Kingsoft Cloud Holdings Limited (“Kingsoft Cloud” or the “Company”)

(NASDAQ: KC and HKEX: 3896), a leading independent cloud service

provider in China, today announced its unaudited financial results

for the first quarter ended March 31, 2023.

Mr. Tao Zou, Chief Executive Officer of Kingsoft Cloud,

commented, “This quarter we remained committed to our high-quality

and sustainable development strategy, continued to build our

success based on technology, built our full life-cycle brand

recognition centered around our clients, while keep enhancing our

management of operating. Our results over the past few quarters

demonstrate the effectiveness of our strategy. As we prepare to

meet future opportunities and challenges head-on, we will nimbly

execute on our strategy to create value for our customers,

shareholders, employees, and society.”

Mr. Henry He, Chief Financial Officer of Kingsoft Cloud, added,

“We are pleased to see that our profitability further improved

steadily in the first quarter with the adjusted gross margin

increasing for a fourth consecutive quarter and rising by a

significant 6.6 percentage points year-over-year to a historical

high of 10.4%. To help capital market better understand our path to

improve our profitability, this quarter we started to provide gross

profit and margin for public cloud and enterprise cloud services

separately. Gross margin of public cloud services increased to 2.1%

from negative 3.4% a year ago and gross margin of enterprise cloud

services also improved significantly from 16.1% to 23.8%,

testifying to the effectiveness of our strategy. Looking ahead, we

will continue to take various measures to cut down expenses and we

believe we are well on track to quarterly adjusted EBITDA

breakeven.”

First Quarter

2023 Financial

Results

Total Revenues reached

RMB1,864.4 million (US$271.51 million), representing a decrease of

14.2% from RMB2,173.8 million in the same period of 2022. The

decrease was mainly due to our proactive scaling down of CDN

services, with its gross billings decreased by 11.7% on

year-over-year basis, and more stringent selection of enterprise

cloud projects.

Revenues from public

cloud services decreased by 16.4% to RMB1,153.7 million (US$168.0

million), compared with RMB1,380.8 million in the same quarter of

2022. The year-over-year decrease was mainly due to the

above-mentioned scaling down of our CDN services.

__________________1 This announcement contains translations

of certain Renminbi (RMB) amounts into U.S. dollars (US$) at a

specified rate solely for the convenience of the reader. Unless

otherwise noted, the translation of RMB into US$ has been made at

RMB6.8676 to US$1.00, the noon buying rate in effect on March 31,

2023 as certified for customs purposes by the Federal Reserve Bank

of New York.

Revenues from

enterprise cloud services were RMB710.0 million (US$103.4 million),

representing a decrease of 10.4% from RMB792.5 million in the same

quarter of 2022. The year-over-year decrease was mainly due to the

impact of the surging wave of COVID-19 infections in January 2023,

seasonality of Chinese New Year holidays, as well as more stringent

project selection.

Other revenues were

RMB0.8 million (US$0.1 million).

Cost of

revenues was RMB1,670.2 million (US$243.2

million), representing a significant decrease of 20.2% from

RMB2,093.9 million in the same quarter of 2022. We continue to

enhance our cost control measures. IDC costs decreased

significantly by 21.4% year-over-year from RMB1,110.3 million to

RMB872.4 million this quarter. Depreciation and amortization costs

decreased by 8.7% from RMB246.1 million to RMB224.6 million.

Solution development and services costs decreased by 11.0% from

RMB476.0 million to RMB423.6 million this quarter. Fulfillment

costs and other costs were RMB122.7 million and RMB26.9 million

this quarter, which is in line with our enterprise cloud projects’

quality control strategy.

Gross profit was RMB194.2

million (US$28.3 million), which is a record high quarterly gross

profit, representing a significant increase of 142.8% from RMB80.0

million in the same period in 2022. Gross

margin was 10.4%, compared with 3.7% in the same

period in 2022. Non-GAAP gross

profit2 was RMB194.4 million (US$28.3 million),

compared with RMB83.6 million in the same period in 2022.

Non-GAAP gross

margin2 was 10.4%, compared with

3.8% in the same period in 2022. The significant improvement of our

gross profit and margin was mainly due to our strategic adjustment

of revenue mix, optimized enterprise cloud project selection and

efficient cost control measures, showing our strong commitment to

improving our profitability and delivering high-quality and

sustainable development.

