Verizon Communications Inc. (“Verizon”) (NYSE, NASDAQ: VZ) today

announced the expiration and final results of its previously

announced offers to exchange any and all of the outstanding series

of notes listed in the table below (collectively, the “Old Notes”)

for newly issued notes of Verizon due 2035 (the “New Notes”) (the

“Exchange Offers”), on the terms and subject to the conditions set

forth in an offering memorandum dated July 22, 2024 (as amended by

Verizon’s press release dated July 30, 2024 relating to the

amendment of the terms of the Exchange Offers, Verizon’s press

release dated August 5, 2024, relating to the early results and

extension of the early participation deadline of the Exchange

Offers (the “Early Results Press Release”) and Verizon’s press

release dated August 5, 2024, relating to the pricing of the

Exchange Offers (the “Pricing Press Release”), the “Offering

Memorandum”). The Offering Memorandum and the accompanying

eligibility letter for the Exchange Offers constitute the “Exchange

Offer Documents”.

As previously announced, Verizon settled early all

Old Notes validly tendered at or prior to 5:00 p.m. (New York City

time) on August 2, 2024 (the “Original Early Participation Date”)

and accepted for exchange on August 9, 2024 (the “Early Settlement

Date”).

Verizon’s obligation to accept Old Notes tendered

after the Original Early Participation Date and at or prior to the

Expiration Date in each of the Exchange Offers is subject to the

terms and conditions described in the Offering Memorandum,

including, among other things, (i) the Acceptance Priority

Procedures (as described in Verizon’s press release dated July 22,

2024 announcing the Exchange Offers (the “Launch Press Release”))

and (ii) a cap on the maximum aggregate principal amount of New

Notes that Verizon will issue in all of the Exchange Offers (the

“New Notes Cap”).

The Exchange Offers expired at 5:00 p.m. (New York

City time) on August 19, 2024 (the “Expiration Date”), which was

also the Extended Early Participation Date (as defined in the Early

Results Press Release). All conditions applicable to the Exchange

Offers as of the Expiration Date have been deemed satisfied or

waived by Verizon.

Since the aggregate principal amount of New Notes

to be issued in exchange for the Old Notes validly tendered at or

prior to the Expiration Date and accepted for exchange will not

exceed the New Notes Cap, Verizon has accepted for exchange all Old

Notes that were validly tendered after the Original Early

Participation Date. Eligible holders whose Old Notes have been

accepted for exchange by Verizon after the Original Early

Participation Date will receive on the Final Settlement Date (as

defined below) the applicable Total Exchange Price (as defined in

the Pricing Press Release) and an additional cash payment equal to

accrued and unpaid interest on such Old Notes to, but excluding the

Final Settlement Date (the “Accrued Coupon Payment”). The Accrued

Coupon Payment for the Old Notes exchanged for New Notes at the

Final Settlement Date will be reduced to offset any interest

accrued on such New Notes from the Early Settlement Date, as

further described in the Offering Memorandum.

Exchange Offers

The table below indicates, among other things, the

aggregate principal amount of Old Notes validly tendered after the

Original Early Participation Date and at or prior to the Expiration

Date in each Exchange Offer and accepted for exchange, the Total

Exchange Price (as described below) for each series of Fixed Rate

Notes, each as calculated in the Pricing Press Release in

accordance with the terms set forth in the Offering Memorandum. No

series of Old Notes validly tendered after the Original Early

Participation Date and at or prior the Expiration Date and accepted

in the Exchange Offers was subject to proration.

