Progyny, Inc. (Nasdaq: PGNY) (“Progyny” or the “Company”), a

transformative fertility, family building and women's health

benefits solution, today announced its financial results for the

three-month period ended September 30, 2024 (“the third quarter of

2024”) as compared to the three-month period ended September 30,

2023 (“the third quarter of 2023” or “the prior year period”).

“The utilization rate in the third quarter was

consistent with the expectations we outlined in August. However,

the members that began their journey utilized their benefits in a

manner inconsistent with long-term patterns, taking longer to

progress through their treatment and, therefore, consuming fewer

treatments overall, resulting in lower-than-expected revenue and

profitability this quarter,” said Pete Anevski, Chief Executive

Officer of Progyny.

“Even though our recent results relative to

expectations have been disappointing to us, the business remains

fundamentally very strong, and the success of our most recent

selling season further validates our leading position in a large,

growing and increasingly impactful market,” continued Anevski. “For

the fourth consecutive year, our new sales season produced more

than a million new covered lives across a broadly diverse set of

company sizes and industries, further demonstrating the universal

relevance of fertility, family building and women's health services

to all types of employers.

“We're extremely pleased with the advancement of

our health plan strategy with the addition of a leading national

and a regional health plan as their preferred partner next year.

We're also encouraged with the reception for our newest services in

maternity and menopause, with clients representing more than 1.5

million lives adopting one or more of these programs in 2025. We

believe these wins highlight the significant differentiation of our

solution as compared to other alternatives in the market with

respect to member experience, demonstrated clinical success, and

cost efficiency.”

“We have continued to generate strong cash flow

and have returned value to our shareholders through the repurchase

of more than 12.3 million shares to date under the buyback programs

that began earlier this year,” said Mark Livingston, Progyny’s

Chief Financial Officer.

Third Quarter 2024 Highlights:

| (unaudited; in thousands, except

per share amounts) |

3Q 2024 |

|

3Q 2023 |

|

Revenue |

$286,625 |

|

|

$280,891 |

|

| |

|

|

|

| Gross Profit |

$59,244 |

|

|

$62,624 |

|

|

Gross Margin |

20.7 |

% |

|

22.3 |

% |

| Net Income |

$10,421 |

|

|

$15,898 |

|

| |

|

|

|

| Net Income per Diluted

Share1 |

$0.11 |

|

|

$0.16 |

|

| |

|

|

|

| Adjusted Earnings Per Diluted

Share2 |

$0.40 |

|

|

$0.38 |

|

| |

|

|

|

| Adjusted EBITDA2 |

$46,478 |

|

|

$50,019 |

|

|

Adjusted EBITDA Margin2 |

16.2 |

% |

|

17.8 |

% |

- Net income per

diluted share reflects weighted-average shares outstanding as

adjusted for potential dilutive securities, including options,

restricted stock units, warrants to purchase common stock, and

shares issuable under the employee stock purchase plan.

- Adjusted

earnings per diluted share, Adjusted EBITDA, and Adjusted EBITDA

margin are financial measures that are not required by, or

presented in accordance with, U.S. generally accepted accounting

principles ("GAAP"). Please see Annex A of this press release for a

reconciliation of Adjusted earnings per diluted share to earnings

per share, and Adjusted EBITDA to net income, the most directly

comparable financial measures stated in accordance with GAAP for

each of the periods presented. We calculate Adjusted earnings per

diluted share as net income per diluted share excluding the impact

of stock-based compensation, adjusted for the impact of taxes. We

calculate Adjusted EBITDA margin as Adjusted EBITDA divided by

revenue.

Financial Highlights

Revenue was $286.6 million, a 2.0% increase as

compared to the $280.9 million reported in the third quarter

of 2023, primarily as a result of the increase in our number of

clients and covered lives. As previously announced, a large client

notified Progyny that it would not be renewing its services

agreement in 2025. Excluding the contribution of that one client in

both periods, third quarter revenue increased 3.4%.

- Fertility benefit services revenue

was $178.8 million, a 2.1% increase from the

$175.1 million reported in the third quarter of 2023.

- Pharmacy benefit services revenue

was $107.9 million, a 2.0% increase as compared to the

$105.8 million reported in the third quarter of 2023.

Gross profit was $59.2 million, a decrease of

5.4% from the $62.6 million reported in the third quarter of 2023.

Gross margin was 20.7%, a decrease of 160 basis points from the

22.3% reported in the prior year period primarily due to increases

in personnel-related costs in the delivery of our care management

services, in conjunction with the impact of the unanticipated

decline in cycles per unique utilizer in the quarter.

Net income was $10.4 million, or $0.11 income

per diluted share, as compared to the $15.9 million, or $0.16

income per diluted share, reported in the third quarter of 2023.

The decrease in net income was due primarily to the lower gross

margin and higher provision for income taxes in the current

period.

Adjusted EBITDA was $46.5 million, a

decrease of 7.1% as compared to the $50.0 million reported in

the third quarter of 2023, reflecting the lower gross profit.

Adjusted EBITDA margin was 16.2%, a 160 basis point decrease from

the 17.8% Adjusted EBITDA margin in the third quarter of 2023.

Please refer to Annex A for a reconciliation of Adjusted EBITDA to

net income.