Within that, gross profit of public cloud services was RMB24.8

million (US$3.6 million), which was significantly improved from the

gross loss of RMB47.2 million in same period last year. Gross

margin of public cloud services was 2.1%, compared with negative

3.4% in the same period last year. The improvement was mainly due

to our proactive scale down of CDN services and adjustment of our

clients’ structure. Gross profit of enterprise cloud services was

RMB169.0 million (US$24.6 million), compared with RMB127.4 million

in the same period last year. Gross margin of enterprise cloud

services was 23.8%, improved from 16.1% in the same period last

year. The improvement was mainly due to our more stringent

enterprise cloud project selection.

Total operating

expenses were RMB792.1 million (US$115.3 million),

compared with RMB824.3 million last quarter and RMB612.8 million in

the same period in 2022. Among which:

Selling and

marketing expenses were RMB88.1

million (US$12.8 million), further decreased from RMB126.1 million

last quarter and RMB144.4 million in the same period in 2022.

General and

administrative expenses were

RMB488.6 million (US$71.2 million), compared with RMB 442.8 million

last quarter and RMB221.8 million in the same period in 2022. The

increase was mainly due to one-time long-lived assets impairment

loss of public cloud asset group of RMB185.1 million and loss on

disposal of property and equipment of RMB20.2 million.

Research and

development expenses were

RMB215.4 million (US$31.4 million), further decreased from RMB255.5

million last quarter and RMB246.6 million in the same period in

2022.

Operating loss was RMB597.9

million (US$87.1 million), compared with operating loss of RMB662.4

million last quarter and RMB532.8 million in the same quarter of

2022.

__________________2 Non-GAAP gross profit is defined as

gross profit excluding share-based compensation allocated in the

cost of revenues and we define Non-GAAP gross margin as Non-GAAP

gross profit as a percentage of revenues. See “Use of Non-GAAP

Financial Measures” set forth at the end of this press release.

Net loss was RMB608.8 million

(US$88.7 million), compared with net loss of RMB521.7 million last

quarter and RMB554.8 million in the same quarter of 2022. The

year-over-year increase was mainly due to the impact of operating

loss, while offset by our gross profit improvements.

Non-GAAP net

loss3 was RMB412.5 million

(US$60.1 million), significantly narrowed from net loss of RMB552.7

million last quarter and RMB442.9 million in the same quarter of

2022.

Non-GAAP

EBITDA4 was RMB-130.5 million

(US$-19.0 million), which was largely narrowed from RMB-245.1

million last quarter and RMB-144.2 million in the same quarter of

2022. Non-GAAP EBITDA

margin was-7.0% this quarter, compared with -11.5%

last quarter and -6.6% in the same quarter last year. Excluding

loss on disposal of property and equipment,

normalized Non-GAAP

EBITDA was RMB-110.3 million this quarter,

improved from RMB-216.3 million last quarter and RMB-144.2 million

in the same period last quarter. Normalized

Non-GAAP EBITDA

margin was -5.9%, compared with -10.2% last

quarter and -6.6% in the same quarter of 2022.

Basic and

diluted net loss

per share was RMB0.17 (US$0.02),

compared with RMB0.14 last quarter and RMB0.15 in the same quarter

of 2022.

Cash and cash

equivalents and

short-term investments were

RMB4,461.6 million (US$649.7 million) as of March 31, 2023,

representing strong and sustainable cash reserve.

Outstanding ordinary

shares were 3,509,636,591 as of March 31, 2023,

equivalent to about 233,975,773 ADSs.

Business Outlook

For the second quarter of 2023, the Company expects total

revenues to be between RMB1.85 billion and RMB2.00 billion. This

forecast reflects the Company’s current and preliminary views on

the market and operational conditions, which are subject to

change.

Conference Call

Information

Kingsoft Cloud’s management will host an earnings conference

call on Tuesday, May 23, 2023 at 8:15 am, U.S. Eastern Time (8:15

pm, Beijing/Hong Kong Time on the same day).

Participants can register for the conference call by navigating

to

https://register.vevent.com/register/BI10c24f9a1b6b451b80e048e41962b3b5.

Once preregistration has been completed, participants will receive

dial-in numbers, direct event passcode, and a unique access

PIN.