|

Acceptance Priority Level |

CUSIP Number(s) |

|

Title of Security |

Principal Amount

Outstanding(1) |

Principal Amount Validly Tendered after the Original Early

Participation Date and Accepted under the Exchange

Offers |

Fixed Rate Note Total Exchange

Price(2) |

Floating Rate Note Total Exchange

Price(3) |

|

1 |

92343VEN0/ 92343VEB6/ U9221AAY4 |

|

3.376% notes due 2025 |

$1,339,761,000 |

$516,000 |

$992.90 |

N/A |

| 2 |

92343VEP5 |

|

Floating

Rate notes due 2025 |

$889,448,000 |

$3,116,000 |

N/A |

$1,008.30 |

|

3 |

92343VFS8 |

|

0.850% notes due 2025 |

$1,404,030,000 |

$1,815,000 |

$958.86 |

N/A |

| 4 |

92343VGG3 |

|

1.450%

notes due 2026 |

$1,916,467,000 |

$1,099,000 |

$958.72 |

N/A |

|

5 |

92343VGE8 |

|

Floating Rate notes due 2026 |

$526,229,000 |

$933,000 |

N/A |

$1,013.20 |

| 6 |

92343VDD3 |

|

2.625%

notes due 2026 |

$1,869,415,000 |

$2,106,000 |

$971.46 |

N/A |

|

7 |

92343VDY7 |

|

4.125% notes due 2027 |

$3,250,000,000 |

$5,233,000 |

$1,001.73 |

N/A |

|

8 |

92343VFF6 |

|

3.000% notes due 2027 |

$750,000,000 |

$284,000 |

$974.05 |

N/A |

|

9 |

92343VER1/ 92343VEQ3/ U9221ABK3 |

|

4.329% notes due 2028 |

$4,199,647,000 |

$2,993,000 |

$1,008.93 |

N/A |

|

10 |

92343VGH1 |

|

2.100% notes due 2028 |

$2,829,602,000 |

$8,465,000 |

$933.66 |

N/A |

__________________

- As of the date of the Launch Press Release.

- The “Total Exchange Price” for each series of Fixed Rate Notes

payable in principal amount of New Notes per each $1,000 principal

amount of such series of Fixed Rate Notes validly tendered for

exchange at or prior to the Extended Early Participation Date and

accepted for purchase, and is based on the Fixed Spread for the

applicable series of Fixed Rate Notes, plus the yield of the

specified Reference U.S. Treasury Security for that series (as

quoted on the applicable Bloomberg Reference Page specified in the

Launch Press Release) as of 10:00 a.m. (New York City time), August

5, 2024 (the “Pricing Determination Date”).

- The Total Exchange Price payable in principal amount of New

Notes per each $1,000 principal amount of floating rate notes due

2025 and floating rate notes due 2026 (the “Floating Rate Notes”)

validly tendered for exchange at or prior to the Extended Early

Participation Date and accepted for purchase.

The following table sets forth the terms of the

New Notes to be issued on the Final Settlement Date:

|

Issuer |

Title of Security |

New Notes

Coupon(1) |

Principal Amount Expected to be Issued on the Final

Settlement Date |

|

Verizon Communications Inc. |

Notes due 2035 |

4.780 |

% |

$25,819,000 |

__________________

- Equal to the sum of (a) the yield of the 4.375% U.S. Treasury

Security due May 15, 2034 (the “New Notes Reference Security”), as

calculated by the lead dealer managers in accordance with standard

market practice, that equates to the bid side price of the New

Notes Reference Security appearing at 10:00 a.m. (New York City

time) on the Pricing Determination Date, on the Bloomberg Reference

Page FIT1, plus (b) 107 basis points, such sum rounded to the third

decimal place when expressed as a percentage. The New Notes will

mature on February 15, 2035.

The “Final Settlement Date” will be August 21,

2024, the second business day after the Expiration Date.

When issued, the New Notes will not be registered

under the Securities Act of 1933, as amended (the “Securities

Act”), or any state securities laws. Therefore, the New Notes may

not be offered or sold in the United States absent registration or

an applicable exemption from the registration requirements of the

Securities Act and any applicable state securities laws. Verizon

entered into a registration rights agreement with respect to the

New Notes on August 9, 2024, the Early Settlement Date.

Global Bondholder Services Corporation has acted

as the Exchange Agent and the Information Agent for the Exchange

Offers. Questions or requests for assistance related to the

Exchange Offers may be directed to Global Bondholder Services

Corporation at (855) 654-2015 (toll free) or (212) 430-3774

(collect). You may also contact your broker, dealer, commercial

bank, trust company or other nominee for assistance concerning the

Exchange Offers.

