U.S. Index Futures Mixed, Oil Prices Dip

19 Agosto 2024 - 6:29AM

IH Market News

U.S. index futures are mixed in pre-market trading on Monday

following a week of solid gains on Wall Street, driven by positive

economic data and renewed optimism. Investors are cautiously

awaiting Federal Reserve Chairman Jerome Powell’s speech in Jackson

Hole this week as the market seeks clues about the future direction

of interest rates.

As of 4:51 AM, Dow Jones futures (DOWI:DJI) were up 17 points,

or 0.05%. S&P 500 futures lost 0.05%, and Nasdaq-100 futures

fell 0.22%. The 10-year Treasury yield stood at 3.864%.

In the commodities market, oil prices declined on Monday due to

concerns about weaker demand in China, the world’s largest

importer. Recent data showed a drop in Chinese diesel and gasoline

exports and a slowing economy. Additionally, the market is

concerned about the end of the peak driving season in the U.S.

However, tensions in the Middle East and risks related to the war

in Ukraine continue to support the market as investors monitor

ceasefire negotiations that could impact oil supply.

West Texas Intermediate crude for September fell 0.65% to $76.15

per barrel, while Brent for October dropped 0.55% to $79.24 per

barrel.

The U.S. economic agenda for Monday includes initial remarks

from Fed Governor Christopher Waller at 9:15 AM. At 10 AM, the

focus will shift to July’s leading economic indicators, expected to

decline by 0.4% after a 0.2% increase in the previous month.

Asia-Pacific markets had mixed performances on Monday. Japan’s

Nikkei 225 fell 1.77%, breaking a five-day winning streak, while

China’s CSI 300 rose 0.34%, marking three consecutive days of

gains. Australia’s S&P/ASX 200 saw a slight increase of 0.12%,

and South Korea’s KOSPI dropped 0.85%. Hong Kong’s Hang Seng was up

0.73% near the close.

In Japan, machinery orders fell 1.7% in June year-over-year,

contrary to expectations of a 1.8% increase. Additionally, the

Japanese government plans to list Tokyo Metro by the end of

October, with an estimated IPO valuation of $4.7 billion (700

billion yen), making it Japan’s largest IPO since 2018.

Last week, the U.S. and China signed financial cooperation

agreements in Shanghai. According to the People’s Bank of China,

the Financial Working Group meeting, led by Brent Neiman and Xuan

Changneng, discussed financial stability, capital markets, and

cross-border payments. Both parties exchanged contacts for crisis

situations and explored collaboration opportunities.

In Singapore, the government will introduce the SkillsFuture

Jobseeker Support Scheme to assist workers who have been laid off

or are involuntarily unemployed. The program offers up to $4,561

for six months to low- and middle-income workers who engage in

training and actively seek employment.

In India, the Supreme Court will begin hearings this week on the

alleged rape and murder of a medical intern in Kolkata. The court

took up the case after protests and a nationwide doctors’ strike.

The case, initially mishandled by local police, is now under

investigation by the Federal Central Bureau of Investigation.

European markets are trading mixed on Monday after a week of

gains, with the tech sector opening lower and the mining sector

rising.

On Friday, the Dow Jones rose 0.24%, the S&P 500 advanced

0.20%, and the Nasdaq gained 0.21%. The Nasdaq and S&P 500

closed higher for the seventh consecutive session, reflecting

recent positive momentum and easing economic concerns. Expectations

of a Federal Reserve interest rate cut also boosted the market. In

the previous week, the Nasdaq surged 5.3%, the S&P 500 rose

3.9%, and the Dow gained 2.9%.

In the earnings report front, ZIM Integrated Shipping

Services (NYSE:ZIM), Estée

Lauder (NYSE:EL), Freightos (NASDAQ:CRGO)

are expected to report before the market opens.

After the close, numbers from Palo Alto

Networks (NASDAQ:PANW), Fabrinet (NYSE:FN), Bit

Digital (NASDAQ:BTBT), Agora

Inc (NASDAQ:API), American Resources

Corporation (NASDAQ:AREC), Flexsteel (NASDAQ:FLXS), Fluent (NASDAQ:FLNT), Hesai

Group (NASDAQ:HSAI), E.C.D. Automotive

Design (NASDAQ:ECDA), and more are anticipated.

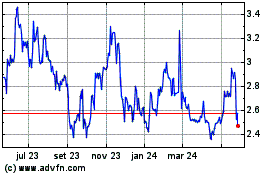

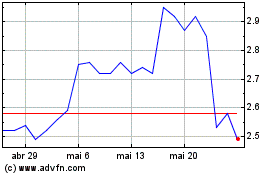

Agora (NASDAQ:API)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Agora (NASDAQ:API)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025