Cash FlowNet cash provided by

operating activities in the third quarter of 2024 was

$44.5 million, compared to net cash provided by operating

activities of $54.2 million in the prior year period. The lower

cash flow as compared to the prior year period was primarily due to

the previously disclosed impacts of certain favorable working

capital items to the prior year period, as well as higher cash

payments for income taxes in the third quarter of 2024.

Balance Sheet and Financial

PositionAs of September 30, 2024, the Company had

total working capital of approximately $337.8 million and no debt.

This included cash and cash equivalents and marketable securities

of $235.7 million, a decrease of $26.5 million from the balances as

of June 30, 2024, reflecting the stock repurchase activity

conducted during the quarter and partially offset by cash flow from

operations.

During the third quarter of 2024, the Company

purchased 2,817,190 shares for $61.4 million through its share

repurchase programs. To date, the Company has purchased 12,382,193

shares collectively in the program and has used all of its existing

authorizations.

Key Metrics

The Company had 468 clients as of

September 30, 2024, as compared to 392 clients as of

September 30, 2023.

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

ART Cycles * |

14,911 |

|

|

15,005 |

|

|

45,275 |

|

|

42,947 |

|

| Utilization - All

Members** |

0.54 |

% |

|

0.56 |

% |

|

1.10 |

% |

|

1.11 |

% |

| Utilization - Female

Only** |

0.47 |

% |

|

0.49 |

% |

|

0.90 |

% |

|

0.93 |

% |

| Average Members*** |

6,444,000 |

|

|

5,428,000 |

|

|

6,381,000 |

|

|

5,366,000 |

|

* Represents the number of ART cycles performed,

including IVF with a fresh embryo transfer, IVF freeze all

cycles/embryo banking, frozen embryo transfers, and egg freezing.**

Represents the member utilization rate for all services, including,

but not limited to, ART cycles, initial consultations, IUIs, and

genetic testing. The utilization rate for all members includes all

unique members (female and male) who utilize the benefit during

that period, while the utilization rate for female only includes

only unique females who utilize the benefit during that period. For

purposes of calculating utilization rates in any given period, the

results reflect the number of unique members utilizing the benefit

for that period. Individual periods cannot be combined as member

treatments may span multiple periods.***Includes approximately

300,000 members from a single client not reflected in utilization

as a result of the client's chosen benefit design.

Financial OutlookThe

substantial majority of the clients added in the most recent

selling season are expected to go live in the first quarter of

2025, though a number of clients have already or will launch their

benefit in 2024. Once all new clients are live in 2025, the Company

anticipates having more than 530 clients, representing

approximately 6.7 million covered lives.

“As the fourth quarter has begun, the rate of

utilization remains healthy and we're seeing members consume more

treatments as compared to the third quarter. Nonetheless, given the

unexpected variability we've seen this year, we believe the prudent

approach is to guide with the expectation this variability

continues. Accordingly, we are revising our expectations for the

balance of the year,” said Mr. Anevski.

“As it relates to 2025, consistent with our past

practice, we expect to provide financial guidance when we report

our year-end results in February, by which time we'll have insights

into our newest clients who are launching on January 1st. Despite

the previously-reported loss of a large client, the business

remains healthy and we expect to continue generating strong

profitability and meaningful cash flow in 2025.”

The Company is providing the following financial

guidance for the full year ending December 31, 2024 and the

three-month period ending December 31, 2024:

- Full Year 2024 Outlook:

- Revenue is now

projected to be $1.135 billion to $1.150 billion, reflecting growth

of 4% to 6%

- Net income is projected to be

$49.9 million to $53.3 million, or $0.52 to $0.56 per diluted

share, on the basis of approximately 96 million assumed

weighted-average fully diluted-shares outstanding

- Adjusted EBITDA1 is projected to be

$189.0 million to $194.0 million

- Adjusted earnings per diluted

share1 is projected to be $1.54 to $1.57

- Fourth Quarter of 2024 Outlook:

- Revenue is projected to be $266.2

million to $281.2 million, reflecting growth of (1)% to 4%

- Net income is projected to be $6.1 million to $9.5 million, or

$0.07 to $0.10 per diluted share, on the basis of approximately 91

million assumed weighted-average fully diluted-shares

outstanding

- Adjusted EBITDA1 is projected to be

$37.8 million to $42.8 million

- Adjusted

earnings per diluted share1 is projected to be $0.31 to $0.35

- Adjusted EBITDA and Adjusted

earnings per diluted share are financial measures that are not

required by, or presented in accordance with, GAAP. Please see

Annex A of this press release for a reconciliation of

forward-looking Adjusted EBITDA to forward-looking net income and

Adjusted net income to net income, the most directly comparable

financial measures stated in accordance with GAAP, for the period

presented.

Conference Call

InformationProgyny will host a conference call at 4:45

P.M. Eastern Time (1:45 P.M. Pacific Time) today, November 12,

2024, to discuss its financial results. Interested participants

from the United States may join by calling 1.866.825.7331 and using

conference ID 265484. Participants from international locations may

join by calling 1.973.413.6106 and using the same conference ID. A

replay of the call will be available until November 19, 2024 at

5:00 P.M. Eastern Time by dialing 1.800.332.6854 (U.S.

participants) or 1.973.528.0005 (international) and entering

passcode 265484. A live audio webcast of the call and subsequent

replay will also be available through the Events &

Presentations section of the Company’s Investor Relations website

at investors.progyny.com.

