0001601830FALSE00016018302025-02-262025-02-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 28, 2025

Recursion Pharmaceuticals, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

Delaware | | 001-40323 | | 46-4099738 |

| (State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

41 S Rio Grande Street

Salt Lake City, UT 84101

(Address of principal executive offices) (Zip code)

(385) 269 - 0203

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17CFR

240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

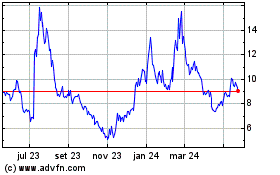

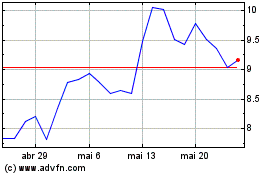

| Class A Common Stock, par value $0.00001 per share | RXRX | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 28, 2025, Recursion Pharmaceuticals, Inc. (the “Company”) issued a press release announcing its results of operations and financial condition for the fourth quarter and fiscal year ended December 31, 2024. A copy of the press release is furnished as Exhibit 99.1 and is incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.

On February 28, 2025, the Company released an updated investor presentation. The investor presentation will be used from time to time in meetings with investors. A copy of the presentation is attached hereto as Exhibit 99.2.

Also on February 28, 2025, the Company released a presentation made in connection with its L(earnings) call on February 28, 2025. A copy of the presentation is attached hereto as Exhibit 99.3.

The Company announces material information to its investors using filings with the Securities and Exchange Commission (the “SEC”), the investor relations page on the Company’s website, at https://ir.recursion.com/, press releases, public conference calls and webcasts. The Company uses these channels, as well as social media, to communicate with investors and the public about the Company, its products and services and other matters. Therefore, the Company encourages investors, the media and others interested in the Company to review the information it makes public in these locations, as such information could be deemed to be material information.

The information furnished pursuant to Item 2.02 (including Exhibit 99.1) and 7.01 (including Exhibits 99.2 and 99.3) on this Form 8-K, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Exhibit Number | Description |

| 99.1 | |

| 99.2 | |

| 99.3 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized on February 28, 2025.

| | | | | | | | |

| RECURSION PHARMACEUTICALS, INC. |

| | |

| By: | /s/ Ben Taylor |

| | Ben Taylor |

| | Chief Financial Officer |

| | |

Recursion Provides Business Updates and Reports Fourth Quarter and Fiscal Year 2024 Financial Results

•Reported promising safety and preliminary efficacy data for REC-617, an oral CDK7 inhibitor, and met primary endpoints and demonstrated encouraging trends in efficacy for REC-994 in cerebral cavernous malformations

•Advanced three new clinical studies across oncology, rare disease, and recurrent C. diff infection with REC-1245, REC-4881, and REC-3964

•Delivered milestones for partners including the first neuro-phenomap for Roche and Genentech and two milestones for Sanofi for aggregate cash inflows of $45 million

•Completed business combination with Exscientia, cementing a position as a leading TechBio company

SALT LAKE CITY, February 28, 2025 (GLOBE NEWSWIRE) — Recursion (Nasdaq : RXRX) a leading clinical stage TechBio company decoding biology to radically improve lives, today reported business updates and financial results for its fourth quarter and fiscal year ended December 31, 2024.

Recursion will host a (L)earnings Call on February 28, 2025 at 8:30 am ET / 6:30 am MT / 1:30 pm GMT from Recursion’s X (formerly Twitter), LinkedIn, and YouTube accounts giving analysts, investors, and the public the opportunity to ask questions of the company by submitting questions here: https://bit.ly/40UiVkb.

“In 2024, Recursion made a transformative leap with the largest TechBio merger in history, combining our pipeline, partnerships, people and platform to further accelerate the Recursion OS as the leading full-stack TechBio platform,” said Chris Gibson, Ph.D., Co-Founder and CEO of Recursion. “With a portfolio of 10 clinical and preclinical programs, including both potential first-in-class and best-in-class therapies, we are driving towards faster and more effective drug development. These advances position us at the forefront of the next generation of medicine, where the impact will be measured not just in scientific breakthroughs through the power of our platform, but in real-world patient outcomes at scale.”

1Includes preclinical programs (programs expected to enter the clinic within the next 18 months); 2Program milestones includes data readouts, preliminary data updates, regulatory submissions, trial initiation, etc.

Summary of Business Highlights

Pipeline

1Includes non-small cell lung cancer (NSCLC), colorectal cancer, breast cancer, pancreatic cancer, ovarian cancer, head and neck cancer.

2Joint venture with Rallybio.

•Clinical Results: Recursion demonstrated promising early efficacy data for two programs in 2024

◦REC-617: A potential best-in-class CDK7 inhibitor optimized using our AI platform, delivered early Phase 1/2 results demonstrating promising safety and efficacy, including a durable partial response in a late-stage metastatic ovarian cancer patient and stable disease across four other patients with solid tumors (e.g. CRC, NSCLC). These findings support further clinical development as the Company continues to explore its potential in combination regimens.

◦REC-994: A potential first-in-disease oral superoxide scavenger for symptomatic CCM, showing robust safety in chronic dosing in a Phase 2 study as well as a reduction in lesion volume as measured by MRI and trends towards symptom stabilization as evaluated by mRS. The data was featured in a late-breaking oral presentation at the 2025 International Stroke Conference. Next steps in this program will be informed by regulatory discussions and long-term extension data expected in 2025.

•Clinical Advancements and Regulatory Milestones:

◦Pipeline advanced with the initiation of three new clinical studies:

◦DAHLIA: Phase 1/2 trial investigating REC-1245, a potential first-in-class RBM39 degrader, in biomarker-enriched advanced solid tumors and lymphoma.

◦TUPELO: Phase 1b/2 trial investigating REC-4881 for familial adenomatous polyposis (FAP).

◦ALDER: Phase 2 trial investigating REC-3964, a potential first-in-class C. diff toxin B inhibitor, for preventing recurrent C. difficile infection.

◦Progressed additional programs

◦REC-4359: received IND clearance for REC-4539 (REC-4539 inhibitor) in small cell lung cancer

◦REC-3565: received CTA approval for REC-3565 (MALT1 inhibitor) in b-cell malignancies

◦REC-4209: progressed REC-4209 in idiopathic pulmonary fibrosis to IND-enabling studies

Partnerships

Roche-Genentech:

•Gastrointestinal-Oncology Advancements: In partnership with Roche and Genentech, Recursion has generated multiple whole-genome phenomaps with chemical perturbations across various disease-relevant cell types, enabling deeper insights into how different cellular contexts respond to gene knockouts and chemicals.

•Neuro-specific CRISPR KO Phenomap: In partnership with Roche and Genentech, Recursion developed the first whole-genome CRISPR knockout map in neural iPSC cells, providing valuable data to identify potential new targets in neuroscience, a field which has historically suffered from limited new discoveries.

•Milestones and Collaboration: The neuroscience phenomap work led to the exercise of a $30M option by Roche and Genentech in August 2024, and the collaboration is already moving forward with target validation projects.

Sanofi:

•Immunology & Oncology Achievements: Through this collaboration, Recursion is using its end-to-end integrated platform to discover and advance up to 15 novel targets in the oncology and immunology therapeutic areas.

◦In 2024, two programs advanced through initial milestones, generating $15M in aggregate payments from Sanofi.

Bayer:

•Oncology Achievements: Completed 25 multimodal oncology data packages utilizing the Recursion OS platform. Multiple programs are rapidly progressing to Lead Series nomination.

•LOWE: Additionally, Bayer has adopted Recursion’s LOWE LLM-orchestrated workflow software to enhance their research capabilities.

Merck KGaA (Darmstadt, Germany):

•Ongoing alliance with Merck KGaA, Darmstadt, Germany is focused on leveraging Recursion’s discovery engine to identify first-in-class and best-in-class targets across oncology and immunology, driving innovation in these key therapeutic areas.

Platform

•Full stack AI powered platform: Our constantly-evolving Recursion OS spans target discovery through clinical development, enabling efficient molecule design and testing for both first and best-in-class opportunities.

◦Integration of Exscientia’s Precision Chemistry Platform (Centaur) & Recursion OS:

▪Integrated Centaur into more than 10 design cycles for programs Recursion has previously partnered, with early validation work achieved and progress accelerating across multiple additional partnered programs.

▪The Recursion OS has been used to identify hit compounds in 7 immune-relevant targets or dual target pairs and early validation work has commenced to prepare reports for our partners.

▪Recursion’s AI synthesis planning capability shows a 25% improved tractability assessment of AI-generated compounds over competitors.

◦Compute: Launched BioHive-2, the most powerful supercomputer owned by any biopharma company, enabling the training of industry-leading foundation models like Phenom-2, MolPhenix, and MolGPS.

◦Protein Target Data Layer: Mapped 1.4 million active ligands to binding pockets for structure-based drug discovery and target deconvolution.

◦Phenomics: Scaled phenomics experimental capabilities can now generate up to 16.2 (135 terabytes) million multi-timepoint brightfield images across up to 2.2 million experiments per week.

◦Transcriptomics: Generated >1.6M individual transcriptomes since its launch in 2023, with just under 1M generated in 2024 including building the world’s first genome-scale CRISPR knockout map in primary human cells.

