Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

06 Março 2025 - 4:18PM

Edgar (US Regulatory)

| | | | | |

| |

| Free Writing Prospectus | Filed pursuant to Rule 433 under the Securities Act |

| (To the Preliminary Prospectus | Registration No. 333-271048 |

| Supplement dated March 5, 2025) | |

Celanese US Holdings LLC

$700,000,000 6.500% Senior Notes due 2030

$1,100,000,000 6.750% Senior Notes due 2033

Term Sheet

March 6, 2025

Terms Applicable to the 6.500% Senior Notes due 2030

| | | | | |

| Principal Amount: | $700,000,000 (which represents an increase of $200,000,000 from the amount shown in the Preliminary Prospectus Supplement) |

| |

| Title of Securities: | 6.500% Senior Notes due 2030 (the “2030 Notes”) |

| |

| Maturity Date: | April 15, 2030 |

| |

| Offering Price: | 100.000% |

| |

| Coupon: | 6.500% |

| |

Yield to Maturity: | 6.500% |

| |

| Interest Payment Dates: | April 15 and October 15 of each year, commencing October 15, 2025 |

| |

| Record Dates: | April 1 and October 1 of each year |

| |

| Optional Redemption: | On and after April 15, 2027, the Issuer may redeem the 2030 Notes in whole at any time, or in part from time to time, at its option, at the redemption prices (expressed as percentages of principal amount of the 2030 Notes to be redeemed) set forth below, plus accrued and unpaid interest thereon, if any, to but not including the applicable redemption date, if redeemed during the twelve-month period beginning on the April 15 of each of the years indicated below: |

| | | | | | | | | | | |

| Year | Percentage | |

| 2027 | 103.250% | |

| 2028 | 101.625% | |

| 2029 and thereafter | 100.000% | |

| | | | | |

| At any time prior to April 15, 2027, the Issuer may redeem the 2030 Notes in whole at any time, or in part from time to time, at its option, at a redemption price equal to 100% of the principal amount of the 2030 Notes redeemed plus the Applicable Premium (as defined below) as of, and accrued and unpaid interest, if any, to but not including the redemption date. |

| |

| “Applicable Premium” means, with respect to any 2030 Notes on any redemption date, the greater of: (1) 1.0% of the principal amount of such note; and (2) the excess, if any, of (a) the present value at such redemption date of (i) the redemption price of such note at April 15, 2027 (such redemption price being set forth in the table appearing above), plus (ii) all required interest payments due on such note through April 15, 2027 (excluding accrued but unpaid interest to the redemption date), computed using a discount rate equal to the Treasury Rate as of such redemption date plus 50 basis points; over (b) the principal amount of such note. |

| |

| | | | | |

| “Treasury Rate” means, with respect to the 2030 Notes, as of the date of the relevant redemption notice, the weekly average rounded to the nearest 1/100th of a percentage point (for the most recently completed week for which such information is available as of the date that is two business days prior to the date of such redemption notice) of the yield to maturity of United States Treasury securities with a constant maturity (as compiled and published in Federal Reserve Statistical Release H.15 with respect to each applicable day during such week or, if such Statistical Release is no longer published or the relevant information is no longer available thereon, any publicly available source of similar market data) most nearly equal to the period from the date of such redemption notice to April 15, 2027; provided, however, that if the period from the date of such redemption notice to April 15, 2027 is not equal to the constant maturity of a United States Treasury security for which such a yield is given, the Treasury Rate shall be obtained by linear interpolation (calculated to the nearest one twelfth of a year) from the weekly average yields of United States Treasury securities for which such yields are given, except that if the period from the redemption date to April 15, 2027 is less than one year, the weekly average yield on actively traded United States Treasury securities adjusted to a constant maturity of one year shall be used. Any such Treasury Rate shall be determined, and the information required to be obtained for its calculation shall be obtained, by the Issuer. |

| |

| Optional Redemption with Equity Proceeds: | Prior to April 15, 2027, the Issuer may, at its option, on one or more occasions, redeem up to 40% of the aggregate principal amount of 2030 Notes at a redemption price equal to 106.500% of the aggregate principal amount thereof, plus accrued and unpaid interest thereon, if any, to but not including the applicable redemption date, with an amount of cash not greater than the net cash proceeds of one or more Equity Offerings; provided that at least 50% of the 2030 Notes originally issued under the indenture remains outstanding immediately after the occurrence of each such redemption; and provided, further, that each such redemption occurs within 180 days of the date of closing of each such Equity Offering. |

