Oxbridge Re Holdings Limited

(NASDAQ: OXBR),

(the “Company”), a provider of reinsurance solutions primarily to

property and casualty insurers, reported its results for the three

months and year ended December 31, 2022.

“By limiting our exposure to underwriting losses

through reinsurance contracts in 2022, we significantly reduced the

potential loss resulting from Hurricanes Ian and Nicole during the

year,” commented Oxbridge Re Holdings President and Chief Executive

Officer Jay Madhu.

“Earlier in 2023 we announced the creation of

our new subsidiary SurancePlus Inc., offering an alternative

investment opportunity leveraging key qualities of blockchain

technology to create a well-designed digital security,” Mr. Madhu

continued. “In other words, we are digitizing reinsurance

securities leveraging blockchain technology via tokenized

reinsurance securities. In addition we recently launched our

capital raise for SurancePlus where investors in a loss-free period

are expected to generate a return of approximately 196% in a

three-year period.”

“Also subsequent to the year end, Oxbridge

Acquisition Corp. (NASDAQ: OXAC), a Special Purpose Acquisition

Company (“SPAC”) in which we have an indirect investment, filed its

business combination agreement to merge with Jet Token Inc.

(“Jet”), a private aviation and artificial intelligence company

offering fractional aircraft ownership, jet card, aircraft

brokerage and charter services. The SPAC also recently filed its

registration statement on Form S-4 with the Securities and Exchange

Commission.” Mr. Madhu concluded.

Financial Performance

For the three months ended December 31, 2022 the

Company generated net income of $678,000 or $0.12 per basic and

diluted earnings per share compared net income of $1.6 million or

$0.27 per basic and diluted earnings per share in the fourth

quarter of 2021. For the year ended December 31, 2022 the Company

incurred a net loss of $1.8 million or ($0.31) per basic and

diluted loss per share compared to net income of $8.6 million or

$1.49 per basic and diluted earnings per share in the prior year.

The decline in fiscal 2022 is primarily due to a decrease in

unrealized gains on the Company’s investment in the SPAC and

increased loss and loss adjustment expenses related to the impact

of Hurricane Ian during the year.

Net premiums earned for the three months ended

December 31, 2022 were nil compared to $210,000 in the same prior

year period. For the year ended December 31, 2022 net premiums

earned increased to $995,000 from $965,000 in the prior year. The

increase in 2022 was due to the acceleration of premium recognition

on two of the Company’s reinsurance contracts due to a limit loss

suffered during year as well as higher rates on reinsurance

contracts compared to the prior year.

Total expenses, including losses and loss

adjustment expenses, policy acquisition costs and general and

administrative expenses, were $363,000 and $2.6 million for the

three months and year ended December 31, 2022, respectively,

compared to $482,000 and $1.6 million, respectively, for the same

periods in the prior year. The overall increase in 2022 was due to

a limit loss incurred on two of the Company’s reinsurance contracts

due to the impact of Hurricane Ian, as well as higher general and

administrative expenses due to inflationary expense fluctuations

and the hiring of an additional member of staff in 2022.

At December 31, 2022, cash and cash equivalents,

and restricted cash and cash equivalents were $3.9 million compared

to $5.4 million at December 31, 2021.

Financial Ratios

Loss Ratio. The loss ratio,

which measures underwriting profitability, is the ratio of losses

and loss adjustment expenses incurred to net premiums earned. The

loss ratio increased to 107.8% for the year ended December 31, 2022

compared to 16.4% in the prior year due to the limit losses

suffered on two of the Company’s reinsurance contracts as a result

of Hurricanes Ian, partially offset by a higher denominator in net

premiums earned, compared with the prior year.

Acquisition Cost Ratio. The

acquisition cost ratio, which measures operational efficiency,

compares policy acquisition costs with net premiums earned,

remained consistent at 11.0% for the year ended December 31, 2022

compared to the prior year.

Expense Ratio. The expense

ratio, which measures operating performance, compares policy

acquisition costs and general and administrative expenses with net

premiums earned. The expense ratio increased to 153.1% for the year

ended December 31, 2022 from 146.2% for the prior year due to

higher general and administrative expenses in 2022 compared to the

prior year.

Combined ratio. The combined

ratio, which is used to measure underwriting performance, is the

sum of the loss ratio and the expense ratio. The combined ratio

increased to 260.9% for the year ended December 31, 2022 from

162.6% for the prior year. The increase is due to the increase in

the loss ratio in 2022 as a result of a limit loss suffered under

two of the Company’s reinsurance contracts and increased general

administrative expenses compared to the prior year.