To join the conference, simply dial the number in the calendar

invite you receive after preregistering, enter the passcode

followed by your PIN, and you will join the conference

instantly.

__________________3 Non-GAAP net loss is defined as net

loss excluding share-based compensation foreign exchange loss

(gain) and impairment of long-lived assets, and we define Non-GAAP

net loss margin as adjusted net loss as a percentage of revenues.

See “Use of Non-GAAP Financial Measures” set forth at the end of

this press release.

4 Non-GAAP EBITDA is defined as Non-GAAP net loss excluding

interest income, interest expense, income tax expense and

depreciation and amortization, and we define Non-GAAP EBITDA margin

as Non-GAAP EBITDA as a percentage of revenues. See “Use of

Non-GAAP Financial Measures” set forth at the end of this press

release.

Additionally, a live and archived webcast of the conference call

will also be available on the Company’s investor relations website

at http://ir.ksyun.com.

Use of

Non-GAAP Financial

Measures

The unaudited condensed consolidated financial information is

prepared in conformity with accounting principles generally

accepted in the United States of America (“U.S. GAAP”). In

evaluating our business, we consider and use certain non-GAAP

measures, Non-GAAP gross profit, Non-GAAP gross margin, Non-GAAP

EBITDA, Non-GAAP EBITDA margin, Non-GAAP net loss and Non-GAAP net

loss margin, as supplemental measures to review and assess our

operating performance. The presentation of these non-GAAP financial

measures is not intended to be considered in isolation or as a

substitute for the financial information prepared and presented in

accordance with U.S. GAAP. We define Non-GAAP gross profit as gross

profit excluding share-based compensation allocated in the cost of

revenues, and we define Non-GAAP gross margin as Non-GAAP gross

profit as a percentage of revenues. We define Non-GAAP net loss as

net loss excluding share-based compensation foreign exchange loss

(gain) and impairment of long-lived assets, and we define Non- GAAP

net loss margin as adjusted net loss as a percentage of revenues.

We define Non-GAAP EBITDA as Non-GAAP net loss excluding interest

income, interest expense, income tax expense and depreciation and

amortization, and we define Non-GAAP EBITDA margin as Non-GAAP

EBITDA as a percentage of revenues. We present these non-GAAP

financial measures because they are used by our management to

evaluate our operating performance and formulate business plans. We

also believe that the use of these non-GAAP measures facilitates

investors’ assessment of our operating performance.

These non-GAAP financial measures are not defined under U.S.

GAAP and are not presented in accordance with U.S. GAAP. These

non-GAAP financial measures have limitations as analytical tools.

One of the key limitations of using these non-GAAP financial

measures is that they do not reflect all items of income and

expense that affect our operations. Further, these non-GAAP

measures may differ from the non-GAAP information used by other

companies, including peer companies, and therefore their

comparability may be limited.

We compensate for these limitations by reconciling these

non-GAAP financial measures to the nearest U.S. GAAP performance

measure, all of which should be considered when evaluating our

performance. We encourage you to review our financial information

in its entirety and not rely on a single financial measure.

Exchange

Rate Information

This press release contains translations of certain RMB amounts

into U.S. dollars at specified rates solely for the convenience of

readers. Unless otherwise noted, all translations from RMB to U.S.

dollars, in this press release, were made at a rate of RMB6.8676 to

US$1.00, the noon buying rate in effect on March 31, 2023 as

certified for customs purposes by the Federal Reserve Bank of New

York.

Safe Harbor

Statement

This announcement contains forward-looking statements. These

statements are made under the “safe harbor” provisions of the U.S.

Private Securities Litigation Reform Act of 1995. These

forward-looking statements can be identified by terminology such as

“will,” “expects,” “anticipates,” “future,” “intends,” “plans,”

