false

0001171759

0001171759

2025-02-11

2025-02-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

Amendment

No. 1

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 11, 2025

RED ROBIN GOURMET BURGERS, INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

001-34851 |

84-1573084 |

(State or other jurisdiction of

incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

10000

E. Geddes Avenue, Suite 500

Englewood, Colorado |

80112 |

| (Address of principal executive offices) |

(Zip Code) |

(303) 846-6000

(Registrant’s telephone number, including area

code)

Not Applicable

(Former name or former address, if changed since last

report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading

symbol(s) |

|

Name of each exchange

on which

registered |

| Common Stock, $0.001 par value |

|

RRGB |

|

Nasdaq (Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers. |

On February 11, 2025,

Red Robin Gourmet Burgers, Inc. (the “Company”) announced the departure of Kevin Mayer, the Company’s Chief

Marketing Officer (the “Executive”), effective February 11, 2025.

In connection with the departure of the Executive, the Company has agreed

to provide to the Executive, pursuant to a severance agreement between the Company and the Executive effective March 1, 2025 (the

“Severance Agreement”), in addition to any accrued but unpaid benefits or obligations: (i) an aggregate amount equal to $425,000,

which equals twelve (12) months of the Executive’s annual base salary as in effect immediately prior to the date of separation,

in installment payments over the twelve (12) months following the date of separation in accordance with the Company’s regular payroll

practices, (ii) a lump-sum cash payment equal to a pro rata portion of the Executive’s annual bonus, if any, for the Company’s

2025 fiscal year under the Company’s 2025 annual bonus plan, based on first quarter and full year actual performance of the Company,

determined by multiplying such annual bonus by a fraction, the numerator of which is the number of days in the 2025 calendar year through

the date of separation and the denominator of which is three hundred and sixty-five (365), payable at such time as bonuses are generally

paid by the Company to its executives, (iii) a lump-sum cash payment in the amount equal to $10,000 in recognition of the upcoming vesting

date of certain time based restricted stock units, and (iv) subject to the Executive’s timely election of continued healthcare coverage

under COBRA, a lump sum cash payment within 30 days after such election in an amount equal to the product of (x) the portion of monthly

premiums of the Executive’s group health insurance, including coverage for the Executive’s eligible dependents, that the Company

paid immediately prior to the date of separation, and (y) 12. The Executive’s vested restricted stock units and performance stock

units shall be subject to the terms and conditions of the applicable equity plan and award agreements issued thereunder, and the Executive

shall forfeit all of his outstanding and unvested restricted stock units and performance stock units. The Executive’s receipt of

the severance benefits mentioned in this paragraph is subject to his execution of a waiver and release of claims in favor of the Company

and its affiliates. The Executive is also subject to certain restrictive covenants in his employment agreement and the Severance Agreement,

including nondisclosure of confidential information, return of company property, non-solicitation and non-hire of certain employees for

12 months following the date of separation, non-solicitation of suppliers and business relations of the Company for 12 months following

the date of separation, post-employment cooperation, and a mutual non-disparagement covenant.

The foregoing

description of the terms of the Severance Agreement is qualified in its entirety by reference to the full terms of the Severance Agreement,

which is filed as an exhibit to this Current Report on Form 8-K and is incorporated herein by reference.

| ITEM 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report

to be signed on its behalf by the undersigned hereunto duly authorized.

Date: March 6, 2025

| |

RED ROBIN GOURMET BURGERS, INC. |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Sarah A. Mussetter |

|

| |

Name: |

Sarah A. Mussetter |

|

| |

Title: |

Chief Legal Officer |

|

EXHIBIT 10.1

SEVERANCE AGREEMENT

This Severance Agreement

(the “Agreement”) is dated as of February 11, 2025, by and among Red Robin Gourmet Burgers, Inc., a Delaware corporation

(the “Company”), and Kevin Mayer (the “Executive”).

