mdf commerce inc. (“

mdf” or the

“

Company”) (TSX: MDF), a SaaS leader in digital

commerce technologies, is pleased to announce the closing of the

previously announced plan of arrangement under the Canada Business

Corporations Act (the “

Arrangement”)

involving the Company and an entity affiliated with funds managed

by KKR, a leading global investment firm.

“Today’s announcement is a significant milestone

in the long-lasting story of mdf commerce. On behalf of the

entire team here at mdf, I want to express our gratitude to all of

our shareholders for their support and commitment to the Company

throughout this transaction and over the years. As we embark on a

new chapter, we are focused on continuing our growth and adding

value for our customers, partners, employees and our new

shareholder across North America,” said Luc Filiatreault,

President and Chief Executive Officer of mdf commerce.

“We are very pleased with the successful outcome

of this transaction,” said Pierre Chadi, Chair of the

Board of Directors. “I am confident that mdf commerce is in good

hands with KKR, a resourceful owner who will support the

Company’s long-term growth plan and take this SaaS leader in

digital commerce technologies to the next level.”

“mdf commerce has a bright future ahead, and we

are thrilled to be part of it,” said John Park, Partner at KKR. “We

look forward to supporting the Company in becoming a leading

commerce platform and working closely with management to fulfill

this vision.”

The Arrangement was approved by the Company's

shareholders at a special meeting of shareholders held on May 10,

2024 (the “Meeting”), and final court approval was

obtained on May 15, 2024. Registered shareholders of the Company

should send their completed and executed letters of transmittal and

share certificates or DRS Advices evidencing ownership of common

shares of the Company (the “Shares”) to the

depositary, Computershare Investor Services Inc., as soon as

possible in order to receive the consideration of C$5.80 in cash

per Share (the “Consideration”) to which they are

entitled. Additional information regarding the Arrangement and the

procedure for exchange of Shares for the Consideration is provided

in the Company’s management information circular in respect of the

Meeting dated April 10, 2024, a copy of which is available on

SEDAR+ under the Company’s profile at www.sedarplus.ca.

As a result of the Arrangement, the Shares are

expected to be delisted from the Toronto Stock Exchange (“TSX”) at

the close of trading on or about May 22, 2024. The Company intends

to submit an application to cease to be a reporting issuer under

applicable Canadian securities laws and to otherwise terminate the

Company's public reporting requirements.

Advisors

Scotiabank acted as exclusive financial advisor

to the Company and Desjardins provided an independent fairness

opinion to the board of directors of the Company. McCarthy Tétrault

LLP and Foley & Lardner LLP acted as legal advisors to the

Company. Stikeman Elliott LLP and Dechert LLP acted as legal

advisors to KKR, and William Blair served as a buyside advisor to

KKR.

Forward Looking Information

This press release contains “forward-looking

information” and “forward-looking statements” (collectively,

“forward-looking information”) within the meaning

of applicable securities laws. This information includes, but is

not limited to, statements relating to mdf commerce's business

objectives, expected growth, results of operations, performance and

financial results. In some cases, forward-looking information can

be identified by the use of forward-looking terminology such as

“expects”, “estimates”, “outlook”, “forecasts”, “projection”,

“prospects”, “intends”, “anticipates”, “believes”, or variations of

such words and phrases or statements that certain actions, events

or results “may”, “could”, “would”, “might”, “will”, “will be

taken”, “occur” or “be achieved”. In addition, any statements that

refer to expectations, intentions, projections or other

characterizations of future events or circumstances contain

forward-looking information. Statements containing forward-looking

information are not historical facts but instead represent

management’s expectations, estimates and projections regarding

future events or circumstances. Forward-looking information in this

press release include, among other things, statements relating to

the business of the Company, the delisting of the Shares from the

TSX and the application to cease to be a reporting issuer under

applicable Canadian securities laws.

Risks and uncertainties related to the

Arrangement include, but are not limited to, the possibility that

the Shares will not be delisted from the TSX in accordance with the

timing currently contemplated, and that the Shares may not be

delisted at all, due to a failure to satisfy, in a timely manner or

otherwise, conditions necessary to delist the Shares from the TSX

or for other reasons.

Although we have attempted to identify important

risk factors that could cause actual results to differ materially

from those contained in forward-looking information, there may be

other risk factors not presently known to us or that we presently

believe are not material that could also cause actual results or

future events to differ materially from those expressed in such

forward-looking information. There can be no assurance that such

information will prove to be accurate, as actual results and future

events could differ materially from those anticipated in such

information. No forward-looking statement is a guarantee of future

results. Accordingly, you should not place undue reliance on

forward-looking information, which speaks only as of the date made.

The forward-looking information contained in this press release

represents the Company’s expectations as of the date of this press

release (or as the date they are otherwise stated to be made) and

are subject to change after such date. However, the Company

disclaims any intention or obligation or undertaking to update or

revise any forward-looking information whether as a result of

new information, future events or otherwise, except as required

under applicable securities laws in Canada. All of the

forward-looking information contained in this press release is

expressly qualified by the foregoing cautionary statements.

About mdf commerce

mdf commerce inc. (TSX: MDF) enables the flow of

commerce by providing a broad set of software as a service (SaaS)

solutions that optimize and accelerate commercial interactions

between buyers and sellers. Our platforms and services empower

businesses around the world, allowing them to generate billions of

dollars in transactions on an annual basis. Our eprocurement,

ecommerce and emarketplaces solutions are supported by a strong and

dedicated team of approximately 650 employees based in Canada and

in the United States. For more information, please visit us at

mdfcommerce.com, follow us on LinkedIn or call at

1-877-677-9088.

About KKR

KKR is a leading global investment firm that

offers alternative asset management as well as capital markets and

insurance solutions. KKR aims to generate attractive investment

returns by following a patient and disciplined investment approach,

employing world-class people, and supporting growth in its

portfolio companies and communities. KKR sponsors investment funds

that invest in private equity, credit and real assets and has

strategic partners that manage hedge funds. KKR’s insurance

subsidiaries offer retirement, life and reinsurance products under

the management of Global Atlantic Financial Group. References to

KKR’s investments may include the activities of its sponsored funds

and insurance subsidiaries. For additional information about KKR

& Co. Inc. (NYSE: KKR), please visit KKR’s website at

www.kkr.com. For additional information about Global Atlantic

Financial Group, please visit Global Atlantic Financial Group’s

website at www.globalatlantic.com.

Contact:

For mdf commerce media inquiries:Brigitte Guay,

Director – Corporate Communications514

702-9658brigitte.guay@mdfcommerce.com

For KKR media inquiries: Liidia Liuksila212

230-9722media@kkr.com

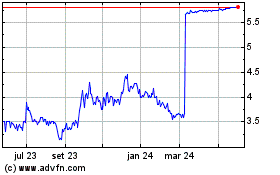

MDF Commerce (TSX:MDF)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

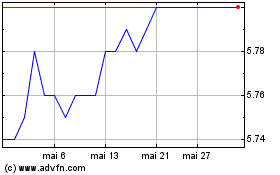

MDF Commerce (TSX:MDF)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025