Goodfood Market Corp. (“Goodfood” or “the Company”) (TSX: FOOD), a

leading Canadian online meal solutions company, today announced

financial results for the second quarter of Fiscal 2024, ended

March 2, 2024.

“The first half for Fiscal 2024 showcased the

efficient operating foundations we have laid, enabling Adjusted

EBITDA1 to grow and reach a total of $9 million over the last

twelve months. These results have driven two key vectors of value

creation: cash flow generation and de-leveraging. This quarter

marks the second quarter in a row with positive adjusted free cash

flow1 and our last twelve months have delivered adjusted free cash

flow1 of more than $7 million. In the past nine months, we have

also reduced our total net debt to adjusted EBITDA2 ratio nearly

70% from 8X nine months ago to a little over 2X now. Combined, the

cash flow generation and improved leverage help better position

Goodfood to manage its capital structure and consider various

capital allocation options as we strive to generate growth and

enhance shareholder value,” said Jonathan Ferrari, Chief Executive

Officer of Goodfood.

“As we look forward to the second half of this

fiscal year and beyond, we are encouraged by the results our growth

strategy is beginning to yield. Sales were stable

quarter-over-quarter and the 5% year-over-year decline is the most

stable performance achieved since the fourth quarter of Fiscal

2021, despite a challenging macroeconomic backdrop and soft

consumer spending. We continue to work to enhance our customer

value proposition and our initiatives have begun bearing results.

Our members’ average basket size was the highest ever this quarter

and we see improvements in our customers’ feedback metrics. As we

continue to augment our value proposition, we are focused on

growing our top line, conscious that this represents a key element

in continuing to grow cash flows and to deliver shareholder value,”

concluded Jonathan Ferrari.

RESULTS OF OPERATIONS – SECOND QUARTER OF FISCAL 2024

AND 2023

The following table sets forth the components of

the Company’s interim condensed consolidated statement of income

and comprehensive income:

(In thousands of Canadian dollars, except per

share and percentage information)

|

For the 13 weeks periods ended |

|

March 2, 2024 |

|

|

March 4, 2023 |

|

|

($) |

|

(%) |

|

|

Net sales |

$ |

39,755 |

|

$ |

42,043 |

|

$ |

(2,288 |

) |

(5 |

)% |

|

Cost of goods sold |

|

22,646 |

|

|

24,929 |

|

|

(2,283 |

) |

(9 |

)% |

|

Gross profit |

$ |

17,109 |

|

$ |

17,114 |

|

$ |

(5 |

) |

0 |

% |

|

Gross margin |

|

43.0% |

|

|

40.7% |

|

|

N/A |

|

2.3 p.p. |

|

Selling, general and administrative expenses |

|

13,893 |

|

|

15,531 |

|

|

(1,638 |

) |

(11 |

)% |

|

Depreciation and amortization |

|

1,818 |

|

|

2,856 |

|

|

(1,038 |

) |

(36 |

)% |

|

Reorganization and other related gains |

|

(1,364 |

) |

|

(2,769 |

) |

|

1,405 |

|

51 |

% |

|

Net finance costs |

|

1,369 |

|

|

1,470 |

|

|

(101 |

) |

(7 |

)% |

|

Income before income taxes |

$ |

1,393 |

|

$ |

26 |

|

$ |

1,367 |

|

5,258 |

% |

|

Deferred income tax recovery |

|

– |

|

|

(72 |

) |

|

72 |

|

N/A |

|

|

Net income, being comprehensive income |

$ |

1,393 |

|

$ |

98 |

|

$ |

1,295 |

|

1,321 |

% |

|

Basic and diluted income per share |

$ |

0.02 |

|

$ |

– |

|

$ |

0.02 |

|

N/A |

|

VARIANCE ANALYSIS FOR THE SECOND QUARTER

OF 2024 COMPARED TO SECOND QUARTER OF 2023

- The decrease in

net sales is primarily driven by the decrease in the number of

active customers, as we focus on customers providing stronger unit

economics, partially offset by an increase in average order value

as a result of price optimizations, increased variety in the

meal-kit offering and a focus on meal-kit offerings with ready meal

solutions and grocery products as add-ons.

- The slight

decrease in gross profit primarily resulted from a decrease in net

sales as well as higher credit and incentives as a percentage of

sales partially offset by lower food costs and production costs as

a percentage of net sales driven by improved inventory management

reducing waste, lower production labour cost and price

optimizations. Gross margin increased mainly due to operational

efficiencies driving lower food and production costs, as well as

pricing optimization, partially offset by an increase in credits

and incentives as a percentage of net sales.

