mdf commerce inc. (“mdf commerce” or the “Company”) (TSX:MDF), a

SaaS leader in digital commerce technologies, today announced it

has entered into an arrangement agreement (the “Arrangement

Agreement”) to be acquired by funds managed by KKR, a leading

global investment firm, in an all-cash transaction (the

“Transaction”). Upon completion of the Transaction, mdf commerce

will become a privately held company.

The Company’s platforms and services empower

businesses around the world, supporting them in generating billions

of dollars in transactions on an annual basis. mdf commerce’s North

American eProcurement platform serves over 6,500 government

agencies and more than 650,000 suppliers across Canada and the

United States and provides a strong foundation to build a leading

government software platform.

“After a comprehensive strategic review process,

we are pleased to have reached an agreement with KKR that provides

immediate liquidity and certainty of value at an attractive premium

to our shareholders,” said Pierre Chadi, Chairman of mdf commerce’s

board of directors (the “Board”).

“We are excited to strategically partner with

KKR to accelerate our expansion and scale our industry-leading

platform even further. We look forward to leveraging their

relationships, resources, and expertise as we execute on our

strategy and explore new projects and opportunities that will

improve mdf commerce’s service offering and continue growing market

share,” stated Luc Filiatreault, President and Chief Executive

Officer, mdf commerce. “KKR has a long history of successfully

investing in market-leading software businesses globally. I am

confident that KKR is the ideal partner for mdf commerce and can

contribute to the Company’s continued success.”

“KKR is closely aligned with management’s vision

to accelerate technology innovation across the broader mdf commerce

platforms,” said John Park, Partner at KKR. “We look forward to the

enormous opportunity ahead for the mdf commerce eProcurement

platform as governments increasingly embrace digital solutions. We

have been impressed with the business that Luc and team have built

in Montreal and are delighted to welcome one of the leading

technology companies in Quebec to the KKR family.”

Following the closing of the Transaction, KKR

will support mdf commerce in creating an equity ownership program

to provide all employees the opportunity to participate in the

benefits of ownership of the Company. This strategy is based on the

belief that employee engagement is a key driver in building

stronger companies. Since 2011, KKR portfolio companies have

awarded billions of dollars of total equity value to over 60,000

non-management employees across more than 40 companies.

KKR is making its investment in mdf commerce

through its Ascendant Strategy, which invests in middle market

businesses in North America as part of KKR’s Americas Private

Equity platform.

Transaction Highlights

- Attractive premium for

shareholders: Consideration of C$5.80 per issued and

outstanding common share of the Company (the “Common Shares”),

payable entirely in cash (the “Consideration”), represents a

premium of approximately 58% to the closing price of the Common

Shares on the Toronto Stock Exchange (the “TSX”) on March 8, 2024

of C$3.68 per Common Share, a premium of approximately 59% to the

20-day volume-weighted average share price on the TSX for the

period ending on March 8, 2024 of C$3.65 per Common Share, and a

30% premium to the 52-week high price on the TSX of C$4.45 per

Common Share achieved on December 8, 2023;

- Certainty of value and

immediate liquidity: The shareholders of mdf commerce (the

“Shareholders”) will receive a price of C$5.80 per Common Share,

payable entirely in cash, which provides certainty of value and

immediate liquidity;

- Unanimous mdf commerce

Board recommendation: The Board unanimously recommends

that Shareholders vote in favour of the Transaction;

- Alignment with major

shareholders:

- KKR is closely aligned with mdf commerce’s management in a

shared vision for the future of the Company and will leverage the

expertise of the existing management team led by Luc Filiatreault,

President and Chief Executive Officer, to continue to support mdf

commerce’s growth strategy and to build a global leader

headquartered in Québec; and

- Long Path Partners and each of the directors and executive

officers of the Company (collectively, the “Supporting

Shareholders”), who currently collectively own approximately 12.4%

of the outstanding Common Shares, have entered into support and

voting agreements pursuant to which they have agreed to vote their

Common Shares in favour of the Transaction.

- Value supported by two

fairness opinions: Scotiabank and Desjardins Capital

Markets (“Desjardins”) each provided a fairness opinion stating

that, as at March 10, 2024, subject to the assumptions, limitations

and qualifications set out in their respective opinions, the

Consideration to be received by the Shareholders pursuant to the

Transaction is fair, from a financial point of view, to the

Shareholders.

mdf commerce Board

Recommendation

The Transaction is the result of an extensive

formal sale process conducted by the Board, pursuant to which

several proposals from interested parties were considered. The

Board has evaluated the Arrangement Agreement with the Company’s

management and legal and financial advisors and has unanimously

determined that the Transaction is in the best interests of the

Company and is fair to the Shareholders. The Board also unanimously

recommends that the Shareholders vote in favour of the Transaction

at the special meeting of Shareholders to be called to approve the

Transaction (the “Meeting”). The Transaction is expected to close

in the second quarter of calendar 2024, subject to the receipt of

the required approvals from the Company’s shareholders and certain

regulatory approvals, as well as the satisfaction of other

customary closing conditions.

