Oxbridge Re Announces Launch of Tokenized Real-World Asset Offering EpilsonCat Re

27 Março 2024 - 10:15AM

Oxbridge Re Holdings Limited

(Nasdaq: OXBR),

(the “Company”), and its subsidiaries which are engaged in the

business of tokenized Real-World Assets (“RWAs”), initially in the

form of Tokenized Reinsurance Securities, and reinsurance business

solutions to property and casualty insurers, announced the launch

of its offering of this year’s Participation Shares represented by

digital tokens to be issued under a 3-year Participation Share

Investment Contract (the “PSIC”). The offering which is the second

year of the Cat Re series, is being conducted by our indirectly

wholly owned subsidiary SurancePlus Inc. (“SurancePlus”) will issue

between 500,000 to 1,000,000 Participation Shares, represented by

digital tokens labelled “EpsilonCat Re”. The Participation Shares

will be offered at an initial price of $10 per Participation Share.

The Participation Shares are not shares in SurancePlus and shall

have no preemptive right or conversion rights. The Participation

Shares solely confer contractual rights against SurancePlus as

contained in the PSIC.

The net proceeds from the offer and sale of the

Participation Shares will be used by SurancePlus to purchase one or

more participating notes of Oxbridge Re NS, an affiliated Cayman

Islands licensed reinsurance entity, and the proceeds from the sale

of such participating notes will be invested in collateralized

reinsurance contracts to be underwritten by Oxbridge Re NS. In a

loss free year the holders of the Participation Shares will be

entitled to proceeds from the payment of the participating notes in

the amount of a preferred return equal to the initial Participation

Share price, plus 20%, and then 80% of any proceeds in excess of

the amount necessary to pay the preferred return.

The EpsilonCat Re tokens are being offered to

accredited investors in the United States by SurancePlus under Rule

506(c) of SEC Regulation D and to non-US investors pursuant to

Regulation S of the US Securities Act 1933, as amended. Assuming no

casualty losses to properties reinsured by Oxbridge Re’s

reinsurance subsidiaries, EpsilonCat Re token investors are

expected to receive a targeted annualized return of 42%. Investors

in last year’s DeltaCat Re token are poised to realize returns

exceeding 45%, surpassing our initial expectations of 42%. This

achievement is particularly noteworthy, given the challenges posed

by Hurricane Idalia, which made landfall in Florida as a Category 3

hurricane in 2023.

“We are particularly enthusiastic about the

prospects of our venture into RWA tokenization and the direction it

sets for our company. Through strategic initiatives undertaken this

year, we are positioning ourselves for substantial growth within

our SurancePlus subsidiary as a premier RWA Web3-focused entity,”

commented Oxbridge Re Holdings President and Chief Executive

Officer Jay Madhu. “Further reinforcing our strategic vision,

Blackrock has announced its intention to tokenize $10 trillion of

its assets. Concurrently, we witness the steady adoption of

blockchain technology across traditional financial institutions and

asset classes, including fiat currencies, equities, government

bonds, and real estate. As pioneers in the RWA market, we are

energized by the transformative potential of our repositioning and

the expansion into new business lines, which we believe will create

significant value for our shareholders.”

Disclaimer: This press

release does not constitute an offer to sell nor a solicitation of

an offer to buy the Participation Shares (the “Securities”) and the

EpsilonCat Re tokens. The Securities are not required to be, and

have not been, registered under the United States Securities Act of

1933, as amended, in reliance on the exemptions provided by

Regulation S and Regulation D (SEC Rule 506(c)) thereunder. Offers

and sales of the Securities are made only by, and pursuant to, the

terms set forth in the Confidential Private Placement Memorandum

relating to the Securities. The offering of the Securities is not

being made to persons in any jurisdiction in which the making or

acceptance thereof would not be in compliance with the securities,

blue sky, or other laws of such jurisdiction.

About Oxbridge Re Holdings

Limited

Oxbridge Re Holdings Limited

(www.OxbridgeRe.com) (NASDAQ: OXBR, OXBRW) (“Oxbridge Re”) is

headquartered in the Cayman Islands. The company offers tokenized

Real-World Assets (“RWAs”) as Tokenized Reinsurance Securities and

reinsurance business solutions to property and casualty insurers,

through its wholly owned subsidiaries Oxbridge Reinsurance Limited,

Oxbridge Re NS, and SurancePlus Inc.

Insurance businesses in the Gulf Coast region of

the United States purchase property and casualty reinsurance

through our licensed reinsurers Oxbridge Reinsurance Limited and

Oxbridge Re NS.

Our new Web3-focused subsidiary, SurancePlus

Inc. has developed the first “on-chain” reinsurance RWA of its kind

to be sponsored by a subsidiary of a publicly traded company. By

digitizing interests in reinsurance contracts as on-chain RWAs,

SurancePlus Inc. has democratized the availability of reinsurance

as an alternative investment to both U.S. and non-U.S.

investors.

About SurancePlus Inc.

SurancePlus Inc. (www.SurancePlus.com) is an

indirect wholly owned subsidiary of Oxbridge Re Holdings Limited,

incorporated in the British Virgin Islands. SurancePlus was

organized to serve as a special-purpose vehicle to make tokenized

side-car investments in reinsurance contracts entered into by

Oxbridge Re’s licensed reinsurance subsidiaries.

Company Contact:Oxbridge Re Holdings LimitedJay Madhu, CEO+1

345-749-7570jmadhu@oxbridgere.com

Forward-Looking Statements

This press release may contain forward-looking

statements made pursuant to the Private Securities Litigation

Reform Act of 1995. Words such as “anticipate,” “estimate,”

“expect,” “intend,” “plan,” “project” and other similar words and

expressions are intended to signify forward-looking statements.

Forward-looking statements are not guarantees of future results and

conditions but rather are subject to various risks and

uncertainties. A detailed discussion of risks and uncertainties

that could cause actual results and events to differ materially

from such forward-looking statements is included in the section

entitled “Risk Factors” contained in our Form 10-K filed with the

Securities and Exchange Commission (“SEC”) on 26th March 2024. The

occurrence of any of these risks and uncertainties could have a

material adverse effect on the Company’s business, financial

condition and results of operations. Any forward-looking statements

made in this press release speak only as of the date of this press

release and, except as required by law, the Company undertakes no

obligation to update any forward-looking statement contained in

this press release, even if the Company’s expectations or any

related events, conditions or circumstances change.

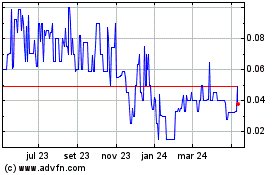

Oxbridge Re (NASDAQ:OXBRW)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

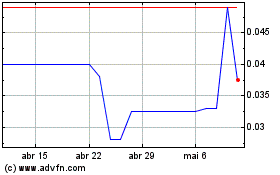

Oxbridge Re (NASDAQ:OXBRW)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025