FS&O and maritime services. The government satcom business also benefitted from a significant new satellite services contract from the US government in Q3 FY2024. Q3

FY2025 total backlog of $2.6 billion decreased 13% YoY; aviation and government satcom backlog increased 22% and 12%, respectively. Revenue In Q3 FY2025, Communication Services revenue decreased 6% YoY to $820 million. The decline was primarily

driven by product revenues which were down 40% primarily due to accelerated IFC terminal deliveries in the prior year period. Service revenue increases of 12% and 11% YoY from aviation and government satcom, respectively, were more than offset by a

21% YoY decrease in FS&O services and a 9% YoY decrease in maritime services as third-party companion offerings created incremental ARPU pressure. Mobility Ka-band service metrics continued to grow YoY and sequentially, ending the quarter with

an aggregate of approximately 20,200 vessels and aircraft in service. Commercial and business aviation ended the quarter with approximately 3,950 and 2,000 aircraft in service, respectively. U.S. fixed broadband ended the quarter with approximately

205,000 subscribers and $115 average revenue per user. Adjusted EBITDA Communication Services Q3 FY2025 Adjusted EBITDA of $330M was flat compared to prior year. Strong operating performance in aviation and government satcom services was offset by

lower incremental revenue flow-through from FS&O, maritime services, and overall product revenues. Q3 FY2025 incremental Adjusted EBITDA contributions improved relative to revenue compared to Q3 FY2024, reflecting increased gross margins as well

as lower R&D expenditures and sales and marketing expenses. Shareholder Letter | Q3 Fiscal Year 2025 3

Defense and Advanced Technologies segment provides a diverse set of resilient, vertically integrated solutions, leveraging core

technical competencies in encryption, cyber security, tactical gateways, modems and waveforms, to government and commercial customers AWARDS, REVENUE AND ADJ. EBITDA1 $ in millions PRODUCT REVENUE MIX $ in millions BACKLOG AND SOLE SOURCE UNAWARDED

IDIQ $ in millions Defense and Advanced Technologies Segment Highlights › Awarded up to $568 million sole-source IDIQ contract to support C5ISR capabilities for US Defense Forces. Through this contract, Viasat will continue to deliver a diverse

portfolio of technologies and services. Our Communication Services and Defense and Advanced Technologies portfolios offer proven and innovative government solutions, including tactical gateways and advanced networking, airborne SATCOM terminals and

hubs, ground terminals and modems, beyond-line-of-sight satellite services, and cybersecurity and encryption capabilities. › Antenna systems (AS), part of SMS, secured a $50 million award from a prime contractor for providing full-motion

antenna systems that will be part of ground infrastructure supporting global coverage for missile warning, tracking, and defeat missions as well as demonstrate advanced tactical data links. › Selected by Defense Innovation Unit to deliver

resilient orchestration software for autonomous systems. Our mobile network orchestration solution is an optimal fit for addressing the network and advanced requirements to enable resilient, multi-path communications through contested and denied

environments. › Ramped up shipment of a $35M Q2 FY2025 award for sales & support of Move Out/ Jump Off (MOJO) Link 16 expeditionary tactical gateway system in support of the Marine Expeditionary Forces. The MOJO kits provide ground

combat forces with the ability to exchange situational awareness and targeting data with other Link 16 or Situational Awareness Data Link (SADL)-enabled platforms, supporting Joint All-Domain Command and Control for operations. Awards Defense and

Advanced Technologies Q3 FY2025 awards increased 49% YoY to $327 million. The YoY growth was primarily driven by significant awards in space and mission systems solutions driven by antenna systems, tactical networking products, and information

security and cyber defense products. Backlog was $925 million in Q3 FY2025, an increase of 26% YoY and flat sequentially, and book-to-bill was 1.1. Revenue Q3 FY2025 Defense and Advanced Technologies revenue was $303 million, a 20% increase YoY. The

YoY revenue growth was driven primarily by product revenue increases in tactical networking, information security and cyber defense, and space and mission systems. Adjusted EBITDA In Q3 FY2025, Defense and Advanced Technologies Adjusted EBITDA

increased 27% YoY to $64 million. Strong YoY operating performance across the segment portfolio from tactical networking, space and mission systems, and information security and cyber defense more than offset higher R&D expenditures. Q3 FY2025

incremental Adjusted EBITDA contributions improved relative to revenue compared to Q3 FY2024, driven primarily by increased product gross margins. Shareholder Letter | Q3 Fiscal Year 2025 4

OPERATING CASH FLOW $ in millions CAPITAL EXPENDITURE $ in millions NET DEBT3 $ in billions Balance Sheet, Cash Flows and Liquidity Operating Cash

Flow Viasat generated $219 million in operating cash flow during the quarter, an increase of $86 million YoY and a decrease of $20 million sequentially. The YoY increase primarily reflects decreased working capital largely from decreases in

receivables and inventory, and lower cash taxes. The sequential decline primarily reflects increased working capital largely from a decrease in accrued liabilities. Capital Expenditure Q3 FY2025 capital expenditures declined 40% YoY to $253 million.

