Recursion (Nasdaq: RXRX) a leading clinical stage TechBio company

decoding biology to radically improve lives, today reported

business updates and financial results for its fourth quarter and

fiscal year ended December 31, 2024.

Recursion will host a (L)earnings Call on February 28, 2025 at

8:30 am ET / 6:30 am MT / 1:30 pm GMT from Recursion’s X (formerly

Twitter), LinkedIn, and YouTube accounts giving analysts,

investors, and the public the opportunity to ask questions of the

company by submitting questions here: https://bit.ly/40UiVkb.

“In 2024, Recursion made a transformative leap with the largest

TechBio merger in history, combining our pipeline, partnerships,

people and platform to further accelerate the Recursion OS as the

leading full-stack TechBio platform,” said Chris Gibson, Ph.D.,

Co-Founder and CEO of Recursion. “With a portfolio of 10 clinical

and preclinical programs, including both potential first-in-class

and best-in-class therapies, we are driving towards faster and more

effective drug development. These advances position us at the

forefront of the next generation of medicine, where the impact will

be measured not just in scientific breakthroughs through the power

of our platform, but in real-world patient outcomes at scale.”

1Includes preclinical programs (programs expected to enter the

clinic within the next 18 months); 2Program milestones includes

data readouts, preliminary data updates, regulatory submissions,

trial initiation, etc.

Summary of Business Highlights

Pipeline

- Clinical Results: Recursion demonstrated

promising early efficacy data for two programs in 2024

- REC-617: A potential best-in-class CDK7

inhibitor optimized using our AI platform, delivered early Phase

1/2 results demonstrating promising safety and efficacy, including

a durable partial response in a late-stage metastatic ovarian

cancer patient and stable disease across four other patients with

solid tumors (e.g. CRC, NSCLC). These findings support further

clinical development as the Company continues to explore its

potential in combination regimens.

- REC-994: A potential first-in-disease oral

superoxide scavenger for symptomatic CCM, showing robust safety in

chronic dosing in a Phase 2 study as well as a reduction in lesion

volume as measured by MRI and trends towards symptom stabilization

as evaluated by mRS. The data was featured in a late-breaking oral

presentation at the 2025 International Stroke Conference. Next

steps in this program will be informed by regulatory discussions

and long-term extension data expected in 2025.

- Clinical Advancements and Regulatory

Milestones:

- Pipeline advanced with the initiation of three new clinical

studies:

- DAHLIA: Phase 1/2 trial investigating REC-1245, a potential

first-in-class RBM39 degrader, in biomarker-enriched advanced solid

tumors and lymphoma.

- TUPELO: Phase 1b/2 trial investigating REC-4881 for familial

adenomatous polyposis (FAP).

- ALDER: Phase 2 trial investigating REC-3964, a potential

first-in-class C. diff toxin B inhibitor, for preventing recurrent

C. difficile infection.

- Progressed additional programs:

- REC-4539: received IND clearance for REC-4539 (LSD1 inhibitor)

in small cell lung cancer

- REC-3565: received CTA approval for REC-3565 (MALT1 inhibitor)

in b-cell malignancies

- REC-4209: progressed REC-4209 in idiopathic pulmonary fibrosis

to IND-enabling studies

Partnerships

- Roche-Genentech:

- Gastrointestinal-Oncology Advancements: In partnership with

Roche and Genentech, Recursion has generated multiple whole-genome

phenomaps with chemical perturbations across various

disease-relevant cell types, enabling deeper insights into how

different cellular contexts respond to gene knockouts and

chemicals.

- Neuro-specific CRISPR KO Phenomap: In partnership with Roche

and Genentech, Recursion developed the first whole-genome CRISPR

knockout map in neural iPSC cells, providing valuable data to

identify potential new targets in neuroscience, a field which has

historically suffered from limited new discoveries.

- Milestones and Collaboration: The neuroscience phenomap work

led to the exercise of a $30M option by Roche and Genentech in

August 2024, and the collaboration is already moving forward with

target validation projects.