◦Invivomics: Grew dataset to 1 million hours of video; 1 million hours of digital biomarkers and 149,000 environment data points.

◦LLM and Knowledge Graph Integration: Reduced manual effort by 60% for evidence collection for hit nomination packages supporting entry into hit-to-lead through knowledge graphs and LLM-based data aggregation with further reduction expected with additional data layers.

•Breakthroughs in Foundation Models: Developed multimodal AI models like Phenom, MolPhenix, and MolGPS that accelerate Recursion’s ability to make high-confidence predictions in our therapeutics programs.

◦Phenom-2: A 1.9B-parameter model trained on 8B microscopy images, achieving 60% better linear separability of genetic perturbations and top performance in biological relationship recall and consistency.

◦MolPhenix: Delivers a 10X improvement over previous models in predicting the effects of molecules on cell assays and morphology.

◦MolGPS: A 3B-parameter model for molecular property prediction that outperforms the state of the art on 12 of 22 ADMET tasks in the Therapeutic data commons (TDC).

◦MolE: A new foundation model trained on 842M molecular graphs, surpassing earlier approaches by ranking first in 10 ADMET tasks in the TDC.

◦Advancement in Causal AI models & Emerging Focus on ClinTech: Transforming clinical development with Recursion’s ClinTech platform and models, focused on:

◦Utilizing AI models and Tempus data to build a patient stratification framework in small cell lung cancer (SCLC). This work is informing clinical strategies for the planned REC-4539 Phase I study commencing in the first half of 2025.

◦Automating key processes like site engagement and enrollment to accelerate patient matching and industrializing workflows to accelerate trial initiation.

◦Centralizing data systems to optimize clinical protocols, streamline operations, and significantly reduce costs and site burden.

Integration & Additional Corporate Updates

•Recursion completed the combination with Exscientia, becoming an industry-leading TechBio company, bringing together Recursion’s biology-first TechBio platform with Exscientia’s chemistry-first TechBio platform, and creating a compelling set of both first and best-in-class clinical programs and sector-leading partnerships.

•Recursion announced it will carve out its Austrian operations into a newly formed company, Alpha Biotechnology GmbH (“Alpha”). Recursion will have a 49% ownership in Alpha, a company leveraging a patient-tissue platform for the development of precision therapeutics for the treatment of hematological and solid cancers, while focusing its efforts and moderating spend.

•The company is on-track to sub-lease or otherwise simplify its real estate footprint post business combination to concentrate employees in a smaller number of sites while moderating spend.

•Recursion is maintaining its guidance of at least $100 million in synergies from the transaction, with a majority of the run rate amount achieved in 2025.

•The company will provide a comprehensive update in May 2025.

Fourth Quarter and Fiscal Year 2024 Financial Results

Financials reported for the full year 2024 include full year Recursion financials combined with financials from Exscientia post-business combination (November 20-December 31, 2024).

•Cash Position: Cash, cash equivalents and restricted cash were $603.0 million as of December 31, 2024, compared to $401.4 million as of December 31, 2023. On a combined basis, Recursion continues to expect cash runway to extend into 2027.

•Revenue: Total revenue, consisting primarily of revenue from collaborative agreements, was $4.5 million for the fourth quarter of 2024, compared to $10.9 million for the fourth quarter of 2023. Total revenue, consisting primarily of revenue from collaboration agreements, was $58.8 million for the year ended December 31, 2024, compared to $44.6 million for the year ended December 31, 2023. For the fourth quarter of 2024, the decrease of $6.4 million compared to the prior period was due to the timing of projects from the Company’s Roche and Genentech collaboration. For the year ended December 31, 2024, the increase of $14.3 million compared to the prior year was due to revenue recognized from our Roche and Genentech collaboration related to the completion of Recursion’s first neuroscience phenomap optioned by Roche and Genentech for $30 million.

•Pro Forma Revenue: The Company’s unaudited pro forma consolidated revenue is presented as if the Exscientia business combination had occurred on January 1, 2023. Pro forma revenue was $82.6 million for the year ended December 31, 2024, compared to $72.5 million for the year ended December 31, 2023.

•Research and Development Expenses: Research and development expenses were $98.3 million for the fourth quarter of 2024, compared to $69.5 million for the fourth quarter of 2023. Research and development expenses were $314.4 million for the year ended December 31, 2024, compared to $241.2 million for the year ended December 31, 2023. The increase in 2024 research and development expenses compared to the prior year was driven by our platform and personnel costs as the Company continues to expand and upgrade its platform, including chemical technology, machine learning and transcriptomics platform.

•General and Administrative Expenses: General and administrative expenses were $77.2 million for the fourth quarter of 2024, compared to $30.5 million for the fourth quarter of 2023. General and administrative expenses were $178.2 million for the year ended December 31, 2024, compared to $110.8 million for the year ended December 31, 2023. The increase in 2024 general and administrative expenses compared to the prior year was primarily driven by an increase in salaries and wages of $21.1 million, transaction costs of $20.5 million, inclusion of Exscientia’s results of $11.3 million and increases in software and lease expenses.

•Net Loss: Net loss was $178.9 million for the fourth quarter of 2024, compared to a net loss of $93.0 million for the fourth quarter of 2023. Net loss was $463.7 million for the year ended December 31, 2024, compared to a net loss of $328.1 million for the year ended December 31, 2023.

•Net Cash: Net cash used in operating activities was $115.4 million for the fourth quarter of 2024, compared to net cash used in operating activities of $74.1 million for the fourth quarter of 2023. Net cash used in operating activities was $359.2 million for the year ended December 31, 2024, compared to net cash used in operating activities of $287.8 million for the year ended December 31, 2023. The difference was primarily driven by (1) higher costs incurred for research and development and general and administrative due to Recursion’s expansion and upgraded capabilities and (2) Recursion’s combination with Exscientia.

◦Recursion noted that the change in Exscientia’s cash and cash equivalents and short term bank deposits from December 31, 2023 to November 20, 2024, the date of the close of the acquisition was $184 million. There were no material financings in this period1:

| | | | | | | | | | | |

| (in thousands) | November 20, 2024 | December 31, 2023 | Change |

| Cash and cash equivalents | $ | 277,104 | | £ | 259,463 | | |

| Short term bank deposits | — | | 103,586 | | |

| Total - GBP | N/A | £ | 363,049 | | |

| GBP to USD rate | N/A | 1.27 | |

| Total - USD | $ | 277,104 | | $ | 461,072 | | $ | (183,968) | |

1 The December 31, 2023 amounts from the above table are from Exscientia’s 20-F Annual Filing. We noted that Exscientia reported their results using International Financial Reporting Standards (IFRS) but that there are no IFRS to U.S. GAAP differences that would impact the measurement of Exscientia’s December 31, 2023 cash and cash equivalents and short term bank deposits amounts. We believe this information is useful to investors as it helps provide additional information on Exscientia’s liquidity prior and up-to the acquisition. We believe that it may provide a more complete understanding of the Company’s liquidity and can facilitate analysis of the Company’s results.

About Recursion

Recursion (NASDAQ: RXRX) is a clinical stage TechBio company leading the space by decoding biology to radically improve lives. Enabling its mission is the Recursion OS, a platform built across diverse technologies that continuously generate one of the world’s largest proprietary biological and chemical datasets. Recursion leverages sophisticated machine-learning algorithms to distill from its dataset a collection of trillions of searchable relationships across biology and chemistry unconstrained by human bias. By commanding massive experimental scale — up to millions of wet lab experiments weekly — and massive computational scale — owning and operating one of the most powerful supercomputers in the world, Recursion is uniting technology, biology and chemistry to advance the future of medicine.

Recursion is headquartered in Salt Lake City, where it is a founding member of BioHive, the Utah life sciences industry collective. Recursion also has offices in Toronto, Montréal, New York, London, Oxford area, and the San Francisco Bay area. Learn more at www.Recursion.com, or connect on X (formerly Twitter) and LinkedIn.

Media Contact

Media@Recursion.com

Investor Contact

Investor@Recursion.com

Recursion Pharmaceuticals, Inc.

Consolidated Statements of Operations (unaudited)

(in thousands, except share and per share amounts)

| | | | | | | | | | | | | | | | | |

| Three months ended | | Years ended |

| December 31, | | December 31, |

| 2024 | 2023 | | 2024 | 2023 |

| Revenue | | | | | |

| Operating revenue | 4,511 | | 10,624 | | | $ | 58,488 | | $ | 43,876 | |

| Grant revenue | 35 | | 267 | | | 351 | | 699 | |

| Total revenue | 4,546 | | 10,891 | | | 58,839 | | 44,575 | |

| | | | | |

| Operating costs and expenses | | | | | |

| Cost of revenue | 12,794 | | 9,881 | | | 45,238 | | 42,587 | |

| Research and development | 98,333 | | 69,482 | | | 314,421 | | 241,226 | |

| General and administrative | 77,186 | | 30,458 | | | 178,184 | | 110,822 | |

| Total operating costs and expenses | 188,313 | | 109,821 | | | 537,843 | | 394,635 | |

| | | | | |

| Loss from operations | (183,767) | | (98,930) | | | (479,004) | | (350,060) | |

| Other income, net | 4,869 | | 4,306 | | | 14,216 | | 17,932 | |

| Loss before income tax benefit | (178,898) | | (94,624) | | | (464,788) | | (332,128) | |

| Income tax benefit | (7) | | $ | 1,628 | | | 1,127 | | $ | 4,062 | |

| Net loss | $ | (178,905) | | $ | (92,996) | | | $ | (463,661) | | $ | (328,066) | |

| | | | | |

| Per share data | | | | | |

| Net loss per share of Class A, B and Exchangeable common stock, basic and diluted | $ | (0.53) | | $ | (0.42) | | | $ | (1.69) | | $ | (1.58) | |

| Weighted-average shares (Class A, B and Exchangeable) outstanding, basic and diluted | 336,035,980 | | 223,158,161 | | | 274,207,146 | | 207,853,702 | |

Recursion Pharmaceuticals, Inc.

