Krane Funds Advisors, LLC (“KraneShares”), an asset management firm

known for its global exchange-traded funds (ETFs), announced that

it added Washington state’s cap-and-trade carbon allowance market

to the KraneShares Global Carbon Strategy ETF (Ticker: KRBN).

Washington carbon allowance (WCA) futures now represent a 5% weight

in KRBN.

The move to include Washington carbon allowances in

KRBN follows a show of overwhelming voter support for these markets

on November 5th 2024. A referendum to repeal Washington state’s

Climate Commitment Act that established the state’s carbon markets

was struck down by a margin of 62% to 38%1.

“KraneShares strives to be at the forefront of

carbon market investing with our flagship KRBN ETF,” said Luke

Oliver, Head of Climate Investments at KraneShares. “The

development of Washington’s cap-and-trade market underscores the

importance of regional markets in the sustainable-energy

transition. As the adoption of cap-and-trade systems expands, we

believe exposure to these markets is becoming an essential

consideration within investors’ portfolios.”

The KraneShares Global Carbon Strategy ETF (KRBN)

is benchmarked to the S&P Global Carbon Credit Index, which

offers broad coverage of cap-and-trade carbon allowances by

tracking the most traded carbon credit futures contracts. The index

introduces a new measure for hedging risk and going long the price

of carbon while supporting responsible investing.

In addition to its latest Washington holding, the

index also covers the other major European and North American

cap-and-trade programs: European Union Allowances (EUA), California

Carbon Allowances (CCA), United Kingdom Allowances (UKA), and the

Regional Greenhouse Gas Initiative (RGGI), which covers the

Northeast US Power Market.

“Since the outset, Climate Finance Partners (CLIFI)

and KraneShares worked with S&P to design KRBN’s index to

evolve alongside the growing and dynamic global carbon markets,”

said Eron Bloomgarden, co-founder and CEO of CLIFI. “The inclusion

of Washington State within KRBN represents a significant step

forward for price discovery in global carbon markets, which now

cover over 25% of global emissions.3”

What are carbon allowances?

Compliance carbon allowances trade under

cap-and-trade programs known as Emissions Trading Systems (ETS).

These systems create transparent, liquid markets that are

government-mandated and regulated. The value of these markets

reached nearly one trillion USD in 2023.2 Carbon allowances are

distinct from project-based carbon offsets and offer a market-based

approach to regulating a region's emissions, with mandatory

participation for specified industries. Carbon allowance supply is

managed by government agencies and adjusted primarily through an

annually declining cap.

For more information on the KraneShares Global

Carbon Strategy ETF (Ticker: KRBN), please visit

https://kraneshares.com/krbn or consult your financial advisor.

Citations:

- Kerber, Rosss, “Carbon markets give

environmentalists hope after US elections,” Reuters. Nov 12,

2024.

- Reuters, “Global carbon markets

value hit record $909 bln last year,” Feb 7, 2023.

- World Bank, “State and Trends of

Carbon Pricing 2024,” May 21, 2024. Note, carbon

About KraneShares

KraneShares is a specialist investment manager

focused on China, Climate, and Alternative Assets. KraneShares

seeks to provide innovative, high-conviction, and first-to-market

strategies based on the firm and its partners' deep investing

knowledge. KraneShares identifies and delivers groundbreaking

capital market opportunities and believes investors should have

cost-effective and transparent tools for attaining exposure to

various asset classes. The firm was founded in 2013 and serves

institutions and financial professionals globally. The firm is a

signatory of the United Nations-supported Principles for

Responsible Investment (UN PRI).

About Climate Finance Partners

Climate Finance Partners delivers innovative

climate finance solutions and investment products to scale capital

into climate impact. CLIFI is an impact focused investment firm and

is led by a team of professionals with deep experience in the

fields of investment and environmental and climate finance.

Carefully consider the Funds’ investment

objectives, risk factors, charges and expenses before investing.

This and additional information can be found in the Funds’ full and

summary prospectus, which may be obtained by visiting:

www.kraneshares.com/krbn. Read the prospectus carefully before

investing.

Risk Disclosures:

Investing involves risk, including possible loss of

principal. There can be no assurance that a Fund will achieve its

stated objectives. Indices are unmanaged and do not include the

effect of fees. One cannot invest directly in an index.

This information should not be relied upon as

research, investment advice, or a recommendation regarding any

products, strategies, or any security in particular. This material

is strictly for illustrative, educational, or informational

purposes and is subject to change. Certain content represents an

assessment of the market environment at a specific time and is not

intended to be a forecast of future events or a guarantee of future

results; material is as of the dates noted and is subject to change

without notice.