- Sanofi:

- Immunology & Oncology Achievements: Through this

collaboration, Recursion is using its end-to-end integrated

platform to discover and advance up to 15 novel targets in the

oncology and immunology therapeutic areas.

- In 2024, two programs advanced through initial milestones,

generating $15M in aggregate payments from Sanofi.

- Bayer:

- Oncology Achievements: Completed 25 multimodal oncology data

packages utilizing the Recursion OS platform. Multiple programs are

rapidly progressing to Lead Series nomination.

- LOWE: Additionally, Bayer has adopted Recursion’s LOWE

LLM-orchestrated workflow software to enhance their research

capabilities.

- Merck KGaA (Darmstadt, Germany):

- Ongoing alliance with Merck KGaA, Darmstadt, Germany is focused

on leveraging Recursion’s discovery engine to identify

first-in-class and best-in-class targets across oncology and

immunology, driving innovation in these key therapeutic areas.

Platform

- Full stack AI powered platform: Our

constantly-evolving Recursion OS spans target discovery through

clinical development, enabling efficient molecule design and

testing for both first and best-in-class opportunities.

- Integration of Exscientia’s Precision Chemistry Platform

(Centaur) & Recursion OS:

- Integrated Centaur into more than 10 design cycles for programs

Recursion has previously partnered, with early validation work

achieved and progress accelerating across multiple additional

partnered programs.

- The Recursion OS has been used to identify hit compounds in 7

immune-relevant targets or dual target pairs and early validation

work has commenced to prepare reports for our partners.

- Recursion’s AI synthesis planning capability shows a 25%

improved tractability assessment of AI-generated compounds over

competitors.

- Compute: Launched BioHive-2, the most powerful supercomputer

owned by any biopharma company, enabling the training of

industry-leading foundation models like Phenom-2, MolPhenix, and

MolGPS.

- Protein Target Data Layer: Mapped 1.4 million active ligands to

binding pockets for structure-based drug discovery and target

deconvolution.

- Phenomics: Scaled phenomics experimental capabilities can now

generate up to 16.2 (135 terabytes) million multi-timepoint

brightfield images across up to 2.2 million experiments per

week.

- Transcriptomics: Generated >1.6M individual transcriptomes

since its launch in 2023, with just under 1M generated in 2024

including building the world’s first genome-scale CRISPR knockout

map in primary human cells.

- InVivomics: Grew dataset to 1 million hours of video; 1 million

hours of digital biomarkers and 149,000 environment data

points.

- LLM and Knowledge Graph Integration: Reduced manual effort by

60% for evidence collection for hit nomination packages supporting

entry into hit-to-lead, through knowledge graphs and LLM-based data

aggregation with further reduction expected with additional data

layers.

- Breakthroughs in Foundation Models: Developed

multimodal AI models like Phenom, MolPhenix, and MolGPS that

accelerate Recursion’s ability to make high-confidence predictions

in our therapeutics programs.

- Phenom-2: A 1.9B-parameter model trained on 8B microscopy

images, achieving 60% better linear separability of genetic

perturbations and top performance in biological relationship recall

and consistency.

- MolPhenix: Delivers a 10X improvement over previous models in

predicting the effects of molecules on cell assays and

morphology.

- MolGPS: A 3B-parameter model for molecular property prediction

that outperforms the state of the art on 12 of 22 ADMET tasks in

the Therapeutic data commons (TDC).

- MolE: A new foundation model trained on 842M molecular graphs,

surpassing earlier approaches by ranking first in 10 ADMET tasks in

the TDC.

- Advancement in Causal AI Models & Emerging Focus on

ClinTech: Transforming clinical development with

Recursion’s ClinTech platform and models, focused on:

- Utilizing AI models and Tempus data to build a patient

stratification framework in small cell lung cancer (SCLC). This

work is informing clinical strategies for the planned REC-4539

Phase I study commencing in the first half of 2025.