Capital expenditures decreased YoY primarily due to lower satellite expenditures related to timing of certain space, ground infrastructure and other capex payments. Net Debt and Liquidity Viasat ended Q3 FY2025 with $2.7 billion in available

liquidity which consisted of $1.56 billion in cash and cash equivalents and $1.14 billion of borrowing ability under our two undrawn revolving credit faciliaties. Net Debt3 increased to $5.66 billion primarily due to the GX10 satellite lease,

resulting in a slight sequential increase in our Net Debt relative to LTM Adjusted EBITDA. Shareholder Letter | Q3 Fiscal Year 2025 5

Outlook We are maintaining our FY25 revenue and Adjusted EBITDA outlook, which reflects strong results in the first three quarters including in

our aviation and defense orderbooks, confidence in our competitive position in our markets represented by strong awards, and despite continued headwinds from OEM related delays of aircraft deliveries. For FY2025 our guidance is unchanged. ›

Communication Services FY2025 revenue guidance remains unchanged reflecting strong growth in aviation services and government satcom services that we expect will be more than offset by declines in U.S. fixed broadband and, to a lesser extent,

maritime revenues. › DAT YoY revenue growth guidance for FY2025 remains unchanged and is expected to increase in the mid-teens, driven primarily by tactical networking products, recurring contributions from certain licensing agreements, and

strong demand for high-speed Type 1 encryptors fueled by cloud data center geographic expansion and support for AI applications. Revenue visibility for FY2025 is supported by backlog of over $900 million as of December 31, 2024. For FY2025 our

Adjusted EBITDA guidance is unchanged with the growth expected to be driven by strong revenue flow through from DAT licensing agreements and Communication Services. › We continue to expect Net Debt relative to LTM Adjusted EBITDA to increase

modestly by the end of FY2025 given the prior fiscal year benefit from accelerated insurance payments. › In FY2025 we now expect capital expenditures to decline to approximately $1.1 billion (which includes approximately $300 million for

Inmarsat-related capital expenditures). The FY2025 range excludes the benefit from insurance recoveries and includes capitalized interest in our capex guidance, which is approximately $200 million per year. › Looking ahead to FY2026, we

continue to expect YoY revenue and Adjusted EBITDA growth with capital expenditures of approximately $1.3 billion which indicates an inflection to positive free cash flow in the second half FY2026. In closing, we expect to continue to be successful

in capturing our share of large and growing markets and remain focused on improving operational and capital productivity. We delivered strong YoY growth across our DAT segment and in aviation and government satellite connectivity. As we continue to

launch our multiorbit offerings with ViaSat-3 capabilities in the near future, we expect our competitive position to strengthen further. Customer demand is growing for a diverse set of orbits and spectrum and the importance of avoiding

overdependence on single individual systems is an increasing issue for sovereignty and security. We continue to feel very good about Viasat’s runway of business growth opportunities. We remain a leading player in the satellite communications

industry. We have a very thorough understanding of the competitive environment and believe our technology and business model approach to global partnership & cooperation in space will be a very appealing option for a growing number of nations

and companies that want to sustain and contribute to a healthy space ecosystem. We are intent on achieving that while steadily demonstrating financial and strategic discipline and as we continue to actively evaluate alternatives to unlock value, we

are hyper focused on serving our customers, employees and shareholders. Sincerely, Mark Dankberg Shareholder Letter | Q3 Fiscal Year 2025 6

Viasat Satellite Roadmap Phase1, 2 Assembly, Integration Launch & Early Satellite Design and Test (AI&T) Orbit Phase (LEOP)

Anticipated Mechanical Final Ready Launch Orbit 3 PDR CDR AI&T TVAC Launch IOT Service Entry Environments Ground Test to Ship Campaign Raising ViaSat-3 In service F1 Partner: Entered Service July 2024 ViaSat-3 F2 Partner: Late 2025 ViaSat-3 F3

Partner: + Early 2026 Early-mid GX-10A/B 2025 Partner: Undisclosed GX-7/8/9 Partner: 2027 Inmarsat-8 Partner: 2028 Multi-dimensional, flexible network driving global coverage & capacity and high utilization Key Design Differentiator

ViaSat-3 GX-10A/B GX-7/8/9 Inmarsat-8 Highest Capacity Polar High Capital Efficient & Flexibility Coverage Flexibility Global Safety Service 1 Progress bars are not to scale and are for illustrative purposes only 2 The names of certain key

partners have been redacted for confidentiality reasons 3 All future service dates are projections and are subject to change

Endnotes 1. Adjusted EBITDA is defined as earnings before interest, income taxes, depreciation and amortization, as further adjusted to

exclude certain non-cash items and non-recurring expenses such as stock-based compensation expense, acquisition-related expenses, gain or loss on disposal of assets, gain or loss on debt extinguishment, and impairment of assets. A reconciliation of

Adjusted EBITDA to its closest GAAP equivalent is provided at the end of this letter under “Non-GAAP Financial Reconciliation.” See “Use of Non-GAAP Financial Information” for additional information. 2. Net income (loss) as used

herein is defined as net income (loss) attributable to Viasat, Inc. common stockholders. 3. Net Debt is defined as total debt less cash and cash equivalents and short-term investments. A reconciliation of Net Debt to its closest GAAP equivalent is

provided at the end of this letter under “Non-GAAP Financial Reconciliation.” See “Use of Non-GAAP Financial Information” for additional information. Shareholder Letter | Q3 Fiscal Year 2025 8