Consolidated Balance Sheets (unaudited)

(in thousands)

| | | | | | | | |

| | December 31, |

| | 2024 | 2023 |

| Assets | | |

| Current assets | | |

| Cash and cash equivalents | $ | 594,350 | | $ | 391,565 | |

| Restricted cash | 3,045 | | 3,231 | |

| Other receivables | 49,166 | | 3,094 | |

| Other current assets | 67,708 | | 40,247 | |

| Total current assets | 714,269 | | 438,137 | |

| | |

| Restricted cash, non-current | 5,629 | | 6,629 | |

| Property and equipment, net | 141,063 | | 86,510 | |

| Operating lease right-of-use-assets | 65,877 | | 33,663 | |

| Financing lease right-of-use-assets | 26,273 | | — | |

| Intangible assets, net | 335,855 | | 36,443 | |

| Goodwill | 148,873 | | 52,056 | |

| Deferred tax assets | 1,934 | | — | |

| Other assets, non-current | 8,825 | | 261 | |

| Total assets | $ | 1,448,598 | | $ | 653,699 | |

| | |

| Liabilities and stockholders’ equity | | |

| Current liabilities | | |

| Accounts payable | $ | 21,613 | | $ | 3,953 | |

| Accrued expenses and other liabilities | 81,872 | | 46,635 | |

| Unearned revenue | 61,767 | | 36,426 | |

| Operating lease liabilities | 13,795 | | 6,116 | |

| Notes payable and financing lease liabilities | 8,425 | | 41 | |

| Total current liabilities | 187,472 | | 93,171 | |

| | |

| Unearned revenue, non-current | 118,765 | | 51,238 | |

| Operating lease liabilities, non-current | 67,250 | | 43,414 | |

| Notes payable and financing lease liabilities, non-current | 19,022 | | 1,101 | |

| Deferred tax liabilities | 16,575 | | 1,339 | |

| Other liabilities, non-current | 4,732 | | — | |

| Total liabilities | 413,816 | | 190,263 | |

| | |

| | |

| | |

| Stockholders’ equity | | |

Common stock (Class A, B and Exchangeable) | 4 | | 2 | |

| Additional paid-in capital | 2,473,698 | | 1,431,056 | |

| Accumulated deficit | (1,431,283) | | (967,622) | |

| Accumulated other comprehensive loss | (7,637) | | — | |

| Total stockholders’ equity | 1,034,782 | | 463,436 | |

| | |

| Total liabilities and stockholders’ equity | $ | 1,448,598 | | $ | 653,699 | |

Forward-Looking Statements

This document contains information that includes or is based upon “forward-looking statements” within the meaning of the Securities Litigation Reform Act of 1995, including, without limitation, those regarding Recursion’s positioning at the forefront of the next generation of medicine and achievement of faster and more effective drug development, expectations relating to early and late stage discovery, preclinical, and clinical programs, including timelines for commencement of and enrollment in studies, data readouts, and progression toward IND-enabling studies; expectations and developments with respect to licenses and collaborations, including option exercises by partners and additional partnerships, the value of data generated for the Roche-Genentech partnership, and the promising future of partnership programs, the progress of Bayer partnership programs to Lead Series nomination, the acceleration of progress across multiple partnered programs; prospective products and their potential future indications and market opportunities; developments with Recursion OS and other technologies; business and financial plans and performance, including guidance regarding expected synergies from the Exscientia combination, reduction of its real estate footprint, and the timing of a related comprehensive update; completion of the carve out of the Austrian entity and Recursion’s investment in Alpha Biotechnology GmbH; and all other statements that are not historical facts. Forward-looking statements may or may not include identifying words such as “plan,” “will,” “expect,” “anticipate,” “intend,” “believe,” “potential,” “continue,” and similar terms. These statements are subject to known or unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied in such statements, including but not limited to: challenges inherent in pharmaceutical research and development, including the timing and results of preclinical and clinical programs, where the risk of failure is high and failure can occur at any stage prior to or after regulatory approval due to lack of sufficient efficacy, safety considerations, or other factors; our ability to leverage and enhance our drug discovery platform; our ability to obtain financing for development activities and other corporate purposes; the success of our collaboration activities; our ability to obtain regulatory approval of, and ultimately commercialize, drug candidates; our ability to obtain, maintain, and enforce intellectual property protections; cyberattacks or other disruptions to our technology systems; our ability to attract, motivate, and retain key employees and manage our growth; inflation and other macroeconomic issues; and other risks and uncertainties such as those described under the heading “Risk Factors” in our filings with the U.S. Securities and Exchange Commission, including our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. All forward-looking statements are based on management’s current estimates, projections, and assumptions, and Recursion undertakes no obligation to correct or update any such statements, whether as a result of new information, future developments, or otherwise, except to the extent required by applicable law.

Decoding Biology To Radically Improve Lives FEBRUARY 2025

This presentation of Recursion Pharmaceuticals, Inc. (“Recursion,” “we,” “us,” or “our”) and any accompanying discussion contain statements that are not historical facts may be considered forward-looking statements under federal securities laws and may be identified by words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “potential,” “predicts,” “projects,” “seeks,” “should,” “will,” or words of similar meaning and include, but are not limited to, statements regarding Recursion’s OS industrializing first- and best-in-class drug discovery; the occurrence or realization of potential milestones; current and future preclinical and clinical studies, including timelines for enrollment in studies, data readouts, and progression toward IND-enabling and other potential studies; advancements of its pipeline, partnerships, and data strategies; Recursion’s plans to present clinical trial data at medical conference or in publications; the potential size of the market opportunity for our drug candidates; outcomes and benefits from licenses, partnerships and collaborations, including option exercises by partners and the amount and timing of potential milestone payments; outcomes and benefits expected from the Large Language Model-Orchestrated Workflow Engine (LOWE); the initiation, timing, progress, results, and cost of our research and development programs; advancements of our Recursion OS; the potential for additional partnerships and making data and tools available to third parties; our ability to identify viable new drug candidates for clinical development and the accelerating rate at which we expect to identify such candidates including our ability to leverage the datasets acquired through the license agreement into increased machine learning capabilities and accelerate clinical trial enrollment; and many others. Other important factors and information are contained in Recursion’s most recent Annual Report on Form 10-K and the Company’s other filings with the U.S. Securities and Exchange Commission (the “SEC”), which can be accessed at https://ir.recursion.com, or www.sec.gov. All forward-looking statements are qualified by these cautionary statements and apply only as of the date they are made. Recursion does not undertake any obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise. Certain information contained in this presentation relates to or is based on studies, publications, surveys and other data obtained from third-party sources and the company’s own internal estimates and research. While the company believes these third-party sources to be reliable as of the date of this presentation, it has not independently verified, and makes no representation as to the adequacy, fairness, accuracy or completeness of, any information obtained from third-party sources. In addition, all of the market data included in this presentation involves a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions. Finally, while the company believes its own internal research is reliable, such research has not been verified by any independent source. Information contained in, or that can be accessed through our website is not a part of and is not incorporated into this presentation. Cross-trial or cross-candidate comparisons against other clinical trials and other drug candidates are not based on head-to-head studies and are presented for informational purposes; comparisons are based on publicly available information for other clinical trials and other drug candidates. Any non-Recursion logos or trademarks included herein are the property of the owners thereof and are used for reference purposes only. 2 Important Information

3 4 Large pharma collaborations 10 Clinical and pre- clinical programs1 Oncology, rare diseases, and other high unmet need diseases ~10 Clinical program milestones over the next 18 months2 1 Unified Operating System (OS) with both first & best-in-class capabilities ~10 Additional advanced discovery programs 10+ Partnered programs ~$450M Upfront and milestone payments earned to-date ~$20B potential milestone payments Oncology, immunology, and other high unmet need diseases Portfolio poised for value creation with waves of new pipeline and partner programs emerging from Recursion OS 1. Includes preclinical programs (programs expected to enter the clinic within the next 18 months). 2. Program milestones includes data readouts, preliminary data updates, regulatory submissions, trial initiation, etc.