- Automating key processes like site engagement and enrollment to

accelerate patient matching and industrializing workflows to

accelerate trial initiation.

- Centralizing data systems to optimize clinical protocols,

streamline operations, and significantly reduce costs and site

burden.

Integration & Additional Corporate

Updates

- Recursion completed the combination with Exscientia, becoming

an industry-leading TechBio company, bringing together Recursion’s

biology-first TechBio platform with Exscientia’s chemistry-first

TechBio platform, and creating a compelling set of both first and

best-in-class clinical programs and sector-leading

partnerships.

- Recursion announced it will carve out its Austrian operations

into a newly formed company, Alpha Biotechnology GmbH (“Alpha”).

Recursion will have a 49% ownership in Alpha, a company leveraging

a patient-tissue platform for the development of precision

therapeutics for the treatment of hematological and solid cancers,

while focusing its efforts and moderating spend.

- The company is on-track to sub-lease or otherwise simplify its

real estate footprint post business combination to concentrate

employees in a smaller number of sites while moderating spend.

- Recursion is maintaining its guidance of at least $100 million

in synergies from the transaction, with a majority of the run rate

amount achieved in 2025.

- The company will provide a comprehensive update in May

2025.

Fourth Quarter and Fiscal Year 2024 Financial

Results

Financials reported for the full year 2024 include full year

Recursion financials combined with financials from Exscientia

post-business combination (November 20-December 31, 2024).

- Cash Position: Cash, cash equivalents and

restricted cash were $603.0 million as of December 31, 2024,

compared to $401.4 million as of December 31, 2023. On a combined

basis, Recursion continues to expect cash runway to extend into

2027.

- Revenue: Total revenue, consisting primarily

of revenue from collaborative agreements, was $4.5 million for the

fourth quarter of 2024, compared to $10.9 million for the fourth

quarter of 2023. Total revenue, consisting primarily of revenue

from collaboration agreements, was $58.8 million for the year ended

December 31, 2024, compared to $44.6 million for the year ended

December 31, 2023. For the fourth quarter of 2024, the decrease of

$6.4 million compared to the prior period was due to the timing of

projects from the Company’s Roche and Genentech collaboration. For

the year ended December 31, 2024 the increase of $14.3 million

compared to the prior year was due to revenue recognized from our

Roche and Genentech collaboration related to the completion of

Recursion’s first neuroscience phenomap optioned by Roche and

Genentech for $30 million.

- Pro Forma Revenue: The Company’s unaudited pro

forma consolidated revenue is presented as if the Exscientia

business combination had occurred on January 1, 2023. Pro forma

revenue was $82.6 million for the year ended December 31, 2024,

compared to $72.5 million for the year ended December 31,

2023.

- Research and Development Expenses: Research

and development expenses were $98.3 million for the fourth quarter

of 2024, compared to $69.5 million for the fourth quarter of 2023.

Research and development expenses were $314.4 million for the year

ended December 31, 2024, compared to $241.2 million for the year

ended December 31, 2023. The increase in 2024 research and

development expenses compared to the prior year was driven by our

platform and personnel costs as the Company continues to expand and

upgrade its platform, including chemical technology, machine

learning and transcriptomics platform.

- General and Administrative Expenses: General

and administrative expenses were $77.2 million for the fourth

quarter of 2024 compared to $30.5 million for the fourth quarter of

2023. General and administrative expenses were $178.2 million for

the year ended December 31, 2024, compared to $110.8 million for

the year ended December 31, 2023. The increase in 2024 general and

administrative expenses compared to the prior year was primarily

driven by an increase in salaries and wages of $21.1 million,

transaction costs of $20.5 million, inclusion of Exscientia’s

results of $11.3 million and increases in software and lease

expenses.

- Net Loss: Net loss was $178.9 million for the

fourth quarter of 2024, compared to a net loss of $93.0 million for

the fourth quarter of 2023. Net loss was $463.7 million for the

year ended December 31, 2024, compared to a net loss of $328.1

million for the year ended December 31, 2023.