Forward Looking Statements This shareholder letter contains forward-looking statements regarding future events and our future results

that are subject to the safe harbors created under the Securities Act of 1933 and the Securities Exchange Act of 1934. Forward-looking statements include, among others, statements regarding projections of earnings, revenue, Adjusted EBITDA, net

leverage, free cash flow, capital expenditures, investments, costs, expected cost savings, efficiencies and synergies, deleveraging, return on capital or other financial items, including financial guidance and outlook and expectations for

performance and results of operations in FY2025 and beyond; proposed initiatives to strengthen capital structure, create shareholder value and drive down capital intensity; anticipated trends in our business or key markets; growth opportunities;

ability to successfully compete in our target markets, and durability or strengthening of competitive advantages; the construction, completion, testing, launch, commencement of service, expected performance and benefits of satellites and satellite

payloads (including satellites planned or under construction) and the timing thereof; the expected capacity, coverage, service speeds and other features of our satellites, and the cost, economics and other benefits associated therewith; anticipated

subscriber growth; introduction and integration of multi-orbit capabilities; the ability to capitalize on backlog and awards received and unawarded IDIQ contract vehicles; future economic conditions; the development, customer acceptance and

anticipated performance and demand for our technologies, products or services; our ability to meet the performance and coverage levels required by our customers and to meet customer SLA requirements; our plans, objectives and strategies for future

operations, including expansion into emerging markets such as D2D services and LEO strategies to augment existing D2D services; statements regarding existing and prospective orders from current and new aviation and maritime customers and future

growth in the number of aircraft or vessels in service; and other characterizations of future events or circumstances, are forward-looking statements. Readers are cautioned that these forward-looking statements are only predictions and are subject

to risks, uncertainties and assumptions that are difficult to predict. Factors that could cause actual results to differ materially include: our ability to realize the anticipated benefits of any existing or future satellite; unexpected expenses

related to our satellite projects; risks associated with the construction, launch and operation of satellites, including the effect of any anomaly, launch, operational or deployment failure or degradation in satellite performance; capacity

constraints in our business in the lead-up to the commencement of service on new satellites; increasing levels of competition in our target markets; our ability to successfully implement our business plan on our anticipated timeline or at all; the

ability to realize anticipated benefits and synergies of the Inmarsat acquisition, including the expectation of enhancements to our products and services, greater revenue or growth opportunities, and the realization of operating efficiencies and

cost savings (including the timing and amount thereof); our ability to successfully develop, introduce and sell new technologies, products and services; audits by the U.S. Government; changes in the global business environment and economic

conditions; delays in approving U.S. Government budgets and cuts in government defense expenditures; our reliance on U.S. Government contracts, and on a small number of contracts which account for a significant percentage of our revenues; reduced

demand for products and services as a result of continued constraints on capital spending by customers; changes in relationships with, or the financial condition of, key customers or suppliers; our reliance on a limited number of third parties to

manufacture and supply our products; introduction of new technologies and other factors affecting the communications and defense industries generally; the effect of adverse regulatory changes (including changes affecting spectrum availability or

permitted uses) on our ability to sell or deploy our products and services; changes in the way others use spectrum; our inability to access additional spectrum, use spectrum for additional purposes, and/or operate satellites at additional orbital

locations; competing uses of the same spectrum or orbital locations that we utilize or seek to utilize; the effect of recent changes to U.S. tax laws; our level of indebtedness and ability to comply with applicable debt covenants; our involvement in

litigation, including intellectual property claims and litigation to protect our proprietary technology; and our dependence on a limited number of key employees. In addition, please refer to the risk factors contained in our SEC filings available at

www.sec.gov, including our most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Readers are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date on which they are made. We

undertake no obligation to revise or update any forward-looking statements for any reason. Shareholder Letter | Q3 Fiscal Year 2025 9

Use of Non-GAAP Financial Information To supplement Viasat’s consolidated financial statements presented in accordance with

generally accepted accounting principles (GAAP), Viasat uses non-GAAP net income (loss) attributable to Viasat, Inc., Adjusted EBITDA and Net Debt, measures Viasat believes are appropriate to enhance an overall understanding of Viasat’s past

financial performance and prospects for the future. We believe non-GAAP net income (loss) attributable to Viasat, Inc. and Adjusted EBITDA provide useful information to both management and investors by excluding specific expenses that we believe are

not indicative of our core operating results. We believe Net Debt provides useful information to both management and investors in order to monitor our leverage (including our ability to service our debt and make capital expenditures) and evaluate

our consolidated balance sheet. A limitation associated with using Net Debt is that it subtracts cash and therefore may imply there is less debt than the most comparable GAAP measure. In addition, since we have historically reported non-GAAP results

to the investment community, we believe the inclusion of non-GAAP numbers provides consistency in our financial reporting and facilitates comparisons to Viasat’s historical operating results. Further, these non-GAAP results are among the

primary indicators that management uses as a basis for evaluating the operating performance of our segments, allocating resources to such segments, planning and forecasting in future periods. The presentation of this additional information is not

meant to be considered in isolation or as a substitute for measures of financial performance prepared in accordance with GAAP. A reconciliation of specific adjustments to GAAP results is provided in the tables below. Copyright © 2025 Viasat,

