Agora, Inc. (NASDAQ: API) (the “Company”), a pioneer and leader in

real-time engagement technology, today announced its unaudited

financial results for the third quarter ended September 30, 2024.

“Recently, we launched our Conversational AI SDK

in collaboration with OpenAI’s Realtime API to allow developers to

bring voice-driven AI experiences to any app. We believe multimodal

AI agents that can interact with human through natural voice will

gain widespread adoption across many use cases such as customer

support, education and wellness, and Agora is well positioned to

become a key infrastructure provider for real-time conversational

AI,” said Tony Zhao, founder, chairman and CEO of Agora. “To

support this vision, we recently made some structural changes,

aligning our organization to fully leverage the accelerating

conversational AI opportunities, and operate in a faster, leaner,

and more responsive fashion. These changes will help us build the

next generation real-time engagement technology for the Generative

AI era and strengthen our position as the leader in real-time

engagement space.”

Third Quarter 2024

Highlights

- Total revenues for

the quarter were $31.6 million, a decrease of 9.8% from $35.0

million in the third quarter of 2023, which included decreased

revenue from certain end-of-sale products of $2.4 million.

- Agora: $15.7

million for the quarter, an increase of 2.6% from $15.3 million in

the third quarter of 2023.

- Shengwang:

RMB112.9 million ($15.9 million) for the quarter, a decrease of

20.0% from RMB141.2 million ($19.7 million) in the third quarter of

2023, which included decreased revenue from certain end-of-sale

products of RMB17.5 million ($2.4 million).

- Active Customers

- Agora: 1,762 as of

September 30, 2024, an increase of 5.9% from 1,664 as of September

30, 2023.

- Shengwang: 3,641

as of September 30, 2024, a decrease of 9.7% from 4,034 as of

September 30, 2023.

- Dollar-Based Net Retention

Rate

- Agora: 94% for the

trailing 12-month period ended September 30, 2024.

- Shengwang: 78% for

the trailing 12-month period ended September 30, 2024.

- Net loss for the

quarter was $24.2 million, which included expenses of $11.4 million

in relation to the cancellation of certain employees’ equity

awards, severance expenses of $4.8 million, and losses from equity

in affiliates of $4.2 million, compared to net loss of $22.5

million in the third quarter of 2023. After excluding share-based

compensation expenses, acquisition related expenses, amortization

expenses of acquired intangible assets and income tax related to

acquired intangible assets, non-GAAP net loss for the quarter was

$10.4 million, compared to the non-GAAP net loss of $15.6 million

in the third quarter of 2023.

- Total cash, cash

equivalents, bank deposits and financial products issued by

banks as of September 30, 2024 was $362.6 million.

- Net cash used in operating

activities for the quarter was $4.6 million, compared to

$3.0 million in the third quarter of 2023. Free cash

flow for the quarter was negative $6.0 million, compared

to negative $3.2 million in the third quarter of 2023.

Third Quarter 2024 Financial

Results

RevenuesTotal revenues were

$31.6 million in the third quarter of 2024, a decrease of 9.8% from

$35.0 million in the same period last year. Revenues of Agora were

$15.7 million in the third quarter of 2024, an increase of 2.6%

from $15.3 million in the same period last year, primarily due to

our business expansion and usage growth in sectors such as live

shopping. Revenues of Shengwang were RMB112.9 million ($15.9

million) in the third quarter of 2024, a decrease of 20.0% from

RMB141.2 million ($19.7 million) in the same period last year,

primarily due to a decrease in revenues of RMB 17.5 million ($2.4

million) due to the end-of-sale of certain products and reduced

usage from customers in certain sectors such as social and

entertainment as a result of challenging macroeconomic and

regulatory environment.

Cost of RevenuesCost of

revenues was $10.5 million in the third quarter of 2024, a decrease

of 16.4% from $12.6 million in the same period last year, primarily

due to the end-of-sale of certain products and the decrease in

bandwidth usage and costs, which was offset partially by severance

expenses for customer support teams of $0.3 million.

Gross Profit and Gross

MarginGross profit was $21.0 million in the third quarter

of 2024, a decrease of 6.1% from $22.4 million in the same period

last year. Gross margin was 66.7% in the third quarter of 2024, an

increase of 2.7% from 64.0% in the same period last year, mainly

due to the end-of-sale of certain low-margin products, which was

offset partially by higher severance expenses in the third quarter

of 2024.