- Net Cash: Net cash used in operating

activities was $115.4 million for the fourth quarter of 2024,

compared to net cash used in operating activities of $74.1 million

for the fourth quarter of 2023. Net cash used in operating

activities was $359.2 million for the year ended December 31, 2024,

compared to net cash used in operating activities of $287.8 million

for the year ended December 31, 2023. The difference was primarily

driven by (1) higher costs incurred for research and development

and general and administrative due to Recursion’s expansion and

upgraded capabilities and (2) Recursion’s combination with

Exscientia.

- Recursion noted that the change in Exscientia’s cash and cash

equivalents and short term bank deposits from December 31, 2023 to

November 20, 2024, the date of the close of the acquisition was

$184 million. There were no material financings in this

period1:

|

(in thousands) |

November 20, 2024 |

December 31, 2023 |

Change |

|

Cash and cash equivalents |

$ |

277,104 |

|

£ |

259,463 |

|

|

|

|

| Short term bank deposits |

|

- |

|

|

103,586 |

|

|

|

|

| Total - GBP |

N/A |

|

£ |

363,049 |

|

|

|

|

| GBP to

USD rate |

N/A |

|

|

1.27 |

|

|

|

|

|

Total - USD |

$ |

277,104 |

|

$ |

461,072 |

|

$ |

(183,968 |

) |

|

|

|

|

|

|

|

|

|

|

|

1 December 31, 2023 amounts from the above table are from

Exscientia’s 20-F Annual Filing. Recursion noted that Exscientia

reported its results using International Financial Reporting

Standards (IFRS) but that there are no IFRS to U.S. GAAP

differences that would impact the measurement of Exscientia’s

December 31, 2023 cash and cash equivalents and short term bank

deposits amounts. Recursion believes this information helps provide

additional information on Exscientia’s liquidity prior and up-to

the acquisition and a more complete understanding of the Company’s

liquidity, facilitating analysis of the Company’s results.

About Recursion Recursion (NASDAQ: RXRX) is a

clinical stage TechBio company leading the space by decoding

biology to radically improve lives. Enabling its mission is the

Recursion OS, a platform built across diverse technologies that

continuously generate one of the world’s largest proprietary

biological and chemical datasets. Recursion leverages sophisticated

machine-learning algorithms to distill from its dataset a

collection of trillions of searchable relationships across biology

and chemistry unconstrained by human bias. By commanding massive

experimental scale — up to millions of wet lab experiments weekly —

and massive computational scale — owning and operating one of the

most powerful supercomputers in the world, Recursion is uniting

technology, biology and chemistry to advance the future of

medicine.

Recursion is headquartered in Salt Lake City, where it is a

founding member of BioHive, the Utah life sciences industry

collective. Recursion also has offices in Toronto, Montréal, New

York, London, Oxford area, and the San Francisco Bay area. Learn

more at www.Recursion.com, or connect on X (formerly Twitter) and

LinkedIn.