Inc. All rights reserved. Viasat, the Viasat logo and the Viasat signal are registered trademarks of Viasat, Inc. All other product or company names mentioned are used for identification purposes only and may be trademarks of their respective

owners. Shareholder Letter | Q3 Fiscal Year 2025 10

Third Quarter Fiscal Year 2025 Results

Financial Results

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(In millions, except per

share data) |

|

Q3FY25 |

|

|

Q3FY24 |

|

|

Year-Over-Year

Change |

|

|

First 9 Months

FY25 |

|

|

First 9 Months

FY24 |

|

|

Year-Over-Year

Change |

|

|

|

|

| Revenues |

|

|

$1,123.8 |

|

|

|

$1,128.5 |

|

|

|

0% |

|

|

|

$3,372.5 |

|

|

|

$3,133.7 |

|

|

|

8% |

|

|

|

|

|

| Net income (loss) (1) |

|

|

($158.4) |

|

|

|

($124.4) |

|

|

|

27% |

|

|

|

($328.9) |

|

|

|

($968.6) |

|

|

|

(66)% |

|

|

|

|

|

| Non-GAAP net

income (loss) (1) |

|

|

$14.7 |

|

|

|

$29.7 |

|

|

|

(51)% |

|

|

|

$24.2 |

|

|

|

$179.0 |

|

|

|

(86)% |

|

|

|

|

|

| Adjusted EBITDA |

|

|

$393.3 |

|

|

|

$383.1 |

|

|

|

3% |

|

|

|

$1,172.2 |

|

|

|

$1,052.7 |

|

|

|

11% |

|

|

|

|

|

| Diluted per share net income (loss) (1) |

|

|

($1.23) |

|

|

|

($0.99) |

|

|

|

24% |

|

|

|

($2.57) |

|

|

|

($8.47) |

|

|

|

(70)% |

|

|

|

|

|

| Non-GAAP diluted

per share net income (loss) (1), (2) |

|

|

$0.11 |

|

|

|

$0.24 |

|

|

|

(54)% |

|

|

|

$0.19 |

|

|

|

$1.55 |

|

|

|

(88)% |

|

|

|

|

|

| Fully diluted weighted average shares (2) |

|

|

128.9 |

|

|

|

125.1 |

|

|

|

3% |

|

|

|

128.0 |

|

|

|

114.3 |

|

|

|

12% |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| New contract awards (3) |

|

|

$1,078.0 |

|

|

|

$1,218.3 |

|

|

|

(12)% |

|

|

|

$3,514.8 |

|

|

|

$3,040.6 |

|

|

|

16% |

|

|

|

|

|

| Backlog

(4) |

|

|

$3,541.2 |

|

|

|

$3,722.2 |

|

|

|

(5)% |

|

|

|

$3,541.2 |

|

|

|

$3,722.2 |

|

|

|

(5)% |

|

|

|

|

|

| Segment Results |

|

|

|

|

|

| (In millions) |

|

|

Q3FY25 |

|

|

|

Q3FY24 |

|

|

|

Year-Over-Year

Change |

|

|

|

First 9 Months

FY25 |

|

|

|

First 9 Months

FY24 |

|

|

|

Year-Over-Year

Change |

|

|

|

|

|

| Communication Services |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| New contract awards (3) |

|

|

$750.5 |

|

|

|

$998.5 |

|

|

|

(25)% |

|

|

|

$2,326.3 |

|

|

|

$2,283.4 |

|

|

|

2% |

|

|

|

|

|

| Revenues |

|

|

$820.3 |

|

|

|

$874.9 |

|

|

|

(6)% |

|

|

|

$2,473.5 |

|

|

|

$2,281.7 |

|

|

|

8% |

|

|

|

|

|

| Operating profit (loss) (5) |

|

|

$44.4 |

|

|

|

$36.0 |

|

|

|

23% |

|

|

|

$85.8 |

|

|

|

($805.1) |

|

|

|

* |

|

|

|

|

|

| Adjusted EBITDA |

|

|

$329.6 |

|

|

|

$333.1 |

|

|

|

(1)% |

|

|

|

$955.5 |

|

|

|

$838.3 |

|

|

|

14% |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Defense and Advanced Technologies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| New contract awards (3) |

|

|

$327.4 |

|

|

|

$219.8 |

|

|

|

49% |

|

|

|

$1,188.4 |

|

|

|

$757.2 |

|

|

|

57% |

|

|

|

|

|

| Revenues |

|

|

$303.4 |

|

|

|

$253.7 |

|

|

|

20% |

|

|

|

$899.0 |

|

|

|

$852.1 |

|

|

|

6% |

|

|

|

|

|

| Operating profit (loss) (5) |

|

|

$42.7 |

|

|

|

$11.8 |

|

|

|

264% |

|

|

|

$168.6 |

|

|

|

$115.9 |

|

|

|

45% |

|

|

|

|

|

| Adjusted EBITDA |

|

|

$63.6 |

|

|

|

$50.0 |

|

|

|

27% |

|

|

|

$216.7 |

|

|

|

$214.4 |

|

|

|

1% |

|

|

|

|

|

| (1) |

Attributable to Viasat, Inc. common stockholders. |

| (2) |

As the three and nine months ended December 31, 2024 and December 31, 2023 financial information resulted in a