WHEREAS, the Executive is

employed by the Company, through its wholly owned subsidiary, Red Robin International, Inc., a Nevada corporation (“RRI”),

and is a party to that certain Employment Agreement, dated as of April 20, 2023 (as amended, modified, or supplemented from time to time,

the “Employment Agreement”);

WHEREAS, capitalized terms

used but not otherwise defined in this Agreement are defined as set forth in the Employment Agreement;

WHEREAS, the Executive serves

the Company, RRI, and their respective subsidiaries and affiliates (the “Company Group”) in the office of Chief Marketing

Officer;

WHEREAS, the Company and

the Executive have agreed that the Executive’s employment with the Company is scheduled to terminate effective as of February 11,

2025 (the “Separation Date”);

WHEREAS, on the Separation

Date, the Executive shall resign as Chief Marketing Officer of the Company and shall cease to be an executive officer and employee of

the Company Group;

WHEREAS, the Company wishes

to provide the Executive with a severance package, which is conditioned on the Executive’s timely, irrevocable execution of this

Agreement and fulfilling all of his obligations in both the Employment Agreement, as applicable, and this Agreement, and including his

continued compliance with certain restrictive covenants that survive his employment termination; and

WHEREAS, the Parties desire

to set forth in this Agreement the terms and conditions of the Executive’s termination from employment, and this Agreement shall

govern the Executive’s and the Company’s respective rights and obligations in connection with such termination.

NOW THEREFORE, in consideration

of the promises, mutual covenants and other good and valuable consideration set forth in this Agreement, the receipt and sufficiency of

which are hereby acknowledged, the Executive and the Company (the “Parties”) agree as follows:

1.

Entire Agreement.

Except as otherwise expressly

provided herein, this Agreement, and the release set forth in Section 7 of this Agreement, is the entire agreement between the Parties

with respect to the subject matter hereof and contains all agreements, whether written, oral, express, or implied, between the Parties

relating thereto and supersedes and extinguishes all other agreements relating thereto, whether written, oral, express, or implied, between

the Parties, including, for the avoidance of doubt, the Company’s Executive Severance Plan, effective as of August 25, 2023.

2.

Termination of Employment.

A.

General. The Executive hereby acknowledges and agrees that his separation from service with the Company Group and

his resignation from any and all titles, positions, and appointments the Executive holds with the Company or any member of the Company

Group, whether as an officer, director, employee, consultant, trustee, committee member, agent, or otherwise, will become effective as

of the Separation Date. Except as otherwise expressly set forth herein, effective as of the Separation Date, the Executive shall have

no authority to act on behalf of any member of the Company Group and shall not hold himself out as having such authority, enter into any

agreement or incur any obligations on behalf of any member of the Company Group, commit any member of the Company Group in any manner,

or otherwise act in an executive or other decision-making capacity with respect to any member of the Company Group. The Executive agrees

to promptly execute such documents as the Company, in its sole discretion, shall reasonably deem necessary to effect such resignations.

The Separation Date shall be the termination date of the Executive’s employment for purposes of participation in and coverage under

all benefit plans and programs sponsored by or through the Company, except as otherwise provided herein. For the avoidance of doubt, the

Separation Date will be the last day of the Employment Period.

3.

Entitlements.

In consideration for, and

subject to, the Executive’s entering into this Agreement, the Executive shall be entitled to the payments and benefits set forth

in this Agreement. Notwithstanding the foregoing or anything to the contrary in this Agreement, the payments and benefits described in

this Agreement (other than those described in Section 3.A) are subject to (i) the Executive’s execution and delivery of this

Agreement (including the release set forth in Section 7 herein) within twenty-one (21) days following the date hereof, (ii) the Executive’s

continued compliance with all restrictive covenants with the Company Group to which he is subject (including the restrictive covenants

in Sections 5, 7 and 8 of the Employment Agreement, which are incorporated by reference herein), and (iii) the Executive’s

continued compliance with this Agreement.

A.

