Bitfarms Ltd. (Nasdaq/TSX: BITF) (“

Bitfarms”, or

the “

Company”) a global Bitcoin vertically

integrated company, announces that it has filed an amended and

restated prospectus supplement dated October 4, 2024 (the

“

A&R Prospectus Supplement”), amending and

restating the prospectus supplement dated March 8, 2024 (the

“

March Supplement”), to the Company’s existing

US$375 million base shelf prospectus dated November 10, 2023 (the

“

Base Shelf Prospectus” and, together with the

A&R Prospectus Supplement, the “

A&R

Prospectus”).

As described in the Company’s press release

dated March 8, 2024, the Company previously entered into an

at-the-market offering agreement (the “ATM

Agreement”) dated March 8, 2024 with H.C. Wainwright &

Co., LLC (the “Agent”) as agent, pursuant to which

the Company has established an at-the-market equity program (the

“ATM Program”). Pursuant to the ATM Program, the

Company may, at its discretion and from time-to-time during the

term of the ATM Agreement, sell, through the Agent, such number of

common shares of the Company (“Common Shares”) as

would result in aggregate gross proceeds to the Company of up to

US$375 million. Sales of Common Shares, if any, through the Agent

will be made through “at-the-market” issuances, including without

limitation, sales made directly on the Nasdaq Stock Market or

another trading market for the shares in the United States at the

market price prevailing at the time of each sale. No Common Shares

will be offered or sold under the ATM Program on the TSX or any

other trading market in Canada. The ATM Program may be terminated

by either party at any time.

The Company intends to use the net proceeds of

the ATM Program, if any, primarily on capital expenditures to

support the growth and development of the Company’s existing mining

operations as well as for working capital and general corporate

purposes.

Since the Common Shares will be distributed at

trading prices prevailing at the time of the sale, prices may vary

between purchasers and during the period of distribution. The

volume and timing of sales, if any, will be determined at the sole

discretion of the Company's management and in accordance with the

terms of the ATM Agreement. To date, 109,323,321 Common Shares have

been distributed by the Company for gross proceeds of approximately

US$248 million pursuant to the ATM Agreement by means of the March

Supplement.

The offer and sale of the Common Shares under

the ATM Program will be made only by means of the A&R

Prospectus included within the Company’s U.S. registration

statement on Form F-10 (File No. 333-272989) filed with the U.S.

Securities and Exchange Commission on March 8, 2024 (the

“Registration Statement”). The A&R Prospectus is available on

the Company’s SEDAR+ profile at www.sedarplus.ca and the A&R

Prospectus and Registration Statement are available on the SEC’s

EDGAR website at www.sec.gov.

This news release does not constitute an offer

to sell or the solicitation of an offer to buy, nor shall there be

any sale of these Common Shares in any jurisdiction in which such

offer, solicitation or sale would be unlawful prior to the

registration or qualification under the securities laws of any such

jurisdiction.

About Bitfarms Ltd.

Founded in 2017, Bitfarms is a global vertically

integrated Bitcoin data center company that contributes its

computational power to one or more mining pools from which it

receives payment in Bitcoin. Bitfarms develops, owns, and operates

vertically integrated data centers with in-house management and

company-owned electrical engineering, installation service, and

multiple onsite technical repair centers. The Company’s proprietary

data analytics system delivers best-in-class operational

performance and uptime.

Bitfarms currently has 12 operating Bitcoin data

centers and two under development situated in four countries:

Canada, the United States, Paraguay, and Argentina. Powered

predominantly by environmentally friendly hydro-electric and

long-term power contracts, Bitfarms is committed to using

sustainable and often underutilized energy infrastructure.

To learn more about Bitfarms’ events, developments, and online

communities:

www.bitfarms.comhttps://www.facebook.com/bitfarms/https://twitter.com/Bitfarms_iohttps://www.instagram.com/bitfarms/https://www.linkedin.com/company/bitfarms/

Cautionary Statement

Trading in the securities of the Company should

be considered highly speculative. No stock exchange, securities

commission or other regulatory authority has approved or

disapproved the information contained herein. Neither the Toronto

Stock Exchange, Nasdaq, or any other securities exchange or

regulatory authority accepts responsibility for the adequacy or

accuracy of this release.

