GameStop Corp. (NYSE: GME) (“GameStop” or the “Company”) today

released financial results for the third quarter ended October 28,

2023. The Company’s condensed and consolidated financial

statements, including GAAP and non-GAAP results, are below. The

Company’s Form 10-Q and supplemental information can be found at

https://investor.gamestop.com.

THIRD QUARTER OVERVIEW

- Net sales were $1.078

billion for the period, compared to $1.186 billion in the prior

year's third quarter.

- Selling, general and

administrative (“SG&A") expenses were $296.5 million, or 27.5%

of net sales for the period, compared to $387.9 million, or 32.7%

of net sales, in the prior year's third quarter.

- Net loss was $3.1

million for the period, compared to a net loss of $94.7 million for

the prior year’s third quarter.

- Cash, cash

equivalents and marketable securities were $1.210 billion at the

close of the quarter.

- Long-term debt

remains limited to one low-interest, unsecured term loan associated

with the French government’s response to COVID-19.

The Company will not be holding a conference call

today. Additional information can be found in the Company’s Form

10-Q.

NON-GAAP MEASURES AND OTHER

METRICS

As a supplement to the Company’s financial results

presented in accordance with U.S. generally accepted accounting

principles ("GAAP"), GameStop may use certain non-GAAP measures,

such as adjusted SG&A expense, adjusted operating loss,

adjusted net income (loss), adjusted earnings (loss) per share,

adjusted EBITDA and free cash flow. The Company believes these

non-GAAP financial measures provide useful information to investors

in evaluating the Company’s core operating performance. Adjusted

SG&A expense, adjusted operating loss, adjusted net income

(loss), adjusted earnings (loss) per share and adjusted EBITDA

exclude the effect of items such as certain transformation costs,

asset impairments, severance, as well as divestiture costs. Free

cash flow excludes capital expenditures otherwise included in net

cash flows provided by (used in) operating activities. The

Company’s definition and calculation of non-GAAP financial measures

may differ from that of other companies. Non-GAAP financial

measures should be viewed as supplementing, and not as an

alternative or substitute for, the Company’s financial results

prepared in accordance with GAAP. Certain of the items that may be

excluded or included in non-GAAP financial measures may be

significant items that could impact the Company’s financial

position, results of operations or cash flows and should therefore

be considered in assessing the Company’s actual and future

financial condition and performance.

CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING STATEMENTS - SAFE HARBOR

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Such statements are based upon management’s

current beliefs, views, estimates and expectations, including as to

the Company’s industry, business strategy, goals and expectations

concerning its market position, strategic and transformation

initiatives, future operations, margins, profitability, sales

growth, capital expenditures, liquidity, capital resources,

expansion of technology expertise, and other financial and

operating information, including expectations as to future

operating profit improvement. Such statements include without

limitation those about the Company’s expectations for fiscal 2023,

future financial and operating results, projections and other

statements that are not historical facts. Forward-looking

statements are subject to significant risks and uncertainties and

actual developments, business decisions, outcomes and results may

differ materially from those reflected or described in the

forward-looking statements. The following factors, among others,

could cause actual developments, business decisions, outcomes and

results to differ materially from those reflected or described in

the forward-looking statements: economic, social, and political

conditions in the markets in which we operate; the competitive

nature of the Company’s industry; the cyclicality of the video game

industry; the Company’s dependence on the timely delivery of new

and innovative products from its vendors; the impact of

technological advances in the video game industry and related

changes in consumer behavior on the Company’s sales; interruptions

to the Company’s supply chain or the supply chain of our suppliers;

the Company’s dependence on sales during the holiday selling

season; the Company’s ability to obtain favorable terms from its

current and future suppliers and service providers; the Company’s

ability to anticipate, identify and react to trends in pop culture

with regard to its sales of collectibles; the Company’s ability to

maintain strong retail and ecommerce experiences for its customers;

the Company’s ability to keep pace with changing industry

technology and consumer preferences; the Company’s ability to

manage its profitability and cost reduction initiatives; turnover

in senior management or the Company’s ability to attract and retain

qualified personnel; potential damage to the Company’s reputation

or customers' perception of the Company; risks associated with new

digital asset products and services; the Company’s ability to

maintain the security or privacy of its customer, associate or

Company information; occurrence of weather events, natural

disasters, public health crises and other unexpected events;

