Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

06 Março 2025 - 4:18PM

Edgar (US Regulatory)

| | | | | |

| |

| Free Writing Prospectus | Filed pursuant to Rule 433 under the Securities Act |

| (To the Preliminary Prospectus | Registration No. 333-271048 |

| Supplement dated March 5, 2025) | |

Celanese US Holdings LLC

€750,000,000 5.000% Senior Notes due 2031

Term Sheet

March 6, 2025

Terms Applicable to the 5.000% Senior Notes due 2031

| | | | | |

| Principal Amount: | €750,000,000, which represents an increase of €250,000,000 from the amount shown in the Preliminary Prospectus Supplement |

| |

| Title of Securities: | 5.000% Senior Notes due 2031 (the “Notes”) |

| |

| Maturity Date: | April 15, 2031 |

| |

| Offering Price: | 100.000% |

| |

| Coupon: | 5.000% |

| |

| Yield to Maturity: | 5.000% |

| |

| Interest Payment Dates: | April 15 and October 15 of each year, commencing October 15, 2025. Interest will be computed on the basis of a 360 day year comprised of twelve 30-day months. |

| |

| Record Dates: | April 1 and October 1 of each year |

| |

| Optional Redemption: | On and after October 15, 2027, the Issuer may redeem the Notes in whole at any time, or in part from time to time, at its option, at the redemption prices (expressed as percentages of principal amount of the Notes to be redeemed) set forth below, plus accrued and unpaid interest thereon, if any, to but not including the applicable redemption date, if redeemed during the twelve-month period beginning on the October 15 of each of the years indicated below: |

| | | | | | | | | | | |

| Year | Percentage | |

| 2027 | 102.500% | |

| 2028 | 101.250% | |

| 2029 and thereafter | 100.000% | |

| | | | | |

| At any time prior to October 15, 2027, the Issuer may redeem the Notes in whole at any time, or in part from time to time, at its option, at a redemption price equal to 100% of the principal amount of the Notes redeemed plus the Applicable Premium (as defined below) as of, and accrued and unpaid interest, if any, to but not including the redemption date. |

| |

| “Applicable Premium” means, with respect to any Notes on any redemption date, the greater of: (1) 1.0% of the principal amount of such note; and (2) the excess, if any, of (a) the present value at such redemption date of (i) the redemption price of such note at October 15, 2027 (such redemption price being set forth in the table appearing above), plus (ii) all required interest payments due on such note through October 15, 2027 (excluding accrued but unpaid interest to the redemption date), computed using a discount rate equal to the Comparable Government Bond Rate as of such redemption date plus 50 basis points; over (b) the principal amount of such note. |

| |

| | | | | |

| “Comparable Government Bond” means, in relation to any Comparable Government Bond Rate calculation, at the discretion of an independent investment bank selected by the Issuer, a German government bond whose maturity is closest to October 15, 2027, or if such independent investment bank in its discretion determines that such similar bond is not in issue, such other German government bond as such independent investment bank may, with the advice of three brokers of, and/or market makers in, German government bonds selected by the Issuer, determine to be appropriate for determining the Comparable Government Bond Rate. |

| |

| “Comparable Government Bond Rate” means the yield to maturity, expressed as a percentage (rounded to three decimal places, with 0.0005 being rounded upwards), on the third business day prior to the date fixed for redemption, of the Comparable Government Bond on the basis of the middle market price of the Comparable Government Bond prevailing at 11:00 a.m. (London time) on such business day as determined by an independent investment bank selected by the Issuer. |

| |

| Optional Redemption with Equity Proceeds: | Prior to October 15, 2027, the Issuer may, at its option, on one or more occasions, redeem up to 40% of the aggregate principal amount of Notes at a redemption price equal to 105.000% of the aggregate principal amount thereof, plus accrued and unpaid interest thereon, if any, to but not including the applicable redemption date, with an amount of cash not greater than he net cash proceeds of one or more Equity Offerings; provided that at least 50% of the Notes originally issued under the indenture remains outstanding immediately after the occurrence of each such redemption; and provided, further, that each such redemption occurs within 180 days of the date of closing of each such Equity Offering. |

| |

| “Equity Offering” means a public or private sale of Equity Interests of the Issuer or the Parent Guarantor made for cash, or any cash contribution to the equity capital of the Issuer, in each case made after the Issue Date. |

| |

| ISIN/Common Code: | XS3023780375 / 302378037 |

| |

| Issuer: | Celanese US Holdings LLC |

| |

| Guarantors: | Celanese Corporation and certain subsidiaries of the Issuer |

| |

| Joint Book-Running Managers: | J.P. Morgan Securities plc

Citigroup Global Markets Limited

Deutsche Bank Securities Inc.

