Goldmoney Inc. (TSX:XAU) (“Goldmoney” or the “Company”) announces

acceptance by the Toronto Stock Exchange (the "TSX") of Goldmoney’s

Notice of Intention to make a normal course issuer bid (the "NCIB")

to purchase for cancellation 3,000,000 common shares of Goldmoney,

representing 3.9% of the issued and outstanding common shares as at

March 2, 2018.

As of March 2, 2018, Goldmoney had 76,779,427

common shares issued and outstanding.

The NCIB will commence on March 7, 2018 and will

terminate on March 6, 2019 or at such earlier date in the event

that the number of shares sought in the NCIB has been repurchased.

Goldmoney reserves the right to terminate the NCIB earlier if it

feels that it is appropriate to do so.

All shares will be purchased on the open market

through the facilities of the TSX as well as on alternative

Canadian trading systems at prevailing market rates and any common

shares purchased by Goldmoney will be cancelled. The actual number

of shares that may be purchased and the timing of any such

purchases will be determined by Goldmoney. Any purchases made by

Goldmoney pursuant to the NCIB will be made in accordance with the

rules and policies of the TSX.

During the most recently completed six months,

the average daily trading volume for the common shares of Goldmoney

on the TSX was 162,941 common shares. Consequently, under the

policies of the TSX, Goldmoney will have the right to repurchase

under its NCIB, during any one trading day, a maximum of 40,735

shares, representing 25% of the average daily trading volume. In

addition, Goldmoney will be allowed to make, once per calendar

week, a block purchase (as such term is defined in the TSX Company

Manual) of shares not directly or indirectly owned by the insiders

of Goldmoney, in accordance with TSX policies. Goldmoney will fund

the purchases through available cash. In the previous 12 months,

Goldmoney has not repurchased any of its outstanding common

shares.

The Board of Directors believes the underlying

value of Goldmoney may not be reflected in the market price of its

common shares from time to time and that, at appropriate times,

repurchasing its shares through the NCIB may represent a good use

of Goldmoney’s financial resources, as such action can protect and

enhance shareholder value when opportunities or volatility arise.

Therefore, the Board of Directors has determined that the NCIB is

in the best interest of Goldmoney and its shareholders.

Goldmoney obtained TSX approval for a previous

notice of intention to conduct a normal course issuer bid to

purchase up to 3,000,000 common shares for the period of December

15, 2016 to December 14, 2017. Goldmoney did not make any purchases

of its common shares between the period of December 15, 2016 and

December 14, 2017.

About Goldmoney Inc.

Goldmoney Inc., a financial service company

traded on the Toronto Stock Exchange (TSX:XAU), is a global leader

in precious metal investment services and the world's largest

precious metals payment network. Safeguarding $1.8 billion in

assets for clients located in more than 150 countries, Goldmoney is

focused on a singular mission to make precious metals-backed

savings accessible to all. Powered by Goldmoney’s patented

technology, the Goldmoney® Holding is an online account that

enables clients to invest, earn, or spend gold, silver, platinum,

palladium and cryptocurrencies that are securely stored in insured

vaults in seven countries. All bullion assets are fully allocated

and physically redeemable property. Goldmoney Wealth Limited is

regulated by the Jersey Financial Services Commission (JFSC) as a

Money Services Business. Goldmoney Network is a reporting entity to

the Financial Transactions and Reports Analysis Centre of Canada

(FINTRAC), and is registered with the Financial Crimes Enforcement

Network (FinCEN) in the U.S. For more information about Goldmoney,

visit goldmoney.com.

Media and Investor Relations Inquiries:

Renee WeiDirector of Global Communications

Goldmoney Inc. renee.wei@goldmoney.com

Josh Crumb Chief Strategy Officer &

Director Goldmoney Inc. +1 647-499-6748

Forward‐Looking Statements

This news release contains or refers to certain

forward-looking information. Forward-looking information can often

be identified by forward-looking words such as "anticipate",

"believe", "expect", "plan", "intend", "estimate", "may",

"potential" and "will" or similar words suggesting future outcomes,

or other expectations, beliefs, plans, objectives, assumptions,

intentions or statements about future events or performance. All

information other than information regarding historical fact, which

addresses activities, events or developments that the Goldmoney

Inc. (the "Company") believes, expects or anticipates will or may

occur in the future, is forward looking information.

Forward-looking information does not constitute historical fact but

reflects the current expectations the Company regarding future

results or events based on information that is currently available.

By their nature, forward-looking statements involve numerous

assumptions, known and unknown risks and uncertainties, both

general and specific, that contribute to the possibility that the

predictions, forecasts, projections and other forward-looking

information will not occur. Such forward-looking information in

this release speak only as of the date hereof.

Forward-looking information in this release

includes, but is not limited to, statements with respect to:

service times for transactions on the Goldmoney network; growth of

the Company's business, expected results of operations, and the

market for the Company's products and services and competitive

conditions. This forward-looking information is based on reasonable

assumptions and estimates of management of the Company at the time

it was made, and involves known and unknown risks, uncertainties

and other factors which may cause the actual results, performance

or achievements of the Company to be materially different from any

future results, performance or achievements expressed or implied by

such forward-looking information. Such factors include, among

others: the Company's limited operating history; history of

operating losses; future capital needs and uncertainty of

additional financing; fluctuations in the market price of the

Company's common shares; the effect of government regulation and

compliance on the Company and the industry; legal and regulatory

change and uncertainty; jurisdictional factors associated with

international operations; foreign restrictions on the Company's

operations; product development and rapid technological change;

dependence on technical infrastructure; protection of intellectual

property; use and storage of personal information and compliance

with privacy laws; network security risks; risk of system failure

or inadequacy; the Company's ability to manage rapid growth;

competition; effectiveness of the Company's risk management and

internal controls; use of the Company's services for improper or

illegal purposes; uninsured and underinsured losses; theft &

risk of physical harm to personnel; precious metal trading risks;

and volatility of precious metals prices & public interest in

precious metals investment; and those risks set out in the

Company's most recently filed annual information form, available

on SEDAR. Although the Company has attempted to identify

important factors that could cause actual results to differ

materially, there may be other factors that cause results not to be

as anticipated, estimated or intended. There can be no assurance

that such statements will prove to be accurate as actual results

and future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking information. The Company undertakes no

obligation to update or revise any forward-looking information,

except as required by law.

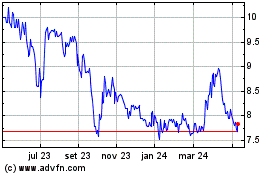

GoldMoney (TSX:XAU)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

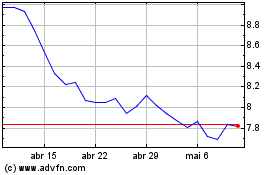

GoldMoney (TSX:XAU)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024