net loss, the weighted average number of shares used to calculate basic and diluted net loss per share is the same, as diluted shares would be anti-dilutive. However, as the non-GAAP financial information for

three and nine months ended December 31, 2024 and December 31, 2023 resulted in non-GAAP net income, 131.3 million, 130.0 million, 126.0 million and 115.3 million, respectively,

diluted weighted average number of shares were used instead to calculate non-GAAP diluted net income per share. |

| (3) |

Awards exclude future revenue under recurring consumer commitment arrangements. |

| (4) |

Amounts include certain backlog adjustments due to contract changes and amendments. Our backlog includes contracts with

subscribers for fixed broadband services in our Communication Services segment. Backlog does not include anticipated purchase orders and requests for the installation of in-flight connectivity systems or

future recurring in flight internet service revenues under our commercial in-flight internet agreements in our Communication Services segment. |

| (5) |

Before corporate and amortization of acquired intangible assets. |

| * |

Percentage not meaningful. |

Note: Some totals may not foot due to rounding.

Shareholder Letter | Q3 Fiscal Year 2025 11

Third Quarter Fiscal Year 2025 Results (cont.)

Condensed Consolidated Statements of Operations

(Unaudited)

(In thousands, except per share

data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

Nine months ended |

| |

|

December 31, 2024 |

|

December 31, 2023 |

|

December 31, 2024 |

|

December 31, 2023 |

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

| Service revenues |

|

$ |

809,370 |

|

|

$ |

825,466 |

|

|

$ |

2,428,405 |

|

|

$ |

2,192,571 |

|

| Product revenues |

|

|

314,397 |

|

|

|

303,073 |

|

|

|

944,084 |

|

|

|

941,174 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenues |

|

|

1,123,767 |

|

|

|

1,128,539 |

|

|

|

3,372,489 |

|

|

|

3,133,745 |

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of service revenues |

|

|

527,718 |

|

|

|

514,757 |

|

|

|

1,575,978 |

|

|

|

1,374,860 |

|

| Cost of product revenues |

|

|

234,229 |

|

|

|

252,519 |

|

|

|

671,872 |

|

|

|

703,617 |

|

| Selling, general and administrative (1) |

|

|

238,024 |

|

|

|

271,734 |

|

|

|

761,594 |

|

|

|

1,640,304 |

|

| Independent research and development |

|

|

36,701 |

|

|

|

41,728 |

|

|

|

108,654 |

|

|

|

104,161 |

|

| Amortization of acquired intangible assets |

|

|

65,847 |

|

|

|

91,719 |

|

|

|

198,086 |

|

|

|

200,904 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) from operations |

|

|

21,248 |

|

|

|

(43,918 |

) |

|

|

56,305 |

|

|

|

(890,101 |

) |

| Interest (expense) income, net |

|

|

(76,768 |

) |

|

|

(112,616 |

) |

|

|

(251,196 |

) |

|

|

(203,037 |

) |

| (Loss) gain on extinguishment of debt, net |

|

|

(96,614 |

) |

|

|

— |

|

|

|

(99,814 |

) |

|

|

— |

|

| Other income (expense), net |

|

|

(9,976 |

) |

|

|

— |

|

|

|

(9,976 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) before income taxes |

|

|

(162,110 |

) |

|

|

(156,534 |

) |

|

|

(304,681 |

) |

|

|

(1,093,138 |

) |

| (Provision for) benefit from income taxes |

|

|

11,798 |

|

|

|

34,496 |

|

|

|

4,699 |

|

|

|

128,106 |

|

| Equity in income (loss) of unconsolidated affiliates, net |

|

|

3,405 |

|

|

|

2,689 |

|

|

|

9,592 |

|

|

|

3,018 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

|

|

(146,907 |

) |

|

|

(119,349 |

) |

|

|

(290,390 |

) |

|

|

(962,014 |

) |

| Less: net income (loss) attributable to noncontrolling interest, net of tax |

|

|

11,506 |

|

|

|

5,050 |

|

|

|

38,519 |

|

|

|

6,627 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) attributable to Viasat, Inc. |

|

$ |

(158,413 |

) |

|

$ |

(124,399 |

) |

|

$ |

(328,909 |

) |

|

$ |

(968,641 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted net income (loss) per share attributable to Viasat, Inc. common stockholders |

|

$ |

(1.23 |

) |

|

$ |

(0.99 |

) |

|

$ |

(2.57 |

) |

|

$ |

(8.47 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted common equivalent shares (2) |

|

|

128,941 |

|

|

|

125,097 |

|

|

|

127,968 |

|

|

|

114,317 |

|

AN ITEMIZED RECONCILIATION BETWEEN NET INCOME (LOSS) ATTRIBUTABLE TO VIASAT, INC.