Operating ExpensesOperating

expenses were $45.9 million in the third quarter of 2024, an

increase of 24.3% from $36.9 million in the same period last year,

primarily due to the increase in restructuring and severance

expenses in the third quarter of 2024, which included share-based

compensation of $11.4 million as a result of the cancellation of

certain employees’ equity awards and immediate recognition of

relevant remaining unrecognized compensation expenses, as well as

severance expenses of $4.4 million.

- Research and

development expenses were $29.3 million in the third

quarter of 2024, an increase of 46.1% from $20.0 million in the

same period last year, primarily due to restructuring and severance

expenses in the third quarter of 2024, including share-based

compensation of $9.0 million due to equity award cancellation and

severance expenses of $3.6 million.

- Sales and

marketing expenses were $6.9 million in the third quarter

of 2024, a decrease of 11.9% from $7.8 million in the same period

last year, primarily due to a decrease in personnel costs as the

Company optimized its global workforce, which was offset partially

by severance expenses of $0.7 million in the third quarter of

2024.

- General and

administrative expenses were $9.7 million in the third

quarter of 2024, an increase of 7.4% from $9.1 million in the same

period last year, primarily due to restructuring and severance

expenses in the third quarter of 2024, including share-based

compensation of $2.4 million as a result of the equity award

cancellation, which was offset partially by a decrease in personnel

costs as the Company optimized its global workforce.

Loss from OperationsLoss from

operations was $24.7 million in the third quarter of 2024, compared

to $13.9 million in the same period last year.

Interest IncomeInterest income

was $3.9 million in the third quarter of 2024, compared to $4.9

million in the same period last year, primarily due to the decrease

in the average balance of cash, cash equivalents, bank deposits and

financial products issued by banks and the decrease in average

interest rate realized.

Losses from equity in

affiliatesLosses from equity in affiliates were $4.2

million in the third quarter of 2024, primarily due to an

impairment loss on an investment in certain private company of $4.1

million.

Net LossNet loss was $24.2

million in the third quarter of 2024, compared to $22.5 million in

the same period last year.

Net Loss per American Depositary Share

attributable to ordinary shareholdersNet loss per American

Depositary Share (“ADS”)1 attributable to ordinary shareholders was

$0.26 in the third quarter of 2024, compared to $0.23 in the same

period last year.

_____________

1 One ADS represents four Class A ordinary

shares.

Share Repurchase Program

During the three months ended September 30,

2024, the Company repurchased approximately 6.8 million of its

Class A ordinary shares (equivalent to approximately 1.7 million

ADSs) for approximately US$3.9 million under its share repurchase

program, representing 1.9% of its US$200 million share repurchase

program.

As of September 30, 2024, the Company had

repurchased approximately 129.4 million of its Class A ordinary

shares (equivalent to approximately 32.3 million ADSs) for

approximately US$113.7 million under its share repurchase program,

representing 57% of its US$200 million share repurchase

program.

As of September 30, 2024, the Company had 368.3

million ordinary shares (equivalent to approximately 92.1 million

ADSs) outstanding, compared to 449.8 million ordinary shares

(equivalent to approximately 112.5 million ADSs) outstanding as of

January 31, 2022 before the share repurchase program commenced.

The current share repurchase program will expire

at the end of February 2025.

Executive Leadership Update

Today the Company announced that Chief Security

Officer Roger Hale will be leaving the Company, effective

immediately. Mr. Hale has served in this role for the past 2.5

years, during which he made significant contributions to enhancing

the Company’s security, compliance, and data protection

protocols.

Mr. Hale will work closely with senior

leadership to ensure a smooth transition of his responsibilities.

Moving forward, Patrick Ferriter and Robbin Liu will assume

responsibility for security and compliance, reflecting the

Company’s commitment to maintaining a strong and effective security

framework. Mr. Hale will continue to provide strategic advice as an

advisor to the Company.

“We are grateful for Roger’s dedication and

expertise over the past two and a half years. His leadership has

been invaluable in strengthening our security & compliance

foundation,” said Tony Zhao, founder, chairman and CEO of Agora.

“Security and compliance remain top priorities for Agora, and we

will continue to uphold the highest standards to protect our

customers and stakeholders.”