Accrued Obligations. The Company shall pay to the Executive (A) an amount equal to the sum of (1) the Executive’s

Annual Base Salary through the Separation Date to the extent not theretofore paid and (2) reimbursement for any unreimbursed business

expenses incurred through the Separation Date, which shall be paid in a lump sum in cash within thirty (30) days following the Separation

Date or such earlier date as may be required by law, (B) any payments, benefits, or fringe benefits to which the Executive shall be entitled

under the terms of any applicable compensation arrangement or benefit, equity or fringe benefit plan or program or grant, or the Employment

Agreement, which shall be paid at such times and in such forms as provided for by such plan, program, or grant or such earlier date as

may be required by law and (C) any Annual Bonus earned but unpaid with respect to fiscal year 2024, which shall be paid in a lump sum

in cash when such Annual Bonus payment is regularly paid to similarly situated executives; provided, that this Section 3.A shall

not result in duplication of benefits with any other payment or benefit under this Agreement or any other agreement or plan. For the avoidance

of doubt, any medical, dental, and other health insurance coverage in which the Executive (and his

beneficiaries) participate as of the Separation

Date shall continue through the end of the month during which the Separation Date takes place.

B.

Severance. The Company shall (1) pay to the Executive an aggregate amount equal to $425,000, which equals twelve

(12) months of the Executive’s Annual Base Salary as in effect immediately prior to the Separation Date, in installment payments

over the twelve (12) months following the Separation Date in accordance with the Company’s regular payroll practices, (2) pay to

the Executive a lump-sum cash payment equal to a pro rata portion of the Executive’s Annual Bonus, if any, for 2025 based on Q1

and full-year actual performance of the Company (as determined by the Board and the Compensation Committee), determined by multiplying

such Annual Bonus by a fraction, the numerator of which is the number of days in the then-current calendar year through the Separation

Date and the denominator of which is three hundred and sixty-five (365), payable at such time as bonuses are generally paid by the Company

to its similarly situated executives, (3) pay to the Executive a lump-sum cash payment in an amount equal to $10,000 in recognition of

the upcoming vesting date of certain time based restricted stock units (“RSUs”), payable within thirty (30) days of

the Separation Date, and (4) subject to the Executive’s timely election of continuation coverage under the Consolidated Omnibus

Budget Reconciliation Act of 1985, as amended, pay to the Executive a lump sum cash payment within thirty (30) days after such election

of an amount equal to the product of (x) the portion of the monthly premiums of the Executive’s group health insurance, including

coverage for the Executive’s eligible dependents, that the Company paid immediately prior to the Executive’s Separation Date

and (y) twelve (12).

C.

Full Satisfaction. The Executive acknowledges and agrees that, except as expressly provided in this Agreement, (i)

the Executive is not entitled to any other compensation or benefits from the Company or any member of the Company Group (including, without

limitation, any severance or termination compensation or benefits), and (ii) as of and after the Separation Date, except for purposes

of any medical, dental, and other health insurance coverage in which the Executive (and his beneficiaries) participate pursuant to Section

3.B of this Agreement, the Executive shall no longer participate in, accrue service credit, or have contributions made on his behalf under

any employee benefit plan sponsored by any member of the Company Group in respect of periods commencing on and following the Separation

Date, including without limitation, any plan that is intended to qualify under Section 401(a) of the Internal Revenue Code of 1986, as

amended (the “Code”).

D.

Equity. The Executive’s vested RSUs and performance stock units (“PSUs”) shall be subject

to the terms and conditions of the applicable equity plan and award agreements issued thereunder. For purposes of clarity, to the extent

any outstanding but unvested RSUs and PSUs do not vest in accordance with their terms as of the Separation Date, such unvested RSUs and

PSUs shall be immediately forfeited.

4.