Merrill Lynch International

HSBC Securities (USA) Inc.

MUFG Securities EMEA plc

UniCredit Bank GmbH

PNC Capital Markets LLC

SMBC Bank International plc |

| |

| Co-Managers: | Morgan Stanley & Co. LLC

Regions Securities LLC

Banco Santander, S.A.

TD Securities (USA) LLC

Truist Securities, Inc.

U.S. Bancorp Investments, Inc. |

| |

| Trade Date: | March 6, 2025 |

| |

| Settlement Date: | March 14, 2025 (T+6) |

| |

| | | | | |

| We expect that delivery of the Notes will be made to investors on or about March 14, 2025, which will be the sixth Business Day following the date of pricing of the Notes (such settlement being referred to as T+6). Under Rule 15c6- 1 under the Securities Exchange Act of 1934, trades in the secondary market are required to settle in one Business Day, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade Notes prior to one Business Day before their delivery will be required, by virtue of the fact that the Notes initially settle in T+6, to specify an alternative settlement arrangement at the time of any such trade to prevent a failed settlement. Purchasers of the Notes who wish to trade the Notes prior to one Business Day before their delivery should consult their advisors. |

| |

| Distribution: | SEC Registered Offering |

| |

| Net Proceeds: | We estimate that the net proceeds from this offering of the Notes will be approximately €742,500,000 after deducting the underwriting discount and before deducting other estimated fees and expenses of this offering. |

| |

| Clearing and Settlement: | Euroclear / Clearstream |

| |

| Denominations: | €100,000 and integral multiples of €1,000 in excess thereof |

| |

| Anticipated Listing: | New York Stock Exchange |

| |

| Concurrent Offerings: | Concurrently with this offering, Celanese US Holdings LLC is offering $700,000,000 aggregate principal amount of 6.500% Senior Notes due 2030 and $1,100,000,000 aggregate principal amount of 6.750% Senior Notes due 2033 (the “Concurrent Offerings”). The Concurrent Offerings are being made by means of a separate prospectus supplement and not by means of the prospectus supplement to which this pricing term sheet relates. This communication is not an offer to sell or a solicitation of an offer to buy any securities being offered in the Concurrent Offerings. The closing of this offering and the Concurrent Offerings are not conditioned on each other. |

Changes to Preliminary Prospectus Supplement

The Issuer has increased the aggregate principal amount of the Notes offered from €500,000,000 to €750,000,000 and has increased the aggregate principal amount of the notes issued in the Concurrent Offerings from $1,500,000,000 to $1,800,000,000.

As a result of the change in offering size, all information (including the disclosure related to offering size, sources and uses of funds, capitalization table, summary financial data and other financial information) presented in the Preliminary Prospectus Supplement is deemed to have changed to the extent affected by the changes described herein.

Solely for the purposes of each manufacturer’s product approval process, the target market assessment in respect of the Notes has led to the conclusion that: (i) the target market for the Notes is eligible counterparties and professional clients only, each as defined in MiFID II; and (ii) all channels for distribution of the Notes to eligible counterparties and professional clients are appropriate. Any person subsequently offering, selling or recommending the Notes (a “distributor”) should take into consideration the manufacturers’ target market assessment; however, and without prejudice to our obligations in accordance with MiFID II, a distributor subject to MiFID II is responsible for undertaking its own target market assessment in respect of the Notes (by either adopting or refining the manufacturers’ target market assessment) and determining appropriate distribution channels.

The Notes are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the United Kingdom. For these purposes, a retail investor means a person who is one (or more) of: (i) a retail client, as defined in point (8) of Article 2 of Regulation (EU) No 2017/565 as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018 (the “EUWA”); or (ii) a customer within the meaning of the provisions of the FSMA and any rules or regulations made under the Financial Services and Markets Act 2000 (the “FSMA”) to implement Directive (EU) 2016/97, where that customer would not qualify as a professional client, as defined in point (8) of Article 2(1) of Regulation (EU) No 600/ 2014 as it forms part of domestic law by virtue of the EUWA. Consequently, no key information document required by Regulation (EU) No 1286/2014 as it forms part of domestic law by virtue of the EUWA (the “UK PRIIPs Regulation”) for offering or selling the Notes or otherwise making them available to retail investors in the UK has been prepared and, therefore, offering or selling the Notes or otherwise making them available to any retail investor in the UK may be unlawful under the UK PRIIPs Regulation.

