A Slow Week On the Cards for S&P 500 Investors

11 Maio 2023 - 7:32AM

Finscreener.org

The hustle and bustle of

corporate earnings, job reports, and the FOMC meeting are behind

us, and next week might be a bit more low-key in

comparison.

Despite bank turmoil and a

slowing economy, job growth exceeded expectations in April, as

reported by the Labor Department on Friday. Nonfarm payrolls

increased by 253,000, beating Wall Street estimates of 180,000. In

addition, the unemployment rate was 3.4%, the lowest since 1969,

and average hourly earnings rose 0.5%, the highest monthly gain in

a year, with wages increasing 4.4% annually.

The strong numbers increase the

likelihood of a June interest rate hike by the Federal Reserve.

Wall Street reacted positively, with the Dow Jones Industrial

Average rising almost 400 points, Treasury yields increasing, and

robust earnings reports from Apple and banking stocks.

Is a recession on the cards?

The economy may be headed toward

a possible recession later in the year, as Gross Domestic Product

(GDP) increased only by 1.1% in Q1. Signs of weakness in consumer

spending have been evident, such as a 0.7% decrease in credit card

spending from a year ago.

Despite recession fears and bank

troubles, the Federal Reserve has raised its benchmark interest

rate, though it acknowledges the pressure it may put on households.

Fed Chairman Jerome Powell stated that the economy would likely

face further challenges from tighter credit conditions, as the

central bank aims to bring inflation down to a 2% annual

level.

Rising wages contribute to

inflation pressure, with Powell indicating that a 3% annual wage

gain is consistent with the FedU+02019s 2% mandate.

Corporate earnings remain under focus

After a bustling week of

corporate earnings, next week might seem a little more subdued.

However, we can still anticipate earnings updates from several

significant companies,

such as Airbnb (NYSE: ABNB), Disney (NYSE:

DIS),

PayPal (NASDAQ:

PYPL), and

Electronic Arts (NASDAQ: EA).

As of Friday, 85% of

S&P 500 firms have

reported earnings. Of these, 79% have exceeded expectations on

earnings per share (EPS), while 75% have exceeded revenue

estimates, according to FactSet. The blended earnings decrease for

S&P 500 firms combining those already reported earnings with

those yet to report is 2.2%, representing the second consecutive

quarterly decline in earnings.

Among firms that generate more

than 50% of their revenue in the U.S., earnings grew on average by

2.7%, indicating that international sales were a headwind for

S&P 500 companies in the first quarter.

Inflation under the radar

Regarding economic data,

weU+02019ll get the latest inflation readings next week, with the

April Consumer Price Index (CPI) on Wednesday and the Producer

Price Index (PPI) on Thursday. The CPI is expected to have risen

0.4% last month after an increase of 0.1% in

March.

Year-over-year, prices were

likely up by 4.9%, the slowest pace in two years, decelerating

slightly from 5% in March. Core prices, excluding volatile food and

energy costs, are expected to have risen by 0.3% last month and by

5.6% annually.

The PPI will follow on Thursday,

tracking inflation from the perspective of manufacturers and

wholesalers. Producer prices are projected to have risen by 0.3%

last month, recovering from an unexpected 0.5% decrease in March.

Year-over-year, they are likely up by 2.4%, the slowest pace since

January 2021, decelerating from 2.7% in March.

Lastly, on Thursday, Bank of

England (BoE) policymakers will hold their latest meeting on

interest rates, following the U.S. Federal Reserve and European

Central Bank (ECB) that raised interest rates. As a result, BoE

policymakers are anticipated to increase the bank rate by 25 basis

points to 4.5%, marking the 12th consecutive rate hike since early

last year.

However, the UK is experiencing

its highest inflation in four decades, currently at an annual rate

of 10.1%, coupled with a stagnant economy. The latest GDP report,

due on Friday, is expected to show growth of just 0.1% in the first

quarter and stagnation on an annual basis.

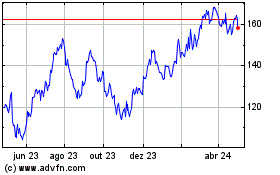

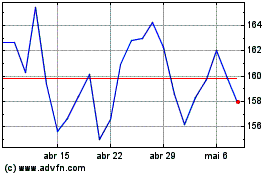

Airbnb (NASDAQ:ABNB)

Gráfico Histórico do Ativo

De Dez 2024 até Dez 2024

Airbnb (NASDAQ:ABNB)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024