Financial Outlook

Based on currently available information, the

Company expects total revenues for the fourth quarter of 2024 to be

between $34 million and $36 million, compared to $31.6 million in

the third quarter of 2024, and $33.3 million in the fourth quarter

of 2023 if revenues from certain end-of-sale low-margin products

were excluded. The Company also expects significant improvement in

net income / (loss) in the fourth quarter. This outlook reflects

the Company's current and preliminary views on the market and

operational conditions, which are subject to change.

Earnings Call

The Company will host a conference call to

discuss the financial results at 5 p.m. Pacific Time / 8 p.m.

Eastern Time on November 25, 2024. Details for the conference call

are as follows:Event title: Agora, Inc. 3Q 2024 Financial

ResultsThe call will be available at

https://edge.media-server.com/mmc/p/wie28zvrInvestors who want to

hear the call should log on at least 15 minutes prior to the

broadcast. Participants may register for the call with the link

below.https://register.vevent.com/register/BIf58a0b6f500c4362b1a8c64f9fa4cea8Please

visit the Company’s investor relations website at

https://investor.agora.io on November 25, 2024 to view the earnings

release and accompanying slides prior to the conference call.

Use of Non-GAAP Financial

Measures

The Company has provided in this press release

financial information that has not been prepared in accordance with

generally accepted accounting principles in the United States

(“GAAP”). The Company uses these non-GAAP financial measures

internally in analyzing its financial results and believe that the

use of these non-GAAP financial measures is useful to investors as

an additional tool to evaluate ongoing operating results and trends

and in comparing its financial results with other companies in its

industry, many of which present similar non-GAAP financial

measures. Besides free cash flow (as defined below), each of these

non-GAAP financial measures represents the corresponding GAAP

financial measure before share-based compensation expenses,

acquisition related expenses, amortization expenses of acquired

intangible assets, income tax related to acquired intangible assets

and impairment of goodwill. The Company believes that such non-GAAP

financial measures help identify underlying trends in its business

that could otherwise be distorted by the effects of such

share-based compensation expenses, acquisition related expenses,

amortization expenses of acquired intangible assets, income tax

related to acquired intangible assets and impairment of goodwill

that it includes in its cost of revenues, total operating expenses

and net income (loss). The Company believes that all such non-GAAP

financial measures also provide useful information about its

operating results, enhance the overall understanding of its past

performance and future prospects and allow for greater visibility

with respect to key metrics used by its management in its financial

and operational decision-making.

Non-GAAP financial measures are not meant to be

considered in isolation or as a substitute for comparable GAAP

financial measures and should be read only in conjunction with the

Company’s consolidated financial statements prepared in accordance

with GAAP. A reconciliation of its historical non-GAAP financial

measures to the most directly comparable GAAP measures has been

provided in the tables captioned “Reconciliation of GAAP to

Non-GAAP Measures” included at the end of this press release, and

investors are encouraged to review the reconciliation.

Definitions of the Company’s non-GAAP financial

measures included in this press release are presented below.

Non-GAAP Net Income (Loss)

Non-GAAP net income (loss) is defined as net

income (loss) adjusted to exclude share-based compensation

expenses, acquisition related expenses, amortization expenses of

acquired intangible assets, income tax related to acquired

intangible assets and impairment of goodwill.

Free Cash Flow

Free cash flow is defined as net cash provided

by operating activities less purchases of property and equipment

(excluding the acquisition of land use right and the payment for

the headquarters project). The Company considers free cash flow to

be a liquidity measure that provides useful information to

management and investors regarding net cash provided by operating

activities and cash used for investments in property and equipment

required to maintain and grow the business.

Operating Metrics

The Company also uses other operating metrics

included in this press release and defined below to assess the

performance of its business.

Active Customers

An active customer at the end of any period is

defined as an organization or individual developer from which the

Company generated more than $100 of revenue during the preceding 12

months. Customers are counted based on unique customer account

identifiers. Generally, one software application uses the same

customer account identifier throughout its life cycle while one

account may be used for multiple applications.