About ProgynyProgyny (Nasdaq:

PGNY) is a transformative fertility, family building and women's

health benefits solution, trusted by the nation's leading

employers, health plans and benefit purchasers. We envision a world

where everyone can realize their dreams of family and ideal health.

Our outcomes prove that comprehensive, inclusive and intentionally

designed solutions simultaneously benefit employers, patients, and

physicians.

Our benefits solution empowers patients with

concierge support, coaching, education, and digital tools; provides

access to a premier network of fertility and women's health

specialists who use the latest science and technologies; drives

optimal clinical outcomes; and reduces healthcare costs.

Headquartered in New York City, Progyny has been

recognized for its leadership and growth as a TIME100 Most

Influential Company, CNBC Disruptor 50, Modern Healthcare’s Best

Places to Work in Healthcare, Forbes' Best Employers, Financial

Times Fastest Growing Companies, INC. 5000, INC. Power Partners and

Crain’s Fast 50 for NYC. For more information, visit

www.progyny.com.

Safe Harbor Statement Under the Private

Securities Litigation Reform Act of 1995This press release

contains forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. We intend such

forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in Section 27A

of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. All statements

contained in this press release other than statements of historical

fact, including, without limitation, statements regarding our

financial outlook for the fourth quarter and full year 2024,

including the impact of our sales season and client launches; our

anticipated number of clients and covered lives for 2024; our

expected utilization rates and average revenue per utilizing

member; the demand for our solutions; our expectations for our

selling season for 2025 launches; our positioning to successfully

manage economic uncertainty on our business; the timing of client

decisions; our ability to retain existing clients and acquire new

clients; and our business strategy, plans, goals and expectations

concerning our market position, future operations, and other

financial and operating information. The words “anticipates,”

“assumes,” “believe,” “contemplate,” “continues, ” “could,”

“estimates,” “expects,” “future,” “intends,” “may,” “plans,”

“predict,” “potential,” “project,” “seeks,” “should,” “target,”

“will,” and the negative of these or similar expressions and

phrases are intended to identify forward-looking statements, though

not all forward-looking statements use these words or

expressions.

Forward-looking statements are neither promises

nor guarantees, but involve known and unknown risks, uncertainties

and other important factors that may cause our actual results,

performance or achievements to be materially different from any

future results, performance or achievements expressed or implied by

the forward-looking statements. These risks include, without

limitation, failure to meet our publicly announced guidance or

other expectations about our business; competition in the market in

which we operate; our history of operating losses and ability to

sustain profitability; risks related to the impact of the COVID-19

pandemic, such as the scope and duration of the outbreak, the

spread of new variants, government actions and restrictive measures

implemented in response, delays and cancellations of fertility

procedures and other impacts to the business; unfavorable

conditions in our industry or the United States economy; our

limited operating history and the difficulty in predicting our

future results of operations; our ability to attract and retain

clients and increase the adoption of services within our client

base; the loss of any of our largest client accounts; changes in

the technology industry; changes or developments in the health

insurance market; negative publicity in the health benefits

industry; lags, failures or security breaches in our computer

systems or those of our vendors; a significant change in the level

or the mix of utilization of our solutions; our ability to offer

high-quality support; positive references from our existing

clients; our ability to develop and expand our marketing and sales

capabilities; the rate of growth of our future revenue; the

accuracy of the estimates and assumptions we use to determine the

size of target markets; our ability to successfully manage our

growth; reductions in employee benefits spending; seasonal

fluctuations in our sales; the adoption of new solutions and

services by our clients or members; our ability to innovate and

develop new offerings; our ability to adapt and respond to the

medical landscape, regulations, client needs, requirements or

preferences; our ability to maintain and enhance our brand; our

ability to attract and retain members of our management team, key

employees, or other qualified personnel; our ability to maintain

our Company culture; risks related to any litigation against us;

our ability to maintain our Center of Excellence network of

healthcare providers; our strategic relationships with and

monitoring of third parties; our ability to maintain our pharmacy

distribution network if there is a disruption to our network or

their supply chains; our relationship with key pharmacy program

partners or any decline in rebates provided by them; our ability to

maintain our relationships with benefits consultants; exposure to

credit risk from our members; risks related to government

regulation; risks related to potential sales to government

entities; our ability to protect our intellectual property rights;

risks related to acquisitions, strategic investments, partnerships,

or alliances; federal tax reform and changes to our effective tax

rate; the imposition of state and local state taxes; our ability to

utilize a significant portion of our net operating loss or research

tax credit carryforwards; our ability to develop or maintain

effective internal control over financial reporting and the

increased costs of operating as a public company; and our ability

to adapt and respond to the changing SEC expectations regarding

environmental, social and governance practices. For a detailed

discussion of these and other risk factors, please refer to our

filings with the Securities and Exchange Commission (the “SEC”),

including in the section entitled “Risk Factors” in our Annual

Report on Form 10-K for the fiscal year ended December 31, 2023,

and subsequent reports that we file with the SEC, which are

available at http://investors.progyny.com and on the SEC’s website

at https://www.sec.gov.

Forward-looking statements represent our

management’s beliefs and assumptions only as of the date of this

press release. Our actual future results could differ materially

from what we expect. Except as required by law, we assume no

obligation to update these forward-looking statements publicly, or

to update the reasons.