2024 Year in Review: A Scaled Pipeline of Best- & First-In-Class Opportunities 4 Clinical data read-outs: • REC-617: Potential best-in-class CDK7 inhibitor for advanced solid tumors showed promising safety and preliminary efficacy in Phase 1 dose escalation • REC-994: Oral superoxide scavenger for potential first-in-disease symptomatic CCM demonstrated safety and encouraging trends in MRI- based lesion reduction and functional improvement in Phase 2 New clinical trials launched: • REC-1245: DAHLIA (RBM39 degrader for solid tumors) – Phase 1/2 • REC-4881: TUPELO (FAP) – Phase 1b/2 • REC-3964: ALDER (C. difficile) – Phase 2 CTA/IND updates for additional programs: • REC-4539: IND clearance for LSD1 (SCLC) • REC-3565: CTA for MALT1 (B-cell malignancies) • REC-4209: Initiated IND-enabling studies (IPF) • REV102: Initiated IND-enabling studies (HPP)

O T H E R R A R E O N C O L O G Y Candidate Target Indication Preclinical IND-Enabling Phase 1/2 Pivotal / Phase 3 Status & Anticipated Milestones REC-617 CDK7 Advanced solid tumors1 ✓ Ph1/2 interim data presented2 in 4Q24 • Combination study initiation – 1H25 REC-1245 RBM39 Biomarker-enriched solid tumors & lymphoma ✓ FPD – 4Q24 • Ph 1 dose-escalation update – 1H26 REC-3565 MALT1 B-cell malignancies ✓ CTA Clearance – 4Q24 • Ph 1 FPD – 1H25 REC-4539 LSD1 Small-cell lung cancer (SCLC) ✓ IND Clearance – 1Q25 • Ph 1 FPD – 1H25 REC-994 Superoxide Cerebral cavernous malformations (CCM) ✓ Ph 2 data presented3 in 1Q25 • Program update – 2H 2025 REC-4881 MEK1/2 Familial adenomatous polyposis (FAP) • Ph 1b/2 safety & early efficacy – 1H25 REC-2282 HDAC Neurofibromatosis type 2 (NF2) ✓ Ph 2 fully enrolled – 3Q24 • PFS6 futility – 1H25 REV1024 ENPP1 Hypophosphatasia (HPP) ✓ IND-enabling studies initiated REC-3964 TcdB Prevention of recurrent C. difficile (rCDI) ✓ FPD – 4Q24 • Ph 2 update – 1Q26 REC-4209 Undisclosed Idiopathic pulmonary fibrosis (IPF) • IND-enabling studies ongoing ~10 advanced discovery programs including a PI3Kα H1047Ri ELUCIDATE POPLAR ALDER TUPELO SYCAMORE EXCELERIZE ENLYGHT DAHLIA 5 Pipeline of ~10 clinical and preclinical technology-enabled programs 1. Includes non-small cell lung cancer (NSCLC), colorectal cancer, breast cancer, pancreatic cancer, ovarian cancer, head and neck cancer 2. AACR Special Conference in Cancer Research: Optimizing Therapeutic Efficacy and Tolerability through Cancer Chemistry; plenary session presentation 3. International Stroke Conference; late breaking oral abstract 4. Joint venture with Rallybio

2024 Year in Review: Partnerships Delivering Meaningful Milestones Sanofi Advanced two programs through initial milestones, generating $15 million in aggregate payments 6 Roche-Genentech Generated multiple whole-genome phenomaps in oncology and neuro to uncover new targets and potential therapies; $30M in milestones received Bayer Delivered 25 multimodal oncology data packages and LOWE software to enhance research capabilities Merck KGaA Advanced alliance in oncology and immunology targets

2024 Year in Review: Our Platform Leads the Industry in Data, Models, and Compute Compute: • Built Biohive-2 with NVIDIA, believed to be the most powerful wholly-owned and operated supercomputer in biopharma Data Capabilities: • Mapped 1.4 million active ligands to binding pockets for structure-based drug discovery and target deconvolution • Generating up to 16.2M multi-timepoint brightfield images per week • Produced just under 1 million transcriptomes this year (>1.6 million since launch in 2023), including the first genome-scale CRISPR knockout map in primary human cells Foundation Models: • Phenom-2: improves genetic perturbation separation by 60% • MolPhenix: 10X improvement in predicting molecule effects on cell assays compared to previous models • MolGPS: Outperforms state-of-the-art models on 12 of 22 ADMET tasks1 Causal AI models and ClinTech: • Utilizing AI models and Tempus data to build a patient stratification framework in SCLC • Automating site engagement and enrollment to accelerate patient matching 7 1. Ranked in the TDC (Therapeutics Data Commons)

8 Unified Recursion OS with First-in-Class & Best-in-Class capabilities

9 Unified Recursion OS with First-in-Class & Best-in-Class capabilities

10 Recursion OS moves medicines to clinic faster and at a lower cost (Far Left): Time from hypothesis screening to validated hit package for legacy Recursion programs. (Center Left): Legacy Exscientia compounds synthesized from hit to candidate ID. (Center Right): Total spend from hypothesis screening to the completion of IND-enabling studies for legacy Recursion novel chemical entity (NCE) programs that advanced to clinical trials. The cost to IND has been inflation-adjusted using the US Consumer Price Index (CPI) (Far Right). Time to validated lead is the average of >280 legacy Recursion programs since late 2017 through 2024. Industry data adapted from Paul, et al., Nature Reviews Drug Discovery (2010) 9, 203–214

On-track to deliver at least $100M in synergies from the business-combination 11 Operating Expense Update • At least $100 million in synergies with majority of the run rate amount achieved in 2025 • Carved out Vienna operations with 49% ownership in a newly formed company focused on precision oncology, Alpha Biotechnology GmbH • On-track to sub-lease multiple legacy sites • The company will provide a comprehensive update in May 2025 FY2024 REVENUE FY24 pro forma revenue $82.6 million1 CASH $603 million in cash, cash equivalents and restricted cash2 1. Unaudited pro forma consolidated revenue is presented as if the Exscientia business combination had occurred on January 1, 2023. U.S GAAP revenue was $58.8 million in the Recursion consolidated financial statements 2. Recursion noted that the change in Exscientia’s cash and cash equivalents and short term bank deposits from December 31, 2023 to November 20, 2024, the date of the close of the acquisition was $184 million Expected cash runway into 2027

Positioned for a catalyst-rich 2025 12 Pipelines REC-994 (Superoxide Scavenger) in CCM Late breaker oral presentation (Phase 2) at International Stroke Conference Feb 5th, 2025 REC-3565 (MALT-1i) in B-cell malignancies Phase 1 first patient dosed 1H25 REC-617 (CDK7i) in advanced solid tumors Initiation of combination studies 1H25 REC-4881 (MEK1/2i) in FAP Phase 1b/2 safety and early efficacy data 1H25 REC-2282 (HDACi) in NF2 PFS6 futility analysis 1H25 REC-4539 (LSD-1i) in SCLC Phase 1 first patient dosed 1H25 REC-617 (CDK7i) in advanced solid tumors Additional Phase 1 data from ELUCIDATE 2H25 Advancement of discovery programs including PI3Kα H1047Ri FY25 Partnerships Potential for additional phenomap options Potential for multiple new project initiations Potential for multiple programs optioned by partners Platform Updates on early clinical development AI build in Recursion OS Updates on industry-leading foundation models at multiple biological levels Integration of technology and autonomous workflows to support best- and first-in-class programs

13 Full-stack Recursion OS is industrializing first-in-class & best-in- class drug discovery

14 The Race to Accurately Simulate Biology at Scale

MICRO Pathway Model MACRO Largest, fit-for-purpose perturbative biology + foundation models make Recursion a leader Protein Model Increasingly commoditized – Partnering with builders of frontier models for early access Atomistic Model AI + QM/MD + Compute = Recipe for leadership 15 The Race to Accurately Simulate Biology at Scale Patient Models Real-world patient data + AI

Build internal pipeline in indications with potential for advance transformational medicines for patients Pipeline strategy • Oncology • Rare disease • Other areas of high unmet need Partnership strategy Partner in complex therapeutic areas requiring large financial commitment or competitive arbitrage Leverage partner knowledge and clinical development capabilities • Neuroscience • Oncology • Immunology • Other large, intractable areas of biology License subsets of data and key tools Direct generation of new data internally to maximize pipeline and partnership value-drivers Data strategy • Licensing • Augment Recursion OS • LOWE P IP E L IN E P A R T N E R S H IP D A T A 16 Recursion OS We harness value from the Recursion OS with a multi-pronged capital efficient business strategy

VALUE CREATION Pipeline

Oncology PIPELINE

• Aberrant CDK7 overexpression common in advanced transcriptionally- addicted solid tumors • Potential to address multiple indications, including post CDK4/6 population patients • Potential Best-in-Class and First-in-Class CDK7 Inhibitor • Designed with reduced transporter interactions to minimize GI adverse events seen with competitor molecules • Reversible CDK7 inhibitor • Dual function that targets both cell cycle progression and transcriptional regulation ~185,000 Treatable US + EU1 Mechanism of Action Unmet Need Differentiation Recursion Approach • AI-powered precision design to optimize PK/PD and maximize potential therapeutic index What’s Next • Combination studies initiation expected in 1H25 • Additional Phase 1 data expected in 2H25 19 Development Strategy Phase 2 Combination Dose Expansion Phase 1 Monotherapy Dose Escalation Q1 2025 CURRENT STAGE EXPECTED STAGES Phase 1 Combo (SERD) Dose Escalation H2 2025 • REC-617 safe and well-tolerated in Phase 1 dose escalation with no treatment-related discontinuations Key Clinical Data 136 Novel compounds synthesized to candidate ID ONCOLOGY Advanced Solid Tumors (CDK7 Inhibitor): REC-617* 1 cPR At week 16 (-34%) in late-line ovarian cancer patient ~44% Reduction in CA125 in late-line ovarian cancer patient 1. Advanced solid tumors including breast, NSCLC, ovarian, pancreatic, colorectal and head & neck. US and EU5 treatable incidence, 2022. 2. Besnard et al, AACR (2022). 3. PK studies conducted in CD1 mice, single-dose administration. >10 hr IC80 results in significant body weight loss.