potential failure or inadequacy of the Company's computerized

systems; the ability of the Company’s third party delivery services

to deliver products to the Company’s retail locations, fulfillment

centers and consumers and changes in the terms the Company has with

such service providers; the ability and willingness of the

Company’s vendors to provide marketing and merchandising support at

historical or anticipated levels; restrictions on the Company’s

ability to purchase and sell pre-owned products; the Company’s

ability to renew or enter into new leases on favorable terms; the

potential monetary losses, user disputes, reputational harm and

regulatory scrutiny from any hacking, social engineering or other

cyber attacks in connection with digital assets; the potential

failure or inadequacy of the Company’s or its third party partners’

systems or blockchain networks related to the Company’s digital

asset products and services; the unique risks and challenges

related to content moderation and control from peer-to-peer NFT

marketplaces; unfavorable changes in the Company’s global tax rate;

legislative actions; the Company’s ability to comply with federal,

state, local and international laws and regulations and statutes;

the evolution of government regulation related to the Company’s

business initiatives; potential future litigation and other legal

proceedings; potential legal, regulatory and other actions arising

from the Company’s digital asset products and services; potential

investigations or litigation arising from the Company’s digital

asset investments, products or services; potential exposure to

litigation arising from violations of law by third parties using

the Company’s digital asset products or services; potential

unfavorable development regarding treatment of digital assets under

U.S. and foreign tax laws; the Company’s ability to comply with

anti-money laundering and sanctions laws in connection with its

digital asset products and services; volatility in the Company’s

stock price, including volatility due to potential short squeezes;

continued high degrees of media coverage by third parties; the

availability and future sales of substantial amounts of the

Company’s Class A common stock; fluctuations in the Company’s

results of operations from quarter to quarter; the restrictions

contained in the agreement governing the Company’s revolving credit

facility; the Company’s ability to generate sufficient cash flow to

fund its operations; the Company’s ability to incur additional

debt; risks associated with the Company’s investment in marketable,

nonmarketable and interest-bearing securities, including the impact

of such investments on Company’s financial results; the Company’s

ability to implement a new ERP system; the Company’s ability to

maintain effective control over financial reporting; and the

effects of recent developments on the price of digital assets and

reputation of the digital asset industry. Additional factors that

could cause results to differ materially from those reflected or

described in the forward-looking statements can be found in

GameStop's most recent Annual Report on Form 10-K filed with the

SEC on March 28, 2023, in GameStop’s Quarterly Reports on Form 10-Q

filed with the SEC on June 7, 2023, September 6, 2023, and the date

hereof, and other filings made from time to time with the SEC and

available at www.sec.gov or on the Company’s investor relations

website (https://investor.gamestop.com). Forward-looking statements

contained in this press release speak only as of the date of this

press release. The Company undertakes no obligation to publicly

update any forward-looking statement, whether as a result of new

information, future developments or otherwise, except as may be

required by any applicable securities laws.