Non-GAAP Financial MeasuresIn

addition to disclosing financial measures prepared in accordance

with U.S. generally accepted accounting principles (“GAAP”), this

press release and the accompanying tables include the non-GAAP

financial measures Adjusted EBITDA, Adjusted EBITDA margin,

Adjusted EBITDA margin on incremental revenue and Adjusted earnings

per share.

Adjusted EBITDA, Adjusted EBITDA margin,

Adjusted EBITDA margin on incremental revenue and Adjusted earnings

per share are supplemental financial measures that are not required

by, or presented in accordance with, GAAP. We believe that these

non-GAAP measures, when taken together with our GAAP financial

results, provide meaningful supplemental information regarding our

operating performance and facilitates internal comparisons of our

historical operating performance on a more consistent basis by

excluding certain items that may not be indicative of our business,

results of operations or outlook. In particular, we believe that

the use of Adjusted EBITDA, Adjusted EBITDA margin, Adjusted EBITDA

margin on incremental revenue and Adjusted earnings per share are

helpful to our investors as they are measures used by management in

assessing the health of our business, determining incentive

compensation, evaluating our operating performance, and for

internal planning and forecasting purposes.

Adjusted EBITDA, Adjusted EBITDA margin,

Adjusted EBITDA margin on incremental revenue and Adjusted earnings

per share are presented for supplemental informational purposes

only, have limitations as analytical tools and should not be

considered in isolation or as a substitute for financial

information presented in accordance with GAAP. Some of the

limitations of Adjusted EBITDA, Adjusted EBITDA margin, Adjusted

EBITDA margin on incremental revenue and Adjusted earnings per

share include: (1) it does not properly reflect capital commitments

to be paid in the future; (2) although depreciation and

amortization are non-cash charges, the underlying assets may need

to be replaced and Adjusted EBITDA does not reflect these capital

expenditures; (3) it does not consider the impact of stock-based

compensation expense; (4) it does not reflect other non-operating

income and expenses, including interest and other income, net; (5)

it does not reflect tax payments that may represent a reduction in

cash available to us. In addition, our non-GAAP measures may not be

comparable to similarly titled measures of other companies because

they may not calculate such measures in the same manner as we

calculate these measures, limiting their usefulness as comparative

measures. Because of these limitations, when evaluating our

performance, you should consider Adjusted EBITDA, Adjusted EBITDA

margin, Adjusted EBITDA margin on incremental revenue and Adjusted

earnings per share alongside other financial performance measures,

including our net income, gross margin, and our other GAAP

results.

We calculate Adjusted EBITDA as net income,

adjusted to exclude depreciation and amortization; stock-based

compensation expense; interest and other income, net; and provision

for income taxes. We calculate Adjusted EBITDA margin as Adjusted

EBITDA divided by revenue. We calculate Adjusted EBITDA margin on

incremental revenue as incremental Adjusted EBITDA in 2024 divided

by incremental revenue in 2024. We calculate Adjusted earnings per

diluted share as net income per diluted share excluding the impact

of stock-based compensation, adjusted for the associated impact of

taxes. Please see Annex A: “Reconciliation of GAAP to Non-GAAP

Financial Measures” elsewhere in this press release.

| For Further Information, Please

Contact: |

|

Investors: |

Media: |

| James Hart |

Alexis Ford |

| investors@progyny.com |

media@progyny.com |

|

|

|

PROGYNY, INC.Consolidated Balance

Sheets(Unaudited)(in thousands,

except share and per share amounts) |

| |

| |

September 30, |

|

December 31, |

|

|

2024 |

|

2023 |

| ASSETS |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

91,480 |

|

|

$ |

97,296 |

|

|

Marketable securities |

|

144,240 |

|

|

|

273,791 |

|

|

Accounts receivable, net of $55,671 and $46,636 of allowances at

September 30, 2024 and December 31, 2023,

respectively |

|

280,724 |

|

|

|

241,869 |

|

|

Prepaid expenses and other current assets |

|

29,858 |

|

|

|

27,451 |

|

| Total current assets |

|

546,302 |

|

|

|

640,407 |

|

| Property and equipment,

net |

|

11,928 |

|

|

|

10,213 |

|

| Operating lease right-of-use

assets |

|

17,439 |

|

|

|

17,605 |

|

| Goodwill |

|

15,796 |

|

|

|

11,880 |

|

| Intangible assets, net |

|

1,448 |

|

|

|

— |

|

| Deferred tax assets |

|

63,757 |

|

|

|

73,120 |

|

| Other noncurrent assets |

|

3,302 |

|

|

|

3,395 |

|

| Total

assets |

$ |

659,972 |

|

|

$ |

756,620 |

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

130,463 |

|

|

$ |

125,426 |

|

|

Accrued expenses and other current liabilities |

|

78,008 |

|

|

|

60,524 |

|

| Total current liabilities |

|

208,471 |

|

|

|

185,950 |

|

| Operating lease noncurrent

liabilities |

|

16,625 |

|

|

|

17,241 |

|

| Total

liabilities |

|

225,096 |

|

|

|

203,191 |

|

| Commitments and

Contingencies |

|

|

|

| STOCKHOLDERS’

EQUITY |

|

|

|

|

Common stock, $0.0001 par value; 1,000,000,000 shares authorized;