Post-Employment Cooperation. Upon reasonable request and notice following the Separation Date, the Executive shall cooperate

to the best of his ability with the Company to answer, to the extent of his best knowledge and information, any questions or provide any

information that the Company reasonably requires, and to cooperate to the best of his ability in any other manner reasonably requested

by the Company, including in preparing for any trials, hearings, or other proceedings, and providing truthful testimony in connection

therewith, in each

case relating to his time of employment with

the Company and the business of the Company. The Company shall reimburse the Executive for any reasonable, out-of-pocket expenses incurred

by him in connection with his compliance with this Section 4 pursuant to the Company’s expense reimbursement policy. The Company

agrees that the Executive’s obligations in this Section 4 are not intended to unreasonably interfere with his ongoing business

and personal activities.

5.

Restrictive Covenants. The Executive agrees that Sections 5 and 7 through 11 of the Employment Agreement survive the termination

of his employment, and he confirms that he is bound by such provisions, including but not limited to the non-disclosure and non-solicitation

obligations set forth therein, but, for the avoidance of doubt, not including the non-competition provisions set forth in Section 6 of

the Employment Agreement; provided, however, that the duration of the covenants under Section 7(a) of the Employment Agreement shall apply

only for the 12-month period following the Separation Date. The Executive also agrees that he is subject to continuing obligations under

the terms of the equity award agreements between the Executive and the Company that survive the termination of his employment, and he

confirms that he is bound by such provisions, including the non-solicitation obligations set forth therein. If there is a conflict between

the Executive’s continuing obligations under the Employment Agreement, the equity award agreements, and any other restrictive covenants

to which the Executive may be bound, the provisions more protective of the Company Group’s interests shall apply, as determined

by the Company Group in its sole discretion.

6.

No Complaints, Claims, or Actions Filed. The Executive represents that the Executive has not filed any complaints, claims,

or actions against the Company or any Released Party (as defined in Section 7 below) with any state, federal, or local agency or court.

The Executive covenants and agrees that the Executive will not file any complaints, claims, or actions against the Company or any Released

Party with respect to a claim released pursuant to Section 7 below at any time hereafter. The Executive warrants and represents that,

as of the date of execution of this Agreement, the Executive is not aware of any facts that would establish, tend to establish, or in

any way support an allegation that the Company or any Released Party has engaged in conduct that the Executive believes could violate

any federal, state, or local law, or to the extent that the Executive has or ever had any such information, the Executive has reported

that information to the Company in accordance with Company policy.

7.

Release of All Claims. In consideration for the promises and obligations set forth in this Agreement, the Executive hereby

irrevocably, unconditionally, and fully releases the Company, RRI, each member of the Company Group, and any affiliated entities, and

each and all of its/their current and former shareholders, officers, agents, directors, supervisors, employees, and representatives, and

its/their successors and assigns, and all persons acting by, though, under, or in concert with any of them (“Released Parties”),

from any and all charges, complaints, claims, and liabilities of any kind or nature whatsoever, known or unknown, suspected or unsuspected

(hereinafter referred to as “claim” or “claims”), that the Executive at any time had or claimed to have or that

the Executive may have or claim to have regarding any matter as of the date of this Agreement, including, without limitation, any and

all claims related to or in any manner incidental to the Executive’s employment or termination of employment with the Company. It

is expressly understood by the Executive that among the various rights and claims being waived in this release include those arising under

Title VII of the Civil Rights Act of 1964, the Americans with

Disabilities Act, the Age Discrimination in

Employment Act (“ADEA”), the Family and Medical Leave Act, common law and any and all other applicable federal, state,

county or local statutes, ordinances, or regulations, and the law of contract and tort. The released claims also include claims of discrimination

or harassment on the basis of workers’ compensation status, but do not include workers’ compensation claims. By signing this

Agreement, the Executive acknowledges that the Executive intends to waive and release all rights known or unknown that Executive may

have against the Released Parties under these and any other laws; provided that the Executive does not waive or release claims

with respect to (A) any rights that the Executive may have to any payments or benefits pursuant to Section 3 of this Agreement, (B) any

claims or rights under the indemnification policy of any member of the Company Group, which all parties acknowledge survives the termination

of the Executive’s employment pursuant to its terms, and (C) rights that cannot be released as a matter of law.