Media ContactMedia@Recursion.com

Investor Contact Investor@Recursion.com

|

Recursion Pharmaceuticals, Inc. |

|

|

|

Consolidated Statements of Operations

(unaudited) |

|

|

|

(in thousands, except share and per share

amounts) |

|

|

|

|

| |

|

Three months ended |

|

Years ended |

| |

|

December 31, |

|

December 31, |

| Revenue |

|

2024 |

|

|

2023 |

|

|

|

2024 |

|

|

2023 |

|

| |

Operating

revenue |

$ |

4,511 |

|

$ |

10,624 |

|

|

$ |

58,488 |

|

$ |

43,876 |

|

|

|

Grant revenue |

|

35 |

|

|

267 |

|

|

|

351 |

|

|

699 |

|

| Total revenue |

|

4,546 |

|

|

10,891 |

|

|

|

58,839 |

|

|

44,575 |

|

| |

|

|

|

|

|

| Operating costs and expenses |

|

|

|

|

|

| |

Cost of revenue |

|

12,794 |

|

|

9,881 |

|

|

|

45,238 |

|

|

42,587 |

|

| |

Research and development |

|

98,333 |

|

|

69,482 |

|

|

|

314,421 |

|

|

241,226 |

|

|

|

General and

administrative |

|

77,186 |

|

|

30,458 |

|

|

|

178,184 |

|

|

110,822 |

|

| Total

operating costs and expenses |

|

188,313 |

|

|

109,821 |

|

|

|

537,843 |

|

|

394,635 |

|

|

|

|

|

|

|

|

| Loss from operations |

|

(183,767 |

) |

|

(98,930 |

) |

|

|

(479,004 |

) |

|

(350,060 |

) |

| |

Other income, net |

|

4,869 |

|

|

4,306 |

|

|

|

14,216 |

|

|

17,932 |

|

| Loss

before income tax benefit |

|

(178,898 |

) |

|

(94,624 |

) |

|

|

(464,788 |

) |

|

(332,128 |

) |

| |

Income tax benefit |

|

(7 |

) |

|

1,628 |

|

|

|

1,127 |

|

|

4,062 |

|

|

Net loss |

$ |

(178,905 |

) |

$ |

(92,996 |

) |

|

$ |

(463,661 |

) |

$ |

(328,066 |

) |

| Per share data |

|

|

|

|

|

|

Net loss per share of Class A, B and Exchangeable common

stock, basic and diluted |

$ |

(0.53 |

) |

$ |

(0.42 |

) |

|

$ |

(1.69 |

) |

$ |

(1.58 |

) |

|

Weighted-average shares (Class A, B and Exchangeable)