97,477,153 and 96,348,522 shares issued; 88,343,258 and 96,348,522

shares outstanding at September 30, 2024 and December 31,

2023, respectively |

|

9 |

|

|

|

9 |

|

|

Additional paid-in capital |

|

551,587 |

|

|

|

461,639 |

|

|

Treasury stock, at cost, $0.0001 par value; 9,749,875 and 615,980

shares at September 30, 2024 and December 31, 2023,

respectively |

|

(250,825 |

) |

|

|

(1,009 |

) |

|

Accumulated earnings |

|

133,775 |

|

|

|

89,971 |

|

|

Accumulated other comprehensive income |

|

330 |

|

|

|

2,819 |

|

| Total stockholders’

equity |

|

434,876 |

|

|

|

553,429 |

|

| Total liabilities and

stockholders’ equity |

$ |

659,972 |

|

|

$ |

756,620 |

|

|

PROGYNY, INC.Consolidated Statements of

Operations(Unaudited)(in

thousands, except share and per share amounts) |

| |

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Revenue |

$ |

286,625 |

|

$ |

280,891 |

|

$ |

868,790 |

|

$ |

818,658 |

| Cost of services |

|

227,381 |

|

|

218,267 |

|

|

678,859 |

|

|

636,753 |

| Gross profit |

|

59,244 |

|

|

62,624 |

|

|

189,931 |

|

|

181,905 |

| Operating expenses: |

|

|

|

|

|

|

|

|

Sales and marketing |

|

16,457 |

|

|

14,911 |

|

|

48,332 |

|

|

44,577 |

|

General and administrative |

|

30,329 |

|

|

29,524 |

|

|

89,931 |

|

|

88,944 |

| Total operating expenses |

|

46,786 |

|

|

44,435 |

|

|

138,263 |

|

|

133,521 |

| Income from operations |

|

12,458 |

|

|

18,189 |

|

|

51,668 |

|

|

48,384 |

| Interest and other income,

net |

|

5,504 |

|

|

2,742 |

|

|

13,876 |

|

|

6,045 |

| Income before income

taxes |

|

17,962 |

|

|

20,931 |

|

|

65,544 |

|

|

54,429 |

|

Provision for income taxes |

|

7,541 |

|

|

5,033 |

|

|

21,740 |

|

|

5,862 |

| Net income |

$ |

10,421 |

|

$ |

15,898 |

|

$ |

43,804 |

|

$ |

48,567 |

| Net income per share: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.12 |

