Digihost Announces 50% Increase in Cash and Crypto Position Over Previous Month-End and Provides August 2024 Production Update

04 Setembro 2024 - 7:00AM

Digihost Technology Inc. (“

Digihost” or the

“

Company”) (Nasdaq / TSXV: DGHI), an innovative

U.S. based blockchain technology and computer infrastructure

company, is pleased to provide unaudited comparative Bitcoin

(“

BTC”) production results for the month ended

August 31, 2024, combined with an operations update. All monetary

references are expressed in USD unless otherwise indicated.

Monthly Production Highlights for August

2024

- The Company held cash, BTC and cash

deposits of approximately $10.4 million as of August 31, 2024

(based on a BTC price of $58,970 as of August 31, 2024 per

CoinMarketCap), as compared to $6.9 million as of July 31, 2024

(based on a BTC price of $65,100 as of July 31, 2024 per

CoinMarketCap).

- Between self-mining and hosting

agreements, miners at the Company’s facilities produced

approximately 55 BTC during the month of August, representing an

increase of approximately 30% as compared to July 2024.

- As previously disclosed in its news

release of June 11, 2024, Digihost entered into a new agreement

pursuant to which the Company will integrate 11,000

state-of-the-art S21 miners (200/TH) (the “S21

Miners”) into its facilities, translating to approximately

44MW of shared revenues. The deployment of those next-generation,

energy-efficient miners has commenced and will be completed in

phases, and the Company is targeting to be at a total of 3.2 EH/s

by the end of September 2024.

- The Company spent approximately

$0.8 million on capital expenditures, mining infrastructure support

equipment, and deposits. Digihost continues to monitor its capital

expenditures closely, using self-funding to limit equity dilution

for its shareholders when viable.

Financing

In August, the Company closed its previously

announced private placement of its equity securities (the

“Private Placement”). The Private Placement was

for gross proceeds of US$4 million and consisted of the sale of

3,636,363 units of the Company (“Units”) at a

purchase price of US$1.10 per Unit. Each Unit is comprised of one

subordinate voting share of the Company (a

“Share”) and one warrant (a

“Warrant”), with each Warrant entitling the holder

to purchase one additional Share. The Warrants have an exercise

price of US$2.00 per Share and an exercise period of three years

from February 15, 2025.

Operations Update

Presently, Digihost’s consolidated operating

capacity across its three sites represents approximately 90MW of

available power, and Digihost is mining at hashrate of 2.75 EH/s.

The Company is currently exploring opportunities to build its

initial Tier 3 data center with a target completion date of end of

2025.

About Digihost

Digihost is a growth-oriented technology company

focused on the blockchain industry. The Company operates from three

sites in the U.S. and, in addition to managing its own operations,

provides hosting arrangements at its facilities.

For further information, please contact:

Digihost Technology

Inc.www.digihost.caMichel Amar, Chief Executive

Officer T: 1-818-280-9758Email: michel@digihost.ca

Cautionary Statement

Trading in the securities of the Company should

be considered highly speculative. No stock exchange, securities

commission or other regulatory authority has approved or

disapproved the information contained herein. Neither the TSX

Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

Except for the statements of historical fact,

this news release contains “forward-looking information” and

“forward-looking statements” (collectively, “forward-looking

information”) that are based on expectations, estimates and

projections as at the date of this news release and are covered by

safe harbors under Canadian and United States securities laws.

Forward-looking information in this news release includes

information about potential further improvements to profitability

and efficiency across mining operations, including, as a result of

the Company’s expansion efforts, potential for the Company’s

long-term growth, and the business goals and objectives of the

Company. Factors that could cause actual results to differ

materially from those described in such forward-looking information

include, but are not limited to: future capital needs and

uncertainty of additional financing; share dilution resulting from

equity issuances; risks relating to the strategy of maintaining and

increasing Bitcoin holdings and the impact of depreciating Bitcoin

prices on working capital; effects on Bitcoin prices as a result of

the most recent Bitcoin halving; development of additional

facilities and installation of infrastructure to expand operations

may not be completed on the timelines anticipated by the Company,

or at all; ability to access additional power from the local power

grid; a decrease in cryptocurrency pricing, volume of transaction

activity or generally, the profitability of cryptocurrency mining;

further improvements to profitability and efficiency may not be

realized; development of additional facilities to expand operations

may not be completed on the timelines anticipated by the Company;

ability to access additional power from the local power grid; an

increase in natural gas prices may negatively affect the

profitability of the Company’s power plant; the digital currency

market; the Company’s ability to successfully mine digital currency

on the cloud; the Company may not be able to profitably liquidate

its current digital currency inventory, or at all; a decline in

digital currency prices may have a significant negative impact on

the Company’s operations; the volatility of digital currency

prices; and other related risks as more fully set out in the Annual

Information Form of the Company and other documents disclosed under

the Company’s filings at www.sedarplus.ca and www.SEC.gov/EDGAR.

The forward-looking information in this news release reflects the

current expectations, assumptions and/or beliefs of the Company

based on information currently available to the Company. In

connection with the forward-looking information contained in this

news release, the Company has made assumptions about: the current

profitability in mining cryptocurrency (including pricing and

volume of current transaction activity); profitable use of the

Company’s assets going forward; the Company’s ability to profitably

liquidate its digital currency inventory as required; historical

prices of digital currencies and the ability of the Company to mine

digital currencies on the cloud will be consistent with historical

prices; the ability to maintain reliable and economical sources of

power to run its cryptocurrency mining assets; the negative impact

of regulatory changes in the energy regimes in the jurisdictions in

which the Company operates; and there will be no regulation or law

that will prevent the Company from operating its business. The

Company has also assumed that no significant events occur outside

of the Company's normal course of business. Although the Company

believes that the assumptions inherent in the forward-looking

information are reasonable, forward-looking information is not a

guarantee of future performance and accordingly undue reliance

should not be put on such information due to the inherent

uncertainties therein. The Company undertakes no obligation to

revise or update any forward-looking information other than as

required by law.

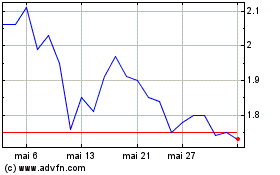

Digihost Technology (TSXV:DGHI)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Digihost Technology (TSXV:DGHI)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024