Dollar-Based Net Retention

Rate

Dollar-Based Net Retention Rate is calculated

for a trailing 12-month period by first identifying all customers

in the prior 12-month period, and then calculating the quotient

from dividing the revenue generated from such customers in the

trailing 12-month period by the revenue generated from the same

group of customers in the prior 12-month period. As the vast

majority of revenue generated from Agora’s customers is denominated

in U.S. dollars, while the vast majority of revenue generated from

Shengwang’s customers is denominated in Renminbi, Dollar-Based Net

Retention Rate is calculated in U.S. dollars for Agora and in

Renminbi for Shengwang, which has substantially removed the impact

of foreign currency translations. Shengwang excluded the revenues

from certain end-of-sale products, Easemob’s CEC business and K12

academic tutoring sector. The Company believes Dollar-Based Net

Retention Rate facilitates operating performance comparisons on a

period-to-period basis.

Safe Harbor Statements

This press release contains “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended and Section 21E of the Securities Exchange Act

of 1934, as amended and the Private Securities Litigation Reform

Act of 1995. All statements other than statements of historical or

current fact included in this press release are forward-looking

statements, including but not limited to statements regarding the

Company’s financial outlook, beliefs and expectations.

Forward-looking statements include statements containing words such

as “expect,” “anticipate,” “believe,” “project,” “will” and similar

expressions intended to identify forward-looking statements. Among

other things, the Financial Outlook in this announcement contain

forward-looking statements. These forward-looking statements are

based on the Company’s current expectations and involve risks and

uncertainties. The Company’s actual results and the timing of

events could differ materially from those anticipated in such

forward-looking statements as a result of these risks and

uncertainties, which include, without limitation, risks related to

the growth of the RTE-PaaS market; the Company’s ability to manage

its growth and expand its operations; the continued impact of

COVID-19 on global markets and the Company’s business, operations

and customers; the Company’s ability to attract new developers and

convert them into customers; the Company’s ability to retain

existing customers and expand their usage of its platform and

products; the Company’s ability to drive popularity of existing use

cases and enable new use cases, including through quality

enhancements and introduction of new products, features and

functionalities; the Company’s fluctuating operating results;

competition; the effect of broader technological and market trends

on the Company’s business and prospects; general economic

conditions and their impact on customer and end-user demand; and

other risks and uncertainties included elsewhere in the Company’s

filings with the Securities and Exchange Commission (“SEC”),

including, without limitation, the final prospectus related to the

IPO filed with the SEC on June 26, 2020. You are cautioned not to

place undue reliance on these forward-looking statements, which

speak only as of the date of this press release. All

forward-looking statements are qualified in their entirety by this

cautionary statement, and the Company undertakes no obligation to

revise or update any forward-looking statements to reflect events

or circumstances after the date hereof.

About Agora, Inc.

Agora, Inc. is the Cayman Islands holding

company of two independent divisions, under Agora brand and

Shengwang brand, respectively, whose businesses are conducted

through separate entities.

Headquartered in Santa Clara, California, Agora

is a pioneer and global leader in Real-Time Engagement

Platform-as-a-Service (PaaS), providing developers with simple,

flexible, and powerful application programming interfaces, or APIs,

to embed real-time voice, video, interactive live-streaming, chat,

whiteboard, and artificial intelligence capabilities into their

applications.

Headquartered in Shanghai, China, Shengwang is a

pioneer and leading Real-Time Engagement PaaS provider in the China

market.

For more information on Agora, please visit:

www.agora.ioFor more information on Shengwang, please visit:

www.shengwang.cn

Agora, Inc.Condensed

Consolidated Balance Sheets(Unaudited, in US$

thousands)