|

$ |

0.17 |

|

$ |

0.48 |

|

$ |

0.51 |

|

Diluted |

$ |

0.11 |

|

$ |

0.16 |

|

$ |

0.46 |

|

$ |

0.48 |

| Weighted-average shares used

in computing net income per share: |

|

|

|

|

|

|

|

|

Basic |

|

90,067,675 |

|

|

95,502,250 |

|

|

91,650,576 |

|

|

94,698,616 |

|

Diluted |

|

93,821,812 |

|

|

100,879,576 |

|

|

95,758,529 |

|

|

100,552,705 |

|

PROGYNY, INC.Consolidated Statements of

Cash Flows(Unaudited)(in

thousands) |

| |

| |

Nine Months EndedSeptember

30, |

| |

2024 |

|

2023 |

| OPERATING

ACTIVITIES |

|

|

|

|

Net income |

$ |

43,804 |

|

|

$ |

48,567 |

|

| Adjustments to reconcile net

income to net cash provided by operating activities: |

|

|

|

|

Deferred tax expense |

|

10,351 |

|

|

|

5,862 |

|

|

Non-cash interest expense |

|

— |

|

|

|

58 |

|

|

Depreciation and amortization |

|

2,307 |

|

|

|

1,647 |

|

|

Stock-based compensation expense |

|

97,271 |

|

|

|

93,812 |

|

|

Bad debt expense |

|

12,734 |

|

|

|

15,062 |

|

|

Net accretion of discounts on marketable securities |

|

(3,759 |

) |

|

|

(2,701 |

) |

|

Foreign currency exchange rate loss |

|

0 |

|

|

|

12 |

|

| Changes in operating assets

and liabilities: |

|

|

|

|

Accounts receivable |

|

(51,579 |

) |

|

|

(43,761 |

) |

|

Prepaid expenses and other current assets |

|

(2,396 |

) |

|

|

(2,523 |

) |

|

Accounts payable |

|

5,072 |

|

|

|

22,884 |

|

|

Accrued expenses and other current liabilities |

|

13,132 |

|

|

|

11,744 |

|

|

Other noncurrent assets and liabilities |

|

4 |

|

|

|

492 |

|

|

Net cash provided by operating activities |

|

126,941 |

|

|

|

151,155 |

|

| |

|

|

|

| INVESTING

ACTIVITIES |

|

|

|

| Purchase of property and

equipment, net |

|

(3,510 |

) |

|

|

(2,963 |

) |

| Purchase of marketable

securities |

|

(170,339 |

) |

|

|

(262,961 |

) |

| Sale of marketable

securities |

|

299,955 |

|

|

|

158,813 |

|

| Acquisition of business, net

of cash acquired |

|

(5,304 |

) |

|

|

— |

|

|

Net cash provided by (used in) investing activities |

|

120,802 |

|

|

|

(107,111 |

) |

| |

|

|

|

| FINANCING

ACTIVITIES |

|

|

|

| Repurchase of common

stock |

|

(245,176 |

) |

|

|

— |

|

| Proceeds from exercise of

stock options |

|

1,097 |

|

|

|

3,573 |

|

| Payment of employee taxes

related to equity awards |

|

(10,389 |

) |

|

|

(10,504 |

) |

| Proceeds from contributions to

employee stock purchase plan |

|

915 |

|

|

|

884 |

|

|

Net cash used in financing activities |

|

(253,553 |

) |

|

|

(6,047 |

) |

| Effect of exchange rate

changes on cash and cash equivalents |

|

(6 |

) |

|

|

0 |

|

| Net (decrease) increase in

cash and cash equivalents |

|

(5,816 |

) |

|

|

37,997 |

|

| Cash and cash equivalents,

beginning of period |

|

97,296 |

|

|

|

120,078 |

|

| Cash and cash equivalents, end

of period |

$ |

91,480 |

|

|

$ |

158,075 |

|

| |

|

|

|

| SUPPLEMENTAL

DISCLOSURE OF CASH FLOW INFORMATION |

|

|

|

| Cash paid for income taxes,

net of refunds received |

$ |

34,872 |

|

|

$ |

2,318 |

|

| SUPPLEMENTAL

DISCLOSURE OF NON-CASH INVESTING AND FINANCING

ACTIVITIES |

|

|

|

| Additions of property and

equipment, net included in accounts payable and accrued

expenses |

$ |

144 |

|

|

$ |

128 |

|

ANNEX A

PROGYNY,

INC.Reconciliation of GAAP to Non-GAAP Financial

Measures(unaudited)(in thousands,

except share and per share amounts)

Costs of Services, Gross Margin and Operating Expenses

Excluding Stock-Based Compensation CalculationThe

following table provides a reconciliation of cost of services,

gross profit, sales and marketing and general and administrative

expenses to each of these measures excluding the impact of

stock-based compensation expense for each of the periods

presented:

| |

Three Months Ended |

|

Three Months Ended |

| |

September 30, 2024 |

|

September 30, 2023 |

| |

GAAP |

|

Stock-BasedCompensationExpense |

|

Non-GAAP |

|

GAAP |

|

Stock-BasedCompensationExpense |

|

Non-GAAP |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of services |

$ |

227,381 |

|

|

$ |

(9,528 |

) |

|

$ |

217,853 |

|

|

$ |

218,267 |

|

|

$ |

(8,941 |

) |

|

$ |

209,326 |

|

| Gross profit |

$ |

59,244 |

|

|

$ |

9,528 |

|

|

$ |

68,772 |

|

|

$ |

62,624 |

|

|

$ |

8,941 |

|

|

$ |

71,565 |

|

| Sales and marketing |

$ |

16,457 |

|

|

$ |

(8,101 |

) |

|

$ |

8,356 |

|

|

$ |

14,911 |

|

|

$ |

(6,938 |

) |

|

$ |

7,973 |

|

| General and

administrative |

$ |

30,329 |

|

|

$ |

(15,554 |

) |

|

$ |

14,775 |

|

|

$ |

29,524 |

|

|

$ |

(15,372 |

) |

|

$ |

14,152 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Expressed as a

Percentage of Revenue |

|

|

|

|

|

|

|

|

| Gross margin |

|

20.7 |

% |

|

|

3.3 |

% |

|

|

24.0 |

% |

|

|

22.3 |

% |

|

|

3.2 |

% |

|

|

25.5 |

% |

| Sales and marketing |

|

5.7 |

% |

|

(2.8 |

)% |

|

|

2.9 |

% |

|

|

5.3 |

% |

|

(2.5 |

)% |

|

|

2.8 |

% |

| General and

administrative |

|

10.6 |

% |

|

(5.4 |

)% |

|

|

5.2 |

% |

|

|

10.5 |

% |

|

(5.5 |

)% |

|

|

5.0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Nine Months Ended |

|

Nine Months Ended |

| |

September 30, 2024 |

|

September 30, 2023 |

| |

GAAP |

|

Stock-BasedCompensationExpense |

|

Non-GAAP |

|

GAAP |

|

Stock-BasedCompensationExpense |

|

Non-GAAP |

| |

|

|

|

|

|

|

|

|

|

|

|

| Cost of services |

$ |

678,859 |

|

|

$ |

(28,009 |

) |

|

$ |

650,850 |

|

|

$ |

636,753 |

|

|

$ |

(25,967 |

) |

|

$ |

610,786 |

|

| Gross profit |

$ |

189,931 |

|

|

$ |

28,009 |

|

|

$ |

217,940 |

|

|

$ |

181,905 |

|

|

$ |

25,967 |

|

|

$ |

207,872 |

|

| Sales and marketing |

$ |

48,332 |

|

|

$ |

(23,515 |

) |

|

$ |

24,817 |

|

|

$ |

44,577 |

|

|

$ |

(20,389 |

) |

|

$ |

24,188 |

|

| General and

administrative |

$ |

89,931 |

|

|

$ |

(45,747 |

) |

|

$ |

44,184 |

|

|

$ |

88,944 |

|

|

$ |

(47,456 |

) |

|

$ |

41,488 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Expressed as a

Percentage of Revenue |

|

|

|

|

|

|

|

|

| Gross margin |

|

21.9 |

% |

|

|

3.2 |

% |

|

|

25.1 |

% |

|

|

22.2 |

% |

|

|

3.2 |

% |

|

|

25.4 |

% |

| Sales and marketing |

|

5.6 |

% |

|

(2.7 |

)% |

|

|

2.9 |

% |

|

|

5.4 |

% |

|

(2.5 |

)% |

|

|

3.0 |

% |

| General and

administrative |

|

10.4 |

% |

|

(5.3 |

)% |

|

|

5.1 |

% |

|

|

10.9 |

% |

|

(5.8 |

)% |

|

|

5.1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

Note: percentages shown in the table may not cross foot due to

rounding.