Forward-Looking Statements

This news release contains certain

“forward-looking information” and “forward-looking statements”

(collectively, “forward-looking information”) that are based on

expectations, estimates and projections as at the date of this news

release and are covered by safe harbors under Canadian and United

States securities laws. The statements and information in this

release regarding the ATM Program and any sales of the Common

Shares thereunder and proceeds to the Company therefrom, as well as

the potential use of such proceeds, are forward-looking

information. Any statements that involve discussions with respect

to predictions, expectations, beliefs, plans, projections,

objectives, assumptions, future events or performance (often but

not always using phrases such as “expects”, or “does not expect”,

“is expected”, “anticipates” or “does not anticipate”, “plans”,

“budget”, “scheduled”, “forecasts”, “estimates”, “prospects”,

“believes” or “intends” or variations of such words and phrases or

stating that certain actions, events or results “may” or “could”,

“would”, “might” or “will” be taken to occur or be achieved) are

not statements of historical fact and may be forward-looking

information and are intended to identify forward-looking

information.

This forward-looking information is based on

assumptions and estimates of management of the Company at the time

they were made, and involves known and unknown risks, uncertainties

and other factors which may cause the actual results, performance,

or achievements of the Company to be materially different from any

future results, performance or achievements expressed or implied by

such forward-looking information. Such factors include, among

others, risks relating to: the construction and operation of the

Company’s facilities may not occur as currently planned, or at all;

there is no guarantee that the Company will be able to complete the

acquisition of Stronghold Digital Mining, Inc. on the terms as

announced, or at all; expansion may not materialize as currently

anticipated, or at all; the digital currency market; the ability to

successfully mine digital currency; revenue may not increase as

currently anticipated, or at all; it may not be possible to

profitably liquidate the current digital currency inventory, or at

all; a decline in digital currency prices may have a significant

negative impact on operations; an increase in network difficulty

may have a significant negative impact on operations; the

volatility of digital currency prices; the anticipated growth and

sustainability of hydroelectricity for the purposes of

cryptocurrency mining in the applicable jurisdictions; the

inability to maintain reliable and economical sources of power for

the Company to operate cryptocurrency mining assets; the risks of

an increase in the Company’s electricity costs, cost of natural

gas, changes in currency exchange rates, energy curtailment or

regulatory changes in the energy regimes in the jurisdictions in

which the Company operates and the adverse impact on the Company’s

profitability; the ability to complete current and future

financings; the risk that a material weakness in internal control

over financial reporting could result in a misstatement of the

Company’s financial position that may lead to a material

misstatement of the annual or interim consolidated financial

statements if not prevented or detected on a timely basis; any

regulations or laws that will prevent Bitfarms from operating its

business; historical prices of digital currencies and the ability

to mine digital currencies that will be consistent with historical

prices; and the adoption or expansion of any regulation or law that

will prevent Bitfarms from operating its business, or make it more

costly to do so. For further information concerning these and other

risks and uncertainties, refer to the Company’s filings on

www.sedarplus.ca (which are also available on the website of the

U.S. Securities and Exchange Commission at www.sec.gov), including

the MD&A for the year-ended December 31, 2023, filed on March

7, 2024. Although the Company has attempted to identify important

factors that could cause actual results to differ materially from

those expressed in forward-looking statements, there may be other

factors that cause results not to be as anticipated, estimated or

intended, including factors that are currently unknown to or deemed

immaterial by the Company. There can be no assurance that such

statements will prove to be accurate as actual results and future

events could differ materially from those anticipated in such

statements. Accordingly, readers should not place undue reliance on

any forward-looking information. The Company undertakes no

obligation to revise or update any forward-looking information

other than as required by law.

Investor Relations Contacts:

Tracy KrummeSVP, Head of IR & Corp. Comms.+1

786-671-5638tkrumme@bitfarms.com

Media Contacts:

Québec: TactLouis-Martin Leclerc+1

418-693-2425lmleclerc@tactconseil.ca

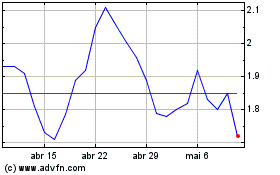

Bitfarms (NASDAQ:BITF)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Bitfarms (NASDAQ:BITF)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025