Subsequent Events

On February 28, 2023, the Company announced that

Oxbridge Acquisition Corp. (“Oxbridge Acquisition”) filed a Current

Report on Form 8-K with the Securities and Exchange Commission in

connection with Oxbridge Acquisition’s business combination with

Jet Token Inc. (“Jet”), a Delaware based company. Upon the closing

of the transaction, the combined company will be named Jet.AI Inc.

Jet offers fractional aircraft ownership, jet card, aircraft

brokerage and charter service through its fleet of private aircraft

and those of Jet’s Argus Platinum operating partner. Jet’s charter

app enables travelers to look, book and fly. The funding and

capital markets access from this transaction is expected to enable

Jet to continue its growth strategy of AI software development and

fleet expansion. The business combination is expected to be

completed late in the second quarter of 2023.

The Company’s wholly-owned licensed reinsurance

subsidiary, Oxbridge Reinsurance Limited (“Oxbridge Reinsurance”),

is the lead investor in Oxbridge Acquisition’s sponsor and holds

the equivalent of 1,426,180 Class B shares, which at closing of the

business combination will have a value of $14,261,800. This does

not include the value of the 3,094,999 private placement warrants

that the Company beneficially holds in Oxbridge Acquisition.

On March 27th, 2023, Oxbridge Re Holdings

Limited (the “Company”) and its indirect wholly-owned subsidiary

SurancePlus Inc. (“SurancePlus”), a British Virgin Islands Business

Company, announced the commencement of an offering by SurancePlus

of up to $5.0 million (USD) of DeltaCat Re Tokens (the “Tokens”),

which represent Series DeltaCat Preferred Shares of SurancePlus

(“Preferred Shares”, and together with the Tokens, the

“Securities”). Each Token, which will have a purchase price of

$10.00 per Token, will represent one Preferred Share of

SurancePlus.

The proceeds from the offer and sale of the

Securities will be used by SurancePlus to purchase one or more

participating notes of Oxbridge Re NS, a Cayman Islands licensed

reinsurance subsidiary of the Company, and the proceeds from the

sale of participating notes will be invested in collateralized

reinsurance contracts to be underwritten by Oxbridge Re NS. The

holders of the Securities will generally be entitled to proceeds

from the payment of participating notes in the amount of a

preferred return of $12.00 plus 80% of any proceeds in excess of

the amount necessary to pay the preferred return. Assuming no

casualty losses to properties reinsured by Oxbridge Re’s

reinsurance subsidiaries, DeltaCat Re token investors are expected

to receive a return on the original purchase price of the tokens of

up to 196% after three years.

Conference Call

Management will host a conference call later

today to discuss these financial results, followed by a question

and answer session. President and Chief Executive Officer Jay Madhu

and Chief Financial Officer Wrendon Timothy will host the call

starting at 4:30 p.m. Eastern time. The live presentation can be

accessed by dialing the number below or by clicking the webcast

link available on the Investor Information section of the company’s

website at www.oxbridgere.com.

Date: March 30 , 2023Time: 4.30 p.m. Eastern

timeToll-free number: - 877-524-8416International number: +1

412-902-1028

Please call the conference telephone number 10

minutes before the start time. An operator will register your name

and organization. If you have any difficulty connecting with the

conference call, please contact InComm Conferencing at

+1-201-493-6311media@incommconferencing.com

A replay of the call will be available by

telephone after 4:30 p.m. Eastern time on the same day of the call

and via the Investor Information section of Oxbridge’s website at

www.oxbridgere.com until April 13, 2023.

Toll-free replay number:

877-660-6853International replay number: +1-201-612-7415Conference

ID: 13737512

About Oxbridge Re Holdings

Limited

Oxbridge Re (www.oxbridgere.com) is a Cayman

Islands exempted company that was organized in April 2013 to

provide reinsurance business solutions primarily to property and

casualty insurers in the Gulf Coast region of the United States.

Through Oxbridge Re’s licensed reinsurance subsidiaries, Oxbridge

Reinsurance Limited and Oxbridge RE NS, it writes fully

collateralized policies to cover property losses from specified

catastrophes. Oxbridge Re specializes in underwriting medium

frequency, high severity risks, where it believes sufficient data

exists to analyze effectively the risk/return profile of

reinsurance contracts and it makes investments that can contribute

to the growth of capital and surplus in its licensed reinsurance

subsidiaries over time. The company’s ordinary shares and warrants

trade on the NASDAQ Capital Market under the symbols “OXBR” and

“OXBRW,” respectively.