|

|

|

GameStop Corp. |

|

Consolidated Statements of Operations |

|

(in millions, except per share data) |

|

|

|

(unaudited) |

|

|

|

|

13 Weeks ended October 28, 2023 |

|

13 Weeks ended October 29, 2022 |

|

Net sales |

$ |

1,078.3 |

|

|

|

$ |

1,186.4 |

|

|

|

Cost of sales |

|

796.5 |

|

|

|

|

894.8 |

|

|

|

Gross profit |

|

281.8 |

|

|

|

|

291.6 |

|

|

|

Selling, general and administrative expenses |

|

296.5 |

|

|

|

|

387.9 |

|

|

|

Operating loss |

|

(14.7 |

) |

|

|

|

(96.3 |

) |

|

|

Interest income, net |

|

(12.9 |

) |

|

|

|

(3.7 |

) |

|

|

Other loss, net |

|

2.5 |

|

|

|

|

— |

|

|

|

Loss before income taxes |

|

(4.3 |

) |

|

|

|

(92.6 |

) |

|

|

Income tax (benefit) expense |

|

(1.2 |

) |

|

|

|

2.1 |

|

|

|

Net loss |

$ |

(3.1 |

) |

|

|

$ |

(94.7 |

) |

|

| |

|

|

|

|

Loss per share: |

|

|

|

|

Basic loss per share |

$ |

(0.01 |

) |

|

|

$ |

(0.31 |

) |

|

|

Diluted loss per share |

|

(0.01 |

) |

|

|

|

(0.31 |

) |

|

| |

|

|

|

|

Weighted-average common shares outstanding: |

|

|

|

|

Basic |

|

305.3 |

|

|

|

|

304.2 |

|

|

|

Diluted |

|

305.3 |

|

|

|

|

304.2 |

|

|

| |

|

|

|

|

Percentage of Net Sales: |

|

|

|

| |

|

|

|

|

Net sales |

|

100.0 |

|

% |

|

|

100.0 |

|

% |

|

Cost of sales |

|

73.9 |

|

|

|

|

75.4 |

|

|

|

Gross profit |

|

26.1 |

|

|

|

|

24.6 |

|

|

|

Selling, general and administrative expenses |

|

27.5 |

|

|

|

|

32.7 |

|

|

|

Operating loss |

|

(1.4 |

) |

|

|

|

(8.1 |

) |

|

|

Interest income, net |

|

(1.2 |

) |

|

|

|

(0.3 |

) |

|

|

Other loss, net |

|

0.2 |

|

|

|

|

— |

|

|

|

Loss before income taxes |

|

(0.4 |

) |

|

|

|

(7.8 |

) |

|

|

Income tax (benefit) expense |

|

(0.1 |

) |

|

|

|

0.2 |

|

|

|

Net loss |

|

(0.3 |

) |

% |

|

|

(8.0 |

) |

% |

|

|

|

GameStop Corp. |

|

Consolidated Statements of Operations |

|

(in millions, except per share data) |

|

|

|

(unaudited) |

|

|

|

|

39 Weeks ended October 28, 2023 |

|

39 Weeks ended October 29, 2022 |

|

Net sales |

$ |

3,479.2 |

|

|

|

$ |

3,700.8 |

|

|

|

Cost of sales |

|

2,604.2 |

|

|

|

|

2,828.5 |

|

|

|

Gross profit |

|

875.0 |

|

|

|

|

872.3 |

|

|

|

Selling, general and administrative expenses |

|

964.7 |

|

|

|

|

1,227.6 |

|

|

|

Asset Impairments |

|

— |

|

|

|

|

2.5 |

|

|

|

Operating loss |

|

(89.7 |

) |

|

|

|

(357.8 |

) |

|

|

Interest income, net |

|

(34.2 |

) |

|

|

|

(3.3 |

) |

|

|

Other loss, net |

|

2.4 |

|

|

|

|

— |

|

|

|

Loss before income taxes |

|

(57.9 |

) |

|

|

|

(354.5 |

) |

|

|

Income tax (benefit) expense |

|

(1.5 |

) |

|

|

|

6.8 |

|

|

|

Net loss |

$ |

(56.4 |

) |

|

|

$ |

(361.3 |

) |

|

| |

|

|

|

|

Loss per share: |

|

|

|

|

Basic loss per share |

$ |

(0.18 |

) |

|

|

$ |

(1.19 |

) |

|

|

Diluted loss per share |

|

(0.18 |

) |

|

|

|

(1.19 |

) |

|

| |

|

|

|

|

Weighted-average common shares outstanding: |

|

|

|

|

Basic |

|

304.9 |

|

|

|

|

304.1 |

|

|

|

Diluted |

|

304.9 |

|

|

|

|

304.1 |

|

|

| |

|

|

|

|

Percentage of Net Sales: |

|

|

|

| |

|

|

|

|

Net sales |

|

100.0 |

|

% |

|

|

100.0 |

|

% |

|

Cost of sales |

|

74.9 |

|

|

|

|

76.4 |

|

|

|

Gross profit |

|

25.1 |

|

|

|

|

23.6 |

|

|

|