Adjusted Earnings Per Diluted Share

CalculationThe following table provides a reconciliation

of net income to Adjusted Earnings Per Diluted Share for each of

the periods presented:

| |

Three Months Ended |

|

Three Months Ended |

| |

September 30, 2024 |

|

September 30, 2023 |

|

Net Income |

$ |

10,421 |

|

|

$ |

15,898 |

|

| Add: |

|

|

|

|

Stock-based compensation |

|

33,183 |

|

|

|

31,251 |

|

|

Income tax effect of non-GAAP adjustment |

|

(6,199 |

) |

|

|

(8,901 |

) |

| Adjusted Net income |

$ |

37,405 |

|

|

$ |

38,247 |

|

| |

|

|

|

| Diluted Shares |

|

93,821,812 |

|

|

|

100,879,576 |

|

| Adjusted Earnings Per Diluted

Share |

$ |

0.40 |

|

|

$ |

0.38 |

|

| |

|

|

|

| |

|

|

|

| |

Nine Months Ended |

|

Nine Months Ended |

| |

September 30, 2024 |

|

September 30, 2023 |

| Net Income |

$ |

43,804 |

|

|

$ |

48,567 |

|

| Add: |

|

|

|

|

Stock-based compensation |

|

97,271 |

|

|

|

93,812 |

|

|

Income tax effect of non-GAAP adjustment |

|

(22,017 |

) |

|

|

(33,714 |

) |

| Adjusted Net income |

$ |

119,058 |

|

|

$ |

108,665 |

|

| |

|

|

|

| Diluted Shares |

|

95,758,529 |

|

|

|

100,552,705 |

|

| Adjusted Earnings Per Diluted

Share |

$ |

1.24 |

|

|

$ |

1.08 |

|

Adjusted EBITDA and Adjusted EBITDA Margin on

Incremental Revenue CalculationThe following table

provides a reconciliation of Net income to Adjusted EBITDA for each

of the periods presented:

| |

Three Months Ended |

|

Nine Months Ended |

| |

September 30, |

|

September 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net income |

$ |

10,421 |

|

|

$ |

15,898 |

|

|

$ |

43,804 |

|

|

$ |

48,567 |

|

| Add: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

837 |

|

|

$ |

579 |

|

|

|

2,307 |

|

|

$ |

1,647 |

|

|

Stock‑based compensation expense |

|

33,183 |

|

|

$ |

31,251 |

|

|

|

97,271 |

|

|

$ |

93,812 |

|

|

Interest and other income, net |

|

(5,504 |

) |

|

$ |

(2,742 |

) |

|

|

(13,876 |

) |

|

$ |

(6,045 |

) |

|

Provision for income taxes |

|

7,541 |

|

|

$ |

5,033 |

|

|

|

21,740 |

|

|

$ |

5,862 |

|

| Adjusted EBITDA |

$ |

46,478 |

|

|

$ |

50,019 |

|

|

$ |

151,246 |

|

|

$ |

143,843 |

|

| |

|

|

|

|

|

|

|

| Revenue |

$ |

286,625 |

|

|

$ |

280,891 |

|

|

$ |

868,790 |

|

|

$ |

818,658 |

|

| |

|

|

|

|

|

|

|

| Incremental revenue vs.