- The decrease in

selling, general and administrative expenses is primarily due to

lower marketing spend as well as lower wages and salaries,

utilities and maintenance and insurance expenses primarily

resulting from the Company’s costs saving initiatives. Selling,

general and administrative expenses as a percentage of net sales

decreased from 36.9% to 34.9%.

- The decrease in

reorganization and other related gains is mainly due to higher net

gains in Fiscal 2023 as a result of termination of leases following

the Company’s costs reduction initiatives compared to a net gain on

reversal of impairment resulting from a sublease agreement

concluded in the second quarter of Fiscal 2024.

- The decrease in

depreciation and amortization expense is mainly due to the

reduction in right-of-use assets following exiting facilities as

part of the Company’s costs reduction initiatives.

- The improvement

in net income is mainly the result of operational efficiencies

reducing food costs and product costs as well as lower wages and

salaries in cost of goods sold, lower depreciation and amortization

expense partially offset by a lower net sales base and lower

reorganization and other related gains.

RESULTS OF OPERATIONS – YEAR-TO-DATE FISCAL 2024 AND

2023

The following table sets forth the components of

the Company’s interim condensed consolidated statement of loss and

comprehensive loss:

(In thousands of Canadian dollars, except per

share and percentage information)

|

For the 26 weeks periods ended |

|

March 2, 2024 |

|

|

March 4, 2023 |

|

|

($) |

|

(%) |

|

|

Net sales |

$ |

80,214 |

|

$ |

89,191 |

|

$ |

(8,977 |

) |

(10 |

)% |

|

Cost of goods sold |

|

47,176 |

|

|

55,318 |

|

|

(8,142 |

) |

(15 |

)% |

|

Gross profit |

$ |

33,038 |

|

$ |

33,873 |

|

$ |

(835 |

) |

(2 |

)% |

|

Gross margin |

|

41.2% |

|

|

38.0% |

|

|

N/A |

|

3.2 p.p. |

|

Selling, general and administrative expenses |

|

28,381 |

|

|

37,529 |

|

|

(9,148 |

) |

(24 |

)% |

|

Depreciation and amortization |

|

3,773 |

|

|

6,625 |

|

|

(2,852 |

) |

(43 |

)% |

|

Reorganization and other related gains |

|

(1,361 |

) |

|

(1,650 |

) |

|

289 |

|

18 |

% |

|

Net finance costs |

|

2,825 |

|

|

3,040 |

|

|

(215 |

) |

(7 |

)% |

|

Loss before income taxes |

$ |

(580 |

) |

$ |

(11,671 |

) |

$ |

11,091 |

|

95 |

% |

|

Deferred income tax recovery |

|

– |

|

|

(61 |

) |

|

61 |

|

N/A |

|

|

Net loss, being comprehensive loss |

$ |

(580 |

) |

$ |

(11,610 |

) |

$ |

11,030 |

|

95 |

% |

|

Basic and diluted loss per share |

$ |

(0.01 |

) |

$ |

(0.15 |

) |

$ |

0.14 |

|

93 |

% |

VARIANCE ANALYSIS FOR THE YEAR-TO-DATE

2024 COMPARED TO SAME PERIOD OF 2023

- The decrease in

net sales is primarily driven by a decrease in the number of active

customers partially offset by an increase in average order value as

a result of price optimizations, increased variety in the meal-kit

offering and a focus on meal-kit offerings with ready meal

solutions and grocery products as add-ons. This net sales decrease

can also be explained by the Company’s decision to discontinue its

on-demand offering. The decrease in active customers is mainly

driven by the Company’s focus on attracting and retaining customers

that provide higher gross margins and by changing customer

behaviours.

- The slight

decrease in gross profit primarily resulted from a decrease in net

sales as well as higher credit and incentives as a percentage of

sales mostly offset by lower food, production and fulfilment costs

as a percentage of net sales driven by improved inventory

management reducing waste, lower production labour cost and lower

packaging and shipping costs. Gross margin increased mainly due to

operational efficiencies driving lower food and production costs,

as well as pricing optimization, partially offset by an increase in

credits and incentives as a percentage of net sales.