Selling, general and administrative expenses |

|

27.7 |

|

|

|

|

33.2 |

|

|

|

Asset Impairments |

|

— |

|

|

|

|

0.1 |

|

|

|

Operating loss |

|

(2.6 |

) |

|

|

|

(9.7 |

) |

|

|

Interest income, net |

|

(1.0 |

) |

|

|

|

(0.1 |

) |

|

|

Other loss, net |

|

0.1 |

|

|

|

|

— |

|

|

|

Loss before income taxes |

|

(1.7 |

) |

|

|

|

(9.6 |

) |

|

|

Income tax (benefit) expense |

|

— |

|

|

|

|

0.2 |

|

|

|

Net loss |

|

(1.7 |

) |

% |

|

|

(9.8 |

) |

% |

| |

|

GameStop Corp. |

|

Condensed Consolidated Balance Sheets |

|

(in millions) |

|

|

|

(unaudited) |

| |

| |

October 28, 2023 |

|

October 29, 2022 |

|

ASSETS: |

|

Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

909.0 |

|

|

$ |

803.8 |

|

|

Marketable securities |

|

300.5 |

|

|

|

238.3 |

|

|

Receivables, net of allowance of $2.1 and $2.0, respectively |

|

88.3 |

|

|

|

125.3 |

|

|

Merchandise inventories, net |

|

1,021.3 |

|

|

|

1,131.3 |

|

|

Prepaid expenses and other current assets |

|

57.7 |

|

|

|

283.1 |

|

|

Total current assets |

|

2,376.8 |

|

|

|

2,581.8 |

|

|

Property and equipment, net of accumulated depreciation of $973.0

and $981.4, respectively |

|

114.5 |

|

|

|

138.5 |

|

|

Operating lease right-of-use assets |

|

570.4 |

|

|

|

523.2 |

|

|

Deferred income taxes |

|

16.6 |

|

|

|

14.3 |

|

|

Other noncurrent assets |

|

68.6 |

|

|

|

64.7 |

|

|

Total assets |

$ |

3,146.9 |

|

|

$ |

3,322.5 |

|

| |

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY: |

|

Current liabilities: |

|

|

|

|

Accounts payable |

$ |

812.7 |

|

|

$ |

888.4 |

|

|

Accrued liabilities and other current liabilities |

|

425.7 |

|

|

|

504.2 |

|

|

Current portion of operating lease liabilities |

|

188.9 |

|

|

|

186.2 |

|

|

Current portion of long-term debt |

|

10.5 |

|

|

|

9.9 |

|

|

Total current liabilities |

|

1,437.8 |

|

|

|

1,588.7 |

|

|

Long-term debt, net |

|

20.0 |

|

|

|

28.8 |

|

|

Operating lease liabilities |

|

394.8 |

|

|

|

349.6 |

|

|

Other long-term liabilities |

|

31.5 |

|

|

|

110.4 |

|

|

Total liabilities |

|

1,884.1 |

|

|

|

2,077.5 |

|

|

Total stockholders’ equity |

|

1,262.8 |

|

|

|

1,245.0 |

|

|

Total liabilities and stockholders’ equity |

$ |

3,146.9 |

|

|

$ |

3,322.5 |

|

|

|

|

GameStop Corp. |

|

Condensed Consolidated Statements of Cash

Flows |

|

(in millions) |

|

(unaudited) |

|

|

| |

13 Weeks ended October 28, 2023 |

|

13 Weeks ended October 29, 2022 |

|

Cash flows from operating activities: |

|

|

|

|

Net loss |

$ |

(3.1 |

) |

|

$ |

(94.7 |

) |

|

Adjustments to reconcile net loss to net cash flows from operating

activities: |

|

|

|

|

Depreciation and amortization |

|

11.3 |

|

|

|

15.1 |

|

|

Stock-based compensation expense, net |

|

6.4 |

|

|

|

13.3 |

|

|

Gain on sale of digital assets |

|

— |

|

|

|

(0.2 |

) |

|

Digital asset impairments |

|

— |

|

|

|

0.2 |

|

|

(Gain) loss on disposal of property and equipment, net |

|

(5.6 |

) |

|

|

3.5 |

|

|

Other, net |

|

5.8 |

|

|

|

11.9 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

Receivables, net |

|

(13.3 |

) |

|

|

(26.0 |

) |

|

Merchandise inventories, net |

|

(357.5 |

) |

|

|

(414.6 |

) |

|

Prepaid expenses and other current assets |

|

1.7 |

|

|

|

(11.3 |

) |

|

Prepaid income taxes and income taxes payable |