| |

| “Equity Offering” means a public or private sale of Equity Interests of the Issuer or the Parent Guarantor made for cash, or any cash contribution to the equity capital of the Issuer, in each case made after the Issue Date. |

| |

| CUSIP Number: | 15089QAZ7 |

| |

| ISIN Number: | US15089QAZ72 |

Terms Applicable to the 6.750% Senior Notes due 2033

| | | | | |

| Principal Amount: | $1,100,000,000, which represents an increase of $100,000,000 from the amount shown in the Preliminary Prospectus Supplement |

| |

| Title of Securities: | 6.750% Senior Notes due 2033 (the “2033 Notes” and together with the 2030 Notes, the “Notes”) |

| |

| Maturity Date: | April 15, 2033 |

| |

| Offering Price: | 100.000% |

| |

| Coupon: | 6.750% |

| |

| Yield to Maturity: | 6.750% |

| |

| Interest Payment Dates: | April 15 and October 15 of each year, commencing October 15, 2025 |

| |

| Record Dates: | April 1 and October 1 of each year |

| |

| Optional Redemption: | On and after April 15, 2028, the Issuer may redeem the 2033 Notes in whole at any time, or in part from time to time, at its option, at the redemption prices (expressed as percentages of principal amount of the 2033 Notes to be redeemed) set forth below, plus accrued and unpaid interest thereon, if any, to but not including the applicable redemption date, if redeemed during the twelve-month period beginning on the April 15 of each of the years indicated below: |

| | | | | | | | | | | |

| Year | Percentage | |

| 2028 | 103.375% | |

| 2029 | 101.688% | |

| 2030 and thereafter | 100.000% | |

| | | | | |

| At any time prior to April 15, 2028, the Issuer may redeem the 2033 Notes in whole at any time, or in part from time to time, at its option, at a redemption price equal to 100% of the principal amount of the 2033 Notes redeemed plus the Applicable Premium (as defined below) as of, and accrued and unpaid interest, if any, to but not including the redemption date. |

| |

| “Applicable Premium” means, with respect to any 2033 Notes on any redemption date, the greater of: (1) 1.0% of the principal amount of such note; and (2) the excess, if any, of (a) the present value at such redemption date of (i) the redemption price of such note at April 15, 2028 (such redemption price being set forth in the table appearing above), plus (ii) all required interest payments due on such note through April 15, 2028 (excluding accrued but unpaid interest to the redemption date), computed using a discount rate equal to the Treasury Rate as of such redemption date plus 50 basis points; over (b) the principal amount of such note. |

| |

| “Treasury Rate” means, with respect to the 2033 Notes, as of the date of the relevant redemption notice, the weekly average rounded to the nearest 1/100th of a percentage point (for the most recently completed week for which such information is available as of the date that is two business days prior to the date of such redemption notice) of the yield to maturity of United States Treasury securities with a constant maturity (as compiled and published in Federal Reserve Statistical Release H.15 with respect to each applicable day during such week or, if such Statistical Release is no longer published or the relevant information is no longer available thereon, any publicly available source of similar market data) most nearly equal to the period from the date of such redemption notice to April 15, 2028; provided, however, that if the period from the date of such redemption notice to April 15, 2028 is not equal to the constant maturity of a United States Treasury security for which such a yield is given, the Treasury Rate shall be obtained by linear interpolation (calculated to the nearest one twelfth of a year) from the weekly average yields of United States Treasury securities for which such yields are given, except that if the period from the redemption date to April 15, 2028 is less than one year, the weekly average yield on actively traded United States Treasury securities adjusted to a constant maturity of one year shall be used. Any such Treasury Rate shall be determined, and the information required to be obtained for its calculation shall be obtained, by the Issuer. |

| |

| Optional Redemption with Equity Proceeds: | Prior to April 15, 2028, the Issuer may, at its option, on one or more occasions, redeem up to 40% of the aggregate principal amount of 2033 Notes at a redemption price equal to 106.750% of the aggregate principal amount thereof, plus accrued and unpaid interest thereon, if any, to but not including the applicable redemption date, with an amount of cash not greater than the net cash proceeds of one or more Equity Offerings (as defined above); provided that at least 50% of the 2033 Notes originally issued under the indenture remains outstanding immediately after the occurrence of each such redemption; and provided, further, that each such redemption occurs within 180 days of the date of closing of each such Equity Offering. |