|

|

As of |

|

As of |

|

|

|

September 30, |

|

December 31, |

|

|

|

2024 |

|

2023 |

|

|

Assets |

|

|

|

|

|

Current assets: |

|

|

|

|

|

Cash and cash equivalents |

32,118 |

|

36,894 |

|

|

Short-term bank deposits |

161,906 |

|

86,924 |

|

|

Short-term financial products issued by banks |

106,638 |

|

84,853 |

|

|

Short-term investments |

3,066 |

|

7,983 |

|

|

Accounts receivable, net |

37,381 |

|

34,668 |

|

|

Prepayments and other current assets |

21,087 |

|

9,059 |

|

|

Contract assets |

1,127 |

|

1,048 |

|

|

Total current assets |

363,323 |

|

261,429 |

|

|

Property and equipment, net |

4,238 |

|

5,365 |

|

|

Construction in progress for the headquarters project |

35,429 |

|

17,343 |

|

|

Operating lease right-of-use assets |

4,476 |

|

4,011 |

|

|

Intangible assets |

741 |

|

1,274 |

|

|

Long-term bank deposits |

20,500 |

|

143,127 |

|

|

Long-term financial products issued by banks |

41,400 |

|

20,000 |

|

|

Long-term investments |

41,012 |

|

43,893 |

|

|

Land use right, net |

166,434 |

|

167,246 |

|

|

Other non-current assets |

13,943 |

|

10,907 |

|

|

Total assets |

691,496 |

|

674,595 |

|

|

|

|

|

|

|

|

Liabilities and shareholders’ equity |

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

Accounts payable |

15,196 |

|

12,996 |

|

|

Advances from customers |

8,155 |

|

7,765 |

|

|

Taxes payable |

1,686 |

|

906 |

|

|

Current operating lease liabilities |

1,924 |

|

2,447 |

|

|

Accrued expenses and other current liabilities |

32,148 |

|

32,780 |

|

|

Total current liabilities |

59,109 |

|

56,894 |

|

|

Long-term operating lease liabilities |

2,429 |

|

1,726 |

|

|

Deferred tax liabilities |

113 |

|

196 |

|

|

Long-term borrowings for the headquarters project |

33,762 |

|

11,027 |

|

|

Other non-current liabilities |

19,543 |

|

3 |

|

|

Total liabilities |

114,956 |

|

69,846 |

|

|

|

|

|

|

|

|

Shareholders’ equity: |

|

|

|

|

|

Class A ordinary shares |

39 |

|

39 |

|

|

Class B ordinary shares |

8 |

|

8 |

|

|

Additional paid-in-capital |

1,148,502 |

|

1,138,346 |

|

|

Treasury shares, at cost |

(77,316) |

|

(79,716) |

|

|

Accumulated other comprehensive loss |

(7,907) |

|

(10,027) |

|

|

Accumulated deficit |

(486,786) |

|

(443,901) |

|

|

Total shareholders’ equity |

576,540 |

|

604,749 |

|

|

Total liabilities and shareholders’ equity |

691,496 |

|

674,595 |

|

|

|

|

|

|

|

Agora, Inc.Condensed

Consolidated Statements of Comprehensive

Loss(Unaudited, in US$ thousands, except share and

per ADS amounts)

|

|

Three Month Ended |

|

Nine Month Ended |

|

|

September 30, |

|

September 30, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Real-time engagement service revenues |

