Today, RBC iShares expands access to BlackRock’s

award-winning investment platform with the launch of two active

bond ETFs (collectively the iShares Funds).1 The iShares Funds

provide clients with the best of BlackRock’s fixed income

investment insights in liquid, transparent and cost-effective ETFs.

The iShares Flexible Monthly Income ETF (XFLI,

XFLI.U) invests in the BlackRock Flexible Income ETF (BINC)2,

managed by Rick Rieder, Chief Investment Officer of Global Fixed

Income at BlackRock. The strategy will also be available hedged to

the Canadian dollar with the listing of the iShares Flexible

Monthly Income ETF (CAD-Hedged)(XFLX). The iShares Funds seek

to deliver monthly income by primarily allocating to hard-to-reach

global fixed income sectors, such as high yield, emerging markets

debt and securitized assets.

The iShares Flexible Monthly Income ETF has now

closed the initial offering of its units and the units will be

listed on the Toronto Stock Exchange (TSX) when markets open today.

The units of the iShares Flexible Monthly Income ETF (CAD-Hedged)

are expected to be listed on the TSX when markets open on October

1, 2024.

The iShares Funds are designed to complement

core bond exposures by providing enhanced yield across the global

fixed income opportunity set, unconstrained by traditional

benchmarks. They leverage the scale of BlackRock’s US$2.8 trillion

fixed income platform,3 providing clients with unparalleled market

access.

Rick Rieder, Chief Investment Officer of Global Fixed

Income, BlackRock:

“Today’s investment environment presents a

golden age for fixed income. Investors can achieve high yields

without taking on excessive risk. By staying active, agile, and

well-diversified, these ETFs aim to capture historic opportunities

across fixed income markets whenever and wherever they become

available.”

Helen Hayes, Head of iShares Canada,

BlackRock:

“The launch of these ETFs

brings the alpha generation capabilities of BlackRock’s global

fixed income platform to Canadian investors. The deep resources and

specialized market insights of our Fundamental Fixed Income Team

will provide investors exposure to less accessible sectors of fixed

Income, further enabling opportunities to capitalize on the strong

yield environment.”

The new iShares Funds are noted in the table

below and will be managed by BlackRock Asset Management Canada

Limited (“BlackRock Canada”), an indirect wholly-owned subsidiary

of BlackRock, Inc.

|

Fund Name |

Ticker |

Management Fee4 |

Listing Date |

|

iShares Flexible Monthly Income ETF |

XFLIXFLI.U |

0.55 |

% |

September 26, 2024 |

|

iShares Flexible Monthly Income ETF (CAD-Hedged) |

XFLX |

0.55 |

% |

October 1, 20245 |

RBC iShares aims to help clients achieve their

investment objectives by empowering them to build efficient

portfolios and take control of their financial futures. RBC iShares

is committed to delivering a truly differentiated ETF experience

and positive outcomes for clients.

For more information about RBC iShares, please

visit https://www.rbcishares.com.

About

BlackRock

BlackRock’s purpose is to help more and more

people experience financial well-being. As a fiduciary to investors

and a leading provider of financial technology, we help millions of

people build savings that serve them throughout their lives by

making investing easier and more affordable. For additional

information on BlackRock, please visit

www.blackrock.com/corporate.

About iShares ETFs

iShares unlocks opportunity across markets to

meet the evolving needs of investors. With more than twenty years

of experience, a global line-up of 1400+ exchange traded funds

(ETFs) and US$3.86 trillion in assets under management as of June

30, 2024, iShares continues to drive progress for the financial

industry. iShares funds are powered by the expert portfolio and

risk management of BlackRock.

iShares® ETFs are managed by BlackRock Asset

Management Canada Limited. About

RBC

Royal Bank of Canada is a global financial

institution with a purpose-driven, principles-led approach to

delivering leading performance. Our success comes from the 100,000+

employees who leverage their imaginations and insights to bring our

vision, values and strategy to life so we can help our clients

thrive and communities prosper. As Canada’s biggest bank and one of

the largest in the world, based on market capitalization, we have a

diversified business model with a focus on innovation and providing

exceptional experiences to our more than 18 million clients in

Canada, the U.S. and 27 other countries. Learn more at rbc.com.

We are proud to support a broad range of

community initiatives through donations, community investments and

employee volunteer activities. See how at

rbc.com/community-social-impact.

About RBC Global Asset

ManagementRBC Global Asset Management (RBC GAM) is the

asset management division of Royal Bank of Canada (RBC). RBC GAM is

a provider of global investment management services and solutions

to institutional, high-net-worth and individual investors through

separate accounts, pooled funds, mutual funds, hedge funds,

exchange-traded funds and specialty investment strategies. RBC

Funds, BlueBay Funds, PH&N Funds and RBC ETFs are offered by

RBC Global Asset Management Inc. (RBC GAM Inc.) and distributed

through authorized dealers in Canada. The RBC GAM group of

companies, which includes RBC GAM Inc. (including PH&N

Institutional) and RBC Indigo Asset Management Inc., manage

approximately $660 billion in assets and have approximately 1,600

employees located across Canada, the United States, Europe and

Asia.

RBC iShares ETFs are comprised of RBC ETFs

managed by RBC Global Asset Management Inc. and iShares ETFs

managed by BlackRock Asset Management Canada Limited. Commissions,

trailing commissions, management fees and expenses all may be

associated with investing in ETFs. Please read the relevant

prospectus before investing. ETFs are not guaranteed, their values

change frequently and past performance may not be repeated. Tax,

investment and all other decisions should be made, as appropriate,

only with guidance from a qualified professional.

® / TM Trademark(s) of Royal Bank of Canada.

Used under license. iSHARES is a registered trademark of BlackRock,

Inc., or its subsidiaries in the United States and elsewhere. Used

under license. © 2023 BlackRock Asset Management Canada Limited and

RBC Global Asset Management Inc. All rights reserved.

Contact for Media: Reem Jazar

Email: reem.jazar@blackrock.com

1 Rick Rieder, Chief Investment Officer of

Global Fixed Income at BlackRock, was awarded the U.S. Morningstar

Award for Investing Excellence: Outstanding Portfolio Manager on

March 21, 2023.2 Currently, the iShares Funds will, directly or

indirectly, invest all or substantially all of their assets in

BINC.3 Source: BlackRock Q2 2024 Earnings, as of June 30, 2024.

4 As an annualized percentage of the iShares

Fund’s daily net asset value. If applicable, BlackRock Canada or an

affiliate is entitled to receive a fee for acting as manager of

each iShares ETF in which this iShares Fund may invest (an

“underlying product fee” and together with the management fee

payable to BlackRock Canada, the “total annual fee”). As the

underlying product fees are embedded in the market value of the

iShares ETFs in which this iShares Fund may invest, any underlying

product fees are borne indirectly by this iShares Fund. BlackRock

Canada will adjust the management fee payable to it by this iShares

Fund to ensure that the total annual fees paid directly or

indirectly to BlackRock Canada and its affiliates by this iShares

Fund will not exceed the percentage of the NAV set out above. The

total annual fee is exclusive of HST. Any underlying product fees

borne indirectly by this iShares Fund are calculated and accrued

daily and are paid not less than annually.5 Listing date is subject

to regulatory approvals.

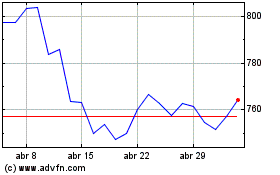

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024