Castor Maritime Inc. (NASDAQ: CTRM), (“Castor” or the “Company”), a

diversified global shipping and energy company, announces that on

December 16, 2024, Thalvora Holdings GmbH, a wholly owned

subsidiary of the Company, completed the acquisition of 26,116,378

shares of common stock representing 74.09% of the share capital of

the Frankfurt-listed investment and asset manager MPC Münchmeyer

Petersen Capital AG (Deutsche Börse, Scale, ISIN DE000A1TNWJ4)

(“MPC Capital”) from Münchmeyer Petersen & Co. GmbH at the

agreed price of €7.00 per share, which is equal to an aggregate

consideration of €182.8 million (approx. USD 192.6 million

equivalent).

In connection with the closing of the

transaction, the composition of the Supervisory Board of MPC

Capital will change to consist of Mr. Ulf Holländer and two new

members, Mr. Petros Panagiotidis, Chief Executive Officer and

Chairman of the Company, and Mr. Petros Zavakopoulos. Mr.

Panagiotidis’ and Mr. Zavakopoulos’ appointments will be effective

once the relevant confirmations from the local court of Hamburg are

obtained and will have a duration until MPC Capital’s next ordinary

Annual General Meeting.

About MPC Münchmeyer Petersen Capital

AG

MPC Münchmeyer Petersen Capital AG is an

investment and asset manager specializing in infrastructure

projects in the maritime and energy sectors. Partnering and

co-investing with institutional investors, MPC Capital provides

tailor-made investment solutions, excellent project access, and

integrated asset management expertise, including technical and

commercial ship management. Listed on the Frankfurt Stock Exchange

since 2000, MPC Capital has assets under management (AuM) totaling

EUR 4.8 billion.

MPC Capital is the founder and cornerstone

shareholder of Oslo-listed MPC Container Ships ASA (Oslo Børs:

MPCC) a leading container tonnage provider focusing on small to

mid-size container ships, and MPC Energy Solutions NV (Oslo Børs:

MPCES).

About Castor Maritime Inc.

Castor Maritime Inc. is a diversified global

shipping and energy company, with activities directly and

indirectly in investment and asset management, vessel ownership,

technical and commercial ship management and energy infrastructure

projects. Castor has a fleet of 13 vessels, with an aggregate

capacity of 0.9 million dwt, and is the majority shareholder of the

Frankfurt-listed investment and asset manager MPC Capital.

For more information, please visit the Company’s

website at www.castormaritime.com. Information on our website does

not constitute a part of this press release.

Cautionary Statement Regarding

Forward-Looking Statements

Matters discussed in this press release may

constitute forward-looking statements. We intend such

forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in Section 27A

of the Securities Act of 1933, as amended (the “Securities Act”)

and Section 21E of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”). Forward-looking statements include statements