“believes,” “estimates” and similar statements. Among other things,

the Business Outlook, and quotations from management in this

announcement, as well as Kingsoft Cloud’s strategic and operational

plans, contain forward-looking statements. Kingsoft Cloud may also

make written or oral forward-looking statements in its periodic

reports to the U.S. Securities and Exchange Commission (“SEC”), in

its annual report to shareholders, in press releases and other

written materials and in oral statements made by its officers,

directors or employees to third parties. Statements that are not

historical facts, including but not limited to statements about

Kingsoft Cloud’s beliefs and expectations, are forward-looking

statements. Forward-looking statements involve inherent risks and

uncertainties. A number of factors could cause actual results to

differ materially from those contained in any forward-looking

statement, including but not limited to the following: Kingsoft

Cloud’s goals and strategies; Kingsoft Cloud’s future business

development, results of operations and financial condition;

relevant government policies and regulations relating to Kingsoft

Cloud’s business and industry; the expected growth of the cloud

service market in China; the expectation regarding the rate at

which to gain customers, especially Premium Customers; Kingsoft

Cloud’s ability to monetize the customer base; fluctuations in

general economic and business conditions in China; the impact of

the COVID-19 to Kingsoft Cloud’s business operations and the

economy in China and elsewhere generally; China’s political or

social conditions and assumptions underlying or related to any of

the foregoing. Further information regarding these and other risks

is included in Kingsoft Cloud’s filings with the SEC. All

information provided in this press release and in the attachments

is as of the date of this press release, and Kingsoft Cloud does

not undertake any obligation to update any forward-looking

statement, except as required under applicable law.

About

Kingsoft

Cloud

Holdings

Limited

Kingsoft Cloud Holdings Limited (NASDAQ: KC and HKEX:3896) is a

leading independent cloud service provider in China. With extensive

cloud infrastructure, cutting-edge cloud-native products based on

vigorous cloud technology research and development capabilities,

well-architected industry- specific solutions and end-to-end

fulfillment and deployment, Kingsoft Cloud offers comprehensive,

reliable and trusted cloud service to customers in strategically

selected verticals.

For more information, please visit: http://ir.ksyun.com.

For investor

and media

inquiries,

please

contact:

Kingsoft Cloud Holdings Limited Nicole ShanTel: +86 (10)

6292-7777 Ext. 6300Email: ksc-ir@kingsoft.com

Christensen In ChinaMr. Eric YuanPhone: +86-10-5900-1548Email:

eric.yuan@christensencomms.com

In USMs. Linda Bergkamp Phone: +1-480-6143004Email:

lbergkamp@christensenir.com

|

|

|

KINGSOFT CLOUD HOLDINGS LIMITED |

|

UNAUDITED CONDENSED CONSOLIDATED BALANCE

SHEETS |

|

(All amounts in thousands) |

|

|

Dec 31, 2022 |

Mar 31, 2023 |

Mar 31, 2023 |

|

|

RMB |

RMB |

US$ |

|

ASSETS |

|

|

|

|

Current assets: |

|

|

|

|

Cash and cash equivalents |

3,419,166 |

|

3,568,288 |

|

519,583 |

|

|

Restricted cash |

114,560 |

|

97,897 |

|

14,255 |

|

|

Accounts receivable, net |

2,402,430 |

|

2,232,702 |

|

325,107 |

|

|

Short-term investments |

1,253,670 |

|

893,311 |

|

130,076 |

|

|

Prepayments and other assets |

1,612,022 |

|

1,614,758 |

|

235,126 |

|

|

Amounts due from related parties |

246,505 |

|

307,347 |

|

44,753 |

|

|

Total current assets |

9,048,353 |

|

8,714,303 |

|

1,268,900 |

|

|

Non-current assets: |

|

|

|

|

Property and equipment, net |

2,132,994 |

|

1,786,097 |

|

260,076 |

|

|

Intangible assets, net |

1,008,020 |

|

962,968 |

|

140,219 |

|

|

Prepayments and other assets |

21,263 |

|

21,046 |

|

3,065 |

|

|

Equity investments |

273,580 |

|

268,338 |

|

39,073 |

|

|

Goodwill |

4,605,724 |

|

4,605,724 |

|

670,645 |

|

|

Amounts due from related parties |

5,758 |

|

6,389 |

|

930 |

|

|

Operating lease right-of-use assets |

220,539 |

|

192,393 |

|

28,015 |

|

|

Total non-current assets |

8,267,878 |

|

7,842,955 |

|

1,142,023 |

|

|

Total assets |

17,316,231 |

|

16,557,258 |

|

2,410,923 |

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

Current liabilities: |

|

|

|

|

Short-term bank loans |

909,500 |

|

1,087,206 |

|

158,309 |

|

|

Accounts payable |

2,301,958 |

|

2,195,642 |

|

319,710 |

|

|

Accrued expenses and other current liabilities |

2,830,826 |

|

2,671,739 |

|

389,035 |

|

|

Income tax payable |

51,892 |

|

55,117 |

|

8,026 |

|

|

Amounts due to related parties |

427,727 |

|

420,088 |

|

61,170 |

|

|

Current operating lease liabilities |

136,723 |

|

115,769 |

|

16,857 |

|

|

Total current liabilities |

6,658,626 |

|

6,545,561 |

|

953,107 |

|

|

Non-current liabilities: |

|

|

|

|

Deferred tax liabilities |

167,052 |

|

155,522 |

|

22,646 |

|

|

Amounts due to related parties |

413,464 |

|

337,583 |

|

49,156 |

|

|

Other liabilities |

370,531 |

|

447,981 |

|

65,231 |

|

|

Non-current operating lease liabilities |

123,059 |

|

114,458 |

|

16,666 |

|

|

Total non-current liabilities |

1,074,106 |

|

1,055,544 |

|

153,699 |

|

|

Total liabilities |

7,732,732 |

|

7,601,105 |

|

1,106,806 |

|

|

Shareholders’ equity: |

|

|

|

|

Ordinary shares |

25,062 |

|

25,070 |

|

3,650 |

|

|

Treasury stock |

(208,385 |

) |

(208,385 |

) |

(30,343 |

) |

|

Additional paid-in capital |

18,648,205 |

|

18,659,506 |

|

2,717,034 |

|

|

Statutory reserves funds |

(14,700 |

) |

(14,700 |

) |

(2,140 |

) |

|

Accumulated deficit |

(10,102,236 |

) |

(10,709,224 |

) |

(1,559,384 |

) |

|

Accumulated other comprehensive income |

453,074 |

|

423,241 |

|

61,629 |

|

|

Total Kingsoft Cloud Holdings Limited shareholders’