Forward-Looking Statements

This press release, together with other

statements and information publicly disseminated by the Company,

contains certain forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. The Company

intends such forward-looking statements to be covered by the safe

harbor provisions for forward-looking statements contained in the

Private Securities Litigation Reform Act of 1995 and includes this

statement for purposes of complying with these safe harbor

provisions. Any statements made in this press release or during the

earnings call that are not statements of historical fact, including

statements about our beliefs and expectations, are forward-looking

statements and should be evaluated as such. Forward-looking

statements include information concerning possible or assumed

future results of operations, including descriptions of our

business plan and strategies. These statements often include words

such as “anticipate,” “expect,” “suggests,” “plan,” “believe,”

“intend,” “estimates,” “targets,” “projects,” “should,” “could,”

“would,” “may,” “will,” “forecast” and other similar expressions.

We base these forward-looking statements on our current

expectations, plans and assumptions that we have made in light of

our experience in the industry, as well as our perceptions of

historical trends, current conditions, expected future developments

and other factors we believe are appropriate under the

circumstances at such time. Although we believe that these

forward-looking statements are based on reasonable assumptions at

the time they are made, you should be aware that many factors could

affect our business, results of operations and financial condition

and could cause actual results to differ materially from those

expressed in the forward-looking statements. These statements are

not guarantees of future performance or results. The

forward-looking statements are subject to and involve risks,

uncertainties and assumptions, and you should not place undue

reliance on these forward-looking statements. These forward-looking

statements include, but are not limited to, statements concerning

the following: our significant indirect investment in Oxbridge

Acquisition Corp., a blank check company commonly referred to as a

special purpose acquisition company, whereby we will suffer the

loss of all of our investment if the proposed business combination

with Jet Token Inc. fails, or if Oxbridge Acquisition Corp. does

not complete an acquisition by August 16, 2023; our use of fair

value accounting of our indirect investment in Oxbridge Acquisition

Corp. which would result in income statement volatility if a

business combination is not completed; and the other important

factors discussed under the caption “Risk Factors” in SurancePlus’

offering documents, and our Form 10-K filed with the U.S.

Securities and Exchange Commission on March 30, 2023, as may be

updated from time to time in subsequent filings. These cautionary

statements should not be construed by you to be exhaustive and are

made only as of the date of this press release. We undertake no

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by applicable law.

Company Contact:Oxbridge Re Holdings LimitedJay

Madhu, CEO345-749-7570jmadhu@oxbridgere.com

OXBRIDGE RE HOLDINGS LIMITED AND

SUBSIDIARIESConsolidated Balance

Sheets(expressed

in thousands of U.S. Dollars, except per share and share

amounts)