• Molecular glue RBM39 degrader via E3 ligase adaptor DCAF15 • Disrupts RNA splicing to downregulate cell cycle checkpoints, DDR networks, triggering cell stress, apoptosis • Potential First-in-Class RBM39 Degrader • No significant in vitro safety concerns (hERG, CEREP) • Solid tumor and lymphoma patients experience disease progression while on frontline therapies • Potential as a single agent or in combination with chemo/IO • REC-1245 shows significant monotherapy regressions • Dose-dependent anti-tumor activity correlates with PD Key Preclinical Data Mechanism of Action Unmet Need Differentiation Development Strategy Phase 2 Monotherapy Dose Expansion Phase 1 Monotherapy Dose Escalation CURRENT STAGE EXPECTED STAGES 20 Phase 1 Monotherapy Dose Confirmation Recursion Approach • Unbiased ML-powered phenomap insight to identify novel DDR signature and relate cellular phenotypes What’s Next • Phase 1 update in dose- escalation expected in 1H26 >100,000 Treatable US + EU1 204 Novel compounds synthesized to candidate ID 18 months From Target ID to IND-Enabling studies ONCOLOGY PD: Target Engagement3CDX Model: OVK182 Solid Tumors & Lymphoma (RBM39 Degrader): REC-1245 1. Internal company estimates. Assumes US+EU5 addressable incidence with biomarker-enriched solid tumors and other select histologies. 2. N=8 mice per group REC-1245 administered BID PO at doses noted. 3. PD evaluated after 5 days BID oral administration of REC-1245 at doses noted; N=3 mice per group in PD portion.

• Mutations causing constitutive MALT1 protease activity and MALT1-cIAP fusions are aggressive with limited treatment options • Potential to enhance NF-κB inhibition with BTK inhibitors • Reversible allosteric MALT1 inhibitor • Dampens NF-κB signaling which drives survival and proliferation of B-cell tumors including ABC-DLBCL, MCL, FL, and CLL Mechanism of Action Unmet Need ~41,000 Treatable US + EU51 21 • Potential Best-in-Class MALT1 Inhibitor • Low UGT1A1 anticipated liability versus competitors • No significant off-target safety concerns (CEREP, Kinome) Differentiation Development Strategy Phase 1 Combination Dose Expansion Phase 1 Combination Dose Escalation Phase 1 Monotherapy Dose Escalation Q1 2025 EXPECTED STAGES • REC-3565 monotherapy shows significant tumor regression • Sustained anti-tumor activity in combo with zanubrutinib Key Preclinical Data 70% Of mice in combination arm (REC-3565 + zanu) had no palpable tumors 10-days post last dose Recursion Approach • AI-powered precision designed novel molecule using molecular dynamics and hotspot analysis What’s Next • Phase 1 First Patient Dosed in B-Cell Malignancies (e.g., chronic lymphocytic leukemia) expected in 1H25 344 Novel compounds synthesized to candidate ID ONCOLOGY CDX Model: OCI-Ly102 B-Cell Malignancies (MALT1 Inhibitor): REC-3565* 1. Cerner Enviza Treatment Architecture Reports 2023, rounded to nearest 1,000 patients per year. 2. Payne et al. ENA, (2024).

• SCLC is a highly progressive disease with 5-year OS ~3% in the extensive stage • Clinical trial enrollment remains NCCN-recommended after 1L chemo/IO, despite advancements with DLL3-targeting BiTEs2 • Potential Best-in-Class LSD1 Inhibitor • Shorter-predicted half-life plus reversible MOA to manage on-target AEs • Dose-dependent efficacy in SCLC human xenograft model • Well tolerated with limited impact on platelet levels • Reversible LSD1 inhibitor that can selectively upregulate NOTCH signaling • Promotes differentiation of neuroendocrine cancer cells Key Preclinical Data Mechanism of Action Unmet Need Differentiation >45,000 Treatable US + EU51 22 Recursion Approach • Precision design using Active Learning, combining reversibility with CNS penetration What’s Next • Phase 1 First Patient Dosed in SCLC expected in 1H25 Development Strategy Phase 1 Combination Dose Expansion Phase 1 Combination Dose Escalation Phase 1 Monotherapy Dose Escalation H1 2025 EXPECTED STAGES 414 Novel compounds synthesized to candidate ID ONCOLOGY Plasma ProGRP4CDX Model: H14173 Small-Cell Lung Cancer (LSD1 Inhibitor): REC-4539* 1. EvaluatePharma Epidemiology 2023 (US and EU5). 2. Referenced with permission from the NCCN Clinical Practice Guidelines in Oncology (NCCN Guidelines®) for Small Cell Lung Cancer V.3.2025. 3. Payne et al. AACR, (2023). 4. Data on File.

PIPELINE Rare disease

• Reduces lesion number & size in preclinical models • Phase 2 primary endpoint of safety and tolerability met • REC-994 400 mg improved clinical function (mRS) in in CCM patients, including those with brainstem lesions • No approved therapy • Surgical resection or stereotactic radiosurgery is non curative and not always feasible because of location • Potential First-in-Disease oral therapeutic for CCM • No TEAEs leading to discontinuation up to 800 mg in Ph 13 • Selective, orally bioavailable redox-cycling nitroxide • Promotes the metabolism of ROS to reduce oxidative stress within cells • Stabilizes endothelial barrier function Mechanism of Action Unmet Need Differentiation Development Strategy ~360,000 Symptomatic US + EU51 Phase 2b/3 Contingent on FDA feedback Phase 2 LTE ongoing 24 Recursion Approach • Unbiased ML-aided phenotypic drug screen to identify effective therapeutics driving CCM What’s Next • LTE ongoing • Program updates expected in 2H25CURRENT STAGE FDA mtg EXPECTED STAGES H2 2025 80% Of Ph2 patients continued to LTE ODD In US + EU RARE DISEASE Key Data • Cerebral Cavernous Malformation (Superoxide Scavenger): REC-994 Baseline 12 months ~38% Reduction in baseline lesion volume in 39 yr old female diagnosed with sporadic CCM brainstem lesion 1. Prevalence for hereditary and sporadic symptomatic population; Internal company estimates. 2. Gibson et al, Circulation (2015) and Data on File. 3. Alfa et al, Pharmacol Res Perspect (2024). LTE: long-term extension; ODD: Orphan Drug Designation

• No approved therapy • Colectomy during adolescence is standard of care • Patients at significant risk of GI cancer and suffer substantial decrease in quality-of-life • Potential First-in-Disease and Best-in-Class for FAP • Potent, non-competitive, allosteric MEK1/2 inhibitor • Oral 4 mg dose is pharmacologically active • APCmin/- mouse model: Significantly reduces polyp count and pre-cancerous adenoma, outperforming celecoxib • Loss of APC drives FAP disease progression through aberrant pathway signaling (e.g., Wnt/B- catenin, MAPK signaling) • REC-4881 selectively blocks the activation of ERK (MAPK pathway) Key Preclinical Data2 Mechanism of Action Unmet Need Differentiation Development Strategy Phase 2 Dose Expansion Phase 2 Dose escalation H1 2025 H2 2025 25 ~50,000 Diagnosed US + EU51 Recursion Approach • Unbiased ML-aided phenomap insight in human cancer cells What’s Next • Phase 1b/2 safety & early efficacy data expected in 1H25 Preliminary Data EXPECTED STAGESCURRENT STAGE Mean Polyps Per Group2 % Pre-Cancerous Polyps2 FTD In US ODD In US + EU RARE DISEASE Familial Adenomatous Polyposis (MEK1/2 inhibitor): REC-4881 1. Prevalence for adult and pediatric population, Internal company estimates. 2. Data on file. FTD: Fast Track Designation; ODD: Orphan Drug Designation