|

(3.8 |

) |

|

|

— |

|

|

Accounts payable and accrued liabilities |

|

381.9 |

|

|

|

672.7 |

|

|

Operating lease right-of-use assets and liabilities |

|

(3.7 |

) |

|

|

8.1 |

|

|

Changes in other long-term liabilities |

|

(1.0 |

) |

|

|

(0.7 |

) |

|

Net cash flows provided by operating activities |

|

19.1 |

|

|

|

177.3 |

|

|

Cash flows from investing activities: |

|

|

|

|

Proceeds from sale of digital assets |

|

— |

|

|

|

0.1 |

|

|

Purchases of marketable securities |

|

— |

|

|

|

(237.0 |

) |

|

Proceeds from sale of property and equipment |

|

13.1 |

|

|

|

— |

|

|

Capital expenditures |

|

(8.0 |

) |

|

|

(13.0 |

) |

|

Other |

|

— |

|

|

|

0.3 |

|

|

Net cash flows provided by (used in) investing activities |

|

5.1 |

|

|

|

(249.6 |

) |

|

Cash flows from financing activities: |

|

|

|

|

Settlements of stock-based awards |

|

— |

|

|

|

(0.3 |

) |

|

Repayments of French term loans |

|

(2.6 |

) |

|

|

— |

|

|

Net cash flows used in financing activities |

|

(2.6 |

) |

|

|

(0.3 |

) |

|

Exchange rate effect on cash, cash equivalents and restricted

cash |

|

(7.6 |

) |

|

|

(24.9 |

) |

|

Increase (decrease) in cash, cash equivalents and restricted

cash |

|

14.0 |

|

|

|

(97.5 |

) |

|

Cash, cash equivalents and restricted cash at beginning of

period |

|

915.2 |

|

|

|

957.0 |

|

|

Cash, cash equivalents and restricted cash at end of period |

$ |

929.2 |

|

|

$ |

859.5 |

|

| |

|

GameStop Corp. |

|

Condensed Consolidated Statements of Cash

Flows |

|

(in millions) |

|

(unaudited) |

| |

| |

39 Weeks ended October 28, 2023 |

|

39 Weeks ended October 29, 2022 |

|

Cash flows from operating activities: |

|

|

|

|

Net loss |

$ |

(56.4 |

) |

|

$ |

(361.3 |

) |

|

Adjustments to reconcile net loss to net cash flows from operating

activities: |

|

|

|

|

Depreciation and amortization |

|

37.6 |

|

|

|

47.5 |

|

|

Stock-based compensation expense, net |

|

14.0 |

|

|

|

32.2 |

|

|

Asset impairments |

|

— |

|

|

|

2.5 |

|

|

Gain on sale of digital assets |

|

— |

|

|

|

(7.1 |

) |

|

Digital asset impairments |

|

— |

|

|

|

33.9 |

|

|

(Gain) loss on disposal of property and equipment, net |

|

(5.0 |

) |

|

|

5.1 |

|

|

Other, net |

|

2.9 |

|

|

|

6.9 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

Receivables, net |

|

65.7 |

|

|

|

13.3 |

|

|

Merchandise inventories, net |

|

(357.1 |

) |

|

|

(245.0 |

) |

|

Prepaid expenses and other current assets |

|

5.7 |

|

|

|

(38.7 |

) |

|

Prepaid income taxes and income taxes payable |

|

(5.1 |

) |

|

|

0.9 |

|

|

Accounts payable and accrued liabilities |

|

114.5 |

|

|

|

288.7 |

|

|

Operating lease right-of-use assets and liabilities |

|

(7.1 |

) |

|

|

(7.7 |

) |

|

Changes in other long-term liabilities |

|

(2.4 |

) |

|

|

(1.2 |

) |

|

Net cash flows used in operating activities |

|

(192.7 |

) |

|

|

(230.0 |

) |

|

Cash flows from investing activities: |

|

|

|

|

Proceeds from sale of digital assets |

|

2.8 |

|

|

|

77.4 |

|

|

Purchases of marketable securities |

|

(313.0 |

) |

|

|

(237.0 |

) |

|

Proceeds from the maturities and sales of marketable

securities |

|

270.5 |

|

|

|

— |

|

|

Capital expenditures |

|

(27.2 |

) |

|

|

(44.3 |

) |

|

Proceeds from sale of property and equipment |

|

13.1 |