equity |

8,801,020 |

|

8,175,508 |

|

1,190,446 |

|

|

Noncontrolling interests |

782,479 |

|

780,645 |

|

113,671 |

|

|

Total equity |

9,583,499 |

|

8,956,153 |

|

1,304,117 |

|

|

Total liabilities and shareholders’ equity |

17,316,231 |

|

16,557,258 |

|

2,410,923 |

|

| |

|

|

|

|

KINGSOFT CLOUD HOLDINGS LIMITED |

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF

COMPREHENSIVE LOSS |

|

(All amounts in thousands, except for share and per share

data) |

|

|

Three Months Ended |

|

|

Mar 31, 2022 |

Dec 31, 2022 |

Mar 31, 2023 |

Mar 31, 2023 |

|

|

RMB |

RMB |

RMB |

US$ |

|

Revenues: |

|

|

|

|

|

Public cloud services |

1,380,807 |

|

1,344,293 |

|

1,153,674 |

|

167,988 |

|

|

Enterprise cloud services |

792,509 |

|

785,918 |

|

709,976 |

|

103,381 |

|

|

Others |

493 |

|

802 |

|

750 |

|

109 |

|

|

Total revenues |

2,173,809 |

|

2,131,013 |

|

1,864,400 |

|

271,478 |

|

|

Cost of revenues |

(2,093,851 |

) |

(1,969,056 |

) |

(1,670,215 |

) |

(243,202 |

) |

|

Gross profit |

79,958 |

|

161,957 |

|

194,185 |

|

28,276 |

|

|

Operating expenses: |

|

|

|

|

|

Selling and marketing expenses |

(144,405 |

) |

(126,081 |

) |

(88,053 |

) |

(12,822 |

) |

|

General and administrative expenses |

(221,763 |

) |

(442,764 |

) |

(488,628 |

) |

(71,150 |

) |

|

Research and development expenses |

(246,633 |

) |

(255,488 |

) |

(215,370 |

) |

(31,360 |

) |

|

Total operating expenses |

(612,801 |

) |

(824,333 |

) |

(792,051 |

) |

(115,332 |

) |

|

Operating loss |

(532,843 |

) |

(662,376 |

) |

(597,866 |

) |

(87,056 |

) |

|

Interest income |

21,157 |

|

21,688 |

|

14,068 |

|

2,048 |

|

|

Interest expense |

(34,066 |

) |

(31,694 |

) |

(27,927 |

) |

(4,066 |

) |

|

Foreign exchange (loss) gain |

(18,741 |

) |

132,290 |

|

93 |

|

14 |

|

|

Other (loss) gain, net |

(12,035 |

) |

26,399 |

|

(7,946 |

) |

(1,157 |

) |

|

Other income, net |

20,038 |

|

4,085 |

|

12,286 |

|

1,789 |

|

|

Loss before income taxes |

(556,490 |

) |

(509,608 |

) |

(607,292 |

) |

(88,428 |

) |

|

Income tax benefit (expense) |

1,670 |

|

(12,049 |

) |

(1,529 |

) |

(223 |

) |

|

Net loss |

(554,820 |

) |

(521,657 |

) |

(608,821 |

) |

(88,651 |

) |

|

Less: net loss attributable to noncontrolling interests |

(1,571 |

) |

(12,779 |

) |

(1,833 |

) |

(267 |

) |

|

Net loss attributable to Kingsoft Cloud Holdings

Limited |

(553,249 |

) |

(508,878 |

) |

(606,988 |

) |

(88,384 |

) |

|

|

|

|

|

|

|

Net loss per share: |

|

|

|

|

|

Basic and diluted |

(0.15 |

) |

(0.14 |

) |

(0.17 |

) |

(0.02 |

) |

|

Shares used in the net loss per share

computation: |

|

|

|

|

|

Basic and diluted |

3,648,282,282 |

|

3,528,680,363 |

|

3,546,512,621 |

|

3,546,512,621 |

|

|

Other comprehensive income (loss), net of tax of

nil: |

|

|

|

|

|

Foreign currency translation adjustments |

(9,764 |

) |

(136,070 |

) |

(29,833 |

) |

(4,344 |

) |

|

Comprehensive loss |

(564,584 |

) |

(657,727 |

) |

(638,654 |

) |

(92,995 |

) |

|

Less: Comprehensive income (loss) attributable to noncontrolling

interests |

408 |

|

(12,682 |

) |

(1,834 |

) |

(267 |

) |

|

Comprehensive loss attributable to Kingsoft Cloud Holdings

Limited shareholders |

(564,992 |

) |

(645,045 |

) |

(636,820 |

) |

(92,728 |

) |

| |

|

|

|

|

|

KINGSOFT CLOUD HOLDINGS LIMITED |

|

RECONCILIATION OF GAAP AND NON-GAAP RESULTS |

|

(All amounts in thousands, except for

percentage) |

|

|

Three Months Ended |

|

|

Mar 31, 2022 |

Dec 31, 2022 |

Mar 31, 2023 |

Mar 31, 2023 |

|

|

RMB |

RMB |

RMB |

US$ |

|

Gross profit |

79,958 |

161,957 |

194,185 |

28,276 |

|

Adjustments: |

|

|

|

|

|

– Share-based compensation expenses |

