mdf commerce inc. (“

mdf” or the

“

Company”) (TSX: MDF), a SaaS leader in digital

commerce technologies, announced today that at the Company’s

special meeting (the “

Meeting”) of its

shareholders (the “

Shareholders”) held

earlier today, an overwhelming majority of Shareholders voted in

favour of the special resolution (the “

Arrangement

Resolution”) approving the previously announced

statutory plan of arrangement under the Canada Business

Corporations Act involving the Company and 9511-1357 Québec Inc.

(the “

Purchaser”), an entity affiliated with funds

managed by KKR, a leading global investment firm, pursuant to which

the Purchaser will acquire all of the issued and outstanding common

shares (the “

Shares”) in the capital of the

Company for $5.80 in cash per Share

(the “

Consideration”), the whole subject to

the terms and conditions of the arrangement agreement dated March

11, 2024 (the “

Arrangement Agreement”) between the

Company and the Purchaser

(the “

Arrangement”).

Approval of the Arrangement Resolution required

the affirmative vote of at least two-thirds (66 2/3%) of the

votes cast by Shareholders virtually present or represented by

proxy and entitled to vote at the Meeting (each holder of Shares

being entitled to one vote per Share).

Details on the voting results at the Meeting are

set forth below:

|

Total Shares voted at the Meeting |

29,134,025 |

|

Total Shares voted FOR the Arrangement Resolution |

28,881,981 |

|

Percentage of Shares voted FOR the Arrangement Resolution |

99.13% |

A report on voting results for the Meeting will

be filed under the Company’s profile on SEDAR+ at

www.sedarplus.ca.

mdf anticipates returning to the Superior Court

of Québec (the “Court”) on May 15, 2024 to

seek a final order of the Court approving the Arrangement.

Completion of the Arrangement remains subject to closing conditions

as set forth in the Arrangement Agreement, including approval of

the Court. Assuming that the conditions to closing are satisfied or

waived (if permitted), it is expected that the Arrangement will be

completed on or about May 17, 2024. Following completion of the

Arrangement, KKR intends to cause the Shares to be delisted from

the Toronto Stock Exchange (“TSX”) and

applications will be made for mdf to cease to be a reporting issuer

under applicable securities laws.

Additional information regarding the Arrangement

and the procedure for exchange of Shares for the Consideration is

provided in the Company’s management information circular in

respect of the Meeting dated April 10, 2024, a copy of which is

available on SEDAR+ under the Company’s profile at

www.sedarplus.ca.

Forward Looking Information

This press release contains “forward-looking

information” and “forward-looking statements” (collectively,

“forward-looking information”) within the meaning of applicable

securities laws. This information includes, but is not limited to,

statements relating to mdf commerce's business objectives, expected

growth, results of operations, performance and financial results.

In some cases, forward-looking information can be identified by the

use of forward-looking terminology such as “expects”, “estimates”,

“outlook”, “forecasts”, “projection”, “prospects”, “intends”,

“anticipates”, “believes”, or variations of such words and phrases

or statements that certain actions, events or results “may”,

“could”, “would”, “might”, “will”, “will be taken”, “occur” or “be

achieved”. In addition, any statements that refer to expectations,

intentions, projections or other characterizations of future events

or circumstances contain forward-looking information. Statements

containing forward-looking information are not historical facts but

instead represent management’s expectations, estimates and

projections regarding future events or circumstances.

Forward-looking information in this press release include, among

other things, statements relating to the anticipated timing for

completion of the Arrangement, including the parties’ ability to

satisfy the conditions to the consummation of the Arrangement; the

delisting of the Shares from the TSX and the Company ceasing to be

a reporting issuer under applicable securities laws; the timing of

the hearing for the final order; and the receipt of the required

Court approval and other customary closing conditions.