2023 |

|

|

|

|

$ |

50,132 |

|

|

|

| |

|

|

|

|

|

|

|

| Incremental Adjusted EBITDA

vs. 2023 |

|

|

|

|

$ |

7,403 |

|

|

|

| |

|

|

|

|

|

|

|

| Adjusted EBITDA margin on

incremental revenue |

|

|

|

|

|

14.8 |

% |

|

|

Reconciliation of Non-GAAP Financial Guidance for the

Three Months and Year Ending December 31, 2024

| |

Three Months Ending December 31,

2024 |

|

Year Ending December 31,

2024 |

| (in thousands) |

Low |

|

High |

|

Low |

|

High |

|

Revenue |

$ |

266,210 |

|

|

$ |

281,210 |

|

|

$ |

1,135,000 |

|

|

$ |

1,150,000 |

|

| Net Income |

$ |

6,096 |

|

|

$ |

9,496 |

|

|

$ |

49,900 |

|

|

$ |

53,300 |

|

| Add: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

$ |

893 |

|

|

$ |

893 |

|

|

$ |

3,200 |

|

|

$ |

3,200 |

|

|

Stock-based compensation expense |

$ |

32,729 |

|

|

$ |

32,729 |

|

|

$ |

130,000 |

|

|

$ |

130,000 |

|

|

Other income, net |

$ |

(4,624 |

) |

|

$ |

(4,624 |

) |

|

$ |

(18,500 |

) |

|

$ |

(18,500 |

) |

|

Provision for income taxes |

$ |

2,660 |

|

|

$ |

4,260 |

|

|

$ |

24,400 |

|

|

$ |

26,000 |

|

|

Adjusted EBITDA* |

$ |

37,754 |

|

|

$ |

42,754 |

|

|

$ |

189,000 |

|

|

$ |

194,000 |

|

| |

Three Months Ending December 31,

2024 |

|

Year Ending December 31,

2024 |

| |

Low |

|

High |

|

Low |

|

High |

|

Net Income |

$ |

6,095 |

|

|

$ |

9,495 |

|

|

$ |

49,900 |

|

|

$ |

53,300 |

|

| Add: |

|

|

|

|

|

|

|

|

Stock-based compensation |

|

32,729 |

|

|

|

32,729 |

|

|

|

130,000 |

|

|

|

130,000 |

|

|

Income tax effect of non-GAAP adjustment |

|

(10,250 |

) |

|

|

(10,250 |

) |

|

|

(32,267 |

) |

|

|

(32,267 |

) |

| Adjusted Net income* |

$ |

28,574 |

|

|

$ |

31,974 |

|

|

$ |

147,633 |

|

|

$ |

151,033 |

|

| |

|

|

|

|

|

|

|

| Diluted Shares |

|

91,000,000 |

|

|

|

91,000,000 |

|

|

|

96,000,000 |

|

|

|

96,000,000 |

|

| Adjusted Earnings Per Diluted

Share |

$ |

0.31 |

|

|

$ |

0.35 |

|

|

$ |

1.54 |

|

|

$ |

1.57 |

|

* All of the numbers in the table above reflect

our future outlook as of the date hereof. Net income and

Adjusted EBITDA ranges do not reflect any estimate for other

potential activities and transactions, nor do they contemplate any

discrete income tax items, including the income tax impact related

to equity compensation activity.

Assisted Reproductive Technology (ART) Cycles per Unique

Female UtilizerThe following tables provide historical

trend and guidance assumptions for average members, female

utilization rate, and ART Cycles per Unique Female Utilizer for the

full year and quarterly periods presented:

| |

|

|

|

|

|

|

Guidance Assumptions For: |

| |

|

|

|

|

|

|

Year Ending December 31, 2024 |

| |

Year Ending December 31, |

|

Low End as of |

|

High End as of |

| |

|

2021 |

|

|

|

2022 |

|

|

|

2023 |

|

|

November 12, 2024 |

|

November 12, 2024 |

| Average Members* |

|

2,812,000 |

|

|

|

4,349,000 |

|

|

|

5,383,000 |

|

|

6,088,000* |

|

|

6,088,000* |

|

| |

|

|

|

|

|

|

|

|

|

|

Female Utilization Rate |

|

1.07 |

% |

|

|

1.03 |

% |

|

|

1.09 |

% |

|

|

1.05 |

% |

|

|

1.06 |

% |

| |

|

|

|

|

|

|

|

|

|

| Female Unique Utilizers |

|

30,053 |

|

|

|

44,600 |

|

|

|

58,596 |

|

|

|

64,100 |

|

|

|

64,500 |

|

| |

|

|

|

|

|

|

|

|

|

| ART Cycles |

|

28,413 |

|

|

|

42,598 |

|

|

|

58,013 |

|

|

|

59,800 |

|

|

|

60,400 |

|

| |

|

|

|

|

|

|

|

|

|

| ART Cycles per Unique Female

Utilizer |

|

0.95 |

|

|

|

0.96 |

|

|

|

0.99 |

|

|

|

0.93 |

|

|

|

0.94 |

|

| |

|

|

|

|

|

|

|

|

|

| Revenue ($ in millions) |

$ |

500.6 |

|

|

$ |

786.9 |

|

|

$ |

1,088.6 |

|

|

$ |

1,135.0 |

|

|

$ |

1,150.0 |

|

*Calculations for 2024 exclude approximately 300,000 members

from a single client not reflected in female utilizers as a result

of the client's chosen benefit design

Quarterly ART Cycles per Unique Female

Utilizer

| |

|

Three Months Ending |

|

Year Ending |

|

|

|

March 31, |

|

June 30, |

|

September 30, |

|

December 31, |

|

December 31, |

|

2022 |

|

0.50 |

|

0.55 |

|

0.56 |

|

0.58 |

|

0.96 |

| |

|

|

|

|

|

|

|

|

|

|

|

2023 |

|

0.51 |

|

0.55 |

|

0.56 |

|

0.58 |

|

0.99 |

| |

|

|

|

|

|

|

|

|

|

|

|

2024: Low End of Guidance Range* |

|

0.53 |

|

0.54 |

|

0.52 |

|

0.51E |

|

0.93E |

| |

|

|

|

|

|

|

|

|

|

|

|

2024: High End of Guidance Range* |

|

0.53 |

|

0.54 |

|

0.52 |

|

0.52E |

|

0.94E |

| |

|

|

|

|

|

|

|

|

|

|

*Calculations for 2024 exclude approximately 300,000 members

from a single client not reflected in female utilizers as a result

of the client's chosen benefit design; E indicates the estimated

value assumed

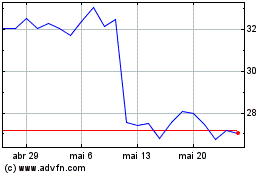

Progyny (NASDAQ:PGNY)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Progyny (NASDAQ:PGNY)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025