• Potential First-in-Class and Best-in-Class ENPP1 Inhibitor • Non-immunogenic small molecule offering potentially safer solution than ERT (3-6 injections per week) • Opportunity to significantly reduce costs & treatment burden • Many patients, particularly adults, may have difficulty accessing ERT • Those who can access ERT face high treatment burden and tolerability hurdles • Improvement in mineralization in mouse models of HPP • Significantly reduced PPi levels to that of wild-type mice • ENPP1 inhibition is a genetically validated target in HPP models • Potent ENPP1 inhibitor that restores PPi balance and enables bone mineralization Key Preclinical Data2 Mechanism of Action Unmet Need Differentiation Development Strategy >7,800 Diagnosed prevalence US + EU51 26 Recursion Approach3 • Precision designed for both high potency and a lifetime of chronic dosing • Structurally distinct differences vs competitor ENPP1 inhibitors • Maintain selectivity and deliver a candidate with high oral bioavailability in the clinic What’s Next • IND-enabling studies ongoing IND-Enabling Studies Phase 1 Healthy Volunteers 20262025 EXPECTED STAGES RARE DISEASE WT Mouse Model Adult-onset HPP model Bone Morphometric Analysis Pathologic soft tissue calcification REV101-TreatedControl L3 Vertebrate (n=5)Distal Femur (n=5) ControlWildtype REV101- TreatedControlWildtype REV101- Treated Plasma Levels of PPi Hypophosphatasia (ENPP1 Inhibitor): REV102 1. HPP prevalence at birth. Mornet et al, 2020. 2. Narisawa et al. ASBMR (2024). 3. Joint venture with Rallybio ERT= Enzyme Replacement Therapy

• No approved therapy • Surgery/RT is standard of care (when feasible)2 • Location may make complete resection untenable, leading to hearing loss, facial paralysis, poor balance and visual difficulty • Potential First-in-Disease and Best-in-Class for NF2 • Potential to rescue disease-inducing effects of NF2 loss • Prevents growth & regrowth of NF2-deficient meningioma model in mice3 • Loss of Merlin (NF2) leads to PI3K signaling and meningioma proliferation • REC-2282 indirectly facilitates AKT dephosphorylation by disrupting the PP1-HDAC interaction Key Preclinical Data Mechanism of Action Unmet Need Differentiation Development Strategy ~33,000 Treatable US + EU51 Phase 2 NF2 meningioma 2-arm study Futility analysis H1 2025 27 Recursion Approach • Unbiased ML-aided phenomap insight and drug screen in human cells What’s Next • Phase 2 PFS data maturing • Futility analysis (PFS6) expected in 1H25 CURRENT STAGE EXPECTED STAGES FTD In US ODD In US + EU RARE DISEASE + REC-2282 (months) + Normal diet (months) Neurofibromatosis Type 2 (HDAC Inhibitor): REC-2282 1. Annual US and EU5 incidence for all NF2-driven meningiomas. 2. Rogers et al. J Neurosurg, (2015). 3. Data on File. FTD: Fast Track Designation; ODD: Orphan Drug Designation

Other areas of high unmet need PIPELINE

• Limited treatment options for high-risk population with recurrent CDI cases • Ability to address populations not eligible for FMT or microbiome-based therapies • Potential First-in-Class as non-antibiotic oral for rCDI • Highly potent and well-tolerated with no reported DLTs, SAEs or treatment-related discontinuations in Phase 1 • REC-3964 significantly extended survival vs bezlotoxumab alone at the end of treatment (p<0.001, log rank test)2 • Highly potent, orally bioavailable C. diff toxin B (TcdB) selective inhibitor • Selectively inhibits catalytic activity of bacterial glucosyltransferase Key Preclinical Data Mechanism of Action Unmet Need Differentiation Development Strategy ~175,000 Recurrent C. diff cases US1 29 Recursion Approach • Unbiased ML-aided conditional phenotypic drug screen in human cells What’s Next • Phase 2 update expected in 1Q26 Phase 2 CURRENT STAGE 250 mg orally BID 500 mg orally BID Observational Patients with rCDI Vancomycin 123 Novel compounds synthesized to candidate ID OTHER C. difficile (C. diff Toxin B Selective Inhibitor): REC-3964 1. Incidence of addressable US cases of recurrent CDI, Shields et al., Anaerobe (2016). 2. N=10 hamsters per group. C. difficile strain 630, Data on File.

• Approved therapies show modest slowing of IPF progression • No improvement in survival (mOS 3-5 years) or quality of life with current treatments • Potential First-in-Class treatment for IPF • Potential for safe and well-tolerated novel treatment • In vitro models suggest capability of reversing the fibrotic process driving IPF progression • REC-4209 at low doses reduces total lung collagen by 45% to 60% versus vehicle mice2 • Reversible, orally bioavailable, and potent Target Epsilon inhibitor • Promotes tissue repair and has potential to reverses fibrosis likely by modulating TGF-ß • Modulator of immuno-mesenchymal populations in fibrosis, which reduces fibrotic markers in in vivo and in vitro models of fibrotic disease Key Preclinical Data Mechanism of Action Unmet Need Differentiation Development Strategy Control Vehicle 0.03 0.1 0.3 0 1,000 2,000 3,000 4,000 5,000 Total Lung Collagen Lu ng O H P (u g/ lu ng ) 30 ~130,000 Diagnosed prevalence US1 Recursion Approach • Unbiased ML-powered phenomap drug screen in human cells What’s Next • IND-enabling studies ongoing IND-Enabling Studies CURRENT STAGE Phase 1 Healthy Volunteers 20252024 EXPECTED STAGES 204 Novel compounds synthesized to candidate ID OTHER REC-4209 mg/kg (PO, BID) + Bleomycin **** Idiopathic Pulmonary Fibrosis (Target Epsilon - Undisclosed): REC-4209 1. Global Data, Internal company estimates on IPF prevalence, Collard et al., Chest (2014). 2. Groups compared against Vehicle. ****p<0.0001; one-way ANOVA with Tukey’s multiple comparison test. Data reflects mean ± 95% CI.

Partnerships & Data Strategy VALUE CREATION

Build internal pipeline in indications with potential for advance transformational medicines for patients Pipeline strategy • Oncology • Rare disease • Other areas of high unmet need Partnership strategy Partner in complex therapeutic areas requiring large financial commitment or competitive arbitrage Leverage partner knowledge and clinical development capabilities • Neuroscience • Oncology • Immunology • Other large, intractable areas of biology License subsets of data and key tools Direct generation of new data internally to maximize pipeline and partnership value-drivers Data strategy • Licensing • Augment Recursion OS • LOWE P IP E L IN E P A R T N E R S H IP D A T A 32 Recursion OS We harness value from the Recursion OS with a multi-pronged capital efficient business strategy

T E C H P A R T N E R S H I P S $20M upfront with up to $674M in aggregate and with mid-single to low-double digit tiered royalties ONCOLOGY & IMMUNOLOGY $30M upfront and $50M equity investment. Increased per program milestones up to $1.5B in aggregate with low- to mid-single digit tiered royalties on net sales for up to seven programs ONCOLOGY $100M upfront with the potential of $5.2B in total milestones plus high- single digit to mid-teen tiered royalties ONCOLOGY & IMMUNOLOGY $150M upfront and up to 40 programs in neuroscience and one indication in gastrointestinal cancer, each of which could yield more than $300M in development, commercialization and net sales milestones with mid-to high-single digit tiered royalties on net sales NEUROSCIENCE & ONCOLOGY 33 Recursion OS Partnerships with approximately $450M1 earned to date and potential to receive more than $20B2 in additional milestones 1. Upfront and milestone payments from these therapeutic partnerships 2. Additional milestone payments, excluding royalties

We harness value from the Recursion OS with a multi-pronged capital efficient business strategy Build internal pipeline in indications with potential for advance transformational medicines for patients Pipeline strategy • Oncology • Rare disease • Other areas of high unmet need Partnership strategy Partner in complex therapeutic areas requiring large financial commitment or competitive arbitrage Leverage partner knowledge and clinical development capabilities • Neuroscience • Oncology • Immunology • Other large, intractable areas of biology License subsets of data and key tools Direct generation of new data internally to maximize pipeline and partnership value-drivers Data strategy • Licensing • Augment Recursion OS • LOWE P IP E L IN E P A R T N E R S H IP D A T A 34 Recursion OS

We license subsets of data and key tools to generate new data to maximize pipeline and partnership value-drivers Recursion OS Preferential access to >20 PBs of real-world, multi-modal oncology data and ability to train causal AI models with utility in target discovery, biomarker development & patient selection. REAL-WORLD DATA ACCESS Access to hundreds of thousands of de-identified records to train causal AI models and design biomarker & patient stratification strategies across broad disease areas. REAL-WORLD DATA ACCESS Partnership on advanced computation, priority access to compute hardware or DGXCloud Resources. COMPUTATION & ML/AI Explore generative AI capabilities, drive improved search and access, scaled compute resources, improved management of data, and continued data privacy and security support. COMPUTATION & ML/AI Utilizes Recursion’s predicted protein- ligand interactions for ~36B compounds from Enamine’s REAL Library. CHEMINFORMATICS & CHEMICAL SYNTHESIS 35

LOWE puts the Recursion OS at your fingertips via natural language without any coding expertise required 36 Note: Large Language Model-Orchestrated Workflow Engine (LOWE) is Recursion’s LLM-based software that can perform complex drug discovery tasks and orchestrate both wet-lab and dry-lab components of the Recursion OS using a natural language interface.