| |

|

At December 31, 2022 |

|

|

At December 31, 2021 |

|

| |

|

|

|

|

|

|

| Assets |

|

|

|

|

|

|

|

|

|

Investments: |

|

|

|

|

|

|

|

|

|

Equity securities, at fair value (cost: $1,926 and $1,522) |

|

$ |

642 |

|

|

|

577 |

|

|

Cash and cash equivalents |

|

|

1,207 |

|

|

|

3,527 |

|

|

Restricted cash and cash equivalents |

|

|

2,721 |

|

|

|

1,891 |

|

|

Premiums receivable |

|

|

282 |

|

|

|

284 |

|

|

Other Investments |

|

|

11,423 |

|

|

|

11,173 |

|

|

Due from related parties |

|

|

45 |

|

|

|

5 |

|

|

Deferred policy acquisition costs |

|

|

- |

|

|

|

38 |

|

|

Operating lease right-of-use assets |

|

|

44 |

|

|

|

135 |

|

|

Prepayment and other assets |

|

|

114 |

|

|

|

50 |

|

|

Prepaid offering costs |

|

|

133 |

|

|

|

- |

|

|

Property and equipment, net |

|

|

5 |

|

|

|

9 |

|

|

Total assets |

|

$ |

16,616 |

|

|

|

17,689 |

|

| |

|

|

|

|

|

|

|

|

| Liabilities and

Shareholders’ Equity |

|

|

|

|

|

|

|

|

| Liabilities: |

|

|

|

|

|

|

|

|

|

Reserve for losses and loss adjustment expenses |

|

|

1,073 |

|

|

|

- |

|

|

Notes payable to noteholders |

|

|

216 |

|

|

|

216 |

|

|

Unearned premiums reserve |

|

|

- |

|

|

|

350 |

|

|

Operating lease liabilities |

|

|

44 |

|

|

|

135 |

|

|

Accounts payable and other liabilities |

|

|

294 |

|

|

|

337 |

|

|

Total liabilities |

|

|

1,627 |

|

|

|

1,038 |

|

| |

|

|

|

|

|

|

|

|

| Shareholders’ equity: |

|

|

|

|

|

|

|

|

|

Ordinary share capital, (par value $0.001, 50,000,000 shares

authorized; 5,769,587 and 5,749,587 shares issued and

outstanding) |

|

|

6 |

|

|

|

6 |

|

|

Additional paid-in capital |

|

|

32,482 |

|

|

|

32,355 |

|

|

Accumulated Deficit |

|

|

(17,499 |

) |

|

|

(15,710 |

) |

|

Total shareholders’ equity |

|

|

14,989 |

|

|

|

16,651 |

|

|

Total liabilities and shareholders’ equity |

|

$ |

16,616 |

|

|

|

17,689 |

|

OXBRIDGE RE HOLDINGS LIMITED AND

SUBSIDIARYConsolidated Statements of

Income(expressed

in thousands of U.S. Dollars, except per share and share

amounts)

| |

|

Three Months Ended |

|

|

Year Ended |

|

| |

|

December 31, |

|

|

December 31, |

|

| |

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

| |

|

|

|

|

|

|

| Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Assumed premiums |

|

$ |

- |

|

|

|

- |

|

|

|

705 |

|

|

|

904 |

|

| Premiums ceded |

|

|

- |

|

|

|

- |

|

|

|

(60 |

) |

|

|

- |

|

| Change in unearned premiums

reserve |

|

|

- |

|

|

|

210 |

|

|

|

350 |

|

|

|

61 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net premiums earned |

|

|

- |

|

|

|

210 |

|

|

|

995 |

|

|

|

965 |

|

|

Net investment and other income |

|

|

73 |

|

|

|

34 |

|

|

|

201 |

|

|

|

99 |

|

|

Net realized investment gains |

|

|

- |

|

|

|

- |

|

|

|

27 |

|

|

|

755 |

|

|

Unrealized gain (loss) on other investment |

|

|

951 |

|

|

|

2,027 |

|

|

|

(35 |

) |

|

|

9,173 |

|

|

Change in fair value of equity securities |

|

|

17 |

|

|

|

(202 |

) |

|

|

(338 |

) |

|

|

(767 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenue |

|

|

1,041 |

|

|

|

2,069 |

|

|

|

850 |

|

|

|

10,225 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Losses and loss adjustment

expenses |

|

|

- |

|

|

|

- |

|

|

|

1,073 |

|

|

|

158 |

|

| Policy acquisition costs and

underwriting expenses |

|

|

- |

|

|

|

23 |

|

|

|

110 |

|

|

|

106 |

|

| General and administrative

expenses |

|

|

363 |

|

|

|

459 |

|

|

|

1,413 |

|

|

|

1,305 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total expenses |

|

|

363 |

|

|

|

482 |

|

|

|

2,596 |

|

|

|

1,569 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) before income attributable to noteholders |

|

|

678 |

|

|

|

1,587 |

|

|

|

(1,746 |

) |

|

|

8,656 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income attributable to noteholders |

|

|

- |

|

|

|

(26 |

) |

|

|

(43 |

) |

|

|

(91 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

|

$ |

678 |

|

|

|

1,561 |

|

|

|

(1,789 |

) |

|

|

8,565 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings (loss) per

share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and Diluted |

|

$ |

0.12 |

|

|

|

0.27 |

|

|

|

(0.31 |

) |

|

|

1.49 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average

shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and Diluted |

|

|

5,775,006 |

|

|

|

5,733,587 |

|

|

|

5,772,396 |

|

|

|

5,735,779 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Performance ratios to

net premiums earned: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss ratio |

|

|

0.0 |

% |

|

|

0.0 |

% |

|

|

107.8 |

% |

|

|

16.4 |

% |

| Acquisition cost ratio |

|

|

0.0 |

% |

|

|

11.0 |

% |

|

|

11.1 |

% |

|

|

11.0 |

% |

| Expense ratio |

|

|

0.0 |

% |

|

|

229.5 |

% |

|

|

153.1 |

% |

|

|

146.2 |

% |

| Combined ratio |

|

|

0.0 |

% |

|

|

229.5 |

% |

|

|

260.9 |

% |

|

|

162.6 |

% |

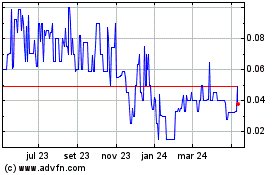

Oxbridge Re (NASDAQ:OXBRW)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

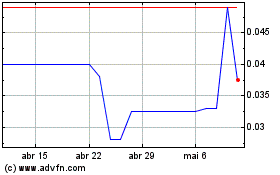

Oxbridge Re (NASDAQ:OXBRW)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025