- The decrease in

selling, general and administrative expenses is primarily due to

lower wages and salaries, utilities, maintenance, operating leases

and software expenses as well as lower marketing spend driven

primarily by the Company’s costs saving initiatives. Selling,

general and administrative expenses as a percentage of net sales

decreased from 42.1% to 35.4%.

- The decrease in

depreciation and amortization expense is mainly due to the

reduction in right-of-use assets following exiting facilities as

part of the Company’s costs reduction initiatives.

- The decrease in

reorganization and other related gains is mainly due to higher net

gains in Fiscal 2023 as a result of termination of leases and

headcount reduction costs compared to a net gain on reversal of

impairment resulting from a sublease agreement concluded in Fiscal

2024.

- The decrease in

net finance costs is mainly due to lower interest expense on lease

obligations in relation to the Company’s costs saving, lower

interest on debt as a result of a lower debt balance as well as

lower debt renewal fees in Fiscal 2024 partially offset with higher

interest expense on debentures in relation to the Company’s $30

million convertible debentures issued in February 2023.

- The decrease in

net loss is mainly due to lower wages and salaries in cost of goods

sold and in selling, general and administrative expenses as well as

lower food costs, lower utilities and maintenance, operating leases

and software expenses and lower marketing spend partially offset by

a lower sales base.

METRICS AND NON-IFRS FINANCIAL MEASURES –

RECONCILIATION

ADJUSTED GROSS

PROFIT1 AND

ADJUSTED GROSS

MARGIN1

The reconciliation of gross profit to adjusted

gross profit1 and adjusted gross margin1 is as follows:

(In thousands of Canadian dollars, except

percentage information)

|

|

For the 13 weeks ended |

|

For the 26 weeks ended |

|

|

|

|

March 2, 2024 |

|

|

March 4, 2023 |

|

|

March 2, 2024 |

|

|

March 4, 2023 |

|

|

Gross profit |

$ |

17,109 |

|

$ |

17,114 |

|

$ |

33,038 |

|

$ |

33,873 |

|

|

Discontinuance of products related to on-demand offering |

|

– |

|

|

631 |

|

|

– |

|

|

1,274 |

|

|

Adjusted gross profit |

$ |

17,109 |

|

$ |

17,745 |

|

$ |

33,038 |

|

$ |

35,147 |

|

|

Net sales |

$ |

39,755 |

|

$ |

42,043 |

|

$ |

80,214 |

|

$ |

89,191 |

|

|

Gross margin |

|

43.0% |

|

|

40.7% |

|

|

41.2% |

|

|

38.0% |

|

|

Adjusted gross margin (%) |

|

43.0% |

|

|

42.2% |

|

|

41.2% |

|

|

39.4% |

|

For the 13 weeks ended March 2, 2024, adjusted

gross profit decreased by $0.6 million while adjusted gross margin

increased by 0.8 percentage points compared to the same quarter

last year. This adjusted gross margin improvement can mainly be

explained by operational efficiencies driving lower food and

production costs as a percentage of net sales resulting from

improved inventory management reducing waste and lower production

labour cost, as well as pricing optimization, partially offset by

an increase in credits and incentives as a percentage of net

sales.

For the 26 weeks ended March 2, 2024, the

adjusted gross profit decreased by $2.1 million primarily due to a

decrease in net sales partially offset by lower costs of goods sold

mainly in food, production and fulfilment costs. The increase in

adjusted gross margin of 1.8 percentage points can be explained by

lower food, production and fulfilment costs as a percentage of net

sales driven by improved inventory management to reduce waste,

lower production labour cost and lower packaging and shipping

costs, as well as pricing optimization, partially offset by an

increase in credits and incentives as a percentage of net

sales.

EBITDA1, ADJUSTED

EBITDA1 AND

ADJUSTED EBITDA

MARGIN1

The reconciliation of net income (loss) to

EBITDA1, adjusted EBITDA1 and adjusted EBITDA margin1 is as

follows:

(In thousands of Canadian dollars, except

percentage information)

|

|

For the 13 weeks ended |

|

For the 26 weeks ended |

|

|

|

|

March 2, 2024 |

|

|

March 4, 2023 |

|

|

March 2, 2024 |

|

|

March 4, 2023 |

|

|

Net income (loss) |

$ |

1,393 |

|

$ |

98 |

|

$ |

(580 |

) |

$ |

(11,610 |

) |

|

Net finance costs |

|

1,369 |

|

|

1,470 |

|

|

2,825 |

|

|

3,040 |

|

|

Depreciation and amortization |

|

1,818 |

|

|

2,856 |

|

|

3,773 |

|

|

6,625 |

|

|

Deferred income tax recovery |

|

– |

|

|

(72 |

) |

|

– |

|

|

(61 |

) |

|

EBITDA |

$ |

4,580 |

|

$ |

4,352 |

|

$ |

6,018 |

|

$ |

(2,006 |

) |

|

Share-based payments expense |

|

325 |

|

|

794 |

|

|

338 |

|

|

3,087 |

|

|

Discontinuance of products related to on-demand offering |

|

– |

|

|

631 |

|

|

– |

|

|

1,274 |

|

|

Reorganization and other related gains |

|

(1,364 |

) |

|

(2,769 |

) |

|

(1,361 |

) |

|

(1,650 |

) |

|

Adjusted EBITDA |

$ |

3,541 |

|

$ |

3,008 |

|

$ |

4,995 |

|

$ |

705 |

|

|

Net sales |

$ |

39,755 |

|

$ |

42,043 |

|

$ |

80,214 |

|

$ |

89,191 |

|

|

Adjusted EBITDA margin (%) |

|

8.9 |

% |

|

7.2 |

% |

|

6.2 |

% |

|

0.8 |

% |

For the 13 weeks ended March 2, 2024, adjusted

EBITDA margin improved by 1.7 percentage points compared to the

corresponding period in 2023 mainly driven by lower selling,

general and administrative expenses mostly as a result of lower

marketing spend as well as the Company’s cost savings measures

which reduced salaries, utilities, maintenance and insurance

expenses. The improved adjusted EBITDA margin was partly offset by

a lower net sales base.

For the 26 weeks ended March 2, 2024, adjusted

EBITDA margin improved by 5.4 percentage points compared to the

corresponding period in 2023 mainly driven by stronger adjusted

gross margin and lower selling, general and administrative expenses

mostly as a result of the Company’s cost savings measures which

reduced salaries, utilities and maintenance, operating leases and

software expenses. The improved adjusted EBITDA margin was partly

offset by a lower net sales base.

FREE CASH FLOW1 AND ADJUSTED FREE

CASH FLOW1

The reconciliation of net cash flows from

operating activities to free cash flow1 and adjusted free cash

flow1 is as follows:

(In thousands of Canadian dollars)

|

|

For the 13 weeks ended |

|

For the 26 weeks ended |

|

|

|

|

March 2, 2024 |

|

|

March 4, 2023 |

|

|

March 2, 2024 |

|

|

March 4, 2023 |

|

|

Net cash provided by (used in) operating activities |

$ |

90 |

|

$ |

(4,417 |

) |

$ |

3,927 |

|

$ |

(10,492 |

) |

|

Additions to fixed assets |

|

– |

|

|

(3 |

) |

|

(32 |

) |

|

(689 |

) |

|

Additions to intangible assets |

|

(118 |

) |

|

(494 |

) |

|

(246 |

) |

|

(620 |

) |

|

Free cash flow |

$ |

(28 |

) |

$ |

(4,914 |

) |

$ |

3,649 |

|

$ |

(11,801 |

) |

|

Payments related for discontinuance of products related to

on-demand offering |

|

– |

|

|

127 |

|

|

– |

|

|

127 |

|

|

Payments made to reorganization and other related costs |

|

359 |

|

|

2,576 |

|

|

689 |

|

|

4,694 |

|

|

Adjusted free cash flow |

$ |

331 |

|

$ |

(2,211 |

) |

$ |

4,338 |

|

$ |

(6,980 |

) |

For the 13 weeks ended March 2, 2024, adjusted

free cash flow was $0.3 million compared to negative $2.2 million

in the same period last year. This is an improvement of $2.5

million compared to the same period last year which is mainly

driven by higher net income after non-cash items resulting from

lower selling, general and administrative expenses as well as the

completion of our cost saving initiatives in Fiscal 2023. The

improvement to the adjusted free cash flow can also be explained by

a favorable change in non-cash operating working capital due to a

positive change in accounts payable and accrued liabilities

resulting from lower supplier payments as well as lower spend on

intangible assets projects during the second quarter 2024.