30,356 |

|

32,718 |

|

|

95,716 |

|

100,798 |

|

|

Real-time engagement on-premise solution and other revenues |

1,217 |

|

2,298 |

|

|

3,087 |

|

4,699 |

|

|

Total revenues |

31,573 |

|

35,016 |

|

|

98,803 |

|

105,497 |

|

|

Cost of revenues |

10,524 |

|

12,594 |

|

|

36,304 |

|

38,693 |

|

|

Gross profit |

21,049 |

|

22,422 |

|

|

62,499 |

|

66,804 |

|

|

Operating expenses: |

|

|

|

|

|

|

Research and development |

29,271 |

|

20,040 |

|

|

65,551 |

|

61,356 |

|

|

Sales and marketing |

6,860 |

|

7,789 |

|

|

19,944 |

|

26,903 |

|

|

General and administrative |

9,741 |

|

9,070 |

|

|

26,349 |

|

27,100 |

|

|

Total operating expenses |

45,872 |

|

36,899 |

|

|

111,844 |

|

115,359 |

|

|

Other operating income |

134 |

|

620 |

|

|

914 |

|

1,515 |

|

|

Impairment of goodwill |

- |

|

- |

|

|

- |

|

(31,928 |

) |

|

Loss from operations |

(24,689 |

) |

(13,857 |

) |

|

(48,431 |

) |

(78,968 |

) |

|

Exchange gain (loss) |

43 |

|

20 |

|

|

108 |

|

(191 |

) |

|

Interest income |

3,924 |

|

4,850 |

|

|

13,244 |

|

14,006 |

|

|

Interest expense |

(86 |

) |

- |

|

|

(251 |

) |

- |

|

|

Investment income (loss) |

839 |

|

(13,356 |

) |

|

(4,033 |

) |

(18,497 |

) |

|

Losses from extinguishment of convertible note |

- |

|

- |

|

|

- |

|

(1,230 |

) |

|

Other income |

- |

|

- |

|

|

- |

|

550 |

|

|

Loss before income taxes |

(19,969 |

) |

(22,343 |

) |

|

(39,363 |

) |

(84,330 |

) |

|

Income taxes |

- |

|

(164 |

) |

|

(149 |

) |

(323 |

) |

|

(Losses) income from equity in affiliates |

(4,211 |

) |

(6 |

) |

|

(3,373 |

) |

45 |

|

|

Net loss |

(24,180 |

) |

(22,513 |

) |

|

(42,885 |

) |

(84,608 |

) |

|

Net loss attributable to ordinary shareholders |

(24,180 |

) |

(22,513 |

) |

|

(42,885 |

) |

(84,608 |

) |

|

Other comprehensive loss: |

|

|

|

|

|

|

Foreign currency translation adjustments |

3,197 |

|

1,164 |

|

|

2,119 |

|

(6,097 |

) |

|

Gain on available-for-sale debt securities |

- |

|

- |

|

|

- |

|

1,385 |

|

|

Total comprehensive loss attributable to ordinary shareholders |

(20,983 |

) |

(21,349 |

) |

|

(40,766 |

) |

(89,320 |

) |

|

|

|

|

|

|

|

|

Net loss per ADS attributable to ordinary shareholders, basic and

diluted |

(0.26 |

) |

(0.23 |

) |

|

(0.46 |

) |

(0.84 |

) |

|

|

|

|

|

|

|

|

Weighted-average shares used in computing net loss per ADS

attributable to ordinary shareholders, basic and diluted |

371,733,050 |

|

389,359,207 |

|

|

372,336,342 |

|

405,036,312 |

|

|

|

|

|

|

|

|

|

Share-based compensation expenses included in: |

|

|

|

|

|

|

Cost of revenues |

31 |

|

129 |

|

|

184 |

|

576 |

|

|

Research and development expenses |

10,776 |

|

3,769 |

|

|

15,886 |

|

10,668 |

|

|

Sales and marketing expenses |

241 |

|

800 |

|

|

838 |

|

3,705 |

|

|

General and administrative expenses |

2,599 |

|

1,945 |

|

|

4,332 |

|

5,953 |

|

|

|

|

|

|

|

|

|

|

|

|

Agora, Inc.Condensed

Consolidated Statements of Cash Flows(Unaudited,

in US$ thousands)