|

|

|

— |

|

|

Other |

|

— |

|

|

|

0.3 |

|

|

Net cash flows used in investing activities |

|

(53.8 |

) |

|

|

(203.6 |

) |

|

Cash flows from financing activities: |

|

|

|

|

Settlements of stock-based awards |

|

(0.1 |

) |

|

|

(3.3 |

) |

|

Repayments of debt |

|

(8.0 |

) |

|

|

— |

|

|

Net cash flows used in financing activities |

|

(8.1 |

) |

|

|

(3.3 |

) |

|

Exchange rate effect on cash, cash equivalents and restricted

cash |

|

(12.2 |

) |

|

|

(23.5 |

) |

|

Decrease in cash, cash equivalents and restricted cash |

|

(266.8 |

) |

|

|

(460.4 |

) |

|

Cash, cash equivalents and restricted cash at beginning of

period |

|

1,196.0 |

|

|

|

1,319.9 |

|

|

Cash, cash equivalents and restricted cash at end of period |

$ |

929.2 |

|

|

$ |

859.5 |

|

|

|

|

Schedule I |

|

Sales Mix |

|

(in millions) |

|

(unaudited) |

|

|

|

|

|

|

|

13 Weeks ended October 28, 2023 |

|

13 Weeks ended October 29, 2022 |

|

|

Net |

|

Percent |

|

Net |

|

Percent |

|

Net Sales: |

Sales |

|

of Total |

|

Sales |

|

of Total |

| |

|

|

|

|

|

|

|

|

Hardware and accessories (1) |

$ |

579.4 |

|

|

53.7 |

|

% |

|

$ |

627.0 |

|

|

52.8 |

|

% |

|

Software (2) |

|

321.3 |

|

|

29.8 |

|

|

|

|

352.1 |

|

|

29.7 |

|

|

|

Collectibles |

|

177.6 |

|

|

16.5 |

|

|

|

|

207.3 |

|

|

17.5 |

|

|

| |

|

|

|

|

|

|

|

|

Total |

$ |

1,078.3 |

|

|

100.0 |

|

% |

|

$ |

1,186.4 |

|

|

100.0 |

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

39 Weeks ended October 28, 2023 |

|

39 Weeks ended October 29, 2022 |

|

|

Net |

|

Percent |

|

Net |

|

Percent |

|

Net Sales: |

Sales |

|

of Total |

|

Sales |

|

of Total |

| |

|

|

|

|

|

|

|

|

Hardware and accessories (1) |

$ |

1,902.2 |

|

|

54.7 |

|

% |

|

$ |

1,897.2 |

|

|

51.3 |

|

% |

|

Software (2) |

|

1,056.7 |

|

|

30.3 |

|

|

|

|

1,152.2 |

|

|

31.1 |

|

|

|

Collectibles |

|

520.3 |

|

|

15.0 |

|

|

|

|

651.4 |

|

|

17.6 |

|

|

| |

|

|

|

|

|

|

|

|

Total |

$ |

3,479.2 |

|

|

100.0 |

|

% |

|

$ |

3,700.8 |

|

|

100.0 |

|

% |

| |

|

|

|

|

|

|

|

| (1) Includes

sales of new and pre-owned hardware, accessories, hardware bundles

in which hardware and digital or physical software are sold

together in a single SKU, interactive game figures, strategy

guides, mobile and consumer electronics. |

| |

|

(2) Includes sales of new and pre-owned video game software,

digital software and PC entertainment software. |

|

|

|

|

|

GameStop Corp. |

|

Schedule II |

|

(in millions, except per share data) |

|

(unaudited) |

Non-GAAP results

The following tables reconcile the Company's

selling, general and administrative expenses ("SG&A expense"),

operating loss, net loss and loss per share as presented in its

unaudited consolidated statements of operations and prepared in

accordance with U.S. generally accepted accounting principles

("GAAP") to its adjusted EBITDA, adjusted SG&A expense,

adjusted operating loss, adjusted net income (loss) and adjusted

earnings (loss) per share. The diluted weighted-average shares

outstanding used to calculate adjusted earnings per share may

differ from GAAP weighted-average shares outstanding. Under GAAP,

basic and diluted weighted-average shares outstanding are the same

in periods where there is a net loss. The reconciliations below are

from continuing operations only.