In addition, in the United Kingdom, the prospectus supplement is being distributed only and is directed only at , and any offer subsequently made may only be directed at persons who (a) have professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the “Order”), (b) are persons falling within Article 49(2)(a) to (d) (“high net worth companies, unincorporated associations, etc.”) of the Order (c) are outside the United Kingdom or (d) are persons to whom an invitation or inducement to engage in investment activity (within the meaning of section 21 of the Financial Services and Markets Act 2000 (the “FSMA”)) in connection with the issue or sale of any Notes may otherwise lawfully be communicated or caused to be communicated (all such persons together being referred to as “relevant persons”). This document must not be acted on or relied on in the United Kingdom by persons who are not relevant persons. In the United Kingdom, any investment or investment activity to which this document relates is only available to, and will be engaged in with, relevant persons. The Notes are being offered solely to “qualified investors” as defined in the Prospectus Regulation as it forms part of United Kingdom domestic law by virtue of the EUWA (the “UK Prospectus Regulation”).

Solely for the purposes of each manufacturer’s product approval process, the target market assessment in respect of the Notes has led to the conclusion that: (i) the target market for the Notes is only eligible counterparties, as defined in the FCA Handbook Conduct of Business Sourcebook, and professional clients, as defined in Regulation (EU) No 600/2014 as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018 (“UK MiFIR”); and (ii) all channels for distribution of the Notes to eligible counterparties and professional clients are appropriate. Any distributor should take into consideration the manufacturers’ target market assessment; however, a distributor subject to the FCA Handbook Product Intervention and Product Governance Sourcebook (the “UK MiFIR Product Governance Rules”) is responsible for undertaking its own target market assessment in respect of the Notes (by either adopting or refining the manufacturers’ target market assessment) and determining appropriate distribution channels.

The Notes are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the EEA. For these purposes, a retail investor means a person who is one (or more) of: (i) a retail client as defined in point (11) of Article 4(1) of Directive 2014/65/EU (as amended, “MiFID II”); (ii) a customer within the meaning of Directive (EU) 2016/97 (as amended, the “Insurance Distribution Directive”), where that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II; or (iii) not a “qualified investor” as defined in the Prospectus Regulation. Consequently, no key information document required by Regulation (EU) No 1286/2014 (as amended, the “PRIIPs Regulation”) for offering or selling the Notes or otherwise making them available to retail investors in the EEA has been prepared and therefore offering or selling the Notes or otherwise making them available to any retail investor in the EEA may be unlawful under the PRIIPs Regulation. For the purposes of this section, the expression an “offer of Notes to the public” in relation to any Notes in any relevant Member State of the EEA means the communication in any form and by any means of sufficient information on the terms of the offer and the Notes to be offered so as to be enable an investor to decide to purchase or subscribe the Notes, as the same may be varied in that Member State by any measure implementing the Prospectus Regulation in that Member State. Neither this prospectus supplement or the accompanying prospectus is a prospectus for the purposes of the Prospectus Directive.

The Issuer has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (the “SEC”) for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement, the preliminary prospectus supplement and other documents the Issuer has filed with the SEC for more complete information about the Issuer and this offering. You may get these documents for free by visiting the Next-Generation EDGAR System on the SEC web site at www.sec.gov. Alternatively, the Issuer or any underwriter will arrange to send you the prospectus if you request it by calling J.P. Morgan Securities plc (for non-U.S. investors) at +44 207-134-2468 or J.P. Morgan Securities LLC (for U.S. investors) at 1-212-834-4533 (collect).

The information in this communication supersedes the information in the preliminary prospectus supplement to the extent it is inconsistent with such information. Before you invest, you should read the preliminary prospectus supplement (including the documents incorporated by reference therein) for more information concerning the Issuer and the Notes.

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

Any disclaimers or other notices that may appear below are not applicable to this communication and should be disregarded. Such disclaimers or other notices were automatically generated as a result of this communication being sent via Bloomberg email or another communication system.

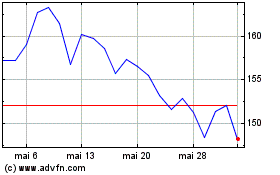

Celanese (NYSE:CE)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Celanese (NYSE:CE)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025