Risks and uncertainties related to the

transactions contemplated by the Arrangement Agreement include, but

are not limited to: the possibility that the Arrangement will not

be completed on the terms and conditions, or on the timing,

currently contemplated, and that it may not be completed at all,

due to a failure to obtain or satisfy, in a timely manner or

otherwise, required regulatory and court approvals and other

conditions to the closing of the Arrangement or for other reasons;

the negative impact that the failure to complete the Arrangement

for any reason could have on the price of the Shares or on the

business of the Company; KKR’s failure to pay the Consideration at

closing of the Arrangement; the business of mdf commerce may

experience significant disruptions, including loss of clients or

employees due to Arrangement related uncertainty, industry

conditions or other factors; risks relating to employee retention;

the risk of regulatory changes that may materially impact the

business or the operations of the Company; the risk that legal

proceedings may be instituted against mdf commerce; and risks

related to the diversion of management’s attention from mdf

commerce’s ongoing business operations while the Arrangement is

pending; and other risks and uncertainties affecting mdf commerce,

including those described in the “Risk Factors and Uncertainty”

section of the Company’s Annual Information Form for the year ended

as at March 31, 2023, as well as in the “Risk Factors and

Uncertainties” section of the Company’s Management’s Discussion and

Analysis for the third quarter ended December 31, 2023 and

elsewhere in the Company’s filings with the Canadian securities

regulators, as applicable.

Although we have attempted to identify important

risk factors that could cause actual results to differ materially

from those contained in forward-looking information, there may be

other risk factors not presently known to us or that we presently

believe are not material that could also cause actual results or

future events to differ materially from those expressed in such

forward-looking information. There can be no assurance that such

information will prove to be accurate, as actual results and future

events could differ materially from those anticipated in such

information. No forward-looking statement is a guarantee of future

results. Accordingly, you should not place undue reliance on

forward-looking information, which speaks only as of the date made.

The forward-looking information contained in this press release

represents the Company’s expectations as of the date of this press

release (or as the date they are otherwise stated to be made) and

are subject to change after such date. However, the Company

disclaims any intention or obligation or undertaking to update or

revise any forward-looking information whether as a result of new

information, future events or otherwise, except as required under

applicable securities laws in Canada. All of the

forward-looking information contained in this press release is

expressly qualified by the foregoing cautionary statements.

About mdf commerce inc.

mdf commerce inc. enables the flow of commerce

by providing a broad set of software as a service (SaaS) solutions

that optimize and accelerate commercial interactions between buyers

and sellers. Our platforms and services empower businesses around

the world, allowing them to generate billions of dollars in

transactions on an annual basis. Our eprocurement, ecommerce and

emarketplaces solutions are supported by a strong and dedicated

team of approximately 650 employees based in Canada and in the

United States. For more information, please visit us at

mdfcommerce.com, follow us on LinkedIn or call at 1 877

677-9088.

About KKR

KKR is a leading global investment firm that

offers alternative asset management as well as capital markets and

insurance solutions. KKR aims to generate attractive investment

returns by following a patient and disciplined investment approach,

employing world-class people, and supporting growth in its

portfolio companies and communities. KKR sponsors investment funds

that invest in private equity, credit and real assets and has

strategic partners that manage hedge funds. KKR’s insurance

subsidiaries offer retirement, life and reinsurance products under

the management of Global Atlantic Financial Group. References to

KKR’s investments may include the activities of its sponsored funds

and insurance subsidiaries. For additional information about

KKR & Co. Inc. (NYSE: KKR), please visit KKR’s website at

www.kkr.com. For additional information about Global Atlantic

Financial Group, please visit Global Atlantic Financial Group’s

website at www.globalatlantic.com.

Source: mdf commerce inc.

www.mdfcommerce.com

Contact:

For mdf commerce media inquiries:Brigitte Guay,

Director – Corporate Communications514

702-9658brigitte.guay@mdfcommerce.com

For KKR media inquiries: Liidia Liuksila212

230-9722media@kkr.com

This press release shall not constitute an offer

to purchase or a solicitation of an offer to sell any securities,

or a solicitation of a proxy of any securityholder of any person in

any jurisdiction. Any offers or solicitations will be made in

accordance with the requirements under applicable law. Shareholders

are advised to review any documents that may be filed with

securities regulatory authorities and any subsequent announcements

because they will contain important information regarding the

Arrangement and the terms and conditions thereof. The circulation

of this press release and the Arrangement may be subject to a

specific regulation or restrictions in some countries.

Consequently, persons in possession of this press release must

familiarize themselves and comply with any restrictions that may

apply to them.

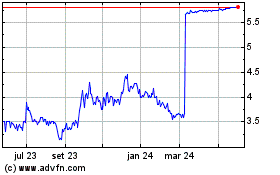

MDF Commerce (TSX:MDF)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

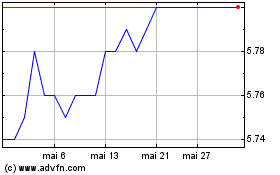

MDF Commerce (TSX:MDF)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025