outstanding, basic and diluted |

|

336,035,980 |

|

|

233,158,161 |

|

|

|

274,207,146 |

|

|

207,853,702 |

|

| |

|

|

|

|

|

|

|

Recursion Pharmaceuticals Inc |

| |

|

Consolidated Balance Sheets (unaudited) |

| |

|

(in thousands) |

|

|

| |

December 31, |

|

December 31, |

| |

| |

2024 |

|

2023 |

| Assets |

|

|

|

|

Current assets |

|

|

|

|

Cash and cash equivalents |

$ |

594,350 |

|

$ |

391,565 |

|

Restricted cash |

3,045 |

|

3,231 |

|

Other receivables |

49,166 |

|

3,094 |

|

Other current assets |

67,708 |

|

40,247 |

|

Total current assets |

714,269 |

|

438,137 |

|

Restricted cash, non-current |

5,629 |

|

6,629 |

|

Property and equipment, net |

141,063 |

|

86,510 |

|

Operating lease right-of-use assets |

65,877 |

|

33,663 |

|

Financing lease right-of-use assets |

26,273 |

|

_ |

|

Intangible assets, net |

335,855 |

|

36,443 |

|

Goodwill |

148,873 |

|

52,056 |

|

Deferred tax assets |

1,934 |

|

_ |

|

Other assets, non-current |

8,825 |

|

261 |

|

Total assets |

$ |

1,448,598 |

|

$ |

653,699 |

| |

|

|

|

| Liabilities and stockholders’ equity |

|

|

|

|

Current liabilities |

|

|

|

|

Accounts payable |

$ |

21,613 |

|

$ |

3,953 |

|

Accrued expenses and other liabilities |

81,872 |

|

46,635 |

|

Unearned revenue |

61,767 |

|

36,426 |

|

Operating lease liabilities |

13,795 |

|

6,116 |

|

Notes payable and financing lease liabilities |

8,425 |

|

41 |

|

Total current liabilities |

187,472 |

|

93,171 |

|

Unearned revenue, non-current |

118,765 |

|

51,238 |

|

Operating lease liabilities, non-current |

67,250 |

|

43,414 |

|

Notes payable and financing lease liabilities, non-current |

19,022 |

|

1,101 |

|

Deferred tax liabilities |

16,575 |

|

1,339 |

|

Other liabilities, non-current |

4,732 |

|

_ |

|

Total liabilities |

413,816 |

|

190,263 |

|

Commitments and contingencies |

|

|

|

|

Stockholders’ equity |

|

|

|

|

Common stock (Class A, B and Exchangeable) |

4 |

|

2 |

|

Additional paid-in capital |

2,473,698 |

|

1,431,056 |

|

Accumulated deficit |

(1,431,283) |

|

(967,622) |

|

Accumulated other comprehensive loss |

(7,637) |

|

_ |

|

Total stockholders’ equity |

1,034,782 |

|

463,436 |

|

|

|

|

|

|

Total liabilities and stockholders’ equity |

$ |

1,448,598 |

|

$ |

653,699 |

Forward-Looking Statements

This document contains information that includes or is based

upon “forward-looking statements” within the meaning of the

Securities Litigation Reform Act of 1995, including, without

limitation, those regarding Recursion’s positioning at the

forefront of the next generation of medicine and achievement of

faster and more effective drug development, expectations relating

to early and late stage discovery, preclinical, and clinical

programs, including timelines for commencement of and enrollment in

studies, data readouts, and progression toward IND-enabling

studies; expectations and developments with respect to licenses and

collaborations, including option exercises by partners and

additional partnerships, the value of data generated for the

Roche-Genentech partnership, and the promising future of

partnership programs, the progress of Bayer partnership programs to

Lead Series nomination, the acceleration of progress across

multiple partnered programs; prospective products and their

potential future indications and market opportunities; developments

with Recursion OS and other technologies; business and financial

plans and performance, including guidance regarding expected

synergies from the Exscientia combination, reduction of its real

estate footprint, and the timing of a related comprehensive update;

completion of the carve out of the Austrian entity and Recursion’s

investment in Alpha Biotechnology GmbH; and all other statements

that are not historical facts. Forward-looking statements may or

may not include identifying words such as “plan,” “will,” “expect,”

“anticipate,” “intend,” “believe,” “potential,” “continue,” and

similar terms. These statements are subject to known or unknown

risks and uncertainties that could cause actual results to differ

materially from those expressed or implied in such statements,

including but not limited to: challenges inherent in pharmaceutical

research and development, including the timing and results of

preclinical and clinical programs, where the risk of failure is

high and failure can occur at any stage prior to or after

regulatory approval due to lack of sufficient efficacy, safety

considerations, or other factors; our ability to leverage and

enhance our drug discovery platform; our ability to obtain

financing for development activities and other corporate purposes;

the success of our collaboration activities; our ability to obtain

regulatory approval of, and ultimately commercialize, drug

candidates; our ability to obtain, maintain, and enforce

intellectual property protections; cyberattacks or other

disruptions to our technology systems; our ability to attract,

motivate, and retain key employees and manage our growth; inflation

and other macroeconomic issues; and other risks and uncertainties

such as those described under the heading “Risk Factors” in our

filings with the U.S. Securities and Exchange Commission, including

our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q.

All forward-looking statements are based on management’s current

estimates, projections, and assumptions, and Recursion undertakes

no obligation to correct or update any such statements, whether as

a result of new information, future developments, or otherwise,

except to the extent required by applicable law.

Photos accompanying this announcement are available

at:https://www.globenewswire.com/NewsRoom/AttachmentNg/1c9c0293-61d6-4bdb-acf0-b96563e50f72https://www.globenewswire.com/NewsRoom/AttachmentNg/20ff6a72-7f34-4217-bfde-d68945316fad

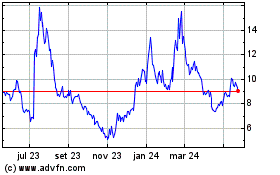

Recursion Pharmaceuticals (NASDAQ:RXRX)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

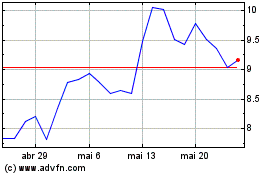

Recursion Pharmaceuticals (NASDAQ:RXRX)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025