ON A GAAP BASIS AND NON-GAAP BASIS IS AS FOLLOWS:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (In thousands, except per share data) |

|

Three months ended |

|

Nine months ended |

| |

|

December 31, 2024 |

|

December 31, 2023 |

|

December 31, 2024 |

|

December 31, 2023 |

| GAAP net income (loss) attributable to Viasat, Inc. |

|

$ |

(158,413 |

) |

|

$ |

(124,399 |

) |

|

$ |

(328,909 |

) |

|

$ |

(968,641 |

) |

| Amortization of acquired intangible assets |

|

|

65,847 |

|

|

|

91,719 |

|

|

|

198,086 |

|

|

|

200,904 |

|

| Stock-based compensation expense |

|

|

21,503 |

|

|

|

22,199 |

|

|

|

63,468 |

|

|

|

65,669 |

|

| Acquisition and transaction related expenses

(3) |

|

|

20,855 |

|

|

|

65,068 |

|

|

|

57,706 |

|

|

|

130,254 |

|

| Loss (gain) on extinguishment of debt, net |

|

|

96,614 |

|

|

|

— |

|

|

|

99,814 |

|

|

|

— |

|

| Other (income) expense, net |

|

|

9,976 |

|

|

|

— |

|

|

|

9,976 |

|

|

|

— |

|

| Satellite impairment and related charges, net |

|

|

— |

|

|

|

5,496 |

|

|

|

— |

|

|

|

905,496 |

|

| Income tax effect (4) |

|

|

(41,724 |

) |

|

|

(30,415 |

) |

|

|

(75,957 |

) |

|

|

(154,727 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP net income (loss) attributable to Viasat, Inc. |

|

$ |

14,658 |

|

|

$ |

29,668 |

|

|

$ |

24,184 |

|

|

$ |

178,955 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP diluted net income (loss) per share attributable to Viasat,

Inc. common stockholders |

|

$ |

0.11 |

|

|

$ |

0.24 |

|

|

$ |

0.19 |

|

|

$ |

1.55 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted common equivalent shares (2) |

|

|

131,256 |

|

|

|

125,957 |

|

|

|

130,017 |

|

|

|

115,276 |

|

AN ITEMIZED RECONCILIATION BETWEEN NET INCOME (LOSS) ATTRIBUTABLE TO

VIASAT, INC.

AND ADJUSTED EBITDA IS AS FOLLOWS:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (In thousands) |

|

Three months ended |

|

Nine months ended |

| |

|

December 31, 2024 |

|

December 31, 2023 |

|

December 31, 2024 |

|

December 31, 2023 |

| GAAP net income (loss) attributable to Viasat, Inc. |

|

$ |

(158,413 |

) |

|

$ |

(124,399 |

) |

|

$ |

(328,909 |

) |

|

$ |

(968,641 |

) |

| Provision for (benefit from) income taxes |

|

|

(11,798 |

) |

|

|

(34,496 |

) |

|

|

(4,699 |

) |

|

|

(128,106 |

) |

| Interest expense (income), net |

|

|

76,768 |

|

|

|

112,616 |

|

|

|

251,196 |

|

|

|

203,037 |

|

| Depreciation and amortization |

|

|

337,755 |

|

|

|

336,626 |

|

|

|

1,023,625 |

|

|

|

844,970 |

|

| Stock-based compensation expense |

|

|

21,503 |

|

|

|

22,199 |

|

|

|

63,468 |

|

|

|

65,669 |

|

| Acquisition and transaction related

expenses (3) |

|

|

20,855 |

|

|

|

65,068 |

|

|

|

57,706 |

|

|

|

130,254 |

|

| Loss (gain) on extinguishment of debt, net |

|

|

96,614 |

|

|

|

— |

|

|

|

99,814 |

|

|

|

— |

|

| Other (income) expense, net |

|

|

9,976 |

|

|

|

— |

|

|

|

9,976 |

|

|

|

— |

|

| Satellite impairment and related charges, net |

|

|

— |

|

|

|

5,496 |

|

|

|

— |

|

|

|

905,496 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

$ |

393,260 |

|

|

$ |

383,110 |

|

|

$ |

1,172,177 |

|

|

$ |

1,052,679 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

Amounts include satellite impairment and related charges, net, of approximately $5 million and $905 million for the three

and nine months ended December 31, 2023, respectively. |

| (2) |

As the three and nine months ended December 31, 2024 and December 31, 2023 financial information resulted in a net loss,

the weighted average number of shares used to calculate basic and diluted net loss per share is the same, as diluted shares would be anti-dilutive. However, as the non-GAAP financial information for the three and nine months ended December 31, 2024

and December 31, 2023 resulted in non-GAAP net income, diluted weighted average number of shares were used instead to calculate non-GAAP diluted net income per share. |

| (3) |

Costs typically consist of acquisition, integration, and disposition related costs. |

| (4) |

The income tax effect is calculated using the tax rate applicable for the non-GAAP

adjustments. |

Shareholder Letter | Q3 Fiscal Year 2025 12

Third Quarter Fiscal Year 2025 Results (cont.)