Waiver of California Civil

Code section 1542. To effect a full and complete general release as described above, the Executive expressly waives and relinquishes

all rights and benefits of section 1542 of the Civil Code of the State of California, and does so understanding and acknowledging the

significance and consequence of specifically waiving section 1542. Section 1542 of the Civil Code of the State of California states as

follows:

A general release does not extend to claims

which the creditor or releasing party does not know or suspect to exist in his or her favor at the time of executing the release and that,

if known by him or her would have materially affected his or her settlement with the debtor or released party.

Thus, notwithstanding the

provisions of section 1542, and to implement a full and complete release and discharge of the Released Parties, the Executive expressly

acknowledges this Agreement is intended to include in its effect, without limitation, all claims the Executive does not know or suspect

to exist in the Executive’s favor at the time of signing this Agreement, and that this Agreement contemplates the extinguishment

of any such claims. The Executive warrants the Executive has read this Agreement, including this waiver of California Civil Code section

1542, and that the Executive has consulted with or had the opportunity to consult with counsel of the Executive’s choosing about

this Agreement and specifically about the waiver of section 1542, and that the Executive understands this Agreement and the section 1542

waiver, and so the Executive freely and knowingly enters into this Agreement. The Executive further acknowledges that the Executive later

may discover facts different from or in addition to those the Executive now knows or believes to be true regarding the matters released

or described in this Agreement, and even so the Executive agrees that the releases and agreements contained in this Agreement shall remain

effective in all respects notwithstanding any later discovery of any different or additional facts. The Executive expressly assumes any

and all risk of any mistake in connection with the true facts involved in the matters, disputes, or controversies released or described

in this Agreement or with regard to any facts now unknown to the Executive relating thereto.

8.

Reemployment. The Executive hereby waives any and all claims to reemployment with the Company or any of its affiliates and

affirmatively agrees not to seek further employment with the Company or any of its affiliates.

9.

Release of Claims and Notices Required under the Age Discrimination in Employment Act and the Older Workers’ Benefit

Protection Act. The Executive understands and agrees that the Executive:

A.

Has been offered at least twenty-one (21) days during which to consider this Agreement before signing it and understands that if

he signs this Agreement prior to the expiration of such twenty-one (21) day period he knowingly and voluntarily waives the remainder of

such consideration period;

B.

Has carefully read and fully understands all of the provisions of this Agreement;

C.

Is waiving and releasing any rights under the ADEA, among other claims;

D.

Knowingly and voluntarily agrees to all of the terms set forth in this Agreement;

E.

Knowingly and voluntarily intends to be legally bound by the terms of this Agreement;

F.

Was advised and hereby is advised in writing to consider the terms of this Agreement and consult with an attorney of the Executive’s

choice prior to executing this Agreement;

G.

Has a full seven (7) days from the date of execution of this to revoke this Agreement (including, without limitation, any and all

claims arising under the ADEA) by sending written notice to Sarah Mussetter, Chief Legal Officer, and that neither the Company nor any

other person is obligated to provide any payments or benefits to the Executive pursuant to Section 3.B until eight (8) days have passed

since the Executive’s signing of this Agreement without the Executive’s having revoked this Agreement;

H.

Understands that rights or claims under the Age Discrimination in Employment Act of 1967 (29 U.S.C. § 621, et seq.)

that may arise after the date this Agreement is executed are not waived;

I.

Understands that nothing in this Agreement (including Section 7) prevents or precludes the Executive from challenging or seeking

a determination of the validity of this waiver under the ADEA in good faith, nor that it imposes any condition precedent, penalties, or

costs for doing so, unless specifically authorized by federal law;

J.