For the 26 weeks ended March 2, 2024, adjusted

free cash flow was $4.3 million compared to negative $7.0 million

in the same period last year. This is an improvement of $11.3

million compared to the corresponding period in 2023 mainly driven

by lower net loss resulting from stronger adjusted gross margin and

lower selling, general and administrative expenses. The improvement

to the adjusted free cash flow can also be explained by a favorable

change in non-cash operating working capital due to a positive

change in accounts payable and accrued liabilities resulting from

lower supplier payments as well as lower spend on fixed assets and

intangible assets projects in Fiscal 2024.

TOTAL NET DEBT TO ADJUSTED

EBITDA

The reconciliation of total net debt to adjusted

EBITDA (net leverage) is as follows:

(In thousands of Canadian dollars, except the

ratio)

|

As at |

March 2, 2024 |

|

June 3, 2023 |

|

|

Debt |

$ |

1,763 |

|

$ |

4,322 |

|

|

Convertible debentures, liability component |

|

43,475 |

|

|

40,920 |

|

|

Total debt |

$ |

45,238 |

|

$ |

45,242 |

|

|

Cash and cash equivalents |

|

(23,712 |

) |

|

(28,368 |

) |

|

Total net debt |

$ |

21,526 |

|

$ |

16,874 |

|

|

Adjusted EBITDA (trailing 12 months) (1) |

$ |

8,985 |

|

$ |

2,062 |

|

|

Total net debt to adjusted EBITDA |

|

2.4 |

|

|

8.2 |

|

|

(1) |

Please refer to the “Selected Quarterly Financial Information”

section of the Management’s Discussion and Analysis for the 12

months Adjusted EBITDA |

Total net debt to adjusted EBITDA is calculated

as total net debt divided by the last twelve months adjusted

EBITDA. Total net debt consists of debt and the liability component

of the convertible debentures less cash and cash equivalents.

With stronger results in the last four quarters

and adjusted EBITDA now reaching $9 million over the last twelve

months, we reduced our total net debt to adjusted EBITDA nearly 70%

from 8X nine months ago to approximately 2X now. Although this is

not a non-IFRS metric that we consider important to understand our

performance on a recurring basis, we included it in the Press

Release this quarter as there has been a significant improvement

over the last 9 months that is important to note. We do not expect

to present this metric in the future as we do not anticipate total

net debt to adjusted EBITDA ratio to fluctuate at the same level as

it has in the last 9 months.

FINANCIAL OUTLOOK

Goodfood’s core purpose is to create experiences

that spark joy and help our community live longer on a healthier

planet. As a food brand with a strong following from Canadians

coast to coast, we are focused on growing the Goodfood brand

through our meal solutions including meal kits and prepared meals,

with a range of exciting Goodfood branded add-ons to complete a

unique food experience for customers.

We believe there is runway for additional

penetration of meal kits into Canadian households, as evidenced by

2023 and 2024 industry research estimating the Canadian meal kit

market to grow at a CAGR in the mid-teen percentage points through

2028. We believe that consumers’ willingness to simplify their

weekly meal planning combined with their desire for joyful,

exciting, and nourishing food experiences at home while reducing

food waste provides for significant room to increase online food

delivery penetration.

Before scaling our efforts to endeavour to

capture an outsized share of the Canadian meal solutions market,

our focus has been and continues to be on further improving and

growing cash flows. We are pleased to have now reported five

consecutive quarters of positive adjusted EBITDA1, which on a last

twelve months basis stands at $9 million. The substantial rise in

adjusted EBITDA1 has led to significant adjusted free cash flow1

improvement which has now been positive in three of our last four

quarters. The improved adjusted EBITDA1 and adjusted free cash

flow1 on the back of stable net sales highlights the cost

discipline we have shown in improving our operational efficiency,

reducing our selling, general and administrative expense and

consistently enhancing our unit economics. These improvements help

position Goodfood to turn its focus to growth and to fund this

growth with internally generated cash flows.

During Fiscal 2024, Goodfood will focus on key

growth pillars to drive growth in top line and, most importantly,

in profitability and cash flows: 1) customer growth, 2) order

frequency increase, 3) basket size enhancement, and 4) continue to

enhance our sustainability practices.

To grow our customer base, the first step is

building customer acquisition cost efficiencies to enable adding

more active customers to the Goodfood platform every week with the

same investment. In recent months, we have completed a thorough

review of and made significant adjustments to our acquisition

channels. We have also made and continue to make investments in our

digital product to elevate the customer experience by reducing

friction and enhancing ease of use. Combined with reactivations of

previous Goodfood members, these initiatives have driven a

reduction of our customer acquisition costs since the fourth

quarter of Fiscal 2023 and improved the profitability and unit

economics of customers.