The Fund may invest in derivatives, which are often

more volatile than other investments and may magnify the Fund’s

gains or losses. A derivative (i.e., futures/forward contracts,

swaps, and options) is a contract that derives its value from the

performance of an underlying asset. The primary risk of derivatives

is that changes in the asset’s market value and the derivative may

not be proportionate, and some derivatives can have the potential

for unlimited losses. Derivatives are also subject to liquidity and

counterparty risk. The Fund is subject to liquidity risk, meaning

that certain investments may become difficult to purchase or sell

at a reasonable time and price. If a transaction for these

securities is large, it may not be possible to initiate, which may

cause the Fund to suffer losses. Counterparty risk is the risk of

loss in the event that the counterparty to an agreement fails to

make required payments or otherwise comply with the terms of the

derivative.

The Fund relies on the existence of cap and trade

regimes. There is no assurance that cap and trade regimes will

continue to exist, or that they will prove to be an effective

method of reduction in GHG emissions. Changes in U.S. law and

related regulations may impact the way the Fund operates, increase

Fund costs and/or change the competitive landscape. New

technologies may arise that may diminish or eliminate the need for

cap and trade markets. Ultimately, the cost of emissions credits is

determined by the cost of actually reducing emissions levels. If

the price of credits becomes too high, it will be more economical

for companies to develop or invest in green technologies, thereby

suppressing the demand for credits. Fluctuations in currency of

foreign countries may have an adverse effect to domestic currency

values. The use of futures contracts is subject to special risk

considerations. The primary risks associated with the use of

futures contracts include: (a) an imperfect correlation between the

change in market value of the reference asset and the price of the

futures contract; (b) possible lack of a liquid secondary market

for a futures contract and the resulting inability to close a

futures contract when desired; (c) losses caused by unanticipated

market movements, which are potentially unlimited; (d) the

inability to predict correctly the direction of market prices,

interest rates, currency exchange rates and other economic factors;

and (e) if the Fund has insufficient cash, it may have to sell

securities or financial instruments from its portfolio to meet

daily variation margin requirements, which may lead to the Fund

selling securities or financial instruments at a loss.

The Fund invests through a subsidiary, and is

indirectly exposed to the risks associated with the Subsidiary’s

investments. Since the Subsidiary is organized under the law of the

Cayman Islands and is not registered with the SEC under the

Investment Company Act of 1940, as such the Fund will not receive

all of the protections offered to shareholders of registered

investment companies. The Fund and the Subsidiary will be

considered commodity pools upon commencement of operations, and

each will be subject to regulation under the Commodity Exchange Act

and CFTC rules. Commodity pools are subject to additional laws,

regulations and enforcement policies, which may increase compliance

costs and may affect the operations and performance of the Fund and

the Subsidiary. Futures and other contracts may have to be

liquidated at disadvantageous times or prices to prevent the Fund

from exceeding any applicable position limits established by the

CFTC. The value of a commodity-linked derivative investment

typically is based upon the price movements of a physical commodity

and may be affected by changes in overall market movements,

volatility of the Index, changes in interest rates, or factors

affecting a particular industry or commodity.

The Fund is subject to interest rate risk, which is

the chance that bonds will decline in value as interest rates rise.

Narrowly focused investments typically exhibit higher volatility.

The Fund’s assets are expected to be concentrated in a sector,

industry, market, or group of concentrations to the extent that the

Underlying Index has such concentrations. The securities or futures

in that concentration could react similarly to market developments.

Thus, the Fund is subject to loss due to adverse occurrences that

affect that concentration. KRBN is non-diversified.

ETF shares are bought and sold on an exchange at

market price (not NAV) and are not individually redeemed from the

Fund. However, shares may be redeemed at NAV directly by certain

authorized broker-dealers (Authorized Participants) in very large

creation/redemption units. The returns shown do not represent the

returns you would receive if you traded shares at other times.

Shares may trade at a premium or discount to their NAV in the

secondary market. Brokerage commissions will reduce returns.

Beginning 12/23/2020, market price returns are based on the

official closing price of an ETF share or, if the official closing

price isn't available, the midpoint between the national best bid

and national best offer (“NBBO”) as of the time the ETF calculates

the current NAV per share. Prior to that date, market price returns

were based on the midpoint between the Bid and Ask price. NAVs are

calculated using prices as of 4:00 PM Eastern Time.

The KraneShares ETFs and KFA Funds ETFs are

distributed by SEI Investments Distribution Company (SIDCO), 1

Freedom Valley Drive, Oaks, PA 19456, which is not affiliated with

Krane Funds Advisors, LLC, the Investment Adviser for the Funds, or

any sub-advisers for the Funds.

For media inquiries, please contact:

info@kraneshares.com

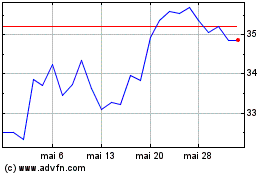

KraneShares Global Carbo... (AMEX:KRBN)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

KraneShares Global Carbo... (AMEX:KRBN)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024