|

|

Three Month Ended |

|

Nine Month Ended |

|

|

September 30, |

|

September 30, |

|

|

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net loss |

(24,180 |

) |

(22,513 |

) |

|

(42,885 |

) |

(84,608 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

|

Share-based compensation expenses |

13,647 |

|

6,643 |

|

|

21,240 |

|

20,902 |

|

|

Allowance for current expected credit losses |

2,415 |

|

1,857 |

|

|

7,263 |

|

5,358 |

|

|

Depreciation of property and equipment |

788 |

|

1,558 |

|

|

2,726 |

|

5,680 |

|

|

Amortization of intangible assets |

131 |

|

345 |

|

|

533 |

|

1,036 |

|

|

Amortization of land use right |

856 |

|

850 |

|

|

2,572 |

|

2,312 |

|

|

Deferred tax benefit |

(20 |

) |

(53 |

) |

|

(82 |

) |

(159 |

) |

|

Amortization of right-of-use asset and interest on lease

liabilities |

687 |

|

704 |

|

|

2,035 |

|

2,218 |

|

|

Investment (income) loss |

(839 |

) |

13,356 |

|

|

4,033 |

|

18,497 |

|

|

Losses from extinguishment of convertible note |

- |

|

- |

|

|

- |

|

1,230 |

|

|

Interest income on debt securities and investments |

- |

|

- |

|

|

- |

|

(105 |

) |

|

Losses (income) from equity in affiliates |

4,211 |

|

6 |

|

|

3,373 |

|

(45 |

) |

|

Loss (gain) on disposal of property and equipment |

1 |

|

34 |

|

|

16 |

|

(10 |

) |

|

Impairments of goodwill |

- |

|

- |

|

|

- |

|

31,928 |

|

|

Changes in assets and liabilities, net of effect of

acquisition: |

|

|

|

|

|

|

Accounts receivable |

(1,627 |

) |

(4,503 |

) |

|

(9,418 |

) |

(7,856 |

) |

|

Contract assets |

(38 |

) |

(86 |

) |

|

(67 |

) |

(942 |

) |

|

Prepayments and other current assets |

347 |

|

(659 |

) |

|

(12,129 |

) |

(1,008 |

) |

|

Other non-current assets |

(472 |

) |

(2,104 |

) |

|

6,668 |

|

(5,160 |

) |

|

Accounts payable |

(2,531 |

) |

2,653 |

|

|

2,042 |

|

3,639 |

|

|

Advances from customers |

(41 |

) |

100 |

|

|

316 |

|

(559 |

) |

|

Taxes payable |

107 |

|

31 |

|

|

761 |

|

(802 |

) |

|

Operating lease liabilities |

(677 |

) |

(324 |

) |

|

(2,319 |

) |

(1,869 |

) |

|

Deferred income |

256 |

|

- |

|

|

62 |

|

(160 |

) |

|

Accrued expenses and other liabilities |

2,357 |

|

(928 |

) |

|

(5,404 |

) |

(6,808 |

) |

|

Net cash used in operating activities |

(4,622 |

) |

(3,033 |

) |

|

(18,664 |

) |

(17,291 |

) |

|

Cash flows from investing activities: |

|

|

|

|

|

|

Purchase of property and equipment |

(1,333 |

) |

(206 |

) |

|

(2,297 |

) |

(656 |

) |

|

Purchase of short-term bank deposits |

- |

|

(58,000 |

) |

|

(43,100 |

) |

(187,521 |

) |

|

Purchase of short-term financial products issued by banks |

(50,300 |

) |

(19,525 |

) |

|

(70,391 |

) |

(29,899 |

) |

|

Purchase of short-term investments |

- |

|

(789 |

) |

|

- |

|

(789 |

) |

|

Proceeds from maturity of short-term bank deposits |

37,000 |

|

86,000 |

|

|

111,241 |

|

434,058 |

|

|

Proceeds from maturity of short-term financial products issued by

banks |

59,482 |

|

- |

|

|

69,511 |

|

8,310 |

|

|

Purchase of long-term bank deposits |

(10,500 |

) |

- |

|

|

(20,500 |

) |

(143,127 |

) |

|

Purchase of long-term financial products issued by banks |

(32,000 |

) |

- |

|

|

(41,400 |

) |

(20,000 |

) |

|

Purchase of long-term investments |

(562 |

) |

- |

|

|

(562 |

) |

(15 |

) |

|

Purchase of land use right |

- |

|

- |

|

|

- |

|

(5,133 |

) |

|

Payment for the headquarters project |

(10,918 |

) |

(1,839 |

) |

|

(21,895 |

) |

(4,326 |

) |

|

Cash received for business disposal |

- |

|

- |

|

|

- |

|

5,769 |

|

|

Cash received from disposal of property and equipment |

2 |

|

36 |

|

|

58 |

|

87 |

|

|

Cash paid for a business combination |

- |

|

- |

|

|

- |

|

(3,680 |

) |

|

Cash received from disposal of long-term investments |

28 |

|

- |

|

|

155 |

|

- |

|

|

Net cash (used in) provided by investing activities |

(9,101 |

) |

5,677 |

|

|

(19,180 |

) |