A key driver that can enhance order frequency is

product variety. In addition to launching our VIP program, which

rewards high-frequency customers, we have increased the diversity

of our recipe and ingredient offering to provide additional choices

to enhance order rate. With a focus on Better-for-You products like

organic chicken breasts, organic lean ground beef, bison,

sustainably raised steelhead trout and paleo and keto meals,

combined with exciting partnerships with first-rate restaurants, we

plan on offering a growing and mouth-watering selection to

customers to drive consistently increasing order frequency.

The dollar-value of the baskets our customers

are building is also increasing and we are building a

differentiated set of meal kits, ready-to-eat meals and grocery

add-ons to provide Canadians with an exciting online meal solutions

option and increasingly capture a larger share of their food

wallet. In addition, we have provided and continue to provide more

choice of proteins to our customers, with the launch of upsells and

upcoming launch of customization within our meal-kit recipes

allowing customers to swap or double the proteins included in their

chosen recipes. With these initiatives, we aim to provide customers

with an array of options to easily make their meals better and

their baskets bigger.

We are also continuously looking to enhance our

sustainability initiatives by prioritizing planet-friendly options.

Not only do we offer perfectly portioned ingredients that save from

food waste, we also constantly look to simplify our supply chain by

removing middlemen from farm to kitchen table. This year, we are

also offsetting carbon emissions on deliveries and introducing

packaging innovations that have helped us to remove the equivalent

of 2.4 million plastic bags annually from our deliveries. Our goal

is clear, build a business that helps our customers live healthier

lives on a healthier planet.

In addition to focusing on these key pillars of

top-line growth, we are currently testing the potential for

multi-channel partnerships that can broaden Goodfood’s customer

reach and resilience.

Our strategic execution to drive profitability

and cash flows continues to position us for growth and

profitability, underpinned by consistent improvement in adjusted

EBITDA1 and cash flows. Coupled with our unrelenting focus on

nurturing our customer relationships, profitable growth remains our

top priority. The Goodfood team is fully focused on building and

growing Canada’s most loved millennial food brand.

TRENDS AND SEASONALITY

The Company’s net sales and expenses are

impacted by seasonality. During the winter holiday season and the

summer season, the Company anticipates net sales to be lower as a

higher proportion of customers elect to skip their delivery. The

Company generally anticipates the number of active customers to be

lower during these periods. During periods with significantly

colder or warmer weather, the Company anticipates packaging costs

to be higher due to the additional packaging required to maintain

food freshness and quality. The Company also anticipates food costs

to be positively affected due to improved availability during

periods with warmer weather.

CONFERENCE CALL

Goodfood will hold a conference call to discuss

these results on April 16, 2024, at 8:00AM Eastern Time. Interested

parties can join the call by dialing 1 289 514 5100 (Toronto or

overseas) or 1 800 717 1738 (elsewhere in North America). To access

the webcast and view the presentation, click on this link:

https://www2.makegoodfood.ca/en/investisseurs/evenements

Parties unable to call in at this time may

access a recording by calling 1 888 660 6264 and entering the

playback passcode 24585#. This recording will be available until

April 23, 2024.

A full version of the Company’s Management’s

Discussion and Analysis (MD&A) and Consolidated Financial

Statements for the second quarters ended March 2, 2024, and March

4, 2023, will be posted on http://www.sedarplus.ca later today.

NON-IFRS FINANCIAL MEASURES

Certain non-IFRS financial measures included in

this press release do not have standardized definitions prescribed

by IFRS and, therefore, may not be comparable to similar measures

presented by other companies. They are provided as additional

information to complement IFRS measures and to provide a further

understanding of the Company’s results of operations from our

perspective. For a more complete description of these measures and

a reconciliation of Goodfood's non-IFRS financial measures to

financial results, please see Goodfood's Management's Discussion

and Analysis for the Fiscal year 2023.