AN ITEMIZED RECONCILIATION BETWEEN SEGMENT OPERATING PROFIT (LOSS) BEFORE CORPORATE

AND AMORTIZATION OF ACQUIRED INTANGIBLE ASSETS AND ADJUSTED EBITDA IS AS FOLLOWS:

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended December 31, 2024 |

|

Three months ended December 31, 2023 |

| |

|

Communication

Services Segment |

|

Defense and

Advanced

Technologies

Segment |

|

Total |

|

Communication

Services Segment |

|

Defense and

Advanced

Technologies

Segment |

|

Total |

| Segment operating profit (loss) before corporate and amortization of acquired intangible assets |

|

$ |

44,357 |

|

|

$ |

42,738 |

|

|

$ |

87,095 |

|

|

$ |

36,049 |

|

|

$ |

11,752 |

|

|

$ |

47,801 |

|

| Depreciation (5) |

|

|

244,673 |

|

|

|

12,401 |

|

|

|

257,074 |

|

|

|

218,860 |

|

|

|

10,620 |

|

|

|

229,480 |

|

| Stock-based compensation expense |

|

|

12,884 |

|

|

|

8,619 |

|

|

|

21,503 |

|

|

|

14,252 |

|

|

|

7,947 |

|

|

|

22,199 |

|

| Other amortization |

|

|

10,289 |

|

|

|

4,545 |

|

|

|

14,834 |

|

|

|

12,414 |

|

|

|

3,013 |

|

|

|

15,427 |

|

| Acquisition and transaction related expenses

(3) |

|

|

14,061 |

|

|

|

6,794 |

|

|

|

20,855 |

|

|

|

43,410 |

|

|

|

21,658 |

|

|

|

65,068 |

|

| Satellite impairment and related charges, net |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

5,496 |

|

|

|

— |

|

|

|

5,496 |

|

| Equity in income (loss) of unconsolidated affiliates, net |

|

|

3,405 |

|

|

|

— |

|

|

|

3,405 |

|

|

|

2,689 |

|

|

|

— |

|

|

|

2,689 |

|

| Noncontrolling interest |

|

|

(30 |

) |

|

|

(11,476 |

) |

|

|

(11,506 |

) |

|

|

(60 |

) |

|

|

(4,990 |

) |

|

|

(5,050 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

$ |

329,639 |

|

|

$ |

63,621 |

|

|

$ |

393,260 |

|

|

$ |

333,110 |

|

|

$ |

50,000 |

|

|

$ |

383,110 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Nine months ended December 31, 2024 |

|

Nine months ended December 31, 2023 |

| |

|

Communication

Services Segment |

|

Defense and

Advanced

Technologies

Segment |

|

Total |

|

Communication

Services Segment |

|

Defense and

Advanced

Technologies

Segment |

|

Total |

| Segment operating profit (loss) before corporate and amortization of acquired intangible assets |

|

$ |

85,829 |

|

|

$ |

168,562 |

|

|

$ |

254,391 |

|

|

$ |

(805,080 |

) |

|

$ |

115,883 |

|

|

$ |

(689,197 |

) |

| Depreciation (5) |

|

|

744,136 |

|

|

|

35,539 |

|

|

|

779,675 |

|

|

|

567,313 |

|

|

|

30,739 |

|

|

|

598,052 |

|

| Stock-based compensation expense |

|

|

38,462 |

|

|

|

25,006 |

|

|

|

63,468 |

|

|

|

41,286 |

|

|

|

24,383 |

|

|

|

65,669 |

|

| Other amortization |

|

|

31,998 |

|

|

|

13,866 |

|

|

|

45,864 |

|

|

|

37,425 |

|

|

|

8,589 |

|

|

|

46,014 |

|

| Acquisition and transaction related expenses

(3) |

|

|

45,532 |

|

|

|

12,174 |

|

|

|

57,706 |

|

|

|

88,976 |

|

|

|

41,278 |

|

|

|

130,254 |

|

| Satellite impairment and related charges, net |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

905,496 |

|

|

|

— |

|

|

|

905,496 |

|

| Equity in income (loss) of unconsolidated affiliates, net |

|

|

9,592 |

|

|

|

— |

|

|

|

9,592 |

|

|

|

3,018 |

|

|

|

— |

|

|

|

3,018 |

|

| Noncontrolling interest |

|

|

(90 |

) |

|

|

(38,429 |

) |

|

|

(38,519 |

) |

|

|

(180 |

) |

|

|

(6,447 |

) |

|

|

(6,627 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

$ |

955,459 |

|

|

$ |

216,718 |

|

|

$ |

1,172,177 |

|

|

$ |

838,254 |

|

|

$ |

214,425 |

|

|

$ |

1,052,679 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (5) |

Depreciation expenses not specifically recorded in a particular segment have been allocated based on other indirect

allocable costs, which management believes is a reasonable method. |

Condensed Consolidated Balance Sheets

(Unaudited)

(In thousands)

|

|

|

|

|

|

|

|

|

| |

|

As of |

|

As of |

| Assets |

|

December 31, 2024 |

|

March 31, 2024 |

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

1,556,489 |

|

|

$ |

1,901,033 |

|

| Accounts receivable, net |

|

|

648,962 |

|

|

|

678,210 |

|

| Inventories |

|

|

320,137 |

|

|

|

317,878 |

|

| Prepaid expenses and other current assets |

|

|

316,012 |

|

|

|

581,783 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

2,841,600 |

|

|

|

3,478,904 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Property, equipment and satellites, net |

