The S&P 500 Remains Under Pressure as Investor Sentiment Turns Bearish

21 Agosto 2023 - 8:56AM

Finscreener.org

On Friday, stocks wrapped up with

weekly losses, extending Wall StreetU+02019s challenging month of

August. The

Dow Jones Industrial Average Index is down 2.2% this month, marking its steepest

decline since March. The

S&P 500 experienced a drop of 2.1%, recording losses for

the third consecutive week, a pattern not seen since

February.

The Nasdaq Composite also fell by approximately 2.6%, its third

back-to-back weekly decline, a sequence not observed since

December.

In a CNBC interview, Michelle

Cluver, a senior portfolio strategist at Global X ETFs, remarked,

“It appears the markets are reassessing the earlier optimism of

July. While we still witness economic growth, thereU+02019s rising

uncertainty regarding the potential increase in interest rates,

leading to increased focus on longer-duration yields.”

Following the release of the

Federal Reserve’s July meeting minutes, which hinted at possible

upcoming rate hikes due to persistent inflation worries, the

10-year U.S. Treasury yield reached its peak since October 2022 on

Thursday. However, on Friday, the yields retreated slightly, with

the 10-year Treasury rate settling around 4.25%, down by

approximately five basis points.

Zoom and Nvidia forecast to report earnings

In the upcoming week, retailers

such as Dollar Tree (NASDAQ:

DLTR),

Macy’s (NYSE:

M) , and

Lowe’s (NYSE:

LOW) are scheduled to report quarterly results,

providing insights into consumer spending patterns. Based on the

major retailers that have reported quarterly earnings, about 79%

surpassed earnings predictions, while 64% beat revenue forecasts,

as per Refinitiv data.

Moreover, tech companies such as

Zoom Video (NASDAQ:

ZM) and Nvidia

(NASDAQ:

NVDA) will also report results. Analysts tracking Zoom

Video expect sales to rise by 1.4% to $1.11 billion in fiscal Q2 of

2024 (ended in July). Comparatively, earnings per share are

forecast to remain flat at $1.05. Zoom Video has seen top-line

growth decelerate significantly in recent quarters as economies

have reopened following COVID-19. ZM stock is currently trading 88%

below all-time highs.

Semiconductor giant Nvidia

is rising the AI wave as the stock

has tripled year-to-date. It is on track to report revenue of

$11.17 billion, an increase of 66.7% year over year, while earnings

are forecast to rise 300% to $2.07 per share.

Economist set to meet at Jackson Hole

The three-day Jackson Hole

Economic Symposium will commence this week. An annual event

organized by the Kansas City Fed since 1981, the symposium is a

gathering for central bankers, finance officials, economists, and

scholars worldwide to deliberate on pressing economic

topics.

The theme for this year,

“Structural Shifts in the World Economy,” will likely center on

strategies for central banks to navigate economies out of

recession, especially after having escalated interest rates to a

level unseen in over two decades.

Home sales overview

On Tuesday, the National

Association of Realtors (NAR) is scheduled to release data on

existing home sales. These sales are predicted to have marginally

decreased to 4.15 million units in the previous month, down from

4.16 million in June.

The surge in mortgage rates to a

peak not seen in 21 years, combined with a revival in home prices

since February, likely dampened sales due to reduced affordability.

However, sales of new homes are anticipated to have increased,

possibly reaching 701,000, up from 697,000 in June.

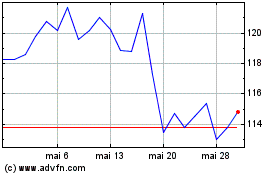

Dollar Tree (NASDAQ:DLTR)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Dollar Tree (NASDAQ:DLTR)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024