Goodfood's definition of the non-IFRS financial

measures are as follows:

- Adjusted gross profit is defined as

gross profit excluding the impact of the discontinuance of products

related to Goodfood On-Demand offering pursuant to the Company’s

costs saving initiatives. Adjusted gross margin is defined as the

percentage of adjusted gross profit to net sales. The Company uses

adjusted gross profit and adjusted gross margin to measure its

performance from one period to the next excluding the variation

caused by the items described above. Adjusted gross profit and

adjusted gross margin are non-IFRS financial measures. We believe

that these metrics are useful measures of financial performance to

assess how efficiently the Company uses its resources to service

its customers as well as to assess underlying trends in our ongoing

operations without the variations caused by the impacts of

strategic initiatives such as the items described above and

facilitates the comparison across reporting periods.

- EBITDA is defined as net income or

loss before net finance costs, depreciation and amortization and

income taxes. Adjusted EBITDA is defined as EBITDA excluding

share-based payments expense, the impact of the inventories

write-downs due to the discontinuance of products related to

Goodfood On-Demand offering, impairment and reversal of impairment

of non-financial assets and reorganization and other related

(gains) costs pursuant to the Company’s costs saving initiatives.

Adjusted EBITDA margin is defined as the percentage of adjusted

EBITDA to net sales. EBITDA, adjusted EBITDA, and adjusted EBITDA

margin are non-IFRS financial measures. We believe that EBITDA,

adjusted EBITDA, and adjusted EBITDA margin are useful measures of

financial performance to assess the Company’s ability to seize

growth opportunities in a cost-effective manner, to finance its

ongoing operations and to service its debt. They also allow

comparisons between companies with different capital structures. We

also believe that these metrics are useful measures of financial

performance to assess underlying trends in our ongoing operations

without the variations caused by the impacts of the items described

above and facilitates the comparison across reporting periods.

- Free cash flow is defined as net

cash used in or provided by operating activities less additions to

fixed assets and additions to intangible assets. This measure

allows the Company to assess its financial strength and liquidity

as well as to assess how much cash is generated and available to

invest in growth opportunities, to finance its ongoing operations

and to service its debt. It also allows comparisons between

companies with different capital structures. Adjusted free cash

flow is defined as free cash flow excluding cash payments made to

costs related to reorganization activities. We believe that

adjusted free cash flow is a useful measure when comparing between

companies with different capital structures by removing variations

caused by the impacts of the items described above. We also believe

that this metric is a useful measure of financial and liquidity

performance to assess underlying trends in our ongoing operations

without the variations caused by the impacts of the items described

above and facilitates the comparison across reporting periods.

- Please refer to the “Metrics and

non-IFRS financial measures – reconciliation” and the “Liquidity

and capital resources” sections of the MD&A for a

reconciliation of these non-IFRS financial measures to the most

comparable IFRS financial measures.

ACTIVE CUSTOMERS

An active customer is a customer that has placed

an order within the last three months. For greater certainty, an

active customer is only accounted for once, although different

products and multiple orders might have been purchased within a

quarter. While the active customers metric is not an IFRS or

non-IFRS financial measure, and, therefore, does not appear in, and

cannot be reconciled to a specific line item in the Company’s

consolidated financial statements, we believe that the active

customers metric is a useful metric for investors because it is

indicative of potential future net sales. The Company reports the

number of active customers at the beginning and end of the period,

rounded to the nearest thousand.

ABOUT GOODFOOD

Goodfood (TSX: FOOD) is a leading digitally

native meal solutions brand in Canada, delivering fresh meals and

add-ons that make it easy for customers from across Canada to enjoy

delicious meals at home every day. The Goodfood team is building

Canada’s most loved millennial food brand, with the mission to

create experiences that spark joy and help our community live

longer on a healthier planet. Goodfood customers have access to

uniquely fresh and delicious products, as well as exclusive

pricing, made possible by its world-class culinary team and

direct-to-consumer infrastructures and technology. Goodfood is

passionate about connecting its partner farms and suppliers to its

customers’ kitchens while eliminating food waste and costly retail

overhead. The Company’s administrative offices are based in

Montreal, Québec, with production facilities located in the

provinces of Quebec and Alberta.