|

|

7,555,524 |

|

|

|

7,557,206 |

|

| Operating lease right-of-use

assets |

|

|

422,021 |

|

|

|

393,077 |

|

| Other acquired intangible assets, net |

|

|

2,338,088 |

|

|

|

2,544,467 |

|

| Goodwill |

|

|

1,620,267 |

|

|

|

1,621,763 |

|

| Other assets |

|

|

822,851 |

|

|

|

733,947 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

15,600,351 |

|

|

$ |

16,329,364 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As of |

|

As of |

| Liabilities and Equity |

|

December 31, 2024 |

|

March 31, 2024 |

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

218,585 |

|

|

$ |

287,206 |

|

| Accrued and other liabilities |

|

|

854,900 |

|

|

|

950,621 |

|

| Current portion of long-term debt |

|

|

506,922 |

|

|

|

58,054 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

1,580,407 |

|

|

|

1,295,881 |

|

|

|

|

|

|

|

|

|

|

| Senior notes |

|

|

3,649,874 |

|

|

|

4,354,714 |

|

| Other long-term debt |

|

|

2,885,929 |

|

|

|

2,774,521 |

|

| Non-current operating lease liabilities |

|

|

411,784 |

|

|

|

379,644 |

|

| Other liabilities |

|

|

2,226,228 |

|

|

|

2,452,100 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

10,754,222 |

|

|

|

11,256,860 |

|

|

|

|

|

|

|

|

|

|

| Total Viasat Inc. stockholders’ equity |

|

|

4,760,621 |

|

|

|

5,025,430 |

|

| Noncontrolling interest in subsidiary |

|

|

85,508 |

|

|

|

47,074 |

|

|

|

|

|

|

|

|

|

|

| Total equity |

|

|

4,846,129 |

|

|

|

5,072,504 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and equity |

|

$ |

15,600,351 |

|

|

$ |

16,329,364 |

|

|

|

|

|

|

|

|

|

|

Shareholder Letter | Q3 Fiscal Year 2025 13

Non-GAAP Financial Reconciliation

AN ITEMIZED RECONCILIATION BETWEEN NET INCOME (LOSS) ATTRIBUTABLE TO VIASAT, INC.

AND ADJUSTED EBITDA IS AS FOLLOWS:

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

| |

|

December 31, 2024 |

|

September 30, 2024 |

|

June 30, 2024 |

|

March 31, 2024 |

|

December 31, 2023 |

| GAAP net income (loss) attributable to Viasat,

Inc. (6) |

|

$ |

(158,413 |

) |

|

$ |

(137,584 |

) |

|

$ |

(32,912 |

) |

|

$ |

(100,263 |

) |

|

$ |

(124,399 |

) |

| Provision for (benefit from) income taxes |

|

|

(11,798 |

) |

|

|

5,915 |

|

|

|

1,184 |

|

|

|

(11,946 |

) |

|

|

(34,496 |

) |

| Interest expense (income), net |

|

|

76,768 |

|

|

|

91,444 |

|

|

|

82,984 |

|

|

|

101,103 |

|

|

|

112,616 |

|

| Depreciation and amortization |

|

|

337,755 |

|

|

|

354,666 |

|

|

|

331,204 |

|

|

|

312,554 |

|

|

|

336,626 |

|

| Stock-based compensation expense |

|

|

21,503 |

|

|

|

22,783 |

|

|

|

19,182 |

|

|

|

17,962 |

|

|

|

22,199 |

|

| Acquisition and transaction related

expenses (3) |

|

|

20,855 |

|

|

|

34,550 |

|

|

|

2,301 |

|

|

|

27,325 |

|

|

|

65,068 |

|

| Loss (gain) on extinguishment of debt, net |

|

|

96,614 |

|

|

|

3,200 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Other (income) expense, net |

|

|

9,976 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| (Gain) loss on the Link-16 TDL Sale |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

11,000 |

|

|

|

— |

|

| Satellite impairment and related charges, net |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

5,496 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

$ |

393,260 |

|

|

$ |

374,974 |

|

|

$ |

403,943 |

|

|

$ |

357,735 |

|

|

$ |

383,110 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As of |

| NET DEBT |

|

December 31, 2024 |

|

September 30, 2024 |

|

June 30, 2024 |

|

March 31, 2024 |

|

December 31, 2023 |

| (In thousands) |

|

|

|

|

|

|

|

|

|

|

| Total debt |

|

$ |

7,218,294 |

|

|

$ |

9,064,558 |

|

|

$ |

7,456,369 |

|

|

$ |

7,475,842 |

|

|

$ |

7,566,577 |

|

| Less: cash and cash equivalents |

|

|

1,556,489 |

|

|

|

3,529,770 |

|

|

|

1,811,599 |

|

|

|

1,901,033 |

|

|

|

1,621,228 |

|

| Less: short term investments |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

30,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net debt |

|

$ |

5,661,805 |

|

|

$ |

5,534,788 |

|

|

$ |

5,644,770 |

|

|

$ |

5,574,809 |

|

|

$ |

5,915,349 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (3) |

Costs typically consist of acquisition, integration, and disposition related costs. |

| (6) |

The three months ended March 31, 2024 GAAP net income (loss) attributable to Viasat, Inc. includes $10.4 million

loss from discontinued operations related to the Link-16 TDL Sale. There is no impact to Adjusted EBITDA as Adjusted EBITDA and Adjusted EBITDA from continuing operations are the same. |

Shareholder Letter | Q3 Fiscal Year 2025 14

Selected Segment Information

Selected Segment Information

(Unaudited)

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

|

Nine months ended |

|

| |

|

December 31, 2024 |

|

|

December 31, 2023 |

|

|

December 31, 2024 |

|

|

December 31, 2023 |

|

| Revenues: |

|

|

|

|

|