Genius Group Announces Exercise of Warrants for $3.8 Million Gross Proceeds

20 Maio 2024 - 9:00AM

Genius Group Limited (NYSE American: GNS) (“Genius Group” or the

“Company”), a leading AI-powered education group, today announced

the entry into definitive agreements for the immediate exercise of

certain outstanding Series 2024-C warrants to purchase up to an

aggregate of 10,950,451 of the Company’s ordinary shares originally

issued in January 2023, at the current exercise price of $0.35 per

share. The ordinary shares issuable upon exercise of the warrants

are registered pursuant to an effective registration statement on

Form F-1 (No. 333-273841). The gross proceeds to the Company from

the exercise of the warrants are expected to be approximately $3.8

million, prior to deducting placement agent fees and estimated

offering expenses.

H.C. Wainwright & Co. is acting as the

exclusive placement agent for the offering.

In consideration for the immediate exercise of

the warrants for cash, the Company will issue new unregistered

Series 2024-D warrants to purchase up to 10,950,451 ordinary shares

and new unregistered Series 2024-E warrants to purchase up to

10,950,451 ordinary shares. The new warrants will have an exercise

price of $0.35 per share and will be immediately exercisable upon

issuance. The Series 2024-D warrants will have a term of five and

one-half years from the issuance date and the Series 2024-E

warrants will have a term of two years from the issuance date.

The offering is expected to close on or about

May 22, 2024, subject to satisfaction of customary closing

conditions. The Company intends to use the net proceeds from the

offering for general corporate purposes, including working capital,

operating expenses, debt repayment and to support acquired

assets.

The Company also has agreed, effective upon the

closing of the offering, to (i) amend certain existing warrants to

purchase up to an aggregate of 8,945,000 ordinary shares that were

previously issued in April 2024 and have an exercise price of $0.41

per share, such that the amended warrants will have a reduced

exercise price of $0.35 per share and (ii) issue to the holder of

such existing warrants a warrant to purchase up to an aggregate of

6,000,000 ordinary shares, at an exercise price of $0.35 per share,

which will be immediately exercisable upon issuance and will have a

term of five years from the issuance date.

The new warrants described above were offered in

a private placement pursuant to an applicable exemption from the

registration requirements of the Securities Act of 1933, as amended

(the “1933 Act”) and, along with the ordinary shares issuable upon

their exercise, have not been registered under the 1933 Act, and

may not be offered or sold in the United States absent registration

with the Securities and Exchange Commission (“SEC”) or an

applicable exemption from such registration requirements. The

Company has agreed to file a registration statement with the SEC

covering the resale of the ordinary shares issuable upon exercise

of the new warrants.

This press release shall not constitute an offer

to sell or a solicitation of an offer to buy nor shall there be any

sale of these securities in any state or jurisdiction in which such

offer, solicitation or sale would be unlawful prior to the

registration or qualification under the securities laws of any such

state or jurisdiction.

About Genius Group

Genius Group (NYSE: GNS) is a leading provider

of AI-powered, digital-first education solutions, disrupting the

highly standardized system of traditional education with a

personalized, flexible and life-long learning curriculum for the

modern student. Genius Group services 5.6 million users in over 200

countries, providing personalized curriculums for individuals,

enterprises and governments. The comprehensive, AI-powered platform

offers programs for K-12 education, accredited university courses

and skills-based courses for entrepreneurs. To learn more, please

visit https://www.geniusgroup.net/.

Forward-Looking Statements

Statements made in this press release include

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934. Forward-looking statements can be

identified by the use of words such as “may,” “will,” “plan,”

“should,” “expect,” “anticipate,” “estimate,” “continue,” or

comparable terminology. Such forward-looking statements are

inherently subject to certain risks, trends and uncertainties,

including market and other conditions, many of which the Company

cannot predict with accuracy and some of which the Company might

not even anticipate and involve factors that may cause actual

results to differ materially from those projected or suggested.

Forward-looking statements in this press release include, without

limitation, statements pertaining to the completion of the

offering, the satisfaction of customary closing conditions related

to the offering and the intended use of proceeds from the offering.

Readers are cautioned not to place undue reliance on these

forward-looking statements and are advised to consider the factors

listed above together with the additional factors under the heading

“Risk Factors” in the Company’s Annual Reports on Form 20-F, as may

be supplemented or amended by the Company’s Reports of a Foreign

Private Issuer on Form 6-K. The Company assumes no obligation to

update or supplement forward-looking statements that become untrue

because of subsequent events, new information or otherwise, except

as required by law.

Contacts

Brian M. Prenoveau, CFAManaging DirectorMZ Group

- MZ North America (561) 489-5315GNS@mzgroup.uswww.mzgroup.us

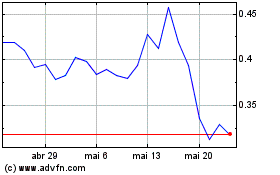

Genius (AMEX:GNS)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

Genius (AMEX:GNS)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024