This announcement is for informational purposes

only. This announcement is not an offer to purchase or a

solicitation of an offer to purchase any Old Notes. The Exchange

Offers have been made solely pursuant to the Exchange Offer

Documents. The Exchange Offers have not been made to holders of Old

Notes in any jurisdiction in which the making or acceptance thereof

would not be in compliance with the securities, blue sky or other

laws of such jurisdiction. In any jurisdiction in which the

securities laws or blue sky laws require the Exchange Offers to be

made by a licensed broker or dealer, the Exchange Offers will be

deemed to be made on behalf of Verizon by the dealer managers or

one or more registered brokers or dealers that are licensed under

the laws of such jurisdiction.

This communication and any other documents or

materials relating to the Exchange Offers have not been approved by

an authorized person for the purposes of Section 21 of the

Financial Services and Markets Act 2000, as amended (the “FSMA”).

Accordingly, this announcement is not being distributed to, and

must not be passed on to, persons within the United Kingdom save in

circumstances where section 21(1) of the FSMA does not apply.

Accordingly, this communication is only addressed to and directed

at persons who are outside the United Kingdom and (i) persons

falling within the definition of investment professionals (as

defined in Article 19(5) of the Financial Services and Markets Act

2000 (Financial Promotion) Order 2005 (the “Financial Promotion

Order”)), or (ii) within Article 43 of the Financial Promotion

Order, or (iii) high net worth companies and other persons to whom

it may lawfully be communicated falling within Article 49(2)(a) to

(d) of the Financial Promotion Order, or (iv) to whom an invitation

or inducement to engage in investment activity (within the meaning

of Section 21 of the FSMA) in connection with the issue or sale of

any securities may otherwise lawfully be communicated or caused to

be communicated (such persons together being “relevant persons”).

The New Notes are only available to, and any invitation, offer or

agreement to subscribe, purchase or otherwise acquire such New

Notes will be engaged in only with, relevant persons. Any person

who is not a relevant person should not act or rely on any document

relating to the Exchange Offers or any of their contents.

This communication and any other documents or

materials relating to the Exchange Offer are only addressed to and

directed at persons in member states of the European Economic Area

(the “EEA”), who are “Qualified Investors” within the meaning of

Article 2(e) of Regulation (EU) 2017/1129. The New Notes are only

available to, and any invitation, offer or agreement to subscribe,

purchase or otherwise acquire such New Notes, will be engaged in

only with, Qualified Investors. The Exchange Offer is only

available to Qualified Investors. None of the information in the

Offering Memorandum and any other documents and materials relating

to the Exchange Offer should be acted upon or relied upon in any

member state of the EEA by persons who are not Qualified

Investors.

Cautionary statement regarding

forward-looking statements

In this communication Verizon has made

forward-looking statements, including regarding the conduct and

completion of the Exchange Offers. These forward-looking statements

are not historical facts, but only predictions and generally can be

identified by use of statements that include phrases such as

“will,” “may,” “should,” “continue,” “anticipate,” “assume,”

“believe,” “expect,” “plan,” “appear,” “project,” “estimate,”

“hope,” “intend,” “target,” “forecast,” or other words or phrases

of similar import. Similarly, statements that describe our

objectives, plans or goals also are forward-looking statements.

These forward-looking statements are subject to risks and

uncertainties that could cause actual results to differ materially

from those currently anticipated, including those discussed in the

Offering Memorandum under the heading “Risk Factors” and under

similar headings in other documents that are incorporated by

reference in the Offering Memorandum. Eligible holders are urged to

consider these risks and uncertainties carefully in evaluating the

forward-looking statements and are cautioned not to place undue

reliance on these forward-looking statements. The forward-looking

statements included in this press release are made only as of the

date of this press release, and Verizon undertakes no obligation to

update publicly these forward-looking statements to reflect new

information, future events or otherwise. In light of these risks,

uncertainties and assumptions, the forward-looking events might or

might not occur. Verizon cannot assure you that projected results

or events will be achieved.

Media contact:

Katie Magnotta 201- 602-9235

katie.magnotta@verizon.com

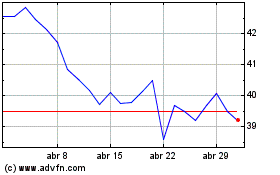

Verizon Communications (NYSE:VZ)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

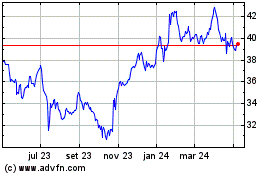

Verizon Communications (NYSE:VZ)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024