Understands that once the Company has made its final offer of severance, any changes, whether material or immaterial, to this Agreement

do not restart the twenty-one (21) day period in which to consider the Agreement before signing it; and

10.

No Admission of Liability. This Agreement and compliance with this Agreement shall not be construed as an admission by the

Company or any Released Party of any liability whatsoever, or as an admission by the Company or any Released Party of any violations of

the rights of the Executive or any person or violation of any order, law, statute, duty, or contract whatsoever against the Executive

or any person. The Company and each Released Party specifically disclaims any liability to the Executive or any other person for any alleged

violation of the rights of the Executive or any person, or for any alleged violation of any order, law, statute, duty, or contract on

the part of the Company or any Released Party.

11.

Communication with Government Agency. Nothing in this Agreement, including Sections 4, 6, and 7, (A) limits or affects

the Executive’s right to challenge the validity of this Agreement, including, without limitation, a challenge under the ADEA; (B)

in any way interferes with the Executive’s right and responsibility to give truthful testimony under oath; or (C) precludes the

Executive from participating in an investigation, filing a charge or otherwise communicating with any federal, state or local government

office, official or agency, including, but not limited to, the Equal Employment Opportunity Commission, Department of Labor, or National

Labor Relations Board. However, the Executive promises never to seek or accept any compensatory damages, back pay, front pay, or reinstatement

remedies for the Executive personally with respect to any claims released by this Agreement.

12.

Miscellaneous.

A.

Modification. This Agreement may not be modified or amended, nor may any rights hereunder be waived, except in a

writing signed and agreed to by the Parties.

B.

Notices. Any notice given pursuant to this Agreement to any party hereto shall be deemed to have been duly given

when mailed by registered or certified mail, return receipt requested, or by overnight courier, or when hand delivered as follows:

If to the Company:

Red Robin International, Inc.

10000 E. Geddes Avenue, Suite 500

Greenwood Village, CO 80112

Attention: Chief Legal Officer

If to the Executive, at the Executive’s most recent address

on the payroll records of the Company.

or at such other address any party shall from time to time designate

by written notice, in the manner provided herein, to the other parties hereto.

C.

Successors and Assigns. This Agreement shall be binding upon the Executive and the Company Group and upon their respective

heirs, administrators, representatives, executors, successors, and assigns, and shall inure to the benefit of said parties, and each of

them, and to their respective heirs, administrators, representatives, executors, successors, and assigns. The Executive expressly warrants

that the Executive has not transferred to any party or entity any rights, causes of action, or claims released in this Agreement. The

Executive agrees that each successor or affiliate of the Company shall be an express third-party beneficiary hereto and shall be entitled

to enforce the provisions of this Agreement.

D.

General Consequences of Breach. If any party to this Agreement breaches this Agreement, for example, by bringing

a lawsuit based on claims that such party has released, by making a false representation in this Agreement, or by a past or future breach

of Section 4 of this Agreement, the non-breaching party will be entitled to recover all damages flowing from such breach; specifically,

including, but not limited to reasonable attorneys’ fees and all other costs

incurred by the non-breaching party as a result

of the breach or false representation, such as the cost of defending any suit brought with respect to a released claim by the breaching

party.

E.

Taxes. The Executive shall be responsible for the payment of any and all required federal, state, local, and foreign

taxes incurred, or to be incurred, in connection with any amounts payable to the Executive under this Agreement. Notwithstanding any other

provision of this Agreement to the contrary, the Company or any member of the Company Group, as applicable, may withhold from all amounts

payable under this Agreement all federal, state, local, and foreign taxes that are required to be withheld pursuant to any applicable

laws and regulations.

F.

Section 409A. The Parties intend that the compensation and benefits under this Agreement either be exempt from or

compliant with Section 409A of the Code, and Section 17 of the Employment Agreement is hereby incorporated by reference mutatis mutandis

as if fully set forth herein.

G.