53,078 |

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

Proceeds from long-term borrowings for headquarters project |

11,123 |

|

- |

|

|

22,177 |

|

- |

|

|

Deposits returned for business disposal |

- |

|

- |

|

|

- |

|

(1,000 |

) |

|

Proceeds from exercise of employees’ share options |

175 |

|

74 |

|

|

550 |

|

590 |

|

|

Deposit received in relation to headquarters project |

- |

|

- |

|

|

19,280 |

|

- |

|

|

Repurchase of Class A ordinary shares |

(3,913 |

) |

(12,462 |

) |

|

(9,667 |

) |

(52,829 |

) |

|

Net cash provided by (used in) financing activities |

7,385 |

|

(12,388 |

) |

|

32,340 |

|

(53,239 |

) |

|

Effect of foreign exchange rate changes on cash, cash equivalents

and restricted cash |

819 |

|

53 |

|

|

678 |

|

(1,286 |

) |

|

Net decrease in cash, cash equivalents and restricted cash |

(5,519 |

) |

(9,691 |

) |

|

(4,826 |

) |

(18,738 |

) |

|

Cash balance recorded in held-for sale assets at beginning of

period |

- |

|

- |

|

|

- |

|

1,488 |

|

|

Cash, cash equivalents and restricted cash at beginning of period

* |

37,867 |

|

38,268 |

|

|

37,174 |

|

45,827 |

|

|

Cash, cash equivalents and restricted cash at end of period ** |

32,348 |

|

28,577 |

|

|

32,348 |

|

28,577 |

|

|

Supplemental disclosure of cash flow information: |

|

|

|

|

|

|

Income taxes paid |

24 |

|

33 |

|

|

133 |

|

65 |

|

|

Cash payments included in the measurement of operating lease

liabilities |

677 |

|

324 |

|

|

2,319 |

|

1,869 |

|

|

Right-of-use assets obtained in exchange for operating lease

obligations |

1,812 |

|

- |

|

|

2,325 |

|

4,088 |

|

|

Non-cash financing and investing activities: |

|

|

|

|

|

|

Proceeds receivable from exercise of employees’ share options |

328 |

|

25 |

|

|

328 |

|

25 |

|

|

Payables for property and equipment |

33 |

|

24 |

|

|

33 |

|

24 |

|

|

Payables for construction in progress for the headquarters

project |

11,614 |

|

6,458 |

|

|

11,614 |

|

6,458 |

|

|

Payables for treasury shares, at cost |

24 |

|

301 |

|

|

24 |

|

301 |

|

|

* includes restricted cash balance |

280 |

|

280 |

|

|

280 |

|

154 |

|

|

** includes restricted cash balance |

230 |

|

280 |

|

|

230 |

|

280 |

|

|

|

|

|

|

|

|

|

|

|

|

Agora,

Inc.Reconciliation of GAAP to Non-GAAP

Measures(Unaudited, in US$ thousands, except share

and per ADS amounts)

|

|

Three Month Ended |

|

Nine Month Ended |

|

|

September 30, |

|

September 30, |

|

|

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

|

GAAP net loss |

(24,180 |

) |

(22,513 |

) |

|

(42,885 |

) |

(84,608 |

) |

|

Add: |

|

|

|

|

|

|

Share-based compensation expenses |

13,647 |

|

6,643 |

|

|

21,240 |

|

20,902 |

|

|

Acquisition related expenses |

- |

|

13 |

|

|

- |

|

(400 |

) |

|

Amortization expenses of acquired intangible assets |

129 |

|

345 |

|

|

531 |

|

1,035 |

|

|

Income tax related to acquired intangible assets |

(20 |

) |

(53 |

) |

|

(82 |

) |

(159 |

) |

|

Impairment of goodwill |

- |

|

- |

|

|

- |

|

31,928 |

|

|

Non-GAAP net loss |

(10,424 |

) |

(15,565 |

) |

|

(21,196 |

) |

(31,302 |

) |

|

|

|

|

|

|

|

|

Net cash used in operating activities |

(4,622 |

) |

(3,033 |

) |

|

(18,664 |

) |

(17,291 |

) |

|

Purchase of property and equipment |

(1,333 |

) |

(206 |

) |

|

(2,297 |

) |

(656 |

) |

|

Free Cash Flow |

(5,955 |

) |

(3,239 |

) |

|

(20,961 |

) |

(17,947 |

) |

|

Net cash (used in) provided by investing activities |

(9,101 |

) |

5,677 |

|

|

(19,180 |

) |

53,078 |

|

|

Net cash provided by (used in) financing activities |

7,385 |

|

(12,388 |

) |

|

32,340 |

|

(53,239 |

) |

|

|

|

|

|

|

|

|

|

|

|

Investor Contact:

investor@agora.io

Media Contact:

press@agora.io

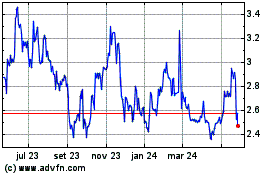

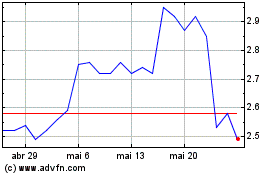

Agora (NASDAQ:API)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Agora (NASDAQ:API)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024