The Supporting Shareholders, who currently

collectively own approximately 12.4% of the outstanding Common

Shares, have entered into support and voting agreements pursuant to

which they have agreed to vote their Common Shares in favour of the

Transaction, subject to certain conditions.

Fairness Opinions

In connection with their review and

consideration of the Transaction, the Board engaged Scotiabank as

its financial advisor and Desjardins as its independent financial

advisor to provide an independent fairness opinion. Both Scotiabank

and Desjardins provided a verbal opinion to the Board that, as at

March 10, 2024, subject to the assumptions, limitations and

qualifications set out in their respective opinions, the

Consideration to be received by the Shareholders pursuant to the

Transaction is fair, from a financial point of view, to such

Shareholders.

Both fairness opinions will be included in the

management information circular to be mailed to the Shareholders in

connection with the Meeting and to be filed by the Company under

its profile on SEDAR+ at www.sedarplus.ca and to be made available

on the Company’s website at www.mdfcommerce.com.

Additional Transaction

Details

The Transaction will be implemented by way of

statutory plan of arrangement under the Canada Business

Corporations Act and is subject to approval by certain regulatory

bodies and court approval, after considering the procedural and

substantive fairness of the Transaction. The Transaction is not

subject to any financing condition and KKR is providing an

equity-back stop for all the Consideration payable pursuant to the

Transaction.

The Transaction is subject to certain approvals

at the Meeting, including the approvals by at least two-thirds of

the votes cast by Shareholders voting in person or by proxy.

The Arrangement Agreement contains customary

non-solicitation covenants on the part of the Company, subject to

customary “fiduciary out” provisions, as well as “right to match”

provisions in favor of KKR. A termination fee of approximately

C$7.7 million would be payable by the Company to KKR in certain

circumstances, including in the context of a superior proposal

supported by the Company.

Upon closing of the Transaction, KKR intends to

cause the Common Shares to be delisted from the TSX, and to cause

the Company to submit an application to cease to be a reporting

issuer under applicable Canadian securities laws.

Additional details regarding the terms and

conditions of the Transaction, the rationale for the

recommendations made by the Board, the fairness opinions, the

applicable voting requirements for the Transaction, and how

Shareholders can participate in and vote at the Meeting, will be

set out in mdf commerce’s management information circular to be

prepared and made available to Shareholders in connection with the

Meeting on SEDAR+ at www.sedarplus.ca and on the Company’s website

at www.mdfcommerce.com. Copies of the Arrangement Agreement, the

voting and support agreements, the management information circular

and proxy materials in respect of the Meeting will be filed by the

Company under its profile on SEDAR+ at www.sedarplus.ca.

Advisors

Scotiabank is acting as exclusive financial

advisor to the Company and Desjardins is providing an independent

fairness opinion to the Board of Directors. McCarthy Tétrault LLP

and Foley & Lardner LLP are acting as legal advisors to the

Company. Stikeman Elliott LLP and Dechert LLP are acting as legal

advisors to KKR.

About mdf commerce

mdf commerce inc. (TSX:MDF) enables the flow of

commerce by providing a broad set of software as a service (SaaS)

solutions that optimize and accelerate commercial interactions

between buyers and sellers. Our platforms and services empower

businesses around the world, allowing them to generate billions of

dollars in transactions on an annual basis. Our eprocurement,

ecommerce and emarketplaces solutions are supported by a strong and

dedicated team of approximately 650 employees based in Canada

and in the United States. For more information, please visit us at

mdfcommerce.com, follow us on LinkedIn or call at

1-877-677-9088.

About KKR

KKR is a leading global investment firm that

offers alternative asset management as well as capital markets and

insurance solutions. KKR aims to generate attractive investment

returns by following a patient and disciplined investment approach,

employing world-class people, and supporting growth in its

portfolio companies and communities. KKR sponsors investment funds

that invest in private equity, credit and real assets and has

strategic partners that manage hedge funds. KKR’s insurance

subsidiaries offer retirement, life and reinsurance products under

the management of Global Atlantic Financial Group. References to

KKR’s investments may include the activities of its sponsored funds

and insurance subsidiaries. For additional information about KKR

& Co. Inc. (NYSE: KKR), please visit KKR’s website at

www.kkr.com. For additional information about Global Atlantic

Financial Group, please visit Global Atlantic Financial Group’s

website at www.globalatlantic.com.

Forward-Looking Information

This press release contains “forward-looking

information” and “forward-looking statements” (collectively,

“forward-looking information”) within the meaning of applicable

securities laws. This information includes, but is not limited to,

statements relating to mdf commerce’s business objectives, expected

growth, results of operations, performance and financial results.

