American Hotel Income Properties REIT LP (“AHIP”, or the “Company”)

(TSX: HOT.UN, TSX: HOT.U, TSX: HOT.DB.V ), today announced that

AHIP and certain of its subsidiaries are in a dispute with hotel

manager ONE Lodging Holdings LLC, itself a subsidiary of Aimbridge

Hospitality, and various of its own subsidiaries (collectively,

“

Aimbridge”) related to Aimbridge’s mismanagement

of AHIP’s hotel portfolio.

Earlier this month, AHIP delivered a detailed

notice of default (the “Default Notice”) to

Aimbridge providing notice that Aimbridge is in material default of

the Master Hotel Management Agreement dated February 20, 2013, as

amended (the “Master HMA”) and the individual

hotel management agreements made thereunder (the

“Individual HMAs”, and together with the Master

HMA, the “HMAs”). Aimbridge’s management failures,

arising in part from a lack of leadership consistency and recurring

organizational instability, have caused AHIP material economic

harm.

Pursuant to the dispute resolution procedure

called for in the contract between the parties, AHIP also delivered

a notice of appointment referring the matters set forth in the

Default Notice to an independent expert for a determination that

Aimbridge is in default of the Master HMA entitling AHIP to

terminate the HMAs and recover damages.

AHIP is now in receipt of a notice of civil

claim (the “Claim”) filed by Aimbridge in the

Supreme Court of British Columbia. Aimbridge is claiming, amongst

other things, that the matters identified in the appointment notice

must be resolved by the courts of British Columbia notwithstanding

the agreed dispute resolution procedure. AHIP believes the Claim is

meritless and intended solely to delay the prompt determination of

Aimbridge’s material defaults as mandated by the agreed dispute

resolution procedure in the HMAs. AHIP intends to vigorously oppose

the Claim and to seek resolution of, and compensation for, the

matters set forth in the Default Notice.

Notwithstanding the dispute, AHIP’s entire

portfolio of premium branded, select-service hotels continue to be

in operation and AHIP remains focused on creating long-term value

for its Unitholders.

ABOUT AMERICAN HOTEL INCOME PROPERTIES REIT

LP

American Hotel Income Properties REIT LP (TSX:

HOT.UN, TSX: HOT.U, TSX: HOT.DB.V), or AHIP, is a limited

partnership formed to invest in hotel real estate properties across

the United States. AHIP’s portfolio of premium branded,

select-service hotels are located in secondary metropolitan markets

that benefit from diverse and stable demand. AHIP hotels operate

under brands affiliated with Marriott, Hilton, IHG and Choice

Hotels through license agreements. AHIP’s long-term objectives are

to build on its proven track record of successful investment,

deliver monthly U.S. dollar denominated distributions to

unitholders, and generate value through the continued growth of its

diversified hotel portfolio. More information is available at

www.ahipreit.com.

FORWARD-LOOKING INFORMATION

Certain statements in this news release may

constitute “forward-looking information” within the meaning of

applicable securities laws. Forward-looking information generally

can be identified by words such as “anticipate”, “believe”,

“continue”, “expect”, “estimates”, “intend”, “may”, “outlook”,

“objective”, “plans”, “should”, “will” and similar expressions

suggesting future outcomes or events. Forward-looking information

includes, but is not limited to, statements made or implied

relating to the objectives of AHIP, AHIP’s strategies to achieve

those objectives and AHIP’s beliefs, plans, estimates, projections

and intentions and similar statements concerning anticipated future

events, results, circumstances, performance, or expectations that

are not historical facts. Forward-looking information in this news

release includes, but is not limited to, statements with respect

to: AHIP’s intention to vigorously oppose the Claim and seek

resolution of, and compensation for, the matters set forth in the

Default Notice; AHIP’s belief that the Claim is meritless and

intended solely to delay the prompt determination of Aimbridge’s

material defaults as mandated by the agreed dispute resolution

procedure in the HMAs; AHIP remaining focussed on creating

long-term value for its Unitholders, and AHIP’s other stated

long-term objectives.

Although the forward-looking information

contained in this news release is based on what AHIP’s management

believes to be reasonable assumptions, AHIP cannot assure investors

that actual results will be consistent with such information.

Forward-looking information is based on a number of key

expectations and assumptions made by AHIP, including, without

limitation: AHIP will be successful in opposing the Claim and will

resolve the matters set out in the Default Notice in a manner that

is acceptable to AHIP; and AHIP will achieve its long term

objectives.

Forward-looking information involves significant

risks and uncertainties and should not be read as a guarantee of

future performance or results as actual results may differ

materially from those expressed or implied in such forward-looking

information, accordingly undue reliance should not be placed on

such forward-looking information. Those risks and uncertainties

include, among other things, risks related to: the outcome of the

Claim, the Default Notice and the dispute resolution procedures

under the HMAs cannot be predicted, and may be determined in a

manner unfavorable to AHIP, which may have a substantial negative

impact on AHIP’s financial position and results of operations; AHIP

may incur significant costs in relation to the Claim, regardless of

its merit, the Default Notice and the dispute resolution procedures

under the HMAs and may be ordered to pay damages and costs in any

such proceedings; the outcome of the Claim may be subject to

appeal; if Aimbridge is removed, the financial terms of the

engagement of any replacement hotel manager cannot be determined at

this time and could less advantageous to AHIP than the terms of the

HMAs, and AHIP may suffer some operational disruption in the course

of any replacement of Aimbridge; and AHIP may not achieve its long

term objectives. Management believes that the expectations

reflected in the forward-looking information are based upon

reasonable assumptions and information currently available;

however, management can give no assurance that actual results will

be consistent with the forward-looking information contained

herein. Additional information about risks and uncertainties is

contained in AHIP’s management’s discussion and analysis for the

three months ended March 31, 2024 and 2023, and AHIP’s annual

information form for the year ended December 31, 2023, copies of

which are available on SEDAR+ at www.sedarplus.com.

The forward-looking information contained herein

is expressly qualified in its entirety by this cautionary

statement. Forward-looking information reflects management's

current beliefs and is based on information currently available to

AHIP. The forward-looking information is made as of the date of

this news release and AHIP assumes no obligation to update or

revise such information to reflect new events or circumstances,

except as may be required by applicable law.

For additional information, please

contact:

Investor Relationsir@ahipreit.com

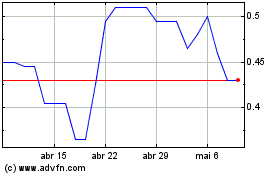

American Hotel Income Pr... (TSX:HOT.U)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

American Hotel Income Pr... (TSX:HOT.U)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024