Culture and Team

Board of Directors Dean Li, MD PHD Co-Founder of RXRX, President of Merck Research Labs Zavain Dar Co-Founder & Partner of Dimension Rob Hershberg, MD PHD Co-Founder, CEO, & Chair of HilleVax; Former EVP, CSO, & CBO of Celgene Zachary Bogue Co-Founder & Partner of Data Collective Najat Khan, PHD Chief R&D Officer & Chief Commercial Officer Franziska Michor, PHD Chair at Dana-Farber Cancer Institute & Professor at Harvard University Executive Team Ben Mabey Chief Technology Officer Kristen Rushton Chief Operations Officer Ben Taylor Chief Financial Officer & President Recursion UK Nathan Hatfield Chief Legal Officer David Mauro, MD PHD Chief Medical Officer Matt Kinn Chief Business Officer Najat Khan, PHD Chief R&D Officer & Chief Commercial Officer Erica Fox Chief People & Impact Officer David Hallett, PHD Chief Scientific Officer Lina Nilsson, PHD SVP, Head of Platform Blake Borgeson, PHD Co-Founder of RXRX 38 Chris Gibson, PHD Co-Founder, & Chief Executive Officer Chris Gibson, PHD Co-Founder & Chief Executive Officer Our leadership brings together experience & innovation to advance TechBio Note: Trademarks are the property of their respective owners and used for informational purposes only.

Parity Pledge Signer: Gender parity and people of color parity Technology – data science, software engineering, automation, etc. Life Sciences – biology, chemistry, development, etc. Strategic Operations ~800 employees Community Impact Founding Partner, Life Science Accelerator Founding Member, Life Science Collective ESG Highlights Learn more about Recursion’s ESG stewardship: www.recursion.com/esg Milpitas, California Salt Lake City, Utah Toronto, Ontario Montréal, Québec London, England Oxford, England New York, New York Headquartered in Salt Lake City, Utah with other primary locations in: • Milpitas, California • New York, New York • Toronto, Ontario • Montréal, Québec • London, England • Oxford, England 39 Our people are the most important ingredient for our mission

Pipeline Details APPENDIX

Oncology PIPELINE

Program Status • Potential Best-in-Class and First-in-Class CDK7 inhibitor • Phase 1/2 study in advanced solid tumors ongoing • Initial Phase 1 monotherapy safety, PK/PD update presented at AACR Special Conference in Cancer Research held on December 9, 2024 Mechanism of Action • Reversible CDK7 inhibitor that targets both cell cycle progression and transcriptional regulation Thesis & Differentiation • Non-covalent binding and improved selectivity to decrease off- target toxicity • 8-10 hours of therapeutic coverage at IC80 with a short half-life to reduce on-target toxicity • Rapid absorption and permeability at lowest possible dose Unmet Need1 • Multiple cancer indications that have the potential to address ~185,000 patients annually • R/R solid tumors including breast, NSCLC, ovarian, pancreatic, colorectal, and head & neck 42 Recursion Approach • AI-powered precision design to optimize PK/PD to maximize potential therapeutic index • 136 novel compounds synthesized to candidate ID REC-617: CDK7 Inhibitor A precision designed highly selective CDK7 inhibitor for Relapsed and/or Refractory (R/R) Solid Tumors 1. Advanced solid tumors including breast, NSCLC, ovarian, pancreatic, colorectal and head & neck. US and EU5 treatable incidence, 2022.

Assay DC Criteria Ph 1 Competitor Ph 1/2 Competitor REC-617 CDK7 IC50 (nM) <10 CDK family selectivity >100-fold HCC70 (breast cancer) IC50 (nM) <100 Caco-2 A2B (efflux) 10⁻⁶ cm/s >5 (<3) Predicted human half-life (hr) <15 Potent tumor regression with minimal IC80 exposureREC-617 has Best-in-Class potential1 Designed to avoid efflux transporter substrate to minimize GI adverse events Key Preclinical Data 43 Meets or exceeds criteria Minor deviation Major deviation Development Candidate (DC) Criteria: • CDK7 IC50: green <10nM; yellow 10-30nM; red >30nM • CDK7 selectivity: green >100-fold; yellow 30-100-fold; red <30-fold • HCC70 IC50: green <100nM; yellow 100-500nM; red >500 nM • Caco-2 A2B (efflux): green >5(<3); yellow >1.5 (<10); red <1.5 (>30) • Half-life: green <15, yellow <24, red >24 • REC-617 demonstrates potent tumor regression with less than 10 hours of exposure above IC80 to optimize benefit-risk CDX Model: OVCAR32 Mouse PK3 REC-617: Robust antitumor activity demonstrated in disease relevant preclinical tumor models Initial clinical safety and PK/PD presented at AACR Special Congress in December 2024 1. Data on File. 2. Besnard et al, AACR (2022). 3. PK studies conducted in CD1 mice, single-dose administration. >10 hr IC80 results in significant body weight loss.

Development Strategy Part A • Monotherapy Part B • Initial combination with SERD in HR+/HER2- post CDK4/6 inhibitor population • N = 30-60 patients in combination • N will depend on number of disease specific cohorts Primary Endpoint: • Safety and Tolerability • Recommended Dose RP2D Phase 1 Dose Escalation (N≤60) Phase 1/2 study design CURRENT STAGE Primary Endpoint: • ORR 44 Trial Update • Phase 1 monotherapy preliminary safety and PK/PD data update presented at AACR Special Conference in Cancer Research in December 2024 • Continue dose escalation (QD & BID) • Initiate combination study in 1H25 • Leverage new tech and clinical data partnerships for patient stratification REC-617 Competitive Profile • Potential Best-in-Class CDK7 inhibitor • Reduced risk of off-target toxicity • Highly selective & potent REC-617 (CDK7 inhibitor): Study Design and Next Steps

REC-617 (CDK7 inhibitor): REC-617 achieves dose dependent PK/PD and strong target modulation in the clinic 45 PK/PD Summary • Dose-Linear PK: REC-617 exceeds CDK7 IC80 with rapid absorption (Tmax 0.5–2h) and short t½ (5–6h) • Robust Target Engagement: Early POLR2A 3-4x modulation suggests ~80–90% target engagement1 • Rapid Transient Modulation: Quick, time-limited target engagement with POLR2A normalization in 24h • BID Evaluation: Twice-daily dosing under investigation 1. Papadopoulos KM, et al. ENA (2020).

REC-617 (CDK7 inhibitor): REC-617 offers a competitive and unique profile that potentially improves the therapeutic index 46 Key Differentiation • Data suggests superior target coverage for REC- 6171 compared to two clinical CDK7 inhibitors • REC-617 is more rapidly absorbed (earlier Tmax) compared to reported PK from two CDK7 inhibitors2,3 suggesting a reduction in localized GI residence time • A shorter half-life would allow for flexible target modulation, which may improve the therapeutic index in the clinic 0 4 8 12 16 20 24 0.01 0.1 1 10 100 Time (hr) F r e e P la s m a C o n c e n tr a ti o n / I C 8 0 CDK7 IC80 Coverage REC-617 20 mg QD SY-5609 3 mg QD3 Samuraciclib 360 mg QD2 1. CDK7 IC80 reflects biochemical in vitro potencies on file. 2. Coombes, RC, Nat Comms (2023). 3. Papadopoulos KM, et al. ENA (2020).

REC-617 (CDK7 inhibitor): Durable monotherapy PR observed in a metastatic ovarian cancer patient after 4 prior lines of therapy 47 Baseline Week 16 Para-aortic LN Para-aortic LN Clinical Updates • Continue dose escalation (QD & BID) • Initiate combination study in 1H25 • Leverage new tech and clinical data partnerships for patient stratification One confirmed, durable partial response (PR)1 • Partial response (-34%) achieved at Week 16 • Meaningful reduction of tumor markers • Response ongoing after 6+ months treatment Early data indicates favorable safety profile • Maximum tolerated dose (MTD) not reached ~44% ~68% 1. By RECIST 1.1. Response evaluation criteria in solid tumors, PR: decrease of more than 30% in the sum of the longest diameters of target lesions + no new lesions + no progression of non target lesions.

Program Status • Potential First-in-Class RBM39 degrader in solid tumors • First patient dosed in 4Q24 • Phase 1 monotherapy update on dose-escalation expected in 1H26 Mechanism of Action • Molecular glue that degrades RBM39 via E3 ligase adaptor DCAF15 • Disrupts RNA splicing to downregulate cell cycle checkpoints and DDR networks Thesis & Differentiation • RBM39 phenotypically mimics CDK12 and is distinct from CDK13 in Recursion OS • Novel approach to target DDR biology via RBM39 avoids on-target toxicities associated with cell cycle checkpoint inhibitors (e.g., CDK12, WEE1, ATR, ATM, PLK1) • Selective RBM39 degrader with minimal ITGA2 liability to limit thrombocytopenia Unmet Need1 • >100,000 patients with solid tumor or lymphoma experience disease progression while on frontline therapies • Potential to be used as a single agent or in combination with chemo/IO 48 Recursion Approach • Unbiased ML-aided genomics screen to identify biological signature and relate cellular phenotypes • Progressed REC-1245 from target biology to IND-Enabling studies in under 18 months (vs. 42 months in industry2) REC-1245: RBM39 Degrader A highly selective RBM39 degrader for Biomarker-Enriched Solid Tumors and Lymphoma 1. Internal company estimates. Assumes US+EU5 addressable incidence with biomarker-enriched solid tumors and other select histologies. 2. Paul et al, Nat Rev Drug Discov (2010).