Severability. In the event that any provision of this Agreement is determined to be invalid or unenforceable, the

remaining terms and conditions of this Agreement shall be unaffected and shall remain in full force and effect. In addition, if any provision

is determined to be invalid or unenforceable due to its duration and/or scope, the duration and/or scope of such provision, as the case

may be, shall be reduced, such reduction shall be to the smallest extent necessary to comply with applicable law, and such provision shall

be enforceable, in its reduced form, to the fullest extent permitted by applicable law.

H.

Entire Agreement Between Parties. This Agreement (and the documents referenced herein) sets forth the entire agreement

between the Parties hereto and, unless otherwise set forth herein, fully supersedes any and all prior agreements or understandings, written

or oral, between the Parties hereto pertaining to the subject matter hereof; provided, however, if there is a conflict between

this Agreement and any confidentiality, non-compete, or non-solicitation agreement the Executive previously signed, the provisions more

protective of the Company’s interests shall apply, as determined by the Company in its sole discretion.

I.

Amendments; Waivers. This Agreement may not be modified, amended, or terminated except by an instrument in writing

signed by the Executive and a duly authorized officer of the Company (other than the Executive) that expressly identifies the amended

provision of this Agreement. By an instrument in writing similarly executed and similarly identifying the waived compliance, the Executive

or a duly authorized officer of the Company may waive compliance by the other party or parties with any provision of this Agreement that

such other party was or is obligated to comply with or perform; provided, however, that such waiver shall not operate as

a waiver of, or estoppel with respect to, any other or subsequent failure to comply or perform. No failure to exercise and no delay in

exercising any right, remedy, or power hereunder shall preclude any other or further exercise of any other right, remedy, or power provided

herein or by law or in equity.

J.

Governing Law. THIS AGREEMENT AND THE LEGAL RELATIONS HEREBY CREATED BETWEEN THE PARTIES HERETO SHALL BE GOVERNED

BY AND CONSTRUED UNDER AND IN ACCORDANCE WITH THE INTERNAL LAWS OF THE STATE OF COLORADO, WITHOUT REGARD TO CONFLICTS OF LAWS PRINCIPLES

THEREOF. THE EXECUTIVE SHALL SUBMIT TO THE

VENUE AND PERSONAL JURISDICTION OF THE COLORADO STATE AND FEDERAL COURTS CONCERNING ANY DISPUTE FOR WHICH JUDICIAL REDRESS IS PERMITTED

PURSUANT TO THIS AGREEMENT; HOWEVER THE COMPANY IS NOT LIMITED IN SEEKING RELIEF IN THOSE COURTS.

K.

Arbitration. Except as otherwise provided herein, any controversy arising out of or relating to this Agreement, its

enforcement or interpretation, or because of an alleged breach, default, or misrepresentation in connection with any of its provisions,

or any other controversy arising out of the Executive’s employment, including, but not limited to, any state or federal statutory

or common law claims, shall be submitted to arbitration in Denver, Colorado, before a sole arbitrator (the “Arbitrator”)

selected from Judicial Arbiter Group, Inc., Denver, Colorado, or its successor (“JAG”), or if JAG is no longer able

to supply the arbitrator, such arbitrator shall be selected from the Judicial Arbitration and Mediation Services, Inc. (“JAMS”),

or other mutually agreed upon arbitration provider, as the exclusive forum for the resolution of such dispute. Provisional injunctive

relief may, but need not, be sought by either party to this Agreement in a court of law while arbitration proceedings are pending, and

any provisional injunctive relief granted by such court shall remain effective until the matter is finally determined by the Arbitrator.

Final resolution of any dispute through arbitration may include any remedy or relief which the Arbitrator deems just and equitable, including

any and all remedies provided by applicable state or federal statutes. At the conclusion of the arbitration, the Arbitrator shall issue

a written decision that sets forth the essential findings and conclusions upon which the Arbitrator’s award or decision is based.