concerning plans, objectives, goals, strategies, future events or

performance, and underlying assumptions and other statements, which

are other than statements of historical facts. We are including

this cautionary statement in connection with this safe harbor

legislation. The words “believe”, “anticipate”, “intend”,

“estimate”, “forecast”, “project”, “plan”, “potential”, “will”,

“may”, “should”, “expect”, “pending” and similar expressions

identify forward-looking statements. The forward-looking statements

in this press release are based upon various assumptions, many of

which are based, in turn, upon further assumptions, including

without limitation, our management’s examination of current or

historical operating trends, data contained in our records and

other data available from third parties. Although we believe that

these assumptions were reasonable when made, because these

assumptions are inherently subject to significant uncertainties and

contingencies which are difficult or impossible to predict and are

beyond our control, we cannot assure you that we will achieve or

accomplish these forward-looking statements, including these

expectations, beliefs or projections. Important factors that, in

our view, could cause actual results to differ materially from

those discussed in the forward‐looking statements include

generally: the effects of the spin-off of our tanker business, our

business strategy, expected capital spending and other plans and

objectives for future operations, dry bulk and containership market

conditions and trends, including volatility in charter rates

(particularly for vessels employed in short-term time charters or

index linked period time charters), factors affecting supply and

demand, fluctuating vessel values, opportunities for the profitable

operations of dry bulk and container vessels and the strength of

world economies, changes in the size and composition of our fleet,

our ability to realize the expected benefits from our past or

future vessel acquisitions, our ability to realize the expected

benefits of vessel acquisitions, increased transactions costs and

other adverse effects (such as lost profit) due to any failure to

consummate any sale of our vessels, our relationships with our

current and future service providers and customers, including the

ongoing performance of their obligations, dependence on their

expertise, compliance with applicable laws, and any impacts on our

reputation due to our association with them, our ability to borrow

under existing or future debt agreements or to refinance our debt

on favorable terms and our ability to comply with the covenants

contained therein, in particular due to economic, financial or

operational reasons, our continued ability to enter into time or

voyage charters with existing and new customers and to re-charter

our vessels upon the expiry of the existing charters, changes in

our operating and capitalized expenses, including bunker prices,

dry-docking, insurance costs, costs associated with regulatory

compliance, and costs associated with climate change, our ability

to fund future capital expenditures and investments in the

acquisition and refurbishment of our vessels (including the amount

and nature thereof and the timing of completion thereof, the

delivery and commencement of operations dates, expected downtime

and lost revenue), instances of off-hire, due to vessel upgrades

and repairs, fluctuations in interest rates and currencies,

including the value of the U.S. dollar relative to other

currencies, any malfunction or disruption of information technology

systems and networks that our operations rely on or any impact of a

possible cybersecurity breach, existing or future disputes,

proceedings or litigation, future sales of our securities in the

public market and our ability to maintain compliance with

applicable listing standards, volatility in our share price,

including due to high volume transactions in our shares by retail

investors, potential conflicts of interest involving affiliated

entities and/or members of our board of directors, senior

management and certain of our service providers that are related

parties, general domestic and international political conditions or

events, including armed conflicts such as the war in Ukraine and

the conflict in the Middle East, acts of piracy or maritime

aggression, such as recent maritime incidents involving vessels in

and around the Red Sea, sanctions, “trade wars”, global public

health threats and major outbreaks of disease, changes in seaborne

and other transportation, including due to the maritime incidents

in and around the Red Sea, fluctuating demand for dry bulk and

container vessels and/or disruption of shipping routes due to

accidents, political events, international sanctions, international

hostilities and instability, piracy or acts of terrorism, changes

in governmental rules and regulations or actions taken by

regulatory authorities, including changes to environmental

regulations applicable to the shipping industry, accidents, the

impact of adverse weather and natural disasters and any other

factors described in our filings with the SEC. The information set

forth herein speaks only as of the date hereof, and we disclaim any

intention or obligation to update any forward looking statements as

a result of developments occurring after the date of this

communication, except to the extent required by applicable law. New

factors emerge from time to time, and it is not possible for us to

predict all or any of these factors. Further, we cannot assess the

impact of each such factor on our business or the extent to which

any factor, or combination of factors, may cause actual results to

be materially different from those contained in any forward-looking

statement. Please see our filings with the Securities and Exchange

Commission for a more complete discussion of these foregoing and

other risks and uncertainties. These factors and the other risk

factors described in this press release are not necessarily all of

the important factors that could cause actual results or

developments to differ materially from those expressed in any of

our forward-looking statements. Given these uncertainties,

investors are cautioned not to place undue reliance on such

forward-looking statements.

CONTACT DETAILS

For further information please contact:

Petros PanagiotidisCastor Maritime Inc. Email:

ir@castormaritime.com

Media Contact: Kevin Karlis Capital LinkEmail:

castormaritime@capitallink.com

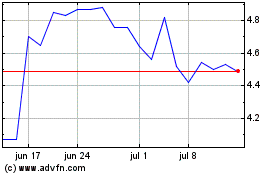

Castor Maritime (NASDAQ:CTRM)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Castor Maritime (NASDAQ:CTRM)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025