In some cases, forward-looking information can be identified by the

use of forward-looking terminology such as “expects”, “estimates”,

“outlook”, “forecasts”, “projection”, “prospects”, “intends”,

“anticipates”, “believes”, or variations of such words and phrases

or statements that certain actions, events or results “may”,

“could”, “would”, “might”, “will”, “will be taken”, “occur” or “be

achieved”. In addition, any statements that refer to expectations,

intentions, projections or other characterizations of future events

or circumstances contain forward-looking information. Statements

containing forward-looking information are not historical facts but

instead represent management’s expectations, estimates and

projections regarding future events or circumstances.

Forward-looking information in this press release include, among

other things, statements relating to mdf commerce’s business in

general, including its growth; statements relating to the

Transaction, the ability to complete the transactions contemplated

by the Arrangement Agreement and the timing thereof, including the

parties’ ability to satisfy the conditions to the consummation of

the Transaction, the receipt of the required shareholder approval

and court approval and other customary closing conditions, the

possibility of any termination of the Arrangement Agreement in

accordance with its terms, and the expected benefits to the Company

and its Shareholders of the Transaction; the creation by KKR of an

equity ownership program.

Risks and uncertainties related to the

transactions contemplated by the Arrangement Agreement include, but

are not limited to: the possibility that the Transaction will not

be completed on the terms and conditions, or on the timing,

currently contemplated, and that it may not be completed at all,

due to a failure to obtain or satisfy, in a timely manner or

otherwise, required regulatory, shareholder and court approvals and

other conditions to the closing of the Transaction or for other

reasons; the risk that competing offers or acquisition proposals

will be made; the negative impact that the failure to complete the

Transaction for any reason could have on the price of the Common

Shares or on the business of the Company; KKR’s failure to pay the

Consideration at closing of the Transaction; the business of mdf

commerce may experience significant disruptions, including loss of

clients or employees due to Transaction related uncertainty,

industry conditions or other factors; risks relating to employee

retention; the risk of regulatory changes that may materially

impact the business or the operations of the Company; the risk that

legal proceedings may be instituted against mdf commerce; and risks

related to the diversion of management’s attention from mdf

commerce’s ongoing business operations while the Transaction is

pending; and other risks and uncertainties affecting mdf commerce,

including those described in the “Risk Factors and Uncertainty”

section of the Company’s Annual Information Form for the year ended

as at March 31, 2023, as well as in the “Risk Factors and

Uncertainties” section of the Company’s Management’s Discussion and

Analysis for the third quarter ended December 31, 2023 and

elsewhere in the Company’s filings with the Canadian securities

regulators, as applicable.

Although we have attempted to identify important

risk factors that could cause actual results to differ materially

from those contained in forward-looking information, there may be

other risk factors not presently known to us or that we presently

believe are not material that could also cause actual results or

future events to differ materially from those expressed in such

forward-looking information. There can be no assurance that such

information will prove to be accurate, as actual results and future

events could differ materially from those anticipated in such

information. No forward-looking statement is a guarantee of future

results. Accordingly, you should not place undue reliance on

forward-looking information, which speaks only as of the date made.

The forward-looking information contained in this press release

represents the Company’s expectations as of the date of this press

release (or as the date they are otherwise stated to be made) and

are subject to change after such date. However, the Company

disclaims any intention or obligation or undertaking to update or

revise any forward-looking information whether as a result of new

information, future events or otherwise, except as required under

applicable securities laws in Canada. All of the forward-looking

information contained in this press release is expressly qualified

by the foregoing cautionary statements.

Source: mdf commerce Inc.

www.mdfcommerce.com

Contact: For mdf commerce media

inquiries:Brigitte Guay, Director – Corporate

Communications514-702-9658brigitte.guay@mdfcommerce.com

For KKR media inquiries: Liidia

Liuksila212-230-9722media@kkr.com

This press release shall not constitute an offer

to purchase or a solicitation of an offer to sell any securities,

or a solicitation of a proxy of any securityholder of any person in

any jurisdiction. Any offers or solicitations will be made in

accordance with the requirements under applicable law. Shareholders

are advised to review any documents that may be filed with

securities regulatory authorities and any subsequent announcements

because they will contain important information regarding the

Transaction and the terms and conditions thereof. The circulation

of this press release and the Transaction may be subject to a

specific regulation or restrictions in some countries.

Consequently, persons in possession of this press release must

familiarize themselves and comply with any restrictions that may

apply to them.

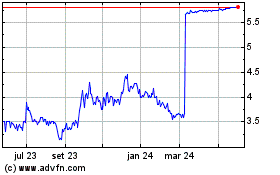

MDF Commerce (TSX:MDF)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

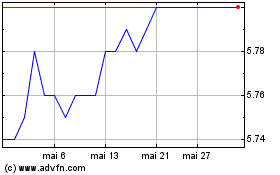

MDF Commerce (TSX:MDF)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025