false000031754000003175402025-01-072025-01-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 7, 2025

COCA-COLA CONSOLIDATED, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 0-9286 | | 56-0950585 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | |

4100 Coca-Cola Plaza Charlotte, NC | | | | 28211 |

| (Address of principal executive offices) | | | | (Zip Code) |

Registrant’s telephone number, including area code: (980) 392-8298

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $1.00 per share | COKE | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

EXPLANATORY NOTE

This Amendment No. 1 (the “Amendment”) amends the Current Report on Form 8-K Coca-Cola Consolidated, Inc. (the “Company”) filed with the Securities and Exchange Commission on January 10, 2025, regarding the retirement of F. Scott Anthony as Executive Vice President and Chief Financial Officer (principal financial officer) of the Company and the appointment of Matthew J. Blickley as Executive Vice President and Chief Financial Officer (principal financial officer). This Amendment provides a description of (i) the terms of F. Scott Anthony’s transition from Executive Vice President and Chief Financial Officer (principal financial officer) to a non-employee consultant of the Company and (ii) the compensation of Matthew J. Blickley in connection with his appointment as Executive Vice President and Chief Financial Officer (principal financial officer) of the Company.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

In connection with his resignation, Mr. Anthony and the Company entered into a Consulting Agreement on February 19, 2025 (the “Consulting Agreement”), to provide consulting and advisory services to the Company from April 1, 2025 through December 31, 2025 (the “Term”). The Consulting Agreement provides Mr. Anthony will continue to be employed by the Company from February 19, 2025, the date of the execution of the Consulting Agreement, through March 31, 2025. The Consulting Agreement will automatically renew at the end of each Term for a further period of one year, unless Mr. Anthony or the Company provides written notice of termination. During the Term of the Consulting Agreement, the Company shall pay Mr. Anthony $20,833.33 per month.

The Consulting Agreement also provides that, during the Term, Mr. Anthony shall be available to provide advisory and consulting services as the Chairman and Chief Executive Officer of the Company (or any designees) may reasonably request. Mr. Anthony shall not accept any other employment that would preclude him from carrying out, or otherwise interfere with, his responsibilities under the Consulting Agreement. Pursuant to the terms of the Consulting Agreement, any services provided by Mr. Anthony during the Term shall be provided as an independent contractor of the Company and not as an employee.

The foregoing description of the terms and conditions of the Consulting Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Consulting Agreement, a copy of which is filed as Exhibit 10.1 hereto and incorporated herein by reference.

In connection with Mr. Blickley’s appointment as Executive Vice President and Chief Financial Officer (principal financial officer) of the Company, effective April 1, 2025, (i) his base salary will be $500,000, (ii) he will continue to participate in the Company’s Annual Bonus Plan with a new target bonus award of 75% of his base salary, (iii) he will continue to participate in the Company’s Long-Term Performance Plan, with a new target award of 75% of his base salary, (iv) he will continue to be eligible to participate in the Company’s Supplemental Savings Incentive Plan, (v) he will continue to participate in the executive Long-Term Disability and Life Insurance programs and (vi) he will continue to receive an executive allowance of $15,000 per year.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | | | | | | | |

| Exhibit No. | | Description | | Incorporated by Reference or

Filed/Furnished Herewith |

| 10.1* | | | | Filed herewith. |

| 104 | | Cover Page Interactive Data File – the cover page interactive data file does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document. | | Filed herewith. |

| | | | | |

| * | Indicates a management contract or compensatory plan or arrangement. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | COCA-COLA CONSOLIDATED, INC. |

| | | | |

Date: February 20, 2025 | | By: | /s/ E. Beauregarde Fisher III | |

| | | E. Beauregarde Fisher III

Executive Vice President, General Counsel and Secretary |

CONSULTING AGREEMENT

THIS CONSULTING AGREEMENT (the “Agreement”) is made and entered into as of the 19th day of February, 2025, by and between F. Scott Anthony (“Consultant”) and COCA-COLA CONSOLIDATED, INC. a Delaware corporation (the “Company”).

W I T N E S S E T H:

WHEREAS, Consultant has been employed for over six years by the Company as Executive Vice President and Chief Financial Officer, and

WHEREAS, Consultant will retire from employment with the Company effective as of the end of March 31, 2025; and

WHEREAS, Consultant possesses valuable skills and experience of a special and personal nature, and unique, personal and confidential business knowledge about the operation of the Company’s business; and

WHEREAS, the Company desires to secure for itself the benefit of Consultant’s ability and expertise, and Consultant has indicated his willingness to provide consulting and advisory services to the Company on the terms and conditions set forth herein.

NOW, THEREFORE, in consideration of the premises and other consideration as expressly provided for herein, the parties hereto agree as follows:

1. Engagement. The Company hereby engages Consultant, as an independent contractor, to provide the consulting services more particularly described herein, and Consultant accepts such engagement, subject to the terms and conditions stated herein.

2. Consulting.

(a) Duties. Consultant shall provide such advisory and consulting services as the Chairman and Chief Executive Officer of the Company (or any of his designees) may reasonably request, including with respect to the matters set forth on Schedule 1 hereto, and shall provide the Company with the benefit of his experience and knowledge concerning all such matters. Consultant agrees to provide the Company with such time and business resources mutually agreed by the parties to be reasonably necessary in order to carry out his responsibilities hereunder. Consultant agrees not to accept any other employment that would preclude him from carrying out or otherwise interfere with his responsibilities hereunder. The Company will provide Consultant office space and a laptop computer with network accessibility and a wireless connection device (such as a MiFi) to enable Consultant to work remotely. Notwithstanding the foregoing, in no event shall Consultant be required to devote time to his duties hereunder that are, on average, more than 20% of the average level of time he performed services as an employee over the 36-month period immediately preceding the execution of this Agreement.

