AGF Partners with Archer to Support Rapid Growth of SMA Model Business

24 Setembro 2024 - 8:25AM

AGF Management Limited (TSX: AGF.B), is pleased to announce a

partnership with Archer Holdco, LLC (“Archer”) to help further grow

its Separately Managed Accounts (SMA) model business.

AGF will leverage the technology capabilities and infrastructure

of Archer, a leading technology-enabled service provider to the

investment management industry.

“We believe Archer will be a key partner as our SMA model

business continues to gain momentum and we look to broaden our

product offerings and onboard additional investment strategies

throughout North America,” said Judy Goldring, President and Head

of Global Distribution, AGF Management Limited. “While focusing on

new opportunities, we will benefit from Archer’s expertise as they

support our business with solutions aligned to meet our evolving

needs and our continued growth.”

“At Archer, we are committed to partnering with leading asset

managers to help build their business through our customized

service model,” said, Bryan Dori, President and CEO of Archer. “We

look forward to developing our relationship with AGF as the firm

leverages our expertise in operations and technology to grow and

support their SMA presence.”

Several leading investment strategies are currently available on

the following SMA platforms: Envestnet Asset Management, Inc.,

Vestmark Advisory Solutions Inc. and SMArtX Advisory Solutions

LLC.

As well, the AGF Global Select ADR Constrained Strategy was

recently named the winner in the Global category at the SMArtX 2024

X Awards* and AGF U.S. Large Cap Growth Equity Strategy was named a

finalist in the Large Cap category.

About AGF Management Limited

Founded in 1957, AGF Management Limited (AGF) is an independent

and globally diverse asset management firm. Our companies deliver

excellence in investing in the public and private markets through

three business lines: AGF Investments, AGF Capital Partners and AGF

Private Wealth.

AGF brings a disciplined approach, focused on incorporating

sound, responsible and sustainable corporate practices. The firm’s

collective investment expertise, driven by its fundamental,

quantitative and private investing capabilities, extends globally

to a wide range of clients, from financial advisors and their

clients to high-net worth and institutional investors including

pension plans, corporate plans, sovereign wealth funds, endowments

and foundations.

Headquartered in Toronto, Canada, AGF has investment operations

and client servicing teams on the ground in North America and

Europe. With nearly $50 billion in total assets under

management and fee-earning assets, AGF serves more than 800,000

investors. AGF trades on the Toronto Stock Exchange under the

symbol AGF.B.

About AGF Investments

AGF Investments is a group of wholly owned subsidiaries of AGF

Management Limited, a Canadian reporting issuer. The subsidiaries

included in AGF Investments are AGF Investments Inc. (AGFI), AGF

Investments America Inc. (AGFA), AGF Investments LLC (AGFUS) and

AGF International Advisors Company Limited (AGFIA). The term AGF

Investments may refer to one or more of these subsidiaries or to

all of them jointly. This term is used for convenience and does not

precisely describe any of the separate companies, each of which

manages its own affairs.

AGF Investments entities only provide investment advisory

services or offers investment funds in the jurisdiction where such

firm and/or product is registered or authorized to provide such

services.

About Archer

Archer is a technology-enabled service provider that helps

investment managers deliver solutions aligned with investor needs.

With Archer, investment managers can maintain their proven

investment process while outsourcing operations and technology to

benefit from a service model geared for growth. Archer has

expansive connectivity across the industry and deep experience

working with asset managers to help them swiftly streamline

operations, enter new distribution channels, and launch new

products.

* SMArtX Awards Criteria and Methodology

Candidates for the Awards are derived from the SMArtX Select

List, which ranks asset managers using a proprietary quantitative

screening based on a robust four-step methodology:

- Ability to generate

alpha compared to the strategy peer group benchmark

- Favorable

risk-adjusted returns that emphasize positive skew

- Effective downside

and tail-risk management

- Consistent return

generation

The Awards calculations add an additional metric to this

existing quantitative screening, namely performance exclusive to

the full previous year. This year, 30 eligible strategies competed

with winners ultimately chosen across 10 categories. These

categories are grouped by market capitalization, geographic focus,

and investment type.

AGF Investments America Inc.’s AGF Global Select ADR Constrained

Strategy was awarded SMARTX’s X award in the Global category on May

29, 2024. The award was a based on the SMARTX methodology above for

the period ending December 31, 2023. AGFA’s AGF U.S. Large Cap

Growth Equity Strategy was also a finalist in the Large Cap

category.

AGF Investments did not pay or provide compensation to

participate in the SMArtX 2024 X Award ranking or to be included in

the eligible strategies list.

Media Contact

Amanda MarchmentDirector, Corporate

Communications416-865-4160amanda.marchment@agf.com

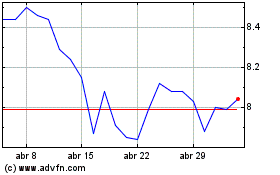

AGF Management (TSX:AGF.B)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

AGF Management (TSX:AGF.B)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025