Except where otherwise indicated, all amounts in

this press release are expressed in Canadian dollars.

|

For further information: Investors and Media |

|

|

Roslane Aouameur Chief Financial Officer(855)

515-5191IR@makegoodfood.ca |

Jennifer

StahlkeExecutive Vice President, Marketing(855)

515-5191media@makegoodfood.ca |

FORWARD-LOOKING INFORMATION

This press release contains “forward-looking

information” within the meaning of applicable Canadian securities

legislation. Such forward-looking information includes, but is not

limited to, information with respect to our objectives and the

strategies to achieve these objectives, as well as information with

respect to our beliefs, plans, expectations, anticipations,

assumptions, estimates and intentions, including, without

limitation, statements in the “Financial Outlook” section of the

MD&A. This forward-looking information is identified by the use

of terms and phrases such as “may”, “would”, “should”, “could”,

“expect”, “intend”, “estimate”, “anticipate”, “plan”, “foresee”,

“believe”, and “continue”, as well as the negative of these terms

and similar terminology, including references to assumptions,

although not all forward-looking information contains these terms

and phrases. Forward-looking information is provided for the

purposes of assisting the reader in understanding the Company and

its business, operations, prospects and risks at a point in time in

the context of historical trends, current condition and possible

future developments and therefore the reader is cautioned that such

information may not be appropriate for other purposes.

Forward-looking information is based upon a

number of assumptions and is subject to a number of risks and

uncertainties, many of which are beyond our control, which could

cause actual results to differ materially from those that are

disclosed in, or implied by, such forward-looking information.

These risks and uncertainties include, but are not limited to, the

following risk factors which are discussed in greater detail under

“Risk Factors” in the Company’s Annual Information Form for the 52

weeks ended September 2, 2023 available on SEDAR+ at

www.sedarplus.ca: limited operating history, negative operating

cash flows and net losses, going concern risk, food industry

including current industry inflation levels, indebtedness and

impact upon financial condition, future capital requirements,

quality control and health concerns, regulatory compliance,

regulation of the industry, public safety issues, product recalls,

damage to Goodfood’s reputation, transportation disruptions,

storage and delivery of perishable foods, product liability,

unionization activities, consolidation trends, ownership and

protection of intellectual property, evolving industry, reliance on

management, fulfillment centers and logistics channels, factors

which may prevent realization of growth targets, competition,

availability and quality of raw materials, environmental and

employee health and safety regulations, online security breaches

and disruptions, reliance on data centers, open source license

compliance, operating risk and insurance coverage, management of

growth, limited number and scope of products, conflicts of

interest, litigation, food costs and availabilities, catastrophic

events, risks associated with payments from customers and third

parties, being accused of infringing intellectual property rights

of others and, climate change and environmental risks, as well as

an inability to maintain high social responsibility standards could

lead to reputational damage and adversely affect our business. This

is not an exhaustive list of risks that may affect the Company’s

forward-looking statements. Other risks not presently known to the

Company or that the Company believes are not significant could also

cause actual results to differ materially from those expressed in

its forward-looking statements. Although the forward-looking

information contained herein is based upon what we believe are

reasonable assumptions, readers are cautioned against placing undue

reliance on this information since actual results may vary from the

forward-looking information. Certain assumptions were made in

preparing the forward-looking information concerning the

availability of capital resources, business performance, market

conditions, as well as customer demand.

In addition, net sales and operating results

could be impacted by changes in the overall economic condition in

Canada and by the continuing inflationary pressures and by the

impact these conditions could have on consumer discretionary

spending. Fears of a looming recession, increases in interest

rates, continuing supply chain disruptions and increased input

costs are expected to have a continuing significant impact on our

economic condition that could materially affect our financial

condition, results of operations and cash flows.

Consequently, all of the forward-looking

information contained herein is qualified by the foregoing

cautionary statements, and there can be no guarantee that the

results or developments that we anticipate will be realized or,

even if substantially realized, that they will have the expected

consequences or effects on our business, financial condition or

results of operation. Unless otherwise noted or the context

otherwise indicates, the forward-looking information contained

herein is provided as of the date hereof, and we do not undertake

to update or amend such forward-looking information whether as a

result of new information, future events or otherwise, except as

may be required by applicable law.

1 Please refer to the “Non-IFRS Financial

Measures” section of this press release for corresponding

definitions.

2 Please refer to the “Metrics and Non-IFRS

Financial Measures - Reconciliation” section of this press release

for corresponding definitions.

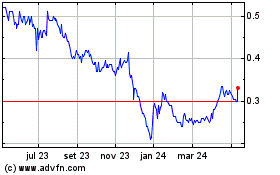

Goodfood Market (TSX:FOOD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

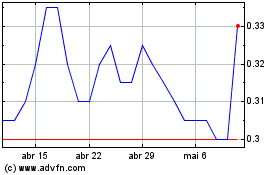

Goodfood Market (TSX:FOOD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024