(b) Consulting Fees. In consideration for the services to be rendered by Consultant hereunder, during the term of this Agreement the Company agrees to pay to Consultant a consulting fee (the “Consulting Fee”) equal to Twenty Thousand Eight Hundred Thirty-Three Dollars and Thirty-Three Cents ($20,833.33) per month. In addition, the Company shall pay or reimburse Consultant for all reasonable bona fide out-of-pocket, third-party business expenses incurred by Consultant in the performance of services under this Agreement in accordance with expense reimbursement plans consistent with current policies in effect for consultants to the Company generally.

3. Term. The term of this Agreement shall commence on April 1, 2025 and shall continue until December 31, 2025. Notwithstanding the foregoing, this Agreement will automatically renew at the end of each term for a further term of one year unless either party gives the other written notice of termination at least 30 days prior to the end of the relevant term. Notwithstanding the foregoing, this Agreement shall terminate prior to the expiration of the initial term (or any extended term) upon the following events:

(a) Either party may elect to terminate this Agreement by providing the other party with seven (7) days advance written notice of the election to terminate this Agreement provided Consultant would be provided up to 30 days of access to his Company computer (without Company network access) following such termination;

(b) The Company may terminate this Agreement effectively immediately upon written notice of (i) Consultant’s commission of an act of embezzlement, dishonesty, fraud, or gross neglect of duties under this Agreement, (ii) Consultant’s commission of a felonious act or other crime involving moral turpitude or public scandal, or (iii) Consultant’s improper communication of confidential information about the Company (or any of its affiliates) or other conduct committed which Consultant knew or should have known was not in the Company (or any of its subsidiaries’) best interest.

(c) The death of Consultant, in which event this Agreement shall terminate automatically, without any requirement of notice; or

(d) A determination made in good faith by the Company that Consultant is unable to perform due to medical infirmity the services assigned to him by the Company pursuant hereto, in which event this Agreement shall terminate automatically, without any requirement of notice.

4. Employee Benefit Plans of the Company. Consultant shall not be entitled to participate in any benefit plans of the Company as a result of his engagement under this Agreement; provided, however, Consultant shall continue to be entitled to all of the accrued rights and benefits afforded to Consultant pursuant to the terms of the employee benefit plans of the Company in which Consultant participated as of his retirement date.

5. Tax Matters. Under this Agreement, as of the Effective Date Consultant will be a self-employed, independent contractor of the Company. However, as Consultant is transitioning from a senior executive position, the Company will withhold from payments made to Consultant

under this Agreement any amounts for income or employment taxes determined by the Company to be appropriate or required to be withheld by applicable federal, state or local tax law.

6. Confidentiality of Company Information. Consultant agrees to keep confidential and not to disclose to anyone other than a person acting on behalf of the Company any information about the Company or any of its subsidiaries concerning its methods and manner of operation, marketing plans, new products, procedures, methods, processes, know-how and techniques, customer lists and other similar information that may be useful by a competitor of the Company. This obligation shall continue throughout the term of this Agreement and thereafter indefinitely.

7. Governing Law. This Agreement shall be governed by and interpreted by the laws of the State of North Carolina, notwithstanding any conflict-of-laws doctrines of such state or any other jurisdiction to the contrary.

8. Entire Agreement. This instrument contains the entire agreement of the parties with respect to the subject matter hereof and all previous agreements and discussions relating to the same or similar subject matter are merged herein. This Agreement may not be changed, amended, modified, terminated or waived except by a writing signed by both parties hereto. Neither this Agreement nor the provisions of this Section may be changed, amended, modified, terminated or waived as a result of any failure to enforce any provision or the waiver of any specific breach or breaches thereof or any course of conduct of the parties.

IN WITNESS WHEREOF, the Company has caused this Agreement to be executed by its duly authorized representative, and Consultant has hereunto set his hand and seal, all as of the day and year first above written.

| | | | | | | | |

| COMPANY: |

| | |

| COCA-COLA CONSOLIDATED, INC. |

| | |

| By: | /s/ David Katz |

| | David Katz |

| | President and Chief Operating Officer |

| | | | | | | | |

| CONSULTANT: |

| | |

| | /s/ F. Scott Anthony |

| | F. Scott Anthony |

Schedule 1

Consulting Duties

•Advise Chairman and Chief Executive Officer, President and Chief Operating Officer, Chief Financial Officer and other Executive Officers regarding key financial matters, long-range planning and other key matters relating to the Company and its subsidiaries

•Assist with continued collaboration and development of key relationships between Chief Financial Officer and key finance personnel at beverage brand partners, other bottlers and system entities

•Assist with investor relations transition as requested

•Such other services as may be requested

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

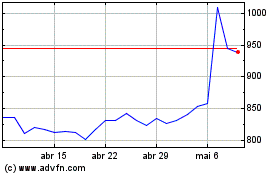

Coca Cola Consolidated (NASDAQ:COKE)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Coca Cola Consolidated (NASDAQ:COKE)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025