What Next After the S&P 500 Slumps 3% Last Week?

29 Agosto 2022 - 5:35AM

Finscreener.org

The equity markets in the U.S.

experienced a sell-off on Friday after Federal Reserve Chairman,

Jerome Powell, indicated the central bank will keep raising

interest rates in the future to keep inflation in check. In the

last week:

The 10-year

Treasury yield stood at 3.03% on the back of a tighter monetary

policy and higher borrowing costs. Further, crude oil prices moved

higher last week as inventories in the U.S. declined due to rising

exports of the commodity. The prices for the West Texas

Intermediate crude

closed at $93 per barrel on Friday.

The upcoming week will remain

crucial for equity markets and investors will closely watch the

U.S. labor markets as the nonfarm payrolls report for August will

be reported on Friday. The Job Opening and Labor Turnover Survey

report will also be released this week, providing information on

hires, resignations, and separations for the month of

July.

Additionally, payroll services

provider ADP will release the National Employment Report, which

tracks the growth in nonfarm private sector payrolls.

The Case-Shiller National Home

Price Index, as well as Freddie Mac’s House Price Index, will be

published on Tuesday. Wall Street will also be waiting for the ISM

and Manufacturing PMI numbers that provide a peek into the health

of the manufacturing sector.

Which companies will report earnings this

week?

There are a few companies

reporting quarterly earnings in the upcoming week. These

include:

Lululemon Athletica: In the quarter that ended in July, analysts

expect Lululemon Athletica (NASDAQ:

LULU) to report revenue of $1.76 billion and adjusted

earnings of $1.86 per share.

Chewy: The

online pet store Chewy (NYSE: CHWY)

is expected to report sales of $2.48 billion and an adjusted loss

of $0.12 per share in the July quarter.

Best Buy: A big

box retailer, Best Buy (NYSE: BBY)

is forecast to report revenue of $10.27 billion and adjusted

earnings of $1.29 per share.

Macro data will continue to impact the S&P

500

With the earnings season coming

to an end, equity indices, including the S&P 500, will

remain volatile in case macroeconomic data disappoints. As

mentioned above, nonfarm payroll data will be reported for the

month of August, and analysts expect jobs to increase by 290,000

this month after they rose by 528,000 in July.

The labor market has already

recovered from pandemic-era losses, with unemployment rates

dropping to 3.5%. A strong labor market is among the few bright

spots for individuals who are wrestling with inflation and rising

interest rates.

Market participants will also try

to analyze the strength of the housing market as Standard and Poor

is set to release its Case-Shiller National Home Price Index for

June on Tuesday.

Home prices rose 1.5% on a

monthly basis in May and were up 20.5% year-over-year. In March,

the Home Price Index reported a record monthly gain of 3.1% in

March.

Mortgage originator Freddie Mac

will also report the National House Price Index for June, which

rose 1.4% in May after it decelerated for four consecutive

months.

The cooldown in the U.S. housing

market is expected, with interest rates rising at an accelerated

pace, making loans expensive. But home prices have continued to

move higher in 2022 despite higher borrowing costs and lower

affordability.

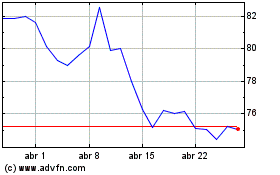

Best Buy (NYSE:BBY)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Best Buy (NYSE:BBY)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024