Similar Opposite Recursion OS Novel Insight Gene: Gene Relationship: Genetic KO of RBM39 and CDK12 found to be phenotypic similar with neither genes demonstrating a relationship to CDK13 genetic KO Gene: Compound Relationship: REC-1245 demonstrates phenotypic similarity to RBM39 and CDK12 genetic KO but not CDK13, in line with inferred hypothesis REC-1245 49 REC-1245 (RBM39 degrader): Platform inferred a functional similarity between RBM39 and CDK12 biology suggesting a novel approach to potential DDR modulation 1. Data on File.

Key Preclinical Data1 REC-1245 is highly selective and potent1 Assay DC Criteria REC-1245 RBM39 Degradation DC50 <100 nM CDK12 Kinase No sig. activity CEREP Safety Panel No sig. activity hERG IC50 (µM) >30 Oral Bioavailability (%F) >30 REC-1245 has compelling efficacy and PK/PD in preclinical models 50 Meets or exceeds criteria Minor deviation Major deviation • REC-1245 shows significant monotherapy regressions • Dose-dependent antitumor activity correlates with PD CDX Model: OVK182 PD: Target Engagement3 REC-1245 (RBM39 degrader): Robust efficacy/PK/PD in biomarker-positive disease relevant preclinical tumor models – Phase 1 initiated in 4Q24 1. Data on File. 2. N=8 mice per group in TV portion. REC-1245 administered BID PO. 3. PD evaluated after 5 days BID oral of REC-1245 at doses noted; N=3 mice per group in PD portion.

Development Strategy Part A • Monotherapy dose-finding Part B • Monotherapy dose- confirmation RP2D Phase 1 Dose Escalation (N~55) Phase 1/2 study design CURRENT STUDY Key Study Characteristics Study objectives: • Safety/Tolerability • RP2D • ORR Eligibility: • Select histologies including a biomarker population and R/R lymphomas 51 Trial Update • First patient dosed in 4Q24 • Trial active and enrolling at 5 US sites • Phase 1 update in dose-escalation in 1H26 REC-1245 Competitive Profile • Highly potent, potential First-in-Class RBM39 degrader (<100nM DC50) • No significant in vitro safety concerns (CEREP, hERG) • No significant activity in CDK12 kinase assay • Minimal ITGA2 liability to limit thrombocytopenia • High oral bioavailability REC-1245 (RBM39 degrader): Study Design and Next Steps DAHLIA: Study of REC-1245 in Participants with Unresectable, Locally Advanced, or Metastatic Cancer

Program Status • Potential Best-in-Class MALT1 inhibitor • Phase 1 initiation in B-Cell Malignancies (e.g., chronic lymphocytic leukemia), expected 1H25 Mechanism of Action • Reversible allosteric MALT1 inhibitor that can dampen NF-κB signaling • Selectively inhibits CLL proliferation with limited impact on T-Cell viability Thesis & Differentiation • Low UGT1A1 liability with potential for reduced risk of hyperbilirubinemia • Potential for reduced liver toxicity and enhanced efficacy in combination with BTK and BCL2 inhibitors • Low predicted human clearance and high oral bioavailability Unmet Need1 • Current monotherapy treatments in B-cell malignancies not curative and prone to resistance • ~41,000 patients with R/R B-cell malignancies (treatable in US and EU5) – targeting CLL combination therapy 52 Recursion Approach • AI powered precision- designed novel molecule using molecular dynamics and hotspot analysis • 344 novel compounds synthesized to candidate ID • Maintain selectivity and deliver a candidate with lower predicted safety risk in the clinic REC-3565*: MALT1 Inhibitor A precision designed selective MALT1 inhibitor for B-Cell Malignancies 1. Cerner Enviza Treatment Architecture Reports 2023, rounded to nearest 1,000 patients per year.

Key Preclinical Data Assay DC Criteria Ph 1 large pharma Ph1 biotech REC-3565 MALT1 IC50 (nM) <100 OCI-Ly3 proliferation IC50 (nM) <400 UGT1A1 IC50 (µM) >10 Caco-2 A2B (efflux) 10⁻⁶ cm/s >5 (<3) REC-3565 has Best-in-Class potential1 Single-agent and synergistic activity in vivo2 • OCI-Ly10 and Rec-1 cells are sensitive to both MALT1i and zanubrutinib in vitro • Administration of REC-3565 as a single agent showed tumor growth regression • Durable tumor growth regression observed when REC-3565 was combined with zanubrutinib Development Candidate (DC) Criteria: • MALT1 IC50 nM: green <100 nM; yellow >100-<300 nM; red>300 nM • OCI-Ly3 IC50 nM: green <400 nM; yellow >400-<1000 nM; red>1000 nM • UGT1A1 IC50 uM: green >10 uM; yellow <10->1 uM; red<1 uM • Caco-2 A2B (efflux): green >5(<3); yellow >1-<5(>3-<10); red <1(>10) 53 Meets or exceeds criteria Minor deviation Major deviation CDX Model: OCI-Ly102 70% Of mice in combination arm (REC-3565 + zanu) had no palpable tumors 10-days post last dose REC-3565 (MALT1 inhibitor): Minimal UGT1A1 liability vs competitors and significant tumor regression observed in vivo with Phase 1 initiation anticipated in 1Q25 1. Data on File. 2. Payne et al. ENA, (2024).

Development Strategy • N ~30 • R/R B-Cell Malignancies • REC-3565 PO QD or BID RD Part A Monotherapy Phase 1 study design Q1 2025 Primary Endpoint: • Safety / tolerability • RD for combination Phase 1 Dose Escalation 54 Trial Update • Trial initiation expected in 1H25 REC-3565 Competitive Profile • Low predicted human clearance and high oral bioavailability • No unexpected in vitro or in vivo safety concerns identified • Well tolerated in rat/dog dose range finding (DRF) studies • GLP-tox studies completed with suitable no- observed-adverse-effect level (NOAEL) enabling clinical trials REC-3565 (MALT1 inhibitor): Study Design and Next Steps

Program Status • Potential Best-in-Class LSD1 inhibitor • Phase 1 initiation in SCLC expected 1H25 Mechanism of Action • Reversible LSD1 inhibitor that can selectively upregulate NOTCH signaling • Promotes differentiation of neuroendocrine cancer cells • Impairs DNA repair pathways sensitizing SCLC cells to immune checkpoint inhibitors Thesis & Differentiation • LSD1 inhibitor designed to be reversible and brain penetrant • Shorter-predicted half life versus competitors to manage on-target toxicity • Highly selective to reduce off-target toxicity • Preclinical data shows therapeutic exposures have minimal effects on platelets, suggesting potential reduced risk of thrombocytopenia Unmet Need1 • >45,000 patients with treatable Stage III/IV SCLC • Limited treatment options post progression on frontline therapies 55 Recursion Approach • Precision design using active learning to select most information rich compounds • 414 novel compounds synthesized to candidate ID • Used multiparameter optimization to design a unique candidate combining reversibility with CNS penetration REC-4539: LSD1 Inhibitor A precision designed unique LSD1 inhibitor with CNS penetrance 1. EvaluatePharma Epidemiology 2023 (US and EU5)

Assay DC Criteria Competitor 1 Competitor 2 REC-4539 Brain: Plasma Ratio >0.5 MDCK-MDR1 Efflux Ratio (Pgp) <2 Predicted Human Half-life QD dosing Key Preclinical Data REC-4539 has Best-in-Class potential1 REC-4539 highly efficacious in SCLC xenograft model2 Development Candidate (DC) Criteria: • Brain:plasma ratio: green >0.5; red <0.5 • MDCK-MDR1 efflux ratio (Pgp): green <2; yellow >2-<10; red >10 • Predicted half-life: green <24 hours; yellow 24-48h hours; red >48 hours 56 Trial Update • Phase 1 First Patient Dosed in SCLC expected in 1H25 Meets or exceeds criteria Minor deviation Major deviation • Dose-dependent regression • Well-tolerated with limited impact on platelet levels CDX Model: H14172 Plasma ProGRP3 REC-4539 (LSD1 inhibitor): Sufficient CNS exposures vs competitors and compelling dose-response demonstrated in vivo with Phase 1 initiation anticipated in 1H25 1. Data on File. 2. Payne et al. AACR (2023). 3. Data on File.

REC-7735 (PI3Kα H1047R): An AI-designed, highly selective H1047R- targeting PI3K inhibitor designed to enhance therapeutic index* 57 Our Approach: AI-powered precision design using automated synthesis and generative molecular design intended to mitigate adverse events seen in class • >100-fold better selectivity against WT PI3Kα, 10x-fold better selectivity vs. other WT sparing inhibitors • Limited hyperglycemia observed in vivo at highest doses (vs. STX-478) • In vivo efficacy superior to SoC (alpelisib) and comparable to STX-478 • CNS penetrant with low- risk of dose-limiting AEs Recursion OS: REC-7735 Discovery PI3Kα H1047R *Program is currently in candidate profiling / late lead optimization