3,619 |

6,557 |

224 |

33 |

|

Adjusted gross profit |

83,577 |

168,514 |

194,409 |

28,309 |

| |

|

|

|

|

|

KINGSOFT CLOUD HOLDINGS LIMITED |

|

RECONCILIATION OF GAAP AND NON-GAAP RESULTS |

|

(All amounts in thousands, except for

percentage) |

| |

Three Months Ended |

| |

Mar 31, 2022 |

Dec 31, 2022 |

Mar 31, 2023 |

|

Gross margin |

3.7 |

% |

7.6 |

% |

10.4 |

% |

|

Adjusted gross margin |

3.8 |

% |

7.9 |

% |

10.4 |

% |

|

KINGSOFT CLOUD HOLDINGS LIMITED |

|

RECONCILIATION OF GAAP AND NON-GAAP RESULTS |

|

(All amounts in thousands, except for

percentage) |

|

|

Three Months Ended |

|

|

Mar 31, 2022 |

Dec 31, 2022 |

Mar 31, 2023 |

Mar 31, 2023 |

|

|

RMB |

RMB |

RMB |

US$ |

|

Net Loss |

(554,820 |

) |

(521,657 |

) |

(608,821 |

) |

(88,651 |

) |

|

Adjustments: |

|

|

|

|

|

– Share-based compensation expenses |

93,182 |

|

101,270 |

|

11,309 |

|

1,647 |

|

|

– Foreign exchange loss (gain) |

18,741 |

|

(132,290 |

) |

(93 |

) |

(14 |

) |

|

– Impairment of long-lived assets |

- |

|

- |

|

185,135 |

|

26,958 |

|

|

Adjusted net loss |

(442,897 |

) |

(552,677 |

) |

(412,470 |

) |

(60,060 |

) |

|

Adjustments: |

|

|

|

|

|

– Interest income |

(21,157 |

) |

(21,688 |

) |

(14,068 |

) |

(2,048 |

) |

|

– Interest expense |

34,066 |

|

31,694 |

|

27,927 |

|

4,066 |

|

|

– Income tax (benefit) expense |

(1,670 |

) |

12,049 |

|

1,529 |

|

223 |

|

|

– Depreciation and amortization |

287,481 |

|

285,515 |

|

266,535 |

|

38,811 |

|

|

Adjusted EBITDA |

(144,177 |

) |

(245,107 |

) |

(130,547 |

) |

(19,008 |

) |

|

– Loss on disposal of property and equipment |

- |

|

28,788 |

|

20,216 |

|

2,944 |

|

|

Excluding loss on disposal of property and equipment, normalized

Adjusted EBITDA |

(144,177 |

) |

(216,319 |

) |

(110,331 |

) |

(16,064 |

) |

| |

|

|

|

|

|

KINGSOFT CLOUD HOLDINGS LIMITED |

|

RECONCILIATION OF GAAP AND NON-GAAP RESULTS |

|

(All amounts in thousands, except for

percentage) |

| |

Three Months Ended |

| |

Mar 31, 2022 |

Dec 31, 2022 |

Mar 31, 2023 |

|

Net loss margin |

-25.5 |

% |

-24.5 |

% |

-32.7 |

% |

|

Adjusted net loss margin |

-20.4 |

% |

-25.9 |

% |

-22.1 |

% |

|

Adjusted EBITDA Margin |

-6.6 |

% |

-11.5 |

% |

-7.0 |

% |

|

Normalized Adjusted EBITDA |

-6.6 |

% |

-10.2 |

% |

-5.9 |

% |

| |

|

|

|

|

KINGSOFT CLOUD HOLDINGS LIMITED |

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF CASH

FLOWS |

|

(All amounts in thousands) |

|

|

Three Months Ended |

|

|

Mar 31, 2022 |

Dec 31, 2022 |

Mar 31, 2023 |

Mar 31, 2023 |

|

|

RMB |

RMB |

RMB |

US$ |

|

Net cash (used in) generated from operating

activities |

(626,008 |

) |

370,446 |

|

(271,387 |

) |

(39,517 |

) |

|

Net cash (used in) generated from investing

activities |

(524,766 |

) |

900,951 |

|

319,670 |

|

46,548 |

|

|

Net cash generated from (used in) financing

activities |

97,609 |

|

(806,656 |

) |

103,994 |

|

15,143 |

|

|

Effect of exchange rate changes on cash, cash equivalents and

restricted cash |

(21,017 |

) |

(137,369 |

) |

(19,818 |

) |

(2,886 |

) |

|

Net (decrease) increase in cash, cash equivalents and restricted

cash |

(1,053,165 |

) |

464,741 |

|

152,277 |

|

22,174 |

|

|

Cash, cash equivalents and restricted cash at beginning of

period |

4,456,621 |

|

3,206,354 |

|

3,533,726 |

|

514,550 |

|

|

Cash, cash equivalents and restricted cash at end of

period |

3,382,439 |

|

3,533,726 |

|

3,666,185 |

|

533,838 |

|

| |

|

|

|

|

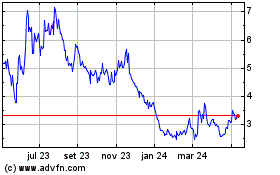

Kingsoft Cloud (NASDAQ:KC)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

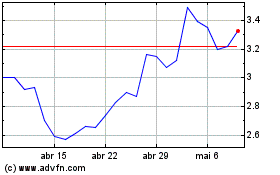

Kingsoft Cloud (NASDAQ:KC)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024