Any award or relief granted by the Arbitrator hereunder shall be final and binding on the Parties and may be enforced by any court of

competent jurisdiction. The Parties acknowledge and agree that they are hereby waiving any rights to trial by jury in any action, proceeding

or counterclaim brought by either of the Parties against the other in connection with any matter whatsoever arising out of or in any way

connected with this Agreement or the Executive’s employment, and under no circumstances shall class claims be processed or participated

in by the Executive. The Parties agree that Company shall be responsible for payment of the forum costs of any arbitration hereunder,

including the Arbitrator’s fee. The Executive and the Company further agree that in any proceeding to enforce the terms of this

Agreement, the prevailing party shall be entitled to its or his reasonable attorneys’ fees and costs incurred by it or him in connection

with resolution of the dispute in addition to any other relief granted.

L.

Headings. The headings in this Agreement are for convenience of identification only and are not intended to describe,

interpret, define or limit the scope, extent, or intent of this Agreement or any provision hereof.

M.

Construction. This Agreement shall be deemed drafted equally by the Parties. Its language shall be construed as a

whole and according to its fair meaning. Any presumption or principle that the language is to be construed against any party shall not

apply. The headings in this Agreement are only for convenience and are not intended to affect construction or interpretation. Any references

to paragraphs, subparagraphs, sections, or subsections are to those parts of this Agreement, unless the context clearly indicates to the

contrary. Also, unless the context clearly indicates to the contrary: (i) the plural includes the singular, and the singular includes

the plural; (ii) “and” and “or” are each used both conjunctively and disjunctively; (iii)

“any,” “all,” “each,”

or “every” means “any and all,” and “each and every”; (iv) “includes” and “including”

are each “without limitation”; and (v) “herein,” “hereof,” “hereunder,” and other similar

compounds of the word “here” refer to the entire Agreement and not to any particular paragraph, subparagraph, section, or

subsection.

N.

Counterparts. The Agreement may be executed by one or more of the Parties hereto on any number of separate counterparts

and all such counterparts shall be deemed to be one and the same instrument. Each party hereto confirms that any facsimile copy or .pdf

of such party’s executed counterpart of the Agreement (or its signature page thereof) shall be deemed to be an executed original

thereof.

[Remainder of Page Intentionally Left Blank]

IN WITNESS WHEREOF,

the Parties have executed and delivered this Agreement as of the date written below.

| EXECUTIVE |

|

|

|

|

|

| |

|

|

|

|

|

|

| Date: |

February 28, 2025 |

|

/s/ Kevin Mayeer |

|

| |

|

|

KEVIN MAYER |

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| COMPANY |

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

RED ROBIN GOURMET BURGERS, INC. |

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Date: |

March 1, 2025 |

|

By: |

/s/ Meghan Spuler |

|

| |

|

|

|

Name: |

Meghan Spuler |

|

| |

|

|

|

Title: |

Chief People Officer |

|

| |

|

|

|

|

|

|

[Signature Page to Separation Agreement]

v3.25.0.1

Cover

|

Feb. 11, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K/A

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 11, 2025

|

| Entity File Number |

001-34851

|

| Entity Registrant Name |

RED ROBIN GOURMET BURGERS, INC.

|

| Entity Central Index Key |

0001171759

|

| Entity Tax Identification Number |

84-1573084

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

10000

E. Geddes Avenue

|

| Entity Address, Address Line Two |

Suite 500

|

| Entity Address, City or Town |

Englewood

|

| Entity Address, State or Province |

CO

|

| Entity Address, Postal Zip Code |

80112

|

| City Area Code |

303

|

| Local Phone Number |

846-6000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Trading Symbol |

RRGB

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

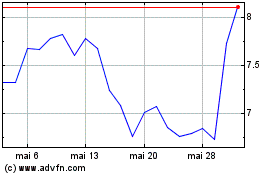

Red Robin Gourmet Burgers (NASDAQ:RRGB)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Red Robin Gourmet Burgers (NASDAQ:RRGB)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025