| |

13 Weeks Ended |

|

13 Weeks Ended |

|

39 Weeks Ended |

|

39 Weeks Ended |

| |

October 28, 2023 |

|

October 29, 2022 |

|

October 28, 2023 |

|

October 29, 2022 |

|

Adjusted SG&A expense |

|

|

|

|

|

SG&A expense |

$ |

296.5 |

|

|

$ |

387.9 |

|

|

$ |

964.7 |

|

|

$ |

1,227.6 |

|

|

Transformation costs(1) |

|

(1.6 |

) |

|

|

(1.3 |

) |

|

|

(4.7 |

) |

|

|

(0.4 |

) |

|

Adjusted SG&A expense |

$ |

294.9 |

|

|

$ |

386.6 |

|

|

$ |

960.0 |

|

|

$ |

1,227.2 |

|

| |

|

|

|

|

|

|

|

|

Adjusted Operating Loss |

|

|

|

|

|

|

|

|

Operating loss |

$ |

(14.7 |

) |

|

$ |

(96.3 |

) |

|

$ |

(89.7 |

) |

|

$ |

(357.8 |

) |

|

Transformation costs(1) |

|

1.6 |

|

|

|

1.3 |

|

|

|

4.7 |

|

|

|

0.4 |

|

|

Asset impairments |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2.5 |

|

|

Adjusted operating loss |

$ |

(13.1 |

) |

|

$ |

(95.0 |

) |

|

$ |

(85.0 |

) |

|

$ |

(354.9 |

) |

| |

|

|

|

|

|

|

|

|

Adjusted Net Income (Loss) |

|

|

|

|

|

|

|

|

Net loss |

$ |

(3.1 |

) |

|

$ |

(94.7 |

) |

|

$ |

(56.4 |

) |

|

$ |

(361.3 |

) |

|

Transformation costs(1) |

|

1.6 |

|

|

|

1.3 |

|

|

|

4.7 |

|

|

|

0.4 |

|

|

Asset impairments |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2.5 |

|

|

Divestitures and other(2) |

|

2.5 |

|

|

|

— |

|

|

|

1.4 |

|

|

|

— |

|

|

Adjusted net income (loss) |

$ |

1.0 |

|

|

$ |

(93.4 |

) |

|

$ |

(50.3 |

) |

|

$ |

(358.4 |

) |

|

|

|

|

|

|

|

|

|

|

Adjusted earnings (loss) per share |

|

|

|

|

|

|

|

|

Basic |

$ |

— |

|

|

$ |

(0.31 |

) |

|

$ |

(0.16 |

) |

|

$ |

(1.18 |

) |

|

Diluted |

|

— |

|

|

|

(0.31 |

) |

|

|

(0.16 |

) |

|

|

(1.18 |

) |

| |

|

|

|

|

|

|

|

|

Number of shares used in adjusted calculation |

|

|

|

|

|

|

|

|

Basic |

|

305.3 |

|

|

|

304.2 |

|

|

|

304.9 |

|

|

|

304.1 |

|

|

Diluted |

|

305.4 |

|

|

|

304.2 |

|

|

|

304.9 |

|

|

|

304.1 |

|

| |

|

|

|

|

|

|

|

|

(1) For the three and nine months ended October 28, 2023,

transformation costs include severance, stock-based compensation

forfeitures related to workforce optimization efforts in the U.S.,

and other costs in connection with our transformation initiatives.

This amount excludes accelerated lease amortization and fixed asset

costs which have not been factored into our non-GAAP measures, but

are included in total transition costs. For the three and nine

months ended October 29, 2022, transformation costs includes the

impact of stock-based compensation forfeitures partially offset by

cash severance costs related to workforce optimization efforts in

connection with our transformation initiatives. |

|

|

|

(2) Divestitures and other includes an overall net loss from our

divestiture of business operations in Europe. |

|

|

| |

13 Weeks Ended |

|

13 Weeks Ended |

|

39 Weeks Ended |

|

39 Weeks Ended |

| |

October 28, 2023 |

|

October 29, 2022 |

|

October 28, 2023 |

|

October 29, 2022 |

|

Reconciliation of Net Loss to Adjusted EBITDA |

|

|

|

|

|

|

|

|

Net loss |

$ |

(3.1 |

) |

|

$ |

(94.7 |

) |

|

$ |

(56.4 |

) |

|

$ |

(361.3 |

) |

|

Interest income, net |

|

(12.9 |

) |

|

|

(3.7 |

) |

|

|

(34.2 |

) |

|

|

(3.3 |

) |

|

Depreciation and amortization |

|

11.3 |

|

|

|

15.1 |

|

|

|

37.6 |

|

|

|

47.5 |

|

|

Income tax (benefit) expense |

|

(1.2 |

) |

|

|

2.1 |

|

|

|

(1.5 |

) |

|

|

6.8 |

|

|

EBITDA |

$ |

(5.9 |

) |

|

$ |

(81.2 |

) |

|

$ |

(54.5 |

) |

|

$ |

(310.3 |

) |

|

Stock-based compensation |

|

6.9 |

|

|

|

13.3 |

|

|

|

25.1 |

|

|

|

32.2 |

|

|

Transformation costs(1) |

|

1.6 |

|

|

|

1.3 |

|

|

|

4.7 |

|

|

|

0.4 |

|

|

Divestitures and other(2) |

|

2.5 |

|

|

|

— |

|

|

|

1.4 |

|

|

|

— |

|

|

Asset impairments |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2.5 |

|

|

Adjusted EBITDA |

$ |

5.1 |

|

|

$ |

(66.6 |

) |

|

$ |

(23.3 |

) |

|

$ |

(275.2 |

) |

| |

|

|

|

|

|

|

|

|

(1) For the three and nine months ended October 28, 2023,

transformation costs include severance, stock-based compensation

forfeitures related to workforce optimization efforts in the U.S.,

and other costs in connection with our transformation initiatives.