| |

| CUSIP Number: | 15089QBA1 |

| |

| ISIN Number: | US15089QBA13 |

Terms Applicable to Each Series of Notes

| | | | | |

| Issuer: | Celanese US Holdings LLC |

| |

| Guarantors: | Celanese Corporation and certain subsidiaries of the Issuer |

| |

| Joint Book-Running Managers: | J.P. Morgan Securities LLC BofA Securities, Inc. HSBC Securities (USA) Inc. Citigroup Global Markets Inc. Deutsche Bank Securities Inc. TD Securities (USA) LLC Truist Securities, Inc. Goldman Sachs & Co LLC U.S. Bancorp Investments, Inc. |

| | | | | |

| |

| Co-Managers: | Morgan Stanley & Co. LLC MUFG Securities Americas Inc. PNC Capital Markets LLC SMBC Nikko Securities America, Inc. Standard Chartered Bank UniCredit Capital Markets LLC |

| |

| Trade Date: | March 6, 2025 |

| |

| Settlement Date: | March 14, 2025 (T+6) |

| |

| We expect that delivery of the Notes will be made to investors on or about March 14, 2025, which will be the sixth Business Day following the date of pricing of the Notes (such settlement being referred to as T+6). Under Rule 15c6- 1 under the Securities Exchange Act of 1934, trades in the secondary market are required to settle in one Business Day, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade Notes prior to one Business Day before their delivery will be required, by virtue of the fact that the Notes initially settle in T+6, to specify an alternative settlement arrangement at the time of any such trade to prevent a failed settlement. |

| |

| Purchasers of the Notes who wish to trade the Notes prior to one Business Day before their delivery should consult their advisors. |

| |

| Distribution: | SEC Registered Offering |

| |

| Net Proceeds: | We estimate that the net proceeds from this offering of the Notes will be approximately $1,782,000,000 after deducting the underwriting discount and before deducting other estimated fees and expenses of this offering. |

| |

| Denominations: | $2,000 and integral multiples of $1,000 in excess thereof |

| |

| Concurrent Offering: | Concurrently with this offering, Celanese US Holdings LLC is offering €750,000,000 aggregate principal amount of 5.000% Senior Notes due 2031 (the “Concurrent Offering”). The Concurrent Offering is being made by means of a separate prospectus supplement and not by means of the prospectus supplement to which this pricing term sheet relates. This communication is not an offer to sell or a solicitation of an offer to buy any securities being offered in the Concurrent Offering. The closing of this offering and the Concurrent Offering are not conditioned on each other. |

Changes to Preliminary Prospectus Supplement

The Issuer has increased the aggregate principal amount of the Notes offered from $1,500,000,000 to $1,800,000,000 and has increased the aggregate principal amount of the notes issued in the Concurrent Offering from €500,000,000 to €750,000,000.

As a result of the change in offering size, all information (including the disclosure related to offering size, sources and uses of funds, capitalization table, summary financial data and other financial information) presented in the Preliminary Prospectus Supplement is deemed to have changed to the extent affected by the changes described herein.

The Issuer has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (the “SEC”) for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement, the preliminary prospectus supplement and other documents the Issuer has filed with the SEC for more complete information about the Issuer and this offering. You may get these documents for free by visiting the Next-Generation EDGAR System on the SEC web site at www.sec.gov. Alternatively, the Issuer or any underwriter will arrange to send you the prospectus if you request it by calling J.P. Morgan Securities plc (for non-U.S. investors) at +44 207-134-2468 or J.P. Morgan Securities LLC (for U.S. investors) at 1-212-834-4533 (collect).

The information in this communication supersedes the information in the preliminary prospectus supplement to the extent it is inconsistent with such information. Before you invest, you should read the preliminary prospectus supplement (including the documents incorporated by reference therein) for more information concerning the Issuer and the Notes.

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

Any disclaimers or other notices that may appear below are not applicable to this communication and should be disregarded. Such disclaimers or other notices were automatically generated as a result of this communication being sent via Bloomberg email or another communication system.

Celanese (NYSE:CE)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

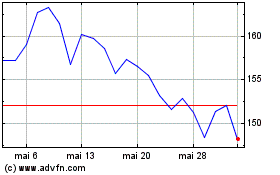

Celanese (NYSE:CE)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025