This amount excludes accelerated lease amortization and fixed asset

costs which have not been factored into our non-GAAP measures, but

are included in total transition costs. For the three and nine

months ended October 29, 2022, transformation costs includes the

impact of stock-based compensation forfeitures partially offset by

cash severance costs related to workforce optimization efforts in

connection with our transformation initiatives. |

|

|

|

(2) Divestitures and other includes an overall net loss from our

divestiture of business operations in Europe. |

|

|

|

|

|

GameStop Corp. |

|

Schedule III |

|

(in millions) |

|

(unaudited) |

Non-GAAP results

The following table reconciles the Company's

cash flows provided by (used in) operating activities as presented

in its unaudited Consolidated Statements of Cash Flows and prepared

in accordance with GAAP to its free cash flow. Free cash flow is

considered a non-GAAP financial measure. Management believes,

however, that free cash flow, which measures our ability to

generate additional cash from our business operations, is an

important financial measure for use by investors in evaluating the

company’s financial performance.

| |

13 Weeks Ended |

|

13 Weeks Ended |

|

39 Weeks Ended |

|

39 Weeks Ended |

| |

October 28, 2023 |

|

October 29, 2022 |

|

October 28, 2023 |

|

October 29, 2022 |

|

Net cash flows provided by (used in) operating activities |

$ |

19.1 |

|

|

$ |

177.3 |

|

|

$ |

(192.7 |

) |

|

$ |

(230.0 |

) |

|

Capital expenditures |

|

(8.0 |

) |

|

|

(13.0 |

) |

|

|

(27.2 |

) |

|

|

(44.3 |

) |

|

Free cash flow |

$ |

11.1 |

|

|

$ |

164.3 |

|

|

$ |

(219.9 |

) |

|

$ |

(274.3 |

) |

Non-GAAP Measures and Other

Metrics

Adjusted EBITDA, adjusted SG&A expense,

adjusted operating loss, adjusted net income (loss) and adjusted

earnings (loss) per share are supplemental financial measures of

the Company’s performance that are not required by, or presented in

accordance with, GAAP. We believe that the presentation of these

non-GAAP financial measures provide useful information to investors

in assessing our financial condition and results of operations. We

define adjusted EBITDA as net loss before income taxes, plus

interest income, net and depreciation and amortization, excluding

stock-based compensation, certain transformation costs, business

divestitures, asset impairments, severance and other non-cash

charges. Net loss is the GAAP financial measure most directly

comparable to adjusted EBITDA. Our non-GAAP financial measures

should not be considered as an alternative to the most directly

comparable GAAP financial measure. Furthermore, non-GAAP financial

measures have limitations as an analytical tool because they

exclude some but not all items that affect the most directly

comparable GAAP financial measures. Some of these limitations

include:

- certain items

excluded from adjusted EBITDA are significant components in

understanding and assessing a company’s financial performance, such

as a company’s cost of capital and tax structure;

- adjusted EBITDA does not reflect

our cash expenditures or future requirements for capital

expenditures or contractual commitments;

- adjusted EBITDA does not reflect

changes in, or cash requirements for, our working capital

needs;

- although depreciation and

amortization are non-cash charges, the assets being depreciated and

amortized will often have to be replaced in the future, and

adjusted EBITDA does not reflect any cash requirements for such

replacements; and

- our computations of adjusted EBITDA

may not be comparable to other similarly titled measures of other

companies.

We compensate for the limitations of adjusted

EBITDA, adjusted SG&A expense, adjusted operating loss,

adjusted net income (loss) and adjusted earnings (loss) per share

as analytical tools by reviewing the comparable GAAP financial

measure, understanding the differences between the GAAP and

non-GAAP financial measures and incorporating these data points

into our decision-making process. Adjusted EBITDA, adjusted

SG&A expense, adjusted operating loss, adjusted net income

(loss) and adjusted earnings (loss) per share are provided in

addition to, and not as an alternative to, the Company’s financial

results prepared in accordance with GAAP, and should not be

considered in isolation or as a substitute for analysis of our

results as reported under GAAP. Because adjusted EBITDA, adjusted

SG&A expense, adjusted operating loss, adjusted net income

(loss) and adjusted earnings (loss) per share may be defined and

determined differently by other companies in our industry, our

definitions of these non-GAAP financial measures may not be

comparable to similarly titled measures of other companies, thereby

diminishing their utility.

Contact

GameStop Investor

Relations817-424-2001ir@gamestop.com

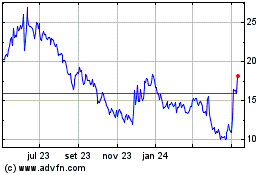

GameStop (NYSE:GME)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

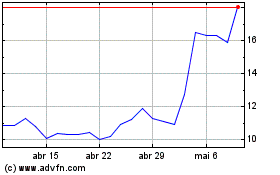

GameStop (NYSE:GME)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024